Not for Distribution to U.S. Newswire Services or for Dissemination in the United States. Any Failure to Comply with this Restriction May Constitute a Violation of U.S. Securities Laws.

VANCOUVER, BC / ACCESSWIRE / November 8, 2019 / Roughrider Exploration Limited (TSXV:REL) ("Roughrider" or the "Company") is pleased to announce that it has entered into a definitive agreement ("Definitive Agreement") with Cazador Resources Ltd., a private BC Company, Rene Bernard, an individual and Elemental Capital Partners LLP, a private BC Partnership, each of which is an independent party at arm's length to the Company (collectively "the "Vendors"), to acquire a 100% interest in the Gin, Eldorado and Bonanza properties located adjacent to Newcrest Mining and Imperial Metals Red Chris Mine in the Golden Triangle Area of northwest B.C. (collectively the "Red Chris Area Properties" or the "Properties") for an aggregate consideration of 11,000,000 Roughrider shares (the "Transaction"). Upon closing, Mr. Adam Travis will be appointed CEO and Director of Roughrider and Dr. Fletcher Morgan will also be appointed a Director of Roughrider.

Exploration and Strategic Potential

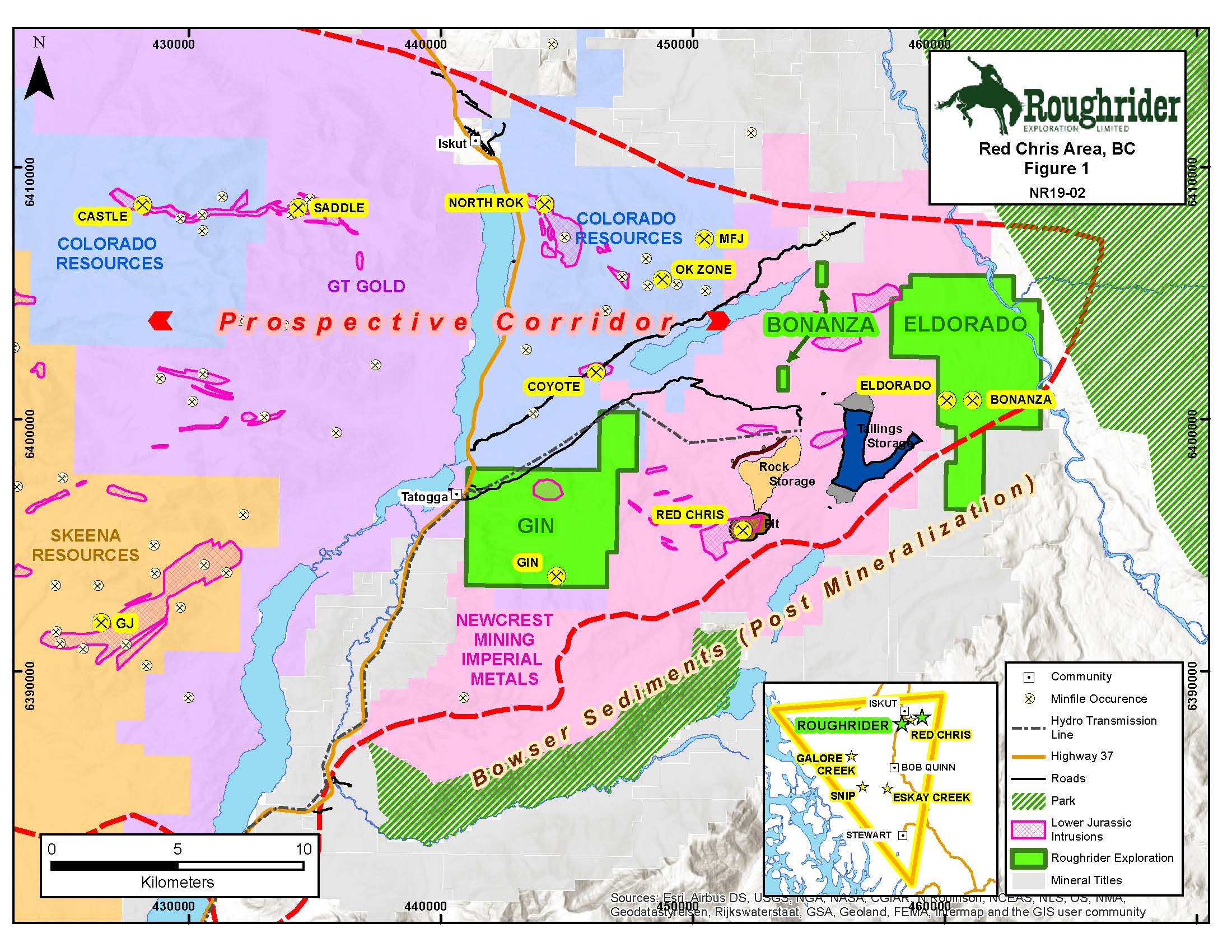

The Properties are located in the heart of the Red Chris Camp within British Columbia's Golden Triangle (see Figure 1) and are adjacent to ground held by Imperial Metals Corp. which includes the producing Red Chris Mine¹. In August 2019, Imperial Metals sold a 70% interest in Red Chris to Newcrest Mining Ltd. for approximately US$775million.

Figure 1

Roughrider is pleased to be able to secure ground in the Red Chris Area joining other companies such as Newcrest/Imperial, GT Gold Corp, Skeena Resources Ltd and Colorado Resources Ltd¹. Recent notable investments in the immediate area by both Newcrest and Newmont attest to the copper-gold potential of this area.

Red Chris Area Properties

Eldorado & Bonanza Properties

Eldorado and Bonanza border the eastern side of the Red Chris Mine property and occur along geological trend to the east hosting mineralized intrusions and volcanics (see Figure 1).

Gin Property

The Gin Property borders the western side of the Red Chris property and is adjacent to both Colorado's North ROK property (southern side) and GT Gold's Tatogga property (southeast side, See Figure 1).

Definitive Agreement

Under the terms of the Definitive Agreement, Roughrider will acquire a 100% interest in the Red Chris Area Properties by issuing 11,000,000 shares in Roughrider ("Consideration Shares") and all current outstanding Roughrider options will be cancelled in connection with the Transaction.

Upon completion of the Transaction, each of the vendors will become insiders holding shares in excess of 10% of the issued and outstanding shares of the Company.

The Transaction is subject to receipt of all necessary regulatory and corporate approvals, including the approval of the TSX Venture Exchange ("TSXV").

All the Consideration Shares issued under the Transaction will subject to a hold period expiring four months and one day from the date of issuance. 4,000,000 of the Consideration Shares will also be subject to a voluntary hold period of one year from the date of closing.

Appointment of Chief Executive Officer and Director

Upon closing, Mr. Adam Travis will be appointed as CEO and Director of Roughrider and Dr. Fletcher Morgan will be appointed as a director of Roughrider. Mr. Wayne Hewgill and Mr. Alex Heath will resign as directors of Roughrider, effective on the closing date of the Transaction.

Mr. Travis will replace Mr. Scott Gibson, who has served as Roughrider's CEO over the last eight years. Mr. Gibson will remain a director of Roughrider.

Incoming CEO and Director, Travis commented, "Investors and colleagues that have followed my career know that I am passionate about B.C.'s Golden Triangle and its potential for multiple new economic discoveries. I am pleased to take on this new opportunity with Roughrider. I sincerely thank Scott Gibson and his team for their stewardship, and I look forward to working with them to transform Roughrider into a flagship B.C. exploration company. The properties that Roughrider will acquire are a good starting point."

Proposed Financing

In connection with the Transaction, Roughrider proposes to conduct a non-brokered private placement (the "Private Placement") of the sale of up to 5,000,000 common shares (the "Shares") at a price of $0.10 per Share for gross proceeds of up to $500,000.

Subject to the approval of the TSXV, finders' fees may be paid in respect of subscriptions by certain arm's length subscribers.

The proceeds of the Private Placement will be used for general working capital purposes and to facilitate the closing of the Transaction.

The Transaction is subject to receipt of all necessary regulatory and corporate approvals, including the approval of the TSX Venture Exchange ("TSXV"). Closing of the Private Placement remains subject to the approval of the TSXV. All the securities issued under the Private Placement will be subject to a hold period expiring four months and one day from the date of issuance.

Qualified Person

David Tupper, P. Geo. Vice President, Exploration, is a Qualified Person within the context of National Instrument 43-101 and has read and approved the technical information in this release.

Cautionary note related to Release and Figure

¹ This Release contains information about adjacent properties on which Roughrider has no right to explore or mine. Readers are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on the Company's properties.

About Roughrider Exploration Limited

Roughrider and its partner ValOre Metals Corp. (formerly named Kivalliq Energy) hold the Genesis uranium project located in the Wollaston-Mudjatik geological trend extending northeast from Saskatchewan's Athabasca Basin. In addition, Roughrider acquired the Sterling property in central British Columbia.

For further information, please contact:

Scott Gibson

Chief Executive Officer

Roughrider Exploration Limited

625 Howe Street, Suite 420

Vancouver, B.C. V6C 2T6, Canada

P: 604-697‐0028

Completion of the Transaction is subject to a number of conditions, including but not limited to, TSXV acceptance Where applicable, the transaction cannot close until the required TSXV approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all. Trading in the securities of the Company should be considered highly speculative.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this press release, including any information regarding the proposed Transaction, private placement, board and management changes, as to our strategy, projects, plans or future financial or operating performance, constitutes "forward-looking statements." All statements, other than statements of historical fact, are to be considered forward-looking statements. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by the company, are inherently subject to significant business, economic, geological and competitive uncertainties and contingencies. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include but are not limited to: fluctuations in market prices, exploration and exploitation successes, continued availability of capital and financing, changes in national and local government legislation, taxation, controls, regulations, expropriation or nationalization of property and general political, economic, market or business conditions. Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance and, therefore, readers are advised to rely on their own evaluation of such uncertainties. All of the forward-looking statements made in this press release, or incorporated by reference, are qualified by these cautionary statements. We do not assume any obligation to update any forward-looking statements.

UNITED STATES ADVISORY

The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), have been offered and sold outside the United States to eligible investors pursuant to Regulation S promulgated under the U.S. Securities Act, and may not be offered, sold, or resold in the United States or to, or for the account of or benefit of, a U.S. Person (as such term is defined in Regulation S under the United States Securities Act) unless the securities are registered under the U.S. Securities Act, or an exemption from the registration requirements of the U.S. Securities Act is available. Hedging transactions involving the securities must not be conducted unless in accordance with the U.S. Securities Act. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in the state in the United States in which such offer, solicitation or sale would be unlawful.

SOURCE: Roughrider Exploration Limited