VANCOUVER, BC / ACCESSWIRE / January 30, 2020 / Sarama Resources Ltd. ("Sarama" or the "Company") (TSXV:SWA) is pleased to announce reconnaissance drilling has intersected a new zone of high-grade gold mineralisation at its Bamako 2 Property ("Bamako 2" or the "Property") in south-western Burkina Faso. The discovery was part of a 2,000m reverse circulation ("RC") reconnaissance drilling program targeting gold-in-soil anomalism and historical artisanal gold workings. The program is the first drilling to be conducted on the Property in approximately 7½ years.

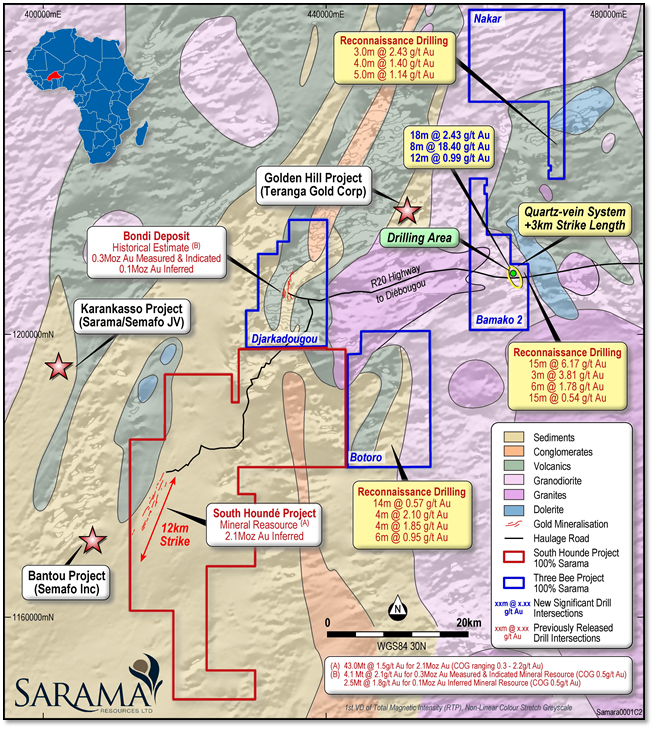

The 119km² Property is part of the Company's 100%-owned(4) ThreeBee Project (refer Figure 1). Sarama believes it has the potential to contribute high-grade feed to a possible central processing facility as part of an eventual regional project development in the southern Houndé Belt involving the Company's combined South Houndé and ThreeBee Projects.

Further field mapping and geological interpretation will be undertaken in Q1 2020 to support follow-up drilling in these newly drilled areas as well as in areas with historical high-grade drill intersections.

Highlights

- Reconnaissance drill program consisted of 21 RC holes, totalling 2,000m. Full results are listed in Appendix A with significant intersections including:

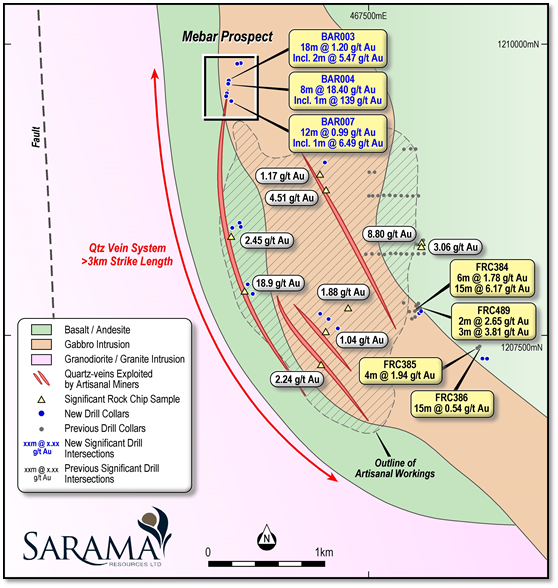

- 18m @ 1.20g/t Au from 44m in BAR003, including 2m at 5.47g/t Au from 56m;

- 8m @ 18.40g/t Au from 42m in BAR004, including 1m at 139g/t Au from 45m; and

- 12m @ 0.99g/t Au from 32m in BAR007, including 1m at 6.94g/t Au from 39m.

- Strike length of surface-mapped mineralisation established at over 3km in strike length

- Mineralisation associated with a north to north-westerly striking quartz vein system associated with shearing and significant wallrock alteration consisting of silica-sericite-pyrite

- The discovery of high-grade mineralisation further supports Sarama's regional development plan for the southern Houndé Belt which features a low capital intensity, high-return project configuration focussed initially on oxide and free-milling material

Sarama's President and CEO, Andrew Dinning, commented:

"We are pleased to have resumed exploration at the Bamako 2 Property and are encouraged by the discovery of this new zone of high-grade mineralisation. While the scout drill program was small, the results highlight the potential for the Property to host mineralisation of significance, especially when considered with the results of historical exploration by Sarama. The high-grade nature of the Property's mineralisation provides Sarama with various potential exploitation options as it is located within trucking distance of Sarama's South Houndé Project and is also proximal to Teranga Gold Corp's Golden Hill Project, lowering the size threshold for an economic resource when it comes time to make a production decision."

Bamako Property Exploration

The 119km2 Bamako 2 Property is part of the Company's 100%-owned(4), 708km² ThreeBee Project (refer Figures 1 and 2), which is positioned on the eastern flank of the well-endowed Houndé Greenstone Belt in south-west Burkina Faso that hosts Endeavour Mining Corp's Hounde Mine, Roxgold Inc's Yaramoko Mine, as well as Semafo Inc's ("Semafo") Mana and Siou Mines further to the north. The Property is also well positioned with respect to known gold deposits, such as Semafo's Bantou Project and Semafo and Sarama's Karankasso JV Project, and is within trucking distance to Sarama's South Houndé Project and adjacent to Teranga Gold Corp's Golden Hill Project.

Sarama first carried out initial-stage exploration over the Property in 2011-2012 and successfully identified several clusters of anomalous gold-in-soil values. Peak values of 13.6g/t Au were encountered(6), prompting a reconnaissance drill program of 3,740m RC in two phases. The drill program intersected high-grade mineralisation in several holes with previously reported highlights of:

- 6m @ 1.78g/t Au from surface, and 15m @ 6.17g/t Au from 9m (including 2m @ 38.5g/t Au) in FRC384;

- 2m @ 2.65g/t Au from 58m and 3m @ 3.81g/t Au from 63m in FRC489;

- 4m @ 1.94g/t Au from 48m in FRC385; and

- 15m @ 0.54g/t Au from 86m in FRC386.

Recent field mapping and reconnaissance work at Bamako 2 revealed the establishment of a large artisanal mining camp, which has now opened a block of current workings measuring approximately 3km-long x 2km-wide. The workings have exposed numerous, subparallel gold-bearing quartz veins, extending for over 3km in strike length, trending to the north and northwest (refer Figure 2). These quartz vein trends are coincident with previously identified anomalous gold-in-soil zones.

The quartz veins are located within a wedge of Birimian-aged greenstone rocks which underlie part of the eastern side of the Property and are mostly represented by weakly-foliated and massive mafic volcanic and gabbroic rocks. The quartz veins appear to broadly follow the contacts of the gabbroic intrusion where an increase in foliation intensity is noted. Recent rock-chip sampling of fresh and altered rocks over several campaigns have also been encouraging with assay results including: 18.9g/t Au, 12.5g/t Au, 8.8g/t Au, and 4.5g/t Au from sample sites both within the gabbroic intrusion and in the bounding mafic volcanic unit.

The new reconnaissance drilling, consisting of 21 RC holes (2,000m), primarily targeted 6 discrete locations within the mapped quartz-vein system. In general terms, the drilling intersected quartz-vein material over trend length of approximately 2.5km, confirming that the system is present to some depth below surface.

Of note is the northern-most drilled zone (Mebar Prospect) where drilling intersected 18m @ 1.20g/t Au from 44m (including 2m @ 5.47g/t Au) and 8m @ 18.40g/t Au from 42m (including 1m @ 139g/t Au) in adjacent holes along strike. The elevated grades and the persistence of anomalous grade in sheared rock chip samples within these zones is a potential indicator of a favourable geological setting for mineralisation of significance.

The Company anticipates undertaking further drilling in the Mebar Prospect, as well as in other areas across the Property where high-grade mineralisation has been previously intersected in scout drilling. Further mapping and interpretation of geophysical survey data will be undertaken to fine tune target areas.

For further information on the Company's activities, please contact:

Andrew Dinning or Paul Schmiede

e: [email protected]

t: +61 (0) 8 9363 7600

Figure 1 - Sarama's Principal Property Interests(4) in the Southern Houndé Belt

Figure 2 - Bamako 2 Property, New Drilling and Historical Exploration Highlights

ABOUT SARAMA RESOURCES LTD

Sarama Resources Ltd (TSX-V: SWA) is a West African focused gold explorer and developer with substantial landholdings in south-west Burkina Faso. Sarama is focused on maximising the value of its strategic assets and advancing its key projects towards development.

Sarama's South Houndé and ThreeBee Projects, in which the Company holds a 100% interest(4) , are located within the prolific Houndé Greenstone Belt in south-west Burkina Faso and are the exploration and development focus of the Company. Its exploration programs have successfully discovered an inferred mineral resource of 2.1Moz gold(1) at the South Houndé Project which is complemented by the ThreeBee Project's Bondi Deposit(4) (historical estimate of mineral resources of 0.3Moz Au measured and indicated and 0.1Moz Au inferred(2).

Together, the projects form a cluster of advanced gold deposits, within trucking distance of one another, which potentially offers a development option for a central processing facility fed from multiple sources in the southern Houndé Belt region of Burkina Faso.

Sarama has built further optionality into its portfolio including a 600km² exploration position in the highly prospective Banfora Belt in south-western Burkina Faso. The Koumandara Project hosts several regional-scale structural features and trends of gold-in-soil anomalism extending for over 40km along strike.

Sarama holds approximately 20% participating interest in the Karankasso Project Joint Venture ("JV") which is situated adjacent to the Company's South Houndé Project in Burkina Faso and is a JV between Sarama and Semafo. Semafo is the operator of the JV, having acquired the previous operator, Savary Gold Corp. ("Savary"). In October 2015, Savary declared a maiden inferred mineral resource estimate of 671,000 ounces of contained gold(3) at the Karankasso Project JV.

The Company's Board and management team have a proven track record in Africa and a strong history in the discovery and development of large-scale gold deposits. Sarama is well positioned to build on its current success with a sound strategy to surface and maximise the value of its property portfolio.

FOOTNOTES

1. South Houndé Project - 43.0Mt @ 1.5g/t Au (reported above cut-off grades ranging 0.3-2.2g/t Au, reflecting the mining methods and processing flowsheets assumed to assess the likelihood of the inferred mineral resources having reasonable prospects for eventual economic extraction). This mineral resource contains an oxide and transition component of 16.0Mt @ 1.2g/t Au for 611koz Au (reported at a cut-off grade of 0.3g/t Au for oxide and 0.8g/t Au for transition material). The effective date of the Company's inferred mineral resource estimate is February 4, 2016. For further information regarding the mineral resource estimate please refer to the technical report titled "NI 43-101 Independent Technical Report South Houndé Project Update, Bougouriba and Ioba Provinces, Burkina Faso", dated March 31, 2016 and prepared by Adrian Shepherd. Adrian Shepherd is an employee of Cube Consulting Pty Ltd and is independent of Sarama. The technical report is available under Sarama's profile on SEDAR at www.sedar.com

2. Bondi Deposit - 4.1Mt @ 2.1g/t Au for 282,000oz Au (measured and indicated) and 2.5Mt @ 1.8g/t Au for 149,700oz Au (inferred), reported at a 0.5 g/t Au cut-off.

i. The historical estimate of the Bondi Deposit reflects a mineral resource estimate compiled by Orezone Gold Corporation ("Orezone") which has an effective date of February 20, 2009. The historical estimate is contained in a technical report titled "Technical Report on the Mineral Resource of the Bondigui Gold Project", dated date of February 20, 2009 and prepared by Yves Buro (the "Bondi Technical Report"). Yves Buro is an employee of Met-Chem Canada Inc and is independent of Orezone and Sarama. The technical report is available under Orezone's profile on SEDAR at www.sedar.com

ii. Sarama believes that the historical estimate is relevant to investors' understanding of the property, as it reflects the most recent technical work undertaken in respect of the Bondi Deposit.

iii. The historical estimate was informed by 886 drillholes, assayed for gold by cyanidation methods, were used to interpret mineralised envelopes and geological zones over the area of the historical estimate. Gold grade interpolation was undertaken using ID² methodology based on input parameters derived from geostatistical and geological analyses assessments. Field measurements and geological logging of drillholes were used to determine weathering boundaries and bulk densities for modelled blocks.

iv. The historical estimate uses the mineral resource reporting categories required under National Instrument 43-101.

v. No more recent estimates of the mineral resource or other data are available.

vi. Sarama is currently undertaking the necessary verification work in the field and on the desktop that may support the future reclassification of the historical estimate to a mineral resource.

vii. A qualified person engaged by Sarama has not undertaken sufficient work to verify the historical estimate as a current mineral resource and Sarama is therefore not treating the historical estimate as a current mineral resource.

3. Karankasso Project - 9.2Mt @ 2.3g/t Au (at a 0.5g/t Au cut-off). The effective date ("Effective Date") of the most recent Karankasso Project JV mineral resource estimate that is supported by a technical report is October 7, 2015. For further information regarding that mineral resource estimate please refer to the technical report titled "Technical Report and Resource Estimate on the Karankasso Project, Burkina Faso", dated October 7, 2015 and prepared by Eugene Puritch and Antoine Yassa. Eugene Puritch and Antoine Yassa are employees of P&E Mining Consultants Inc. and are independent of Savary and Sarama. The technical report is available under Savary's profile on SEDAR at www.sedar.com Sarama has not independently verified Savary's mineral resource estimate and takes no responsibility for its accuracy. Semafo is the operator of the Karankasso Project JV and Sarama is relying on their Qualified Persons' assurance of the validity of the mineral resource estimate. Additional technical work has been undertaken on the Karankasso Project since the Effective Date, including but not limited to, metallurgical testwork, exploration drilling and mineral resource estimation, but Sarama is not in a position to quantify the impact of this additional work on the mineral resource estimate referred to above.

4. The ThreeBee Project comprises the Djarkadougou, Botoro, Bamako 2(5) and Nakar (formerly Bouni)(5) Properties and Sarama has, or is entitled to have, a 100% interest in each of the properties. The Djarkadougou Exploration Permit which was originally issued to Orezone in 2006, subsequently renewed every three years thereafter and transferred to Sarama in 2016 without restriction or encumbrance, is going through a process with the government of Burkina Faso where it is required to be re-issued as a new full-term exploration permit. The Company is in on-going discussion with senior government officials regarding certain impediments to the re-issue of the Exploration Permit and anticipates these discussions will be completed in due course, though there can be no assurance that the process will be successfully completed on a timely basis, or at all.

5. For further information regarding the drilling on the Bamako 2 (formerly Bamako) and Nakar (formerly Bouni) Properties, please refer to the technical report titled "NI 43-101 Independent Technical Report South Houndé Project Update, Bougouriba and Ioba Provinces, Burkina Faso", dated October 28, 2013 and prepared by Adrian Shepherd. Adrian Shepherd is an employee of Cube Consulting Pty Ltd and is considered independent of Sarama. The technical report is available under Sarama's profile on SEDAR at www.sedar.com

6. Gridded soil geochemistry program sampling on partial property conducted in 2012 over two phases - 1st phase consisted of sampling on 400m (N-S) x 100m (E-W) centres and a subsequent infill phase consisted of sampling on 100m (N-S) x 50m (E-W). A total of 3,536 samples were assayed, returning a peak value of 13,575ppb Au, a mean of 36ppb Au and a 98th percentile of 179ppb Au.

NOTES -DRILLING

Drilling results are quoted as downhole intersections. The orientation of the mineralised units is not yet well understood and true widths of mineralisation are unknown.

The reported composites for the drilling were determined using a cut-off grade of 0.30g/t Au to select significant and anomalous intersections, with a maximum of 2m internal dilution being incorporated into the composite where appropriate. No top-cuts were applied to assay grades. Isolated mineralised intersections less than 2m in length have not been reported.

Gold assays for the drilling were undertaken by the ALS laboratory in Ouagadougou, Burkina Faso. Assays are determined by fire assay methods using a 50 gram charge, lead collection and an AAS finish with lower detection limits of 0.01g/t Au.

The drilling was generally designed using a range of azimuths, according to program aims and mineralization orientation, dipping at approximately -50-55° and were 100m in length. Holes were spaced at various intervals according to targeting intent. RC holes where sampled, were sampled at using regular 1m downhole intervals.

All holes were drilled from oxide material (heavily weathered and weathered material) through transition material and into fresh rock. Indicative oxidation states are quoted for each significant intersection.

Sarama undertook geological sampling and assays in accordance with quality assurance/quality control program which includes the use of certified reference materials as well as field duplicates.

For further information regarding the Company's QAQC protocols please refer to the technical report titled "NI 43-101 Independent Technical Report, South Houndé Project Update, Bougouriba and Ioba Provinces, Burkina Faso", dated March 31, 2016. The technical report is available under the Company's profile on SEDAR at www.sedar.com.

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Information in this disclosure that is not a statement of historical fact constitutes forward-looking information. Such forward-looking information includes statements regarding the potential for the Bamako 2 Property to host mineralization of economic significance, any potential development of a central processing facility as part of regional project development, the potential for the receipt of regulatory approvals, the potential of the projects to host mineralization of significance to support regional development plans, the timing and prospects for the re-issuance of the Djarkadougou Exploration Permit by the Government of Burkina Faso, plans for exploration and development at the South Houndé and ThreeBee Projects, the potential to expand the present oxide component of the existing estimated mineral resources at the South Houndé Project and the reliability of the historical estimate of mineral resources at the Bondi Deposit. Forward-looking information regarding potential development plans in the southern Houndé belt may be adversely affected in terms of size, economics and timing for development and require reconfiguring should the Government of Burkina Faso not re-issue the Djarkadougou Exploration Permit.

Actual results, performance or achievements of the Company may vary from the results suggested by such forward-looking statements due to known and unknown risks, uncertainties and other factors. Such factors include, among others, that the business of exploration for gold and other precious minerals involves a high degree of risk and is highly speculative in nature; Mineral Resources are not Mineral Reserves, they do not have demonstrated economic viability, and there is no certainty that they can be upgraded to Mineral Reserves through continued exploration; few properties that are explored are ultimately developed into producing mines; geological factors; the actual results of current and future exploration; changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents. There can be no assurance that any mineralisation that is discovered will be proven to be economic, or that future required regulatory licensing or approvals will be obtained. However, the Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company's ability to carry on its exploration activities, the sufficiency of funding, the timely receipt of required approvals, the price of gold and other precious metals, that the Company will not be affected by adverse political events, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain further financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information.

Sarama does not undertake to update any forward-looking information, except as required by applicable laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

QUALIFIED PERSONS' STATEMENT

Scientific or technical information in this disclosure that relates to exploration activities on the Company's properties in Burkina Faso is based on information compiled or approved by Guy Scherrer. Guy Scherrer is an employee of Sarama Resources Ltd and is a member in good standing of the Ordre des Géologues du Québec and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Guy Scherrer consents to the inclusion in this disclosure of the information, in the form and context in which it appears.

Scientific or technical information in this disclosure that relates to the preparation of the South Houndé Project mineral resource estimate is based on information compiled or approved by Adrian Shepherd. Adrian Shepherd is an employee of Cube Consulting Pty Ltd and is independent of Sarama Resources Ltd. Adrian Shepherd is a Chartered Professional Member in good standing of the Australasian Institute of Mining and Metallurgy and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Adrian Shepherd consents to the inclusion in this disclosure of the information, in the form and context in which it appears.

Scientific or technical information in this disclosure, in respect of the Bondi Deposit relating to mineral resource and exploration information drawn from the Technical Report prepared for Orezone on that deposit has been approved by Guy Scherrer. Guy Scherrer is an employee of Sarama Resources Ltd and is a member in good standing of the Ordre des Géologues du Québec and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Guy Scherrer consents to the inclusion in this disclosure of the information, in the form and context in which it appears.

Scientific or technical information in this disclosure that relates to the quotation of the Karankasso Project's mineral resource estimate is based on information compiled by Paul Schmiede. Paul Schmiede is an employee of Sarama Resources Ltd and is a Fellow in good standing of the Australasian Institute of Mining and Metallurgy. Paul Schmiede has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Paul Schmiede consents to the inclusion in this disclosure of the information, in the form and context in which it appears. Paul Schmiede and Sarama have not independently verified Savary's mineral resource estimate and take no responsibility for its accuracy.

APPENDIX A - BAMAKO 2 DRILLING

|

Location |

Hole |

Hole |

Downhole |

Intersection |

Depth |

Depth |

Dip |

Azimuth |

Hole |

|

BAMAKO 2 |

BAR001 |

RC |

2m @ 1.83 g/t Au |

100% Fresh |

20 |

22 |

-54 |

272 |

100 |

|

BAMAKO 2 |

BAR002 |

RC |

no significant intersections |

0 |

100 |

-54 |

272 |

100 |

|

|

BAMAKO 2 |

BAR003 |

RC |

3m @ 0.71 g/t Au |

100% Fresh |

37 |

40 |

-50 |

92 |

100 |

|

BAMAKO 2 |

BAR003 |

18m @ 1.20 g/t Au |

100% Fresh |

44 |

62 |

||||

|

incl. 2m @ 5.47g/t Au from 56m |

|||||||||

|

BAMAKO 2 |

BAR004 |

RC |

2m @ 0.53 g/t Au |

100% Fresh |

35 |

37 |

-49 |

91 |

100 |

|

BAMAKO 2 |

BAR004 |

8m @ 18.40 g/t Au |

100% Fresh |

42 |

50 |

||||

|

incl. 1m @ 139g/t Au from 45m |

|||||||||

|

BAMAKO 2 |

BAR005 |

RC |

2m @ 0.44 g/t Au |

100% Fresh |

72 |

74 |

-49 |

89 |

100 |

|

BAMAKO 2 |

BAR006 |

RC |

2m @ 0.91 g/t Au |

100% Fresh |

66 |

68 |

-50 |

93 |

100 |

|

BAMAKO 2 |

BAR006 |

4m @ 0.82 g/t Au |

100% Fresh |

94 |

98 |

||||

|

BAMAKO 2 |

BAR007 |

RC |

12m @ 0.99 g/t Au |

100% Fresh |

32 |

44 |

-55 |

269 |

100 |

|

incl. 1m @ 6.94g/t Au from 39m |

|||||||||

|

BAMAKO 2 |

BAR008 |

RC |

no significant intersections |

0 |

100 |

-49 |

273 |

100 |

|

|

BAMAKO 2 |

BAR009 |

RC |

no significant intersections |

0 |

100 |

-52 |

269 |

100 |

|

|

BAMAKO 2 |

BAR010 |

RC |

6m @ 0.41 g/t Au |

100% Trans |

19 |

25 |

-48 |

270 |

100 |

|

BAMAKO 2 |

BAR011 |

RC |

no significant intersections |

0 |

100 |

-50 |

272 |

100 |

|

|

BAMAKO 2 |

BAR012 |

RC |

no significant intersections |

0 |

100 |

-51 |

270 |

100 |

|

|

BAMAKO 2 |

BAR013 |

RC |

4m @ 0.34 g/t Au |

100% Fresh |

34 |

38 |

-52 |

269 |

100 |

|

BAMAKO 2 |

BAR014 |

RC |

no significant intersections |

0 |

100 |

-49 |

271 |

100 |

|

|

BAMAKO 2 |

BAR015 |

RC |

no significant intersections |

0 |

100 |

-52 |

231 |

100 |

|

|

BAMAKO 2 |

BAR016 |

RC |

2m @ 1.33 g/t Au |

100% Fresh |

42 |

44 |

-47 |

230 |

100 |

|

BAMAKO 2 |

BAR017 |

RC |

no significant intersections |

0 |

100 |

-49 |

270 |

100 |

|

|

BAMAKO 2 |

BAR018 |

RC |

no significant intersections |

0 |

40 |

-49 |

225 |

40 |

|

|

BAMAKO 2 |

BAR019 |

RC |

no significant intersections |

0 |

60 |

-55 |

226 |

60 |

|

|

BAMAKO 2 |

BAR020 |

RC |

2m @ 0.42 g/t Au |

100% Fresh |

12 |

14 |

-55 |

90 |

100 |

|

BAMAKO 2 |

BAR021 |

RC |

no significant intersections |

0 |

100 |

-54 |

92 |

100 |

|

SOURCE: Sarama Resources Ltd.