LAKEWOOD, CO / ACCESSWIRE / February 18, 2020 / General Moly, Inc. (General Moly or the "Company") (NYSE:GMO)(TSX:GMO), the only western-exchange listed, pure-play molybdenum ("moly") mineral development company, announced that molybdenum ("moly") spot prices have outperformed the vast majority of metal and energy commodities so far in 2020. The current weekly moly price per pound of $10.65 increased 11% in the past month, 16% year to date, and recovered 29% from the low seen in 4Q 2019, according to Platts' prices.

While most metals and energy prices have declined in the past month in the face of the coronavirus ("COVID-19") outbreak in China and the associated global health threat's potential impact on demand, moly has been a bright spot that BMO Global Commodities Research noted as bucking the broad commodities' downtrend. Other non-agricultural commodities bucking the trend include vanadium, thermal coal and gold. "One market we always look to as a guide to underlying physical conditions is molybdenum. This is a commodity where the financial market has no real ability to influence price," BMO research stated on February 7, 2020.

During 2019, moly prices averaged $11.34 per pound ("lb")and were range bound between a high of $12.70 per pound in March to a softening in late 2019, down to $8.28 per pound.

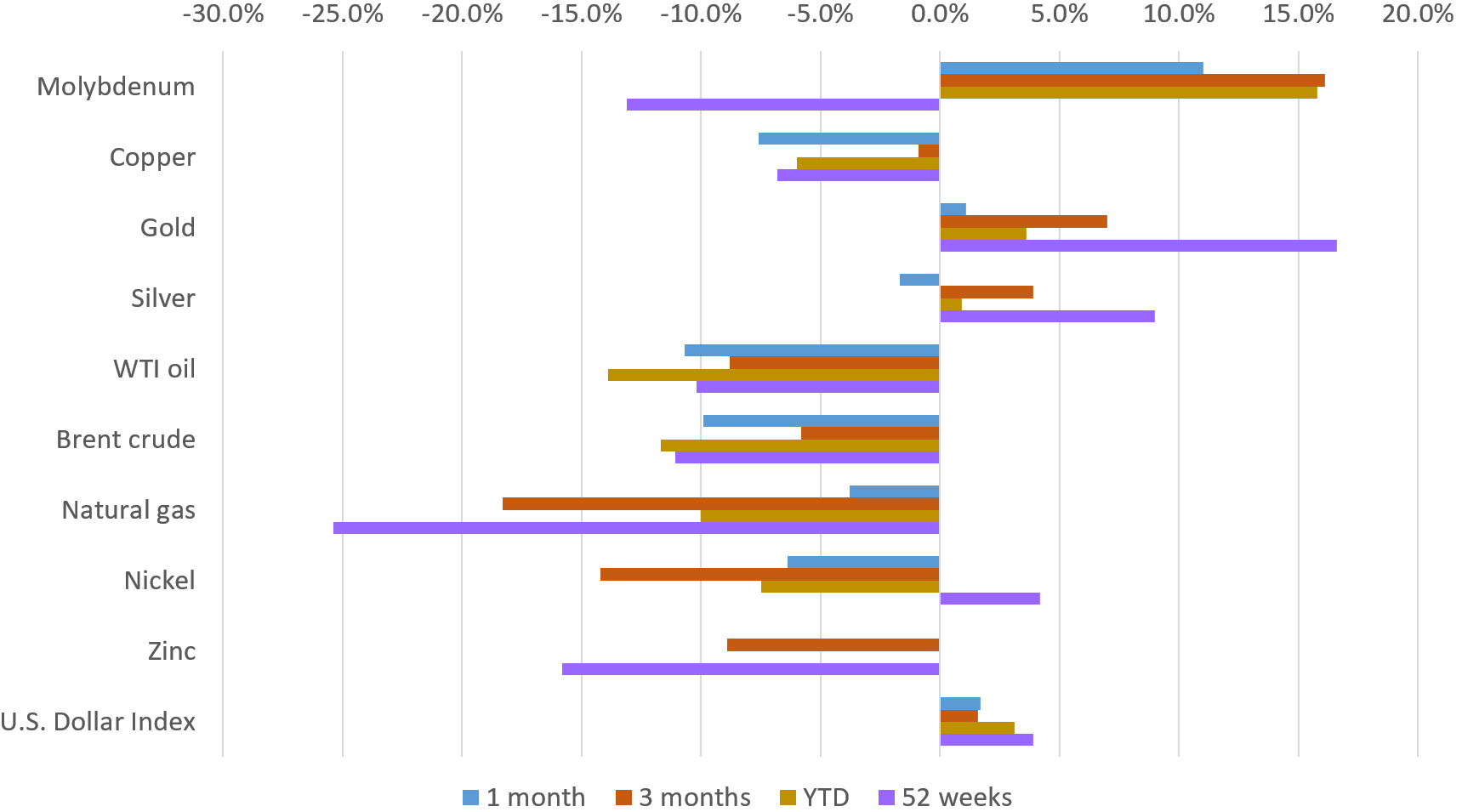

Chart 1: Moly Compared with Commodities and US Dollar Performance

Source: All except for moly, relies on BarChart.com using March 2020 or April 2020 contracts on Nymex, Comex or LME, and using ICE for the US dollar index. Moly performance was derived from Platts' prices.

Robust Moly Fundamentals for 2020

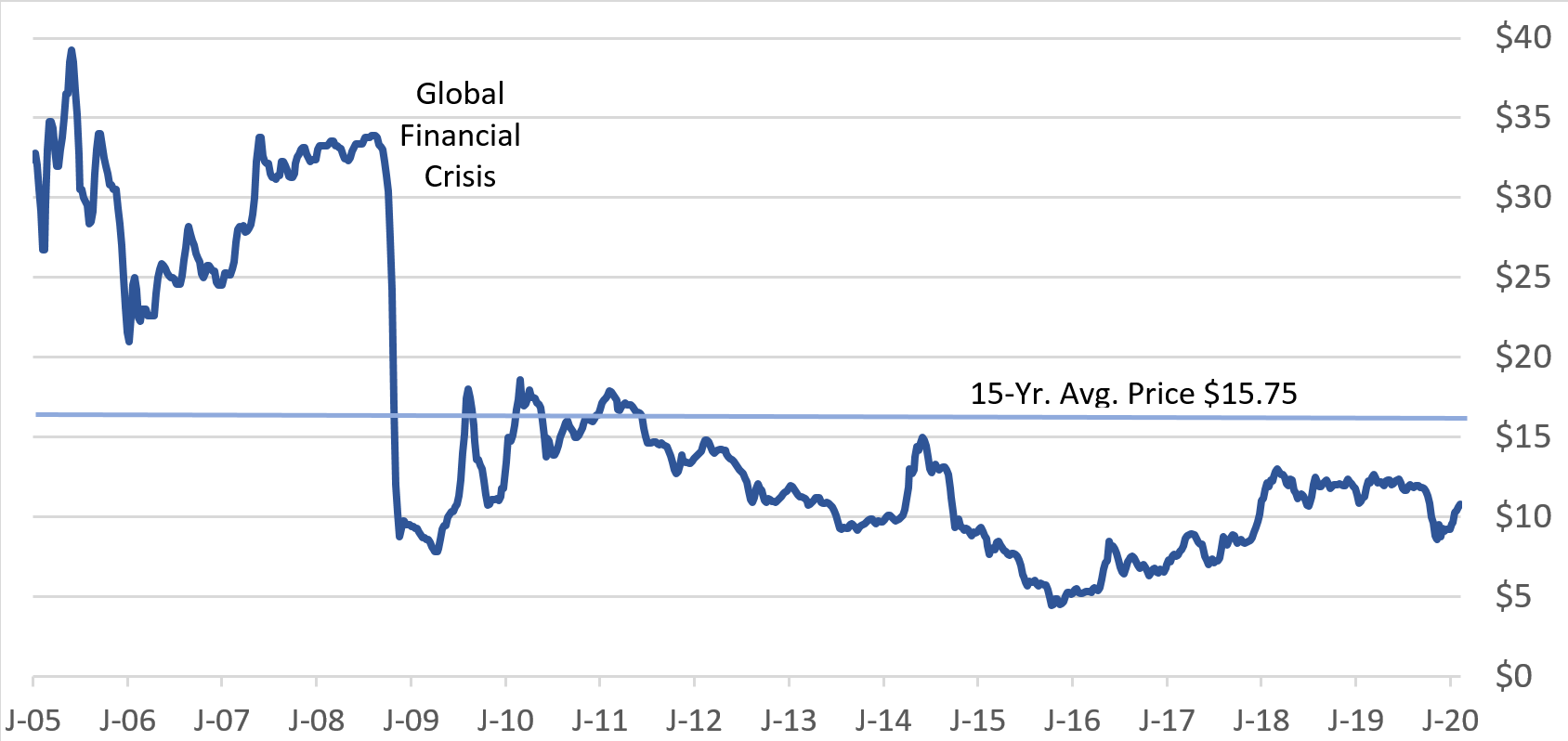

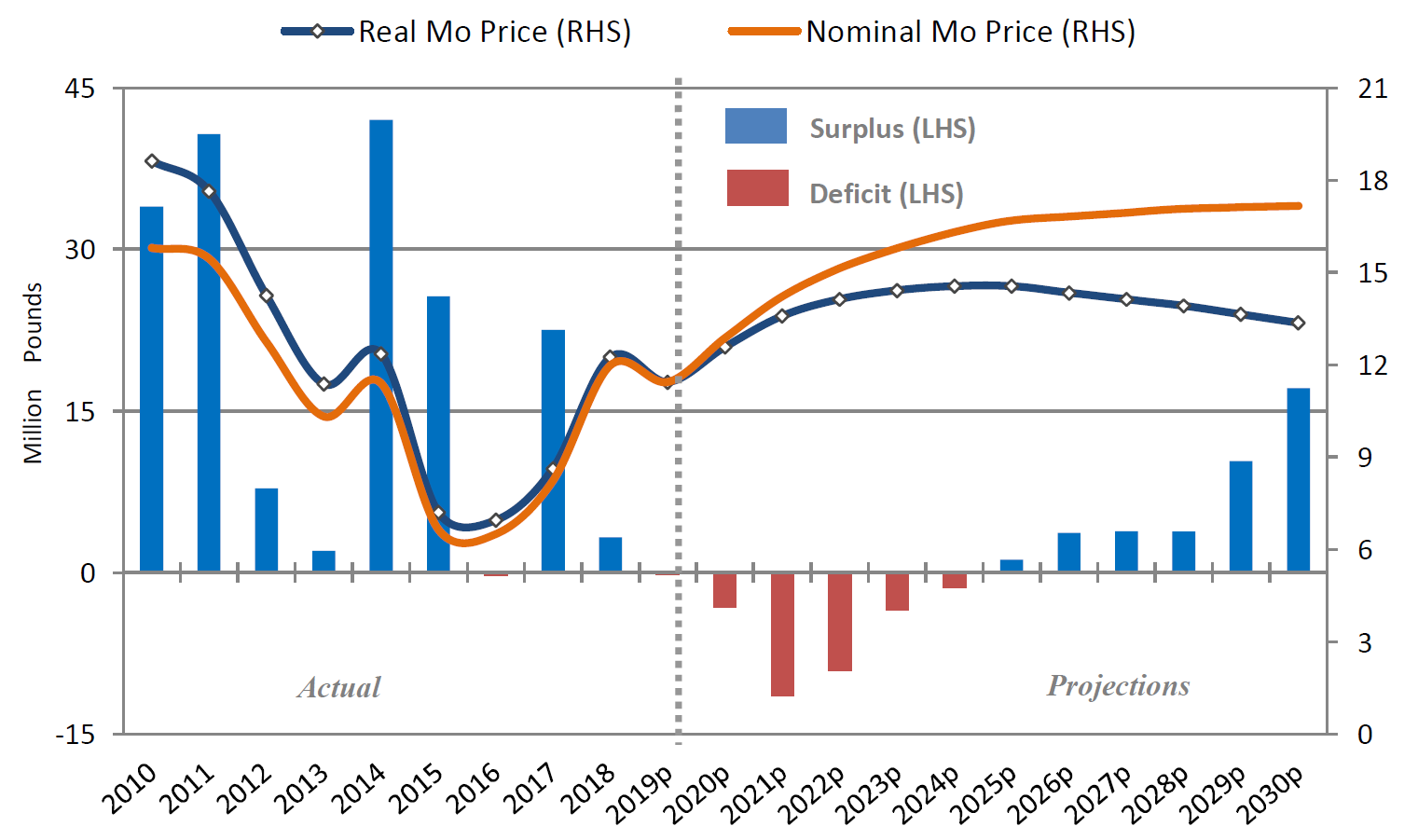

Bruce D. Hansen, Chief Executive Officer of General Moly, commented, "Moly prices have been generally resilient. For 2020, the CPM Group ("CPM") estimates an average moly real price of $12.58 per lb and nominal price of $12.87 per lb (using a base of 2019), surpassing the look-back10-year average of approximately $11.00. CPM projects that with a structural supply deficit deepening, the real price per pound is estimated to rise to an average $14.25 and a nominal price of $15.63 for the five-year period, 2021-2025. This is compared with the look- back 15‑year average price is $15.75 per lb.

"CPM currently anticipates that overall moly supply in 2019 was flat compared with 2018 with a shortfall projected in 2020, and the sharpest shortfall in 2021, as shown in Chart 3 below. CPM also has noted the shortage of new moly production in the global pipeline of projects, whether from primary sources or new copper by-product mines."

Mr. Hansen continued, "In conjunction with an anticipated strengthening of moly market fundamentals, our Company and our financial advisors are pursuing strategic alternatives to realize the enhanced value of our fully-permitted 80%-owned Mt. Hope moly project in Nevada, including seeking project financing to develop this next generation, world-class moly mine."

As moly production reported by companies and governments is updated for the full year 2019, CPM anticipates flatlining moly production in 2019 driven by falling by-product production from Chilean copper producers, including Codelco and the Sierra Gorda mine, and an approximately 5% year-over-year decline in largely primary production from Freeport McMoRan, the largest western moly producer. Such decreases will offset higher production from Bingham Canyon mine in Utah, Zangezur mine in Armenia and a slight increase in Chinese primary production in 2019. Further details about the moly market are also available in the Company's January 21, 2020 news release.

China factors into both sides of the moly supply and demand equation as it is both the largest producer and consumer of moly. Curtailment of transportation and suspension of many business operations in China may temporarily disrupt the moly market, with potential positive or negative implications to prices.

CPM also projects average real price of $13.88 and nominal price of $17.02 for 2026-2030. CPM is a metals research, econometrics, and consulting firm based in New York.

Chart 2: Weekly Moly Prices from January 6, 2005 to February 14, 2020

Source: Platts data.

Chart 3: Moly Supply and Demand Balance and Prices to 2030

Source: CPM.

About General Moly

General Moly is a U.S.-based, molybdenum mineral exploration and development company listed on the NYSE American, previously known as the NYSE MKT and former American Stock Exchange, and the Toronto Stock Exchange under the symbol GMO. The Company's primary asset, an 80% interest in the Mt. Hope Project located in central Nevada, is considered one of the world's largest and highest grade molybdenum deposits. Combined with the Company's wholly-owned Liberty Project, a molybdenum and copper property also located in central Nevada, General Moly's goal is to become the largest primary molybdenum producer in the world.

Molybdenum is a metallic element used primarily as an alloy agent in steel manufacturing. When added to steel, molybdenum enhances steel strength, resistance to corrosion and extreme temperature performance. In the chemical and petrochemical industries, molybdenum is used in catalysts, especially for cleaner burning fuels by removing sulfur from liquid fuels, and in corrosion inhibitors, high performance lubricants and polymers.

Contact:

Scott Roswell

(303) 928-8591

[email protected]

Website: www.generalmoly.com

Forward-Looking Statements

Statements herein that are not historical facts are "forward-looking statements" within the meaning of Section 27A of the Securities Act, as amended and Section 21E of the Securities Exchange Act of 1934, as amended and are intended to be covered by the safe harbor created by such sections. Such forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, expected, or implied by the Company. These risks and uncertainties include, but are not limited to availability of cash to continue ongoing operations, availability of insurance, metals price and production volatility, global economic conditions, currency fluctuations, increased production costs and variances in ore grade or recovery rates from those assumed in mining plans, exploration risks and results, reclamation risks, political, operational and project development risks, ability to maintain required federal and state permits to continue construction, and commence production of molybdenum, copper, silver, lead or zinc, ability to identify any economic mineral reserves of copper, silver, lead or zinc; ability of the Company to obtain approval of its joint venture partner at the Mt. Hope Project in order to mine for molybdenum, copper, silver, lead or zinc, ability to raise required project financing or funding to pursue an exploration program related to potential copper, silver lead or zinc deposits at Mt. Hope, ability to respond to adverse governmental regulation and judicial outcomes, and ability to maintain and /or adjust estimates related to cost of production, capital, operating and exploration expenditures. For a detailed discussion of risks and other factors that may impact these forward looking statements, please refer to the Risk Factors and other discussion contained in the Company's quarterly and annual periodic reports on Forms 10-Q and 10-K, on file with the SEC. The Company undertakes no obligation to update forward-looking statements.

SOURCE: General Moly, Inc.