VANCOUVER, BC / ACCESSWIRE / April 16, 2020 / Group Ten Metals Inc. (TSX.V:PGE; OTCQB:PGEZF; FSE:5D32) (the "Company" or "Group Ten") is pleased to announce 2019 exploration results from the Chrome Mountain and East Boulder target areas at the Company's flagship Stillwater West Platinum Group Element ("PGE")-Ni-Cu Project in Montana, USA.

This is the third in a series of planned news releases to report results of 2019 exploration programs which focused on the advancement of drill-defined mineralized zones at five priority target areas. Subsequent news releases will report results from mapping and surface sampling programs completed in 2019, plus ongoing modelling work, and rhodium assays from drill and field samples.

Work in 2019 at Chrome Mountain and East Boulder included re-logging and re-assaying of drill core along with surface sampling and mapping programs. The aim of this work is to advance 3D modelling of drill-defined mineralization, at the Hybrid Unit, toward delineation of a mineral resource, and to refine early-stage targets for first drill testing.

Highlights include:

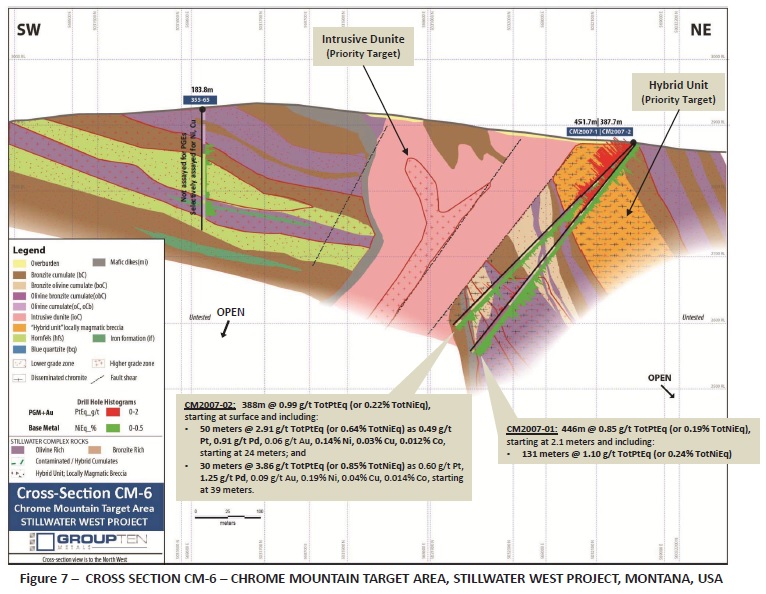

- 388 meters of 1.0 g/t Total Platinum Equivalent ("TotPtEq"), or 0.22% Total Nickel Equivalent ("TotNiEq"), starting at surface, including 30 meters of 3.86 g/t TotPtEq, or 0.85% TotNiEq (0.60 g/t Pt, 1.25 g/t Pd, and 0.19% Ni, plus Au, Cu, and Co values), starting at 39 meters in hole CM-2007-02 at the Hybrid Unit;

- 243 meters of 1.62 g/t TotPtEq or 0.35% TotNiEq in hole CM-2007-04, starting at surface, and including 118 meters of 2.15 g/t TotPtEq or 0.47% TotNiEq with multiple intervals rich in PGEs:

- 18 meters of 0.52 g/t Pt, 0.91 g/t Pd and 0.16% Ni, plus Au, Cu, and Co values for 3.12 g/t TotPtEq (or 0.68% TotNiEq), starting at 34 meters;

- 30 meters of 0.55 g/t Pt, 0.96 g/t Pd and 0.13% Ni, plus Au, Cu, and Co values for 3.07 g/t TotPtEq (or 0.67% TotNiEq), starting at 77 meters;

- 7 meters of 0.88 g/t Pt, 1.76 g/t Pd, and 0.15% Ni, plus Au, Cu, and Co values, for 4.85 g/t TotPtEq, or 1.06% TotNiEq, starting at 88 meters;

- 7.3 meters of 0.83 g/t Pt, 1.54 g/t Pd, and 0.12% Ni, plus Au, Cu, and Co values, for 4.25 g/t TotPtEq, or 0.93% TotNiEq, starting at 171 meters;

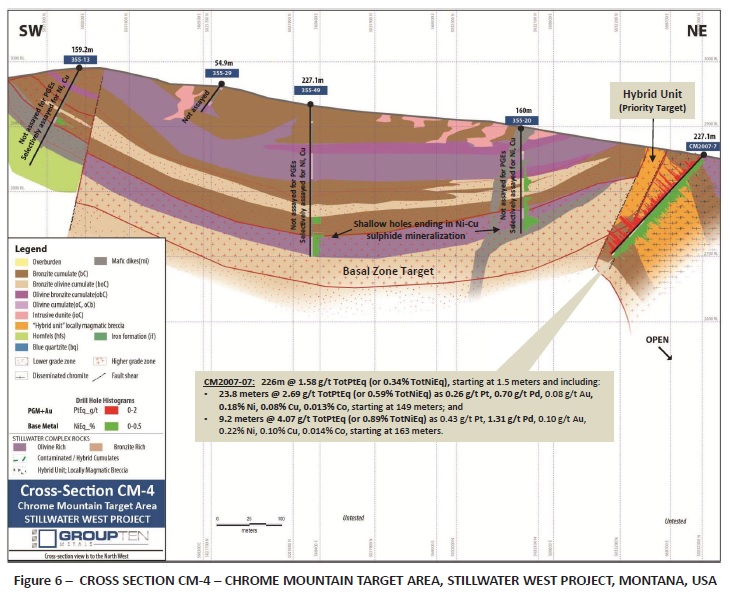

- 226 meters of 1.58 g/t TotPtEq or 0.34% TotNiEq starting at surface, including 24 meters of 2.69 g/t TotPtEq or 0.59% TotNiEq in hole CM-2007-07;

- 210 meters of 1.64 g/t TotPtEq or 0.36% TotNiEq starting at surface, including 20 meters of 2.78 g/t TotPtEq or 0.61% TotNiEq in hole CM-2007-08;

- Re-logging and re-assaying of past core in the early-stage East Boulder target area confirmed the presence of significant PGE-Ni-Cu-Co mineralization two kilometers east of the Hybrid Unit; and

- 3D modelling is now underway to guide priority drilling planned for 2020 at Chrome Mountain.

Michael Rowley, President and CEO, commented, "Results from our 2019 programs have successfully advanced the Hybrid Unit in the Chrome Mountain target area towards delineation of a maiden resource with multiple very wide intervals returning greater than one gram-per-tonne palladium, platinum and gold starting from surface. This is the third target tested at Stillwater West to show ‘Platreef-style' bulk tonnage PGE-Ni-Cu-Co mineralization over hundreds of meters in thickness, placing them alongside our results from the Iron Mountain and Camp target areas as being some of the thickest mineralized intercepts ever recorded in the Stillwater Complex. Our work at the neighboring early-stage East Boulder target area has also confirmed the presence of wide intervals of nickel and copper sulphide mineralization, enriched in palladium, platinum, gold and cobalt, two kilometers east of the Hybrid Unit along the corresponding target stratigraphy that traverses the 25-kilometer-wide Stillwater West project. Our work is identifying a very large-scale mineralized system in the lower Stillwater Complex, with results that are comparable to the style of mineralization found in the Platreef of South Africa's Bushveld Complex, host to some of the world's largest nickel-copper sulphide hosted PGE mines. We look forward to reporting additional results from our 2019 program in the coming weeks along with our plans for 2020."

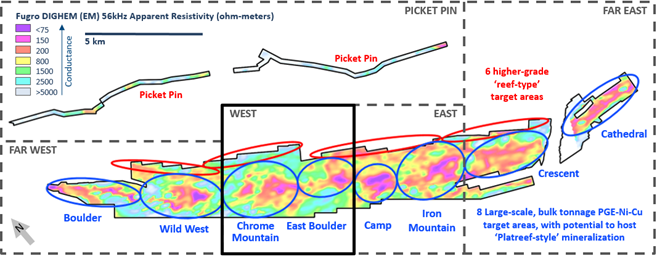

Chrome Mountain and East Boulder

Mineralization at Chrome Mountain and East Boulder sits stratigraphically below the world-class J-M Reef deposit, located adjacent to the Stillwater West project, now being mined by Sibanye-Stillwater. As shown in Figure 1, below, the lower Stillwater Complex stratigraphy continues across Group Ten's 25-kilometer-wide property, hosting a total of eight multi-kilometer-scale target areas that have been identified as having potential for large-scale deposits of nickel and copper sulphide enriched in palladium, platinum, rhodium, gold and cobalt.

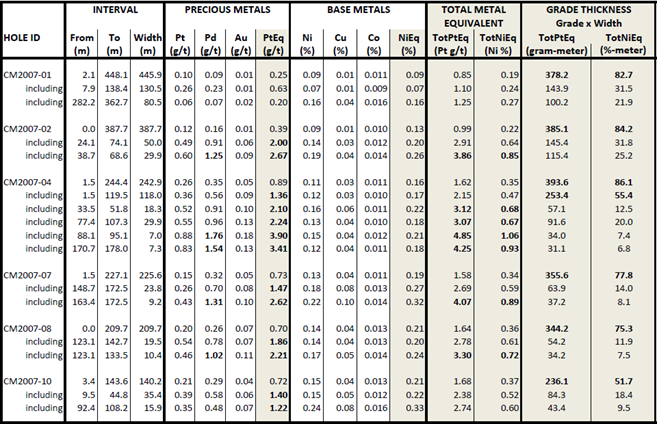

TABLE 1 - Highlight Drill Intercepts from the Discovery Target in the Hybrid Unit at Chrome Mountain

Highlight intercepts with grade-thickness values over 25 gram-meter TotPtEq are presented above. Total Platinum Equivalent (TotPtEq g/t) and Total Nickel Equivalent (TotNiEq %) calculations reflect total gross metal content using metals prices as follows (all USD): $6.00/lb nickel (Ni), $3.00/lb copper (Cu), $20.00/lb cobalt (Co), $900/oz platinum (Pt), $1,400/oz palladium (Pd), and $1,400/oz gold (Au). Values have not been adjusted to reflect metallurgical recoveries. Total metal equivalent values include both base and precious metals. Total platinum equivalent grade-thickness was determined by multiplying the thickness (in meters) by the Total Platinum Equivalent grade (in grams/tonne) to provide gram-meter values (g-m) as shown. Total nickel equivalent grade-thickness was determined by multiplying the thickness (in meters) by the Total Nickel Equivalent grade (in percent) to provide percent-meter values as shown. Grade-thickness values have been determined across continuously mineralized intervals. Nickel equivalent values may be converted to copper equivalent values by multiplying the NiEq value by the price ratio of the two (ie times two per the above prices), such that 0.5% NiEq equates to 1.0% CuEq. Platinum equivalent has been used based on the historic values of platinum and palladium. Platinum equivalent values may be converted to palladium equivalent values by multiplying the PtEq value by the price ratio of the two (ie times 0.64 per the above prices), such that 1 g/t PtEq equates to 0.64 g/t PdEq. Intervals are reported as drilled widths and are believed to be representative of true widths. All holes were conducted by Group Ten's QP and are not considered historic.

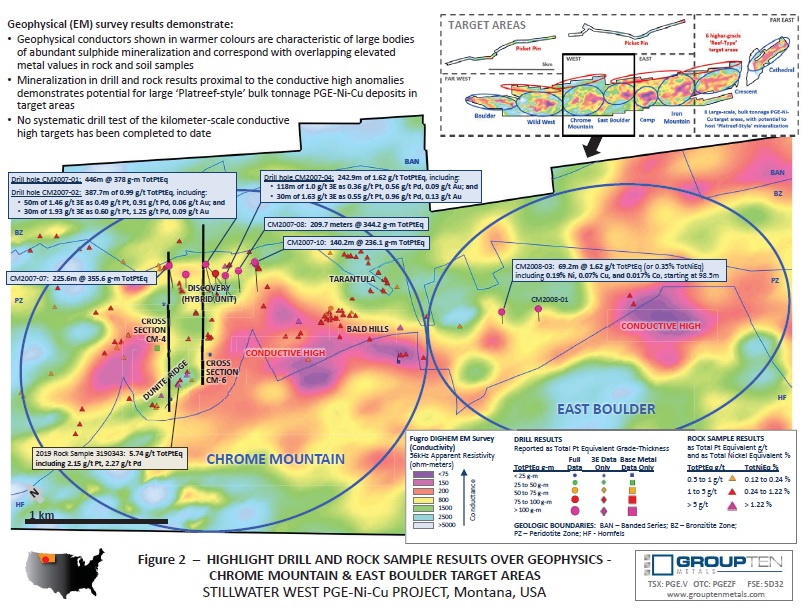

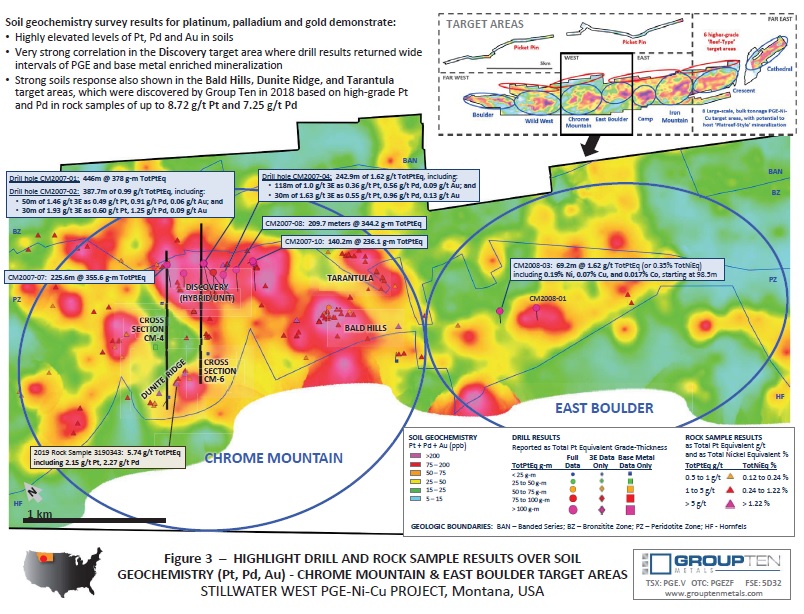

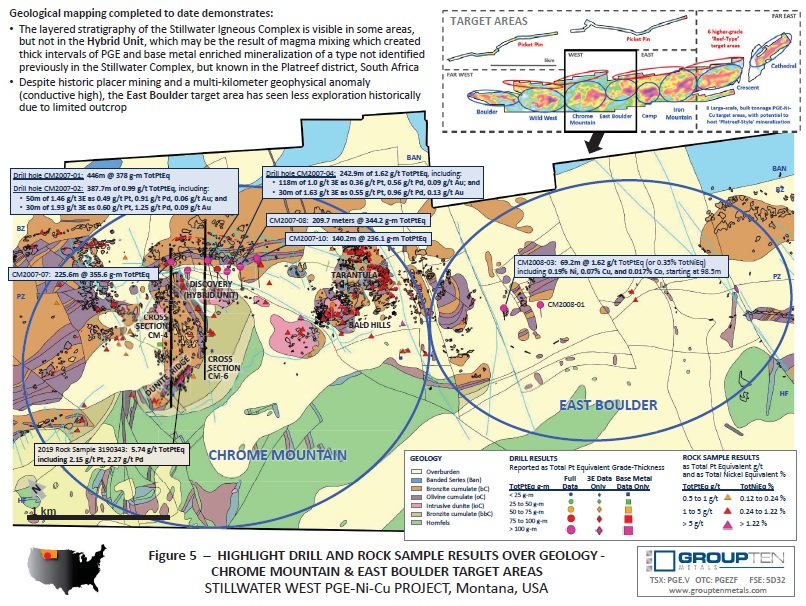

Figures 2 to 7 present the Chrome Mountain and East Boulder target areas, including cross-sections representing the Company's current understanding of the Hybrid Unit and surrounding stratigraphy.

FIGURE 1 - Main Target Areas Across the 25-Kilometer Width of the Stillwater West Project

Group Ten has completed initial 3D modelling of historic drill data, complemented by the Company's 2019 programs, at five of the eight target areas and is now working to define maiden mineral resources at the three most advanced of these areas, including the Hybrid Unit at Chrome Mountain.

Historic sampling has indicated that the PGE mineralization at Stillwater West also includes the rare PGE rhodium along with palladium, platinum and gold. The Stillwater Complex is one of very few locations globally that hosts significant rhodium mineralization. The Company is completing final analysis of rhodium assays from rock and drill samples at several target areas, with results anticipated in the near future.

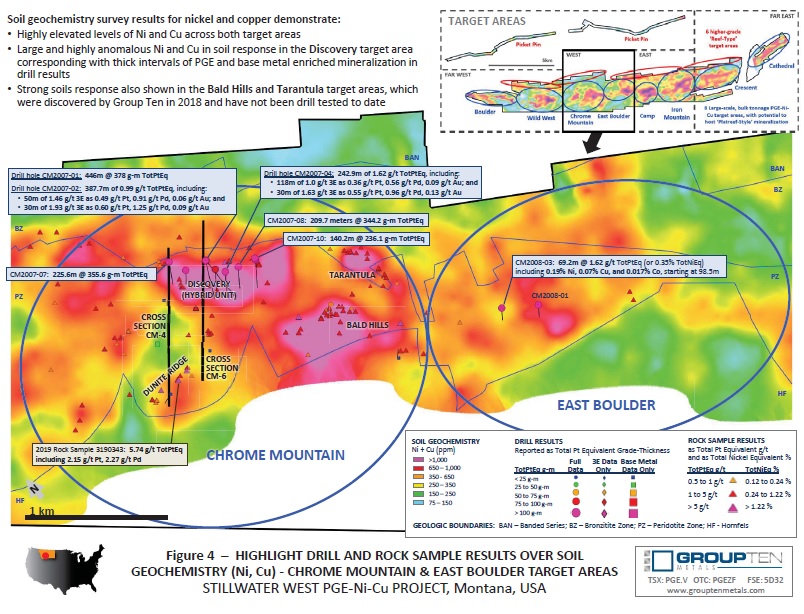

Chrome Mountain - Hybrid Unit

Mineralization at the Hybrid Unit is presently defined by ten drill holes at the Discovery target that delineate a mineralized zone of a type not identified previously in the Stillwater Complex, but known at the Platreef in South Africa's Bushveld Complex (see December 17, 2018 and February 21, 2019 news releases). These six holes returned composite mineralization of 200 to 450 meters in thickness that has been tested to approximately 300 meters vertical depth and occurs over a strike length of approximately 700 meters. Mineralization remains open in all directions and occurs within a broader approximately two-kilometer-wide area of highly anomalous metals in soils (see Figures 3 and 4).

Work at the Discovery target in 2019 focused on re-logging and re-assaying of 11 past drill holes to bring them into the developing block model and define the scale of the mineralized system. These holes were primarily targeted on highly elevated platinum and palladium values in soils.

Chrome Mountain - Dunite Ridge and Bald Hills Targets

Work by Group Ten has identified several intrusive dunite targets across the Stillwater West project, including the Dunite Ridge and Bald Hills targets. Intrusive dunites are well documented in the Bushveld Complex where they can have spectacular PGE grades. However, no systematic exploration effort had been completed on these targets in the Stillwater Complex prior to 2018. Rock sampling and geological mapping work in 2019 returned results up to 4.44 g/t 3E ( 2.15 g/t Pt, 2.27 g/t Pd, 0.02 g/t Au) in sample 3190343 at Dunite Ridge. This same area returned 16.0 g/t 3E (as 8.72 g/t Pt, 7.25 g/t Pd, and 0.03 g/t Au) in one sample, and 7.45 g/t 3E as 2.32 g/t Pt, 5.10 g/t Pd, and 0.02 g/t Au in a second, in the 2018 field campaign.

Results from Bald Hills confirm the presence of widespread orthopyroxene pegmatoid and discordant, serpentinized dunite, both of which contain lenses and disseminations of chromite and base metal sulphide. Lithogeochemical sampling defines a broad, east-west trending zone of anomalous PGE mineralization, approximately 150 meters by 600 meters in extent and open for expansion within a 750-meter-long area of highly anomalous platinum, palladium, gold, nickel and copper in soil.

Dunite Ridge and Bald Hills are priority targets for follow-up work in 2020.

Chrome Mountain - Tarantula Target

Work in 2018 identified the Tarantula target in the eastern area of the Chrome Mountain target area, where highly anomalous PGE mineralization occurs in the Ultramafic Series. Host rocks are pegmatoidal bronzitite; disseminated chromite and sulphide have been described over an approximate strike length of at least 500 meters. Work in 2019 focused on prospecting, rock sampling and geologic mapping to advance the target for additional work in 2020. Several multi-gram PGE results were returned, ranging up to 2.74 g/t 3E (0.85 g/t Pt, 1.88g/t Pd, 0.01 g/t Au) in sample 3191206. Past results from the Chrome Mountain area includes up to 3.56 g/t Pd, 0.618% Ni, and 0.049% Co in 2018. High chromium levels are noted in this area with 15 samples to date returning grades of 10 to 26.8% Cr. Furthermore, highly anomalous platinum, palladium, gold, nickel and copper are shown in soils in the Tarantula target area, as shown in Figures 3 and 4.

The Tarantula target is a priority target for follow-up work in 2020.

East Boulder Target Area

As shown in Figure 2, the East Boulder target area centers on a highly conductive geophysical anomaly with coincident highly elevated levels of PGE, Ni and Cu in soils (Figures 3 and 4) covering an area approximately 2.6 kilometers by 1.9 kilometers. The East Boulder target area has less outcrop exposure than the adjacent Chrome Mountain target area (Figure 5) and, as a result, remains much less explored despite historic placer mining in the area.

Assaying of archived core from drill holes CM-2008-01 and CM-2008-03 returned significant base metal values from intervals that had previously been analyzed for precious metals only, including 69.2 meters of 1.62 g/t TotPtEq (or 0.35% TotNiEq), as 0.19% Ni, 0.07% Cu, and 0.017% Co, plus PGE values, starting at 98.5 meters down hole. These holes were originally drilled to test narrower, higher-grade reef-type PGE deposits and therefore were not optimized for more recent geologic models from the Platreef district, however these new results confirm the extension of bulk tonnage PGE-Ni-Cu-Co mineralization between the Chrome Mountain and Iron Mountain target areas, across the same highly prospective stratigraphic zone. As shown in Figure 2, an untested geophysical conductive high anomaly lies immediately south of holes CM-2008-01 and -02, continuing to the east and west.

Future work at the East Boulder target area will include detailed mapping and rock sampling to develop and refine drill targets in the area of the electromagnetic conductors and coincident soil anomalies.

About Stillwater West

The Stillwater West PGE-Ni-Cu project positions Group Ten as the second largest landholder in the Stillwater Complex, adjoining and adjacent to Sibanye-Stillwater's Stillwater, East Boulder, and Blitz platinum group elements ("PGE") mines in south central Montana, USA1. The Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex, while the lower part of the Stillwater Complex also shows the potential for much larger scale disseminated and high-sulphide PGE-Ni-Cu deposits, possibly similar to Platreef in the Bushveld Complex2. Group Ten's Stillwater West property covers the lower part of the Stillwater Complex along with the Picket Pin PGE Reef-type deposit in the upper portion, and includes extensive historic data, including soil and rock geochemistry, geophysical surveys, geologic mapping, and historic drilling.

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt and gold exploration assets in top North American mining jurisdictions. The Company's core asset is the Stillwater West PGE-Ni-Cu project adjacent to Sibanye-Stillwater's high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project in the Rainy River district of northwest Ontario and the Kluane PGE-Ni-Cu project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry's highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon's high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon's Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry's leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

Note 1: References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company's projects.

Note 2: Magmatic Ore Deposits in Layered Intrusions-Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012-1010.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: [email protected] Phone: (604) 357 4790

Web: http://grouptenmetals.com Toll Free: (888) 432 0075

Quality Control and Quality Assurance

2019 field samples and re-assayed core from 2007 and 2008 were analyzed by ACT Labs in Vancouver, B.C. Sample preparation: crush (< 7 kg) up to 80% passing 2 mm, riffle split(250 g) and pulverize (mild steel) to 95% passing 105 µm included cleaner sand. Gold, platinum, and palladium were analyzed by fire assay (1C-OES) with ICP finish. Selected major and trace elements were analyzed by peroxide fusion with 8-Peroxide ICP-OES finish to insure complete dissolution of resistate minerals.

2007 and 2008 drilling was conducted by Group Ten's QP while working for Beartooth Platinum.

Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Group Ten Metals Inc.