Not for distribution to U.S. newswire services or for release, publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States

TIMMINS, ON / ACCESSWIRE / May 14, 2020 / Golden Birch Resources Inc. (CSE:GBRX) ("Golden Birch" or the "Company") announces that, in connection with its previously announced private placement (the "Offering"), the Company has completed the first tranche ("First Tranche") of the Offering. The Offering is composed of the sale of units ("Units") of the Company at a price of C$0.15 per Unit. Each Unit shall consist of one common share in the capital of the Company ("Share") and one Share purchase warrant ("Warrant"). Each whole Warrant shall entitle the holder to purchase one additional Share at an exercise price of C$0.20 per Share, for a period of five (5) years from the date of issuance. The First Tranche consisted of the sale of 7,500,000 Units for aggregate gross proceeds of C$1,125,000. It is presently anticipated that closing of the second and final tranche (the "Second Tranche") of the Offering will occur on or around June 8, 2020.

In connection with the closing of the First Tranche, the Company has agreed to pay to IBK Capital Inc. ("IBK") a commission of (i) C$101,250, payable in cash; and (ii) 750,000 broker warrants to purchase Units ("Broker Warrants"), with each whole Broker Warrant entitling the holder to purchase one additional Unit at price C$0.15 per Unit, for a period of five (5) years from the date of issuance.

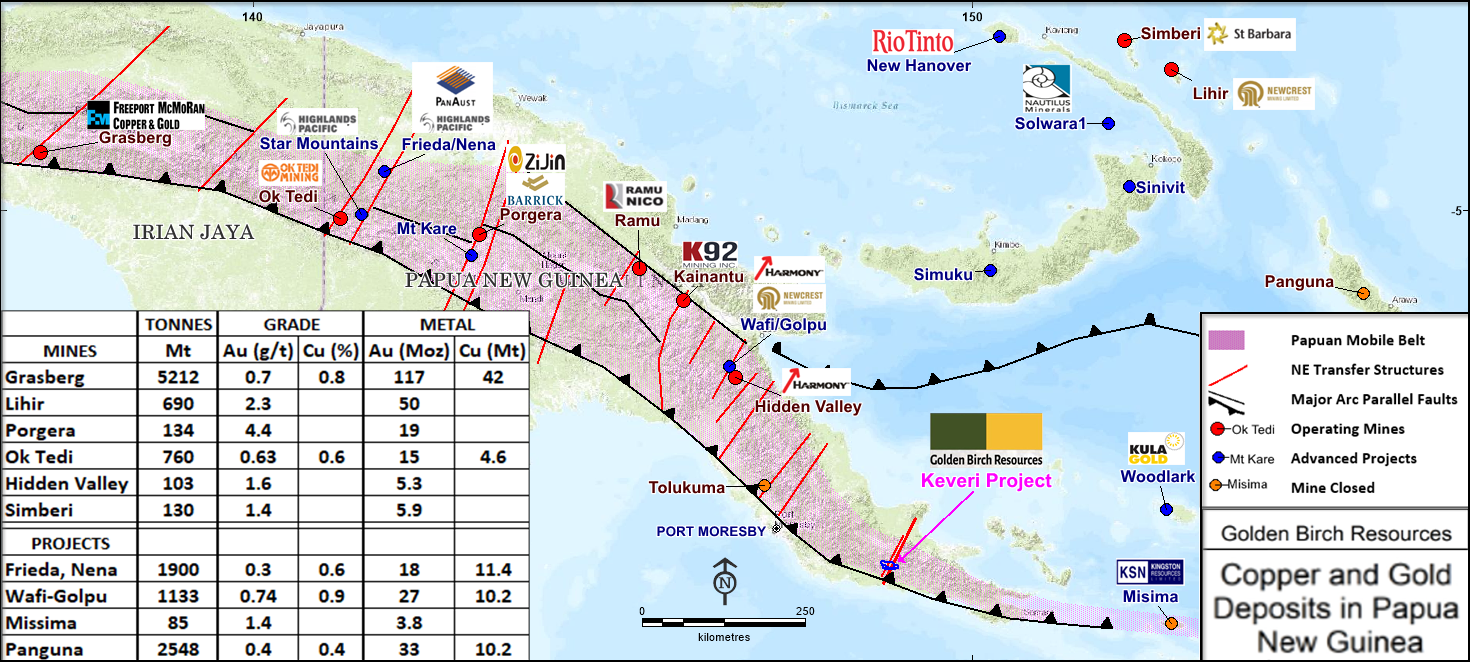

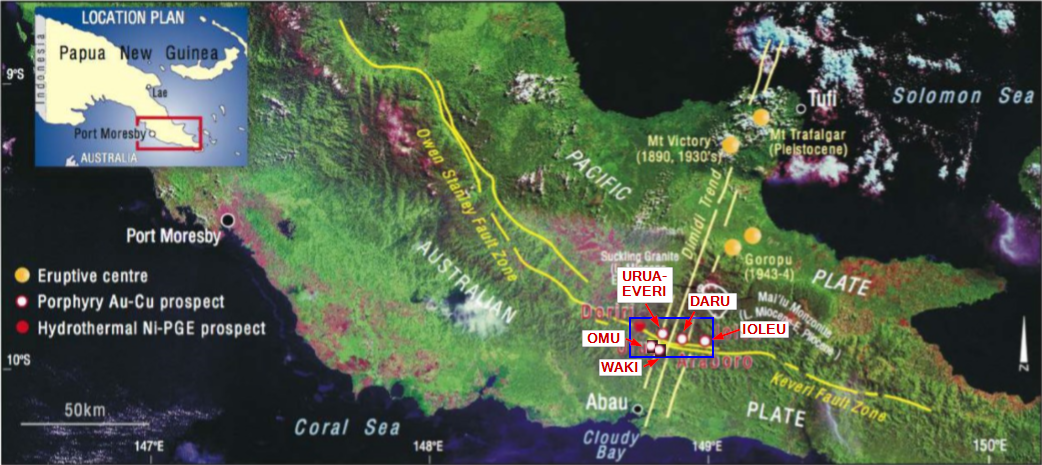

Alan Martin, President and CEO of Golden Birch stated: "The Company is excited to close this first tranche of the financing through the support of IBK and it welcomes the introduction of new investors to its register. As previously announced in its news releases, the Company's flagship property, the Keveri Project, is located in the southeastern part of the Papuan Fold Belt which is host to known1 porphyry copper-gold deposits in Papua New Guinea ("PNG"), as shown in Figures 1, 2 and 3 below. The presence of northeast (NE) transfer faults and their intersection with northwest-southeast arc parallel faults within the Keveri Project provide a similar geologic environment that exists for copper-gold porphyry deposits found within the Papuan Fold Belt in PNG. Exploration by the Company to date has uncovered three priority targets within the Keveri Project being Omu, Waki, and Daru-Araboro."

Figure 1: Copper and gold deposits of Papua New Guinea, with the location of the Keveri Project within the Papuan Fold Belt. The Company has an interest in only the Keveri Project. Source data in respect of the other deposits is attached here as Appendix A. Mineralization hosted on adjacent and/or nearby properties and operations is not necessarily indicative of mineralization hosted at the Keveri Project.

Figure 2: Satellite Image of Keveri Project. The Owen Stanley & Keveri Fault Zones are northwest-southeast "arc parallel" structures of the Papuan Fold Belt. The Keveri Project (approximate location outlined in blue) has multiple traverse structures associated with the Dimidi Trend (Papuan Minerals Ltd., Exploration Report, D. Lindley, January 2018) which intersect these arc parallel faults.

Figure 3: Copper-gold targets within the Keveri Project being explored by Golden Birch.

Michael White, President and CEO of IBK Capital Corp., stated: "We are excited to see the results of exploration by Golden Birch to-date at the Keveri Project. We are also pleased that proceeds from this first tranche of the Company's financing can go towards the planning of its maiden drilling program on their main copper-gold porphyry targets at Omu and Waki. The balance of the financing is expected to fully fund the drill program requirements for Stage 1 which would enable the company to earn 51% of the Keveri Project. The remainder of the Financing is expected to close in mid-June 2020."

All securities issued and issuable pursuant to the Offering will be subject to a hold period of four months and one day from the date of issuance. Completion of the Offering is subject to the receipt of all regulatory approvals, including the approval of the Exchange.

Use of Proceeds

The Company intends to use the proceeds from this private placement for exploration on the Keveri Project, specifically, the drilling of two discovery targets at Omu and Waki, which management believes has certain characteristics of tier-1 copper-gold porphyry deposits, and for working capital, corporate overhead and general and administrative purposes.

Qualified Person

Mr. Ian Taylor, MAusIMM(CP), a consultant to the Company, and a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, has approved the applicable contents of this news release.

About Golden Birch Resources Inc.

Golden Birch Resources Inc. is a mineral exploration company focused on acquiring, exploring, and developing quality mineral properties in Papua New Guinea. Core values for the Company are respect for the Community, the Landowners, the environment and operating a safe workplace for its employees. The Company is also committed to best practise standards of Corporate Governance.

For further information please visit the Company's website at www.goldenbirchresources.ca or contact:

Golden Birch Resources

Iain Martin, Chief Administrative Officer (CAO) & Executive Director

Tel: +1 (0) 705 288 0249

[email protected]

Yellow Jersey PR Limited

Sarah Hollins

Henry Wilkinson

Emma Becirovic

Tel: +44 (0) 20 3004 9512

[email protected]

Forward-Looking Statements

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This Press Release contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. Such statements reflect the Company's present views, future plans, objective or goals, including words to the effect that the Company or management expects a stated condition or result to occur. When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect" and similar expressions are intended to identify forward-looking statements. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Many risks, uncertainties, and other factors involved with forward-looking information could cause our actual results to differ materially from the statements made, including those factors discussed in filings made by us with the Canadian securities regulatory authorities.

Forward-looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, such actual results of current exploration programs, the Offering, the general risks associated with the mining industry, the price of copper, gold and other metals, currency and interest rate fluctuations, increased competition and general economic and market factors, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR.

Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Appendix A: Known copper and gold deposits of Papua New Guinea

Table 1: Known porphyry copper and gold deposits in the Papuan Mobile Fold Belt. Total indicated and inferred tonnes of mineral resources.

|

TONNES |

GRADE |

METAL |

|||

|

MINES |

Mt |

Au (g/t) |

Cu (%) |

AU (Moz) |

Cu (Mt) |

|

Grasberg (Porter GeoConsultancy, Rio Tinto 2007/2008) |

5761 |

0.68 |

0.78 |

126.5 |

44.8 |

|

Lihir (Newcrest December 2018, Explanatory Notes) |

690 |

2.3 |

- |

50.0 |

- |

|

Porgera (Porter GeoConsultancy, Total Mineral Resources December 2007) |

167.86 |

3.33 |

- |

17.9 |

- |

|

Ok Tedi (Porter GeoConsultancy, Resources at 1984) |

700 |

0.63 |

0.63 |

14.2 |

4.4 |

|

Hidden Valley (Porter GeoConsultancy, Resources at 2010/2011, Morobe JV) |

102 |

1.71 |

- |

5.6 |

- |

|

Simberi(1) (St Barbara Ltd Mineral Resources Statement, August 2019) |

90.8 |

1.4 |

- |

4.2 |

- |

|

PROJECTS |

Mt |

Au (g/t) |

Cu (%) |

AU (Moz) |

Cu (Mt) |

|

Frieda, Nena (Highlands Pacific Feasibility Study, April 2017) |

2742 |

0.23 |

0.42 |

19.7 |

11.5 |

|

Wafi-Golpu(2) (Porter GeoConsultancy, Newcrest Mining Ltd. August 2012) |

1133 |

0.73 |

0.9 |

26.7 |

9.0 |

|

Misima (Kingston Resources, November 2017 Resources Release) |

158.4 |

1.2 |

- |

5.7 |

- |

|

Panguna (Porter GeoConsultancy, incl historic prod & Resources at March 2016) |

2548 |

0.42 |

0.36 |

34.4 |

9.3 |

Notes:

|

(1) |

Mineral Resources excludes historic gold production. |

|

(2) |

Includes total resources for both Golpu and Wafi deposits. |

1 The Company only has an interest in the Keveri Project. Source data for the deposits provided in Appendix A.

SOURCE: Golden Birch Resources Inc.