VANCOUVER, BC / ACCESSWIRE / May 15, 2020 / MGX Minerals Inc. ("MGX" or the "Company") (CSE:XMG)(FKT:1MG)(OTC:MGXMF) is pleased to announce an agreement with Dykes Geologic Systems Inc. for over 1,000 digital data files and drawings covering the Heino-Money gold deposit and Tillicum Claims, including, excel spreadsheets of all the data, drill holes, assays, surveys, underground workings and assays, trenches, topography, geology and 3D model, as well as sections and plans through the deposit and original scans of documents. The Company will pay $42,500 CDN to the Vendor comprised of $7,500 in cash and 500,000 shares at a deemed price of $0.07. See British Columbia MINFILE 082FNW234 for detailed information regarding the deposit and claims.

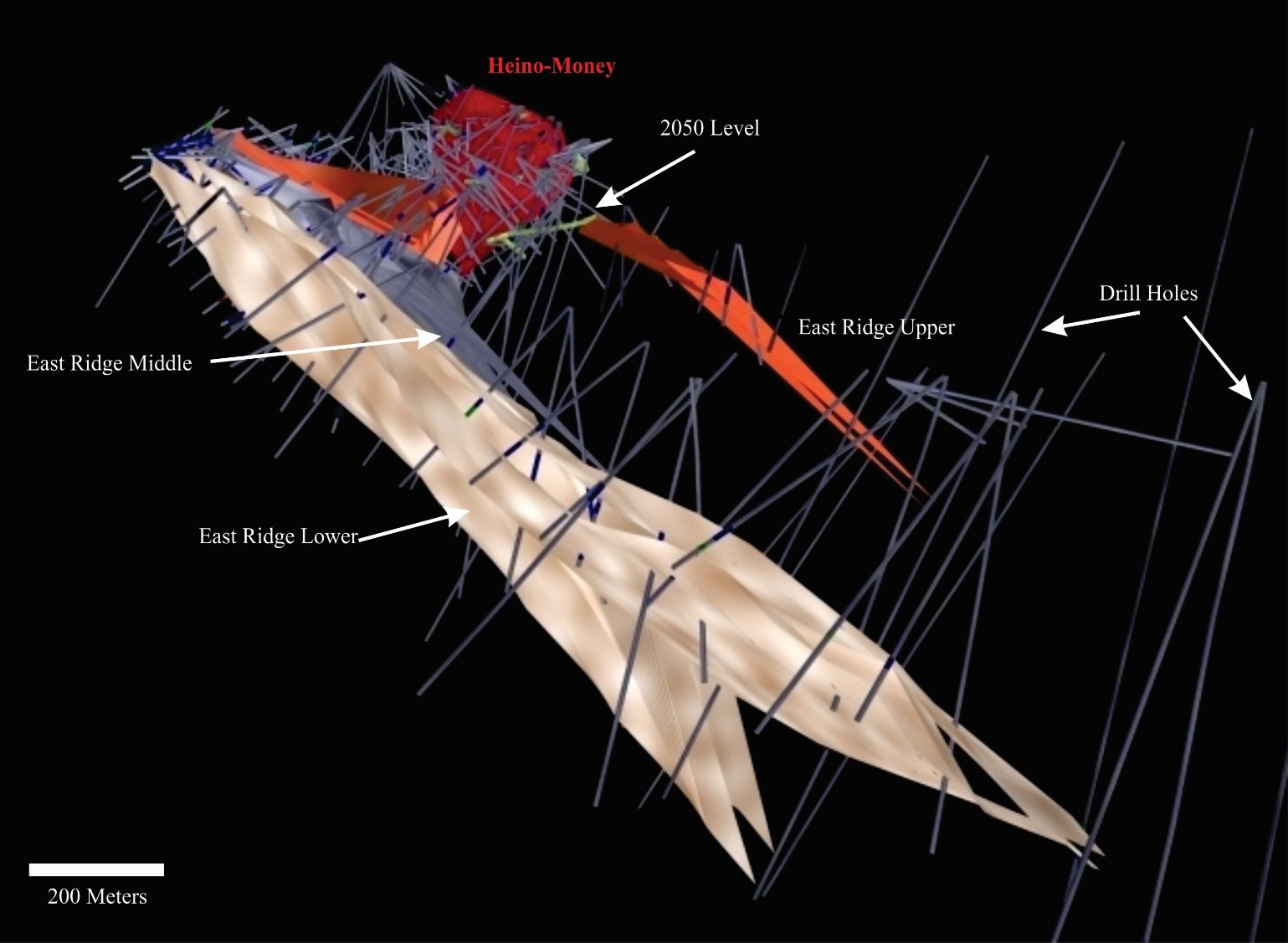

Figure 1 - 3D Drill Hole Model (Assessment Report 27144)

Historical Exploration and Production Summary

In 1981, a bulk sample of 58 tonnes shipped from the Money Pit averaged 78.8 grams per tonne gold. In 1986, a 3175- tonne bulk sample was shipped to the Dankoe mill at Keremeos and yielded 109.44 kilograms of gold (Assessment Report 19437). In 1993, as a result of mining at the Heino-Money zone, a total of 5503 tonnes of mineralization with an estimated head grade of 24.4 grams per tonne gold was shipped to the Goldstream mill (MINFILE 082M 141) for processing. Approximately 102,443 grams of gold and 149,546 grams of silver were recovered into concentrates that were shipped to Japan for smelting (George Cross News Letter No. 237 December 10, 1993).

Summary of production from Heino-Money zone, 1981 to 1993:

|

Year |

Mined tonnes |

Milled tonnes |

Au grams recovered |

Au troy ounces recovered |

Au troy oz/t (recovered ounces/ton) |

Ag troy ounces recovered |

Ag troy oz/t (recovered ounces/ton) |

|

1993 |

5,503 |

5,503 |

102,455 |

3,294 |

0.599 |

5,275 |

0.959 |

|

1991 |

9,207 |

296 |

|||||

|

1985 |

227 |

168 |

48,351 |

1,554 |

6.850 |

1,658 |

7.304 |

|

1981 |

58 |

58 |

4,239 |

146 |

2.517 |

105 |

1.810 |

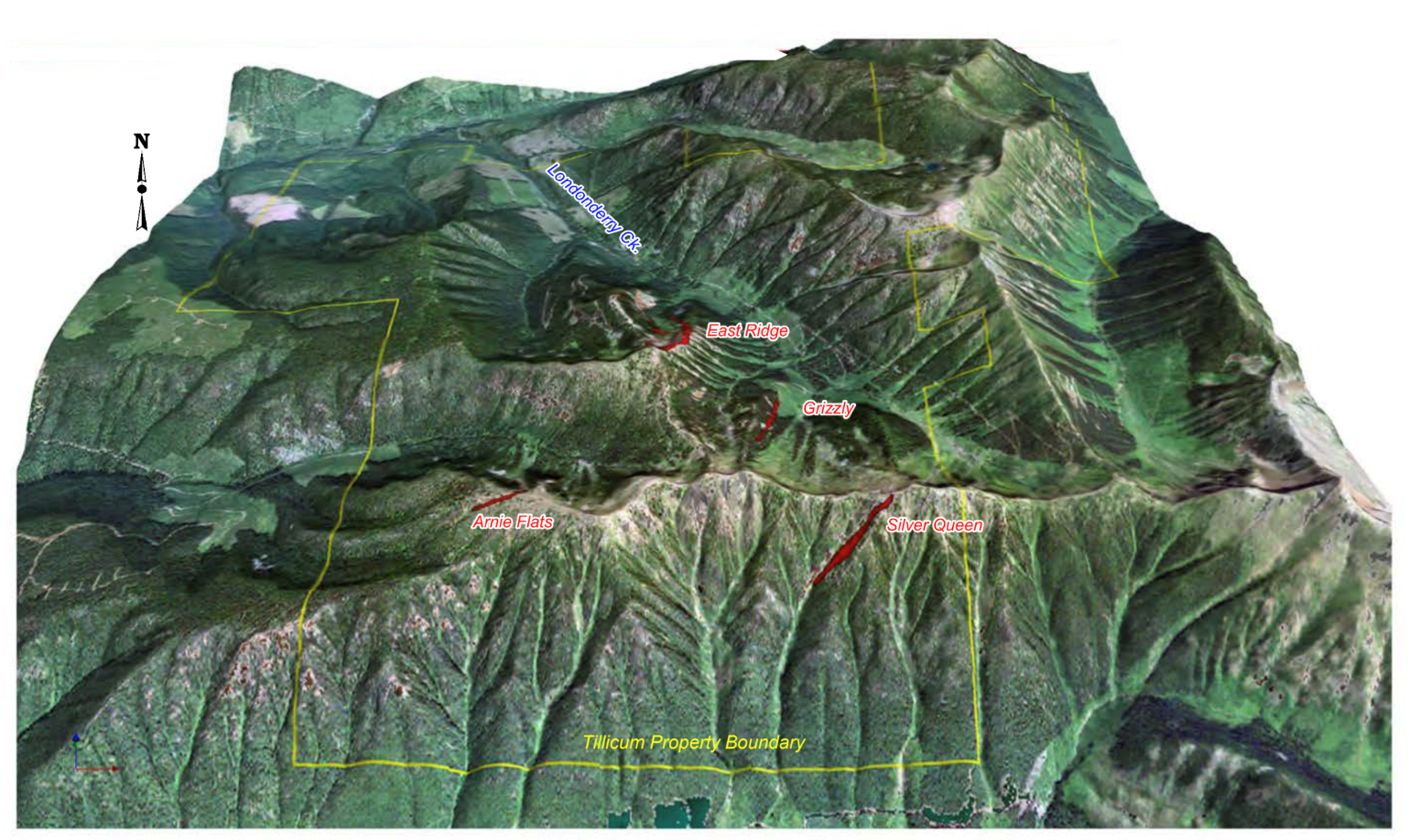

The property contains several mineralized zones with various amounts of work on each: soil geochemistry, geological mapping, trenching, diamond drilling and underground development and sampling. By far, the majority of work was concentrated in two areas: Heino-Money and East Ridge Zones. In addition, are the Grizzley, Annie Flats and Silver Queen Occurrences (MINFILE 082FNW220).

The East Ridge zone is 300 metres east of the Heino-Money zone. Gold mineralization occurs in a blanket-like zone that straddles the contact between porphyritic diorite and meta-arkose, quartzite, siltstone and minor argillite. The gold-bearing, near-vertical calc-silicate skarn structures occur within a 9.1 to 24.3- metre zone that strikes northeast and dips 70 degrees northwest. The skarn structures have widths that vary from 1.5 to 4.6 metres, but average 2.1 metres. The East Ridge zone has been traced by drilling for 1100 metres along strike and 365 metres down-dip at an average width of 1.5 metres. The East Ridge zone is comprised of two parallel upper skarn structures 0.9 to 1.5 metres thick and a lower skarn structure. Gold occurs in randomly distributed high- grade pockets separated by areas of lower grade material. Within the zone, gold-bearing sulphide mineralization consists of pyrrhotite, pyrite-marcasite, arsenopyrite, chalcopyrite, sphalerite, galena and native gold with traces

Exploration activity in 1982 included 1128 metres of diamond drilling : 16 holes on the Heino-Money zone, eight holes on the East Ridge zone and three holes on the Jenny zone. In 1983, a 60.9-metre crosscut adit was driven on the East Ridge zone and further geochemical surveys and trenching carried out. Diamond drilling was done in 18 holes on the Heino-Money zone. Drilling in 1983 totalled 2319 metres in 38 holes. In 1984, a 60-metre adit was driven into the upper part of the Heino-Money zone. Further diamond drilling was done in five holes on the East Ridge zone. La Teko provided financing of exploration to the end of 1985 ($2.28 million) to earn a 39.6 per cent interest in Esperanza. La Teko was unable to provide further financing and the 1982 option agreement expired at the end of 1985. In 1986, Esperanza Explorations completed a drill program of 25 surface diamond drill holes, totalling 835.5 metres and nine underground diamond drill holes, totalling 176.8 metres, including DDH Haus86-6 which intercepted 12.8 meters @ 90.57 g/t Au. Underground development included 153 metres of drifting and 46.5 metres of raises. By this time, 5 levels had been developed at elevations of 2112, 2130, 2148, 2160 and 2171 metres on the Heino-Money zone. In 1989, a further 10 diamond drill holes, totalling 1437.6 metres, were completed on the East Ridge zone.

In 1989, Esperanza Explorations Ltd wrote a summary of the mineralization on the Heino-Money Zone (Property File 825275, Roberts, 1989):

The gold mineralization is contained in a near vertical skarn structure which averages about six feet in width and which, to date, has been delineated over a strike length of about 600 feet and a vertical extent of 300 feet. The mineralized zone remains open both on strike and to depth.

In 1993, Bethlehem Resources Corporation and Goldnev Resources Inc. optioned the property and

obtained a permit for an underground mining operation. Mining commenced in mid-August of that yearand was completed in late October. A total of 29,009m of surface and 3,865m of underground drilling for a total of 376 holes. In addition, underground development consisting of 1,374m in the Heino-Money zone and 410m in the East Ridge zone was completed.

In 1994 Columbia Gold Mines Ltd. (formerly Esperanza Explorations Ltd.) commissioned Ross Glanville & Associates to carry out a valuation of the Tillicum Mountain project.

Figure 2 - Topography with Zones of Mineralization (Assessment Report 35269)

N.I. 43-101 and Customary Approvals

The Company will complete a N.I. 43-101 Technical Report within 45 days and will seek to verify data and previous work. All work prior to the implementation of N.I. 43-101 was completed by qualified professionals of their day and is believed to be accurate. The Company is currently seeking final exchange and corporate approvals.

Qualified Person

Andris Kikauka (P. Geo.), Vice President of Exploration for MGX Minerals, has prepared, reviewed and approved the scientific and technical information in this press release. Mr. Kikauka is a non-independent Qualified Person within the meaning of National Instrument 43-101 Standards.

About MGX Minerals Inc.

MGX Minerals invests in commodity and technology companies and projects focusing on battery and energy mass storage technology, extraction of minerals from fluids, and exploration for battery metals, industrial minerals, and precious metals.

Contact Information

Patrick Power

Chief Executive Officer

[email protected]

Web: www.mgxminerals.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking information provided by the Company is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Company's public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Company's profile on SEDAR at www.sedar.com.

SOURCE: MGX Minerals Inc.