VANCOUVER, BC / ACCESSWIRE / June 22, 2020 / Group Ten Metals Inc. (TSX.V:PGE)(OTCQB:PGEZF)(FSE:5D32) (the "Company" or "Group Ten") announces that it has satisfied all earn-in requirements set out in the agreement announced June 27, 2017 (the "Stillwater Agreement") and now has 100% ownership of the Stillwater West property, subject to a 2% NSR royalty interest which includes a 1% buy-down provision. The Stillwater Agreement was amended prior to completion to include an updated area of interest clause to incorporate an expanded claim block, which has more than doubled since the acquisition date.

Group Ten President and CEO, Michael Rowley, stated, "We are very pleased to have completed the earn-in requirements at Stillwater West, securing an exceptional land package and strengthening our position beside Sibanye-Stillwater, the world's largest platinum producer, in the productive and metal-rich Stillwater Igneous Complex. Our systematic approach to consolidating the district and compiling all available data resulted in the confirmation of Platreef-style nickel-copper sulphide mineralization, enriched in palladium, platinum, rhodium, cobalt, and gold, in our 2019 drill campaign, which returned some of the best mineralized intervals to date in the district on a grade-thickness basis. We are now advancing drill-defined mineralization towards delineation of formal resources in four of the five most advanced target areas as we continue to demonstrate the potential for much larger mineralized systems than have been recognized previously in the district. We look forward to providing further updates on that work, in addition to announcing our 2020 exploration plans, in the near future."

With respect to Group Ten's other projects, the Company is currently soliciting and reviewing expressions of interest on its non-core assets (all of which are 100%-owned) as part of its focus on Stillwater West.

Summaries of all assets presently in Group Ten are provided below:

Stillwater West, Montana, USA

Applying Bushveld deposit models to North America's premier PGE district

- 100% owned, subject to a 2% NSR royalty interest, which includes a buy-down provision to 1%;

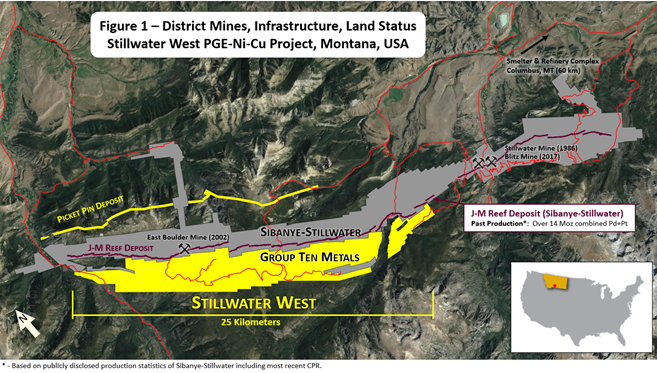

- At 54 square kilometers, Stillwater West establishes Group Ten with the second largest land position in the western hemisphere's most valued and productive palladium and platinum district, sharing the Stillwater Igneous Complex with Sibanye-Stillwater's three producing mines, 60km from a world-class metallurgical complex;

- The district is known for the size and grade of its palladium-platinum mines, which are the highest grade in the world and the largest outside of Africa and Russia, yet remains surprisingly underexplored overall;

- Group Ten is the first to systematically explore for Platreef-style mineralization, targeting bulk tonnage PGE-Ni-Cu mineralization in the lower Stillwater complex based on known similarities with South Africa's Platreef district. The north limb of the Bushveld complex, or Platreef, is host to some of the largest, most profitable, and longest-lived nickel-copper sulphide hosted PGE mines in the world, including Anglo American's Mogalakwena mine, and Ivanhoe's Platreef mine;

- The Company also has target areas focused on more conventional reef-type mineralization;

- Group Ten's 2019 drill program returned some of the longest mineralized intercepts ever reported in the district, confirming the presence of "Platreef-style" mineralization in key target areas, and enabling 3D block modeling of drill-defined mineralization in four target areas which are now being advanced to maiden resources; and

- In addition to the palladium, platinum, nickel, copper, and cobalt mineralization demonstrated to date, recent work has expanded the understanding and potential for high-grade gold and rhodium at Stillwater West.

Black Lake - Drayton Gold Project, Northwest Ontario, Canada

District-scale high-grade gold project adjoining Treasury Metals, Northwest Ontario

- 100% owned, subject to only standard royalties on certain claim blocks, all of which have buy-down provisions;

- 137 square kilometer land position adjoining Treasury Metals' recently consolidated high-grade gold Goliath-Goldlund project, in the Rainy River district of Northwest Ontario;

- Substantial database with more than 20 historic mineral occurrences, multiple high-grade bulk samples, and over 127 drill holes, in addition to geological, geochemical and geophysical data;

- 43% of past drill holes intercepted gold or copper mineralization, however past work did not adequately test the mineralized zones which are now better understood in the area; and

- Much of the project's more than 30 km of strike length remains untested, despite the success of neighboring deposits and the broader Abrams‐Minnitaki Lake archean greenstone belt, which now hosts more than 10 million ounces gold.

Kluane PGE-Ni-Cu Project, Southwest Yukon, Canada

District-scale asset adjoining one of largest undeveloped PGE-Ni-Cu deposits in the world

- 100% owned, subject to only standard royalties on certain claim blocks, all of which have buy-down provisions; and

- At 255 square kilometers, Group Ten's Kluane PGE-Ni-Cu project is the largest land position in the Kluane Ultramafic Belt, a mafic-ultramafic system that extends from northern British Columbia through the Yukon to central Alaska and hosts multiple PGE-Ni-Cu deposits, including the Nickel Shäw project now being advanced by Nickel Creek Platinum Corp.

Yankee-Dundee Project, Southeast BC, Canada

Royalty payments plus back-in rights at a past-producing Au-Ag-Pb-Zn mine

- Group Ten may receive up to $4 million or more by way of cash and royalty payments, depending on mine performance, commodity markets, and other factors, subject to specified production milestones as defined by a 2013 sale agreement on the past-producing Yankee-Dundee gold-silver-lead-zinc mine in Southeast British Columbia; and

- The Company maintains a back-in right on the project in the event that certain milestones are not met.

Duke Island Ni-Cu-PGE Project, Southeast Alaska, USA

Multiple Ni-Cu-PGE targets in the Alexander platinum belt

- 100% owned, subject to a 1% royalty;

- 31 claims located in the Alexander Platinum Belt of SE Alaska, 50 kilometers south of Ketchikan and 94 kilometers northwest of Prince Rupert, with demonstrated nickel, copper and PGEs values in mafic/ultramafic host rocks.

Mines and Money EMEA Online Event

Group Ten Metals is pleased to announce that the Company will be participating in Mines and Money's online EMEA (Europe, the Middle East and Africa) event June 30th to July 2nd with some of the most prominent names in the mining industry. Details of the event are available here: https://minesandmoney.com/online/emea/

About Stillwater West

The Stillwater West PGE-Ni-Cu project positions Group Ten as the second largest landholder in the Stillwater Complex, adjoining and adjacent to Sibanye-Stillwater's Stillwater, East Boulder, and Blitz platinum group elements ("PGE") mines in south central Montana, USA1. The Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex, while the lower part of the Stillwater Complex also shows the potential for much larger scale disseminated and high-sulphide PGE-Ni-Cu deposits, possibly similar to Platreef in the Bushveld Complex2. Group Ten's Stillwater West property covers the lower part of the Stillwater Complex along with the Picket Pin PGE Reef-type deposit in the upper portion, and includes extensive historic data, including soil and rock geochemistry, geophysical surveys, geologic mapping, and historic drilling.

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt and gold exploration assets in top North American mining jurisdictions. The Company's core asset is the Stillwater West PGE-Ni-Cu project adjacent to Sibanye-Stillwater's high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project in the Rainy River district of northwest Ontario and the Kluane PGE-Ni-Cu project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry's highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon's high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon's Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry's leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

Note 1: References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company's projects.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: [email protected] Phone: (604) 357 4790

Web: http://grouptenmetals.com Toll Free: (888) 432 0075

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Group Ten Metals Inc.