DALLAS, TX / ACCESSWIRE / August 5, 2020 / Credit expert and financial coach, Arnita Johnson-Hall, creates a financial literacy platform for millennial women to manage finances on their own terms, by improving their credit, creating a budget, and becoming financially savvy.

When she graduated high school, as a graduation gift, her mother gave her 700 credit scores. Her mother was able to do this by adding Arnita onto her credit cards as an authorized user when she was young. This gave Arnita instant access to better credit offers, low interest rates, and easy approvals.

This led her to believe that she had it all figured out. However, her good credit score was not accompanied by the financial responsibility of paying debts on time. This caused her credit score to fall to an all-time low, where it dropped from a 700 to a 303 at just 25 years old. The fact that she was a single mother on government assistance and living off minimum wage at the time did not help her get out of her rut.

She soon began to suffer from the result of having bad credit. She was denied an apartment, vehicle, and even a job.

This situation opened her eyes to the importance of credit scores, which propelled her to take it upon herself to learn how it works. With much research and countless days at the library, she was able to improve her credit scores from a 303 to 645. Arnita began to reap the benefits of what good credit had to offer again. She was able to purchase a new car and get approved for another apartment.

People began to wonder how she did it. When Johnson received an envelope of $3500 from a coworker for helping her fix her credit in order to refinance her home, the idea of helping others learn about credit scores and improving their credit reports became really attractive to her.

Johnson's quest to be free of government assistance and provide a better lifestyle for her and her daughter resulted in her own credit education services. As Arnita's business grew, she was able to gain financial independence and get off of all government assistance programs. As a result, she successfully got certified as a credit consultant in 2009 and FICO certified in 2013. "It is a luxury to have your credit and finances together. It's something that everyone should have." Johnson stated. That luxurious life is what she aims for when helping her clients.

As a woman of color, Johnson faces some challenges when trying to scale in business. In the early stages of marketing her business, she was having a hard time maximizing her client intake due to peoples' uncertainty of taking financial and credit advice from a young African American woman. In an industry dominated by men, Arnita decided to hide behind her business and rebrand it to make it seem as if it was run by a balding middle aged white man.

She rebranded her company around his persona and made people believe that he was the owner of her business to increase publicity. As expected, her strategy worked like magic as people started to flock in her direction for credit and financial advice. People found it more comfortable, and no one ever bothered to question the fact that she was always available to answer their calls. Arnita had presented herself as a credit consultant/customer service representative for her company and not that of the owner. Everything was working out very well for until the cat was out of the bag.

One day, an affiliate who would send clients to Arnita decided to do more research on the company and found out that it was owned by Arnita, he was shocked and impressed. "I honestly never thought that I would see the day where someone would find out that I owned the company. Everything was going so well. I was shocked and honestly scared, but thank God it all worked out."

This episode prompted her to revamp her business again and this time she chose to rebrand herself and get rid of the male persona. She took the courage to become the face of her own brand where she started to show herself on social media more, add her face to her business's marketing material and reached out to influencers where she offered her services in exchange for their reviews. She used this strategy to position herself as an expert and gain social proof from well respected influencers in the social media community.

"I wanted to create a fun, unique, and engaging way for people, especially women, to learn about money and be able to comfortably talk about it." Johnson commented. Even though her company is open to all, she gears her services towards millennial women. Arnita stated, "Let's face women, we women are going back to school, trying to climb the corporate ladder, start new businesses, raise our kids, be great partners, all why trying to protect our financial future. I found myself wearing so many hats as a woman…as a black woman, my finances were something that was always sacrificed and not leveraged." The more women learn how to manage and control their finances, she will become more confident and will be able to teach and uplift other women into doing the same.

Through her AMB Credit website, Arnita makes it easy for those who are interested in reaching their credit goals be able to easily submit their credit reports and schedule a consultation call to where one of her Board Certified Credit Consultants will call them back and go over their credit reports and credit goals at the designated time that they chose. "Let's face it, bad credit is stressful enough and communicating with the credit bureaus isn't as easy as one think,". Therefore she wanted to create a simple straightforward approach for her clients to correct inaccuracies on their credit reports and she believes the best way to do that is to be their voice and advocate for a thorough and complete investigation when submitting disputes with the credit bureaus, collection agencies, and original creditors.

Being in the finance industry for over 13 years, Arnita was trying to figure out ways on how to be more innovative when it came to helping women stay motivated on reaching their finance goals, and would keep them accountable when it comes to budgeting and keeping their finances on track.

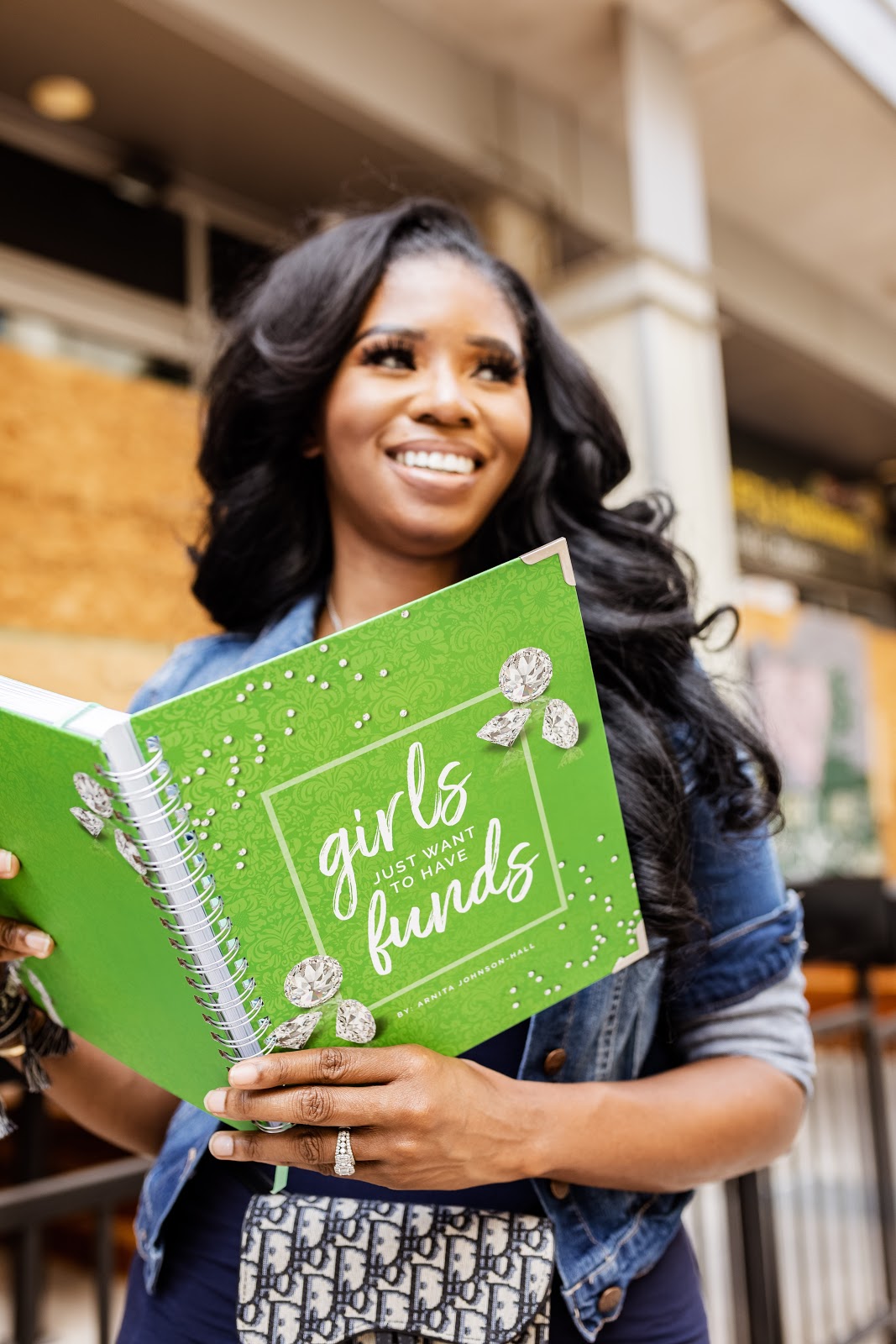

This birthed Arnita's newest project, the Luxurious Lifestyle Planner. The Luxurious Lifestyle Planner is for any woman who wants to get her finances together and learn how to incorporate financial wellness into her everyday lifestyle. It's for the woman who is tired of being financially reckless and desires to be more strategic with creating the luxurious life she's always dreamed of so that she can spoil herself and live life on her own terms. It is an educational money management system transformed into a stationary planner. "From expense sheets, savings goals to monthly bill organizers, meal planning, grocery lists, and debt free worksheets, there are so many activities inside that will help women smash their finance goals and transition their mindset on how they view money." Arnita said.

Arnita has created a financial powerhouse full of resources and tools for millennial women to become money savvy, understand credit, build wealth, and break financial generational curses.

Due to her excellent services and relentless hard work, people are becoming even more curious to find out the woman who is taking credit scores by storm. Arnita is committed to helping women live the luxurious life they've always dreamed of.

To learn more about Arnita Johnson, AMB Consultants and Luxurious Credit, click the links below:

Website: www.LuxuriousCredit.com

Website: www.AMBCredit.com

Instagram: @helloarnita and @luxuriouscredit

Planner: www.LuxuriousLifestylePlanner.com

Written By: Alya Putri

Media Contact:

Lela Bodley

[email protected]

SOURCE: Luxurious Credit