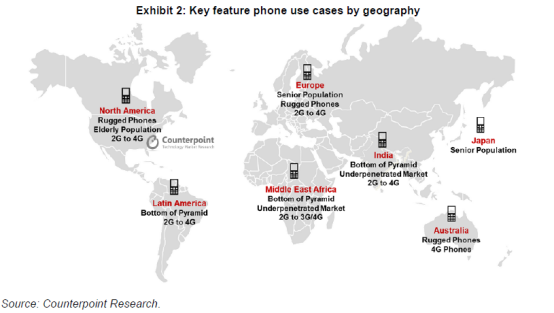

SHANGHAI, CHINA / ACCESSWIRE / August 31, 2020 / Though 5G will dominate the market in the next decade, the technology transition will take 10 years, Counterpoint points out. Over the next five years, we estimate 5G subscription uptake will be significantly faster than LTE when it was introduced. However, 4G and 5G technologies will coexist for a long time to come. During the transition period, countries will phase out 2G and 3G, and 4G will play an important role, especially in India, Middle East/Africa, Latin America and other parts of Asia-Pacific. India, the Middle East and Africa remain the main drivers of the feature phone market, with more than 740 million units shipped in the next five years, or accounting for about 75% of global feature phone shipments.

While users at the bottom of the social pyramid will still be buying feature phones, more and more feature phones are starting to support advanced 4G networks, with improvements in performance, specs, and screen sizes. These enhanced feature phones can meet the diverse needs of users. Some users will choose to buy and use feature phones even if they can afford a smart phone.

Indeed, shipments of 4G feature phones are growing across regions, as Reliance's Jio Phone in India shows. In the future, 4G mobile phones will also bring considerable sales volume and income to the ecological participants. By 2024, India will be the world's largest market for feature phones, followed by Bangladesh and Nigeria. The revival of Nokia's feature phones, the steady growth of brands such as Itel and Tecno in Africa, and sales of more powerful feature phones such as Jio Phone in India have provided continued momentum for the feature Phone market. True Superhero 4G and other multifunctional 4G feature phones based on customized operating systems are emerging and encourage upstream component manufacturers to release solutions to get a profit from this market. For example, UNISOC launched T117 for 4G feature phones, and thus took the lead in the major feature phone market.

Components are also a key part of driving market growth, with primary chip solution providers playing a vital role, such as providing new solutions with affordable prices and superior performance, the report said. During the 2019 Mobile Congress in India, UNISOC unveiled the highly integrated T117 main chip platform in response to the growing demand for 4G feature phones in the mass market. The T117 integrates LTE/WCDMA/GSM modems, BT/FM, and multimedia capabilities with built-in LPDDR to minimize board area. The chip also supports HD voice, VoLTE and LTE dual cards and dual standby, greatly improving the phone's calling experience. T117 series achieves a balance between cost, performance and power consumption and is the ideal 4G smart phone platform for basic Internet users with limited budgets.

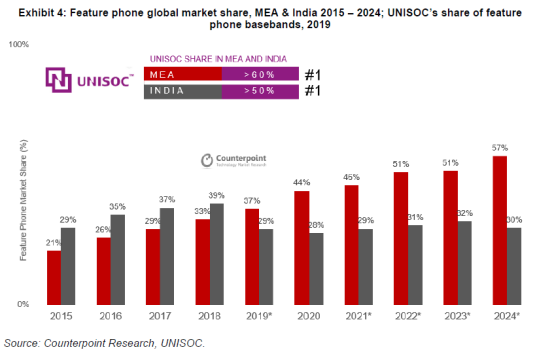

The success of phones such as the JioPhone in India has reignited the attention of the market, as manufacturers explore potential market opportunities to upgrade from basic phones to enhanced 4G phones. In 2019, in the Middle East, Africa and India, With moderate price and excellent performance, UNISOC accounted for more than 60% and 50% respectively in the base band market of feature phones, occupying the first position in the market.

In addition, according to Counterpoint's report, operators will face significant market opportunities in the 4G mobile phone market.4G feature phones could generate $7 billion in revenue for operators. Details refer to: Counterpoint website - free English version and Chinese version download link

https://www.counterpointresearch.com/cellular-technology-transitions-potential-soc-players/

Media Contact:

UNISOC Technologies Co., Ltd

Miranda Wu - UNISOC PR Team

E-mail: [email protected]

Website: http://www.unisoc.com

SOURCE: UNISOC Technologies Co., Ltd