- 1Q 2021 net sales totaled $3,304,000, up $513,000, or 18%, versus same period prior year primarily driven by new direct-to-consumer sales and organic retail growth

- Net income for the quarter was $109,000, or 3% of net sales, compared to net income of $120,000, or 4% of net sales, in the same period of 2020

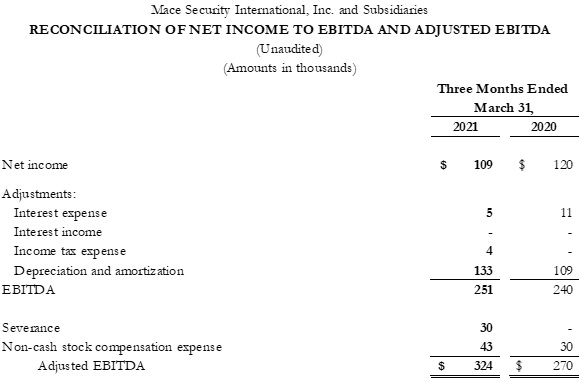

- EBITDA for the quarter was $251,000, or 8% of net sales, versus $240,000, or 9% of net sales, in the first quarter of 2020

CLEVELAND, OH / ACCESSWIRE / April 30, 2021 / Mace Security International (OTCQX:MACE) today announced its first quarter 2021 financial results for the quarter ended March 31, 2021.

The Company's net sales for the first quarter were $3,304,000, up 18% versus the same period in the prior year. Sales during first quarter 2021 were impacted by international supply chain and logistics issues as well as severe winter weather in the Southwest United States during February. Combined, these events impeded net sales growth by an estimated 15% for the first quarter of 2021. We expect the supply chain and logistics issues to be resolved during the first half of the current quarter. Net sales increases for the first quarter reflect organic growth across our e-commerce and retail channels, which increased $898,000 and were partially offset by lower incoming orders for international customers which have been slow to rebound due to COVID-related challenges in other countries.

The Company reported a gross margin rate of 39% for the first quarter of 2021, flat with the same quarter last year. Gross profit was primarily impacted by one-time, non-recurring personnel costs and inventory dispersion costs, and excess manufacturing costs related to processing past-due orders. These costs were incurred prior to process improvements and workforce reductions, both commencing in March 2021. SG&A expenses were $1,061,000, or 32% of net sales, in the first quarter of 2021 compared with $881,000, or 32% of net sales, in the same quarter of 2020. The increase in SG&A expenses is a direct result of investments made for future growth - including salaries and advertising expenses - and customer delivery penalties from disruptions in the Company's international supply chain.

President and CEO Gary Medved commented, "Though Q1 revenue was impacted by a few remaining supply chain issues and severe winter weather in the Southwest, our continued focus on retail expansion has resulted in further market penetration in both the number of locations and product assortment. Our digital sales continued to strengthen with an increase of more than 90% over the first quarter of 2020. We've optimized our production operations, which resulted in additional costs during the quarter. We are also implementing a number of additional process improvements during Q2 and Q3 to achieve our minimum target of 50% gross margin rate on an annualized basis. Mace introduced two new products during Q1 that are doing exceptionally well and have several new products in development. Though we incurred additional SG&A expenditures during Q1, the investment was targeted to help position the company for future growth."

Sanjay Singh, Executive Chairman, commented, "We started the year with some headwinds, namely, supply chain delays and internal operational inefficiencies due to higher-than-expected labor costs. We have been building inventory to overcome delays from our vendors and the efficiencies are now on target. We expect to return to a 15% EBITDA plus run rate in the coming months. We have made capital expenditure investments and hired a Lean Management expert to spearhead the implementation of a best-in-class plant operating system that is focused on meeting our customers' on-time delivery and quality requirements as well as our ambitions of achieving a 50% gross margin run rate this year. Our orders continue to be strong, and we are optimistic that we can deliver on our commitments."

First Quarter 2021 Financial Highlights

- Net sales were $3,304,000, up 18% versus the same period in the prior year, primarily driven by new direct-to-consumer sales, organic retail growth through more stores and expanded product offerings.

- Gross profit rate remained consistent year-over-year at 39% while incurring incremental costs for the modification of manufacturing processes and transition to new personnel.

- Gross profit for the first quarter increased by $194,000, or 18%, over the first quarter of 2020, driven purely by increased sales volume.

- SG&A expenses increased by $180,000 to $1,061,000 for the quarter, or 32% of net sales, driven primarily by year-over-year increases in advertising costs to further penetrate the direct-to-consumer market, personnel related expense, sales commissions and penalties related to supply chain delays.

- Net income of $109,000 declined $11,000 from the $120,000 generated in the first quarter of 2020.

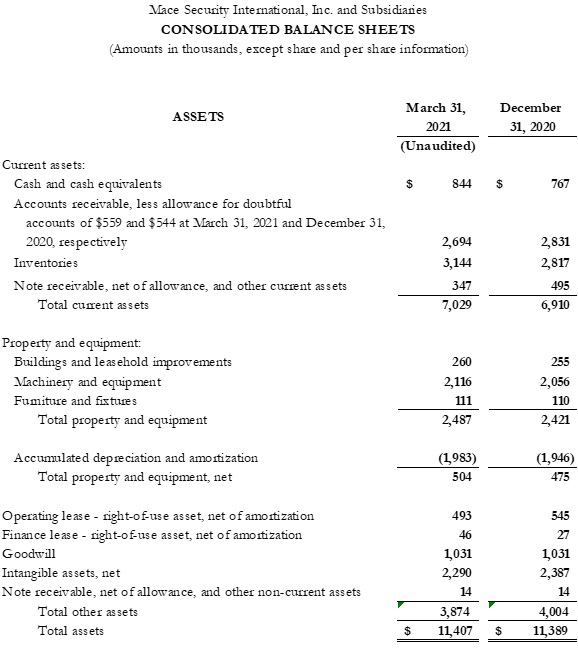

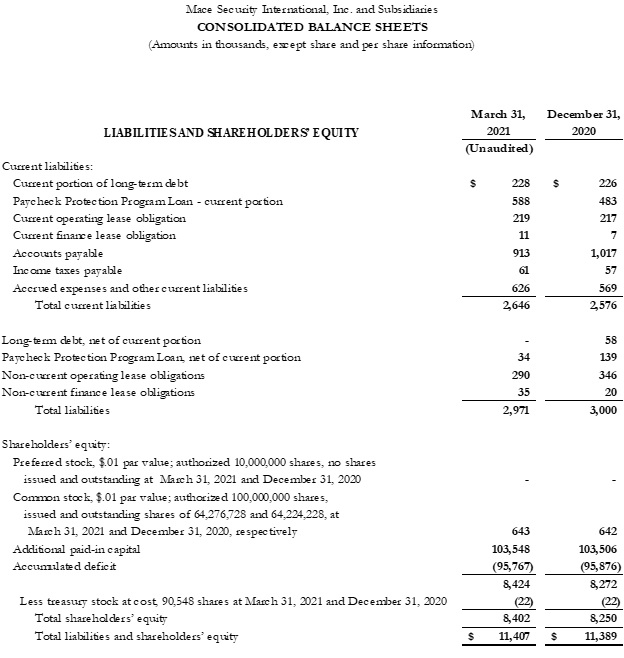

- Cash and cash equivalents increased to $844,000 as of March 31, 2021, an increase of $77,000 over the $767,000 on hand on December 31, 2020.

- Working capital increased by $49,000 compared to December 31, 2020 with a $137,000 decline in net accounts receivable. There was an increase in inventory of $327,000 inclusive of a $524,000 increase in finished goods inventory to support the anticipated sales growth in 2021.

- Adjusted EBITDA for the first quarter 2021 was $324,000 compared to $270,000 for the first quarter of 2020.

First Quarter 2021 Operational Highlights

- The Company began its process and workforce modification during the first quarter 2021 which resulted in higher costs than anticipated but has adjusted the operations model as planned to drive future cost efficiencies, improved gross margins and better in-stock positions to support customer orders as sales growth continues. Personnel were added in key positions to improve focus on, and diminish, supply chain disruptions and improve the overall flow of production. Labor efficiencies were improved at the end of the quarter, as compared to the start of the quarter.

Conference Call

Mace® will conduct a conference call on Tuesday, May 4, 2021 at 11 AM EDT, 8 AM PDT, to discuss its financial and operational performance for the first quarter 2021.

Participant Toll-Free Dial-In Number: (833) 360-0862; Conference ID 4899590.

A full set of the consolidated financial statements and OTCQX Quarterly Report are available on www.corp.mace.com under "Newsroom" / "Financial Reports" along with a Q1 2021 Financial Overview Presentation located under "Newsroom" / "Presentations." A digital recording of the conference call will be available for replay two hours after the call's completion. The recording will be available as listed below. To access the recording, use the dial-in number listed below and the conference ID 4899590.

Encore dial-in number: 855-859-2056 (or internationally on 404-537-3406)

Encore dates: Will be available 2 hours after the call and will expire midnight on July 4, 2021.

About Mace Security International, Inc.

Mace Security International, Inc. is a globally recognized leader in personal safety products. Based in Cleveland, Ohio, the Company has spent more than 30 years designing and manufacturing consumer and tactical products for personal defense and security under its world-renowned Mace® Brand - the original trusted brand of pepper spray products. The Company's other leading brands include Tornado® Brand stun devices and pepper spray, and Vigilant® Brand personal alarms. The Company also offers aerosol defense sprays for law enforcement and security professionals worldwide through its Take Down® Brand.

Mace Security International, Inc. distributes and supports its products and services through mass-market retailers, wholesale distributors, independent dealers, e-commerce channels and through its website, www.Mace.com. For more information, please visit www.mace.com.

Forward-Looking Statements

Certain statements and information included in this press release constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. When used in this press release, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "projected," "intend to" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks, known and unknown, and uncertainties, including but not limited to economic conditions, dependence on management, our ability to compete with competitors, dilution to shareholders, and limited capital resources.

In this press release, the Company's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures provides useful supplemental information to investors and facilitates the analysis of the Company's core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company's business. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached schedules.

CONTACTS:

Mike Weisbarth

Chief Financial Officer

[email protected]

SOURCE: MACE SECURITY INTERNATIONAL INC