Highlights:

- First quarter 2021 gross revenue increased 164% to $4.2 million as compared to $1.6 million in the first quarter of 2020

- Raised $70.1 million in net cash proceeds during February 2021 with an underwritten public offering

COLUMBIA, MD / ACCESSWIRE / May 10, 2021 / Rekor Systems, Inc, (NASDAQ:REKR) ("Rekor"), a provider of real-time roadway, customer and public safety intelligence to enable AI-driven decisions, today announced its unaudited financial results for the first quarter of 2021.

"Our results in the first quarter have demonstrated a continuing high level of growth on a year-over-year basis," said Eyal Hen, Chief Financial Officer, Rekor. "In the first quarter we stepped up our sales outreach by actively marketing our eCommerce platform and expanding our channel partners program along with continuing our aggressive direct sales efforts. These activities were key to increased revenue generation in the first quarter of 2021. Rekor's go-to-market strategy reaches a global customer base with frictionless transactions and gives us great confidence moving forward."

"We are pleased with our results for the first quarter 2021, which demonstrate substantial ongoing year-over-year improvement," said Robert A. Berman, President and CEO, Rekor. "This quarter we accelerated growth in both our commercial and government sectors."

In February 2021, the Company completed an underwritten offering with resulting net proceeds of $70.1 million in cash.

The company has continued to expand its product and service offerings in recent quarters. The product suite incorporates intensive machine learning, which was been developed over the last three years and, which differentiates Rekor's offerings from its competitors. Importantly, we also launched the beta version of the Rekor One platform, which is now ready for demonstration to all commercial and public sector potential customers.

First Quarter 2021 and First Quarter 2020 Financial Results

Revenues

Revenue for the three months ended March 31, 2021, increased $2,621,000 or 164% to $4,216,000, compared to $1,595,000 for the three months ended March 31, 2020. The increase in revenue for the three months ended March 31, 2021, compared to the three months ended March 31, 2020, was a result of additional products and services the Company offered and increases in direct sales and Partner Program sales of our existing products and services. In the first quarter of 2021, we initiated services for the state of Oklahoma's Uninsured Vehicle Enforcement Diversion (UVED) Program, which issued over 25,000 diversion notices of non-compliance and generated approximately $1,000,000 in revenue for the state and $245,000 of revenue for the Company in the current quarter. We also had significant growth in our eCommerce revenue, which is defined as revenue recognized through our eCommerce platform as well as from our solutions in the tolling industry. For the three months ended March 31, 2021 and 2020, the Company recognized eCommerce revenues of $442,000 and $177,000 respectively. The remainder of the increase was attributable to increased sales of hardware and software subscriptions through our Partner Program and direct sales channels.

Cost of Revenue, Gross Profit and Gross Margin

Gross profit for the three months ended March 31, 2021, increased to $2,254,000 with a gross margin of 53%, compared to $1,101,000 and a gross margin of 69% for the three months ended March 31, 2020. The increase in gross profit was primarily attributable to the increase in revenue for the corresponding period. The decrease in gross margin was attributable to a higher level of hardware sales that occurred during the three months ended March 31, 2021, as hardware sales typically have lower margins than software sales.

Loss from Operations

Operating loss for the three months ended March 31, 2021, increased to $5,308,000, compared to $2,604,000 for the three months ended March 31, 2020. The increase in the operating loss during the period is attributable mainly to the increased headcount to support our growth plan and professional services related to our merger and acquisition activities. In addition, we continue to increase our R&D expenses to keep developing new solutions and advancing our technology.

Loss per Share

Loss per share for the three months ended March 31, 2021 decreased to $(0.15), compared to $(0.19) for the three months ended March 31, 2020. The $(0.04) decrease in the loss per share was due to the increase in the weighted average of shares outstanding for the three months ended March 31, 2021 compared to the three months ended March 31, 2020. During the period subsequent to March 31, 2020, the Company issued shares in connection with an At-the-Market sales agreement, the retirement of debt, the conversion of preferred stock and an underwritten public offering, all of which caused an increase in the weighted average of common shares outstanding for the three months ended March 31, 2021.

Performance Obligations

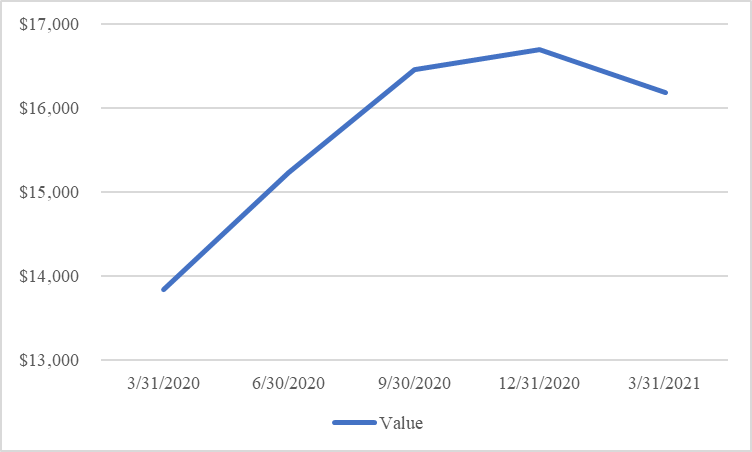

As of March 31, 2021, we had approximately $16,186,000 of contracts that were closed prior to March 31, 2021, but have a contractual period beyond March 31, 2021. These contracts generally cover a term of one to five years, in which we will recognize revenue ratably over the contract term. We currently expect to recognize approximately 32% of this amount over the succeeding twelve months, and the remainder is expected to be recognized over the following four years. On occasion our customers will prepay the full contract or a substantial portion of the contract. Amounts related to the prepayment of the contract for a service period that is not yet met are recorded as part of our contract liabilities balance.

The table below reflects the 17% growth in the remaining value of contracts from March 31, 2020, compared to March 31, 2021 (dollars in thousands):

EBITDA and Adjusted EBITDA

We calculate EBITDA as net loss before interest, taxes, depreciation and amortization. We calculate Adjusted EBITDA as net loss before interest, taxes, depreciation and amortization, adjusted for (i) impairment of intangible assets, (ii) loss on extinguishment of debt, (iii) stock-based compensation, (iv) losses or gains on sales of subsidiaries, (v) losses associated with equity method investments, (vi) merger and acquisition transaction costs and (vii) other unusual or non-recurring items. EBITDA and Adjusted EBITDA are not measurements of financial performance or liquidity under accounting principles generally accepted in the U.S. ("U.S. GAAP") and should not be considered as an alternative to net earnings or cash flow from operating activities as indicators of our operating performance or as a measure of liquidity or any other measures of performance derived in accordance with U.S. GAAP. EBITDA and Adjusted EBITDA are presented because we believe they are frequently used by securities analysts, investors and other interested parties in the evaluation of a company's ability to service and/or incur debt. However, other companies in our industry may calculate EBITDA and Adjusted EBITDA differently than we do.

The following table sets forth the components of the EBITDA and Adjusted EBITDA for the periods included (dollars in thousands)

|

|

Three Months ended March 31, | |||||||

|

|

2021 | 2020 | ||||||

|

Total comprehensive loss from continuing operations

|

$ | (5,401 | ) | $ | (3,774 | ) | ||

|

Income taxes

|

3 | 7 | ||||||

|

Interest

|

32 | 1,163 | ||||||

|

Depreciation and amortization

|

614 | 423 | ||||||

|

EBITDA

|

$ | (4,752 | ) | $ | (2,181 | ) | ||

|

|

||||||||

|

Share-based compensation

|

781 | 171 | ||||||

|

Loss due to change in value of equity investments

|

76 | - | ||||||

|

One-time consulting fees

|

776 | - | ||||||

|

Adjusted EBITDA

|

$ | (3,119 | ) | $ | (2,010 | ) | ||

Rekor has scheduled a conference call to discuss the 2021 first quarter results on Monday, May 10, 2021, at 4:30 P.M. (Eastern).

All interested parties may listen to a live webcast of the call at:

Online: https://www.webcaster4.com/Webcast/Page/2523/40874

By phone: Toll Free: 877-407-8033 or International: 201-689-8033

An archived webcast will also be available to replay this conference call directly from the Company's website under Investors, Events & Presentations. Slides that accompany the conference call will be available on the Company's website.

About Rekor Systems, Inc.

Rekor (Nasdaq: REKR) provides real-time, customer and public safety intelligence to enable AI-driven decisions. Rekor bridges commercial and government sectors with actionable, real-time vehicle recognition data to enable informed decisions faster, and with greater outcomes. Rekor is transforming industries like Public Safety, Customer Experience, and Smart Cities in approximately 80 countries across the globe with smarter, quicker, cost-competitive vehicle recognition solutions for security, revenue discovery and recovery, public safety, electronic toll collection, brand loyalty, parking operations, logistics, and traffic management. We use the power of artificial intelligence to analyze video streams and transform them into AI-driven decisions by our clients. Our machine learning software can turn most IP cameras into highly accurate and affordable vehicle recognition devices used to help protect lives, increase brand loyalty, and enhance operations and logistics, without the need to install expensive new infrastructure. We make what was once considered impossible, possible. To learn more please visit our website: https://rekor.ai.

Forward-Looking Statements

This press release includes statements concerning Rekor Systems, Inc. and its future expectations, plans and prospects that constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as "may," "should," "expects," "plans," "anticipates," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential," or "continue," by the negative of these terms or by other similar expressions. You are cautioned that such statements are subject to many risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual circumstances, events or results may differ materially from those projected in the forward-looking statements, particularly as a result of various risks and other factors identified in our filings with the Securities and Exchange Commission. Important factors that could have such a result include a decline or weakness in general economic conditions, an outbreak of hostilities, the ongoing pandemic and responses thereto related to COVID-19, a decline or volatility in the securities markets or regulatory changes or other adverse developments with respect to the markets for the Company's products and services or an inability to obtain adequate financing. All forward-looking statements contained in this press release speak only as of the date on which they were made and are based on management's assumptions and estimates as of such date. We do not undertake any obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events, or otherwise.

Media:

Robin Bectel

REQ For Rekor Systems, Inc.

[email protected]

Company Contact:

Rekor Systems, Inc.

Eyal Hen

Chief Financial Officer

Phone: +1 (443) 545-7260

[email protected]

Investor Relations Contact:

Rekor Systems, Inc.

Charles Degliomini

[email protected]

REKOR SYSTEMS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except share data)

(Unaudited)

|

|

March 31, 2021 | December 31, 2020 | ||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 62,845 | $ | 20,595 | ||||

|

Restricted cash and cash equivalents

|

1,005 | 412 | ||||||

|

Short-term investments

|

23,996 | - | ||||||

|

Accounts receivable, net

|

2,474 | 1,038 | ||||||

|

Inventory

|

1,101 | 1,264 | ||||||

|

Note receivable, current portion

|

340 | 340 | ||||||

|

Other current assets, net

|

626 | 469 | ||||||

|

Current assets of discontinued operations

|

1 | 2 | ||||||

|

Total current assets

|

92,388 | 24,120 | ||||||

|

Long-term Assets

|

||||||||

|

Property and equipment, net

|

1,337 | 1,047 | ||||||

|

Right-of-use lease assets, net

|

352 | 426 | ||||||

|

Goodwill

|

6,336 | 6,336 | ||||||

|

Intangible assets, net

|

6,633 | 7,038 | ||||||

|

Investments in unconsolidated companies

|

74 | 75 | ||||||

|

Note receivable, long-term

|

1,275 | 1,360 | ||||||

|

Total long-term assets

|

16,007 | 16,282 | ||||||

|

Total assets

|

$ | 108,395 | $ | 40,402 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 4,712 | $ | 3,898 | ||||

|

Notes payable, current portion

|

985 | - | ||||||

|

Loan payable, current portion

|

625 | 517 | ||||||

|

Lease liability, short-term

|

199 | 253 | ||||||

|

Contract liabilities

|

1,497 | 1,126 | ||||||

|

Current liabilities of discontinued operations

|

128 | 124 | ||||||

|

Total current liabilities

|

8,146 | 5,918 | ||||||

|

Long-term Liabilities

|

||||||||

|

Notes payable, long-term

|

- | 980 | ||||||

|

Loan payable, long-term

|

350 | 469 | ||||||

|

Lease liability, long-term

|

167 | 188 | ||||||

|

Contract liabilities, long-term

|

910 | 958 | ||||||

|

Deferred tax liability, long-term

|

27 | 24 | ||||||

|

Long term liabilities of discontinued operations

|

- | 5 | ||||||

|

Total long-term liabilities

|

1,454 | 2,624 | ||||||

|

Total liabilities

|

9,600 | 8,542 | ||||||

|

Series A Cumulative Convertible Redeemable Preferred stock, $0.0001 par value; authorized: 505,000 shares authorized at March 31, 2021 and December 31, 2020; issued and outstanding: 0 and 502,327 shares issued and outstanding at March 31, 2021 and December 31, 2020

|

- | 6,669 | ||||||

|

Commitments and Contingencies

|

||||||||

|

Stockholders' Equity

|

||||||||

|

Common stock, $0.0001 par value; authorized; 100,000,000 shares; issued: 40,972,238 shares at March 31, 2021 and 33,013,271 at December 31, 2020; outstanding: 40,952,877 shares at March 31, 2021 and 33,013,271 at December 31, 2020

|

4 | 3 | ||||||

|

Preferred stock, $0.0001 par value, 2,000,000 authorized, 505,000 shares designated as Series A and 240,861 shares designated as Series B as of March 31, 2021 and December 31, 2020, respectively

|

||||||||

|

Series B Cumulative Convertible Preferred stock, $0.0001 par value; authorized: 240,861 shares authorized at March 31, 2021 and December 31, 2020; issued and outstanding: 0 and 240,861 shares issued and outstanding at March 31, 2021 and December 31, 2020

|

- | - | ||||||

|

Treasury stock, 19,361 and 0 shares as of March 31, 2021 and December 31, 2020, respectively

|

(319 | ) | - | |||||

|

Additional paid-in capital

|

147,615 | 68,238 | ||||||

|

Accumulated other comprehensive income

|

2 | - | ||||||

|

Accumulated deficit

|

(48,507 | ) | (43,050 | |||||

|

Total stockholders' equity

|

98,795 | 25,191 | ||||||

|

Total liabilities and stockholders' equity

|

$ | 108,395 | $ | 40,402 | ||||

REKOR SYSTEMS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except share data)

(Unaudited)

|

|

Three months ended March 31, | |||||||

|

|

2021 | 2020 | ||||||

|

Revenue

|

$ | 4,216 | $ | 1,595 | ||||

|

Cost of revenue

|

1,962 | 494 | ||||||

|

Gross profit

|

2,254 | 1,101 | ||||||

|

|

||||||||

|

Operating expenses:

|

||||||||

|

General and administrative expenses

|

5,403 | 2,791 | ||||||

|

Selling and marketing expenses

|

937 | 371 | ||||||

|

Research and development expenses

|

1,222 | 543 | ||||||

|

Operating expenses

|

7,562 | 3,705 | ||||||

|

|

||||||||

|

Loss from operations

|

(5,308 | ) | (2,604 | ) | ||||

|

Other income (expense):

|

||||||||

|

Interest expense

|

(32 | ) | (1,163 | ) | ||||

|

Other income

|

16 | - | ||||||

|

Total other expense

|

(16 | ) | (1,163 | ) | ||||

|

Loss before income taxes

|

(5,324 | ) | (3,767 | ) | ||||

|

Income tax provision

|

(3 | ) | (7 | ) | ||||

|

Equity in loss of investee

|

(76 | ) | - | |||||

|

Net loss from continuing operations

|

(5,403 | ) | (3,774 | ) | ||||

|

Net loss from discontinued operations

|

(3 | ) | (14 | ) | ||||

|

Net loss

|

$ | (5,406 | ) | $ | (3,788 | ) | ||

|

Comprehensive loss:

|

||||||||

|

Net loss from continuing operations

|

(5,403 | ) | (3,774 | ) | ||||

|

Change in unrealized gain on short-term investments

|

2 | - | ||||||

|

Total comprehensive loss from continuing operations

|

(5,401 | ) | (3,774 | ) | ||||

|

Total comprehensive loss

|

$ | (5,404 | ) | $ | (3,788 | ) | ||

|

Loss per common share from continuing operations - basic and diluted

|

(0.15 | ) | (0.19 | ) | ||||

|

Loss per common share discontinued operations - basic and diluted

|

- | - | ||||||

|

Loss per common share - basic and diluted

|

$ | (0.15 | ) | $ | (0.19 | ) | ||

|

|

||||||||

|

Weighted average shares outstanding

|

||||||||

|

Basic and diluted

|

35,944,355 | 21,929,768 | ||||||

SOURCE: Rekor Systems, Inc.