SURREY, UK / ACCESSWIRE / June 10, 2021 / Condor Gold (AIM:CNR; TSX:COG) is pleased to announce that is has commenced an 8,500 metre infill diamond drilling programme within the permitted La Mestiza Open Pit Mineral Resource at La India Project, Nicaragua. Two diamond core drill rigs are currently operating on Mestiza and have drilled approximately 600 metres to date. The programme is anticipated to take a further 4 months to complete. Condor is also pleased to provide updated preminarly mine schedules on La Mestiza Open Pits conducted by SRK Consulting (USA) Inc, based on the existing Mineral Resource and in support of the 8,500 metre drilling programme.

Highlights

- Existing La Mesitza Open Pit Mineral Resource hosts 433kt at 8.6g/t gold for 120,000 oz gold (92kt at 12.1 g/t gold for 36,000 oz gold in the Indicated category and 341kt at 7.7 g/t gold for 85,000 oz gold in the Inferred Category).

- 8,500m infill drilling programme has commenced on the high-grade La Mestiza Open Pit aimed at upgrading Mineral Resources to Indicated category such that it forms a basis for inclusion into future Pre-Feasibility or Feasibility Studies .

- The Mestiza Vein Set is open down dip and along strike and has the potential for a material increase with additional drilling.

- Preliminary mine schedules indicate the potential to deliver 499kt of high grade material to the processing plant at a diluted head grade of 5.37 g/t gold, with the potential to produce 86,000 oz gold.

Mark Child, Chairman and CEO commented:

"Following the purchase of a new SAG mill package in April 2021, Condor engaged SRK Consulting (USA) Inc to produce strategic mine schedules on the high-grade fully permitted La Mesitza Open Pit Mineral Resource, which hosts 433kt at 8.6g/t gold for 120,000 oz gold (92kt at 12.1 g/t gold for 36,000 oz gold in the Indicated category and 341kt at 7.7 g/t gold for 85,000 oz gold in the in the Inferred Category). The schedules developed indicate a potential feed to the processing plant estimated at 499kt, at a diluted head grade of 5.37 g/t gold with potential to produce 86,000 oz gold. The aim of the 8,500m infill drilling programme in La Mestiza open pit is to convert a significant proportion of the Inferred Mineral Resource to an Indicated Mineral Resource for inclusion in future Pre-Feasibility Study or Feasibility Studies, enhance the geological confidence, de-risk future mine plans and attract project financing."

Drill Programme

The current Mineral Resource estimate dated 25 January 2019 (see RNS dated 28 January 2019 and Table 1 below) on the Mestiza Vein Set defines an open pit Mineral Resource of 432kt at 8.6g/t gold (92kt at 12.1g/t gold for 36,000 oz gold in the Indicated category and 341kt at 7.7 g/t gold for 85,000 oz gold in the in the Inferred category), and an underground Mineral Resource of 118kt at 5.5g/t gold in the Indicated category and 984kt at 5.3 g/t gold for 169,000 oz gold in the Inferred category. The 8,500 metres infill drilling programme will target the part of the Mineral Resource that is considered to have the potential to support open pit mining, focussing on the 85,000 oz gold that is currently catagorised as Inferred. The drilling will ‘tighten up' the drill spacing from the current mix of 50 m to 100 m spacing to a regular 25 m along strike and 50 m down-dip. The objective of the drilling program is to improve the confidence of the geological model and future mine schedules, aiming to upgrade a significant proportion of the Inferred open pit Mineral Resource to the Indicated Mineral Resource category for use in future Pre-Feasibility or Feasibility level studies.

The Mestiza Vein Set is located only 3 km from the permitted processing plant on La India Project (see Figure 1). The Mestiza Vein Set is open along strike and down dip and has the potential to be materially increased with further drilling.

Drilling will be accomplished with a combination of PQ and HQ diamond drilling bits, with half-core samples shipped to Bureau Veritas in Managua for sample prep and to Bureau Veritas' facilties in Vancouver, B.C. for assaying.

Table 1 Mineral Resource Estimate - Mestiza Vein Set (January 2019)

SRK MESTIZA MINERAL RESOURCE STATEMENT SPLIT PER VEIN as of January 2019 (3),(4),(5) | |||||||||

Category | Area Name | Vein Name | Cut-Off | gold | silver | ||||

Tonnes (kt) | Au Grade (g/t) | Au (Koz) | Ag Grade (g/t) | Ag (Koz) | |||||

Indicated | Mestiza veinset | Tatiana | 0.5 g/t (OP) | 92 | 12.1 | 36 | 19.5 | 57 | |

Tatiana | 2.0 g/t (UG) | 118 | 5.5 | 21 | 11.3 | 43 | |||

Inferred | Mestiza veinset | Tatiana(1) | 0.5 g/t (OP) | 220 | 6.6 | 47 | 13.6 | 97 | |

Tatiana(2) | 2.0 g/t (UG) | 615 | 3.9 | 77 | 8.8 | 174 | |||

Buenos Aires(1) | 0.5 g/t (OP) | 120 | 9.8 | 38 |

|

| |||

Buenos Aires(2) | 2.0 g/t (UG) | 188 | 7.1 | 43 |

|

| |||

Espenito(2) | 2.0 g/t (UG) | 181 | 8.4 | 49 |

|

| |||

| (1) The Mestiza pits are amenable to open pit mining and the Mineral Resource Estimates are constrained within Whittle optimised pits, which SRK based on the following parameters: A Gold price of USD1,500 per ounce of gold with no adjustments. Prices are based on experience gained from other SRK Projects. Metallurgical recovery assumptions of 96% for gold are based on testwork conducted to date. Marginal costs of USD19.36/t for processing, USD5.69/t G&A and USD2.35/t for mining, slope angles defined by the Company Geotechnical study of 45°, haul cost of USD1.25/t was added to the Mestiza ore tonnes to consider transportation to the plant. | |||||||||

| (2) Underground mineral resources beneath the open pit are reported at a cut-off grade of 2.0 g/t over a minimum width of 1.0m. Cut-off grades are based on a price of USD1,500 per ounce of gold and gold recoveries of 91 percent for resources, costs of USD19.36/t for processing, USD4.55/t G&A and USD50.0/t for mining, without considering revenues from other metals. | |||||||||

| (3) Mineral Resources are not Ore Reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate and have been used to derive sub-totals, totals and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, SRK does not consider them to be material. All composites have been capped where appropriate. The Concession is wholly owned by and exploration is operated by Condor Gold plc | |||||||||

| (4) The reporting standard adopted for the reporting of the MRE uses the terminology, definitions and guidelines given in the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Standards on Mineral Resources and Mineral Reserves (May 2014) as required by NI 43-101. | |||||||||

| (5) SRK Completed a site inspection to the deposit by Mr Benjamin Parsons, MSc (MAusIMM(CP), Membership Number 222568, an appropriate “independent qualified person” as this term is defined in National Instrument 43-101. | |||||||||

Mesitza Open Pit Mine Schedules

SRK Consulting (USA) Inc has recently produced strategic mine schedules based on the fully permitted La Mestiza Open Pit Mineral Resource, as detailed above. The study has looked to optimise the potential material exploitable by open pit mining methods acting as a strategic planning tool for the Company. The updated study has expanded on the separation of the ultimate pit by phase, now representing 9 phases compared to 4 phases previously envisioned. The phase design assumptions include: 40 to 42 overal pit angles, 10m road width, 5 m benches with 2.5 m flitches, waste mined at 10m benches. Various production rates were considered with a 500tpd schedule with low grade stockpiling assessed to produce the best stand alone economics.

Under the study, ore tonnes delivered to the processing plant are 499kt, the diluted head grade is 5.37 g/t gold, waste tonnes 13,257kt. The study assumed the same mining costs of US$2.57 per tonne for both ore and waste mining and processing costs of US$27.30 per tonne. The resultant potential cashflows being considered highly attractive by Condor.

It should be noted that these mining scenarios are part of ongoing work being done by Condor to optimize the Project which has not yet been finalized and so do not replace the 2019 MRE or the technical report entitled "Technical Report on the La India Gold Project, Nicaragua, December 2014" dated 13 November 2017 with an effective date of 21 December 2014 (the "Technical Report"), both of which remain current.

The tonnages, grades and contained gold estimates included in this are based on the mining of the existing, and previously reported Indicated and Inferred Mineral Resources which have been factored to include mining losses and dilution.

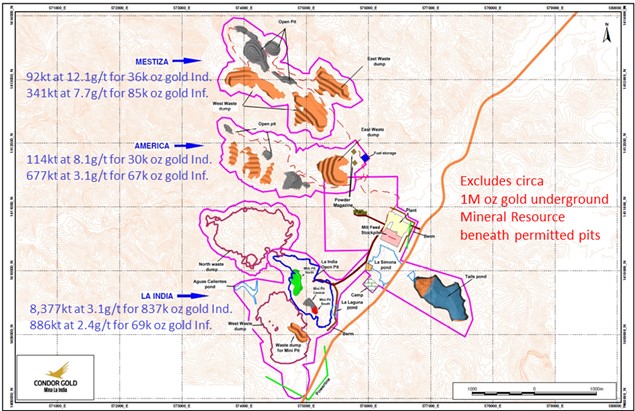

Figure 1. Image showing the location of the Mestiza satellite open pits in relation to the planned La India Gold Mine infrastructure. Open pit mineral resources shown in blue.

- Ends -

For further information please visit www.condorgold.com or contact:

Condor Gold plc | Mark Child, Chairman and CEO +44 (0) 20 7493 2784 | |

Beaumont Cornish Limited | Roland Cornish and James Biddle +44 (0) 20 7628 3396 | |

SP Angel Corporate Finance LLP | Ewan Leggat | |

H&P Advisory Limited | Andrew Chubb and Nilesh Patel +44 207 907 8500 | |

Blytheweigh | Tim Blythe, Camilla Horsfall and Megan Ray +44 (0) 20 7138 3204 |

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006 and dual listed on the TSX in January 2018. The Company is a gold exploration and development company with a focus on Nicaragua.

In August 2018, the Company announced that the Ministry of the Environment in Nicaragua had granted the Environmental Permit ("EP") for the development, construction and operation of a processing plant with capacity to process up to 2,800 tonnes per day at its wholly-owned La India gold project ("La India Project"). The EP is considered the master permit for mining operations in Nicaragua. Condor Gold published a Pre-Feasibility Study ("PFS") on the project in December 2014, summarised in the Technical Report, as defined below. The PFS details an open pit gold Mineral Reserve in the Probable category of 6.9 Mt at 3.0 g/t gold for 675,000 oz gold, producing 80,000 oz gold per annum for 7 years. La India Project contains a Mineral Resource of 9,850 Kt at 3.6 g/t gold for 1.14 Moz gold in the Indicated category and 8,479 Kt at 4.3 g/t gold for 1.18 Moz gold in the Inferred category. The Indicated Mineral Resource is inclusive of the Mineral Reserve. A gold price of $1,500/oz and a cut-off grade of 0.5 g/t and 2.0 g/t gold were assumed for open pit and underground resources, respectively. A cut-off grade of 1.5 g/t gold was furthermore applied within a part of the Inferred Resource. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any part of the Mineral Resources will be converted to Mineral Reserves.

Environmental Permits were granted in April and May 2020 for the Mestiza and America open pits respectively, both located close to La India. The Mestiza open pit hosts 92 Kt at a grade of 12.1 g/t gold (36,000 oz contained gold) in the Indicated Mineral Resource category and 341 Kt at a grade of 7.7 g/t gold (85,000 oz contained gold) in the Inferred Mineral Resource category. The America open pit hosts 114 Kt at a grade of 8.1 g/t gold (30,000 oz) in the Indicated Mineral Resource category and 677 Kt at a grade of 3.1 g/t gold (67,000 oz) in the Inferred Mineral Resource category. Following the permitting of the Mestiza and America open pits, together with the La India open pit Condor has 1.12 Moz gold open pit Mineral Resources permitted for extraction, inclusive of a Mineral Reserve of 6.9 Mt at 3.0 g/t gold for 675,000 oz gold.

Disclaimer

Neither the contents of the Company's website nor the contents of any website accessible from hyperlinks on the Company's website (or any other website) is incorporated into, or forms part of, this announcement.

Qualified Persons

The Mineral Resource Estimate has been completed by Ben Parsons, a Principal Consultant (Resource Geology) with SRK Consulting (U.S.), Inc, who is a Member of the Australian Institute of Mining and Metallurgy, MAusIMM(CP). He has some nineteen years' experience in the exploration, definition and mining of precious and base metals. Ben Parsons is a full-time employee of SRK Consulting (U.S.), Inc, an independent consultancy, and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration, and to the type of activity which he is undertaking to qualify as a "qualified person" as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") of the Canadian Securities Administrators and as required by the June 2009 Edition of the AIM Note for Mining and Oil & Gas Companies. Ben Parsons consents to the inclusion in the announcement of the matters based on their information in the form and context in which it appears and confirms that this information is accurate and not false or misleading.

The technical and scientific information in this press release has been reviewed, verified and approved by Gerald D. Crawford, P.E., who is a "qualified person" as defined by NI 43-101 and is the Chief Technical Officer of Condor Gold plc.

The technical and scientific information in this press release has been reviewed, verified and approved by Andrew Cheatle, P.Geo., who is a "qualified person" as defined by NI 43-101.

Technical Information

Certain disclosure contained in this news release of a scientific or technical nature has been summarised or extracted from the technical report entitled "Technical Report on the La India Gold Project, Nicaragua, December 2014", dated November 13, 2017 with an effective date of December 21, 2014 (the "Technical Report"), prepared in accordance with NI 43-101. The Technical Report was prepared by or under the supervision of Tim Lucks, Principal Consultant (Geology & Project Management), Gabor Bacsfalusi, Principal Consultant (Mining), Benjamin Parsons, Principal Consultant (Resource Geology), each of SRK Consulting (UK) Limited, and Neil Lincoln of Lycopodium Minerals Canada Ltd., each of whom is an independent "qualified person" as defined by NI 43-101.

Forward Looking Statements

All statements in this press release, other than statements of historical fact, are ‘forward-looking information' with respect to the Company within the meaning of applicable securities laws, including statements with respect to: the ongoing mining dilution and pit optimisation studies, and the incorporation of same into any mining production schedule, future development and production plans at La India Project. Forward-looking information is often, but not always, identified by the use of words such as: "seek", "anticipate", "plan", "continue", "strategies", "estimate", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", "could", "might", "will" and similar expressions. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions regarding: future commodity prices and royalty regimes; availability of skilled labour; timing and amount of capital expenditures; future currency exchange and interest rates; the impact of increasing competition; general conditions in economic and financial markets; availability of drilling and related equipment; effects of regulation by governmental agencies; the receipt of required permits; royalty rates; future tax rates; future operating costs; availability of future sources of funding; ability to obtain financing and assumptions underlying estimates related to adjusted funds from operations. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Such forward-looking information involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to: mineral exploration, development and operating risks; estimation of mineralisation, resources and reserves; environmental, health and safety regulations of the resource industry; competitive conditions; operational risks; liquidity and financing risks; funding risk; exploration costs; uninsurable risks; conflicts of interest; risks of operating in Nicaragua; government policy changes; ownership risks; permitting and licencing risks; artisanal miners and community relations; difficulty in enforcement of judgments; market conditions; stress in the global economy; current global financial condition; exchange rate and currency risks; commodity prices; reliance on key personnel; dilution risk; payment of dividends; as well as those factors discussed under the heading "Risk Factors" in the Company's annual information form for the fiscal year ended December 31, 2019 dated March 31, 2020 and available under the Company's SEDAR profile at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Technical Glossary

| Assay | The laboratory test conducted to determine the proportion of a mineral within a rock or other material. Usually reported as parts per million which is equivalent to grams of the mineral (i.e. gold) per tonne of rock |

| Ag | Silver |

| Au | Gold |

| Down-dip | Further down towards the deepest parts of an ore body or zone of mineralisation. |

| Grade | The proportion of a mineral within a rock or other material. For gold mineralisation this is usually reported as grams of gold per tonne of rock (g/t) |

| g/t | grams per tonne |

| Indicated Mineral Resource | That part of a Mineral Resource for which tonnage, densities, shape, physical characteristics, grade and mineral content can be estimated with a reasonable level of confidence. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. The locations are too widely or inappropriately spaced to confirm geological and/or grade continuity but are spaced closely enough for continuity to be assumed. |

| Inferred Mineral Resource | That part of a Mineral Resource for which tonnage, grade and mineral content can be estimated with a low level of confidence. It is inferred from geological evidence and assumed but not verified geological and/or grade continuity. It is based on information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that may be limited, or of uncertain quality and reliability, |

| Kt | Thousand tonnes |

| Mineral Resource | A concentration or occurrence of material of economic interest in or on the Earth's crust in such a form, quality, and quantity that there are reasonable and realistic prospects for eventual economic extraction. The location, quantity, grade, continuity and other geological characteristics of a Mineral Resource are known, estimated from specific geological knowledge, or interpreted from a well constrained and portrayed geological model. |

| NI 43-101 | Canadian National Instrument 43-101 a common standard for reporting of identified mineral resources and ore reserves |

| Open pit mining | A method of extracting minerals from the earth by excavating downwards from the surface such that the ore is extracted in the open air (as opposed to underground mining). |

| Recovery (drilling) | The percentage of the length of rock that is brought to the surface surface by drilling. The rock samples are typically brought to the surface in 1m to 3m long sections and the recovery is expressed as a percentage of the length of each section. |

| Strike length | The longest horizontal dimension of an ore body or zone of mineralisation. |

| Vein | A sheet-like body of crystallised minerals within a rock, generally forming in a discontinuity or crack between two rock masses. Economic concentrations of gold are often contained within vein minerals. |

SOURCE: Condor Gold plc