Nearly 60 Percent of Finance Professionals Reveal Finance Back Office Systems Are Not Meeting Their Needs

SANTA CLARA, CA / ACCESSWIRE / June 28, 2021 / AUDITORIA.AI, a pioneer in AI-driven automation solutions for corporate finance teams, today announced the results of the second-annual State of Automation in the Back Office report. Tipping Point: 2021 State of Automation in the Back Office Report revealed that while automation adoption is widespread across industries, it has yet to permeate the corporate finance department fully.

Click here to download the results of the Tipping Point: 2021 State of Automation in the Back Office Report.

"The opportunities for intelligent, autonomous finance operations continue to rapidly evolve, and offer strategic differentiators for finance leaders to future-proof their back-office operations," said Rohit Gupta, CEO and co-founder, Auditoria. "While once thought to be the fast followers within organizations, the results of the Tipping Point: 2021 State of Automation in the Back Office Report show that now is the time for corporate finance to become the early adopters of the autonomous enterprise."

Auditoria surveyed more than 600 U.S.-based financial professionals in spring 2021, with titles ranging from Chief Financial Officer (CFO) to Finance Specialist. Key results include:

- It's status quo in the finance back office. Results showed that 58 percent of finance professionals do not believe that the finance back office is sufficiently automated, and one-third of finance teams said they are process-heavy.

- Repetitive manual tasks rule the roost in finance. Time spent on repetitive tasks is the top challenge for finance professionals followed by time spent checking and updating data. Additionally, more than 50 percent of finance professionals want a reduction in both manual and repetitive tasks.

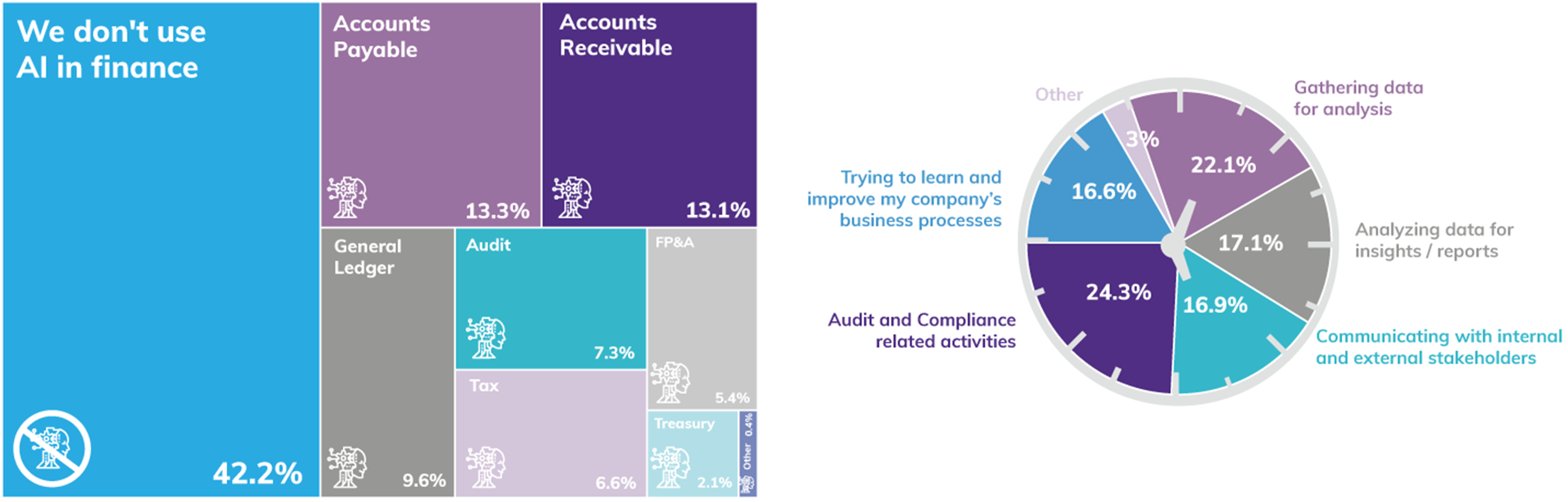

- Accounts Payable is the most manual back-office process. Almost a third of finance professionals believe that the Accounts Payable involved the most manual work within the finance back office, followed by Accounts Receivable.

- Finance is ready to embrace the future. While almost half do not use artificial intelligence (AI) in finance, a third of finance want to invest in new technologies to improve business processes within the next year.

The results of the Tipping Point: 2021 State of Automation in the Back Office Report indicate that the corporate finance back-office must embrace automation to survive in the digital-first corporate environment. With other departments traditionally at the forefront of innovation, finance must shed the reputation that they are slow to adopt new technology and utilize advanced systems, allowing the back office to contribute more directly to the strategic growth of an organization.

Auditoria helps modern finance teams accelerate finance transformation by dramatically improving cash performance. Built with cutting-edge AI, ML, Cognitive RPA, NLP, and Computer Vision, Auditoria streamlines and automates collections, adds controls to procurement spend, and optimizes cash performance. In addition, Auditoria integrates with industry-leading ERP and Financial applications, including Bill.com, Oracle ERP Cloud, Oracle NetSuite, Sage Intacct, Workday, and collaboration tools such as Microsoft Office 365 and Google Workspace.

Download the results of the Tipping Point: 2021 State of Automation in the Back Office Report today: https://info.auditoria.ai/2021-ebook-survey

About Auditoria

Auditoria is an AI-driven SaaS automation provider for corporate finance that automates back-office business processes involving tasks, analytics, and responses in Vendor Management, Accounts Receivables, Planning, and Audit. By leveraging natural language processing, artificial intelligence, and machine learning, Auditoria's platform removes friction and repetition from mundane tasks while also automating complex functions, such as predictive analytical forecasting. Corporate finance and accounting teams use Auditoria to accelerate business value while minimizing heavy IT involvement, improving business resilience, lowering attrition, and accelerating business insights. Give your finance teams superpowers at Auditoria.ai.

Follow Auditoria on LinkedIn and Twitter to stay connected.

Trademarks of Bill.com, Google, Microsoft, Oracle, Sage, and Workday are the properties of their respective owners.

Media Contact:

Meaghan McGrath

York IE

[email protected]

SOURCE: Auditoria