DEL MAR, CA / ACCESSWIRE / July 30, 2021 / HERMESUS, LLC, a recognized blockchain technology company within the global markets, today announced that it has signed an agreement with California-based venture capital firm First Level Capital to initiate its Series A round financing during the official launch of its cryptocurrency exchange "HERMESUS". Cryptocurrency traders will now be able to register and trade securely at highly competitive rates by visiting www.Hermesus.com.

After three years of development, Hermesus is raising outside capital at a valuation of $50 million to help further expand its digital assets trading platform. Following the Series A round closing, Hermesus anticipates allocating an initial tranche of $2.5 million dollars among development, marketing, and operations to take the Hermesus exchange and future NFT marketplace to the next level.

'We recently soft launched the Hermesus exchange, opening it to new client trading accounts in July. This raise is designed to help us accelerate our development and take it to a level that far surpasses what we would be able to attain via organic growth," stated Colin Breeze, managing director at Hermesus. "The closing of this initial financing round will now enable us to build out our sales, compliance, development and client care teams. With new capital from our institutional investors, we will be well-positioned to further enhance our platform while at the same time forge new relationships and strategic partnerships to offer a broader range of asset coverage and trading services", added Breeze.

"With the recent frenzy of fundraising and private equity rolling into the blockchain and crypto arena, and several new public offerings pending with new exchanges, First Level Capital is very excited to be first in with Hermesus and their management team," stated B. Michael Friedman, managing partner for First Level Capital. "We believe Hermesus is well positioned with their proprietary IP, banking relationships, and regulatory compliance to deliver a superior exchange relationship for both seasoned crypto traders as well as new investors seeking their first experience as owning and trading their digital assets of choice."

Recent case studies on digital asset exchange reliability suggest a market opportunity for a compliant, secure, US-based offering.

In particular, Digital Asset Research (DAR), a leading provider of crypto market analysis, recently announced the release of its July 2021 Crypto Exchange Vetting and Asset Vetting results. DAR's vetting processes meet an industry-wide need for reliable crypto data by applying institutional-level diligence to digital asset markets in an environment where cryptocurrencies trade across hundreds of lightly regulated or unregulated exchanges.

DAR evaluated over 450 exchanges to identify only 23 "Vetted Exchanges": B2BX, Binance.us, bitbank, Bitfinex, bitFlyer, BITFRONT, Bitso, Bitstamp, Bittrex, CEX.IO, Coinbase, Coincheck, CoinField, Gemini, GMO Coin Co., itBit, Kraken, Liquid, LMAX, Luno, Okcoin, VCC Exchange, and Zaif. Only a handful of Vetted Exchanges operate on US territory.

In addition, DAR has seventeen exchanges on their Watchlist for potential future inclusion on the Vetted Exchanges list: BHEX (formerly HBTC), Bidesk, Binance, Bitcoin.com, BitOffer, CoinEx, CoinTiger, DCoin, FTX, BKEX, Gate.io, Huobi, LATOKEN, OceanEx, Phemex, Poloniex, and ZB.com. Bitrue was recently removed from the DAR Watchlist due to not meeting quantitative diligence.

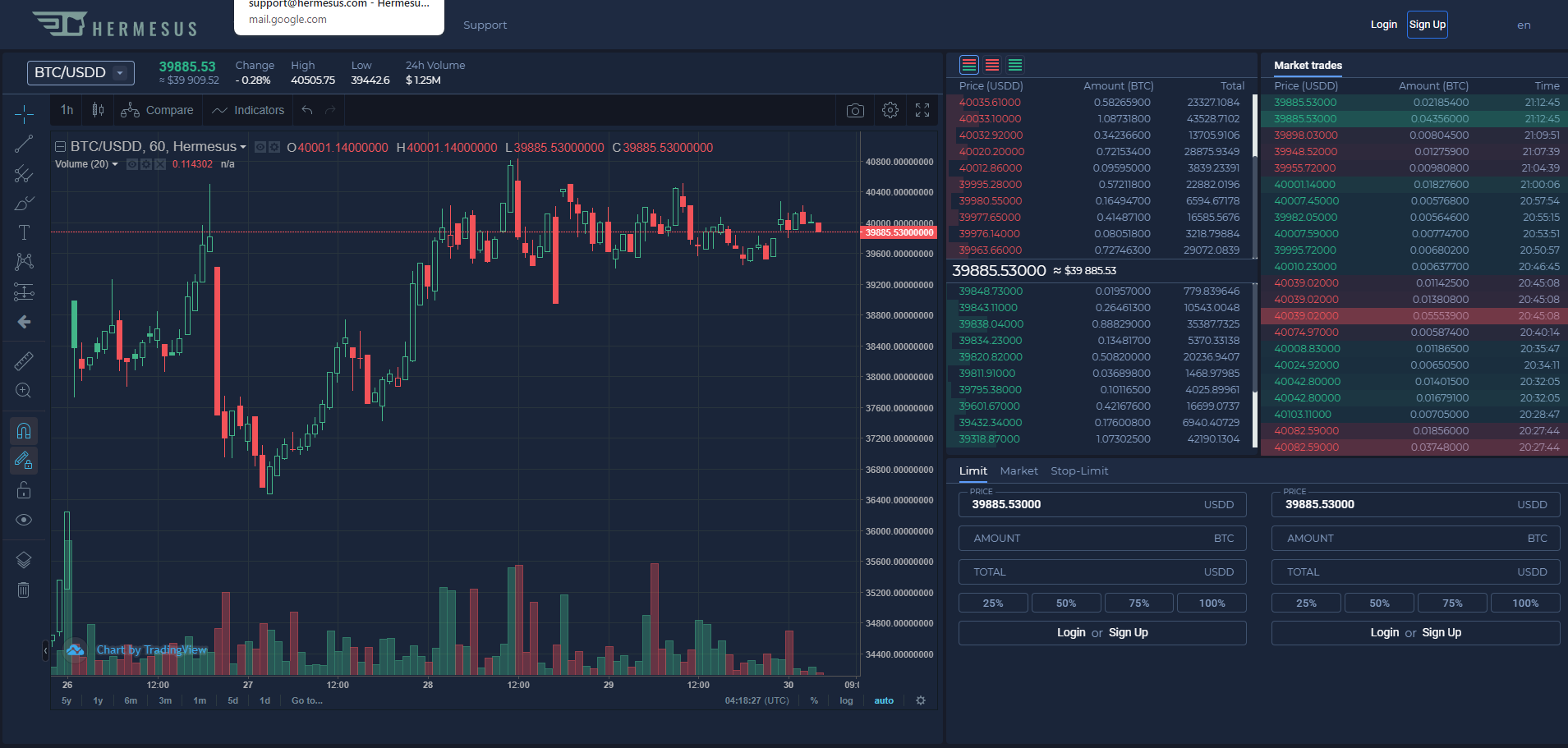

The Hermesus crypto assets trading platform has been built from the ground up, leveraging cutting-edge proprietary software and an intuitive user interface, purpose-built for compliance and digital asset protection. Hermesus offers a wide range of digital currency pairs, including Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE), among others.

About First Level Capital

First Level Capital is an active early-stage venture investor with core focus on FinTech and blockchain based start-ups. We invest globally in digital assets and equity at Seed to Series A stages. Most of our current portfolio are fintech projects out of Canada, Western Europe and The United States. Recent investments by firm members and partners include Instacart, Kraken and Klarna.

About Hermesus LLC

Hermesus LLC is a blockchain technology company with deep experience in digital asset trading. After setting up multiple international exchanges, the Company launched a US-based, professional, convenient, and innovative digital asset financial service platform to expand into the upstream and the downstream of blockchain and cryptocurrency industry value chain. With the launch of digital currency exchange Hermesus.com, the Company seeks to expand its business lines such as custody, staking, and its NFT Marketplace, which together could account for 50% or more of Hermesus' future revenues. For more information, please visit www.Hermesus.com.

Contact:

The Hermesus offering is available to accredited investors in reliance on Rule 506(c) of Regulation D and qualified non-US investors in reliance on Regulation S under the Securities Act of 1933.

Under Rule 506(c), general solicitation of offerings is permitted; however, purchasers in a Rule 506(c) offering must be 'accredited investors.' This press release does not constitute an offer to sell nor a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized and does not constitute an offer within any jurisdiction to any person to whom such an offer would be unlawful.

The securities have not been registered under the Securities Act, or any state securities laws and may not be offered or sold in the United States absent registration or applicable exemption from the registration requirements under the Act and applicable state securities laws.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, the Company's development plans and business outlook, which can be identified by terminology such as "may," "will," "expects," "anticipates," "aims," "potential," "future," "intends," "plans," "believes," "estimates," "continue," "likely to" and other similar expressions. Such statements are not historical facts, and are based upon the Company's current beliefs, plans and expectations, and the current market and operating conditions. Forward-looking statements involve inherent known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company's control, which may cause the Company's actual results, performance and achievements to differ materially from those contained in any forward-looking statement. Further information regarding these and other risks, uncertainties or factors is included in the Company's filings with the U.S. Securities and Exchange Commission. These forward-looking statements are made only as of the date indicated, and the Company undertakes no obligation to update or revise the information contained in any forward-looking statements as a result of new information, future events or otherwise, except as required under applicable law. There is no guarantee that the Company's operation of its cryptocurrency exchange will improve the Company's financial performance or results of operations. Shareholders are cautioned not to place undue reliance on this press release, or the forward-looking statements contained herein.

SOURCE: Hermesus.com