VANCOUVER, BC / ACCESSWIRE / August 9, 2021 / SILVER X MINING CORP. (TSXV:AGX)(OTC Pink:WRPSF) ("Silver X" or the "Company") is pleased to provide an update for the Tangana Mining Unit ("Tangana") at the Company's Nueva Recuperada project in Huancavelica, Peru.

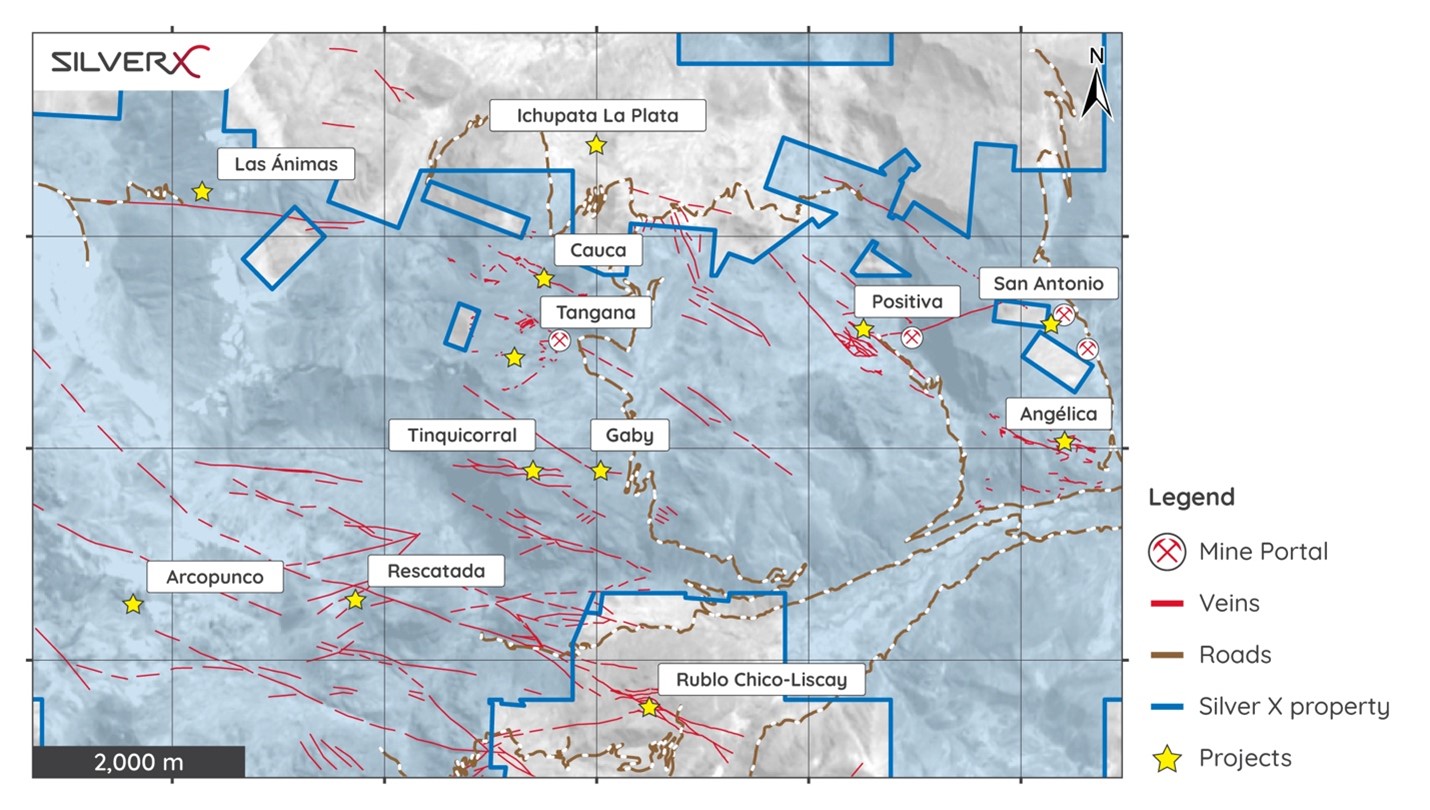

Tangana encompasses 6 principal polymetallic veins that together host an estimated 4,840,015 tonnes of inferred resource grading 116.33 g/t Ag, 3.35% Pb and 1.63% Zn1. Silver X geologists have identified a further 5 potentially economically mineralized veins. In total, the targeted veins identified within the Tangana vein field cover more than 11 kilometres in combined length (see Figure 1). Historical production of polymetallic ore from 1959 to 1976 totalled 269,129 tonnes and was halted due to poor metal pricesz1.

Tangana covers some 4,500 ha of prospective silver-polymetallic ground and provides feed to the Recuperada plant which resumed processing material in 2019, has a capacity of 210,000 tpa and has sold USD $6.5M of polymetallic concentrate in H1-2021 YTD in this mine preparation phase; offsetting most of the exploration and corporate costs to date. The Company has initiated a 25,000-metre drill programme (announced July 19, 2021) of which 9,700 metres are aimed at expanding knowledge on and upgrading the quality of the Tangana inferred resource. Silver X also plans to boost underground mine infrastructure development in potentially economic silver-polymetallic mineralization at Tangana Mining Unit. Silver X initiated a permitting process in Q2 to upgrade the plant's capacity from 600 tpd to 720 tpd; with approval expected in Q3. At an appropriate time upon completion of the Company's programmed resource evaluation activities which include underground drilling and bulk sampling, an updated Silver X NI 43-101 technical report will be released. Silver X has budgeted more than 2,300 m of underground development in Tangana in combination with the drilling program.

Figure 1: Map of Tangana Mining Unit, showing key veins, infrastructure, concession limits, etc.

Tangana Exploration

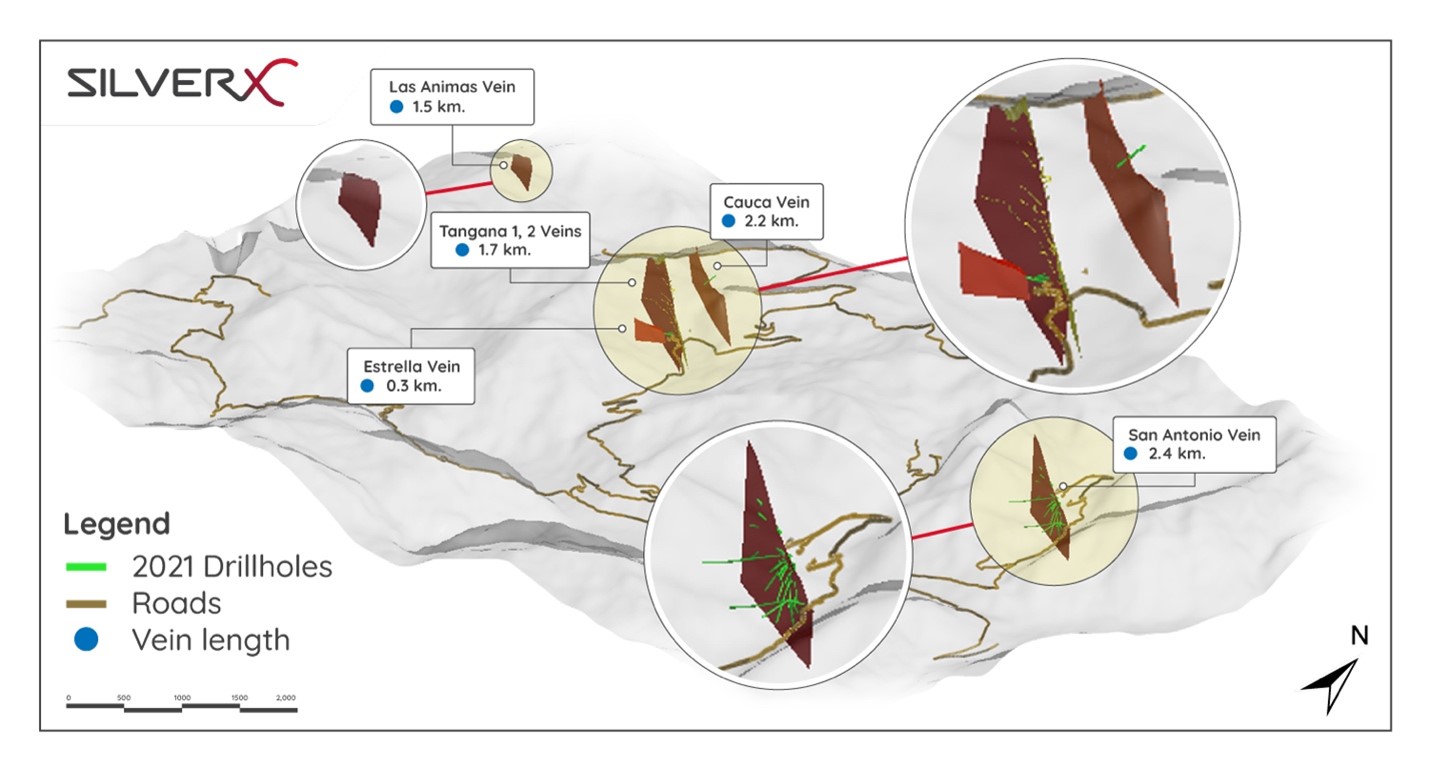

In addition to the 3 veins currently being developed for mining (Tangana 1, 2 and San Antonio - see Figure 2), 8 additional historically known polymetallic veins occur. This system of subparallel and conjugate veins covers a WNW-trending belt that is some 3,500 meters wide. The sum of strike for known Tangana veins covers more than 11 km in total, with the longest single vein, Cauca, being 2.2 kilometres long.

In the eastern portion of Tangana's ‘San Antonio' vein, the polymetallic and silver veins are hosted in carbonates where mineralized structures average 4-metre in width, with an average grade of 218.97 g/t AgEq2. In the volcaniclastic-dominated western portion, this vein is on average 1.5 metres in width.

Figure 2: Image of the Tangana Mining Unit, showing 4 principal veins as depicted via 3D Model

Some key veins at the Tangana mining unit include:

Underground infrastructure currently being developed:

- Tangana 1,2: 1.0 m average width, 1.7 kilometre long, average grade of 286.71g/t AgEq3

- San Antonio (sub-parallel to Tangana and located 2.5 kilometres to the NE): 2.5-4.0 metre average width of mineralized structure, 2.4 kilometres long, grading up to 218.97 g/t AgEq4

Next veins to be considered for development of underground infrastructure:

- Cauca (sub-parallel to Tangana and located 400 metres to the NE): 1.1 m average width, 2.2 kilometres long, average grade of 306.67g/t AgEq5

- Positivas (sub-parallel to San Antonio and located 200 metres to the ESE): 1.0 metre average width, 0.3 kilometres long

- Morlupo (sub-parallel to Tangana and located 200 metres to the NW): 1.6 metre average width, 0.4 kilometres long

- Gaby (sub-parallel to Tangana and located 400 metres to the SW): 0.8 metre average width, 1.0 kilometres long

- Las Animas (aligned almost E-W at some 25° to the Tangana system and located 500 metres to the WNW): 1.2 metre average width, 1.5 kilometres long

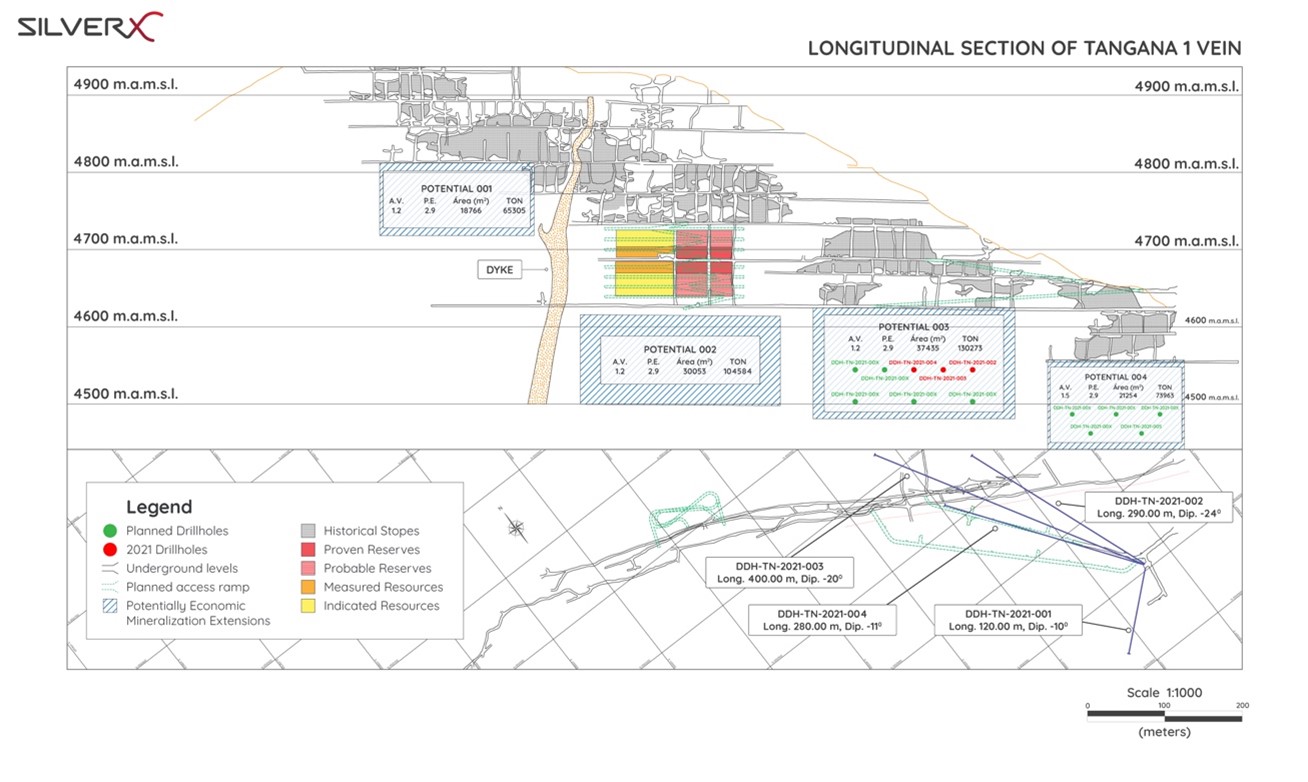

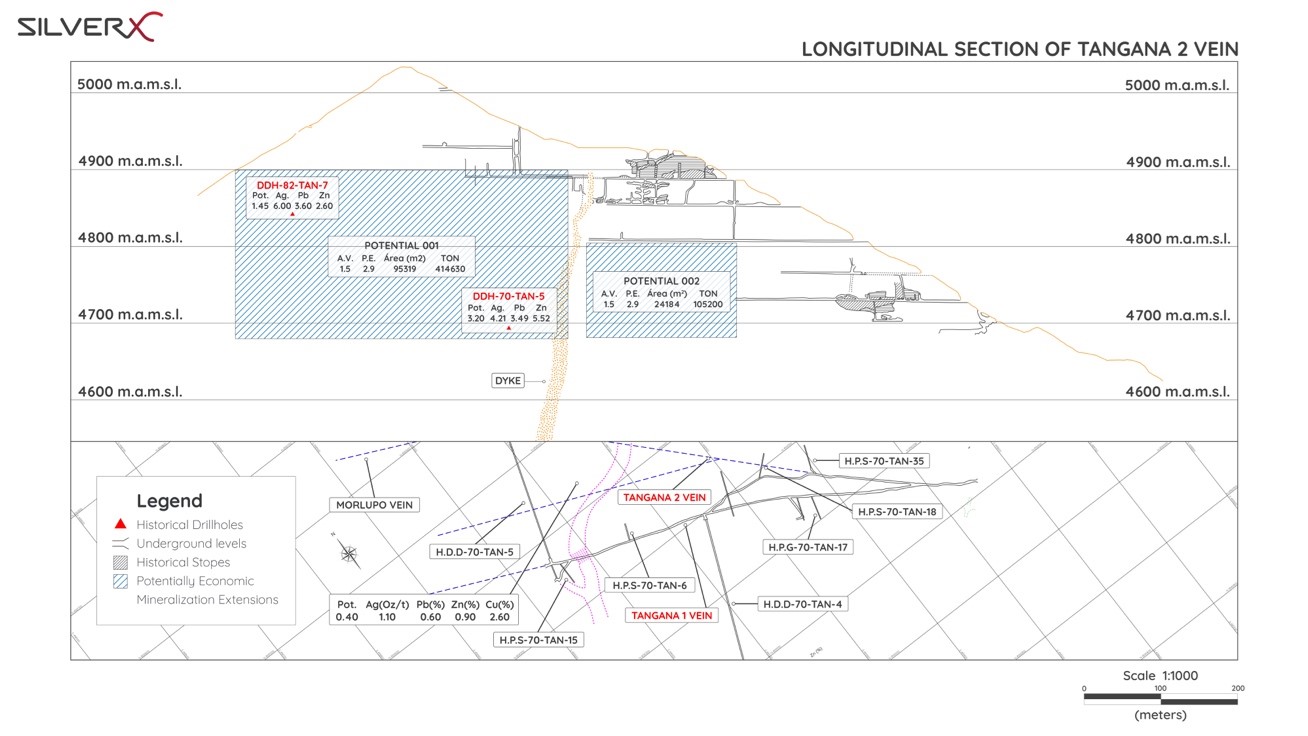

The Company is prioritizing underground mine development and resource expansion drilling in this extensive system of silver-polymetallic veins to provide feed for a future increase in production at Tangana (see Figure 3), having completed more than 330m by July 2021. Additionally, in the coming months, the Company plans to open access crosscuts from near the principal Tangana portal to initiate underground infrastructure development and bulk-sampling of the nearby Morlupo vein, followed thereafter by development of the Cauca vein.

Figure 3: Long section showing current development and resource extension potential of the Tangana Mining Unit

"We are making excellent progress at Tangana, including obtaining some very interesting drill intersections, the results of which are to be imminently released once the QAQC and final assays have been reviewed. These results should confirm the high-grade silver-polymetallic mineralization at depth. At the same time, we have scheduled the start of an underground bulk-sampling period on the Tangana veins for the month of September. Those impressive veins are exposed for longer than 2 kilometres on surface and the outcrop geochemistry and geological interpretation support the notion that Tangana will provide a meaningful boost to our development" commented Jose Garcia, CEO of Silver X. "With two drill rigs turning and more on the way as we speak, and a complete mine-development fleet on site, we anticipate a very solid second half of 2021".

Historical Production

The Tangana Mining Unit land package was acquired by Silver X from Peruvian Metals (TSX.V-PER) and Pan American Silver (TSX: PASS) in 2017. From 1959 to 1976 some 269,128 tonnes were produced from 3 veins (Cauca, Tangana, Positivas)6.

Mining was ultimately halted in 1976 due to poor metals prices however the Company believes historical operations extracted only a small fraction of the polymetallic mineral found at Tangana. Recent exploration by Silver X as announced in a news release dated July 19, 2021, has shown that key veins are open at depth and along strike. Surface geological mapping indicates that the central Tangana 2 vein extends in length for over 0.7 kilometres. In combination with the adjoining Despreciada and Morlupo veins, this mineralized structure can be traced on surface for over 2.3 kilometers. Follow-on geochemical surface sampling of this paramount vein structure is planned for Q3 2021.

Silver-Polymetallic Mineralization at the Tangana Mining Unit

The intermediate epithermal silver-polymetallic mineralization at Tangana is characterized by massive sulphides, veinlets, stringers, blebs and disseminations hosted within anastomosing, steeply-dipping, discrete quartz veins and/or brecciated quartz vein shoots (see Figures 4 & 5). Principal economic minerals of interest include galena, sphalerite, argentiferous galena, tetrahedrite, minor gold. Gangue minerals include pyrite, quartz, rhodochrosite, hydrothermal calcite, etc. Mineralized structures throughout the Tangana system vary around an average of 1.53 metres in width.

At present the open-ended potentially economically mineralized silver-polymetallic veins at Tangana extend in depth to greater than 250 metres below existing surface topography in places. Several conjugate sets of subordinate veins often focus mineralizing fluids into localized, enhanced, dilatational jogs, striking mostly along a general East-West trend. These occur in close association with junctions of well-endowed, principal NW-SE trending silver-polymetallic mineralized veins. In different sectors of the vein system, wall rocks are comprised of andesitic volcanoclastic or calcareous limestone sediments.

Hydrothermal alteration is moderately to weakly developed in halos enveloping veins and nearby mineralized structures. Intense silicification, weak sericitization and argillic alteration dominates near the mineralized structures, whilst chloritization and propylitic alteration occur in the more distant open areas between veins.

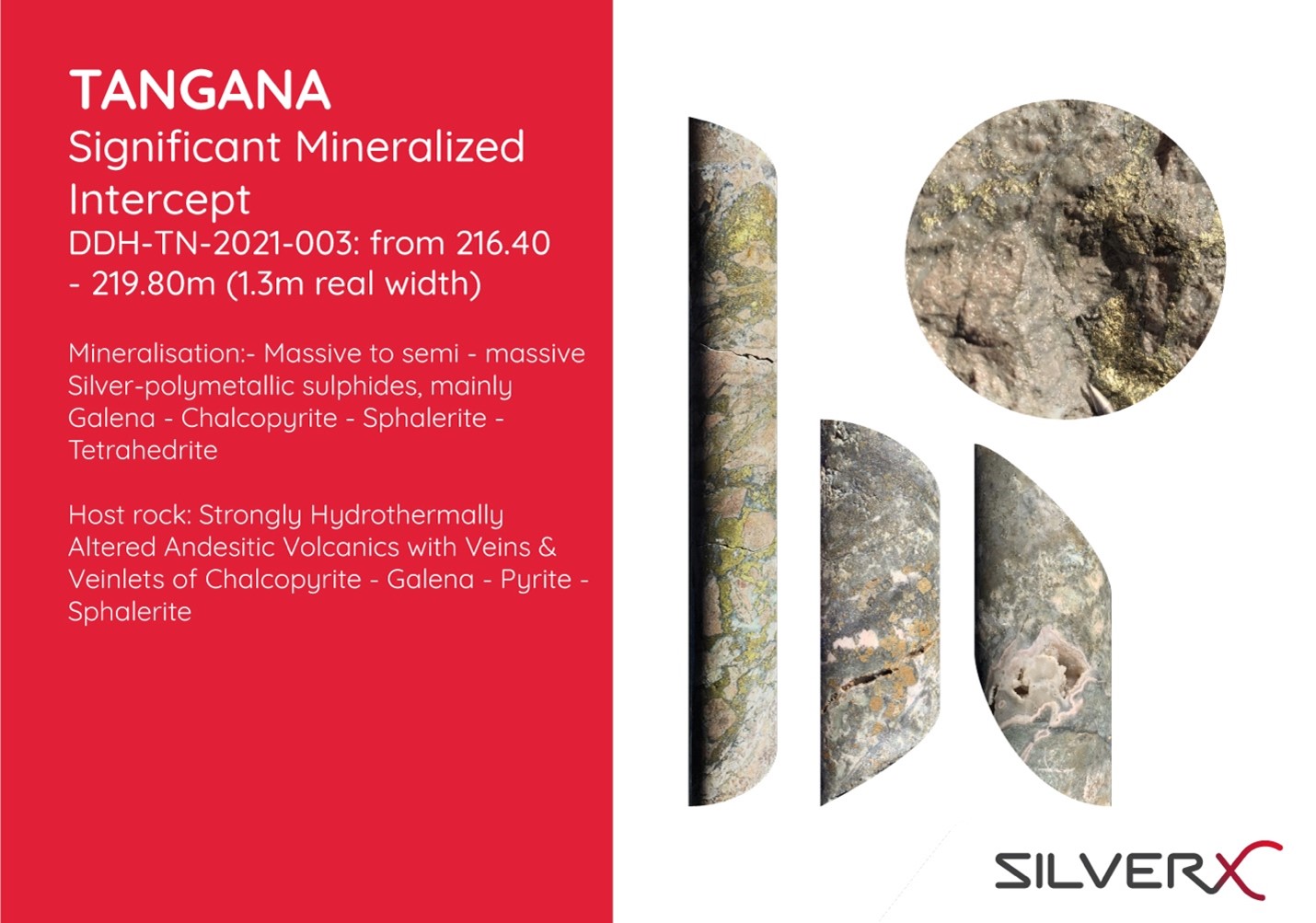

Figure 4: Selected photos of recently intersected significant mineralization.

Figure 5: Selected photos of recently intersected significant mineralization.

In due course, analytical results will be reported for the recently cut drill hole intersections hosting massive polymetallic mineralization, as displayed in Figures 4 and 5 above.

About Silver X Mining

Silver X Mining is a Canadian silver mining company with assets in Peru and Ecuador. The Company's flagship asset is the Nueva Recuperada silver lead zinc project located in Huancavelica, Peru. Founders and management have a successful track record of increasing shareholder value. Silver X Mining has introduced a fully NI 43-101 compliant quality assurance/quality control (QA/QC) protocol on all its advanced and exploration projects. Our trained QAQC staff insert both fine and coarse blank samples, field duplicates and twin samples into each batch of field samples prior to delivery to the independent certified analytical laboratory. These QAQC samples, including the random insertion of certified reference material, are designed to provide an independent check on precision, accuracy and possibilities of contamination during sample preparation and analytical procedure within the elected commercial laboratory. With the objective of assuring best practice compliance, resource and exploration related assay results will not be reported until the results of internal QAQC procedures have been internally reviewed and approved. For more information visit our website at www.silverx-mining.com.

Qualified Person

Mr. A. David Heyl who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Mr. Heyl, B.Sc., C.P.G., QP is a Certified Professional Geologist and Qualified Person under NI 43-101. With over 25 years of field and upper management experience, Mr. Heyl has a solid geological background in generating and conducting exploration and mining programs for gold, rare earth metals, and base metals, resulting in several discoveries. Mr. Heyl has 20 years of experience in Peru. He worked for Barrick Gold, was the exploration manager for Southern Peru Copper, and spent over twelve years working in and supervising underground and open pit mining operations in the Americas. Mr. A. David Heyl is a consultant for Silver X Mining Corp.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release in the United States. Such securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and, accordingly, may not be offered or sold within the United States, or to or for the account or benefit of persons in the United States or "U.S. Persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

ON BEHALF OF THE BOARD

José M García

CEO and Director

For further information, please contact:

Silver X Mining Corp.

+ 1 604 358 1382 | [email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

Some of the statements contained in this news release are forward-looking statements and information within the meaning of applicable securities laws. Forward-looking statements and information can be identified by the use of words such as "expects", "intends", "is expected", "potential", "suggests" or variations of such words or phrases, or statements that certain actions, events or results "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements in this news release include statements in respect of the Company's exploration plans and development potential for the Company's properties. Forward-looking statements and information are not historical facts and are subject to a number of risks and uncertainties beyond the Company's control. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this news release. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, except as may be required by law.

1 Compañía de Minas Buenaventura SA, "MINAS HUACHOCOLPA: Reservas de Mineral al 1° de Enero de 1977" (Issue Date: July 1977)

2 Latitude Base Metals, "Annual Summary - Composite Geological Report, San Antonio Mineral (2019 - Jul 2021)", (Issue Date: August 2020)

3 Latitude Silver, "Plan Comparativo del Proyecto Tangana para Segundo Pulmón de Mineral, Setiembre de 2020" (Issue Date: September 2020)

4 Latitude Silver, "Annual Summary - Composite Geological Report, San Antonio Mineral (2019 - July 2021) (Issue Date: August 2020)

5 Latitude Silver, "Plan Comparativo del Proyecto Tangana para Segundo Pulmón de Mineral, Setiembre de 2020" (Issue Date: September 2020)

6 Compañía de Minas Buenaventura SA, "MINAS HUACHOCOLPA: Reservas de Mineral al 1° de Enero de 1977" (Issue Date: July 1977)

SOURCE: Silver X Mining Corp.