**NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES**

- Four holes have recently been completed for 1,091 metres in the ongoing resource expansion drill campaign at Tangana

- Final assay results have been received for 3 of the initial 4 drill holes at Tangana 1:

- Highlights:

- DDH-TN-2021-003: 928.13g/t AgEq over 1.38 metre interval

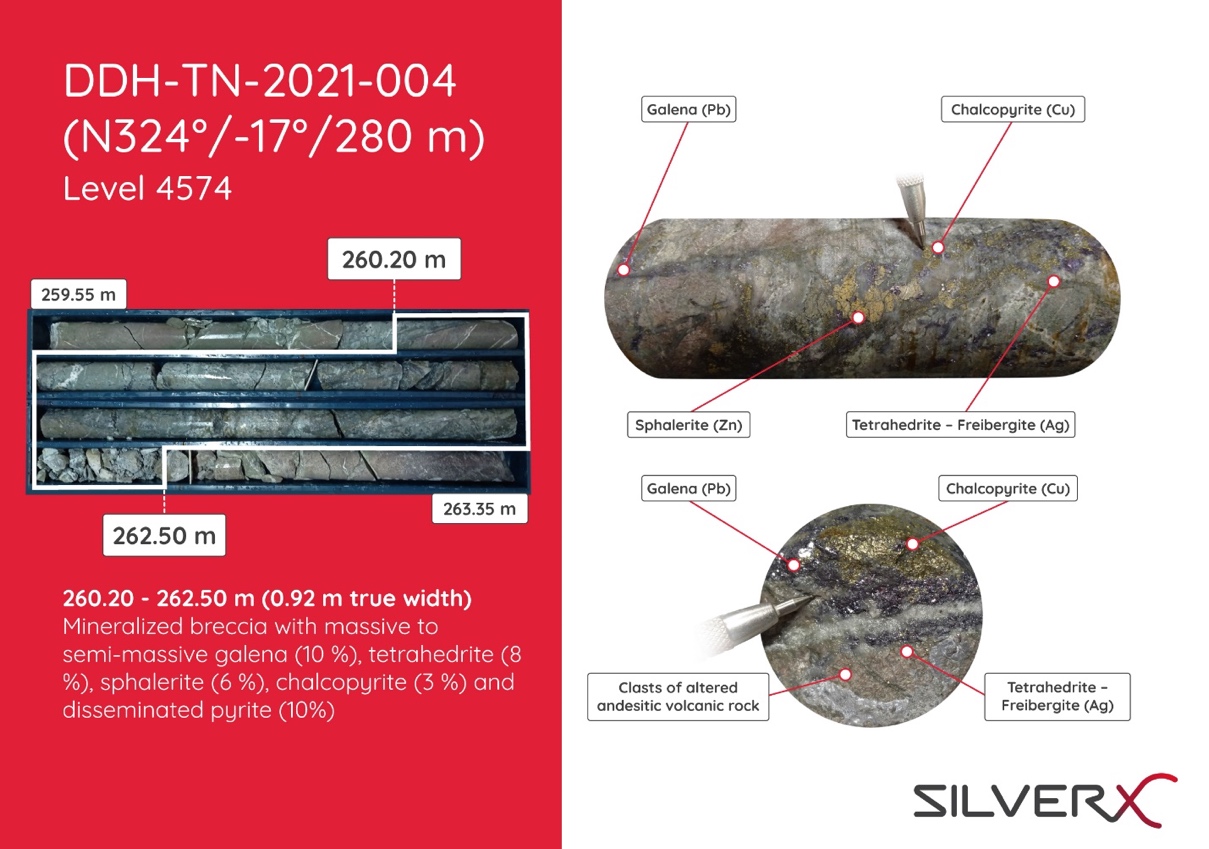

- DDH-TN-2021-004: 631.71g/t AgEq over 0.92 metre interval

- Highlights:

- Drilling continues to expand the extent of known open-ended mineralization at the Tangana Mining Unit

VANCOUVER, BC / ACCESSWIRE / August 23, 2021 / SILVER X MINING CORP. (TSXV:AGX)(OTC PINK:WRPSF) ("Silver X" or the "Company") is pleased to announce it has intersected significant intervals of high-grade silver-polymetallic mineralization at the Tangana Mining Unit ("Tangana") at the Company's Nueva Recuperada project in Huancavelica, Peru. Final analytical assay results received from two of the first four drill holes of the previously announced 25,000 metre drill programs, confirm the presence of easily accessible, contiguous, high-grade, silver-polymetallic mineralization at Tangana 1. The drill holes DDH-TN-2021-002, DDH-TN-2021-003 & DDH-TN-2021-004 targeted vein extensions below past producing underground stopes at Tangana 1 and results show the continuity of the open-ended silver-polymetallic mineralized structure. The planned development mineralization from this newly expanded mineralized zone will feed the currently operating Recuperada plant.

The Recuperada plant has been operating on development and toll feed since 2019, has a capacity of 200,000 tpa and has sold USD $6.5M of polymetallic concentrate in 2021 YTD. On the back of this operating cash flow, the Company has initiated a 25,000-metre drill programme (announced July 19, 2021) of which 9,700 metres are aimed at expanding knowledge on and upgrading the quality of the Tangana inferred resource. No mine production decision has been made, rather resource exploration and upgrade and underground access infrastructure development only.

The Company is not basing its exploration and underground infrastructure development decisions on a feasibility study of mineral reserves demonstrating economic and technical viability, rather on the strong historic production and current geological evidence of potentially economic mineralization extensions that justify its reported exploration and development programs. Later, ongoing current results could in turn justify a decision to initiate a feasibility study to generate mineral reserves and a mine production decision. Any production decision without a positive feasibility study increases uncertainty and the specific economic and technical risks of failure associated with its production decision.

Tangana 1 results include (refer Table 1 below for complete results):

- DDH-TN-2021-003 with 1.38 metres at 928.13 g/t AgEq

- DDH-TN-2021-004 with 0.92 metres at 631.71g /t AgEq

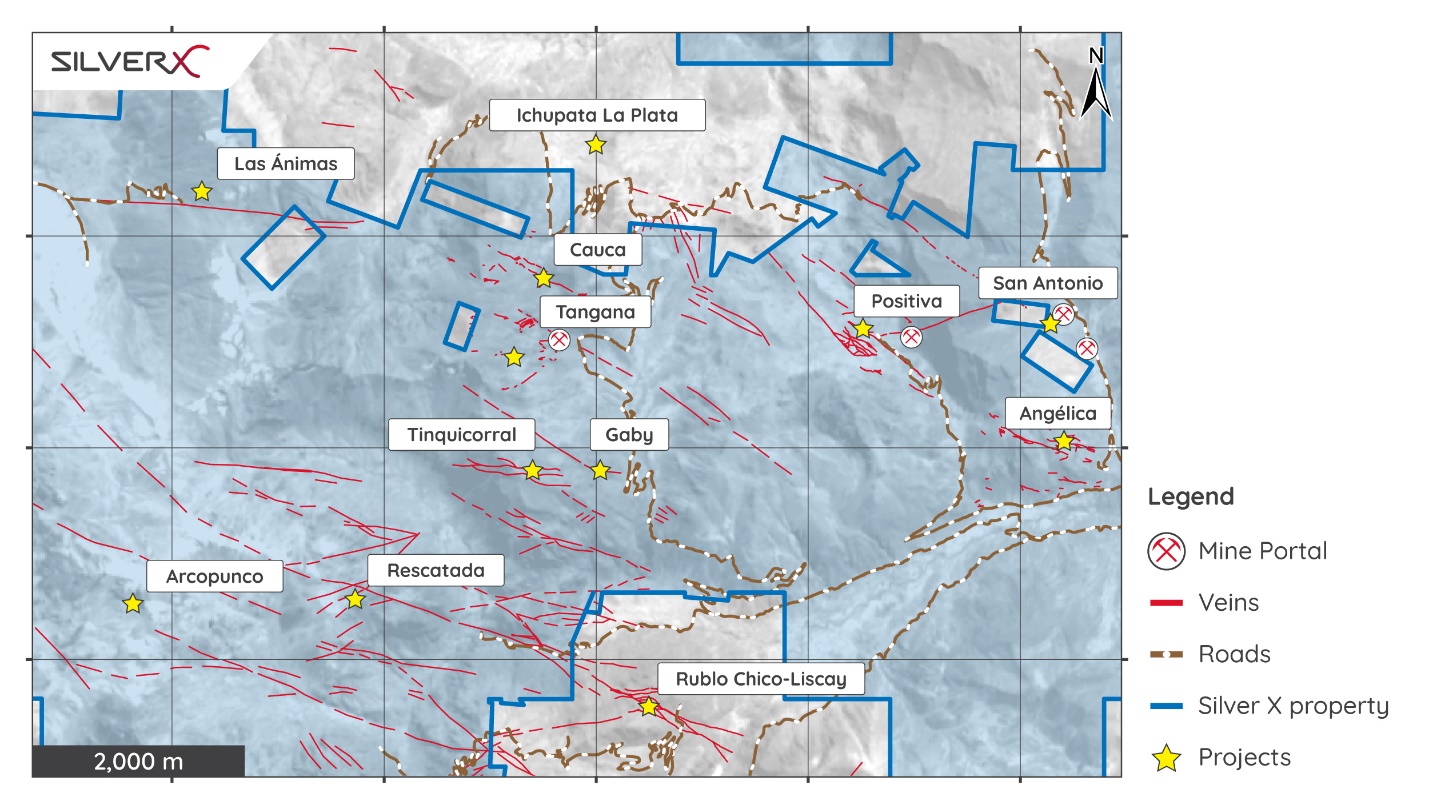

To date, a total of 34 drill holes for 6,660 metres have been completed on the Tangana, Cauca and San Antonio vein systems (Figure1). Tangana encompasses 11 silver-polymetallic vein targets across 4,500 ha of prospective silver-polymetallic concessions. In total, the silver-polymetallic veins identified within the Tangana vein field extend on surface more than 11 kilometres in combined strike-length. In February 2021, from a total of 6 principal silver-polymetallic veins, it was estimated that the Tangana vein field hosted 4,840,015 tonnes of inferred resource grading 116.33 g/t Ag, 3.35% Pb and 1.63% Zn1. The ongoing resource expansion drill campaign continues to broaden the extent of known open-ended mineralization.

As reported August 9, 2021, the mineralized, open-ended, silver-polymetallic vein-structures at the Tangana Mining Unit are known to extend in places more than 250 metres in depth below existing surface topography. Elsewhere in the extensive Tangana vein system the historically mined mineralization in the Angelica vein near Huachocolpa, has demonstrated continuity of mineralization vertically at elevations as low as 4,000 mamsl, or roughly 500 metres below the current Tangana exploration drilling at 4,575 mamsl elevation.

Figure 1: Map of Tangana Mining Unit, showing key veins, infrastructure, concession limits, etc.

"These promising assay results support our model that Tangana can be expanded to become a high-grade, multi-vein mine," said José Garcia, CEO of Silver X. "The ongoing drill program has significantly increased the known extent of silver-polymetallic mineralization while also providing valuable ‘upside' information for consideration for expanded mine development. We look forward to announcing further milestones at Tangana in the coming weeks."

There is a strong structural control on intermediate sulphidation, epithermal, silver-polymetallic mineralization at Tangana which occurs as massive to semi-massive sulphides, veins, veinlets, stringers, blebs and disseminations. The mineralization is hosted within anastomosing, steeply dipping, discrete quartz veins and/or brecciated quartz vein shoots. Principal economic minerals of interest include galena, sphalerite, argentiferous galena and other silver accessory minerals, tetrahedrite, minor copper and gold. Gangue minerals include pyrite, quartz, rhodochrosite, hydrothermal calcite, etc. Mineralized structures throughout the Tangana system vary around an average of 1.53 metres in width.

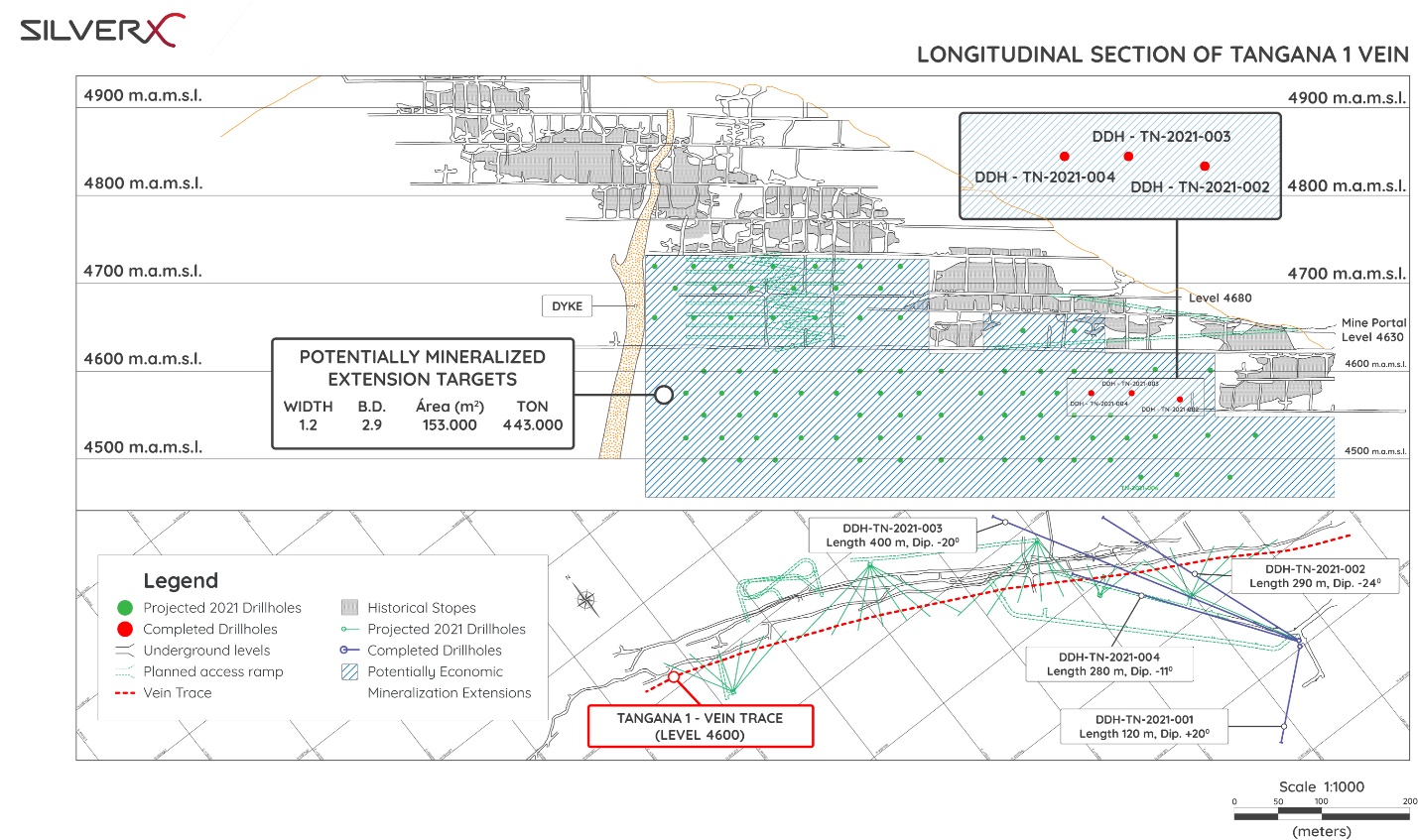

Figure 2: Long section and plan view of the Tangana 1 silver-polymetallic vein project. Targeted potentially mineralized extensions, as well as past-producing mined-out stopes, current access development and the location of recent drill hole intercepts for DDH-TN-2021-002, DDH-TN-2021-003 & DDH-TN-2021-004, are shown. Drill hole DDH-TN-2021-001 targeted a projected secondary structure - no significant results have been obtained. Tabulated summary results for these 4 Tangana drill holes are presented in Tables 1 & 2 below.

Drillhole ID | Intercept (m) | Gold - Silver - Polymetallic Grades | AgEq Grade (g/t) | ||||||

From | To | True width | Au_ppm | Ag_ppm | Cu_% | Pb_% | Zn_% | ||

TN-2021-001 | This hole targeted a projected secondary structure - no significant results obtained | ||||||||

TN-2021-002 | 187.20 | 190.10 | 2.0 | 0.01 | 0.60 | 0.01 | 0.03 | 0.03 | 0.03 |

TN-2021-003 | 216.70 | 219.45 | 1.38 | 1.40 | 386.65 | 1.40 | 2.44 | 4.46 | 928.13 |

TN-2021-004 | 260.20 | 262.50 | 0.92 | 0.25 | 159.09 | 0.41 | 8.77 | 3.09 | 631.71 |

Table 1: Tabulated summary of principal silver-polymetallic grades intersected in drill holes DDH-TN-2021-001 to DDH-TN-2021-004

Drillhole ID | Coordinates (WGS84) | Orientation (True) | Intercept (metres) | AgEq Grade (g/t) | ||||

| Easting | Northing | Azimuth | Dip | From | To | True Width | ||

| TN-2021-001 | 499661.18 | 8560902.82 | 228.85 | 20.08 | No meaningful intersections | |||

| TN-2021-002 | 499664.01 | 8560907.67 | 339.86 | -24.41 | 187.20 | 190.10 | 2.0 | 0.86 |

| TN-2021-003 | 499662.68 | 8560907.63 | 329.33 | -18.48 | 216.70 | 219.45 | 1.38 | 928.13 |

| TN-2021-004 | 499661.86 | 8560906.36 | 325.16 | -16.63 | 260.20 | 262.50 | 0.92 | 631.71 |

Table 2: Tabulated summary of drill hole collar parameters and principal silver-polymetallic AgEq grades intersected in drill holes DDH-TN-2021-001 to DDH-TN-2021-004

Figure 3: Selected photographs showing significantly mineralized core as intersected in DDH-TN-2021-003

Figure 4: Selected photographs showing significantly mineralized core as intersected in DDH-TN-2021-004

Grant of Stock Options

The Company has granted 2,475,000 stock options to certain directors, officers, and consultants of the Company. Each option will be exercisable into one common share at an exercise price of C$0.60 for a term of 5 years.

Sampling, Quality Assurance and Quality Control (QAQC)

Drill core from all underground drill holes is extracted in lengths of 1.52 meters (5 feet) and stored on-site in appropriate core trays in a secure Company core-shed. Drill hole orientation, downhole survey data, and collar coordinates are registered. When the extracted core has been measured and marked up, it is then geologically and geotechnically logged. Sampling of all mineralized structures encountered in the drill core is done from start to finish of the mineralized structure. Minimum sample length is 30 centimeters. No sample collected through potentially economic mineralized intersections is longer than 50 centimeters. Sterile country rock hosting the mineralized structure is sampled for a minimum of 1.0 meter either side of the structure. The interval to be sampled is split by rock-saw. Samples have unique number identifiers for "chain of custody" tracking of samples and for subsequent incorporation into the database once QAQC sign-off on analytical results has been received. The samples are shipped by Company 4x4 vehicle from the field to the certified and independent Certimin analytical laboratory facility in Lima. Certimin complies with ISO 9001, OHSAS 18001 and is a fully recognized and certified facility. The samples are first prepared and then analyzed for gold, silver, and multi-elements using relevant Certimin analytical methodologies. Periodically, duplicate sample pulps are sent to independent umpire laboratories for review and checking of results as received from Certimin.

Silver X Mining has introduced a fully NI 43-101 compliant quality assurance/quality control (QAQC) protocol on all its advanced and exploration projects. Our trained QAQC staff insert both fine and coarse blank samples, field duplicates and twin samples into each batch of field samples prior to delivery to the independent certified analytical laboratory. These QAQC samples, including the random insertion of certified reference material, are designed to provide an independent check on precision, accuracy, and possibilities of contamination during sample preparation and analytical procedure within the elected commercial laboratory. With the objective of assuring best practice compliance, resource and exploration related assay results will not be reported until the results of internal QAQC procedures have been reviewed and approved.

About Silver X Mining

Silver X Mining is a Canadian silver mining company with assets in Peru and Ecuador. The Company's flagship asset is the Nueva Recuperada silver lead zinc project located in Huancavelica, Peru. Founders and management have a successful track record of increasing shareholder value. For more information visit our website at www.silverx-mining.com.

Qualified Person

Mr. A. David Heyl who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Mr. Heyl, B.Sc., C.P.G., QP is a Certified Professional Geologist and Qualified Person under NI 43-101. With over 25 years of field and upper management experience, Mr. Heyl has a solid geological background in generating and conducting exploration and mining programs for gold, rare earth metals, and base metals, resulting in several discoveries. Mr. Heyl has 20 years of experience in Peru. He worked for Barrick Gold, was the exploration manager for Southern Peru Copper, and spent over twelve years working in and supervising underground and open pit mining operations in the Americas. Mr. A. David Heyl is a consultant for Silver X Mining Corp.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described in this news release in the United States. Such securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and, accordingly, may not be offered or sold within the United States, or to or for the account or benefit of persons in the United States or "U.S. Persons," as such term is defined in Regulation S promulgated under the U.S. Securities Act, unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

ON BEHALF OF THE BOARD

José M García

CEO and Director

For further information, please contact:

Silver X Mining Corp.

+ 1 604 358 1382 | [email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

Some of the statements contained in this news release are forward-looking statements and information within the meaning of applicable securities laws. Forward-looking statements and information can be identified by the use of words such as "expects", "intends", "is expected", "potential", "suggests" or variations of such words or phrases, or statements that certain actions, events or results "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements in this news release include statements in respect of the Company's exploration plans and development potential for the Company's properties. Forward-looking statements and information are not historical facts and are subject to a number of risks and uncertainties beyond the Company's control. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this news release. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, except as may be required by law.

[1] Oro X Mining Corp., "Amended & Restated NI 43-101 Technical Report for the Recuperada Project, Peru" (Effective Date: October 15, 2020; Issue Date: March 25, 2021)"

SOURCE: Silver X Mining Corp.