HALIFAX, NS / ACCESSWIRE / September 20, 2021 / Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NMI") (TSXV:NMI) is pleased to provide an update on the development of the Lofdal Heavy Rare Earth project since granting of a Mining Licence in July.

The Company has commenced earth works to develop a starter pit to a depth of about 15 metres at the Area 4 deposit. Mining activities are contracted to Gecko Mining (Pty) Ltd. and blasting to Bulk Mining Explosives A total of 32,100 tons of mineralized material will be extracted, of which 8,300 tons will be representative of fresh (unoxidized) mineralized material from 10 to 15 metre depth and will undergo pilot-scale test work for further processing optimization.

The Lofdal heavy rare earth deposit is one of only two primary xenotime projects under development in the world. The deposit has the potential for significant production of dysprosium and terbium, the two most valuable rare earth elements used in high powered magnets and other high-tech applications.

The Lofdal Project is being developed in joint venture with Japan Oil, Gas and Metals National Corporation ("JOGMEC") targeting a long term, sustainable supply of heavy rare earths to Japan.

The Company is also pleased to announce that JOGMEC, has increased the project funding by additional $437,000 bringing the Term 1 and 2 expenditures to date to $6,600,000.

Darrin Campbell, President of Namibia Critical Metals stated "We are incredibly pleased with the rapid progress of the project after the grant of the Mining License in July. Moving into the pilot-scale phase is yet another impressive milestone achieved in such a short period with our JOGMEC partners. We believe that Lofdal will eventually be recognized as one of the top heavy rare earths deposits of dysprosium and terbium in the western world.

Starter pit and pilot-scale test work

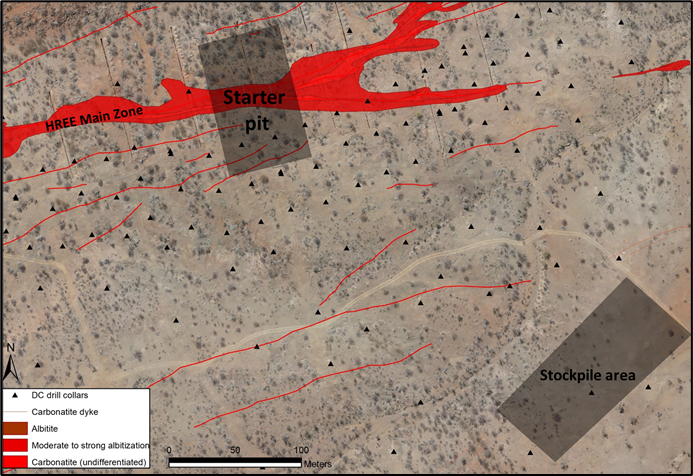

The Company has engaged highly experienced local mining contractor Gecko Mining (Pty) Ltd. to develop the starter pit over a surface area of 120 metres x 25 metres in the central part of the Area 4 deposit (Figure 1). Hard rock blasting is subcontracted to the international specialist group Bulk Mining Explosives (BME). The initial depth of 15 meter is planned to be reached by the second week of October 2021.

Figure 1: Location and outline of the Lofdal Area 4 starter pit

In total about 32,100 tons of mineralized material hosted by eight mining blocks of the current mine model will be extracted of which two blocks with about 8,300 tons are fresh mineralized material. This fresh mineralized material is regarded as representative for the expected typical run-of-mine below oxidation level of the entire Lofdal deposit. The starter pit entails mining of about 10,000 tons of waste rock from the hanging wall.

Figure 2: Ground-breaking at Lofdal Mine

Gecko Mining (Pty) Ltd. is also contracted to crush and screen the fresh mineralized material. Sub-samples will be shipped for pilot-scale test work including XRF sorting at Rados South Africa, XRT and multi-sensor sorting at Tomra Hamburg, and for lab-scale magnetic separation and flotation tests at SGS Canada. Planned test work is designed based on the results of the current lab-scale processing test programs by the above companies to further optimize the key processing steps while operating with industrial scale processes.

Figure 3: "Free-digging" - soft material is excavated to 1.5 m (left) and an additional 0.5-1 m is removed after mechanical rock breaking (right)

Figure 4: Stockpiling of oxidized ore

About Japan Oil, Gas and Metals National Corporation (JOGMEC)

JOGMEC is a Japanese government independent administrative agency which among other things seeks to secure stable resource supplies for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. The mandated areas of responsibilities within JOGMEC relate to oil and natural gas, metals, coal and geothermal energy. JOGMEC facilitates opportunities with Japanese private companies to secure supplies of natural resources for the benefit of the country's economic development.

Rare earths are of critical importance to Japanese industrial interests and JOGMEC has extensive experience with all aspects of the sector. JOGMEC provided Lynas with US$250,000,000 in loans and equity in 2011 to ensure supplies of the Light Rare Earths metals suite to the Japanese industry.

The Company currently owns a 95% interest in the Lofdal project with the remaining 5% held for the benefit of historically disadvantaged Namibians. The terms of the JOGMEC joint venture agreement with the Company stipulate that JOGMEC provides $3,000,000 in Term 1 and $7,000,000 in Term 2 to earn a 40% interest in the Lofdal project. Term 3 calls for a further $10,000,000 of expenditures to earn an additional 10% interest. JOGMEC can also purchase another 1% for $5,000,000 and has first right of refusal to fully fund the project through to commercial production and to purchase all production at market prices. The collective interests of NMI and historically disadvantaged Namibians cannot be diluted below a 26% carried working interest upon payment of $5,000,000 to JOGMEC for the dilution protection. The JV Agreement is structured such that no NMI equity will be issued and it is totally non-dilutive to NMI shareholders. To date, JOGMEC, has funded Term 1 and 2 expenditures totaling $6,600,000.

About Namibia Critical Metals Inc.

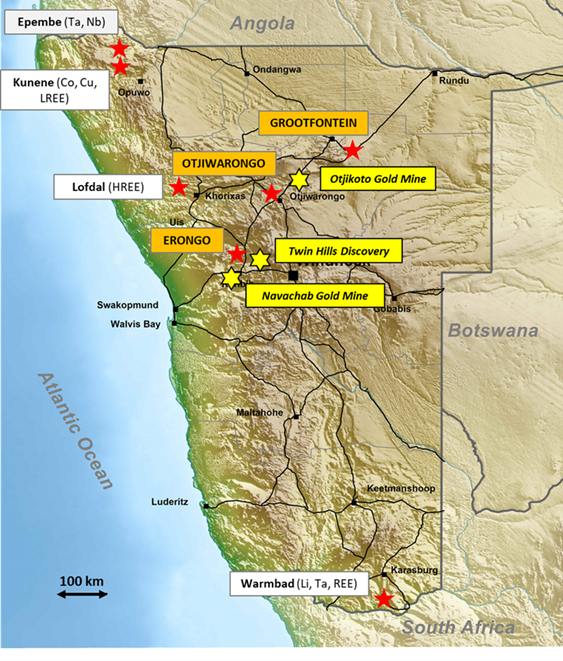

Namibia Critical Metals Inc. holds a diversified portfolio of exploration and advanced stage projects in the country of Namibia focused on the development of sustainable and ethical sources of metals for the battery, electric vehicle and associated industries. The two advanced stage projects in the portfolio are Lofdal and Epembe. The Company also holds significant land positions in areas favourable for gold mineralization.

Figure 5: Location of Namibia Critical Metals' projects highlighting position of gold projects (Erongo, Otjiwarongo and Grootfontein) in relation to important gold projects within the Navachab-Otjikoto gold belt

Heavy Rare Earths: The Lofdal Dysprosium-Terbium Project is the Company's most advanced project being fully permitted with a Mining Licence (ML 200) and Environmental Clearance Certificate (ECC) issued in 2021. The project is being developed in joint venture with Japan Oil, Gas and Metals National Corporation ("JOGMEC") to provide a sustainable supply of heavy rare earths to Japan, most notably dysprosium and terbium.

Gold: The Company's Exclusive Prospecting Licenses ("EPLs") prospective for gold are located in the Central Namibian Gold Belt which hosts a number of significant orogenic gold deposits including the Navachab Gold Mine, the Otjikoto Gold Mine and more recently the discovery of the Twin Hills deposit. At the Erongo Gold Project, stratigraphic equivalents to the meta-sediments hosting the recent Osino gold discovery at Twin Hills have been identified and soil surveys are progressing over this highly prospective area. The Grootfontein Base Metal and Gold Project has potential for magmatic copper-nickel mineralization, Mississippi Valley-type zinc-lead-vanadium mineralization and Otjikoto-style gold mineralization. Detailed interpretation of geophysical data and regional geochemical soil sampling have identified first gold targets, with the first targets being drill-tested.

Tantalum-Niobium: The Epembe Tantalum-Niobium-Uranium Project is at an advanced stage with a well-defined, 10 km long carbonatite dyke that has been delineated by detailed mapping and radiometric surveys and over 11,000 meters of drilling. Preliminary mineralogical and metallurgical studies including sorting tests (XRT), indicate the potential for significant physical upgrading. Further work will be undertaken to advance the project to a preliminary economic assessment stage.

Copper-Cobalt: The Kunene Copper-Cobalt Project comprises a very large area of favorable stratigraphy along strike of the Opuwo cobalt-copper-zinc deposit. Secondary copper mineralization over a wide area points to preliminary evidence of a regional-scale hydrothermal system. Exploration targets on EPLs held in the Kunene project comprise direct extensions of the cobalt-copper mineralization to the west, sediment-hosted copper, orogenic copper, and stratabound manganese and zinc-lead mineralization.

The common shares of Namibia Critical Metals Inc. trade on the TSX Venture Exchange under the symbol "NMI".

Donald M. Burton, P.Geo. is the Company's Qualified Person and has reviewed and approved the scientific and technical information in this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information please contact -

Namibia Critical Metals Inc.

Darrin Campbell, President

Tel: +01 (902) 835-8760

Fax: +01 (902) 835-8761

Email: [email protected]

Web site: www.NamibiaCriticalMetals.com

The foregoing information may contain forward-looking information relating to the future performance of Namibia Critical Metals Inc. forward-looking information, specifically, that concerning future performance, is subject to certain risks and uncertainties, and actual results may differ materially. These risks and uncertainties are detailed from time to time in the Company's filings with the appropriate securities commissions.

SOURCE: Namibia Critical Metals Inc.