After-Tax NPV8% of US$433M and IRR of 32% at $1.20/lb Zinc

VANCOUVER, BC / ACCESSWIRE / October 14, 2021 / Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTCQB:TKRFF) is pleased to announce strongly positive financial results from an updated Preliminary Economic Assessment ("PEA") prepared for its 100%-owned Ayawilca Zinc Zone project in central Peru. The updated PEA is disclosed in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and prepared by Mining Plus Peru S.A.C. ("Mining Plus") as principal consultant, Transmin Metallurgical Consultants ("Transmin"), Envis E.I.R.L ("Envis"), and SLR Consulting (Canada) Ltd ("SLR"). The updated PEA provides the economic assessment for an underground ramp-access mine development with an 8,500 tonnes per day processing plant, a significant throughput increase from the 2019 PEA.

PEA Highlights

- After-tax NPV8% of US$433 million (up 19% from 2019 PEA) using base case metal prices of US$1.20/lb zinc, US$22/oz silver, and US$0.95/lb lead on a 100% equity basis (pre-tax NPV8% of US$720 million);

- Initial Capex of US$264 million with after-tax IRR of 31.9% (pre-tax IRR of 42.6%);

- At current spot price of $1.50/lb zinc, the after-tax NPV8% increases to US$785 million and IRR increases to 45.7% (pre-tax NPV8% of US$1.27 billion and IRR of 61%);

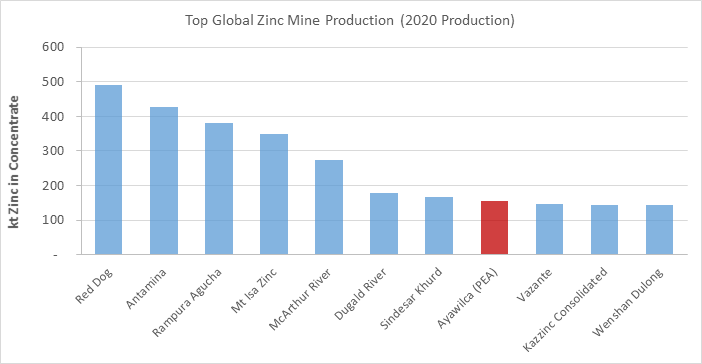

- Average annual production of approximately 155,000 tonnes of zinc in concentrate per year, which would make Ayawilca the largest primary zinc producer in South America and a top-10 global zinc producer;

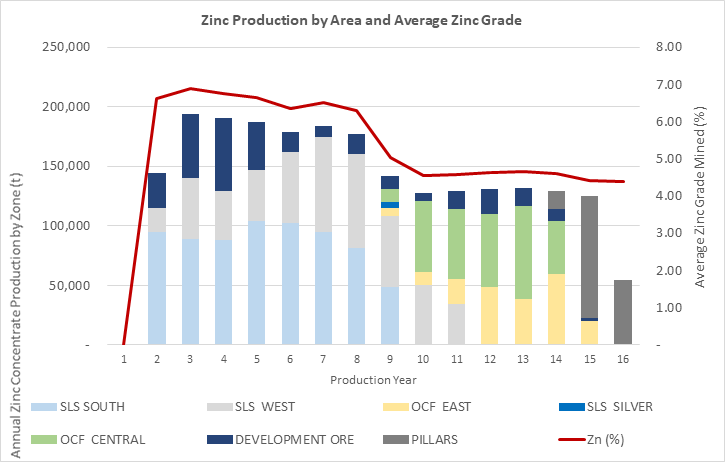

- 43.5 million tonnes mined over 14.4 years using bulk underground mining methods (sub level stoping combined with overhand cut and fill) with daily mill throughput of 8,500 tonnes per day (tpd);

- Project located in a major mining region close to a paved highway under construction, ~200 km from an operating zinc refinery and port;

- Designed to minimize risk and environmental impact - 40% of tailings used as underground backfill and on-surface tailings treatment and storage facility to use filtered dry-stack technology;

- Numerous opportunities to add further value, including

- exploration upside for additional zinc discoveries including at Far South, Yanapizgo, and Zone 3 areas;

- further optimization of zinc and silver metallurgical recoveries;

- incorporating high grade Tin Zone resources into the mine plan.

Note: The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Tinka's President and CEO, Dr. Graham Carman, stated: "We are very excited to release the results of our updated PEA, which shows Ayawilca to be an outstanding zinc project located in a mining friendly jurisdiction, well positioned to be one of the next major zinc development projects worldwide. At current spot zinc prices (around US$1.50 per pound) the PEA shows the project to be highly profitable with a post-tax NPV8% of ~US$785 million. At our base case zinc price of US$1.20 per pound, the PEA has excellent economics with a post-tax NPV8% of US$433 million. The updated PEA takes advantage of a relatively modest initial capital as well as access to a local refinery and port."

"The updated Ayawilca PEA demonstrates that, through the use of bulk tonnage underground mining methods and a larger resource, Ayawilca has the potential to be the largest primary zinc producer in South America. Further opportunities still exist to add more value at Ayawilca, including seeking to improve the zinc recoveries (currently 92%) to a zinc concentrate and silver recovery to a silver-lead concentrate (currently 45%), and also incorporating a tin circuit into the mine plan."

"Tinka is also committed to the highest standards of ESG performance. With the use of dry stack tailings and 100% use of waste rock and 40% of tailings as backfill, Tinka is highlighting its strong commitment to utilize low impact and environmentally sound solutions for tailings disposal. Tinka has been working at Ayawilca for a number of years, and we believe an underground mine built using industry-leading standards incorporating a low environmental impact will provide positive life-changing opportunities for our local stakeholders. We look forward to continuing to advance the Ayawilca project towards development."

"Exploration remains a strong focus for Tinka, and the potential remains for significant new discoveries at Ayawilca to further increase the resource along strike and at depth. Several targets at Ayawilca remain to be drill-permitted, and we have filed for an extended permit to cover those areas. Exploration is currently focused at the adjacent Silvia copper-gold project, where we recently announced the discovery of high grade copper-gold skarn zones at Silvia NW (see news release dated October 7, 2021)."

Financial Summary - Base Case Zn at US$1.20/lb | Pre-tax | After-tax |

NPV (8% discount rate) IRR Payback period | US$720 million 42.6% 2.0 years | US$433 million 31.9% 2.6 years |

Pre-production capital expenditure (Capex)1 Sustaining Capex Life of Mine (LOM) Capex Closure Cost | US$264.0 million US$186.8 million US$450.7 million US$15.2 million | |

Notes: 1 Includes contingencies of US$44 million.

Operating Summary | ||

Processing plant throughput Average annual zinc concentrate production Average annual lead-silver concentrate production Average annual silver in lead concentrate Total LOM zinc production Net Smelter Return from zinc and lead concentrates | 8,500 t/day 309,000 dmt/year 8,680 dmt/year 632,000 oz/year 4,450,000 tonnes US$4,156 million | |

Mining costs Processing costs G&A costs Total Operating Costs (Opex) | US$32.79/t US$7.10/t US$4.27/t US$44.16/t |

Notes: dmt = dry metric tonne.

Numbers may not add due to rounding.

Base Case Metal Prices & Exchange Rate Assumptions | Input value |

Zinc Price Lead Price Silver Price NSR Cut-off value Exchange Rate - Peruvian SOL/USD | US$1.20/lb US$0.95/lb US$22/oz US$65/t 3.87 |

Total material processed (LOM) | 43.5 million tonnes |

Mine Life | 14.4 years |

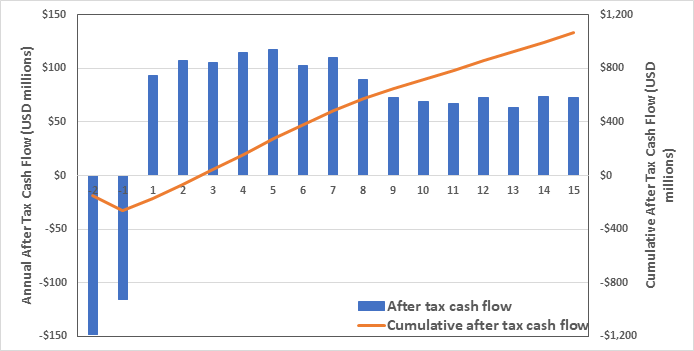

Figure 1. Ayawilca 2021 PEA - After tax cash flow by year of production

PEA Mine Plan - 8,500 Tonnes per Day Underground Mining Operation

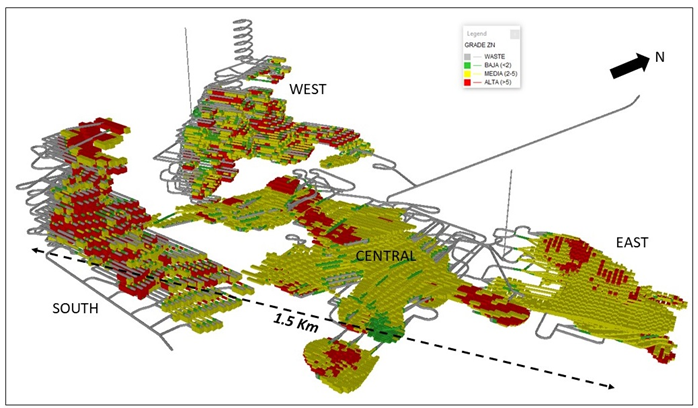

The PEA for the Ayawilca Zinc Zone is based on an underground mine operating at a mining rate of 8,500 tonnes per day for a mine life of 14.4 years. For the purposes of the PEA, production is assumed to commence in 2025 following 18 months of construction and commissioning. This initial mine plan is based on mining a total of 43.5 million tonnes grading 5.56% Zn, 14.5 g/t silver and 0.20% lead over life of mine ("LOM") using an NSR cut-off value of US$65/t. The zinc-rich mill feed will be trucked to the surface via a two-way-traffic ramp system connecting three mine portals to the underground infrastructure and accessing production areas starting at West and South Ayawilca (see Figure 3).

Processing of the zinc mineralization will be through a standard crushing and grinding circuit followed by froth flotation, concentrate thickening and filtration. The mine operation will produce two concentrates: a zinc concentrate which is anticipated to assay 50% zinc based on metallurgical test work; and a lead concentrate which is anticipated to assay 50% lead and 2,272 g/t silver (calculated on assays and based on similar base metal operations). Approximately 60% of the tailings will be thickened and filtered for dry stack tailings disposal. The remaining 40% will be mixed with cement and used as structural backfill in the underground operations.

Based on preliminary mine plan analysis including resource geometry, the scale of the deposit and grade distribution, sublevel stoping ("SLS") and overhand cut and fill with pillars ("OCF") methods were selected. The mining strategy involves dividing the deposit into five zones by spatial location and by mining method: West, South and Silver zones utilizing the SLS method (48.3% of mined tonnes for processing), and the Central and East zones utilizing the OCF method with pillars (36.9% of mined tonnes for processing). Development in ore represents 14.8% of the processed material.

Figure 2. Ayawilca Zinc Zone PEA - Mining by Area showing average zinc grade by year of production

The estimated operating costs, over the life of the project, are as follows:

Operating Costs per Mining Method (Opex)

Description | Cost per Tonne Processed |

Mining - SLS (48.3% of mine plan) Mining - OCF (27.0% of mine plan) | US$25.37 US$29.79 |

Average Mining Cost - including development (14.8% of mine plan) and Pillars (9.9% of mine plan) Process Plant G&A (US$13M/yr) Total Operating Cost | US$32.79 US$7.10 US$4.27 US$44.16 |

Figure 3. Mine plan showing areas by zinc grade (red = >5% Zn; yellow = 2-5% Zn)

The major components of the initial capital expenditures of US$263.9 million include US$83.5 million for the processing plant, US$34.0 million for on-site infrastructure, US$47.2 million for mine equipment and underground pre-production development, US$9.1 million for off-site infrastructure, and US$3.6 million for a starter filtered tailings storage facility direct costs. Contingencies in the capital costs total US$43.8 million. The major components of sustaining capital are US$95.3 million for mining equipment and underground development, and US$91.6 million for tailings management over the 14.4 year mine life.

Capital Cost Item | Initial (US$ M) | Sustaining (US$ M) | Total (US$ M) |

Mining & mine development Process plant On-site infrastructure Off-site infrastructure Filtered tailings storage facility Indirect + Owner costs Contingencies | 47.2 83.5 34.0 9.1 3.6 42.7 43.8 | 95.3 - - - 91.6 - - | 142.5 83.5 34.0 9.1 95.2 42.7 43.8 |

TOTAL PROJECT | 263.9 | 186.8 | 450.7 |

CLOSURE COSTS | 15.2 |

Numbers may not add due to rounding

Metallurgical Recoveries and Off-Site Charges

As reported in the Company's news release on June 5th 2019, metallurgical testing of samples from Ayawilca indicate that a zinc concentrate grading 50% zinc can be produced with 92% of the zinc recovered to the concentrate. The lead metallurgy has been assumed based on similar operations. The lead concentrate is expected to assay 50% lead and 2,272 g/t silver on average over the life of mine. Based on preliminary metallurgical test work, 45% of the silver is expected to report to the lead concentrate and be payable, while 40% of the silver is expected to report to the zinc concentrate and not be payable. The zinc concentrate is expected to be a marketable concentrate with no deleterious elements other than an iron penalty. Concentrate grade assumptions and recoveries for the principal metals are provided in the table below.

Composite Head Grade, Metallurgical Results and Recoveries

Product | Average Grade LOM | Metallurgical Recoveries (%) | ||||||

Zinc (%) | Lead (%) | Silver (g/t) | Zinc Equiv. (%) | Av. NSR (US$/t) | Zinc | Lead | Silver | |

Feed grade Zinc Concentrate Lead Concentrate | 5.56 50.0 4.0 | 0.20 0 to 0.1 50.0 | 14.5 0-100 2,2722 | 5.92 | 96.2 | 100 92 0 | 100 0 70 | 100 40 45 |

Notes: Zinc Equivalent (%) = NSR/16.23. NSR = Zn(%)*US$16.23+Ag(g/t)*US$0.27+Pb(%)*US$10.20

2 Silver grades were calculated for the PEA and range from 1,122 to 4,173 g/t

All of the zinc concentrates are assumed to be delivered directly to a local refinery. All of the lead concentrates are assumed to be shipped overseas. Off-site charges include treatment charges, refining charges, and iron penalties at refinery and summarized below.

Off-site Charges

Description | Zinc Concentrate | Silver-lead Concentrate |

Transport to Port/Local refinery Port Charges Shipping to overseas smelter (FOB) Local refinery Treatment Charge (TC) Overseas Treatment Charge (TC) Refining Charge (RC) Iron Penalty | US$35/wmt - - US$190/dmt - - US$7.50/dmt | US$35/wmt US$17.5/wmt US$45/wmt - US$150/dmt US$1.50/oz - |

Notes: wmt = wet metric tonne. dmt = dry metric tonne

Tailings and Mine Waste Management

The tailings and mine waste concept for Ayawilca is based on a commitment to implementing best available practices and best available technologies, as described in the International Council of Mining and Metals (ICMM) Global Industry Standard for Tailings Management, and other, similar guides and standards. Of note:

- 100% of mine waste rock and 40% of tailings production will be re-used as underground mine backfill;

- On-surface tailings will be processed as dry-filtered tailings, and stacked at a secure, prepared facility. This method will: reduce the environmental footprint; reduce risk of failure and impacts; and reduce closure costs and schedule.

NSR Calculation

The mine plan for the PEA was based on a Net Smelter Return ("NSR") cut-off value of US$65 per tonne. The prices and NSR factors for each metal utilized in the NSR calculation for the 2021 PEA compared to the 2019 PEA are presented in the table below.

Comparison of Metal Prices and NSR Factors from 2019 PEA to 2021 PEA

Metal | 2019 PEA | 2021 PEA* | ||

Metal Price Assumptions | NSR Factor | Metal Price Assumptions | NSR Factor | |

Zinc (Zn) Lead (Pb) Silver (Ag) | US$1.20/lb US$0.95/lb US$18.00/oz | US$15.39 US$12.25 US$0.44 | US$1.20/lb US$0.95/lb US$22.00/oz | US$16.23 US$10.20 US$0.27 |

Notes: * NSR for the 2021 PEA was calculated using the following formula:

NSR = Zn(%)*US$16.23+Ag(g/t)*US$0.27+Pb(%)*US$10.20

Sensitivities

The Ayawilca zinc project is strongly leveraged to zinc price. A 25% increase on the base case zinc price (around current spot price of US$1.50/lb) results in an after-tax NPV8% of US$785M, an increase of US$352M (or 81%).

Figure 4. After-tax NPV8% Sensitivities

Note: Arrow indicates current spot zinc price

Opportunities and Exploration Potential

The Ayawilca Zinc Zone has not been fully delineated and is open in several directions including to the northeast, south and southwest.

Opportunities for additional value on the Ayawilca property not captured in the PEA include, but not limited to:

- Potential for new zinc-silver discoveries outside of the existing resource at South, Far South, Yanapizgo, and Zone 3;

- Optimization of zinc recovery to a zinc concentrate (currently 92%) and silver recovery to a silver-lead concentrate (currently 45%) through more detailed metallurgical test work;

- The potential to incorporate a tin circuit into the mine plan by mining all, or some, of the adjacent Tin Zone resource (see news release dated September 27, 2021).

Tinka is well positioned to continue to move Ayawilca forward towards development. The project is fully permitted to carry out a Prefeasibility Study.

A National Instrument 43-101 Technical Report will be filed on SEDAR within 30 days.

Figure 5. Top-10 world zinc mines by zinc production in 2020, with Ayawilca 2021 PEA highlighted (Source: Stifel GMP and company data)

Mineral Resources

The table below outlines the Indicated and Inferred Mineral Resources estimates (August 30, 2021) for the Ayawilca Zinc Zone used in the PEA, including those that are not included in the mine plan. The Mineral Resource assumes a cut-off value of US$55/t NSR. Metals prices and NSR values are the same as used in the PEA.

Table 1: Ayawilca Zinc Zone Mineral Resources as of August 30, 2021

Tinka Resources Limited - Ayawilca Property

Classification/ | Tonnage | NSR | Grade | Contained Metal | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

(% Zn) | (g/t Ag) | (% Pb) | (Mlb Zn) | (Moz Ag) | (Mlb Pb) | |||||

| Indicated | ||||||||||

West | 11.6 | 108 | 6.26 | 15.9 | 0.25 | 1,607 | 6.0 | 65 | ||

South | 7.3 | 145 | 8.56 | 18.3 | 0.13 | 1,383 | 4.3 | 22 | ||

Total Indicated | 19.0 | 123 | 7.15 | 16.8 | 0.21 | 2,990 | 10.3 | 87 | ||

Inferred | ||||||||||

West | 5.5 | 106 | 5.90 | 20.8 | 0.42 | 719 | 3.7 | 52 | ||

South | 9.0 | 134 | 7.45 | 34.4 | 0.33 | 1,477 | 10.0 | 65 | ||

Central | 17.4 | 81 | 4.55 | 13.8 | 0.34 | 1,747 | 7.7 | 132 | ||

East | 10.6 | 88 | 5.04 | 14.4 | 0.20 | 1,177 | 4.9 | 46 | ||

Silver | 0.4 | 93 | 3.58 | 106.7 | 0.65 | 33 | 1.4 | 6 | ||

Buffer | 4.9 | 87 | 4.66 | 19.2 | 0.63 | 504 | 3.0 | 69 | ||

Total Inferred | 47.9 | 96 | 5.36 | 20.0 | 0.35 | 5,657 | 30.7 | 370 | ||

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported above a cut-off net smelter return (NSR) value of US$55/t.

- The requirement of a reasonable prospect of eventual economic extraction is met by having a minimum modelling width for mineralized zones of three metres, a cut-off based on reasonable input parameters, and continuity of mineralization consistent with a potential underground mining scenario.

- The NSR value was based on estimated metallurgical recoveries, assumed metal prices, and smelter terms, which include payable factors, treatment charges, penalties, and refining charges. Metal price assumptions were, US$1.20/lb Zn, US$22/oz Ag, and US$0.95/lb Pb. Metal recovery assumptions were, 92% Zn, 85% Ag, and 70% Pb. The NSR value for each block was calculated using the following NSR factors; US$16.23/% Zn, US$0.27/g Ag, and US$10.20/% Pb.

- Payability is as follows; Zn 84%, Pb 94% and Ag 47%

- The NSR value was calculated using the following formula:

NSR = Zn(%)*US$16.23+Ag(g/t)*US$0.27+Pb(%)*US$10.20 - Numbers may not add due to rounding.

Qualified Person Statements

Technical information related to the PEA contained in this news release has been reviewed and approved by Kim Kirkland, FAUSIMM, Geological Engineer, Principal Mining Consultant with Mining Plus. Edgard Vilela, MAusIMM (CP), Mining Engineer, Underground Manager, is a full time employee of Mining Plus. Both are Qualified Persons as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The Mineral Resources disclosed in this news release have been estimated by Ms. Dorota El Rassi, P.Eng., SLR Consultant Engineer and Ms. Katharine M. Masun, MSA, M.Sc., P.Geo., SLR Consultant Geologist, both independent of Tinka. By virtue of their education and relevant experience, Ms. El Rassi and Ms. Masun are "Qualified Persons" for the purpose of National Instrument 43-101. The Mineral Resources have been classified in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014). Ms. El Rassi and Ms. Masun have read and approved the contents of this press release as it pertains to the disclosed Mineral Resource estimates.

The metallurgical and recovery inputs have been reviewed and verified by Mr. Adam Johnston, FAusIMM, CP (Metallurgy) of Transmin Metallurgical Consultants, Lima, a Qualified Person as defined by National Instrument 43-101.

The inputs on processing and costs for tailings filtering and storage have been reviewed and verified by Mr. Donald Hickson, P.Eng., of Envis E.I.R.L Peru (Envis), a Qualified Person as defined by National Instrument 43-101.

Dr. Graham Carman, Tinka's President and CEO, reviewed, verified and compiled the technical contents of this release. Dr. Carman is a Fellow of the Australasian Institute of Mining and Metallurgy, and is a Qualified Person as defined by National Instrument 43-101.

Data verification and quality control and assurance

SLR visited the Ayawilca property, reviewed the sampling and preparation methods, QA/QC methods and results, and sample chain of custody procedures; and performed independent resource database verification tests. SLR is of the opinion that the procedures are appropriate and the resource database is suitable to estimate Mineral Resources.

On behalf of the Board, "Graham Carman" Dr. Graham Carman, President & CEO | Further Information: Mariana Bermudez 1.604.685.9316 |

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver-tin project in central Peru. The Zinc Zone deposit has an estimated Indicated Mineral Resource of 19.0 Mt grading 7.15% Zn, 16.8 g/t Ag & 0.2% Pb and an Inferred mineral resource of 47.9 Mt grading 5.4% Zn, 20.0 g/t Ag & 0.4% Pb (dated August 30, 2021). The Ayawilca Tin Zone has an estimated Inferred mineral resource of 8.4 Mt grading 1.02% Sn (dated August 30, 2021). Tinka also owns and is actively exploring early stage copper-gold skarn mineral systems within its highly prospective land package in central Peru.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; timing of geological reports and the preliminary nature of the PEA and the Company's ability to realize the results of the PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Limited