2021 Financial Highlights:

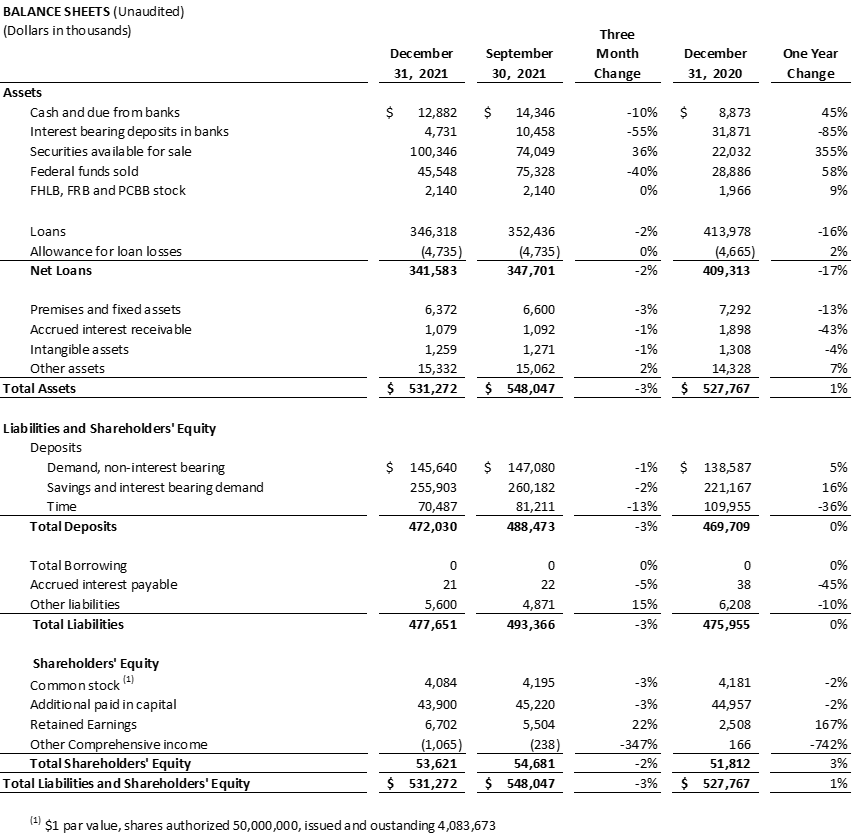

- Total assets increased $3.5 million, or 1%, to $531.3 million on December 31, 2021, from $527.8 million on December 31, 2020.

- Deposits remained stable in 2021, improving the portfolio mix to 31% non-interest bearing, 54% interest bearing, and 15% time deposit.

- Net income of $4.2 million was recorded for the year ending 2021.

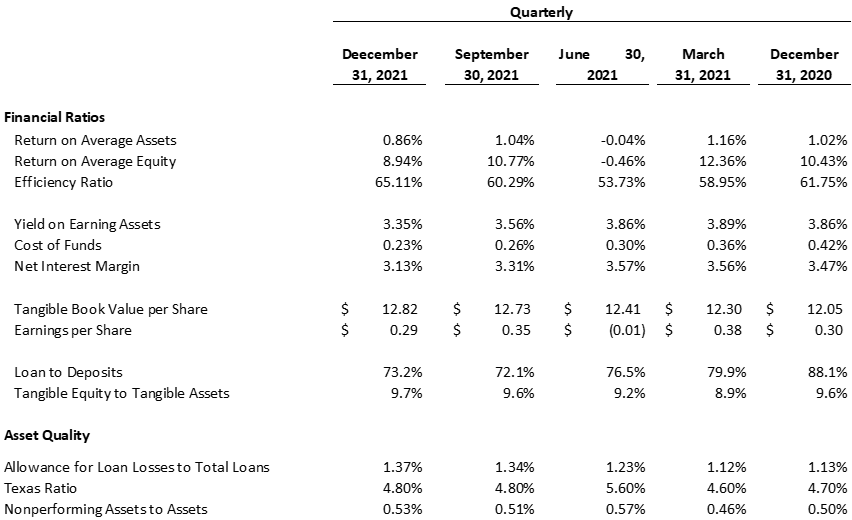

- Tangible book value per share increased to $12.82 on December 31, 2021, from $12.05 on December 31, 2020.

- Second Stock Repurchase Plan approved in 2021.

- Return on average assets of 0.75% for 2021.

- Nonperforming assets to total assets was a modest 0.53% at the end of the year.

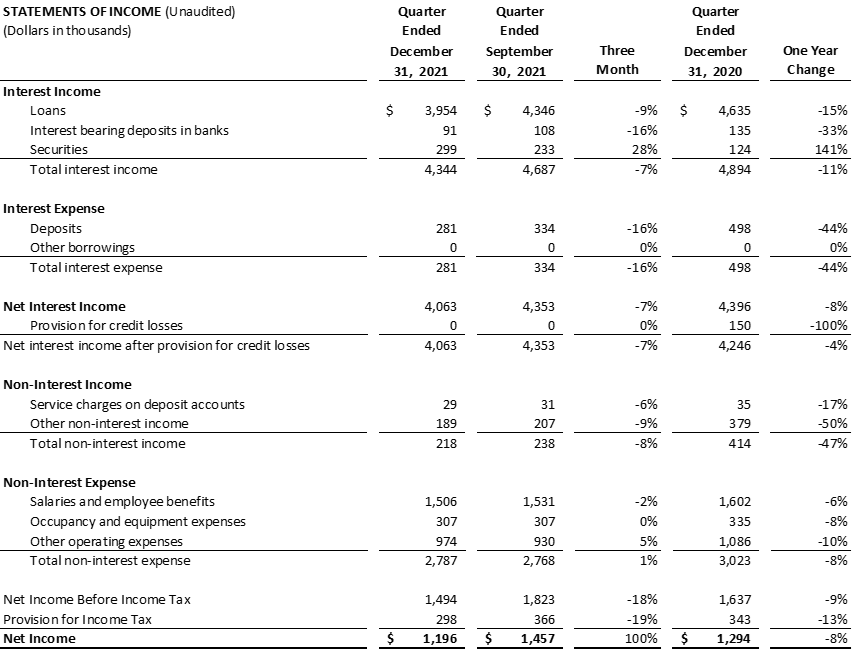

- Interest expense decreased 44% from year-end 2020 from $498 thousand to $281 thousand at year-end 2021.

- Earnings per share of $1.00 for 2021.

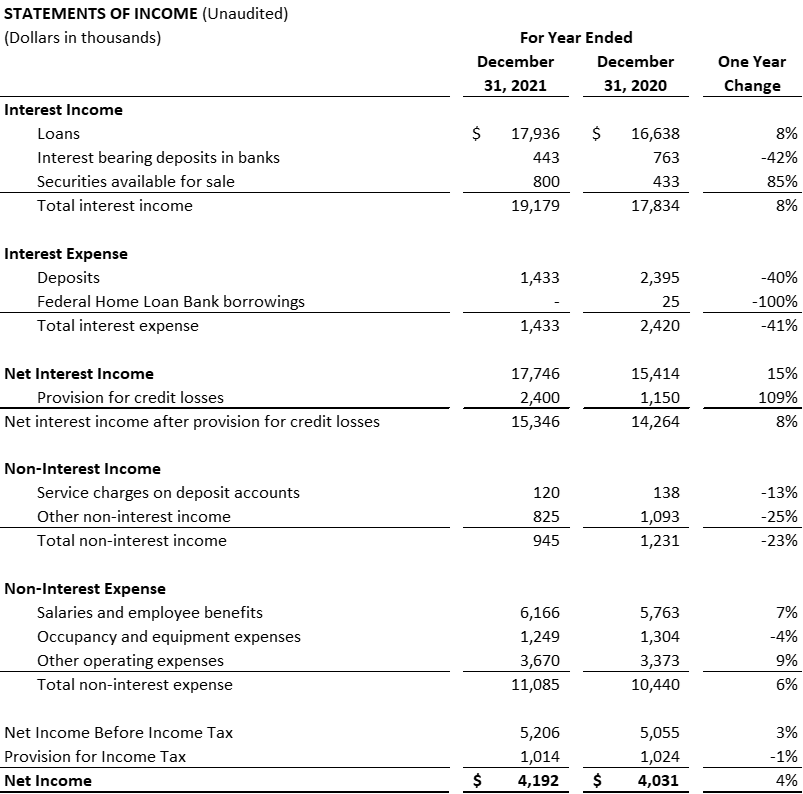

TACOMA, WA / ACCESSWIRE / February 1, 2022 / Commencement Bancorp, Inc. (OTCQX:CBWA) reported a consolidated net income of $4.2 million or $1.00 per share for 2021, compared to $4.0 million or $0.97 per share for 2020. Net interest income after provisions for credit losses was $15.3 million, an 8% increase from 2020. Contributions to the allowance for loan and lease losses (ALLL) totaled $2.4 million compared to $1.15 million the prior year. The increased allocation to the ALLL was determined by a single defaulted credit in mid-2021. The Bank is pursuing collection efforts and is hopeful for a recovery. Capital ratios continued to exceed regulatory requirements.

Liquidity was abundant in 2021 with deposit balances remaining consistent with the previous year. Effects of the Paycheck Protection Program (PPP) forgiveness and national fiscal policy were reflected on the balance sheet in 2020 and 2021. Commencement allocated excess funds to investments to generate a return on otherwise inefficient balances.

Total loans at the end of 2021 were $341.6 million, a decrease of 17%, which was anticipated as a result of PPP forgiveness. Production of core loan growth was $15.2 million, and 5% year-over-year. Nonperforming assets to total assets at year-end was 0.53% and the Bank's Texas Ratio, a measurement of problem loans and bank-owned properties to capital, was 4.8% and consistent with the previous year. The Bank's loan portfolio remained diversified at 26% commercial, 70% commercial real estate, and 4% consumer and other.

Net interest margin decreased to 3.39% for the year ended December 31, 2021. Total deposits at the end of 2021 were $472 million, remaining steady with 2020. The deposit mix at quarter-end was 31% non-interest bearing, 54% interest bearing (checking, savings, and money market), and 15% time deposit.

"The economic uncertainties of 2020, along with PPP forgiveness, braced us for a static year in 2021. While fiscal policy and status of the economy played a role in the financial outcome of many industries, we remained attentive to managing the balance sheet, navigating the interest rate environment, and reducing interest expense. Although one large loan affected the Bank's overall net income, we are pleased to record a $4.2 million profit and a stable and diversified deposit mix and loan portfolio. We remain very optimistic about the opportunities in 2022 and committed to serving our clients and communities," said John Manolides, President and CEO.

###

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit www.commencementbank.com. For information related to the trading of CBWA, please visit www.otcmarkets.com.

For further discussion, please contact the following:

John E. Manolides, President & Chief Executive Officer | 253-284-1802

Thomas L. Dhamers, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s and Commencement Bank's projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Neither Commencement Bancorp, Inc. nor Commencement Bank undertakes any obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bank (WA)