WEST MELBOURNE, FL / ACCESSWIRE / March 17, 2022 / BK Technologies Corporation (NYSE American:BKTI) (the "Company" or "BK") today announced financial and operating results for the fourth quarter and full year ended December 31, 2021. The Company will host a conference call today, March 17, 2022, at 9:00 a.m. Eastern Time.

Recent Financial and Operational Highlights

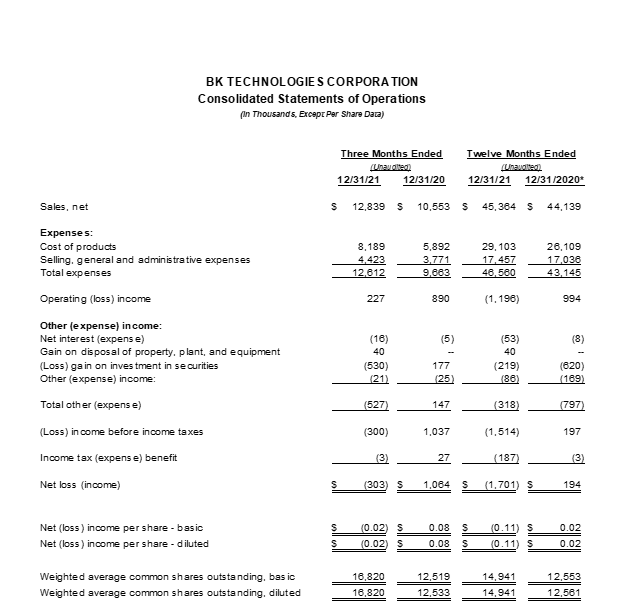

- Fourth quarter revenue grew 21.7% to $12.8 million as compared to revenue of $10.6 million in the fourth quarter of 2020.

- The Company achieved record bookings of $55.5 million in 2021, which included strong order activity for the BKR 5000; a 14% increase compared with $48.7 million in 2020.

- The Company concluded 2021 with a backlog of $13 million, more than double the $5.9 million backlog at December 31, 2020, related to strong demand for the BKR 5000, coupled with extended product delivery schedules associated with supply chain constraints.

- Fourth quarter gross profit margins decreased to 36.2% due to increased material, component and freight costs.

"Our 2021 performance reflects strong order activity for our BKR 5000 line of communications equipment and accessories, " commented John Suzuki, CEO of BK Technologies. "As a result of this marketplace demand, we closed 2021 with record bookings of $55.5 million and a backlog of $13 million. BK Technologies has built a solid reputation for providing consistently dependable communications technology in wide range of settings, with proven success supporting wildland fire operations, emergency responders and land management operations. Wildland fire activity has been growing in frequency and duration, and our communications devices provide vital support to first responders on the front lines. Moving forward, we believe we have a tremendous opportunity to increase the market reach of our radios beyond fire rescue and mitigation operations to better penetrate markets including the military, law enforcement and emergency medical response. To capitalize on this, subsequent to the end of the quarter, we launched a dedicated business unit focused on delivering software as a service solutions to the public safety market. The unit will develop and deliver a comprehensive suite of state-of-the-art, subscription-based business software solutions to first responders via the public cellular network.

"Nationwide supply chain constraints have not yet eased, and we continue to contend with the challenges of extended lead times and delayed product delivery timelines. We are working closely with our suppliers and logistics partners to navigate these challenges, and as a consequence, have increased our inventory. As the supply chain stabilizes, we expect inventory levels to return to normal.

"Finally, our balance sheet is solid and during the fourth quarter, and we implemented an increase in our quarterly dividend and announced a share buyback program so that we can be prepared to act opportunistically for the benefit of our shareholders."

Fourth Quarter 2021 Financial Review

Revenue increased 21.7% to $12.8 million, compared with $10.6 million for the fourth quarter of last year. The gross profit margin was 36.2%, compared to 44.2% for the same quarter of last year.

Selling, General & Administrative expenses totaled $4.4 million, compared with $3.8 million for the fourth quarter of last year.

Operating income totaled approximately $227,000, compared with $890,000, as adjusted, for the fourth quarter of last year.

The Company recorded net loss ($303,000) or $(0.02) per basic and diluted share, compared with net income of $1.1 million, or $0.8 per basic and diluted share, as adjusted, for the fourth quarter of last year. In the fourth quarter of 2021 the Company recognized an unrealized loss of ($530,000) on its investment in FG Financial Group (FGF), compared with an unrealized gain of $177,000 in the same quarter of last year.

Full Year 2021 Financial Review

Revenue for the full year of 2021 totaled $45.4 million, compared with $44.1 million for the full year of 2020. The gross profit margin was approximately 35.8%, compared with 40.8% for the full year of 2020, primarily due to increased material, component and freight costs, as well as one-time inventory reserves related to our legacy product line, the KNG series.

Selling, General & Administrative expenses totaled $17.5 million, compared with $17.0 million for the full year of 2020.

Operating loss totaled approximately ($1.2) million compared with operating income of $994,000, as adjusted, for the full year of 2020.

The Company recorded net loss of ($1.7) million, or $(0.11) per basic and diluted share, compared with a net income of $194,000, or $0.02 per basic and diluted share, for the full year of 2020.

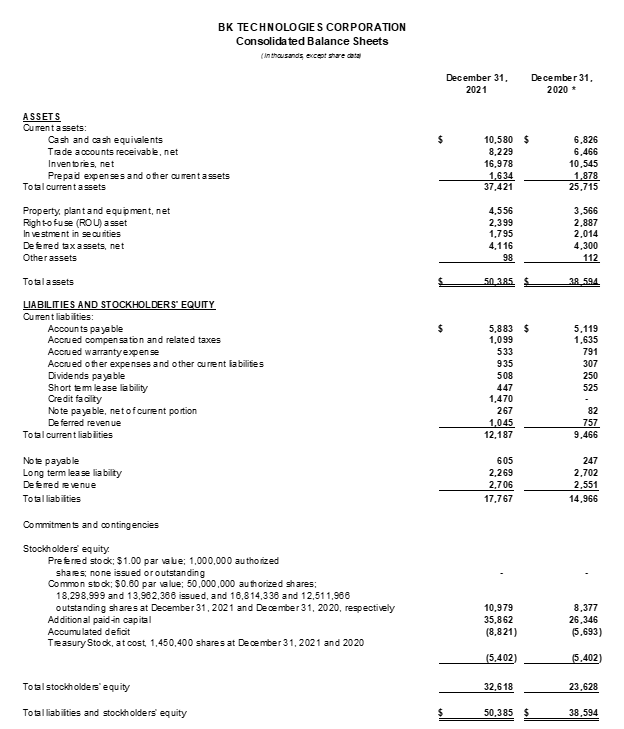

Working capital totaled approximately $25.2 million, of which approximately $18.8 million was comprised of cash, cash equivalents, and trade receivables. This compares with the working capital at year-end of last year of approximately $16.2 million, as adjusted, of which $13.3 million was comprised of cash, cash equivalents, and trade receivables.

On July 1, 2021, the Company changed its accounting to apply the material burden at the time of purchase receipts. Prior to that date, the Company applied the material burden at the time the inventory was issued to work in progress. The financial statements for 2020 and 2021 have been adjusted to apply the accounting change.

Conference Call and Webcast

The Company will host a conference call and webcast for investors today, March 17, 2022, at 9:00 a.m. Eastern Time.

Shareholders and interested parties may participate in the conference call by dialing (888) 506-0062. International participants may join the conference call by dialing (973) 528-0011. All callers must use the access code 591736. The call will also be webcast at www.bktechnologies.com. Please allow extra time prior to the conference call to visit the site.

An online archive of the webcast will be available on the Company's web site for thirty (30) days following the call at www.bktechnologies.com. A replay of the conference call will be available one hour after completion of the call and will remain available until March 24, 2022. Such replay may be accessed by dialing (877) 481-4010 (for domestic participants) or (919) 882-2331 (for international participants). All callers must use passcode 44627 to access the replay.

About BK Technologies

BK Technologies Corporation manufactures high-specification, American-made communications equipment of unsurpassed reliability and value for use by public safety professionals and government agencies. BK Technologies is honored to serve these heroes with reliable equipment when every moment counts. The Company's common stock trades on the NYSE American market under the symbol "BKTI". Maintaining its headquarters in West Melbourne, Florida, BK Technologies can be contacted through its web site at www.bktechnologies.com or directly at 1-800-821-2900.

Forward-Looking Statements

This press release contains certain forward-looking statements that are made pursuant to the "Safe Harbor" provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements concern the Company's operations, economic performance, and financial condition, including, but not limited to, statements regarding the Company's long-term strategic plan, and are based largely on the Company's beliefs and expectations. These statements involve known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of the Company, or industry results, to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Such factors and risks, some of which have been, and may further be, exacerbated by the COVID-19 pandemic and the ongoing war in Ukraine, include, among others, the following: changes or advances in technology; the success of our land mobile radio product line; disruption in the global supply chain creating delays, unavailability and adverse conditions; successful introduction of new products and technologies, including our ability to successfully develop and sell our anticipated new multiband product and other related products in the planned new BKR Series product line; competition in the land mobile radio industry; general economic and business conditions, including federal, state and local government budget deficits and spending limitations, any impact from a prolonged shutdown of the U.S. Government, the ongoing effects of the COVID-19 pandemic and the ongoing war in Ukraine, including the impact of related sanctions being imposed by the U.S. Government and the governments of other countries, impact of potential reprisals as a consequence of the war in Ukraine and any related sanctions; the availability, terms and deployment of capital; reliance on contract manufacturers and suppliers; risks associated with fixed-price contracts; heavy reliance on sales to agencies of the U.S. Government and our ability to comply with the requirements of contracts, laws and regulations related to such sales; allocations by government agencies among multiple approved suppliers under existing agreements; our ability to comply with U.S. tax laws and utilize deferred tax assets; our ability to attract and retain executive officers, skilled workers and key personnel; our ability to manage our growth; our ability to identify potential candidates for, and to consummate, acquisition, disposition or investment transactions, and risks incumbent to being a noncontrolling interest stockholder in a corporation; impact of the COVID-19 pandemic or the ongoing war in Ukraine on the companies in which the Company holds investments; impact of our capital allocation strategy; risks related to maintaining our brand and reputation; impact of government regulation; impact of rising health care costs; our business with manufacturers located in other countries, including changes in the U.S. Government and foreign governments' trade and tariff policies, as well as any further impact resulting from the COVID-19 pandemic or the ongoing war in Ukraine; our inventory and debt levels; protection of our intellectual property rights; fluctuation in our operating results and stock price; acts of war or terrorism, natural disasters and other catastrophic events, such as the COVID-19 pandemic and the ongoing war in Ukraine; any infringement claims; data security breaches, cyber-attacks and other factors impacting our technology systems; availability of adequate insurance coverage; maintenance of our NYSE American listing; risks related to being a holding company; and the effect on our stock price and ability to raise equity capital of future sales of shares of our common stock. Certain of these factors and risks, as well as other risks and uncertainties, are stated in more detail in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and in the Company's subsequent filings with the SEC. These forward-looking statements are made as of the date of this press release, and the Company assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statement.

Company Contact:

IMS Investor Relations

John Nesbett/Jennifer Belodeau

[email protected]

(203) 972-9200

# # #

(Financial Tables to Follow)

* - The amounts for the year ended December 31, 2020 have been adjusted to reflect the change in inventory accounting method, as described in Notes 1 and 2 to the Consolidated Financial Statements in the Company‘s Form 10-K as of December 31, 2021.

* - The amounts as of December 31, 2020 have been adjusted to reflect the change in inventory accounting method, as described in Notes 1 and 2 to the Consolidated Financial Statements in the Company‘s Form 10-K as of December 31, 2021.

SOURCE: BK Technologies Corporation