Total Non-Interest Deposits pass $500 million milestone

LAKEWOOD, CO / ACCESSWIRE / April 29, 2022 / Solera National Bancorp, Inc. (OTC PINK:SLRK) ("Company"), the holding company for Solera National Bank ("Bank"), a business-focused bank located in the Denver metropolitan area, today reported financial results for the three months ended March 31, 2022. For the first quarter of 2022, net income was $3.2 million, up 160% year-over-year.

1Q22 Financial Highlights

(Comparison to 1Q21 unless otherwise noted)

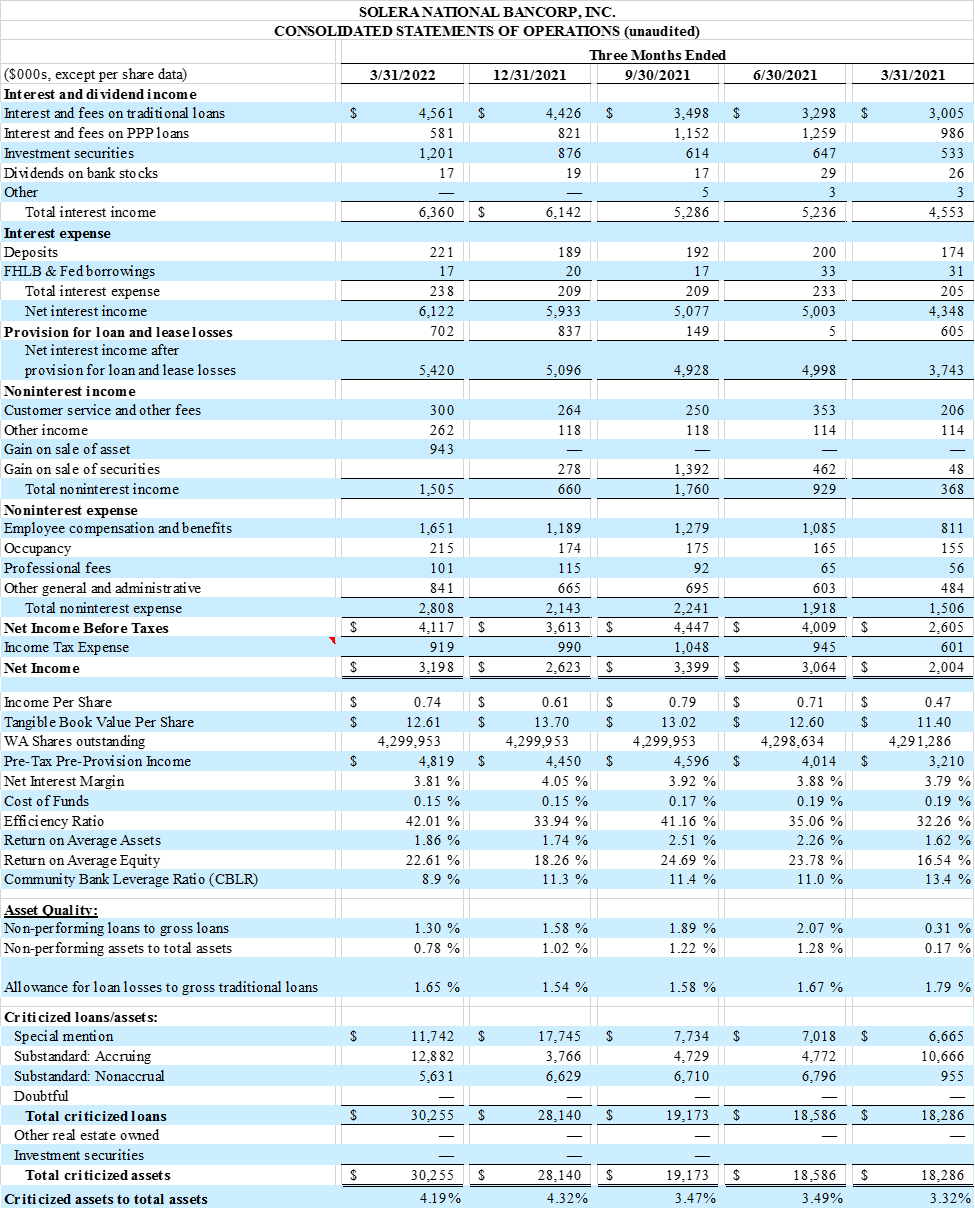

- The Company had record pre-tax and pre-provision earnings of $4.8 million in the first quarter of 2022 compared to $3.2 million in the first quarter of 2021.

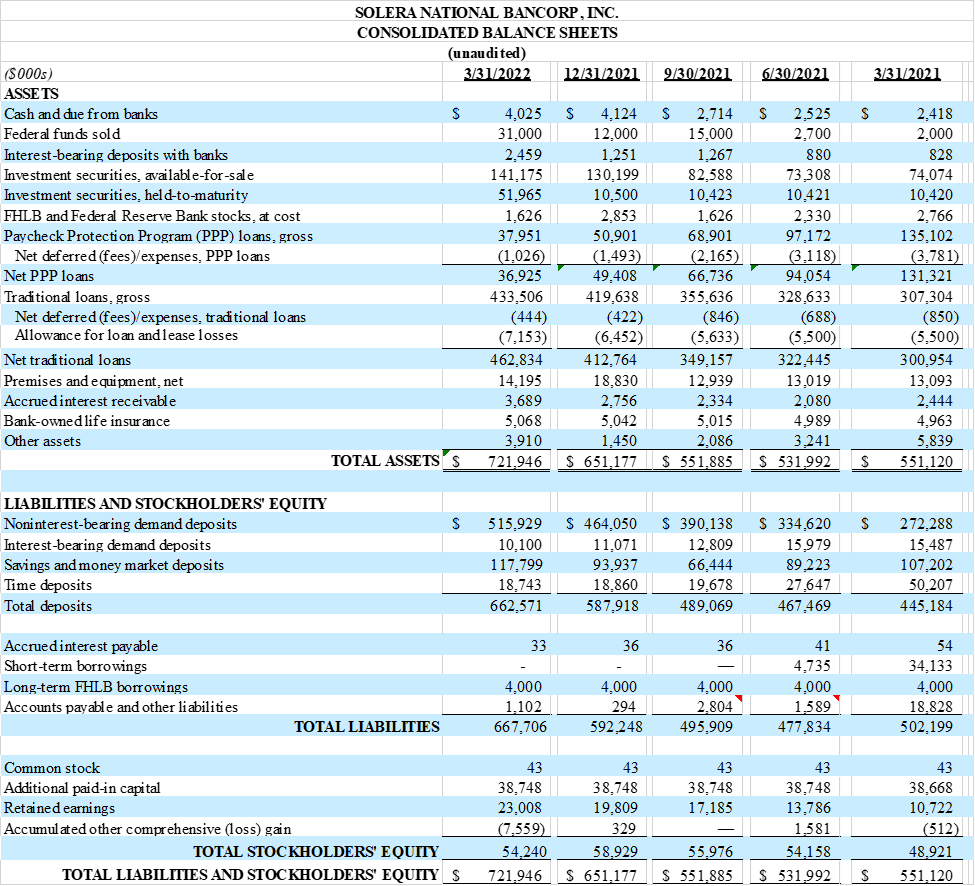

- Noninterest-bearing deposits rose 11% during the quarter to $515.9 million, which is a $51.9 million increase over the previous quarter and an 89% or $243.6 million increase from March 31, 2021.

- Net interest income of $6.1 million for first quarter 2022 represents a 141% increase over the $4.3 million earned in the first quarter 2021.

- Tangible book value per share reached $12.61 per share as of March 31, 2022 compared to $11.40 per share as of March 31, 2021.

- The Company's impressive efficiency ratio of 42% increased slightly from 34% from the fourth quarter 2021.

- Net interest margin ended at 3.81% as of March 31, 2022.

- Asset quality remained strong with a modest level of criticized assets of 4.19% of total assets and nonperforming assets of 0.78% of total assets as of March 31, 2022.

For the three months ended March 31, 2022, the Company reported net income of $3.2 million, or $0.74 per share, compared to net income of $2.6 million, or $0.61 per share, for the three months ended December 31, 2021, and net income of $2.0 million, or $0.47 per share, for the three months ended March 31, 2021.

Michael Quagliano, Executive Chairman of the Board, commented: "The Company hit a record for our pre-tax and pre-provision income at $4.8 million. We continue to see record growth in our noninterest- bearing deposit accounts and we are ahead of last year's record pace."

Jordan Wright, Vice Chairman of the Board, commented: "The Bank is obviously highly performant and we are just scratching the surface on the tech side of the business that will allow us to scale, improve margin and support future growth."

Cheri Walz, CFO, commented: "We started off 2022 with strong financial performance, we grew our noninterest-bearing deposits a record $244 million from this period last year and built upon the Company's solid loan and investment portfolio. Total loans reached $434 million while the investment portfolio grew to $193 million, driven by this strong growth in noninterest bearing deposits."

About Solera National Bancorp, Inc.

Solera National Bancorp, Inc. was incorporated in 2006 to organize and serve as the holding company for Solera National Bank, which opened for business in September 2007. Solera National Bank is a community bank serving the needs of emerging businesses and real estate investors. At the core of Solera National Bank is welcoming, attentive and respectful customer service, a focus on supporting a growing and diverse economy, and a passion to serve our community through service, education and volunteerism. For more information, please visit http://www.SoleraBank.com.

This press release contains statements that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements contained in this release, which are not historical facts and that relate to future plans or projected results of Solera National Bancorp, Inc. and its wholly-owned subsidiary, Solera National Bank, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. We undertake no obligation to update or revise any forward-looking statement. Readers of this release are cautioned not to put undue reliance on forward-looking statements.

Contacts:

Cheri Walz, EVP & CFO (720) 764-9090

FINANCIAL TABLES FOLLOW

SOURCE: Solera National Bancorp, Inc.