KINGSTON, NY / ACCESSWIRE / May 12, 2022 / Kingstone Companies, Inc. (NASDAQ:KINS) (the "Company" or "Kingstone"), a Northeast regional property and casualty insurance holding company, today announced its financial results for the quarter ended March 31, 2022. The Company will host a conference call for analysts and investors on May 13, 2022, at 8:30 a.m. Eastern Time, as previously announced on April 7, 2022.

2022 First Quarter Financial and Operational Highlights

(All results are compared to prior year quarterly period unless otherwise noted)

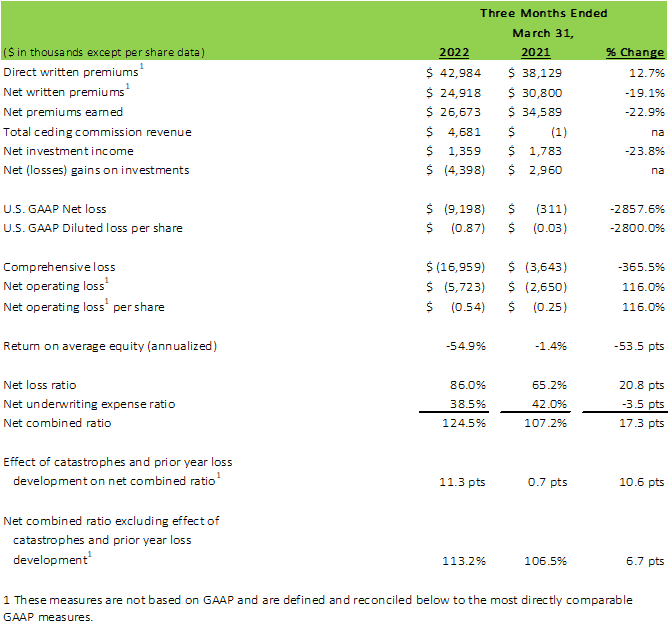

- Operating loss per share1 of $(0.54) compared to $(0.25)

- Catastrophe loss per share impact of $(0.19) compared to $(0.02)

- Unrealized losses on equity securities and other investments, net of tax of $(0.34) compared to unrealized gains of $0.14

- Realized gains on investments, net of tax of $0.01 and $0.08

- Net loss per share of $(0.87) compared to $(0.03)

- Direct written premiums1 grew by 12.7% to $43.0 million

- Net premiums earned decreased 22.9% to $26.7 million due to the inception of a 30% personal lines quota share treaty on December 30, 2021

- Net loss ratio of 86% compared to 65.2% due to heavier catastrophe losses and higher winter water losses

- Net underwriting expense ratio decreased to 38.5% from 42.0%

- Net combined ratio increased to 124.5% from 107.2% driven by an increase in catastrophe and other winter related losses

- Kingstone's "Select" products are now live in states representing 85% of total premium

Annual Meeting of Stockholders

The Company also announced that the 2022 Annual Meeting of Stockholders will be held on Thursday, August 11, 2022 at 9:00 A.M. at 15 Joys Lane, Kingston, New York. Stockholders of record as of the close of business on June 18, 2022 will be entitled to vote at the Annual Meeting.

__________________

1 These measures are not based on accounting principles generally accepted in the United States ("GAAP") and are defined and reconciled below to the most directly comparable GAAP measures.

Management Commentary

Barry Goldstein, Kingstone's Chief Executive Officer, elaborated on the Company's results:

"Our first quarter operating results reflect a typical first quarter for Kingstone. Our Northeast business, with insured properties from Massachusetts to New Jersey, is seasonally impacted by cold winter weather, and we posted an underwriting loss in Q1 as in prior years. This winter was harsher than last, with four catastrophe events and high winter water losses impacting us. Last year was far milder by comparison.

Our earnings and book value declines were in large part the result of a surge in interest rates, which especially impacted a shorter duration primarily fixed income portfolio such as ours. Under current GAAP accounting rules, we are required to mark to market even if we are not bond traders. The decline in bond prices led to declines in Other Comprehensive Income and thus Book Value. With a high-quality A+ rated portfolio composed of obligations from a group of strong and diverse issuers, we expect to recover these losses at maturity."

Meryl Golden, Kingstone's Chief Operating Officer, continued:

"Our Kingstone 2.0 initiatives continue on track, and we are starting to see the impact in our results. Our Select products have now rolled out to states representing 85% of our premium. Our new business quotes are up materially, and our new business policies are up 15% without loosening our tight underwriting standards. Written premium is growing far faster than our policy count indicating margin expansion is underway. And our expense ratio was down 3.5 points for the quarter due to the benefit of ceding commissions from our new quota share treaty along with the favorable impact from our cost containment efforts."

See "Forward-Looking Statements"

Financial Highlights Table

2022 First Quarter Financial Review

Net income:

The loss during the three-month period ended March 31, 2022 was $9.2 million as compared to a net loss of $0.3 million in the prior year period. The increase in the net loss in the latest three-month period is attributed to harsher winter weather leading to a 20.8 point increase in net loss ratio driven by catastrophes and winter related losses, primarily water, and $4.4 million of net losses on equity investments compared to a net gain on investments of $3.0 million in the prior year period.

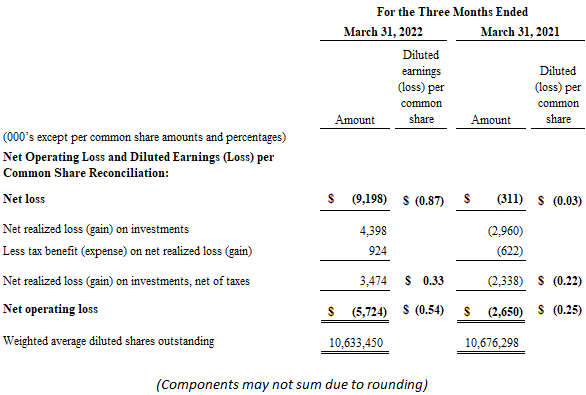

Earnings (Loss) per share ("EPS"):

Kingstone reported a loss of $(0.87) per diluted share for the three months ended March 31, 2022, compared to a loss of $(0.03) per diluted share for the three months ended March 31, 2021. EPS for the three-month periods ended March 31, 2022 and 2021 was based on 10.6 million and 10.7 million weighted average diluted shares outstanding, respectively.

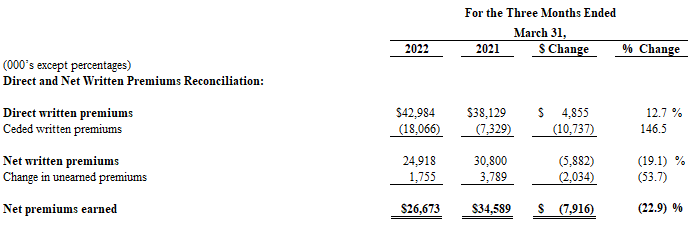

Direct Written Premiums,1 Net Written Premiums1 and Net Premiums Earned

Direct written premiums1 for the first quarter of 2022 were $43.0 million, an increase of $4.9 million or 12.7% from $38.1 million in the prior year period. The increase is primarily attributable to a $4.0 million increase in premiums from our personal lines business and a $0.9 million increase in livery physical damage as the economy continues to reopen and more drivers return to work.

Net written premiums1 decreased $5.9 million, or 19.1% to $24.9 million during the three-month period ended March 31, 2022 from $30.8 million in the prior year period. The decrease was attributable to the inception of the 30% personal lines quota share on December 30, 2021 offset by growth in direct written premiums.

Net premiums earned for the quarter ended March 31, 2022 decreased 22.9% to $26.7 million, compared to $34.6 million for the quarter ended March 31, 2021. The decrease was attributable to the inception of the 30% personal lines quota share treaty on December 30, 2021.

Net Loss Ratio:

For the quarter ended March 31, 2022, the Company's net loss ratio was 86.0%, compared to 65.2% in the prior year period. The loss ratio increase from the prior year period was due to four catastrophe events that added 11.3 points to our quarter's loss ratio vs only 0.7 points in the prior year quarter as well as winter-related water losses that added 12.5 points to the attritional loss ratio for this quarter versus 0.5 points for Q1 2021. There was no prior year development during the current and prior year periods.

Net Underwriting Expense Ratio:

For the quarter ended March 31, 2022, the net underwriting expense ratio was 38.5% as compared to 42.0% in the prior year period, a decrease of 3.5 percentage points. The decrease in the quarter was attributable to the inception of the 30% personal lines quota share treaty and the related increase in provisional ceding commissions as well as a reduction in commission expense and other underwriting expenses.

____________________

1 These measures are not based on GAAP and are defined and reconciled below to the most directly comparable GAAP measures.

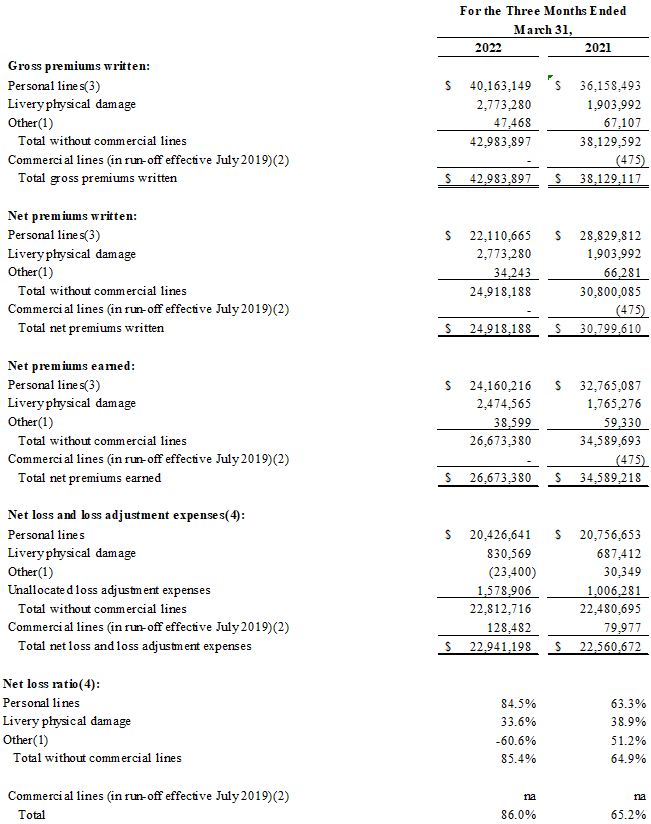

Balance Sheet / Investment Portfolio

Kingstone's cash and investment holdings were $203.9 million at March 31, 2022 compared to $220.7 million at March 31, 2021. The Company's investment holdings are comprised primarily of investment grade corporate, mortgage-backed and municipal securities, with fixed income investments representing approximately 80.5% of total investments at March 31, 2022 and 79.0% at March 31, 2021. The Company's effective duration on its fixed-income portfolio is 5.5 years.

Net investment income decreased to $1.4 million for the first quarter of 2022 from $1.8 million in the prior year period following the fixed income realignment designed to improve credit quality in the 3rd and 4th quarters of 2021 and higher manager and custodial investment expenses.

Accumulated Other Comprehensive Income/Loss (AOCI), net of tax

As of March 31, 2022, AOCI was a loss of $(6.0) million compared to income of $6.5 million at March 31, 2021. The decrease in AOCI at March 31, 2022 of $12.5 million is attributable to the increase in interest rates since March 31, 2021 along with gains realized subsequent to March 31, 2021 from investments previously included in AOCI as of March 31, 2021.

Share Repurchase Program

The Company announced a share repurchase program in March 2021. During the three months ended March 31, 2022, the Company did not repurchase any shares.

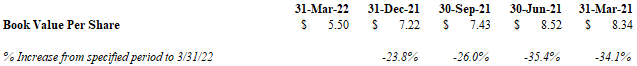

Book Value

The Company's book value per share at March 31, 2022 was $5.50, a decline of 23.8% compared to $7.22 at December 31, 2021.

FOR ADDITIONAL INFORMATION PLEASE VISIT OUR WEBSITE AT WWW.KINGSTONECOMPANIES.COM.

Conference Call Details

Management will discuss the Company's operations and financial results in a conference call on Friday, May 13, 2022, at 8:30 a.m. ET.

The dial-in numbers are:

(877) 407-3105 (U.S.)

(201) 493-6794 (International)

Accompanying Webcast

The call will be simultaneously webcast over the Internet via the Kingstone website or by clicking on the conference call link:

Kingstone Companies First Quarter 2022 Financial Results Webcast

The webcast will be archived and accessible for approximately 30 days.

Definitions and Non-GAAP Measures

Direct written premiums represent the total premiums charged on policies issued by the Company during the respective fiscal period. Net premiums written are direct written premiums less premiums ceded to reinsurers. Net premiums earned, the GAAP measure most comparable to direct written premiums and net premiums written, are net premiums written that are pro-rata earned during the fiscal period presented. All of the Company's policies are written for a twelve-month period. Management uses direct written premiums and net premiums written, along with other measures, to gauge the Company's performance and evaluate results.

Net operating income (loss)- is net income (loss) exclusive of realized investment gains (losses), net of tax. Net income (loss) is the GAAP measure most closely comparable to net operating income (loss).

Management uses net operating income (loss) along with other measures to gauge the Company's performance and evaluate results, which can be skewed when including realized investment gains (losses), and may vary significantly between periods. Net operating income (loss) is provided as supplemental information, not as a substitute for net income (loss) and does not reflect the Company's overall profitability.

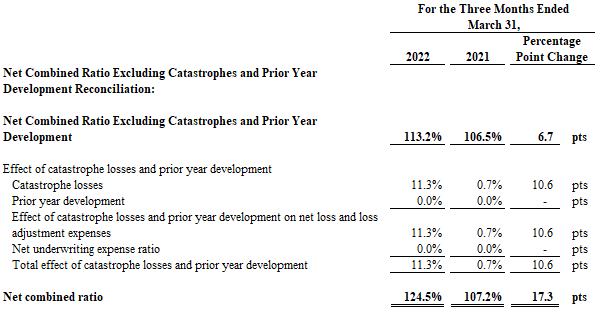

Net combined ratio excluding effect of catastrophes and prior year loss development - is a non-GAAP ratio, which is computed as the difference between GAAP net combined ratio and the effect of catastrophes and prior year loss development on the net combined ratio.

We believe that these ratios are useful to investors and they are used by management to reveal the trends in our business that may be obscured by catastrophe losses and prior year loss development. Catastrophe losses cause our loss ratios to vary significantly between periods as a result of their incidence of occurrence and magnitude, and can have a significant impact on the net loss ratio and net combined ratio. Prior year loss development can cause our loss ratio to vary significantly between periods and separating this information allows us to better compare the results for the current accident period over time. We believe these measures are useful for investors to evaluate these components separately and in the aggregate when reviewing our underwriting performance. We also provide them to facilitate a comparison to our outlook on the net combined ratio excluding the effect of catastrophes and prior year loss development. The most directly comparable GAAP measure is the net combined ratio. The net combined ratio excluding the effect of catastrophes and prior year loss development should not be considered a substitute for the net combined ratio and does not reflect the Company's net combined ratio.

___________________________________________________________________________________________________

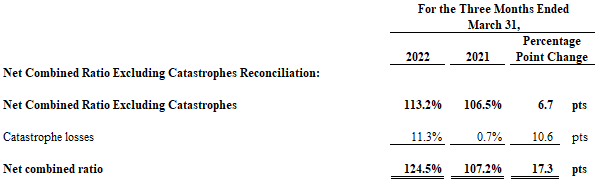

The table below reconciles direct written premiums and net written premiums to net premiums earned for the periods presented:

___________________________________________________________________________________________________

The following table reconciles net operating loss to net loss for the periods indicated:

___________________________________________________________________________________________________

The following table reconciles the net combined ratio excluding catastrophes and prior year loss development to the net combined ratio for the periods presented:

___________________________________________________________________________________________________

The following table reconciles the net combined ratio excluding catastrophes to the net combined ratio for the periods presented:

___________________________________________________________________________________________________

The following table summarizes gross and net written premiums, net premiums earned, net loss and loss adjustment expenses and net loss ratio by major product type, which were determined based primarily on similar economic characteristics and risks of loss.

- "Other" includes, among other things, premiums and loss and loss adjustment expenses from our participation in a mandatory state joint underwriting association and loss and loss adjustment expenses from commercial auto.

- In July 2019, the Company decided that it will no longer underwrite Commercial Liability risks. See discussions above regarding the discontinuation of this line of business.

- See discussion with regard to "Direct Written Premiums, Net Written Premiums and Net Premiums Earned" above.

- See discussions above with regard to "Net Loss Ratio".

About Kingstone Companies, Inc.

Kingstone is a northeast regional property and casualty insurance holding company whose principal operating subsidiary is Kingstone Insurance Company ("KICO"). KICO is a New York domiciled carrier writing business through retail and wholesale agents and brokers. KICO offers primarily personal lines insurance products in New York, New Jersey, Rhode Island, Massachusetts, and Connecticut. Kingstone is also licensed in Pennsylvania, New Hampshire and Maine.

Forward-Looking Statements

Statements in this press release may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, may be forward-looking statements. These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. These statements involve risks and uncertainties that could cause actual results to differ materially from those included in forward-looking statements due to a variety of factors. For more details on factors that could affect expectations, see Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2021 filed with the Securities and Exchange Commission under "Factors That May Affect Future Results and Financial Condition" and Part I, Item 2 and Part II, Item 1A of our Quarterly Report on Form 10-Q for the period ended March 31, 2022 to be filed with the Securities and Exchange Commission. These risks and uncertainties include, without limitation, the following:

- As a property and casualty insurer, we may face significant losses from catastrophes and severe weather events.

- Unanticipated increases in the severity or frequency of claims may adversely affect our operating results and financial condition.

- We are exposed to significant financial and capital markets risk which may adversely affect our results of operations, financial condition and liquidity, and our net investment income can vary from period to period.

- The insurance industry is subject to extensive regulation that may affect our operating costs and limit the growth of our business, and changes within this regulatory environment may adversely affect our operating costs and limit the growth of our business.

- Changing climate conditions may adversely affect our financial condition, profitability or cash flows.

- Because a significant portion of our revenue is currently derived from sources located in New York, our business may be adversely affected by conditions in such state.

- We are highly dependent on a relatively small number of insurance brokers for a large portion of our revenues.

- Actual claims incurred may exceed current reserves established for claims, which may adversely affect our operating results and financial condition.

- We rely on our information technology and telecommunication systems, and the failure of these systems could materially and adversely affect our business.

- We have received a preliminary non-binding indication of interest with regard to the acquisition of all of the outstanding equity of our Company.

Kingstone undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

CONTACT:

Kingstone Companies, Inc.

Richard Swartz

Chief Accounting Officer

(516) 960-1312

SOURCE: Kingstone Companies, Inc.