Charlie's best-selling e-liquids remain in the select minority of 2020 PMTA submissions to the FDA - across the entire vapor products industry - that are still viable

COSTA MESA, CA / ACCESSWIRE / May 16, 2022 / Charlie's Holdings, Inc. (OTCQB:CHUC) ("Charlie's" or the "Company"), an industry leader in the premium, nicotine-based, vapor products space, today reported results for the first quarter ended March 31, 2022, and provided an update on recent business highlights.

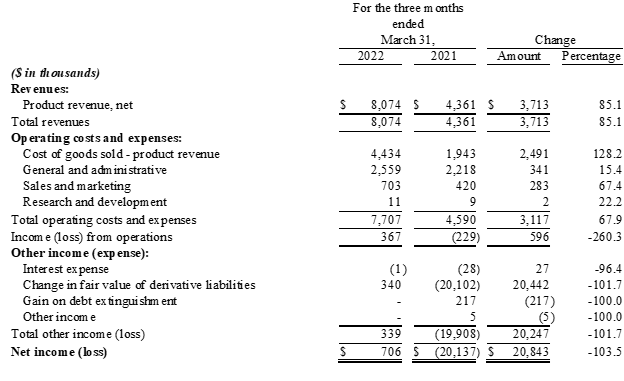

Key Financial Highlights for Q1 2022 (compared with Q1 2021)

- Revenue increased 85% to $8.1 million

- Gross profit increased 51% to $3.6 million

- Operating income improved by $0.6 million to $0.4 million

- Net income improved by $20.8 million to $0.7 million, including gain in fair value of derivative liabilities of $0.3 million

Key Business Highlights During and Subsequent to Q1 2022

- The Company appointed Edward Carmines, Ph.D., accomplished scientist and Premarket Tobacco Application ("PMTA") expert, to Charlie's Board of Directors

- Charlie's best-selling e-liquids remain in the select minority of 2020 PMTA submissions to the Food and Drug Administration ("FDA") that are still viable; the FDA has issued Marketing Denial Orders or "Refuse-to-File" letters on 99% of the PMTAs that were submitted by other companies

- The Company expanded sales and marketing operations with new staff and an office in Williamsville, New York

- On March 15, 2022, Congress passed a new rider to the Federal Food, Drug and Cosmetic Act granting the FDA authority over synthetic nicotine. These new regulations made synthetic nicotine products subject to the same FDA rules as tobacco-derived nicotine products. Subsequently, the Company filed multiple PMTA submissions for its synthetic Pacha Syn products prior to the May 14, 2022 FDA deadline

Results of Operations for the Quarter Ended March 31, 2022 Compared to the Quarter Ended March 31, 2021

Management Commentary

"We had a tremendous start to 2022, highlighted by our 85% revenue growth and strengthened operating income," reported Matt Montesano, Charlie's Holdings, Inc. Chief Financial Officer. "Our quarterly revenue of $8.1 million demonstrates our team's innovative efforts in diversifying Charlie's product lines. With a further reduction of operating expenses as a percentage of revenue to 41% during the first quarter, the Company's operating efficiency continues to improve as we scale our business."

Ryan Stump, Charlie's Chief Operating Officer, commented, "Our strong operational and financial performance is directly correlated with Charlie's commitment to full regulatory compliance and the Company's objective of providing customers with a trusted product portfolio. At this date, Charlie's 2020 PMTA remains in ‘Substantive Review' and stands among the select minority of applications submitted to the FDA - across the entire vapor products industry - that has not received an MDO or Refuse-to-File designation. Our extraordinary efforts and investments over time set Charlie's PMTA apart from those submitted by our peers and we believe these efforts have put us in the best possible position for success."

Henry Sicignano III, Charlie's President, explained, "Striving to include meaningful differentiators from competitors in the marketplace, we are building out a robust domestic and international product portfolio. Indeed, with a laser-sharp focus on the needs of adult smokers who seek better alternatives to combustible tobacco, Charlie's is seeing healthy top line growth and improved profitability. I am proud to report: we are on a trajectory to have our best year in Company history and are very excited for what lies ahead."

Charlie's Best-Selling E-Liquids are in the Select Remaining PMTA Submissions to the FDA that are Still Viable

During the quarter ended September 30, 2020, the FDA's Center for Tobacco Products informed Charlie's that the Company's PMTA received a valid submission tracking number, passed the FDA's filing review phase, and entered the substantive review phase. To date, the Company has invested more than $4.4 million for its initial PMTA submission. Charlie's engaged a team of more than 200 professionals, including doctors, scientists, biostatisticians, data analysts, and numerous contract research organizations to create the Company's comprehensive 2020 PMTA submission. During the quarter ended September, 30 2021, the FDA began to issue Marketing Denial Orders for electronic nicotine delivery system products that lack evidence to demonstrate that permitting the marketing of such products would be appropriate for the protection of the public health. As of today, May 16, 2021, the Company has not received a Marketing Denial Order for any of its submissions; accordingly, Charlie's best-selling e-liquids are in the select remaining 2020 PMTA submissions to the FDA that are still viable.

On March 15, 2022, Congress passed a new rider to the Federal Food, Drug and Cosmetic Act that granted the FDA authority over synthetic nicotine. These new regulations make synthetic nicotine products subject to the same FDA rules as tobacco-derived nicotine products. As such, Charlie's recently filed multiple PMTA submissions for the Company's synthetic nicotine products marketed under the Pacha Syn brand before the FDA's deadline of May 14, 2022.

Highlighted Revenue Growth

The increase in the Company's nicotine-based vapor product sales was driven by Charlie's new 8ml Pacha Syn Disposable line, as well as incremental market penetration of the Company's existing Pacha Syn Disposable products. Pacha Syn Disposables became Charlie's first-ever entrant into the rapidly expanding disposable e-cigarette market and offer users a variety of premium flavors containing synthetic nicotine (not derived from tobacco) in a compact, discrete format. The Company realized significant gains in this product category; however, regulatory challenges including the recently announced requirement for synthetic nicotine products to obtain approval from the FDA, as well as continued uncertainty surrounding the FDA's issuance of Marketing Denial Orders and Refuse-to-File designations, tempered buying patterns in the domestic market as customers reduced inventories of related products. The increase in sales for Charlie's hemp-derived business was directly related to strong performance in the Company's alternative cannabinoid product category, which includes products containing synthetically derived cannabinoids, including Delta-8-THC and other synthetic THC compounds. The Company views this market segment as having significant growth potential, and strong alignment with Charlie's existing sales channels.

Financial Results for the Three Months Ended March 31, 2022:

- Revenue: For the three months ended March 31, 2022, revenue was $8.1 million, an increase of $3.7 million, or 85%, compared with $4.4 million for the same period last year. The increase in revenue was primarily due to a $2.8 million increase in sales of Charlie's nicotine-based vapor products and a $0.9 million increase in sales of the Company's hemp-derived products.

- Gross Profit: For the three months ended March 31, 2022, gross profit was $3.6 million, an increase of $1.2 million, or 51%, compared with $2.4 million for the same period last year. The resulting gross margin was 45.1%, compared with 55.4% for the same period last year. The decrease in gross margin is primarily due to a higher sales mix consisting of Charlie's Pacha Syn Disposable product line, which carries a lower unit margin relative to the Company's other products, as well as comparatively higher freight and delivery expenses and reserves for inventory obsolescence. Cost of revenue was partially offset by a favorable inventory quantity adjustment.

- Total Operating Expenses: For the three months ended March 31, 2022, total operating expense, including general and administrative, sales and marketing expense and research and development costs, were $3.3 million, an increase of $0.6 million, or 24%, compared with $2.7 million for the three months ended March 31, 2021. The increase in operating expenses was primarily attributable higher payroll and benefits costs and professional fees as well as a return to normalized trade-show activity during the quarter. Sales commissions also increased due to revenue growth across Charlie's businesses; however, the increases were mitigated by a reduction in non-cash stock-based compensation and further restructuring of the Company's sales team and compensation program at the beginning of 2022. Operating expenses as a percentage of revenue decreased to 41%, from 61%, for the periods compared.

- Operating Income/Loss: For the three months ended March 31, 2022, operating income was $0.4 million, an improvement of $0.6 million, compared with an operating loss of $0.2 million for the three months ended March 31, 2021.

- Net Income/Loss: For the three months ended March 31, 2022, net income was $0.7 million, compared with a net loss of $20.1 million for the three months ended March 31, 2021. Of note, net income for the three months ended March 31, 2022 included a $0.3 million gain in fair value of derivative liabilities and net loss for the three months ended March 31, 2021 included a $20.1 million loss in fair value of derivative liabilities.

- EPS: For the three months ended March 31, 2022, diluted earnings per share were $0.00, compared with a net loss per share of ($0.10), for the three months ended March 31, 2021.

About Charlie's Holdings, Inc.

Charlie's Holdings, Inc. (OTCQB:CHUC) is an industry leader in the premium, nicotine-based, vapor products space. The Company's products are sold around the world to select distributors, specialty retailers, and third-party online resellers through subsidiary companies Charlie's Chalk Dust, LLC and Don Polly, LLC. Charlie's Chalk Dust, LLC has developed an extensive portfolio of brand styles, flavor profiles, and innovative product formats. Don Polly, LLC creates innovative hemp-derived products and brands.

For additional information, please visit Charlie's corporate website at: CharliesHoldings.com and the Company's branded online websites: CharliesChalkDust.com, PachamamaCBD.com, and Pacha.co.

Safe Harbor Statement

This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to statements regarding the Company's overall business, existing and anticipated markets and expectations regarding future sales and expenses. Words such as "expect," "anticipate," "should," "believe," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "could," "intend," variations of these terms or the negative of these terms, and similar expressions, are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company's control. The Company's actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: the Company's ongoing ability to quote its shares on the OTCQB; whether the Company will meet the requirements to uplist to a national securities exchange in the future; the Company's ability to successfully increase sales and enter new markets; whether the Company's PMTA's will be granted marketing orders by the FDA, and the FDA's decisions with respect to the Company's future PMTA submissions; the Company's ability to manufacture and produce products for its customers; the Company's ability to formulate new products; the acceptance of existing and future products; the complexity, expense and time associated with compliance with government rules and regulations affecting nicotine, synthetic nicotine, and products containing cannabidiol; litigation risks from the use of the Company's products; risks of government regulations, including recent regulation of synthetic nicotine; the impact of competitive products; and the Company's ability to maintain and enhance its brands, as well as other risk factors included in the Company's most recent quarterly report on Form 10-Q, annual report on Form 10-K, and other SEC filings. These forward-looking statements are made as of the date of this press release and were based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this release as a result of new information, future events or changes in its expectations.

Investors Contact:

[email protected]

Phone: 949-570-0691

SOURCE: Charlie's Holdings, Inc.