VANCOUVER, BC / ACCESSWIRE / June 13, 2022 / Electric Royalties Ltd. (TSXV:ELEC) (OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to announce the signing of a binding letter agreement with World Copper Ltd. (TSX.V: WCU) (OTCQB: WCUFF) (FRA: 7LY0) ("World Copper") to acquire a 0.5% gross revenue royalty ("GRR") on the wholly owned Zonia Copper Oxide Project in Arizona, US (the "Zonia Project" or "Zonia") in exchange for C$1,550,000 cash and 2,000,000 common shares of the Company (the "Transaction"). The Company will also have the right, for a period of 15 months after closing of the Transaction, to acquire a further 0.5% GRR on the Zonia Project for C$3,000,000 cash consideration. In addition, the Company will have an option, to acquire a 1% GRR on the Zonia Norte deposit, adjacent to the Zonia Project, for C$3,000,000 cash, at any time during a period of 24 months from the date that World Copper publishes an initial technical report in respect of the Zonia Norte deposit which is prepared in accordance with National Instrument 43-101 and which contains an estimate of Inferred Mineral Resources.

The 2,000,000 common shares will be subject to voluntary escrow which provides that the common shares will be subject to a hold period of 6 months. The Transaction noted herein is subject to completion of due diligence, approval of the TSX Venture Exchange and other customary conditions.

Brendan Yurik, CEO of Electric Royalties commented, "As a royalty company, we seek to acquire development assets that that have a clear path to production. The Zonia Copper Oxide Project is a near-term copper oxide development project in an attractive mining jurisdiction, Arizona, with a clear path to production.

"Zonia has had an extensive amount of drilling and a significant resource estimate of over 500 million pounds of copper with potential for further resource growth. At recent and forecast long-term copper prices, the Zonia Project has robust economics, a compelling case to bring it to production, and a team experienced in project delivery. As the project sits entirely on private patented land in Arizona, there is potential for a permitting and start of operations timeline of under four years. Due to the extensive amount of work already carried out on the project, World Copper's management estimates that C$5 million is sufficient to advance the project to feasibility stage within the next two years. As the world transitions toward a net-zero economy, the clean energy technologies enabling this shift will be metal intensive. Copper demand is projected to exceed supply by five to eight million metric tons by the end of the decade.1 We're very excited to partner with World Copper's management team and believe that Zonia is well positioned to meet this demand."

Zonia Project Royalty Acquisition Highlights

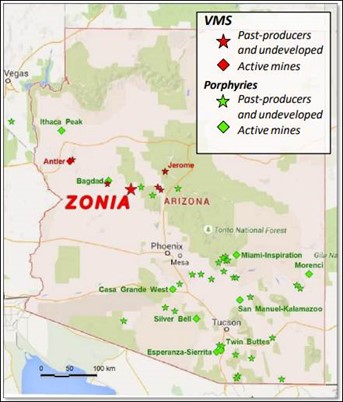

- Located in a part of Arizona with many existing copper mines, past producers and active exploration projects. The project can be easily reached by the existing road network, the majority of which is paved highway. There is existing power on the property and some buildings remain from previous production between 1966 and 1975.

- Mineral Resource estimate2 completed by Tetra Tech Inc. includes:

- Measured and Indicated Resources of 76.8 million short tons grading 0.33% copper (Cu) containing 510 million pounds (lb) of copper (0.2% Cu cut-off grade).

- Inferred Resources of 27.2 million short tons grading 0.28% Cu, containing 154.6 million pounds of copper (0.2% Cu cut-off grade).

- Preliminary Economic Assessment3 ("PEA") announced in 2018, using a base case with a Cu price of US$2.00/lb designed pit shell and a cut-off grade of 0.17% total Cu. At a Cu price of US$3.00/lb, Zonia's forecast economics are:

- After-tax net present value at an 8% discount and Internal rate of Return of US$177 million and 29%, respectively, with a 2.89-year payback of initial capital.

- Initial capital of US$198 million.

- Cumulative Net Cash Flow After Taxes of US$331 million.

- Low life-of-mine strip ratio of 0.6:1.

- The PEA pit has been pre-stripped from former production.

- World Copper plans to prepare for prefeasibility-level studies to further advance the project toward production. This includes a program of infill drilling with goals to upgrade Inferred Resources, convert Measured and Indicated Resources to Mineral Reserves and potentially expand the deposit to the northeast. The program also includes geotechnical and condemnation drilling.

- World Copper plans to drill a new, separate deposit target with copper porphyry-style mineralization, Zonia Norte, near the main resource. No drilling has been done to date.

The PEA is considered preliminary in nature, contains numerous assumptions and includes Inferred Mineral Resources that are considered too speculative, geologically, to have the economic considerations applied that would enable them to be classified as Mineral Reserves. There is no certainty that the results of the PEA (or any update thereto) will be realized. No Mineral Reserves have been estimated for Zonia. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Inferred Mineral Resources are that part of the Mineral Resource for which quantity and grade, or quality are estimated based on limited geologic evidence and sampling, which is sufficient to imply but not verify grade or quality continuity. Inferred Mineral Resources may not be converted to Mineral Reserves. It is reasonably expected, though not guaranteed, that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. Mineral Resources are captured within an optimized pit shell and meet the test of reasonable prospects for economic extraction.

Zonia Project Overview

Figure 1: Location map of Zonia Project. Source: World Copper Ltd.

History

The Zonia Copper Oxide Project in central Arizona has been held under private ownership for almost 100 years and has undergone extensive historical exploration, metallurgical studies and mine development planning. Much of the mineralized area was pre-stripped during previous open-pit mining operations in 1966, at which time, 17 million tons were mined with 7 million tons stacked on heap leach pads, producing cement copper until 1975. The property has been drill-tested with almost 700 drill holes (60,000 metres (m)). This high-density drilling covers 30% of the property and defines the current resource estimate, reducing technical risk on the deposit. Mineralization is mostly open to the northeast, providing considerable opportunity to grow the resource.

Geology

The Zonia deposit is a highly oxidized, supergene enriched, porphyry deposit, located at surface. Oxidation of the original chalcopyrite mineralization and younger secondary supergene chalcocite has been pervasive and deep, extending down over 250 m in the central part of the deposit. The original pyrite-chalcopyrite sulphide mineralization underwent oxidation and remobilization which resulted in development of chalcocite-rich lenses. This supergene mineralization was subsequently oxidized and partly remobilized due to uplift, erosion, and lowering of the water table, resulting in a large deposit of in-situ and transported copper oxide mineralization. Oxide copper deposits such as Zonia are particularly suitable to low-cost heap leaching extraction methods, and also offer the potential to generate pure copper cathode on site, without the need for costly transportation of concentrate to smelters.

Figure 2: Core from drill hole RRC09-27 grading 11.12% copper over 8.5 feet (2.6 m). Supergene chalcocite, copper pitch oxide rim, chrysocolla, malachite. Source: World Copper Ltd.

Mining and Processing

The Zonia project would employ open pit mining with a conventional copper acid heap leach system. The mineralized material would be crushed in a three-stage crushing circuit to a nominal P80 size of 25 millimetres (mm). The crushed material would be agglomerated with acid containing solutions using either raffinate or fresh sulphuric acid, and then be delivered to the heap via conveyors then stacked in 10-m lifts with a radial stacker. The heap is designed to contain up to 10 lifts for a maximum height of 100 m, each with an interlift liner.

The SX circuit consists of two extraction stages and one stripping stage using a conventional mixer/settler arrangement. The electrowinning (EW) circuit consists of two parallel banks of 50 poly-cement cells with 1 m2 cathodes. The plated copper cathodes are stripped using a mechanized stripping system after being washed. Copper cathodes are then sampled and bundled for shipment.

Good copper extractions were achieved from the majority of the metallurgical samples at Zonia and range from 59% to 81% in a 91-day locked cycle column leach test (excluding the high sulphide and low grade samples). The copper extraction from the master composite sample, with a nominal P80 size of 25 mm, was 77.8%. The overall copper extraction based on the total copper assay (% TCu) for the deposit is estimated to be between 71% and 75%. For pit optimization, copper recovery has been assigned based on mineral type with copper oxide minerals at 73%, secondary copper sulphides at 70% and primary copper sulphides at 0%.

Exploration

There is ample opportunity to increase the mine life through successful exploration. There is a compelling target to the northeast of the deposit location. The Zonia Norte target is defined by surface rock sampling and forms a copper-molybdenum anomaly approximately 1,500 m x 2,500 m.

David Gaunt, P.Geo., a Qualified Person who is not independent of Electric Royalties, has reviewed and approved the technical information in this release.

About Electric Royalties Ltd.

Electric Royalties is a royalty company established to take advantage of the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper) that will benefit from the drive toward electrification of a variety of consumer products: cars, rechargeable batteries, large scale energy storage, renewable energy generation and other applications.

Electric vehicle sales, battery production capacity and renewable energy generation are slated to increase significantly over the next several years and with it, the demand for these targeted commodities. This creates a unique opportunity to invest in and acquire royalties over the mines and projects that will supply the materials needed to fuel the electric revolution.

Electric Royalties has a growing portfolio of 19 royalties, including one royalty that currently generates revenue. The Company is focused predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to the clean energy transition via the underlying commodities required to rebuild the global infrastructure over the next several decades towards a decarbonized global economy.

For further information, please contact:

Brendan Yurik

CEO, Electric Royalties Ltd.

Phone: (604) 364‐3540

Email: [email protected]

www.electricroyalties.com

Scott Logan

Renmark Financial Communications Inc.

Phone: (416) 644-2020 or (212) 812-7680

Email: [email protected]

www.renmarkfinancial.com

_______________________

2 Technical report titled "ZONIA COPPER PROJECT, NI 43-101 Technical Report, Yavapai County, Arizona USA", effective November 30, 2015 and dated October, 2017 ("Amended Technical Report"), prepared by Tetra Tech and posted under Cardero Resource Corp.'s profile at www.sedar.com.

3 Preliminary Economic Assessment NI 43-101 technical report titled "ZONIA COPPER PROJECT, NI 43-101 Technical Report, Yavapai County, Arizona USA", effective March 22, 2018 and dated April 17, 2018, prepared by Global Resource Engineering Ltd. and posted under Cardero Resource Corp.'s profile at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor any other regulatory body or securities exchange platform, accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information and Other Company Information

This news release includes forward-looking information and forward-looking statements (collectively, "forward-looking information") with respect to the Company within the meaning of Canadian securities laws. Forward looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. This information represents predictions and actual events or results may differ materially. Forward-looking information may relate to the Company's future outlook and anticipated events and may include statements regarding the financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, industry trends and growth opportunities of the Company and the projects in which it holds royalty interests.

While management considers these assumptions to be reasonable, based on information available, they may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company or these projects to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to risks associated with general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments involving the renewable energy industry; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; the mining industry generally, the Covid-19 pandemic, recent market volatility, income tax and regulatory matters; the ability of the Company or the owners of these projects to implement their business strategies including expansion plans; competition; currency and interest rate fluctuations, and the other risks.

The reader is referred to the Company's most recent filings on SEDAR as well as other information filed with the OTC Markets for a more complete discussion of all applicable risk factors and their potential effects, copies of which may be accessed through the Company's profile page at www.sedar.com and at otcmarkets.com.

Cautionary Note to US Investors Concerning Estimates of Mineral Resources

This news release includes estimates of the mineral resources on that property and uses the terms "Measured Resources", "Indicated Resources" and "Inferred Resources". The Company advises investors that these terms are recognized and required by Canadian regulations under National Instrument 43-101, Standards of Disclosure for Mineral Properties ("43-101"). The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure required for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934 ("The SEC Modernization Rules"). The SEC Modernization Rules include the adoption of definitions of the terms and categories of resources which are "substantially similar" to the corresponding terms under Canadian Regulations in 43-101. Accordingly, there is no assurance any mineral resources that we may report as Measured Resources, Indicated Resources and Inferred Resources under 43-101 would be the same had the resource estimates been prepared under the standards adopted under the SEC Modernization Rules. Investors are cautioned not to assume that all or any part of the mineral deposits in these categories will ever be converted into reserves. In addition, Inferred Resources have a great amount of uncertainty as to their economic and legal feasibility. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or pre-feasibility studies, or economic studies except for a Preliminary Economic Assessment as defined under 43-101.

This news release describes the transaction whereby Electric Royalties may obtain a royalty interest on potential future production on a property with mineral resources from the property owner. Electric Royalties does not directly own this property or its mineral resources.

SOURCE: Electric Royalties Ltd.