MONTRÉAL, QC / ACCESSWIRE / June 13, 2022 / Critical Elements Lithium Corporation (TSXV:CRE)(OTCQX:CRECF)(FSE:F12) ("Critical Elements" or the "Corporation") is pleased to announce results of a new Feasibility Study on the Rose Lithium-Tantalum project ("Rose" or the "Project") in Eeyou-Istchee - James Bay, Québec. Unless otherwise stated, all figures are quoted in American dollars ("US$") and are reported on a 100% equity project basis.

Highlights

- Average production, Year 2 to Year 16 of 173,317 tonnes of chemical grade 5.5% spodumene concentrate

- Average production, Year 2 to Year 16 of 51,369 tonnes of technical grade 6.0% spodumene concentrate

- Average production, Year 2 to Year 16 of 441 tonnes of tantalum concentrate

- Expected life of mine of 17 years

- Average operating costs of US$74.48 per tonne milled, US$540 per tonne of concentrate (all concentrate production combined)

- Estimated initial capital cost $US$357 million before working capital

- 100% equity basis for project

- Average gross margin of 68.3%

- After-tax NPV of US$1,915 million (at 8% discount rate), after-tax IRR of 82.4% and average price assumptions of US$4,039 per tonne technical grade lithium concentrate, US$1,852 per tonne chemical grade lithium concentrate, US$130 per kg tantalum pentoxide (Ta2O5)

- Anticipated construction time to start of production of 21 months

The Rose Lithium-Tantalum Project is 100% owned by Critical Elements. The Corporation's market strategy is to enter the lithium market with a low-risk approach. The completion of the feasibility on the spodumene plant is the first step to enter the market and establish the Corporation as a reliable high quality lithium supplier. The low-risk approach is characterized by simple open-pit mining and conventional lithium processing technologies.

Critical Elements has consistently sought to advance the wholly owned Rose Lithium-Tantalum Project in a low-risk manner. To this end, the Corporation has completed a new Feasibility Study with a conservative spodumene concentrate price deck, as well as capital and operating cost estimates reflective of current market conditions. The new Feasibility Study incorporates a standard truck and shovel open-pit mining operation and conventional lithium processing technologies. The Project will produce technical grade spodumene concentrate for the glass and ceramics industry and chemical grade spodumene concentrate for conversion for use in batteries for e-mobility, as well as a tantalite concentrate.

The mine will excavate a total of 26.3M tonnes ore grading an average of 0.87% Li2O and 138 ppm Ta2O5 after dilution. The mill will process 1.61M tonnes of ore per year to produce an annual average of 224,686 tonnes of technical and chemical grade spodumene concentrates and 441 tonnes of tantalite concentrate. The ore is contained in several parallel and continuous shallow dipping pegmatite dykes outcropping on surface. The ore zones are open at depth and a future underground operation is possible.

Over the life of mine, the open pit will excavate a total of 182.4M tonnes of waste rock and 10.9 M tonnes of overburden. The average strip ratio is 7.3 tonnes of waste per tonne of ore.

Table 1 Rose Key FS Results

Item | Units | Value | |||

Production | |||||

Project life (from start of construction to closure) | years | 19 | |||

Mine life | years | 17 | |||

Total mill feed tonnage | M t | 26.3 | |||

Average mill feed grade | |||||

Li2O | % Li2O | 0.87 | |||

Ta2O5 | ppm Ta2O5 | 138 | |||

Lithium Concentrate Production | |||||

% of Production, Chemical Grade | % | 75 | |||

% of Production, Technical Grade | % | 25 | |||

Mill recoveries | |||||

Li2O, Chemical Grade | % | 90 | |||

Li2O, Technical Grade | % | 87 | |||

Ta2O5 | % | 40 | |||

Payable | |||||

5.5% Li2O Concentrate, Chemical Grade | t | 2,798,000 | |||

6% Li2O Concentrate, Technical Grade | t | 829,000 | |||

Ta2O5 contained in concentrate | kg | 1,453,000 | |||

Average Commodity Prices | |||||

5.5% Li2O Concentrate, Chemical Grade | US$/t conc. | 1,852 | |||

6% Li2O Concentrate, Technical Grade | US$/t conc. | 4,039 | |||

Ta2O5 contained in concentrate | US$/kg contained | 130 | |||

Exchange rate | 1 US$ : 1.30 CAN$ | ||||||

0.77 US$ : 1 CAN$ | |||||||

| Item | Units | Value | |||||

| Project Costs | CA$ | US$ | |||||

| Average Mining Cost | $/t milled | 37.89 | 29.17 | ||||

| Average Milling Cost | $/t milled | 19.88 | 15.31 | ||||

| Average General & Administrative Cost | $/t milled | 20.30 | 15.63 | ||||

| Average Concentrate Transport Costs | $/t milled | 18.66 | 14.37 | ||||

| Project Economics | CA$ | US$ | |||||

| Gross Revenue | $M | 10,855 | 8,358 | ||||

| Total Selling Cost Estimate | $M | 236 | 182 | ||||

| Total Operating Cost Estimate | $M | 2,543 | 1,958 | ||||

| Total Sustaining Capital Cost Estimate | $M | 160 | 123 | ||||

| Total Capital Cost Estimate | $M | 464 | 357 | ||||

| Duties and Taxes | $M | 3,098 | 2,386 | ||||

| Average Annual EBITDA | $M | 493 | 379 | ||||

| Pre-Tax Cash Flow | $M | 7,452 | 5,738 | ||||

| After-Tax Cash Flow | $M | 4,354 | 3,352 | ||||

| Effective Tax Rate | 42% | ||||||

| Discount Rate* | 8% | ||||||

| Pre-Tax Net Present Value @ 8% | $M | 4,368 | 3,363 | ||||

| Pre-Tax Internal Rate of Return | 125.0% | ||||||

| Pre-Tax Payback Period | years | 1.0 | |||||

| After-Tax Net Present Value @ 8% | $M | 2,487 | 1,915 | ||||

| After-Tax Internal Rate of Return | 82.4% | ||||||

| After-Tax payback period | years | 1.4 | |||||

*Discounting starts with commercial production.

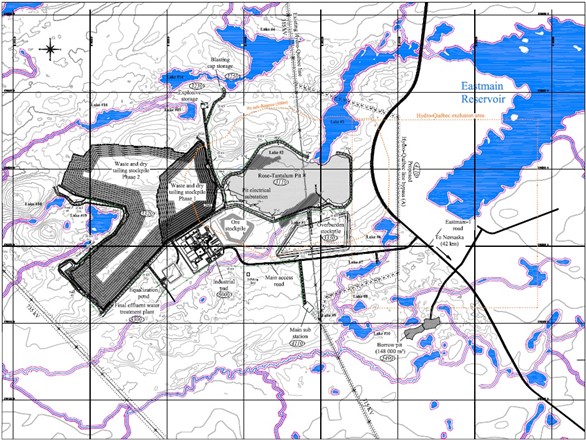

Property

The Rose property is located in northern Québec's administrative region, on the territory of Eeyou Istchee James Bay. It is located on Category III land, on the Traditional Lands of the Eastmain Community, approximately 40 kilometers north of the Cree village of Nemaska. The latter is located approximately 300km north-west of Chibougamau.

The Rose property is accessible by road via the Route du Nord, usable all year round from Chibougamau. The mine site can also be reached by Matagami, via Route 109 and Route du Nord. Figure 1 shows the regional location of the project. The project is located 80 km south of Goldcorp's Éléonore gold mine and 45 km north-west of Nemaska's Whabouchi lithium project and 20 km south of Hydro Québec's Eastmain 1 hydroelectricity generating plant. The Nemiscau airport services the region's air travel needs. The Rose property site is located 50 km by road from the Nemiscau airport.

The Rose property comprises 473 claims spread over a 24,654-ha area. Geologically, the Rose property is located at the north-east end of the Archean Lake Superior Province of the Canadian Shield.

Over the life of mine, the open pit will excavate a total of 182.4M tonnes of waste rock and 10.9 M tonnes of overburden. The average strip ratio is 7.3 tonnes of waste per tonne of ore.

Figure 1 Rose Property Location

Reserve Estimate

A Mineral Reserve Estimate for 17 mineralized zones was prepared during this study. The estimation assumed the production of a chemical grade spodumene concentrate with a price of 20 US$ per kg Li2O and a tantalite concentrate with a price of 130 US$ per Kg of Ta2O5. The recoveries were fixed at 85% and 64% for Li and Ta respectively. The grade-recovery curve used for resource estimate, which became available after the mineral reserves were evaluated, was verified and found to have little influence on the reserve estimate. The production of a higher value technical grade spodumene concentrate was not assumed in the reserve estimate.

Based on compilation status, metal price parameters, and metallurgical recovery inputs, the effective date of the estimate is May 27, 2022.

The estimate was prepared in accordance with CIM's standards and guidelines for reporting mineral resources and reserves.

Table 2 displays the results of the Mineral Reserve Estimate for the Rose Project at the $36.92 NSR per tonne cut-off for the open-pit scenario.

Table 2 Mineral Reserve Estimate

Tonnage | NSR | Li2O_eq | Li2O | Li2O | Ta2O5 | Ta2O5 | |

Category | (Mt) | ($) | (%) | (%) | (000 t) | (ppm) | (000 t) |

| Probable | 26.3 | 204 | 0.92 | 0.87 | 193.8 | 138 | 2.3 |

| Total | 26.3 | 204 | 0.92 | 0.87 | 193.8 | 138 | 2.3 |

- The Independent and Qualified Person for the Mineral Reserve Estimate, as defined by NI 43‑101, is Simon Boudreau, P.Eng, of InnovExplo Inc. The effective date of the estimate is May 27, 2022.

- The model includes 17 mineralized zones.

- Calculations used metric units (metres, tonnes and ppm).

- The number of metric tons was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects. Rounding followed the recommendations in NI 43‑101.

- InnovExplo is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issue that could materially affect the Mineral Reserve Estimate.

Resource Estimate ("MRE")

The current MRE is primarily based on changes made to the net smelter return ("NSR") parameters, supported by new assumptions concerning metal prices and the creation of potentially mineable shape to constrain the MRE for the potential underground extraction scenario. No changes to the interpretation and interpolation parameters were deemed necessary. The mineral resource model for the current MRE is based largely upon the model generated for the 2011 PEA.

The effective date of the estimate is May 27th, 2022, based on compilation status, metal price parameters, metallurgical recovery inputs and creation of the constraining volume.

Given the density of the processed data, the search ellipse criteria, the drill hole density and the specific interpolation parameters, the QP is of the opinion that the current MRE can be classified as Indicated and Inferred resources. The estimate was prepared in accordance with CIM's standards and guidelines for reporting mineral resources and reserves.

Table 3 displays the results of the MRE for the Rose Project using $31.4 NSR/t cut-off for the open-pit potential extraction scenario and and $121.12 NSR cut-off for the underground potential extraction scenario.

Table 3 Mineral Resource Estimate

- The Independent and Qualified Person for the Mineral Resource Estimate, as defined by NI 43‑101, is Carl Pelletier, P.Geo., of InnovExplo Inc. The effective date of the estimate is May 27, 2022. The MRE follow 2014 CIM Definition Standards and the 2019 CIM MRMR Best Practice Guidelines.

- These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability.

- The model includes 23 mineralized zones.

- The reasonable prospect for eventual economic extraction is met by having constraining volumes applied to any blocks (potential open -pit or underground extraction scenario) using Whittle and the Deswik Stope Optimizer (DSO) and by the application of cut-off grades. The mineral resource is reported at a cut-off of $31.4 NSR for the open-pit potential; and of $121.12 NSR for the underground potential based on market conditions (metal price, exchange rate and production cost).

- A range of densities was used on a per-zone basis based on statistical analysis of all available data.

- A minimum true thickness of 2.0 metres was applied, using the grade of the adjacent material when assayed or a value of zero when not assayed.

- High grade capping was done on raw assay data based on the statistical analyses of individual mineralized zones.

- Compositing was done on drill hole intercepts falling within mineralized zones (composite lengths vary from 1.5 m to 3 m in order to distribute the tails adequately).

- Resources were evaluated from drill holes using a 2-pass OK interpolation method in a block model (block size = 5 m x 5 m x 5 m).

- The inferred category is only defined within the areas where blocks were interpolated during pass 1 or pass 2 where continuity is sufficient to avoid isolated blocks being interpolated by only one drill hole. The indicated category is only defined by blocks interpolated by a minimum of two drill holes in areas where the maximum distance to the closest drill hole composite is less than 40 metres for blocks interpolated in pass 1.

- Results are presented in-situ. The number of metric tons was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects. Rounding followed the recommendations in NI 43‑101.

- The qualified persons are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issue, that could materially affect the potential development of mineral resources other than those discussed in the MRE.

Feasibility Study

The parameters used for the feasibility study are the following:

- Open pit mining rate of 1,610,000 tpy

- Spodumene process plant with a 4,600 tpd capacity

Mining Operation

The mineralization is hosted within outcropping pegmatite dykes subparallel to surface. The ore body is relatively flat, close to surface and comprised of north oriented stacked lenses. Mineralization recognized to date on the Rose property includes rare element of Lithium-Cesium-Tantalum or LCT-type pegmatites and molybdenum occurrences.

A conventional truck and shovel open-pit approach was considered to mine the Rose Lithium-Tantalum Project's Probable Mineral Reserves. The dimensions of the engineered pit design are approximately 1,620m long x 900m wide x 220m deep.

The life of mine plan (LOM) proposes to mine 26.3 Mt of ore, 182.4 Mt of waste, and 10.9 Mt of overburden for a total of 219.6 Mt of material. The average stripping ratio is 7.3 tonnes of waste per tonne of ore. The nominal production rate is estimated at 4,600 tonnes per day and 350 operating days per year.

The mining operation production rate is set to approximately 15 Mt of material per year. An open pit mining schedule was planned and resulted in a mine life of 17 years.

Contract mining will be used for the removal of the overburden while Critical Elements will undertake the mining of all hard rock material with its own equipment fleet and operators.

The main production fleet will consist of one (1) backhoe excavator, one (1) electric front shovel, one (1) wheel loader, seven (7) haul trucks (65t), seven (7) haul trucks (135t), two (2) rotary drills, one (1) DTH drill, two (2) bulldozers, one (1) wheel dozer, two (2) graders, one (1) auxiliary excavator, one (1) auxiliary wheel loader, and two (2) water trucks.

The Rose project pit was designed with a 10m single benching arrangement. A 57° inter-ramp angle and an overall pit slope angle of 55° were utilized for the ultimate pit design. A berm width of 7.0m corresponding to the recommended overall slope angle was used. The pit slopes in overburden have a face ratio of 2.5:1 with a 10m berm width.

The main in-pit haulage ramp is designed at 30.9m wide to allow a double-lane traffic, except for the last benches at the pit bottom that are designed at 20.4m wide for single lane traffic. A 2m drainage ditch is included to allow for water drainage and pipe installation. The maximum gradient of the inner curvature of all ramp segments is 10%.

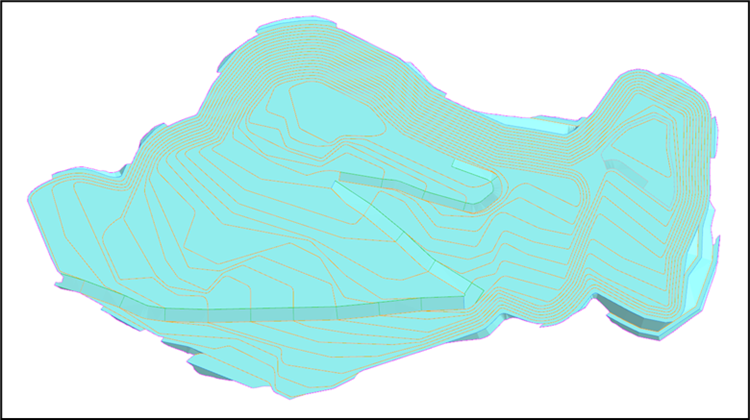

Figure 2 Rose Pit Plan View

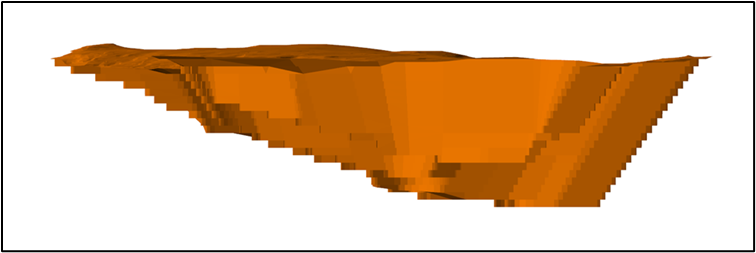

Figure 3 Rose Pit Side View Looking West

Mineral Processing

A standard froth flotation process will be utilized to produce technical grade and chemical grade lithium concentrates and a tantalum concentrate. The mineral process plant will consist of crushing, beneficiation, and dewatering areas. The technical grade lithium concentrate will grade 6.0% Li2O while the chemical grade lithium concentrate will grade 5.5% Li2O. The tantalum concentrate will grade 20% Ta2O5.

The beneficiation process includes crushing, grinding, magnetic separation and flotation. The crushing circuit will consist of a jaw crusher and two (secondary and tertiary) cone crushers, and screens. The crushed ore will have a P80 of 13 mm and will be stockpiled in a 9,200-tonne capacity dome; this is sufficient for approximately two days of mill operation. The grinding circuit will consist of a ball mill operating in a closed circuit and a two-stage cyclone cluster. The tantalum will first be recovered at a grade of 2.0% Ta2O5 by high intensity magnetic separation then upgraded further to 20.0% Ta2O5 by gravity separation. The lithium flotation circuit will include removal of slimes after magnetic separation followed by mica flotation, scrubbing, and spodumene flotation to the required grade. The lithium flotation circuit will remove slimes, separate mica, and purify the lithium to the required grade. The spodumene concentrate will then be thickened, vacuum filtered, dried to 1% moisture, and stored in 1500-tonne silo from where it can be bulk loaded into trucks. The tailings will be thickened, vacuum filtered to 15% moisture or less, and trucked to the waste rock / tailings piles where it will be dry stacked.

The spodumene plant will operate 24 hours per day, 7 days per week, and 52 weeks per year. The process plant was designed with an operating availability of 90%. The crushing circuit was designed using an operating availability of 50%. The concentrator capacity has been established at a nominal throughput rate of 4 900 dry tonnes per day. The plant has a capacity of 1,610,000 per year.

The process plant flowsheet developed by Bumigeme Inc. is presented in Figure 4.

Figure 4 Rose Process Flowsheet

Metallurgy

Bench scale metallurgical testing was performed at ACME Metallurgical Limited in Vancouver in 2011. The results from these tests were used for the PEA study. Three composites; the Rose (main structure), the Rose Sud-Est (Southeast structure) and Tantalum (secondary structure with higher tantalum and lower lithium content) were subjected to various metallurgical tests.

SGS Canada Inc. in Lakefield conducted tests from 2013 to 2015 to improve lithium and tantalum recoveries. In 2015 SGS Canada Inc. developed a conceptual flowsheet based on a series of bench scale tests on various samples from the Rose deposit. The proposed flowsheet consists of conventional three-stage crushing and single stage grinding followed by magnetic separation for the recovery of tantalum, mica flotation, and spodumene flotation. This flowsheet was the basis of the process plant design.

SGS Canada also conducted a pilot plant program in early 2017 on two samples from the Rose project (Rose and Rose South). The main objective of the pilot plant program was to generate spodumene concentrate for testing in a lithium carbonate pilot plant which was conducted by Outotec in Germany and Finland. Secondary objectives were to prove metallurgical performance on a continuous pilot scale and to generate metallurgical and operating data for further studies. The spodumene pilot plant demonstrated the robustness of the design process.

The Feasibility Study assumes 87.3% and 90% recovery for technical and chemical grade lithium concentrates respectively and 40% minimum recovery for the tantalum concentrate.

Process water will be recycled releasing minimal amounts to the equalization pond and final effluent treatment plant.

Environmental and Social Impact Assessment

The final environmental impact assessment (EIA) was submitted to the governments of Canada and Quebec in February 2019. CELC has answered a series of questions from both government bodies (COMEX and CEAA). In August 2021, Critical Elements announced that the Federal Minister of Environment and Climate Change had rendered a favorable decision in respect of the proposed Rose Project. In a Decision Statement, which included the conditions to be complied with by the Corporation, the Minister confirmed that the Project is not likely to cause significant adverse environmental effects when mitigation measures are taken into account.

The final remaining step in the Rose Project's approval process is the completion of the provincial permitting process, which runs parallel to the federal process. Pursuant to the James Bay and Northern Quebec Agreement (JBNQA), the provincial environmental assessment is conducted jointly by the Cree Nation Government and the Government of Quebec under the Environmental and Social Impact Review Committee ("COMEX"). The provincial assessment is already well advanced and has undergone several rounds of questions from COMEX and answered by Critical Elements in the normal course of the assessment process. At this time, Critical Elements has received no further questions from COMEX and remains confident in a positive outcome given the stated support for lithium project development in the Province of Québec.

Critical Elements has been working since the beginning with the Eastmain Community, on whose lands the Project lies. The Corporation has also maintained good relations with the Grand Council of the Cree and with the neighbouring Nation of Nemaska. Consultations have been ongoing and are planned throughout the life of the Project. In 2019, Critical Elements entered into an impact and benefits agreement with the Cree Nation of Eastmain, the Grand Council of the Cree (Eeyou Istchee), and the Cree Nation Government called the Pihkuutaau Agreement.

The Corporation's mine closure and restoration plan was accepted by the Ministry of Energy and Natural Resources of the Province of Québec (MERN) in April 2022.

Infrastructure

The Project infrastructure includes site main access, services and haulage roads, explosive and detonator storage, a spodumene processing plant, a maintenance facility, a warehouse, diesel and gasoline storage, LNG storage and distribution, ore stockpile pad, waste rock and dry tailings stockpile, overburden stockpile, main electrical substation and distribution, fresh and potable water supply, sewage, surface water management, final effluent treatment, communication system, gate house, and an administrative building.

The mine site layout is shown in Figure 5.

Figure 5 Rose Site Layout

Waste rock and tailings samples were analyzed at the SGS Canada's laboratory in Lakefield and both were found to be non-acid generating. The dry tailings and the waste rock will be stored in the same facility which has sufficient capacity for the life of mine. Rain and snow melt water will be collected in ditches and pumped to the water treatment plant.

The industrial pad has an area of 296,000 m2 and will contain the process plant, the maintenance facility, warehouse, administration building, diesel and gasoline storage tanks, LNG storage and distribution, and all associated services. LNG will be used for buildings heating and for the drying of the lithium and tantalum concentrates. The ore pad will have a 3.9M tonne capacity where low-grade material may be stored.

The hydrology study has suggested that water inflow to the open pit is to be expected. In order to maximize pit slopes, water wells will be constructed around the pit periphery to lower the water table below the pit floor. One of these wells will be used to supply the mine site with fresh water. Water from the other wells will be directed to sedimentation ponds and treated, if necessary, before being released to the final effluent.

Water from the waste rock / dry tailings stockpile, the open pit, the industrial pad, the overburden stockpile and the roads will be collected in an equalization pond and treated before being released as final effluent.

The mine site will have a 2.7 km main access road from the Eastmain 1 road to the industrial pad. Including the service roads, the site will total 15.8 km of roads.

Electricity will be provided by Hydro-Québec. A 315 kV electrical transport line (L3176), owned by Hydro‑Québec, runs North-South over the eastern side of the Rose Property. It runs over the planned open pit. The portion running over the open pit representing 4.2 km will be rerouted to allow open pit operation.

Figure 6 Power Line at Rose Site

Capital Costs

The capital and operating costs were estimated in Canadian dollars. An economic analysis was conducted with a discounted cash-flow before and after tax. The initial capital cost is estimated at US$357 M including all infrastructures described earlier with a 10% contingency. The sustaining capital is estimated at US$126 M over the life of mine.

The total payable products are estimated at 2,797,668 tonnes of chemical grade 5.5% Li2O concentrate, 829,198 tonnes of technical grade 6.0% Li2O concentrate, and 7,264 tonnes of 20% Ta2O5 concentrate.

Table 4 Initial Capital and Sustaining Capital Costs

Item | Initial Capital | Sustaining Capital | Initial Capital | Sustaining Capital | ||

M CA$ | M CA$ | M US$ | M US$ | |||

| Direct Capital Estimate | 312.7 | 118.0 | 240.8 | 90.9 | ||

| Mining | 62.8 | 110.3 | 48.3 | 85.0 | ||

| Power & Electrical | 39.3 | 0.8 | 30.3 | 0.6 | ||

| Infrastructure | 40.2 | 0.0 | 30.9 | 0.0 | ||

| Process plant | 153.3 | 0.0 | 118.0 | 0.0 | ||

| TSF and Water management | 17.2 | 6.9 | 13.3 | 5.3 | ||

| Indirect Capital Estimate | 108.6 | 0.5 | 83.6 | 0.4 | ||

| Administration & Overhead | 57.2 | 0.0 | 44.1 | 0.0 | ||

| Project Development (Studies) | 0.4 | 0.0 | 0.3 | 0.0 | ||

| PCM, Other indirects & Other costs | 50.9 | 0.5 | 39.2 | 0.4 | ||

| Contingency | 42.1 | 11.8 | 32.4 | 9.1 | ||

| Mine Rehabilitation (incl. contingency) | 0.0 | 21.7 | 0.0 | 16.7 | ||

| Mine Rehabilitation Bond & Costs | 0.2 | 8.0 | 0.2 | 6.2 | ||

| Total Capital Estimate | 463.7 | 160.0 | 357.0 | 123.2 | ||

Operating Costs

The operating costs are estimated at $96.73 US$74.48 per tonne of ore processed which include:

- Mining - US$29.17 per tonne processed

- Processing - US$15.31 per tonne processed

- G&A - US$15.63 per tonne processed

- Concentrate transportation - US$14.37 per tonne processed

The total operating costs are estimated at US$550/tonne of concentrate after Tantalite Credit, as summarized in Table 5.

Table 5 Operating Costs per Tonne of Concentrate

Item | CA$/t all concentrate | US$/t all concentrate | ||||

| Mining | 274 | 211 | ||||

| Processing | 144 | 111 | ||||

| General and Administration | 147 | 113 | ||||

| Transportation Concentrate | 135 | 104 | ||||

| Total Operating Costs | 701 | 540 | ||||

| SG&A | 35 | 27 | ||||

| Royalties | 30 | 23 | ||||

| Total Operating Costs (w. SG&A and Royalties) | 766 | 590 | ||||

| Less: Tantalite Credit | 52 | 40 | ||||

| Total Operating Costs (after Tantalite Credit) | 714 | 550 | ||||

Energy unit costs are CA$0.06 per kWh for electricity, CA$1.70 per litre for diesel, and CA$0.935 per m3 for LNG.

Project Economics

The mine will process 1,610,000 tonnes ore per year grading an average of 0.87% Li2O and 138 ppm Ta2O5 over a period of 17 years. Over the Life of Mine (LoM), the averages for the price assumptions are US$1,852 per tonne and US$4,039 per tonne of chemical grade and technical grade lithium concentrates respectively (FOB port) and US$130 per kg Ta2O5 contained in the tantalum concentrate (FOB mine site).

Figure 7 shows the prices per year for the lithium concentrate products.

Figure 7 Concentrate Selling Price Per Year

The pre-tax and after-tax NPV at various discount rates are presented in Table 6.

Table 6 Pre-Tax and After-Tax NPV

Discount Rate* | Pre-Tax | After-Tax | Pre-Tax | After-Tax |

M CA$ | M CA$ | M US$ | M US$ | |

NPV @ 0% | $7,452 | $4,354 | $5,738 | $3,352 |

NPV @ 5% | $5,253 | $3,023 | $4,045 | $2,328 |

NPV @ 8% | $4,368 | $2,487 | $3,363 | $1,915 |

NPV @ 10% | $3,896 | $2,201 | $3,000 | $1,695 |

NPV @ 12% | $3,497 | $1,959 | $2,693 | $1,509 |

*Discounting commences with commercial production.

The after-tax internal rate of return is 82.4%.

Sensitivity Analysis

The sensitivity of the NPV to exchange rate and chemical grade lithium concentrate price is presented in Table 7.

Table 7 After-Tax NPV Sensitivity to Exchange Rate and Chemical Grade Lithium Concentrate

Exchange Rate | After-Tax NPV 8% Discount Rate - M CA$ | ||||

Li2O Price - Chemical Grade | |||||

-20% | -10% | Base Case | 10% | 20% | |

-10% | 1475 M CA$ | 1799 M CA$ | 2121 M CA$ | 2443 M CA$ | 2765 M CA$ |

Base Case | 1771 M CA$ | 2129 M CA$ | 2487 M CA$ | 2844 M CA$ | 3202 M CA$ |

10% | 2065 M CA$ | 2459 M CA$ | 2852 M CA$ | 3246 M CA$ | 3639 M CA$ |

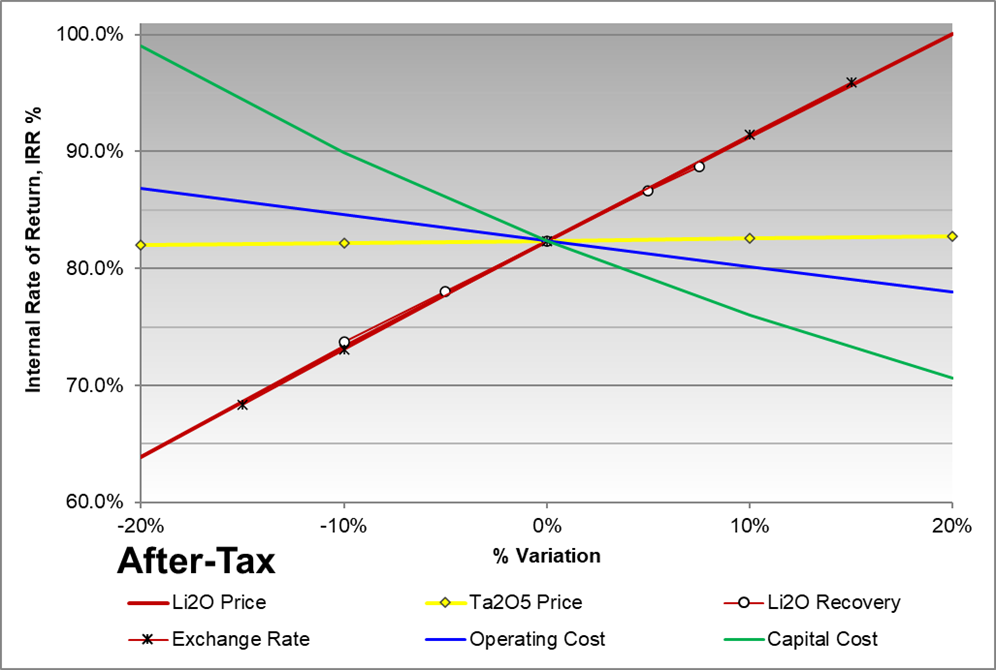

Figures 8 and 9 present the sensitivity of the NPV at 8% discount rate and IRR to prices, Li2O recovery, exchange rate, operating costs, and capital cost. The economics are most sensitive to Li2O price, exchange rate, and Li recovery.

Figure 8 Sensitivity on After-Tax NPV 8%

Figure 9 Sensitivity on After-Tax IRR

Lithium Demand Outlook

The future growth of the lithium market will clearly be dominated by e-mobility powered by Li-ion batteries but also increasingly energy storage systems (ESS). With the declining cost of Li-cells, targets for 1 kWh being now very close to 150 US$, they are also becoming attractive for use in private installations combined with increasing use of photovoltaic roof-top electricity generation (PV). For example, in Germany a new regulation demands that for all PV projects exceeding 1MW power generation an energy storage system has to be installed by 2025. This is intended to avoid peak energy stressing the electricity distribution systems, a phenomenon which already pushes European systems to their limits during the summer months and increasingly so with the ongoing addition of new PV systems, be they commercial or private.

In the coming years the major driver of the Lithium demand growth continues to be the electro mobility. The IHS Markit Global Production Forecasts from December 2021 assumes an electric vehicle penetration rate of 22% in 2025 and 39% in 2030. This mainly in combination with the expected growth of average battery size will result in a strong increase of the Lithium demand.

Considering about 100 million new cars per year by 2030, and assuming that 40% of them are BEVs equipped with an average 55-kWh battery, this market segment alone will require in excess of 1.5 million metric tons of LCE. In addition, this does not include other transport segments such as two/three-wheelers, light duty trucks, heavy duty trucks, electric stationary storage (ESS), etc.

Most recently, all major lithium producers as well as the leading market analysts have increased their forecasts significantly. Figure 10 shows the actual demand forecast as well as previous projections from Albemarle.

Figure 10 Lithium Demand Forecast for 2025 and 2030

Lithium Price Outlook

Based on the actual demand forecast, the increased production cost of incumbents and newcomers, the rising quality requirements and more stringent ESG requirements leading to higher capital expenditures, a price higher than 1,500 US$/MT for 6% spodumene concentrate resulting in an approximate price of 22,000 US$/MT of LCE is a prerequisite for putting new projects into production. As the market faces a structural supply deficit for the remainder of this decade, prices are expected to exceed minimum price requirements. Benchmark Minerals and Fastmarkets both reported in Q2 2022 contractual prices exceeding 60 US$/kg for lithium carbonate and lithium hydroxide as well as 5,500 to 6,000 US$/mt for spodumene 6%. Also, suppliers who are able to provide a higher quality chemical grade spodumene yielding lower conversion cost will also be able to achieve higher prices.

The market for technical grade spodumene is a specialty chemicals market, which addresses the specific needs for customers in the glass and ceramics industry. Historically, prices have been reflecting the higher value of iron free spodumene like in lithium carbonate and specific properties of the crystalline material.

Therefore, pricing for technical grade spodumene is directly linked to the lithium oxide content in lithium carbonate.

Ongoing Work

The geotechnical program is being completed.

Front-End Engineering is being conducted and detailed engineering work will follow.

The detailed design of the co-disposal facility for the stacked tailings and pit waste rock is under way.

Report Filing

The Corporation plans to file an NI 43-101 technical report that summarizes the Rose Lithium-Tantalum project on SEDAR (http://www.sedar.com) and on the Corporation's website (http://www.cecorp.ca/en/) within 45 days.

Qualified Persons

The Feasibility Study was prepared in accordance to 43-101 standards by WSP Canada Inc (WSP), Bumigeme inc, and InnovExplo Inc.. InnovExplo Inc was responsible for the resource estimate and the mine plan, Bumigeme Inc was responsible for the mineral processing, WSP was responsible for environmental study, project infrastructure, financial modelling, and report integration. Information regarding the outlook for lithium comes from a market study prepared by Mr. Gerrit Fuelling on behalf of the Corporation. Mr. Fuelling is an independent consultant specializing in the lithium market.

The qualified persons for the study are:

InnoExplo Inc;

- Carl Pelletier, P.Geo, Geologist

- Simon Boudreau, P.Eng, Mining Engineer

Bumigeme;

- Florent Baril, Eng, Metallurgical Engineer

WSP;

- Eric Poirier, Eng, PMP, Project Manager

- Rick McBride, P.Eng., Mining Engineer

- Olivier Joyal, Geologist

About Critical Elements Lithium Corporation

Critical Elements aspires to become a large, responsible supplier of lithium to the flourishing electric vehicle and energy storage system industries. To this end, Critical Elements is advancing the wholly owned, high purity Rose lithium project in Québec. Rose is the Corporation's first lithium project to be advanced within a land portfolio of over 700 square kilometers. In the Corporation's view, Québec is strategically well-positioned for US and EU markets and boasts good infrastructure including a low-cost, low-carbon power grid featuring 93% hydroelectricity. The project has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government; The Corporation is working to obtain similar approval under the Québec environmental assessment process. The Corporation also has a good, formalized relationship with the Cree Nation.

For further information, please contact:

Patrick Laperrière

Director of Investor Relations and Corporate Development

514-817-1119

[email protected]

www.cecorp.ca

Jean-Sébastien Lavallée, P. Géo.

Chief Executive Officer

819-354-5146

[email protected]

www.cecorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is described in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement concerning forward-looking statements

This news release contains "forward-looking information" within the meaning of Canadian Securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "scheduled", "anticipates", "expects" or "does not expect", "is expected", "scheduled", "targeted", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information contained herein include, without limitation, statements relating to mineral reserve estimates, mineral resource estimates, realization of mineral reserve and resource estimates, capital and operating costs estimates, the timing and amount of future production, costs of production, success of mining operations, the ranking of the project in terms of cash cost and production, permitting, economic return estimates, power and storage facilities, life of mine, social, community and environmental impacts, lithium and tantalum markets and sales prices, off-take agreements and purchasers for the Corporation's products, environmental assessment and permitting, securing sufficient financing on acceptable terms, opportunities for short and long term optimization of the Project, and continued positive discussions and relationships with local communities and stakeholders. Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Although Critical Elements has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking information include, but are not limited to: Critical Elements' ability to secure sufficient financing to advance and complete the Project, uncertainties associated with the Corporation's resource and reserve estimates, uncertainties regarding global supply and demand for lithium and tantalum and market and sales prices, uncertainties associated with securing off-take agreements and customer contracts, uncertainties with respect to social, community and environmental impacts, uncertainties with respect to optimization opportunities for the Project, as well as those risk factors set out in the Corporation's year-end Management Discussion and Analysis dated August 31, 2021 and other disclosure documents available under the Corporation's SEDAR profile. Forward-looking information contained herein is made as of the date of this news release and Critical Elements disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

SOURCE: Critical Elements Lithium Corporation