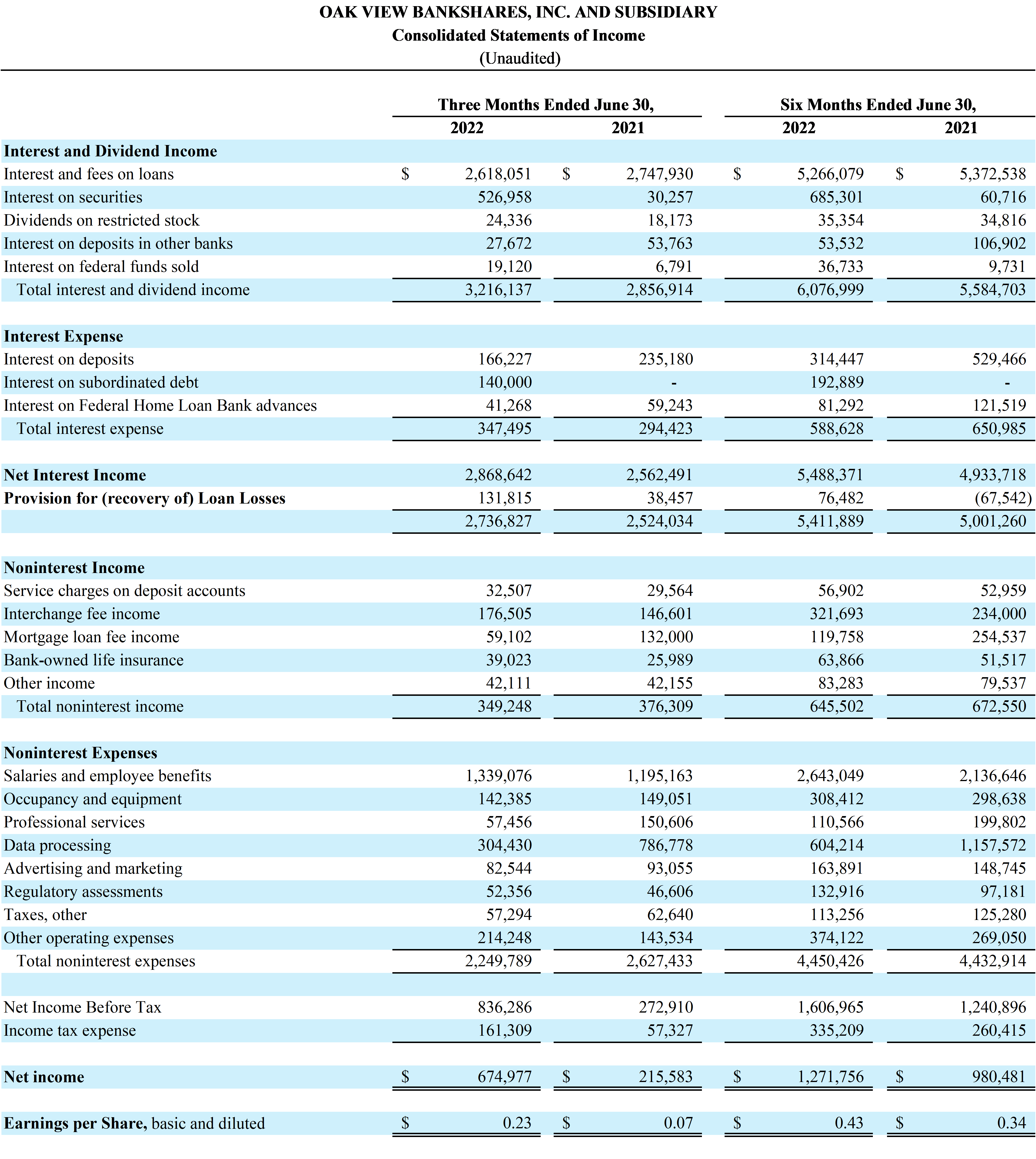

WARRENTON, VA / ACCESSWIRE / July 28, 2922 / Oak View Bankshares, Inc. (the "Company") (OTC Pink:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of $674,977 for the quarter ended June 30, 2022, compared to net income of $215,583 for the quarter ended June 30, 2021. Basic and diluted earnings per share for the second quarter were $0.23 compared to $0.07 per share for the second quarter of 2021.

Net income for the six months ended June 30, 2022, was $1.3 million, compared to $980,481 for the six months ended June 30, 2021. Basic and diluted earnings per share for the six months ended June 30, 2022, were $0.43 compared to $0.34 per share for the six months ended June 30, 2021.

Selected Highlights:

- The net interest margin was 3.13% for the quarter, compared to 3.12% and 3.43% for the prior quarter, and the quarter ended June 30, 2021, respectively. The net interest margin was 3.12% and 3.45% for the six months ended June 30, 2022, and 2021, respectively.

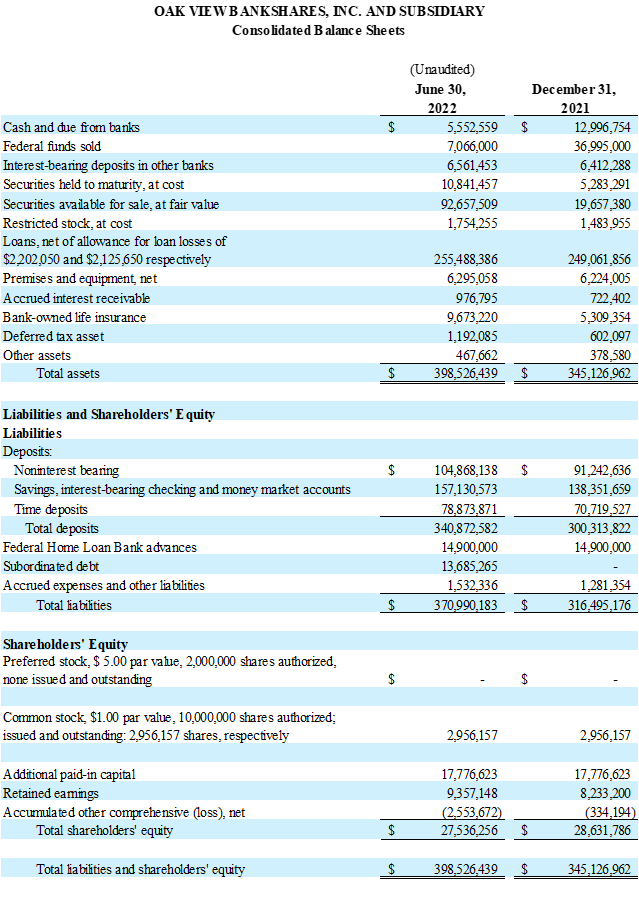

- Total assets increased to $398.5 million on June 30, 2022, compared to $345.1 million on December 31, 2021.

- Total loans increased to $257.6 million on June 30, 2022, compared to $251.2 million on December 31, 2021.

- Credit quality continues to be outstanding. The Company reported no nonperforming loans and no past due loans on June 30, 2022.

- The Bank recorded a provision for loan losses of $131,815 and $38,457 for the quarters ended June 30, 2022, and 2021, respectively and a recovery in the provision for loan losses of $55,333 for the quarter ended March 31, 2022. A provision for loan losses of $76,482 was recorded for the six months ended June 30, 2022, compared to a recovery in the provision for loan losses of $67,542 for the six months ended June 30, 2021.

- Total deposits increased to $340.9 million on June 30, 2022, compared to $300.3 million on December 31, 2021.

- Regulatory capital remains strong with ratios exceeding the well capitalized thresholds in all categories.

Michael Ewing, CEO and Chairman of the Board said, "Through the hard work and dedication of each member of our team, we are pleased to report our second quarter financial results. With total balance sheet growth of over $50 million, our deposit growth has been phenomenal, paving our way in executing many of our strategic initiatives." Mr. Ewing continued by saying, "As we all feel the pressure of the current economic and interest rate environments, our team of dedicated management and employees continue to strive towards our vision of Passionate Community Banking, providing an exceptional experience at every customer interaction, and to amaze every customer, every time, by meeting their financial needs at the time they need it."

Earnings

Return on average assets was 0.70% and return on average equity was 9.83% for the quarter, compared to 0.67% and 8.40%, respectively, for the quarter ended March 31, 2022, and 0.28% and 3.17%, respectively, for the quarter ended June 30, 2021. Return on average assets was 0.68% and 0.65% for the six months ended June 30, 2022, and 2021, respectively. Return on average equity was 9.63% and 7.33% for the six months ended June 30, 2022, and 2021, respectively.

Net Interest Income

Net interest income was $2.9 million for the quarter, compared to $2.6 million for the quarters ended March 31, 2022, and June 30, 2021. Net interest income was $5.5 million and $4.9 million for the six months ended June 30, 2022, and 2021, respectively.

The primary factors contributing to the changes in net interest income are the result of the Company's strategic investment initiatives to deploy funds into higher yielding investments, and increases in interest expense related to the Company's issuance of subordinated debt in February 2022.

Noninterest Income

Noninterest income was $349,248 for the quarter, compared to $296,254 for the prior quarter, and $376,310 for the quarter ended June 30, 2021. This represents an increase of $52,994 compared to the prior quarter and a decrease of $27,062 compared to the quarter ended June 30, 2021. Interchange fee income increased $31,317 and $29,904 compared to the prior quarter and the quarter ended June 30, 2021, respectively, due to the increase in the volume of transactions period-over-period. Income on bank-owned life insurance also increased $14,180 and $13,034 compared to the prior quarter and the quarter ended June 30, 2021, respectively, due to the increase in additional policies purchased during the current period coupled with an increase in average rates earned on these investments. The increase in revenue from interchange income and income received on bank-owned life insurance was offset by decreases in mortgage loan fee income as changes in the interest rate environment directly impact loan originations on the secondary market.

Noninterest income was $645,502 and $672,550 for the six months ended June 30, 2022, and 2021, respectively. As mentioned above, while interchange income and income received from bank-owned life insurance contributed favorably to noninterest income, this was more than offset by the decline in mortgage loan fee income for the six months ended June 30, 2022.

Noninterest Expense

Noninterest expense was $2.2 million, relatively unchanged for the quarter when compared to the prior quarter and $2.6 million for the second quarter of 2021. The decrease in noninterest expense when compared to the same quarter of 2021 was the direct result of expenses associated with the core data processing conversion that occurred during the second quarter of 2021.

Noninterest expense was $4.5 million and $4.4 million for the six months ended June 30, 2022, and 2021, respectively.

Factors contributing to the largest variances in noninterest expenses were related to the increases in salaries and benefits period-over-period due to growth opportunities the Bank has experienced, offset by the reduction in data processing expenses associated with the core data processor conversion, as mentioned above.

Asset Quality

The allowance for loan losses was $2.2 million and $2.1 million on June 30, 2022, and December 31, 2021. Changes in the allowance for loan losses related primarily to additional reserves needed as a result of loan growth and increases to qualitative factors related to the current state of the local, regional and national economy.

Capital

Total consolidated shareholders' equity was $27.5 million on June 30, 2022, compared to $28.6 million on December 31, 2021. Current period earnings increased shareholders' equity by $1.3 million, however, this was offset by $2.6 million of unrealized losses due to the change in the market value of securities available for sale. These losses were the result of declining market values in the available for sale securities portfolio during the six months ended June 30, 2022, stemmed from rising market interest rates.

The Bank's regulatory capital ratios were 15.49% in Common Equity Tier 1 and Total Tier 1 Capital, 16.38% in Total Capital and 9.85% in Leverage Ratio for the quarter ended June 30, 2022. These ratios exceeded the well capitalized thresholds for the period.

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

SOURCE: Oak View Bankshares, Inc.