2022 Second Quarter Financials:

- Total assets were $552 million for quarter-end June 30, 2022.

- Total loans increased $44 million during second quarter 2022 ending at $389.3 million.

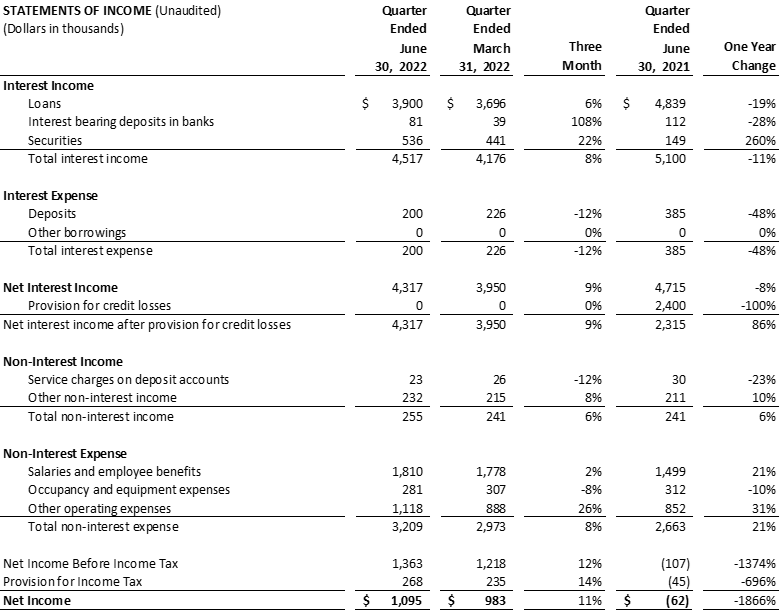

- Net income exceeded $1 million for second quarter.

- Minimal remaining Paycheck Protection Program (PPP) loans outstanding with a balance of $1 million out of $153 million total PPP originations.

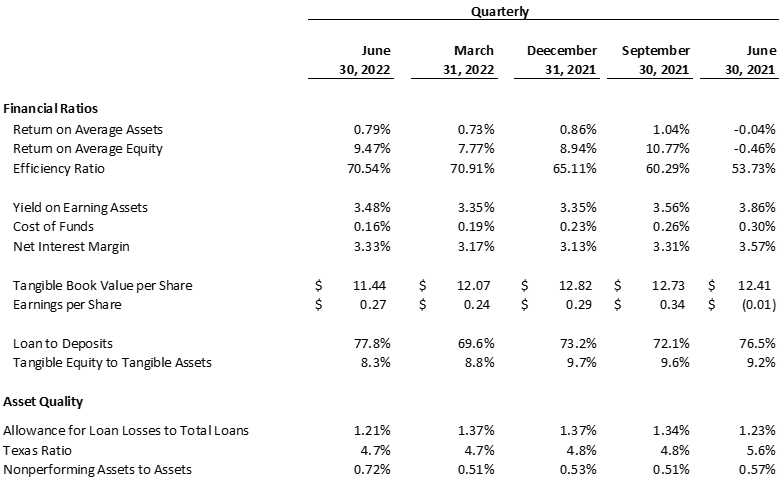

TACOMA, WA / ACCESSWIRE / August 5, 2022 / Commencement Bancorp, Inc. (OTCQX:CBWA) reported a quarterly net income of $1.1 million, or $0.27 earnings per share, for the quarter ending June 30, 2022, compared to a $62 thousand loss for second quarter 2021, which was the result of a large provision to the Allowance for Loan and Lease Losses (ALLL). Total assets were $552 million on June 30, 2022, compared to $562 million, which included $60 million in PPP loans, one year earlier.

Asset composition improved in the second quarter, as excess overnight funds were deployed to support the $44 million loan growth. Second quarter loan growth amounted to 13% compared to first quarter. Forgiveness of 1% PPP loans amounted to over $59 million from the prior year, and over $4 million from first quarter. The loan portfolio remained well-diversified at 73% commercial real estate, 23% commercial, and 4% consumer and other.

Quarter-end deposit balances have been consistent; however, the mix improved favoring relationship deposits and a reduction in higher-cost time deposits. Demand deposits increased 9% from one year prior, while time deposits decreased 46%. Total deposits remained steady at $500 million compared to first quarter 2022.

Other Comprehensive Income, a component of Shareholder's Equity, was impacted by rising interest rates affecting the market values of securities. No impairments exist within the securities portfolio. The stock repurchase program implemented in November 2021 was completed in the second quarter and another was announced on June 15, 2022; the third plan issued overall for the bank holding company.

Interest rate increases implemented by the Federal Open Market Committee (FOMC), primarily in the second quarter, positively impacted interest income. Interest expense declined due to an improved balance of time deposit to transactional accounts. The ALLL remained adequate at 1.21%; therefore, no provision expense was recorded in the first half of 2022. Continued loan growth will impact the level of allowance.

Nonperforming assets to total assets were 0.72%, and the Bank's Texas Ratio, a measurement of problem loans and bank-owned properties to capital, ended at 4.7%. Capital levels remained in excess of regulatory capital requirements.

"The Bank was well-positioned for the interest rate increases implemented by the FOMC, and we continue to monitor the deposit rate environment closely. Due to the hard work of our bankers, we achieved substantial loan growth during the quarter while also improving our deposit mix. Both factors contributed to an improved net interest margin as we re-deployed our excess liquidity from overnight funds into higher yielding loans," said John Manolides, Chief Executive Officer.

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit www.commencementbank.com. For information related to the trading of CBWA, please visit www.otcmarkets.com.

For further discussion, please contact the following:

John E. Manolides, Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Thomas L. Dhamers, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc. undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bancorp, Inc.