VANCOUVER, BC / ACCESSWIRE / September 6, 2022 / Northern Superior Resources Inc. ("Northern Superior" or the "Company") (TSXV:SUP)(OTCQB:NSUPF) and Royal Fox Gold Inc. ("Royal Fox") (TSX-V: FOXG) are pleased to announce having entered into a definitive arrangement agreement dated September 6, 2022 (the "Definitive Agreement") pursuant to which Northern Superior has agreed to acquire all of the issued and outstanding common shares of Royal Fox (the "Royal Fox Shares") by way of a statutory plan of arrangement under the Business Corporations Act (Ontario) (the "Transaction"). Northern Superior and Royal Fox are arm's length parties under the policies of the TSX Venture Exchange (the "TSX-V").

Transaction Highlights Include:

- Each shareholder of Royal Fox (a "Royal Fox Shareholder" and, collectively, the "Royal Fox Shareholders") will receive 0.12 of a Northern Superior share (each whole common share, a "Northern Superior Share") per Royal Fox Share, implying an initial premium of approximately 33% over the closing price of the Royal Fox Shares on the TSX-V on September 2, 2022;

- Further consideration, via the issuance by Northern Superior of a Contingent Value Right ("CVR") for each Royal Fox Share, providing for the issuance of additional Northern Superior Shares to Royal Fox Shareholders following the upcoming mineral resource calculation on Royal Fox's Philibert gold project (the "Philibert Project");

- Maximum additional consideration of 0.06 of a Northern Superior Share in the event of a declaration of a resource calculation of 2,000,000 ounces or more of gold in the measured, indicated or inferred categories (as such terms are defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"));

- Maximum additional consideration would result in total consideration of 0.18 of a Northern Superior Share per Royal Fox Share, an implied value of C$0.09, representing an approximate premium of 100% over the last closing price of Royal Fox Shares on the TSX-V on September 2, 2022;

- Holders of warrants and options of Royal Fox will be required to exercise their warrants and options by the effective date of the Transaction in order to be eligible to receive the CVRs;

- Ontario assets of Northern Superior, including the TPK project, to be considered for a spin out to the shareholders following completion of the Transaction;

- New Board to be comprised of four directors of Northern Superior and three directors of Royal Fox, namely Messrs. Frank Guillemette, Victor Cantore, who is expected to be appointed Executive Chairman, and Simon Marcotte, who will be appointed President and CEO; and

- Dr. Thomas Morris, President and CEO of Northern Superior, to be appointed as Chairman of the Company's high-profile Technical Committee, which will include Gordon Morrison (former VP Exploration of FNX Mining Co. Inc, and President of TMAC Resources Inc.), Catharine Farrow (former CEO and Director of TMAC Resources Inc., and current director of Franco Nevada Corp.), and David Beilhartz (former VP Exploration of Lake Shore Gold Corp.)

Proforma Fundamentals

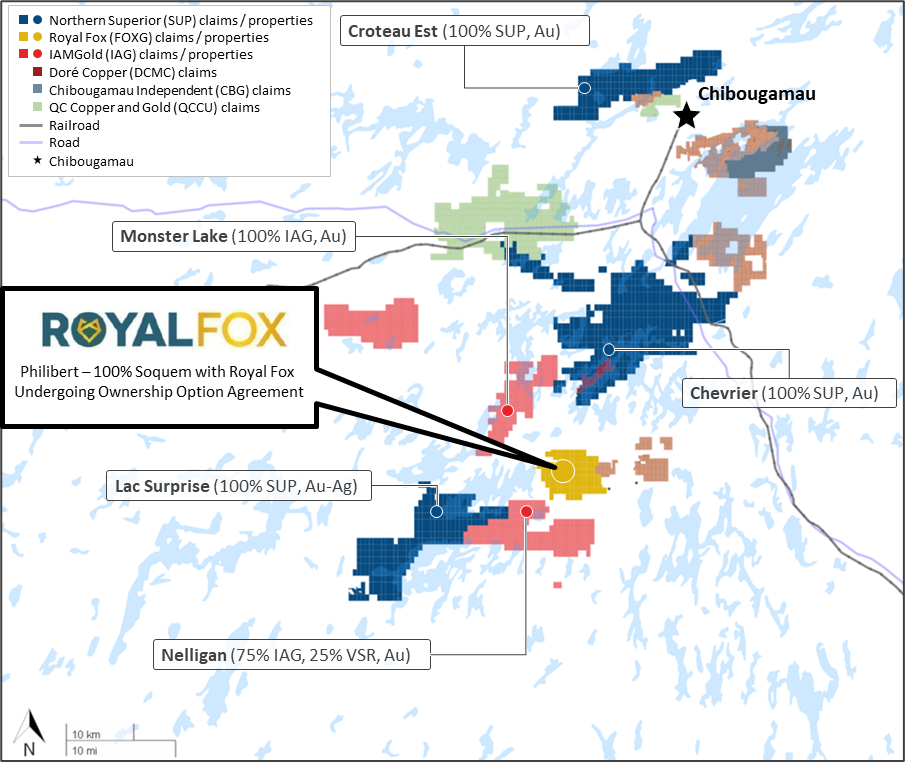

- Following the recent acquisition of Genesis Metals, the Transaction positions Northern Superior as a leading company in the Chapais-Chibougamau district, a mining-friendly region having produced over 6.7 million ounces of gold, and which hosts several major deposits including IAMGOLD Corporation's Nelligan deposit (inferred gold resource estimate of 3.2 million ounces at 1.02 g/t gold1);

- Largest land holdings in the district which is now estimated to be more than 62,000 hectares, including four major properties, each of which having either a NI 43-101 compliant mineral resource estimate (Croteau Est2 and Chevrier3) or meaningful gold discoveries being advanced towards mineral resource calculations (Lac Surprise and Philibert);

- Pro forma NI 43-101 compliant mineral resource estimates of approximately:

- 1,295,000 ounces in the inferred category (643,000 ounces at Croteau Est2 and 652,000 ounces at Chevrier3), and

- 260,000 ounces in the indicated category (Chevrier3);

- Additionally, two significant gold discoveries with potential to move towards a NI 43-101 compliant mineral resource calculation by the end of 2023:

- The Lac Surprise (Falcon Gold Zone), located just 12 km southwest of the Philibert Project, which has defined 900m of strike length and 380m of vertical continuity with all 33 holes drilled thus far intersecting gold mineralization, and

- The Philibert Project itself, which is building on a total of 75,000 metres of drilling and is being rapidly advanced with 120 holes completed in the 2022 winter drilling program. To date, more than C$13 MM has been spent on the property;

- Largest property holdings and gold resources of any gold exploration company active in the Chapais-Chibougamau district;

- Strong pro forma balance sheet with approximately C$8 MM cash as of June 30, 2022;

- Improved trading liquidity with an enhanced capital markets profile better positioned to attract a broader base of institutional and retail investors; and

- Strong insider ownership with over 20% of the pro forma shares of the Company.

Thomas Morris, President, CEO and Director of Northern Superior, stated: "Northern Superior has always been a huge proponent of the potential of the Chapais-Chibougamau mining district. The recent geological success we, and others, have had in the camp has demonstrated that this camp has the potential of Tier-1 mining scale. By assuming a leading role in the consolidation of the camp via the recent acquisition of Genesis Metals and now the acquisition of Royal Fox, not only have we consolidated four of the most important properties in the camp under one company but have dramatically increased and accelerated the potential value creation by increasing the scale of the operation, providing geological and operational synergies.

We believe that the Philibert deposit has tremendous potential, and we see significant upside from it's upcoming mineral resource declaration scheduled to be released in 2023. Adding Philibert to our existing NI 43-101 compliant mineral resources at Croteau Est and Chevrier, along with the discovery at the Falcon Zone at Lac Surprise, groups together compelling gold resources all within a highly concentrated area.

I am proud of what we have been able to accomplish during my time at the helm of Northern Superior. This acquisition announced today will allow for my retirement and for the incoming executive team to work with the seasoned Board and technical advisory committee, which will put the Company in an even stronger position to continue to build on its robust success of the last several years. I look forward to continuing to support Victor, Simon, and the entire Board and team at Northern Superior."

Simon Marcotte, President, CEO and Director of Royal Fox, added: "Rarely are we presented with an opportunity to consolidate an emerging gold camp in such a favourable jurisdiction. The small radius within which the resources are being consolidated is expected to create synergies, which would improve the economic potential of the camp, and accelerate its development. I couldn't be more excited to see this opportunity taking hold and look forward to working with our new partners."

Background

Royal Fox Shareholders will be entitled to receive Northern Superior Shares in exchange for their Royal Fox Shares. Additional consideration will be in the form of the right, via the issuance of one CVR per Royal Fox Share, to a contingent payment in additional Northern Superior Shares tied to the declaration of an expected mineral resource estimate on the Philibert Project within 12 months from the closing of the Transaction (see further details below).

Exhibit 1: Chapais-Chibougamau Gold Camp

Source: Capital IQ and company materials | Note: Map is not to scale

Terms of the Transaction

Under the terms of the Definitive Agreement, each Royal Fox Shareholder will receive 0.12 (the "Exchange Ratio") of a Northern Superior Share for each Royal Fox Share held (the "Base Purchase Price"). The implied value of the Base Purchase Price was calculated on September 2, 2022, the last day of trading prior to announcement of the Transaction, as C$0.06 per Royal Fox Share or approximately C$17 million for all of the outstanding Royal Fox Shares. The Base Purchase Price represents a premium of approximately 33% over the closing price of the Royal Fox Shares on the TSX-V on September 2, 2022, and an approximate 24% premium over Royal Fox's volume weighted average share price ("VWAP") over the 20 trading days prior to the announcement of the Transaction.

In addition to the Base Purchase Price, Royal Fox Shareholders will receive contingent consideration in the form of one CVR for each Royal Fox Share that will provide for the potential payment of additional consideration upon the declaration of a maiden mineral resource estimate on the Philibert project of Royal Fox (the "Resource Calculation") within 12 months from the closing of the Transaction (the "Contingent Purchase Price").

If the Resource Calculation confirms a mineral resource estimate of 1.2 million ounces or more of gold in the inferred, measured or indicated categories (as such terms are defined in NI 43-101), each CVR will be exchanged for:

- 0.02 of a Northern Superior Share, if the Resource Calculation is greater than or equal to 1.2 million ounces of gold and less than 1.6 million ounces of gold;

- 0.04 of a Northern Superior Share, if the Resource Calculation is greater than or equal to 1.6 million ounces of gold and less than 2.0 million ounces of gold; or

- 0.06 of a Northern Superior Share, if the Resource Calculation is greater than or equal to 2.0 million ounces of gold.

The considerations above represent a value of C$0.01, C$0.02 and C$0.03 per share, respectively, as of September 2, 2022, the last day of trading prior to announcement of the Transaction.

The CVRs provide further upside for Royal Fox Shareholders, including both further consideration value as well as enhanced pro forma ownership in the combined company. After giving effect to the Contingent Purchase Price under the 2.0-million-ounce scenario, the total consideration represents an approximate 100% premium over the closing price of the Royal Fox Shares on the TSX-V on September 2, 2022, and an approximate 86% premium over Royal Fox's VWAP over the 20 trading days prior to the announcement of the Transaction.

Following the completion of the Transaction, taking into account only the Base Purchase Price, current Royal Fox Shareholders will hold approximately 31% of the pro forma company and Northern Superior shareholders will hold approximately 69% of the pro forma company (on a fully diluted in-the-money basis). Following the completion of the Transaction, taking into account both the Base Purchase Price and the Contingent Purchase Price, based on an implied 0.18 exchange ratio, current Royal Fox Shareholders would hold approximately 43% of the pro forma company and Northern Superior shareholders would hold approximately 57% of the pro forma company (on a fully diluted in-the-money basis).

As part of the Transaction, all outstanding options of Royal Fox will be exchanged for economically equivalent options to purchase Northern Superior Shares (subject to an adjustment based on the Exchange Ratio) and holders of Royal Fox warrants will be entitled, in accordance with the terms of such warrants, to receive Northern Superior Shares on the exercise of such warrants (subject to adjustment based on the Exchange Ratio). Warrant holders and option holders of Royal Fox will be required to exercise their warrants and options prior to the effective date of the Transaction in order to be eligible to receive the additional CVR consideration.

After the closing of the Transaction, a new board will be formed consisting of four members of the current Northern Superior Board and three directors from Royal Fox, namely Messrs. Frank Guillemette, Victor Cantore, who will be appointed Executive Chairman, and Simon Marcotte, who will be appointed President & CEO.

It is contemplated that the Ontario assets of Northern Superior, which include the TPK project in Northern Ontario, will be considered for a spin out and creation of a separate company following completion of the Transaction.

Benefits to Northern Superior Shareholders

- Increasing scale, exploration and development scenarios in the Chapais-Chibougamau camp by adding the Philibert Project, a major gold project with attractive growth potential strategically located within Northern Superior's assets, being only 12 km from the Falcon Gold Zone discovery at Lac Surprise, 18 km from Chevrier, and 56 km from Croteau Est;

- Further cements Northern Superior as the dominant player in the Chapais-Chibougamau camp with the largest land holdings, four key projects and material operational, economic and exploration based synergies;

- Synergies between Northern Superior's and Royal Fox's strong technical and management teams, both with significant experience in the Chapais-Chibougamau camp;

- Increased news flow based on multiple high-impact exploration assets; and

- Enlarged market capitalization increasing institutional relevance, trading liquidity, and capital market profile.

Benefits to Royal Fox Shareholders

- Significant potential premium of up to 100% provided by the CVRs tied to potential mineral resources on the Philibert project;

- Continued consolidation of a highly prospective gold belt and trend (Lac Surprise and the Philibert project, Croteau Est and Chevrier) with continued exposure to Royal Fox's portfolio of exploration projects;

- Asset diversification via exposure to Northern Superior's 640,000 ounce mineral resource estimate at Croteau Est, 912,000 ounce mineral resource estimate at Chevrier, and the discovery of the Falcon Gold Zone at Lac Surprise which currently has a strike of 900 metres and vertical continuity of 382 metres with all 33 holes thus far intersecting the Falcon Gold Zone, with all three of these projects having considerable growth potential;

- Increased velocity of news flow with exposure to multiple high-impact exploration assets (Philibert, Lac Surprise, Croteau Est and Chevrier);

- Ability to leverage respective technical skills to continue growing and de-risking the combined asset base;

- Improved ability to finance continued exploration and development of the combined portfolio;

- Leverage to Northern Superior's strong technical team;

- Enlarged market capitalization increasing institutional relevance, trading liquidity, and capital markets profile.

Additional Details on the Transaction

Completion of the Transaction will, among other things, require the approval of: (i) at least two-thirds (662/3%) of the votes cast by the Royal Fox Shareholders; (ii) at least two-thirds (662/3%) of the votes cast by the Royal Fox Shareholders and the Royal Fox option holders voting as a single class; and (iii) a simple majority of the votes cast by Royal Fox Shareholders, excluding for this purpose the votes of "related parties" and "interested parties" and other votes required to be excluded under Multilateral Instrument 61‐101 - Protection of Minority Security Holders in Special Transactions, with all votes to occur at a special meeting of Royal Fox securityholders to be scheduled to take place in early November 2022 (the "Royal Fox Meeting"). No shareholder vote is required by Northern Superior shareholders.

The Definitive Agreement includes mutual covenants typical for transactions of this nature, including non-solicitation covenants. The Definitive Agreement provides for a C$775,000 termination fee payable by Royal Fox in certain circumstances.

The Transaction is expected to close in November 2022, subject to the satisfaction (or waiver) of a number of conditions precedent, including, but not limited to receipt of all regulatory approvals, including the approval of the Ontario Superior Court of Justice and the acceptance of the TSX-V.

The Transaction has the full endorsement of the respective boards of Royal Fox and Northern Superior. The board of directors of Royal Fox (the "Royal Fox Board") has formed a special committee (the "Special Committee") to oversee the process and has evaluated the Transaction in the context of that process. The Special Committee, following a review of the terms and conditions of the Definitive Agreement and consideration of a number of factors, unanimously recommended that the Royal Fox Board approve the Transaction. After receiving the recommendation of the Special Committee and advice from its advisors, including a fairness opinion from Stifel GMP, the Royal Fox Board has unanimously determined that the Transaction is in the best interests of all Royal Fox's stakeholders and will recommend that Royal Fox Shareholders vote in favour of the Transaction.

Directors and officers of Royal Fox holding an aggregate number of Royal Fox Shares which represent approximately 32.5% of the currently outstanding Royal Fox Shares have entered into customary support agreements with Northern Superior to vote their shares in favour of the Transaction.

Full details of the Transaction will be included in the management information circular of Royal Fox describing the matters to be considered at the Royal Fox Meeting, which is expected to be mailed to the Royal Fox Shareholders in early October 2022. Copies of the management information circular and the Definitive Agreement will be made available on SEDAR (www.sedar.com) under the profile of Royal Fox.

Related Party Transaction

Messrs. Michael Gentile and David Medilek, both directors of Northern Superior, own securities of Royal Fox and, as a result, the Transaction is a "related party transaction" under Multilateral Instrument 61-101 - Protection of Minority Securityholders in Special Transactions ("MI 61-101"). The board of directors of Northern Superior determined that the Transaction is exempt from the formal valuation and minority shareholder approval requirements under MI 61-101 in reliance on the exemptions set forth in sections 5.5(a) and 5.7(1)(a) of MI 61-101 and, in connection therewith, have determined that neither the fair market value of the Northern Superior Shares nor the consideration to be received, insofar as it involves interested parties, exceeds 25% of Northern Superior's market capitalization. Closing of the Transaction remains subject to TSX-V acceptance.

Advisors

Cormark Securities Inc. is acting as a financial advisor to Northern Superior and Cassels Brock & Blackwell LLP is acting as legal counsel to Northern Superior in connection with the Transaction. Stifel GMP has provided a fairness opinion to the Royal Fox Board in connection with the Transaction and Fasken Martineau DuMoulin LLP is acting as legal counsel to Royal Fox.

Victor Cantore

Mr. Cantore is a seasoned capital markets professional specializing in the resource sector. He has more than 30 years of advisory and leadership experience having begun his career in 1992 as an investment advisor and then moving into management roles with both public and private companies. One of his most recent successes is being at the helm of Amex Exploration Inc. (TSX-V: AMEX) (OTCQX: AMXEF) which has evolved from only a few million dollars of market capitalization when he took the leadership role, to a peak of $400 million and more recently at $200 million market capitalization. During his career, he has organized and structured numerous equity and debt financings, mergers and acquisitions, joint venture partnerships and strategic alliances. Mr. Cantore serves on the boards of various private and public companies.

Simon Marcotte

Simon Marcotte is a Chartered Financial Analyst with 25 years of experience focused on commodities, including more than 12 years in executive positions for junior mining companies.

Mr. Marcotte is the founder, President & CEO of Royal Fox and a director of Freeman Gold Corp. (TSX-V: FMAN) (OTCQX: FMANF), a company he co-founded, which is advancing the Lemhi gold project in Idaho, United States.

In 2018, Mr. Marcotte was instrumental in the launch of Arena Minerals Inc. (TSX-V: AN) (OTCQX: AMRZF) in the lithium brine industry in Argentina, and the subsequent strategic investments by both Ganfeng Lithium (HKG: 1772) and Lithium Americas Corp. (NYSE: LAC) (TSX: LAC).

In 2012, Mr. Marcotte co-founded Mason Graphite Inc. (TSX-V: LLG) (OTXCQ: MGPHF) and held the position of Vice-President Corporate Development until February 2018. Under his leadership, the company was awarded: the TSXV's recognition as "Top 10 Performing Stock" in 2013, the "Best 50 OTCQX" in both 2016 and 2017. At the end of 2017, Mason Graphite reached a peak market capitalization of $365 million, with approximately 35 institutional shareholders. In 2022, in line with shareholders wishes, Mr. Marcotte negotiated, executed, and implemented an Option and Joint Venture Agreement between Mason Graphite Inc. and Nouveau Monde Graphite Inc. (TSX-V: NOU) (NYSE: NMG) setting the stage for the emergence of a leading graphite industry in the province of Québec.

In 2010, Mr. Marcotte joined Verena Minerals Corp., which was then renamed Belo Sun Mining Corp. (TSX: BSX) (OTCQX: BSXGF), as Vice-President Corporate Development, working alongside the president and chief executive officer until 2014 on all decision-making processes and helped develop and implement the company's turnaround strategy and assisted in more than $100 million in funding.

Mr. Marcotte has also been involved with several other mining companies, either as an officer or as a director, including being the Founder, President & CEO of Black Swan Graphene Inc. (TSX-V: SWAN), a graphene manufacturing company created based on the graphene technology developed by Thomas Swan & Co. Ltd., a mid-tier chemical company based in Northern England and founded in 1926.

Prior to his corporate involvement, Mr. Marcotte was working in senior positions in capital markets with CIBC World Markets, from 1998 to 2006, and with Sprott Securities Inc. and Cormark Securities Inc., from 2006 to 2010, where he was also a member of the board of directors.

Qualified Persons

Rodney Barber, Vice President of Exploration for Northern Superior (BSc., P.Geo.) is the Qualified Person for the TPK property. Michel Leblanc (BSc., PGeo) and Sarah Dean (BSc., P.Geo.) are the Qualified Persons for the Croteau Est and Lac Surprise properties. All three individuals are Qualified Persons within the meaning of NI 43-101 and have reviewed and approved the technical information disclosed in this news release. The Qualified Person within the meaning of NI 43-101 who has reviewed and approved the information disclosed in this news release relating to Royal Fox is Mrs. Adree DeLazzer, P.Geo., Vice-President of Exploration for Royal Fox and a Qualified Person under NI 43-101.

References

#1: (Nelligan) Reference for IAMGOLD/Vanstar's Nelligan 3.2MM Inferred Gold Resource: "Carrier, Alain (M.Sc., P.Geo); Nadeau-Benoit, Vincent (P.Geo); Fauvre, Stéphane (PhD., P.Geo). October 22, 2019. NI 43-101 Technical Report and Initial Resource Estimate for the Nelligan Project, Québec, Canada."

#2: (Croteau Est) Reference for Northern Superior's 640,000-ounce Inferred Gold Resource: "Drabble, Mark (B. App. Sci. (Geology), MAIG, MAusIMM); Glacken, Ian (BSc Hons (Geology), FAusIMM (CP), MIMMM, CEng; Kahan, Cervoj (B. App. Sci., MAIG, MAusIMM); Morgan, Rebecca (BSc Hons (Geology), GDip (Mining), MAIG, MAusIMM). October 12, 2015. Technical Report on the Croteau Est Gold Project, Québec September 2015, Mineral Resource Estimate."

#3: (Chevrier) Reference for Genesis Metals Corp. (Northern Superior) Mineral Resources Estimation: "Lomas, Susan (P.Geo); Lavoie, Jonathan (Eng., M.Sc.); Liboiron, André (Géo). March 10, 2022.NI 43-101 Technical Report Mineral Resource Estimation for the Chevrier Main Deposit, Chevrier Project, Chibougamau, Québec, Canada."

About Royal Fox Gold Inc.

Royal Fox Gold Inc. is a mineral exploration company focused on the development of the Philibert Project near Chibougamau, Québec. The Philibert Project comprises 110 mineral titles having a total approximate area of 5,393 hectares of highly prospective ground, 9km from IAMGOLD's Nelligan Gold project which was awarded the "Discovery of the Year" by the Quebec Mineral Exploration Association (AEMQ) in 2019.

To date, more than C$13M (historical value) have been spent on the Philibert Project, with more than 75,000 metres of drilling completed. Royal Fox is focused on de-risking the asset and releasing a maiden NI 43-101 mineral resource estimate which will incorporate results from both brownfield and greenfield exploration, combined with extensive historical data. The Philibert Project is owned by SOQUEM. Royal Fox is currently undergoing an ownership option process, details of which can be found in the corporate presentation available on Royal Fox's website. More details are available in the corporate presentation of Royal Fox at: www.royalfoxgold.com.

About Northern Superior Resources Inc.

Northern Superior is a gold exploration company focused on the Chapais-Chibougamau Camp in Quebec. The Company has consolidated the largest land package in the region, with total land holdings currently exceeding 56,000 hectares. The three main properties include, Lac Surprise, Chevrier and Croteau Est. Chevrier hosts an inferred mineral resource of 652,000 ounces Au and an indicated mineral resource of 260,000 ounces Au, Croteau Est hosts an inferred mineral resource of 640,000 ounces Au, and Lac Surprise hosts the Falcon Zone Discovery, the western strike extension of IAMGOLD/Vanstar's Nelligan Deposit (3.2 million ounces at 1.02 g/t gold1). Northern Superior also owns significant exploration assets in Northern Ontario highlighted by the district scale TPK property. See Northern Superior Corporate Presentation, www.nsuperior.com

Northern Superior is a reporting issuer in British Columbia, Alberta, Ontario and Québec, and trades on the TSX-V under the symbol "SUP", and the OTCQB Venture Market under the symbol "NSUPF".

None of the securities to be issued pursuant to the Definitive Agreement have been or will be registered under the United State Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and any securities issued in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Neither the TSX-V nor its regulation services provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

For further information, please contact:

Thomas F. Morris PhD., P.Geo.,FGAC, ICD.D

President &CEO, Northern Superior Resources Inc.

Tel: (705) 525 ‐0992

Fax:(705) 525 ‐7701

Email: [email protected]

www.nsuperior.com

Simon Marcotte, CFA

President & CEO, Royal Fox Gold Inc.

Tel: (647) 801-7273

Email: [email protected]

www.royalfoxgold.com

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release constitute forward-looking information under applicable Canadian, United States and other applicable securities laws, rules and regulations, including, without limitation, statements with respect to the completion of the Transaction, the conditions to the completion of the Transaction that must be fulfilled and the anticipated benefits and advantages of the Transaction, including the Transaction positioning Northern Superior as a leading company in the Chapais-Chibougamau district with the largest land holdings in the district and creating significant synergies and scale in the Chapais-Chibougamau Camp, and the declaration of an expected mineral resource estimate on the Philibert Project within 12 months from the closing of the Transaction. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on Northern Superior and Royal Fox's (collectively, the "Companies") current beliefs or assumptions as to the outcome and timing of such future events. There can be no assurance that such statements will prove to be accurate, as the Company's actual results and future events could differ materially from those anticipated in these forward-looking statements. Factors that could cause actual results and future events to differ materially from those anticipated in these forward-looking statements include the risks, uncertainties and other factors and assumptions made with regard to the Companies' ability to complete the proposed Transaction; the Companies' ability to secure the necessary shareholder, securityholder, legal and regulatory approvals required to complete the Transaction; the estimated costs associated with the advancement of the Companies combined projects; and the Companies' ability to achieve the synergies expected as a result of the Transaction. Important factors that could cause actual results to differ materially from the Companies' expectations include risks associated with the business of Northern Superior and Royal Fox; risks related to the satisfaction or waiver of certain conditions to the closing of the Transaction; non-completion of the Transaction; risks related to exploration and potential development of the combined projects; business and economic conditions in the mining industry generally; the impact of COVID-19 on the Companies' business; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and indigenous groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and additional risks identified in Northern Superior and Royal Fox's filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to Northern Superior and Royal Fox. The forward-looking information contained in this news release is made as of the date hereof and Northern Superior and Royal Fox undertake no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

SOURCE: Northern Superior Resources Inc.