- Assays from first drill three diamond drill holes at Pepas prospect, in the north of the Anzá Project - PEP001, PEP002 and PEP003

- Assay results from PEP001 have returned a substantial, high-grade gold intersection of 150.90m @ 3.00g/t Au (from surface).

- Additional holes are currently underway across Pepas and Pupino prospects.

- The Company's JV partner, Minera Monte Águila has informed the Company that it has met its expenditure commitment of US$4million for the current JV year.

LONDON, UK / ACCESSWIRE / September 6, 2022 / Orosur Mining Inc. ("Orosur" or the "Company") (TSXV:OMI)(AIM:OMI), is pleased to announce an update on the progress of exploration activities at the Company's flagship Anzá Project ("Project") in Colombia.

The Project is the subject of an Exploration Agreement with Venture Option ("Exploration Agreement") with Colombian company Minera Monte Águila ("MMA"). MMA is itself a 50/50 JV between Newmont Corporation ("Newmont") (NYSE:NEM, TSX:NEM) and Agnico Eagle Mines Limited ("Agnico") (TSX:AEM), and is the Colombian vehicle by which these two companies jointly exercise their rights and obligations with respect to the Exploration Agreement over the Project.

MMA is the operator of the Project after exercising its right to assume operational control in the second half of 2021.

Assay Results

Assay results for the first three diamond drill holes (PEP001, 002, 003) at the new Pepas prospect have been received. The Pepas prospect is the most northern prospect of the Project, approximately 12 kilometres north northeast of the central APTA prospect, where most drilling has been historically focussed to date.

Key intersections are noted below.

| Hole Number | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Zn (%) |

| PEP001 | 0.00 | 150.90 | 150.90 | 3.00 | 3.16 | 0.15 |

including | 34.45 | 136.85 | 102.40 | 3.73 | 2.27 | 0.15 |

| PEP002 | 0.00 | 37.25 | 37.25 | 0.54 | 0.55 | 0.06 |

| PEP003 | 23.40 | 55.95 | 32.55 | 0.61 | 1.2 | 0.01 |

| PEP003 | 82.85 | 89.40 | 6.55 | 0.65 | 3.92 | 0.01 |

| PEP003 | 91.80 | 96.00 | 4.20 | 1.30 | 1.23 | - |

| PEP003 | 120.50 | 123.40 | 2.90 | 0.89 | 4.66 | 0.08 |

| PEP003 | 252.05 | 261.25 | 9.20 | 0.74 | 0.64 | 0.05 |

Table 1. Drill Intercepts.

Geology and Drilling

Drilling activities commenced at Pepas in April 2022, and at the nearby Pupino prospect soon afterward. Three diamond drill rigs are currently operating at Pepas with one at Pupino.

Nine holes have been completed, attempted or are underway at Pepas, across approximately 1 kilometre of strike of the main structural corridor defined by the Aragon and Tonusco faults, targeting a range of lithologies and geological features. However, three of these holes encountered difficult drilling conditions from broken ground related to major structures and were terminated at shallow depths. These holes are being, or will be redrilled, although with some modifications to orientation on the basis of recent results.

One hole has been completed at Pupino, with a second underway.

Drilling assay results have been delayed due to difficult ground conditions and the need to undertake re-assay of numerous samples to resolve overlimit issues and meet QAQC requirements.

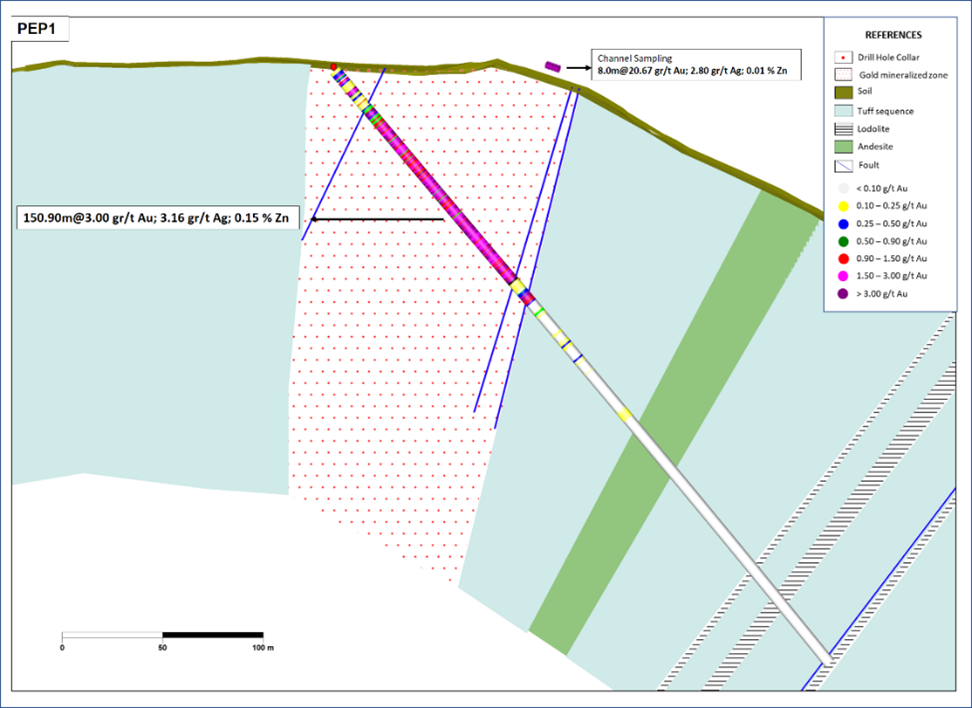

The first hole at Pepas, PEP001, was drilled to a depth of 384m to test highly anomalous rock chip samples that had been identified from previous mapping programs, and publicly announced on March 8th, 2022. The hole intersected a quartz vein stockwork and breccia zone from surface, demonstrating pervasive stockwork veining related to extensive gold mineralisation. The hole was drilled oblique to the zone of vein-development, and with only one hole, the geometry and dimensions of the zone have yet to be fully resolved. However, surface exposures of vein development suggest an east-west strike, with a moderate to steep southerly dip.

Figure 1. Drill section, PEP001

Hole PEP002 was drilled from the same pad as PEP001, but in a westerly direction to better understand the geometry of mineralisation and the controlling structures. This hole intersected only a short interval of the breccia zone, before entering the local host rocks and then being terminated at 74m due to difficult drilling conditions.

Hole PEP003 was collared some 150m northwest of PEP001 and drilled to a depth of 311m in different lithologies, to test the presumed northeast extension of the primary structures identified in PEP001. Some mineralised structures were intersected; however, it is likely that the primary structures trend more northwest and this will be assessed with later holes.

Other early holes at Pepas were drilled some considerable distance from PEP001, to test a wide variety of other geochemical and geophysical anomalies or more conceptual targets. This was an intentional strategy to assess a number of targets in the first drilling pass, and then prioritise future drilling to the most attractive targets once results are received and assessed.

Current drilling is now being focussed on the mineralisation intersected in PEP001, however some modifications were required to drill pad locations to provide better drilling angles.

Joint Venture

MMA has informed the Company that it has exceeded its spending obligation of US$4 million for the year ending Sept 6th, 2022, as per the Exploration Agreement, and as such has completed its Minimum Phase 1 Earn-In Work Requirement.

MMA is thus now entitled to exercise its Phase 1 Earn-In Right by formally providing the Company with a Phase 1 Earn-In Notice.

Upon receipt of the Phase 1 Earn-In Notice, the Company and MMA will begin the process of forming a new mining venture (the "Mining Company") that will hold title to the Project's concessions and applications. Once formed, the Company will have a 49% ownership interest in the Mining Company and MMA the remaining 51%, with MMA being the manager.

MMA may elect to enter into Phase 2 of the Exploration Agreement, which would require MMA to invest US$20m in qualifying exploration expenditure in the Project over a maximum of four years. If completed, such expenditure would see MMA earning an additional 14% equity in the Mining Company for a total of 65%. Orosur would accordingly dilute to 35%. Electing to enter Phase 2 would also trigger a payment of US$2m to the Company.

Finalisation of the Mining Company and of its constituent documents - as per key terms provided in the Exploration Agreement - may take several months; however, during this period, exploration work on the Project may continue uninterrupted at the Company's discretion.

Orosur CEO Brad George commented:

"Results from PEP001 largely speak for themselves. To return such a result for the first hole in the first drill campaign in an untouched area is a spectacular demonstration of the potential of the Anzá Project. With Covid restrictions largely lifted, the increased pace of exploration bodes well for an exciting future ahead."

For further information, visit www.orosur.ca , follow on twitter @orosurm or contact:

Orosur Mining Inc.

Louis Castro, Chairman,

Brad George, CEO

[email protected]

Tel: +1 (778) 373-0100

SP Angel Corporate Finance LLP - Nomad & Joint Broker

Jeff Keating / Caroline Rowe

Tel: +44 (0) 20 3 470 0470

Turner Pope Investments (TPI) Ltd - Joint Broker

Andy Thacker/James Pope

Tel: +44 (0)20 3657 0050

Flagstaff Communications and Investor Communications

Tim Thompson

Mark Edwards

Fergus Mellon

[email protected]

Tel: +44 (0)207 129 1474

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has been incorporated into UK law by the European Union (Withdrawal) Act 2018. Upon the publication of this announcement via Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain.

Drill Hole Details - 2020/2022 Programme*

Hole ID | Easting (m) | Northing (m) | Elevation asl (m) | Dip (°) | Azimuth (°) |

MAP-072 | 400088 | 694745 | 1075 | -55 | 293 |

MAP-073 | 400018 | 694503 | 1097 | -58 | 295 |

MAP-074 | 399981 | 694684 | 1110 | -58 | 295 |

MAP-075 | 400168 | 694723 | 1024 | -55 | 295 |

MAP-076 | 400019 | 694527 | 1107 | -50 | 295 |

MAP-077 | 400168 | 694723 | 1024 | -69 | 295 |

MAP-078 | 399917 | 694719 | 1112 | -50 | 295 |

MAP-079 | 399995 | 693976 | 960 | -55 | 295 |

MAP-080 | 400231 | 694580 | 966 | -55 | 295 |

MAP-081 | 400045 | 693950 | 920 | -55 | 295 |

MAP-082 | 400176 | 694797 | 1020 | -50 | 296 |

MAP-083 | 400176 | 694797 | 1020 | -60 | 310 |

MAP-084 | 400045 | 693950 | 920 | -57 | 321 |

MAP-085 | 400167 | 694552 | 1000 | -46 | 247 |

MAP-086 | 400067 | 694360 | 1068 | -54 | 295 |

MAP-087 | 400027 | 694168 | 988 | -54 | 290 |

MAP-088 | 400168 | 694723 | 1024 | -55 | 341 |

MAP-089 | 400067 | 694360 | 1068 | -59 | 317 |

MAP-090 | 400041 | 694630 | 1059 | -56 | 296 |

MAP-091 | 400060 | 694715 | 1089 | -50 | 295 |

MAP-092 | 399420 | 695235 | 1162 | -50 | 138 |

MAP-093 | 400055 | 694203 | 1006 | -59 | 290 |

MAP-094 | 399954 | 694347 | 1031 | -64 | 303 |

MAP-095 | 399722 | 695252 | 1113 | -50 | 135 |

MAP-096 | 399759 | 694632 | 1082 | -57 | 127 |

MAP-097 | 400054 | 694472 | 1087 | -71 | 311 |

MAP-098 | 399794 | 694730 | 1149 | -65 | 130 |

MAP-099 | 399098 | 695129 | 1157 | -50 | 250 |

MAP-100 | 400096 | 694431 | 1051 | -59 | 283 |

MAP-101 | 400286 | 694890 | 967 | -50 | 331 |

MAP-102 | 400095 | 694426 | 990 | -61.5 | 303.5 |

MAP-103 | 399793 | 694730 | 1162 | -65.5 | 123.3 |

MAP-104 | 399982 | 694294 | 1015 | -60 | 297 |

MAP-105 | 399793 | 694730 | 1162 | -63.8 | 113.3 |

PEP-001 | 403384 | 705000 | 1001 | -50 | 150 |

PEP-002 | 403384 | 705000 | 1001 | -60 | 290 |

PEP-003 | 403240 | 705142 | 1001 | -49.60 | 95.2 |

* Coordinates WGS84, UTM Zone 18

About Orosur Mining Inc.

Orosur Mining Inc. (TSX:OMI)(AIM:OMI) is a minerals explorer and developer focused on identifying and advancing projects in South America. The Company operates in Colombia, Argentina and Brazil.

About the Anzá Project

Anzá is a gold exploration project, comprising three exploration licences, four exploration licence applications, and several small exploitation permits, totalling 207.5km2 in the prolific Mid-Cauca belt of Colombia.

The Anzá Project is currently wholly owned by Orosur via its subsidiary, Minera Anzá S.A.

The project is located 50km west of Medellin and is easily accessible by all-weather roads and boasts excellent infrastructure including water, power, communications and large exploration camp.

The Anzá Project is subject to an Exploration Agreement with Venture Option dated September 7th, 2018, as announced on September 10th, 2018, between Orosur's 100% subsidiary Minera Anzá S.A ("Minera Anzá") and Minera Monte Águila SAS ("Monte Águila"), a 50/50 joint venture between Newmont Corporation ("Newmont") (NYSE:NEM, TSX:NGT), and Agnico Eagle Mines Limited ("Agnico") (NYSE:AEM, TSX:AEM).

Qualified Persons Statement

The information in this news release was compiled, reviewed and verified by Mr. Brad George, BSc Hons (Geology and Geophysics), MBA, Member of the Australian Institute of Geoscientists (MAIG), CEO of Orosur Mining Inc. and a qualified person as defined by National Instrument 43-101.

Orosur Mining staff follow standard operating and quality assurance procedures to ensure that sampling techniques and sample results meet international reporting standards.

Drill core is split in half over widths that vary between 0.3m and 2m, depending upon the geological domain. One half is kept on site in the Minera Anzá core storage facility, with the other sent for assay.

Industry standard QAQC protocols are put in place with approximately 20% of total submitted samples being blanks, repeats or Certified Reference Materials (CRMs).

Samples are sent to the Medellin preparation facility of ALS Colombia Ltd, and then to the ISO 9001 certified ALS Chemex laboratory in Lima, Peru.

30-gram nominal weight samples are then subject to fire assay and AAS analysis for gold with gravimetric re-finish for overlimit assays of >10g/t. ICP-MS Ultra-Trace level multi-element four-acid digest analyses is also undertaken for such elements as silver, copper, lead and zinc, etc.

Gold intersections are reported using a lower cut-off of 0.3g/t Au over 3m.

Forward Looking Statements

All statements, other than statements of historical fact, contained in this news release constitute "forward looking statements" within the meaning of applicable securities laws, including but not limited to the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995 and are based on expectations estimates and projections as of the date of this news release.

Forward-looking statements include, without limitation, the exploration plans in Colombia and the funding from Monte Águila of those plans, Monte Águila´s decision to continue with the Exploration Agreeement, the formation of a new mining company or mining venture to hold the project, the ability for Loryser to implement the Creditor´s Agreement successfully in Uruguay and other events or conditions that may occur in the future. The Company's continuance as a going concern is dependent upon its ability to obtain adequate financing, to reach profitable levels of operations and to reach a satisfactory implementation of the Creditor´s Agreement in Uruguay. These material uncertainties may cast significant doubt upon the Company's ability to realize its assets and discharge its liabilities in the normal course of business and accordingly the appropriateness of the use of accounting principles applicable to a going concern. There can be no assurance that such statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such forward-looking statements. Such statements are subject to significant risks and uncertainties including, but not limited, those as described in Section "Risks Factors" of the MDA and the Annual Information Form. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events and such forward-looking statements, except to the extent required by applicable law.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Orosur Mining Inc.