VANCOUVER, BC / ACCESSWIRE / October 20, 2022 / Mawson Gold Limited ("Mawson" or the "Company") (TSX:MAW)(Frankfurt:MXR)(OTC PINK:MWSNF) is pleased to announce the results of the maiden preliminary economic assessment ("PEA") on its 100% owned Rajapalot gold-cobalt project ("Rajapalot", or the "Project") in northern Finland.The PEA considers a target 1.2 million tonnes per annum underground mining operation over a period of 9 years with an on-site processing facility to produce gold doré and cobalt concentrate. (Unless otherwise stated, all currency references are in US dollars)

Highlights:

- Robust economics underscores significant value of current resource base

- $211 M post-tax NPV5 (real) using $1,700/oz gold ("Au") and $60,000/t cobalt ("Co")

- AISC1 $824/oz Au life of mine ("LoM")

- >92 koz gold equivalent "AuEq2" steady state average production rate. 9 year LoM producing ~700 koz Au and ~2800 t Co

- A significant European mine

- If in production today, Rajapalot could be the EU's third largest cobalt mine and sixth largest gold mine

- Ethical metals sourcing with majority local support and 100% renewable power

- 27% post tax IRR, $191 M initial capex

- Strong cashflows, with $338 M free cash flow in years 1 to 5, and $101 M in LoM cobalt by-product revenues

- 100% owned low-cost project in Tier 1 location

- Underground only operation, utilising predominately long hole open stoping

- 95% Au recovery with conventional gravity-CIL

- Low infrastructure needs

- PEA underpins project to leverage substantial resource growth potential

- Rajapalot deposits are all open at depth, highlighted by the deepest intersection in Palokas of 30.8 m @ 5.1 g/t AuEq from 553 m (announced August 3, 2021).

- 18,000 ha land package with undrilled targets between the project area and other significant gold occurrences such as the Rompas discovery (highlight 6 m @ 617 g/t Au, announced May 31, 2012) 8 km west of Rajapalot.

- AISC is a non-IFRS metric. For definition see Technical Background section below.

- AuEq production figures calculated using metal prices $1,700/oz Au and $60,000/t Co. AuEq = Au oz + (Co t x 35.3).

Mr. Fairhall, CEO of Mawson Gold, comments

"This is the first project wide techno-economic assessment that underpins the significant value of Rajapalot - to Mawson, and to Europe. These incredibly robust results demonstrate a clear case for a mine at Rajapalot and bring out its quality fundamentals: a deposit with high mining and metallurgical efficiency which results in over 80% of every ounce found converted into doré, at an extremely attractive AISC of $824/oz Au. The production of ethical cobalt to EU environmental standards, critical for global and European energy transition, strengthens the strategic attractiveness of the project.

Finland is not only one of the world's lowest risk jurisdictions - it is also a great place to build and operate a mine, with an established mining industry, competitive labour and energy cost base, fantastic infrastructure and low taxes - all permanent features benefiting this starter case, and beyond, as more ounces are discovered on the property".

Want to learn more?

Across 3 videos now on the Mawson website, CEO Ivan Fairhall provides an overview of the PEA, and discussion on both the economics of the project, and also the physical aspects of the project.

The PEA for Rajapalot was prepared by independent consulting firm SRK Consulting (Finland) Oy ("SRK") with contributions from several Qualified Persons with specific subject matter expertise including local consultancy Sweco Oy for process plant and infrastructure design and cost estimating, AFRY for mineral resource estimation, Paterson & Cooke Nordic AB for backfill, and Vahanen Environment for environmental and social assessment.

The Mineral Resource estimate included in the PEA is reported according to the clarification criteria set out in the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Reserves ("CIM Definition Standards"). These standards are internationally recognized and allow the reader to compare the Mineral Resource with that reported for similar projects.

The results of the PEA will be set forth in an independent technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") which will be filed on SEDAR under the Company's profile within 45 days of the date of this news release.

Readers are cautioned that the PEA is preliminary in nature and is intended to provide an initial assessment of the project's economic potential and development options. The PEA mine schedule and economic assessment includes numerous assumptions and is based on inferred mineral resources. Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the inferred mineral resources to be considered in future advanced studies.

PEA Summary

Table 1: PEA operating and financial metrics

| Production Input | Life of Mine | Financial Metric | Life of Mine | ||||

| Mill Feed (underground) | Mt ROM | 10.1 | Au Price | $/oz | 1,700 | ||

| Annual Throughput | Mt/a | 1.2 | Co Price | $/t | 60,000 | ||

| Life of Mine | years | 9 | EUR:USD | - | 1.1 | ||

| Gold Head Grade | g/t Au | 2.26 | Discount rate | % | 5% | ||

| Gold Content | koz | 736 | Corp tax rate | % | 20% | ||

| Feed to Co Processing1 | Mt | 6.1 | Depreciation rate | % | 25% | ||

| Cobalt Head Grade | ppm | 529 | |||||

| Sulphur Head Grade | % | 2.07% | Capex (initial / sustaining) | $M | 191 / 100 | ||

| Cobalt Content | t Co | 3,203 | Opex | $M | 566 | ||

| Gold Recovery | % | 95% | Revenue | $M | 1,286 | ||

| Cobalt Recovery | % | 88% | Gold | $M | 1,185 | ||

| Sulphur Recovery | % | 88% | Cobalt | $M | 101 | ||

| Ave EBITDA (years 2-8) | $M | 84 | |||||

| Production Output | Y 2-8 | LoM | After tax FCF (years 1-5) | $M | 338 | ||

| Gold Production | koz Au | 82 | 699 | ||||

| Cobalt Production | kt Co | 306 | 2,806 | Pre-tax NPV5 | $M | 271 | |

| AuEq Production | koz AuEq | 92 | 798 | Pre-tax IRR | % | 30% | |

| Cobalt Concentrate | kt (dry) | 34 | 314 | ||||

| Cobalt Con grade | % Co | 0.89% | Post-tax NPV | $M | 211 | ||

| Post-tax IRR | % | 27% | |||||

| C1 | $/oz Au | 670 | Post-tax payback | years | 2.9 | ||

| AISC | $/oz Au | 824 | |||||

| 1. Proportion of mined material assessed as producing favourable economic outcome when campaign processed through flotation | |||||||

Au Price | Post-tax NPV ($M) | Post-tax IRR | Y1-5 FCF ($M) | ||||

base case | capex -10% | capex +10% | opex -10% | opex +10% | |||

$1,400 | 89 | 112 | 66 | 106 | 72 | 15% | 234 |

$1,550 | 150 | 173 | 128 | 167 | 133 | 21% | 286 |

$1,700 | 211 | 234 | 189 | 228 | 195 | 27% | 338 |

$1,850 | 272 | 295 | 250 | 289 | 255 | 32% | 390 |

$2,000 | 333 | 356 | 310 | 350 | 316 | 37% | 442 |

Figure 1: Rajapalot free cash flow (post-tax)

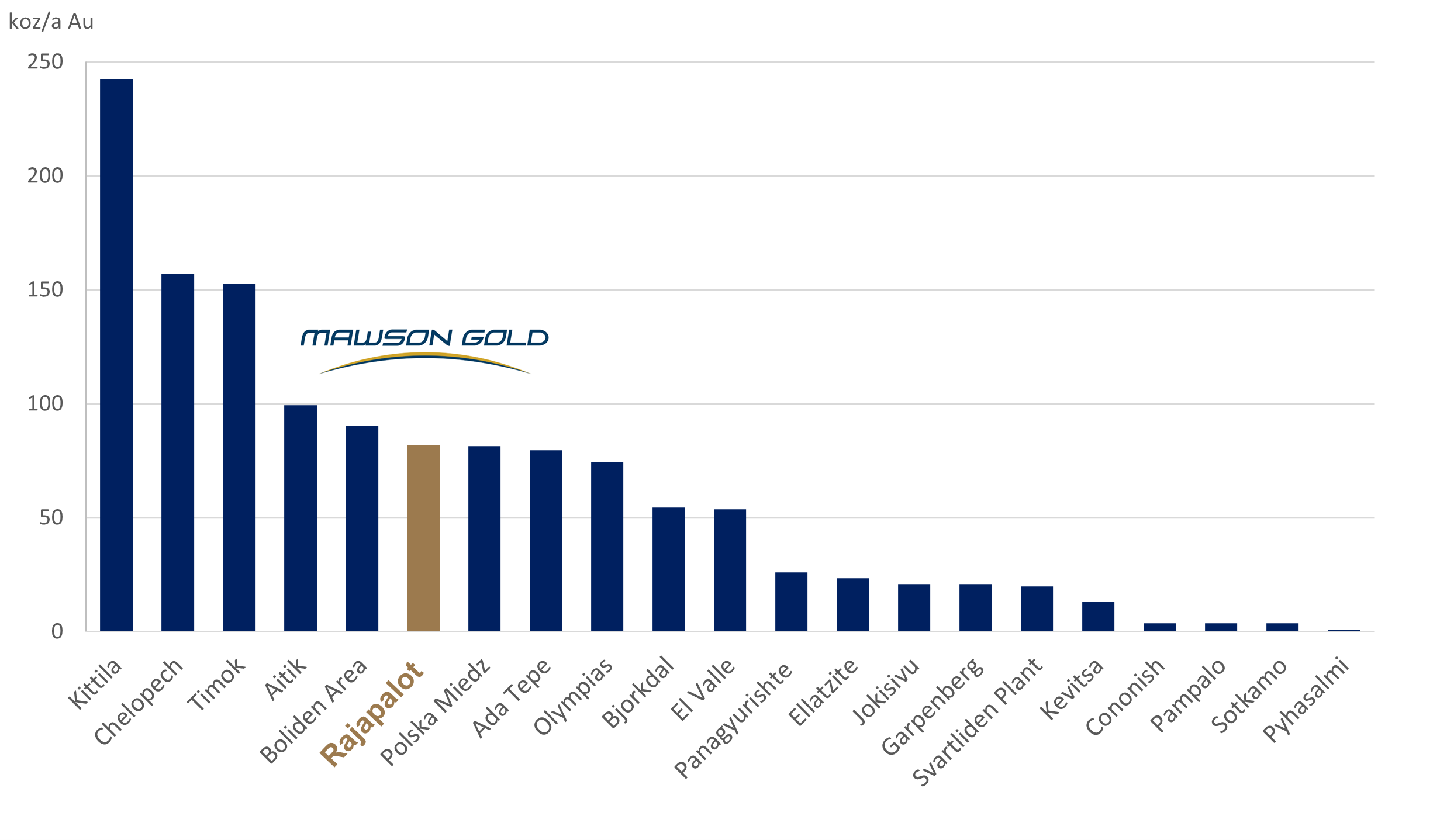

Figure 2: Rajapalot PEA annual gold production benchmarked to 2021 EU gold producers

Mining

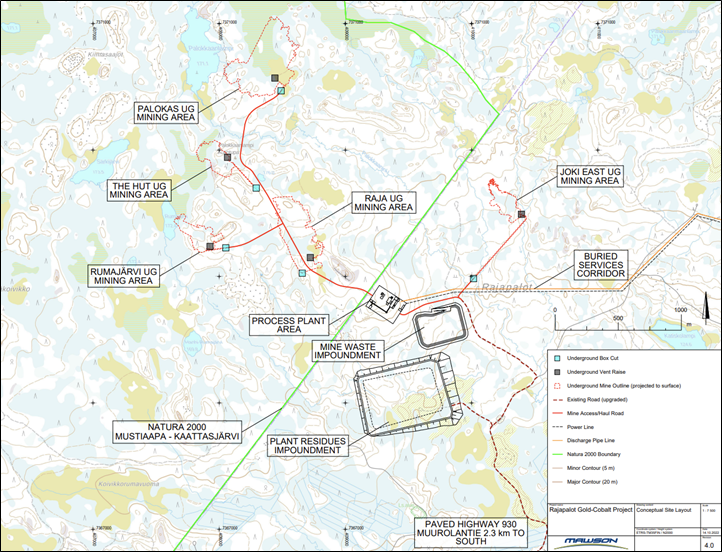

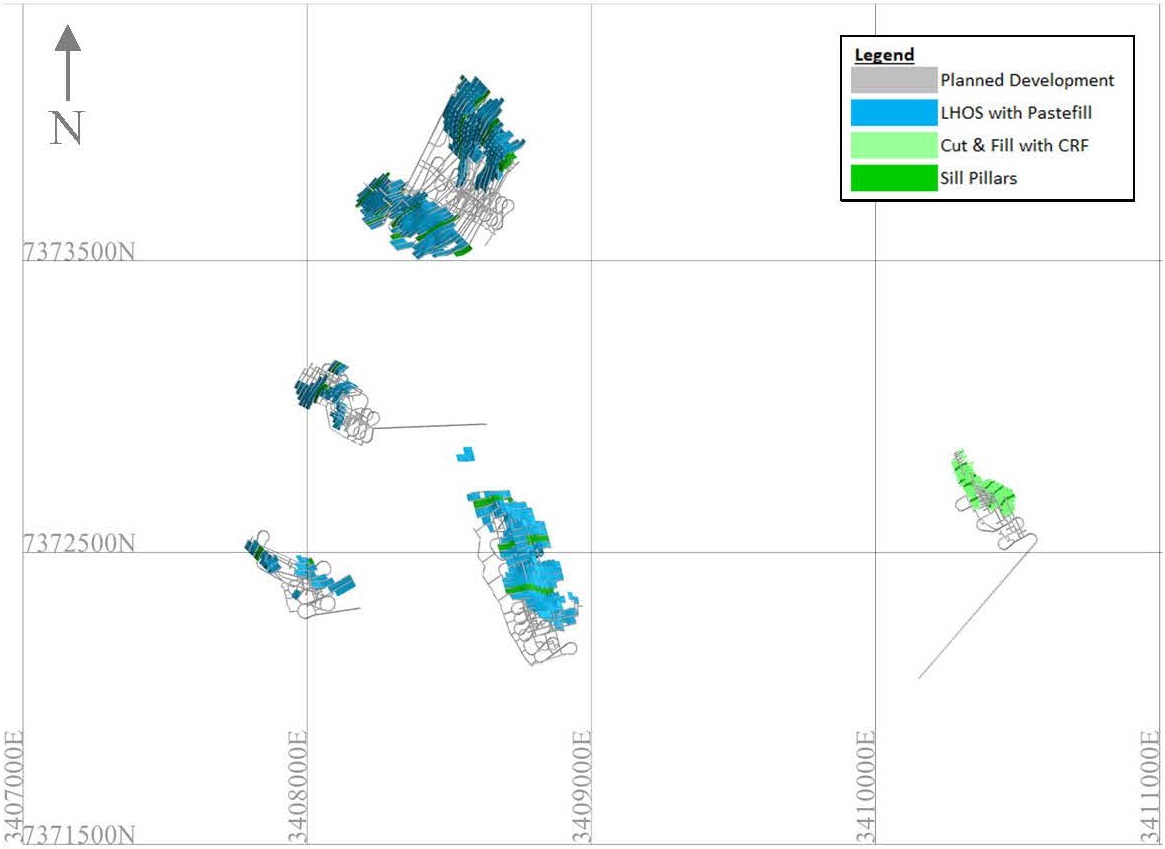

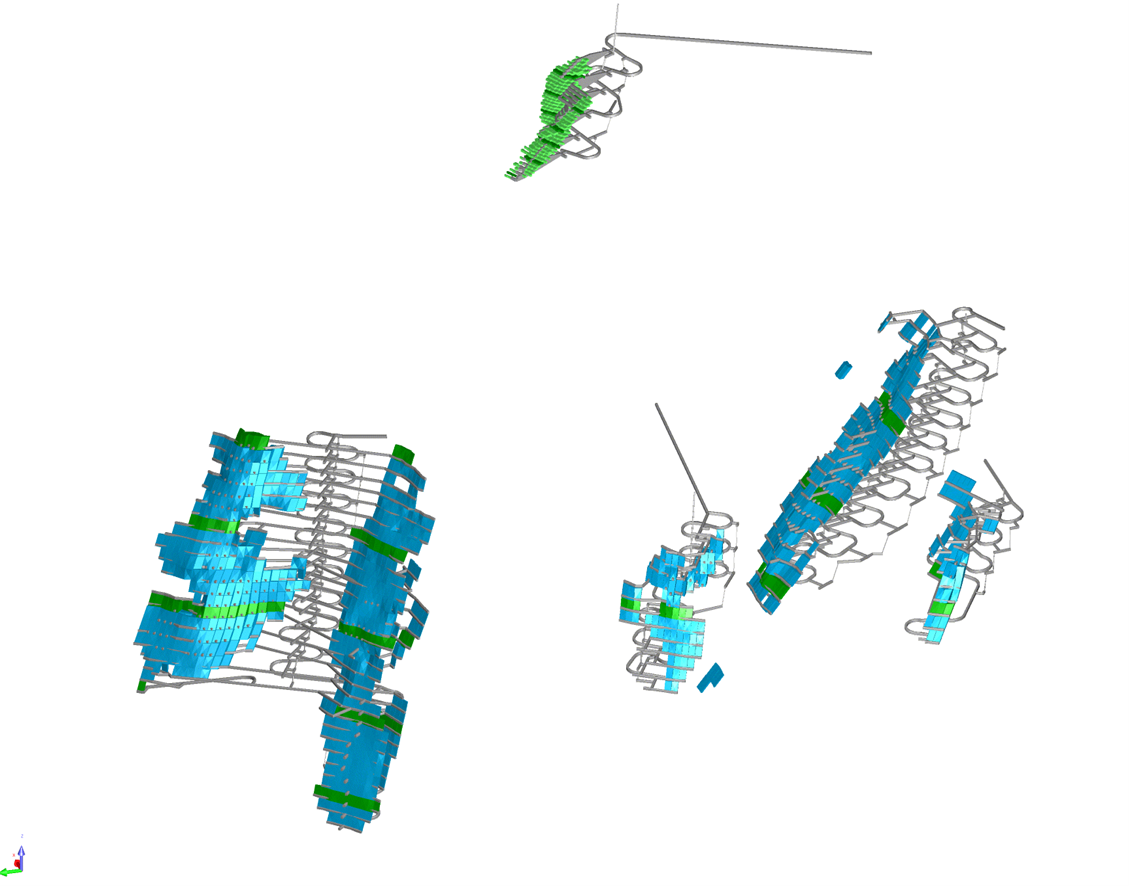

Mining of Rajapalot is envisaged as an underground only operation. The Rajapalot deposits comprise 5 bodies within an area of approximately 3 km from West to East and 2 km from South to North, which commence from outcrops to 100 m below the surface, to a maximum depth of around 600 m (Figures 3 and 4). Each of the near surface deposits are planned to be individually accessed through decline box cuts. Two deposits, Palokas and Raja, contribute 87% of the run of mine ("ROM") tonnes and 91% of the gold ounces to LoM inventory.

Figure 3: Plan view of the Rajapalot deposits and site layout

A total ROM tonnage of 10.1 Mt is estimated (Table 2). The primary mining method selected for the Project is longhole open stoping ("LHOS") with 20 m level spacing and applied to the Palokas, Raja, Hut and Rumajärvi deposits. Stopes are mined in the transverse direction to deposit strike in wider sections of the deposit, and as longitudinal stopes in narrow sections. Paste backfill is used to maximize mining extraction and reduce the tailings storage requirements on surface. There is also local demand for the mine waste rock.

The mining method selected for the Joki East deposit is cut and fill due to its shallower dip angle with cemented rock fill. In total approximately 40% of the extracted mineral resource is returned to underground voids as fill.

Individual ventilation designs have been developed for each deposit with vent raises and escape ways integrated within the mine development schedule.

An NSR Cut-off Value ("CoV") of approximately $52 per mined tonne was applied for the Rajapalot stope optimization, based on initial operating cost estimates for mining, processing and G&A. The Deswik Stope Optimizer module was used to generate mineable shapes with applied modifying factors (mine dilution and losses) to quantify the ROM inventory used as a basis for the LoM schedule.

Table 2: PEA ROM tonnage

| Deposit | ROM (Mt) | Au (g/t) | Co (ppm) | Au (koz) | Co (t) |

| Palokas | 6.1 | 2.24 | 379 | 438 | 2,303 |

| Raja | 2.8 | 2.58 | 305 | 231 | 846 |

| Joki East | 0.4 | 2.87 | 225 | 37 | 90 |

| Hut | 0.6 | 1.19 | 267 | 22 | 152 |

| Rumajärvi | 0.3 | 0.98 | 388 | 10 | 118 |

| Total | 10.1 | 2.26 | 347 | 736 | 3,509 |

| Cobalt Feed | 6.1 | 529 | - | 3,203 |

Figure 4: Plan (left) and orthogonal (right) views of the Rajapalot stopes and mine development

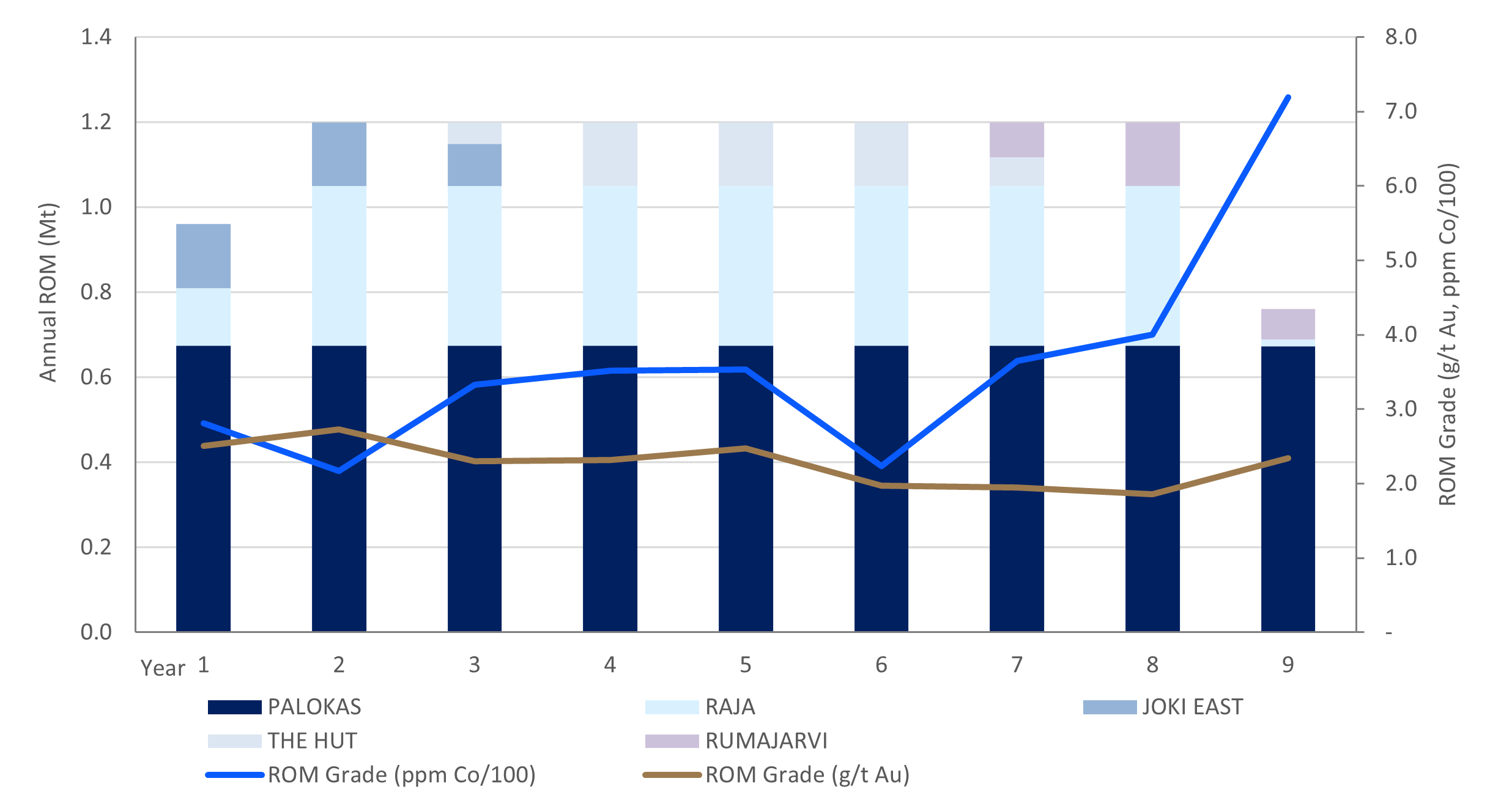

The proposed Rajapalot mine targets a ROM production rate of 1.2 Mt/a through combined mining of 3 deposits at any one time to meet the target annual tonnage (Figure 5). The annual production schedule, which makes allowance for ramp up, is used to derive an equipment fleet schedule including commissioning and replacement periods over the duration of the operation. Fixed and variable labour is estimated for each annual period based on the development, production and equipment schedule. The mine operating cost estimate assumes an owner-operator approach, as is typical in Finland, with mine equipment purchased via a lease-to-own strategy on typical industry terms.

There has been no hydrogeological assessment of the deposit bedrock. However, a preliminary mine dewatering model was developed and calibrated using hydrological parameters from other regional projects and similar geological settings. The base case inflow estimate for the mine complex ranges between 27 L/s and 32 L/s. Mine and surface water infrastructure has been provided to cater for these as a nominal flow rate.

Figure 5: ROM Schedule

Metallurgy and Processing

The Company has completed several phases of metallurgical test work, which highlight free gold mineralization with high cyanide soluble gold recoveries, and amenability for cobalt upgrading to a flotation concentrate.

ROM material will be assessed against an economic cut-off for cobalt extraction, be separately stockpiled, and campaign processed. All feed will be processed for gold recovery but only a proportion, on a feed campaign basis, for cobalt recovery.

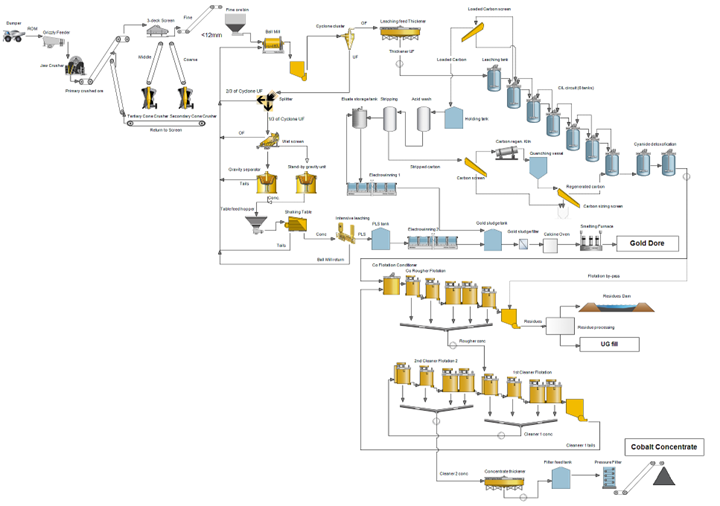

The selected flowsheet (Figure 6) for the PEA consists of a conventional crushing and grinding circuit with integrated gravity gold recovery unit, followed by carbon-in-leach ("CIL") cyanide leaching of gold with carbon acid wash, stripping, electrowinning and smelting to produce gold doré on site. Residual cyanide in the slurry would be destroyed (‘detoxification') using the INCO process ahead of downstream processing.

Following detoxification, the material would be delivered either directly to tails processing, or in the case of cobalt rich feed, to the flotation plant which would consist of roughing and cleaning stages, and concentrate filtration, to produce a marketable cobalt concentrate. Concentrate would be loaded into highway trucks for year-round road transport as is typical at other Finnish base metals operations.

The proposed processing plant is designed with a nominal throughput capacity of 1.2 Mt ROM feed tonnes per year and would incorporate modern automation and controls as well as extensive duty and standby pumps to ensure high availability. High quality European equipment forms the cost base, including a full crushing circuit from Sandvik and a complete grind/leach-elution/float package from Metso-Outotec.

Figure 6: Major process flow diagram

Key findings from PEA stage metallurgical test work, which underpins the plant design and economic criteria including recoveries and reagent consumptions, are:

- Geometallurgical analysis had identified two distinct feed types designated "Raja-South Palokas" (R-SP) and Palokas (Pal). Separate composite samples of each type were selected, prepared, and tested separately. Although roughly aligned with designated mining domains, this is not exclusively so, as the metallurgical-type classification is based on defined mineralogical characteristics and ratio of sulphur to cobalt in the feed.

- Mineralogical examination of the feed type samples showed that the materials were distinguished by differences in silicate mineral occurrence. The R-SP sample had significant cobalt as Cobaltite, whereas the Pal sample had very minor cobaltite. Both types had cobalt intimately associated with iron-sulphide minerals - pyrrhotite and pyrite. For the Pal sample the latter was the dominant occurrence of cobalt.

- Comminution results classified samples as "slightly abrasive", and "medium" with respect to coarse and fine grindability.

- Gravity recoverable gold was identified for both types, with typical recoveries ranging from 10% to 18%. Gravity recovery of gold was shown to be beneficial in consistently achieving high gold leach recovery.

- Combined gravity plus leach gold recoveries of the order of 95% was demonstrated for both feed types, at a P80 grind of 75μm and leach residence time of ~30 hours. Reagent consumptions were in the normal range of expectations.

- Flotation testing of both mineral types demonstrated that high recoveries of cobalt can be achieved with appropriate pulp chemistry and collector additions. For the R-SP sample a simple rougher-cleaner flotation (non-optimised) achieved 88% cobalt recovery to a concentrate grading >0.6% Co. Actual (and modelled) concentrate grades will be a function of the relative grades of cobalt and sulphur in the proportion of the feed which will be directed to the flotation circuit.

- For the Pal sample the equivalent was 78% cobalt recovery to 0.3% Co grade, reflecting the different cobaltite occurrence for the two samples. Where cobalt head grades are low, the response indicates that this mineralogical type will not meet current criteria to justify flotation processing after gold recovery.

Infrastructure

Access

The Project is located 32 km from the capital of Lapland, Rovaniemi in northern Finland. Access to the Project is along an existing 3 km unsealed public road, which connects to a paved national highway (930). The city of Rovaniemi hosts an international airport and a population of over 65,000 people, which reduces the capital, labour and G&A burden compared to projects with camps and/or logistical difficulties.

Plant Residues

Net of backfill requirements, an estimated 6 Mt of plant residues will be produced over the LoM that require surface storage in an engineered impoundment. A storage site ~500 m from the plant was selected after a tradeoff analysis which included both economic and environmental considerations. It is envisaged that the plant residues will be deposited sub-aqueously as a thickened slurry into a ring dyke style embankment, which is raised in stages (60% upfront assumed). The facility would be fully lined with a geosynthetic clay liner, overlain with a 1.5 mm HDPE geomembrane and a geotextile protector.

Costs have been included for permanent closure at the end of the mine life. The dam surface area would be filled to form a convex shedding surface, and then further covered with layers of clay, rock and topsoil for revegetation. A provision for post-closure monitoring is also included.

Water treatment

The site is expected to have a positive water balance. A small amount of raw water will be sourced from a nearby groundwater source for reagent make up and services, with the majority of water inflows emanating from the mine. Water in excess of what can be practically recycled into the process will be treated prior to discharge. Water treatment will be via a dedicated metals precipitation plant followed by a nitrogen removal plant (now considered best practice in Finland). The objective of the water treatment circuit is to ensure the water is of the same or better quality at the point of discharge. Excess water (nominally 150 m3/hr) will be pumped ~15 km via a buried pipeline to an assumed discharge point on the Ternu river. Future studies will assess in detail the site water quality and optimal discharge location, however this strategy and configuration is consistent with other operations in Finland.

Power

FinGrid, the national distribution network operator, has confirmed sufficient power is available for the Project requirements. Several options exist for grid connection, with the lowest risk option selected for the PEA to connect via a dedicated 110 kV distribution line to the existing Valajaskoski substation. A new aerial transmission line will carry power the first ~13 km, after which it is carried via a cable buried alongside the discharge water line for the final ~15 km to the project area. Power is stepped down to 20 kV at a site substation for onward distribution. Alternative grid connections will be evaluated in future studies.

Other

A 10 MW surface facilities heat plant would be installed, fed by woodchips sourced locally. This renewable resource is a typical source of heat in Finland. Heat is reticulated to insulated buildings where the air is heated as appropriate for the space and work activities. Separate electric heating systems are allowed for the underground ventilation.

The majority of process equipment is housed inside buildings/enclosures. Other infrastructure on site includes an 800 m2 permanent integrated administration and crew change building. A 1200 m2 permanent workshop is provided for fixed and mobile maintenance on site. A fully operational laboratory is included to meet the needs of mine and metallurgical assay. Roads and paved parking are also provided for.

Capital and Operating Costs

The total initial capital costs are estimated to be $191 M, which includes a 20% contingency allowance. Sustaining capital costs over the LOM are estimated at $100 M. The estimate (Table 3) includes all necessary site infrastructure to bring the mine into production.

Process design criteria, equipment list, flow diagrams and a preliminary site layout support the estimate of equipment and materials for plant and related infrastructure. The majority of process equipment costs were sources from current budget quotations, as were the installation rates for significant infrastructure such as the water discharge line, powerline and heat plant. In total, approximately 65% of the process and associated infrastructure capex was based on current budget estimates. Historical quotes and factors derived from recent Finnish projects were also used. All European sourcing was assumed, with the potential to explore alternative sourcing considered an optimization opportunity for latter stages of study. Tailings costs were developed from a material take off and unit rates benchmarked from similar projects in the region. The backfill plant is factored for equipment costs, and benchmarked against other similar plants.

Sustaining capital caters for gradual expansion of the plant residues impoundment, and a provision is made for plant and infrastructure upkeep. Mine equipment overhaul and underground development makes up the majority of sustaining capital.

Table 3: Capital Costs

Capital Cost |

| Units | Initial | Sustaining | Total LOM |

| Underground Mine | $M | 4 | 57 | 61 | |

| Capitalized Mine Opex | $M | 11 | - | 11 | |

| Process Plant | $M | 80 | 14 | 94 | |

| Infrastructure | $M | 48 | 18 | 66 | |

| Indirects | $M | 20 | - | 20 | |

| Contingency | $M | 30 | 2 | 32 | |

| Closure | $M | - | 8 | 8 | |

| Total Capital Cost | $M | 191 | 100 | 291 | |

The total LoM average operating cost is $56 per ROM tonne (Table 4).

Mining costs are built from first principles and were benchmarked against similar mines in the region. Mining equipment is assumed to be owner operated, on an industry standard lease-to-own financing package.

Process costs are also derived from first principles, and are based on estimated manning schedule, major reagent consumptions from test work (minor as typical) and an estimated power demand from the equipment list. Labour rates are standardized into defined categories, for which award rates are published nationally. Estimates include all employee benefits and employer on-cost burdens. Power prices are current at August 2022 (defined publicly in Finland). Regent prices were based on budget quotations and inflated historical prices.

Table 4: Operating Costs

| Operating Cost | LoM Average ($/t) | LoM ($M) | |

| Mining | 34.9 | 353 | |

| Process and Infrastructure | 16.9 | 171 | |

| G&A | 4.0 | 40 | |

| Royalties | 0.2 | 2 | |

| Total Operating Cost | 55.9 | 566 | |

Environment and Permitting

Rajapalot will require additional permits to commence mining. Finland has over 40 operating mines, with the permitting and assessment processes transparent and defined in legislation. Mawson has already completed a significant body of environmental and social baseline data, giving it a robust understanding of the process and key sensitivities in project development. To date no environmental red flags have been identified.

The major permits required are a ‘Mining Permit', ‘Environmental Permit', and ‘Water Permit'. Other ancillary permits will also be required. Prior to application for permits, an Environmental Impact Assessment ("EIA") is required, and Mawson has already formally commenced its EIA.

The Rajapalot Project area is partly located on a Natura 2000 area, so a Natura 2000 assessment must be completed as part the EIA. If ‘no significant impact' is determined, the normal Finnish permitting process applies. If significant impact is determined, Mawson will need to apply for an exemption under Article 6.4 of the Habitat Directive. Mining permits have been issued inside Natura zones within the EU, and Anglo American is currently preparing environmental permit application for the Sakatti Ni-Cu-PGE project, which is located in a different Finnish Natura 2000 area.

Natura 2000 is not a system of strict nature reserves where all human activities are excluded, rather the aim of the network is to assure the long-term survival of Europe's most valuable and threatened species and habitats. Development in Natura 2000 areas is defined by clear rules and the emphasis is on ensuring that future management is sustainable, both ecologically and economically.

Mineral Resources

The PEA is based on the inferred mineral resource estimate ("MRE") outlined in the technical report titled "Mineral Resource Estimate NI 43-101 Technical Report - Rajapalot Property" dated 26 August 2021 ("Previous MRE"), available on SEDAR. Owing to the underground only mining scenario selected in the PEA, the MRE utilizes the "All underground Model" as the base case, rather than the "Open Pit-Underground Model" selected previously. All other resource estimation methodologies remain the same. Open pits remain economically viable; however the selected case change reflects a more ‘reasonable prospect of eventual economic extraction' determination that matches the potential development case outlined in the PEA.

Table 5: Inferred Mineral Resource Estimate (all underground), effective date 26 August 2022

| Zone | Tonnes (kt) | Au (g/t) | Co (ppm) | AuEq2 (g/t) | Au (koz) | Co (t) | Oz (AuEq2) |

| Palokas UG | 5,612 | 2.8 | 475 | 3.3 | 501 | 2,664 | 588 |

| Raja UG | 2,702 | 3.1 | 385 | 3.5 | 271 | 1,040 | 305 |

| East Joki UG | 299 | 4.5 | 365 | 4.9 | 43 | 109 | 47 |

| Hut UG | 831 | 1.3 | 427 | 1.8 | 36 | 355 | 48 |

| Rumajärvi UG | 336 | 1.4 | 423 | 1.8 | 15 | 142 | 19 |

| Total UG | 9,780 | 2.8 | 441 | 3.2 | 867 | 4,311 | 1,007 |

- The independent geologist and Qualified Person as defined in NI 43-101 for the mineral resource estimates is Mr. Ove Klavér (EurGeol). The effective date of the MRE remains unchanged to the Previous MRE (August 26, 2021, available on SEDAR), and will be restated in the PEA technical report when it is filed.

- The mineral estimate is reported for a potential underground only scenario. Underground resources were reported at a cut-off grade of 1.1 g/t (AuEq1 Au g/t + Co ppm /1005). Refer to the Previous MRE for details on the cut-off grade calculation used in calculating the Inferred Mineral Resource.

- Resource gold equivalent grades (AuEq2) and ounces stated here are based on the updated PEA metal prices of $1,700/oz Au and $60,000/t Co and recovery assumptions of 95% Au and 87.6% Co. (AuEq2 = Au g/t + Co ppm / 988).

- Wireframe models were generated using gold and cobalt shells separately. Forty-eight separate gold and cobalt wireframes were constructed in Leapfrog Geo and grade distributions independently estimated using Ordinary Kriging in Leapfrog Edge. A gold top cut of 50 g/t Au was used for the gold domains. A cobalt top cut was not applied.

- A parent block size of 12 m x 12 m x 4 m (>20% of the drill hole spacing) was determined as suitable. Sub-blocking down to 4 m x 4 m x 0.5 m was used for geologic control on volumes, thinner and moderately dipping wireframes

- Rounding of grades and tonnes may introduce apparent errors in averages and contained metals.

- Drilling results to 20 June 2021.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability

Resource Upside

Significant potential exists to expand the MRE, locally as well as in the regional Project area. The defined resource bodies are all open down dip, as highlighted by the deepest drilling into the largest body, Palokas, intercepting 30.8 m @ 5.1 g/t AuEq from 553 m (3.9 g/t Au and 1,403 ppm Co).

Regionally, the 18,000 ha contiguous 100% owned land package remains mostly undrilled, despite other significant gold occurrences defined on the property, including Rompas (highlight intersection 6 m @ 617 g/t Au from 7 m) and North Rompas (highlight intersection 0.4 m @ 395 g/t Au from 41 m), located 8 and 10 km respectively from the Rajapalot MRE. The Company has recently announced an exploration plan based on the results of a detailed magnetic survey interpretation, which identified over 30 structural dominant targets in a 4 km x 4 km area between the gold occurrences (refer to press release dated 6 September, 2022).

Future Work

Mawson intends to leverage the robust base case PEA development scenario through outlining the resource growth potential on the property. This will include, subject to permitting, drilling at Rajapalot to demonstrate down-plunge extensions of the existing deposits, as well as exploring for repeat prospects across the already 8 km x 10 km mineralized area between Rajapalot and the Rompas trend.

The main recommendations arising from the PEA study relate to collecting of more empirical, particularly geotechnical and hydrogeological data, and completion of more detailed engineering studies to increase cost estimate accuracy. Further gold and cobalt metallurgical test work is necessary and will be used to refine recoveries and operating assumptions, and alongside cobalt marketing studies, optimize the cobalt NSR. Upgrading the resource classification to indicated through drilling would be required to consider future Mineral Reserve assessments. Environmental baseline studies should continue in support of the in-progress EIA, including assessing opportunities to reduce reliance on fossil fuels and the carbon footprint of the project.

Technical Background and Qualified Person

The PEA was prepared by SRK for Mawson, managed by Mr. Chris Bray MAusIMM(CP) who is a Qualified Person ("QP") as defined in NI 43-101. The Mineral Resources estimate used as a basis for the PEA was prepared by of Mr. Ove Klavér, EurGeol. A QP of AFRY Finland.

Michael Hudson, Executive Chairman of Mawson, a Fellow of the Australasian Institute of Mining and Metallurgy, and QP under NI 43-101 has reviewed and verified the technical contents of this release.

Non-IFRS Financial Measures

Mawson has included certain non-IFRS financial measures in this news release, such as Initial Capital Cost, Sustaining Capital, Cash Operating Costs, Total Cash Cost (C1) and All-In Sustaining Cost (AISC) which are not measures recognized under International Financial Reporting Standards ("IFRS") and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other corporations. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

Total Cash Costs and Total Cash Costs per Ounce. Total Cash Costs are reflective of the cost of production. Total Cash Costs reported in the PEA include mining costs, processing & water treatment costs, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total Cash Costs per Ounce is calculated as Total Cash Costs divided by payable gold ounces.

All-in Sustaining Costs ("AISC") and AISC per Ounce. AISC is reflective of all the expenditures that are required to produce an ounce of gold from operations. AISC reported in the PEA includes total cash costs, sustaining capital and closure costs, but excludes corporate general and administrative costs and salvage. AISC per Ounce is calculated as AISC divided by payable gold ounces.

About Mawson Gold Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic Arctic exploration company with its 100% owned flagship Rajapalot gold-cobalt project in Finland, and right to earn into the Skellefteå North gold project in Sweden. Mawson also owns 60% of Southern Cross Gold Ltd (ASX:SXG) which in turn owns or controls three high-grade, historic epizonal goldfields covering 470 km2 in Victoria, Australia.

On behalf of the Board, "Ivan Fairhall" | Further Information |

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to: capital and other costs varying significantly from estimates; changes in world metal markets; changes in equity markets; ability to achieve goals; that the political environment in which the Company operates will continue to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; risks related to negative publicity with respect to the Company or the mining industry in general; reliance on a single asset; planned drill programs and results varying from expectations; unexpected geological conditions; local community relations; dealings with non-governmental organizations; delays in operations due to permit grants; environmental and safety risks; and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Mawson, in light of management's experience and perception of current conditions and expected developments, Mawson can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

SOURCE: Mawson Gold Limited