Highest Reported Grade to Date of 4.52% Li2O over 1m Multiple High-Grade and Broad Drill Intersections Ewoyaa Lithium Project Ghana, West Africa

SYDNEY, AUSTRALIA / ACCESSWIRE / November 2, 2022 / Atlantic Lithium Limited (AIM:ALL)(OTCQX:ALLIF)(ASX:A11) "Atlantic Lithium" or the "Company"), the funded African-focussed lithium exploration and development company targeting to deliver Ghana's first lithium mine, is pleased to announce assay results from the resource and exploration drilling programme now completed at the Ewoyaa Lithium Project ("Ewoyaa" or the "Project") in Ghana, West Africa.

Figures, Tables and Appendices referred to in this release can be viewed in the PDF version available via this link:

http://www.rns-pdf.londonstockexchange.com/rns/9992E_1-2022-11-1.pdf

HIGHLIGHTS:

Ø Assay results reported for 5,668m of infill and exploration reverse circulation ("RC") drilling completed at the Ewoyaa Main, Grasscutter East, Grasscutter West and Anokyi deposits, part of the now-completed resource evaluation and exploration RC and diamond drilling ("DD") programme.

Ø Newly reported drilling results fall both within and outside the currently defined 30.1Mt @ 1.26% Li2O Ewoyaa JORC (2012) Compliant Mineral Resource Estimate ("MRE" or the "Resource"), providing further confidence in Resource conversion at the Ewoyaa Main deposit, and extending mineralisation downdip at the Grasscutter East, Grasscutter West and Anokyi deposits.

- Highest reported single RC assay result to date of 4.52% Li2O over 1m in hole GRC0704 from 54m and 3.99% Li2O from 53m.

- Broad, high-grade infill drill intersections within the current MRE reported at the Ewoyaa Main deposit including highlights of:

- GRC0697: 95m at 1.48% Li2O from 5m

- GRC0703: 87m at 1.61% Li2O from 0m

- GRC0701: 78m at 1.67% Li2O from 12m

- GRC0710: 74m at 1.65% Li2O from 15m

- GRC0692: 76m at 1.43% Li2O from 14m

- GRC0720: 62m at 1.34% Li2O from 28m

- GRC0722: 57m at 1.31% Li2O from 23m

- GRC0717: 47m at 1.57% Li2O from 43m

- GRC0696: 44m at 1.41% Li2O from 7m

- GRC0712: 72m at 0.85% Li2O from 18m

- GRC0700: 44m at 1.32% Li2O from 46m

- GRC0725: 43m at 1.13% Li2O from 44m

- GRC0706: 27m at 1.57% Li2O from 38m

- GRC0704: 23m at 1.4% Li2O from 36m

- GRC0711: 23m at 1.38% Li2O from 39m

- GRC0696: 30m at 0.94% Li2O from 58m

- GRC0704: 16m at 1.65% Li2O from 73m

- GRC0724: 21m at 1.18% Li2O from 30m

- GRC0694: 20m at 1.05% Li2O from 24m

- Broad, high-grade exploration drill intersections outside of the current MRE, reported at the Grasscutter East, Grasscutter West and Anokyi deposits, including highlights of:

- GRC0721: 45m at 1.16% Li2O from 274m

- GRC0695: 29m at 1.72% Li2O from 141m

- GRC0705: 25m at 1.49% Li2O from 171m

- GRC0693: 23m at 1.18% Li2O from 274m

- GRC0699: 14m at 1.66% Li2O from 213m

- GRC0716: 13m at 1.36% Li2O from 302m

- GRC0721: 11m at 1.44% Li2O from 177m

- GRC0718A: 14m at 0.93% Li2O from 193m

- GRC0713: 10m at 1.2% Li2O from 172m

- GRC0709: 10m at 1.02% Li2O from 176m

- Approximately 21,000m of results from the 47,000m drilling programme reported to date.

- Recently announced Pre-Feasibility Study (refer RNS of 22 September 2022) delivers exceptional financial outcomes for a 2Mtpa operation, producing an average c. 255,000tpa of 6% Li2O spodumene concentrate ("SC6") over a 12.5-year operation:

- LOM revenues exceeding US$4.84bn, Post-tax NPV8 of US$1.33bn, IRR of 224% over 12.5 years

- US$125m capital cost estimate with an industry-leading payback period of <5 months

- C1 cash operating costs of US$278 per tonne of 6% lithium spodumene concentrate Free on Board ("FOB") Ghana Port, after by-product credits

- Average Life of Mine ("LOM") EBITDA of US$248m per annum

- 18.9Mt at 1.24% Li2O Maiden Ore Reserve

- Average annualised US$1,359/dry metric tonne SC6 pricing used

- Significant potential for resource upgrades and exploration upside; potential for project metrics to substantially improve with increased scale.

Commenting on the Company's latest progress, Lennard Kolff, Interim Chief Executive Officer of Atlantic Lithium, said:

"We are delighted to report ongoing high-grade drill intersections, both within the infill programme targeting conversion of Indicated to Measured resources and within the exploration programme targeting resource growth outside the current MRE.

"The latest infill drilling results from within the current Resource at the Ewoyaa Main deposit have returned multiple high-grade pegmatite intervals over 1.5% Li2O and up to 95m long with the hole ending in mineralisation, providing further confidence in future Resource to Reserve conversion.

"Exploration drilling outside of the current Resource has returned multiple intersections, including highlights of 29m at 1.72% Li2O and 25m at 1.49% Li2O at the Anokyi deposit, 45m at 1.16% Li2O at the Grasscutter West deposit and 23m at 1.18% Li2O at the Grasscutter East deposit. These results reaffirm the significant growth potential at the Ewoyaa Project, which we hope to unlock.

"We are thrilled to report our highest-grade RC drilling result to date at the Ewoyaa Project of 4.52% Li2O over 1m, including an adjacent 1m interval of 3.99% Li2O in infill drilling at the Ewoyaa Main deposit.

"We anticipate further news flow from pending drilling results into the end of the year and are targeting a Resource upgrade at the end of 2022 or early 2023, dependent on lab turn-around time. The increased Resource estimate will inform a Definitive Feasibility Study, targeted for completion in mid-2023.

"With the Pre-Feasibility Study now delivered, the Mining Licence application submitted, ongoing positive drilling results and with the support of our funding agreement with Piedmont Lithium, we feel the Company is ideally positioned to benefit from the unprecedented levels of lithium demand that are expected over the coming years."

New Drilling Results:

Further assay results have been received for an additional 5,668m of RC drilling from the recently completed drill programme at the Ewoyaa Project. Multiple high-grade and broad infill 'Measured' drill intersections are reported within the Ewoyaa Main deposit, which falls within the currently defined 30.1Mt @ 1.26% Li2O MRE (refer Table 1, Appendix 1 and Appendix 2). Additionally, multiple drill intersections are reported for exploration drilling results outside of the currently defined Resource (refer Table 2, Appendix 1 and Appendix 2).

ble 1: High-grade infill drill intersection highlights at greater than 20 Li x m, reported at a 0.4% Li2O cut-off and maximum of 4m of internal dilution at the Ewoyaa Main deposit.

Hole ID | Target | From m | To m | Interval m | Hole depth m | assay Li2O % | Intersection | Comment | metal content Li x m |

GRC0697 | MEA | 5.00 | 100.00 | 95.00 | 100.00 | 1.48 | GRC0697: 95m at 1.48% Li2O from 5m |

| 140.33 |

GRC0703 | MEA | 0.00 | 87.00 | 87.00 | 90.00 | 1.61 | GRC0703: 87m at 1.61% Li2O from 0m |

| 139.85 |

GRC0701 | MEA | 12.00 | 90.00 | 78.00 | 90.00 | 1.66 | GRC0701: 78m at 1.67% Li2O from 12m |

| 129.68 |

GRC0710 | MEA | 15.00 | 89.00 | 74.00 | 90.00 | 1.64 | GRC0710: 74m at 1.65% Li2O from 15m |

| 121.66 |

GRC0692 | MEA | 14.00 | 90.00 | 76.00 | 90.00 | 1.42 | GRC0692: 76m at 1.43% Li2O from 14m |

| 108.29 |

GRC0720 | MEA | 28.00 | 90.00 | 62.00 | 90.00 | 1.34 | GRC0720: 62m at 1.34% Li2O from 28m |

| 83.05 |

GRC0722 | MEA | 23.00 | 80.00 | 57.00 | 90.00 | 1.30 | GRC0722: 57m at 1.31% Li2O from 23m |

| 74.25 |

GRC0717 | MEA | 43.00 | 90.00 | 47.00 | 90.00 | 1.57 | GRC0717: 47m at 1.57% Li2O from 43m |

| 73.68 |

GRC0696 | MEA | 7.00 | 51.00 | 44.00 | 90.00 | 1.41 | GRC0696: 44m at 1.41% Li2O from 7m |

| 62.00 |

GRC0712 | MEA | 18.00 | 90.00 | 72.00 | 90.00 | 0.85 | GRC0712: 72m at 0.85% Li2O from 18m |

| 61.20 |

GRC0700 | MEA | 46.00 | 90.00 | 44.00 | 90.00 | 1.31 | GRC0700: 44m at 1.32% Li2O from 46m |

| 57.76 |

GRC0725 | MEA | 44.00 | 87.00 | 43.00 | 90.00 | 1.12 | GRC0725: 43m at 1.13% Li2O from 44m |

| 48.37 |

GRC0706 | MEA | 38.00 | 65.00 | 27.00 | 90.00 | 1.56 | GRC0706: 27m at 1.57% Li2O from 38m |

| 42.22 |

GRC0704 | MEA | 36.00 | 59.00 | 23.00 | 90.00 | 1.40 | GRC0704: 23m at 1.4% Li2O from 36m |

| 32.20 |

GRC0711 | MEA | 39.00 | 62.00 | 23.00 | 90.00 | 1.37 | GRC0711: 23m at 1.38% Li2O from 39m |

| 31.60 |

GRC0696 | MEA | 58.00 | 88.00 | 30.00 | 90.00 | 0.94 | GRC0696: 30m at 0.94% Li2O from 58m |

| 28.20 |

GRC0704 | MEA | 73.00 | 89.00 | 16.00 | 90.00 | 1.65 | GRC0704: 16m at 1.65% Li2O from 73m |

| 26.39 |

GRC0724 | MEA | 30.00 | 51.00 | 21.00 | 90.00 | 1.18 | GRC0724: 21m at 1.18% Li2O from 30m |

| 24.70 |

GRC0694 | MEA | 24.00 | 44.00 | 20.00 | 81.00 | 1.05 | GRC0694: 20m at 1.05% Li2O from 24m |

| 20.91 |

Table 2: High-grade exploration drill intersection highlights at greater than 10 Li x m, reported at a 0.4% Li2O cut-off and maximum of 4m of internal dilution at the Grasscutter East, Grasscutter West and Anokyi deposits.

Hole ID | Target | From m | To m | Interval m | Hole depth m | assay Li2O % | Intersection | Comment | metal content Li x m |

GRC0721 | EXPL | 274.00 | 319.00 | 45.00 | 347.00 | 1.15 | GRC0721: 45m at 1.16% Li2O from 274m |

| 51.77 |

GRC0695 | EXPL | 141.00 | 170.00 | 29.00 | 190.00 | 1.71 | GRC0695: 29m at 1.72% Li2O from 141m |

| 49.70 |

GRC0705 | EXPL | 171.00 | 196.00 | 25.00 | 219.00 | 1.48 | GRC0705: 25m at 1.49% Li2O from 171m |

| 37.03 |

GRC0693 | EXPL | 274.00 | 297.00 | 23.00 | 348.00 | 1.18 | GRC0693: 23m at 1.18% Li2O from 274m |

| 27.12 |

GRC0699 | EXPL | 213.00 | 227.00 | 14.00 | 261.00 | 1.66 | GRC0699: 14m at 1.66% Li2O from 213m |

| 23.22 |

GRC0716 | EXPL | 302.00 | 315.00 | 13.00 | 337.00 | 1.35 | GRC0716: 13m at 1.36% Li2O from 302m |

| 17.60 |

GRC0721 | EXPL | 177.00 | 188.00 | 11.00 | 347.00 | 1.43 | GRC0721: 11m at 1.44% Li2O from 177m |

| 15.75 |

GRC0718A | EXPL | 193.00 | 207.00 | 14.00 | 254.00 | 0.92 | GRC0718A: 14m at 0.93% Li2O from 193m |

| 12.93 |

GRC0713 | EXPL | 172.00 | 182.00 | 10.00 | 210.00 | 1.20 | GRC0713: 10m at 1.2% Li2O from 172m |

| 11.95 |

GRC0709 | EXPL | 176.00 | 186.00 | 10.00 | 207.00 | 1.01 | GRC0709: 10m at 1.02% Li2O from 176m |

| 10.14 |

Resource infill drilling results received to date at the Ewoyaa Main deposit have confirmed mineralisation continuity and ability to convert from Inferred and Indicated resources to Measured resources on a nominal 20m x 20m grid. Measured drilling targeted the first 1.5 to 2 years of planned production at the Ewoyaa Main deposit and was planned to provide Proven Reserves in support of the Definitive Feasibility Study, in addition to further material for test-work and customer acceptance samples within the planned starter pit.

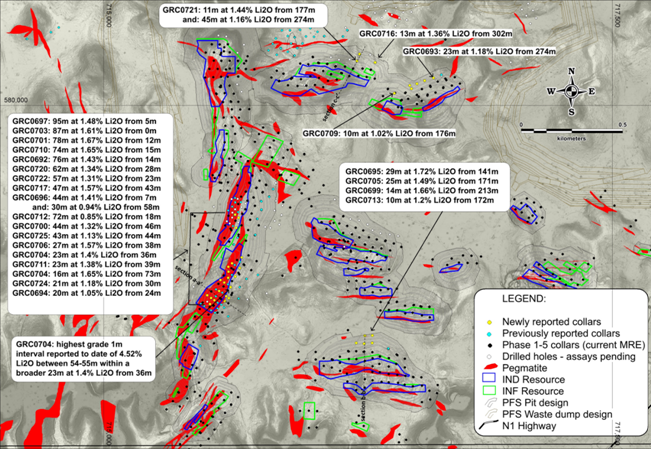

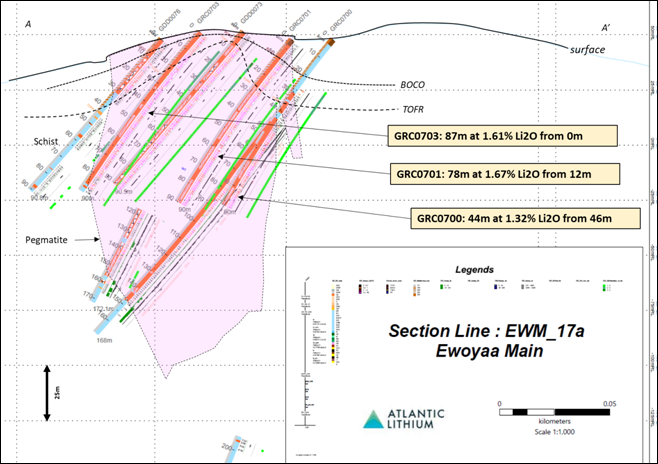

High grades over broad intervals were reported from near surface within the proposed starter pit zone of the Ewoyaa Main deposit, including highlights of 95m at 1.48% Li2O from 5m, 87m at 1.61% Li2O from surface, 78m at 1.67% Li2O from 12m and 74m at 1.65% Li2O from 15m (refer Figure 1 and Figure 2).

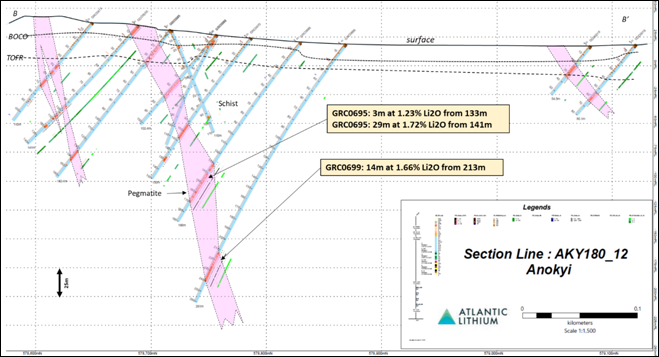

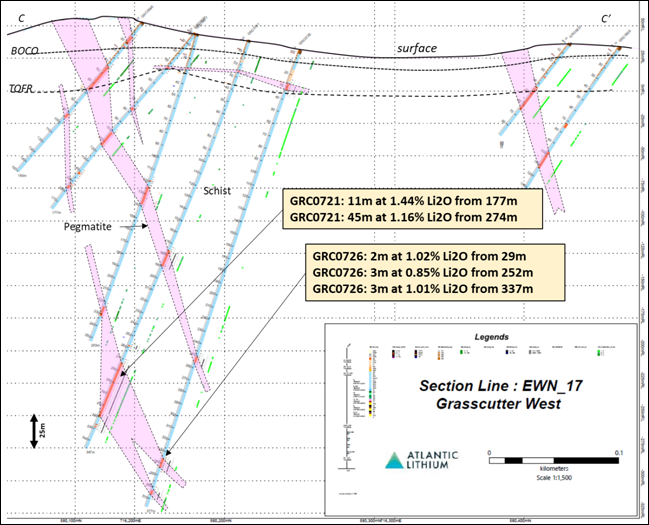

Exploration drilling results outside the 30.1Mt at 1.26% Li2O Resource continue to demonstrate further resource scale potential at the Ewoyaa Project, where new drilling results have returned highlights of 45m at 1.16% Li2O at the Grasscutter West deposit, 29m at 1.72% Li2O and 25m at 1.49% Li2O at the Anokyi deposit and 23m at 1.18% Li2O at the Grasscutter East deposit (refer Figure 1, Figure 3 and Figure 4).

The highest-grade meter interval reported to date in RC drilling of 4.52% Li2O, including an adjacent 1m downhole interval of 3.99% Li2O was achieved in hole GRC0704 between 53m to 55m at the Ewoyaa Main deposit. The mineralisation occurs within a larger reported interval of 23m at 1.4% Li2O from 36m in hole GRC0704 as part of the infill programme and demonstrates the high grades present at the deposit.

Sample preparation was completed by Intertek Ghana and assay by Intertek Perth with all reported results passing QA/QC protocols, providing confidence in reported results.

Figure 1: Location of reported assay results with highlight drill intersections for Measured holes and Exploration holes (inclusive holes highlighted individually outside of Ewoyaa Main).

Figure 2: Cross-section A-A' showing assay results received for infill holes GRC0700, GRC0701 and GRC0703 at the Ewoyaa Main deposit.

Figure 3: Cross-section B-B' assay results received for exploration holes GRC0695 and GRC0699 at the Anokyi deposit.

Figure 4: Cross-section C-C' assay results received for exploration holes GRC0721 and GRC0726 at the Grasscutter West deposit.

Competent Persons

Information in this report relating to the exploration results is based on data reviewed by Mr Lennard Kolff (MEcon. Geol., BSc. Hons ARSM), Chief Geologist of the Company. Mr Kolff is a Member of the Australian Institute of Geoscientists who has in excess of 20 years' experience in mineral exploration and is a Qualified Person under the AIM Rules. Mr Kolff consents to the inclusion of the information in the form and context in which it appears.

Information in this report relating to Mineral Resources was compiled by Shaun Searle, a Member of the Australian Institute of Geoscientists. Mr Searle has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Searle is a director of Ashmore. Ashmore and the Competent Person are independent of the Company and other than being paid fees for services in compiling this report, neither has any financial interest (direct or contingent) in the Company. Mr Searle consents to the inclusion in the report of the matters based upon the information in the form and context in which it appears.

The reported Ore Reserves have been compiled by Mr Harry Warries. Mr Warries is a Fellow of the Australasian Institute of Mining and Metallurgy and an employee of Mining Focus Consultants Pty Ltd. He has sufficient experience, relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking, to qualify as a Competent Person as defined in the 'Australasian Code for Reporting of Mineral Resources and Ore Reserves' of December 2012 ("JORC Code") as prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, the Australian Institute of Geoscientists and the Minerals Council of Australia. Mr Warries gives Atlantic Lithium Limited consent to use this reserve estimate in reports.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

For any further information, please contact:

Atlantic Lithium Limited Lennard Kolff (Interim CEO) Amanda Harsas (Finance Director and Company Secretary) | Tel: +61 2 8072 0640 |

| |

SP Angel Corporate Finance LLP Nominated Adviser Jeff Keating Charlie Bouverat | Tel: +44 (0)20 3470 0470 |

Canaccord Genuity Limited Joint Company Broker Raj Khatri James Asensio Harry Rees | Tel: +44 (0) 20 7523 4500 |

Liberum Capital Limited Joint Company Broker Scott Mathieson Edward Thomas Kane Collings | Tel: +44 (0) 20 3100 2000 |

| |

Yellow Jersey PR Limited Henry Wilkinson Dominic Barretto James Lingfield | Tel: +44 (0)20 3004 9512 |

Notes to Editors:

About Atlantic Lithium

Atlantic Lithium (formerly "IronRidge Resources") is an AIM and ASX-listed lithium company advancing a portfolio of lithium projects in Ghana and Côte d'Ivoire through to production.

The Company's flagship project, the Ewoyaa Project in Ghana, is a significant lithium spodumene pegmatite discovery on track to become Ghana's first lithium-producing mine. The Company signed a funding agreement with Piedmont Lithium Inc. for US$103m towards the development of the Ewoyaa Project. Based on the Pre-Feasibility Study, the Ewoyaa Project has indicated Life of Mine revenues exceeding US$4.84bn, producing a spodumene concentrate via simple gravity only process flowsheet.

Atlantic Lithium holds 560km2 & 774km2 of tenure across Ghana and Côte d'Ivoire respectively, comprising significantly under-explored, highly prospective licenses.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Atlantic Lithium Limited