COEUR D'ALENE, ID / ACCESSWIRE / November 10, 2022 / Idaho Strategic Resources (NYSE American:IDR) ("IDR" or the "Company") is pleased to provide highlights from its latest Paymaster hole, GC 22-224. The goal of the latest holes in this area between the Paymaster and Joe Dandy Shoots of the Golden Chest is to test the potential of ‘connecting' the two shoots at the 800-Level underground and defining additional gold resources. The "800-Level" is of specific importance given it is also the level of current underground production in the Skookum Shoot, which lies directly north of the Paymaster. If indeed the Paymaster and Joe Dandy connect at or near the 800-level, it could provide the Company the opportunity to mine two veins within the same shoot, which should greatly improve efficiency and ultimately production costs. The Company is in the process of evaluating the costs to determine if/when development into the Paymaster-Joe Dandy area may make sense.

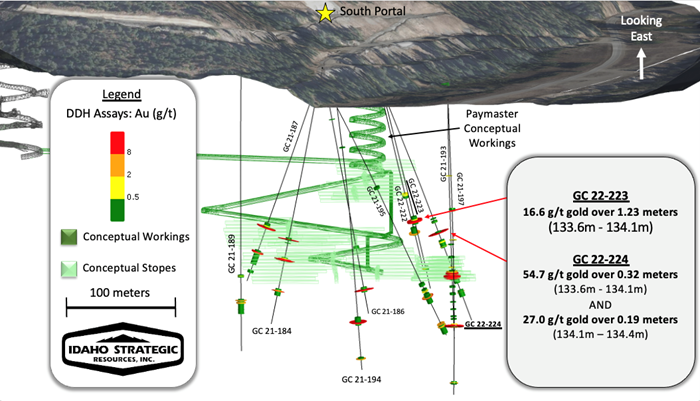

The highlight of GC 22-224 is the 54.7 grams per tonne (gpt) gold vein intercept over 0.32 meters (m) true thickness, from 133.6 m to 134.1 m and 27.0 grams per tonne (gpt) gold intercepted over 0.19 meters (m) true thickness from 134.1 m to 134.4 m (Figure 1). As previously discussed, and as illustrated in the tables below, the Joe Dandy and Paymaster share similar characteristics - such as gold-bearing veins flanking either side of a quartz monzonite sill. Thus far, it appears the Paymaster could be accessed by connecting to the existing Skookum ramp as an escapeway and driving a new ramp for haulage purposes. Core hole GC 22-224 was drilled just prior to moving the company drill rig to the previously discussed summer drill locations in the Murray Gold Belt (MGB).

IDR's Vice President of Exploration, Rob Morgan commented, "We have always been excited about the potential of the Paymaster and Joe Dandy shoots at the Golden Chest. It is only recently that production/development has reached a depth in the Skookum shoot where it may make sense to begin development toward the Paymaster and Joe Dandy. Based on our drill results and our knowledge of the Golden Chest Mine, the Paymaster and Joe Dandy look to be steady and predictable veins with extremely good ground support, which is exactly what we like to see when it comes to increased mining and associated economics."

Intervals below are reported in grams of gold per tonne (gpt) and in true thickness.

Paymaster Intercept Highlights - To Date

GC 20-183 | Paymaster | 14.7 gpt gold over 0.9 m (m) in the upper vein and 6.3 gpt gold over 0.2 m of in the lower vein |

GC 21-184 | Paymaster | 20.1 gpt gold over 1.5 m (including 26.7 gpt gold over 0.9 m) in the upper vein and 3.8 gpt gold over 1.4 m of in the lower vein |

GC 21-186 | Paymaster | 16.4 gpt gold over 1.2 m in the lower vein |

GC 21-187 | Paymaster | 10.9 gpt gold over 1.8 m (including 29.2 gpt gold over 0.6 m) in the upper vein and 4.2 gpt gold over 2.1 m of (including 7.2 gpt gold over 1.2 m) in the lower vein. |

GC 21-189 | Paymaster | 3.1 gpt gold over 2.2 m in the lower vein |

GC 22-222 | Paymaster | 7.33 gpt gold over 0.43 m in the lower vein |

GC 22-223 | Paymaster | 16.6 gpt gold over 1.23 m in the upper vein |

GC 22-224 | Paymaster | 44.31 gpt gold over 0.51 m (including 54.7 gpt over 0.32 m and 27.0 gpt over 0.19 m) in the upper vein. |

Joe Dandy Intercept Highlights - To Date

| GC 21-193 | Joe Dandy | 11.5 gpt gold over 7.3 m (including 19.5 gpt over 2.3 m) in the lower vein |

| GC 21-194 | Joe Dandy | 7.8 gpt gold over 0.5 m in the upper vein and 4.6 gpt gold over 0.4 m in the lower vein |

| GC 21-195 | Joe Dandy | 3.8 gpt gold over 0.5 m in the upper vein and 2.9 gpt gold over 0.4 m in the lower vein |

| GC 21-196 | Joe Dandy | 8.3 gpt gold over 0.6 m in the upper vein and 2.7 gpt gold over 1.7 m in the lower vein |

| GC 21-197 | Joe Dandy | 11.0 gpt gold over 2.6 m (including 28.7 gpt gold over 0.9 m) in the upper vein and 2.6 gpt gold over 0.5 m in the lower vein |

Figure 1-Paymaster Drilling

Idaho Strategic's President and CEO John Swallow concludes, "from a business perspective, the steady and predictable nature of the Paymaster and Joe Dandy shoots create a good setup for our operations and should allow us to build a truly self-sustaining gold mine. When I tell the miners that ‘it was a heck of a lot harder to get where we are today than to get to where we are going' this is exactly what I mean. We are far from being a ‘lifestyle company'. We have the infrastructure, the people, and most importantly the expertise under our current cost structure to develop into the Paymaster and Joe Dandy shoots, all that is left to do is the work. I wouldn't be surprised if one day the Paymaster/Joe Dandy becomes the leading production area of the Golden Chest - with the Paymaster and Skookum together laying the groundwork for a more predictable and reliable base of increased production while we gain a better structural understanding of what's controlling the very high-grade nature of the Klondike. This discussion also naturally ties into our thoughts around potential ore feed for a new mill in the Murray Gold Belt."

Qualified person

IDR's Vice President of Exploration, Robert John Morgan, PG, PLS is a qualified person under S-K 1300 and is a specialist in the fields of geology, exploration, and Mineral Resources and Reserves estimation and classification. Mr. Morgan is considered a QP for this report and has reviewed and approved the technical information and data included in this press release.

About Idaho Strategic Resources, Inc.

Domiciled in Idaho and headquartered in the Panhandle of northern Idaho, Idaho Strategic Resources (IDR) is one of the few resource-based companies (public or private) possessing the combination of officially recognized U.S. domestic rare earth element properties (in Idaho), the largest known concentration of thorium resources in the U.S., and Idaho-based gold production located in an established mining community.

Idaho Strategic Resources produces gold at the Golden Chest Mine located in the Murray Gold Belt (MGB) area of the world-class Coeur d'Alene Mining District, north of the prolific Silver Valley. With over 7,000 acres of patented and unpatented land, the Company has the largest private land position in the area following its consolidation of the Murray Gold Belt for the first time in over 100-years.

In addition to gold and gold production, the Company maintains an important strategic presence in the U.S. Critical Minerals sector, specifically focused on the more "at-risk" Rare Earth Elements (REE's) and Thorium. The Company's Diamond Creek and Roberts REE properties are included the U.S. national REE inventory as listed in USGS, IGS and DOE publications. IDR's Lemhi Pass Thorium-REE Project is recognized by the USGS and IGS as containing the largest concentration of thorium resources in the country. All three projects are located in central Idaho and participating in the USGS Earth MRI program.

With an impressive mix of experience and dedication, the folks at IDR maintain a long-standing "We Live Here" approach to corporate culture, land management, and historic preservation. Furthermore, it is our belief that successful operations begin with the heightened responsibility that only local oversight and a community mindset can provide. Its "everyone goes home at night" policy would not be possible without the multi-generational base of local exploration, drilling, mining, milling, and business professionals that reside in and near the communities of the Silver Valley and North Idaho.

For more information on Idaho Strategic Resources click here for our corporate presentation, go to www.idahostrategic.com or call:

Travis Swallow, Investor Relations & Corporate Development

Email: [email protected]

Phone: (208) 625-9001

Forward Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Often, but not always, forward-looking information can be identified by forward-looking words such as "intends", "potential", "believe", "plans", "expects", "may", "goal', "assume", "estimate", "anticipate", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, assumptions, intentions, or statements about future events or performance. Forward-looking information includes, but are not limited to, Idaho Strategic Resources targeted production rates and results, the expected market prices of gold, individual rare earth elements, and/or thorium, as well as the related costs, expenses and capital expenditures, the potential advancement of the Company's projects, the potential development into the Paymaster and/or Joe Dandy shoots, the economics of the Paymaster and Joe Dandy shoots, the potential to mine two veins at the same time in the Paymaster/Joe Dandy, and the potential for the company to build and permit a new mill onsite in the Murray Gold Belt. Forward-looking information is based on the opinions and estimates of Idaho Strategic Resources as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of IDR to be materially different from those expressed or implied by such forward-looking information. The forward-looking statement information above, and those following are applicable to both this press release, as well as the links contained within this press release. With respect to the business of Idaho Strategic Resources, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreaks, if they occur, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic; interpretations or reinterpretations of geologic information; the accuracy of historic estimates; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms; the ability to operate the Company's projects; and risks associated with the mining industry such as economic factors (including future commodity prices, and energy prices), ground conditions, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Idaho Strategic Resources filings with the SEC on EDGAR. IDR does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

SOURCE: Idaho Strategic Resources, Inc.