VANCOUVER, BC / ACCESSWIRE / December 7, 2022 / Golden Spike Resources Corp. (CSE:GLDS) ("Golden Spike" or the "Company") is pleased to announce that it has added two key mineral licences to the existing Gregory River Copper-Gold property (the "Property"), located in Newfoundland and Labrador, bringing the overall land position to 3,425 hectares.

Highlights:

- Addition of two licences further consolidates Golden Spike's strategic land position over the Gregory River Volcanogenic Massive Sulphide ("VMS") belt.

- Numerous high-priority targets, including the Steep Brook and Lode 9 VMS prospects, and five, high-grade copper ±gold vein prospects added to the Property position.

- Existing Option Agreement is amended to include the two new licences and therefore no new payments are required to the vendor beyond the current Option Agreement.

Golden Spike's President and CEO, Keith Anderson commented,

"We are very excited to announce this important increase to our land position at our 100%-controlled Gregory River Property. These new licences remove two important gaps and further consolidate Golden Spike's land position in this very prospective VMS-belt. The ground covered by the new licences includes several historically explored VMS and vein-style prospects, which greatly enhance the Property's potential for new discoveries. Over the next several weeks the Company will further review the historical work completed over these licences and incorporate this ground into future exploration programs."

Amended Gregory River Copper-Gold Property Option Agreement

On December 6, 2022, the Company signed an amendment to the existing Option Agreement with the Optionors, whereby Golden Spike can acquire a 100%-interest in the Gregory River Copper-Gold Property (refer to September 20, 2022, press release, "Golden Spike Issues Shares Under Gregory River Option Agreement"), subject to a 2% net smelter returns royalty interest (the "NSR") of the Optionors calculated in accordance with the Option Agreement. At any time following the completion of the Option exercise, the Company will have the right to purchase one-half of the NSR from the Optionors for $1,500,000, leaving the Optionors with a 1% NSR. The amended agreement now includes two additional mineral licences (034159M, comprised of 5 claims covering 125 hectares, and 034158M, comprised of 8 claims covering 200 hectares), which bring the total land area of the Property to 3,425 hectares, covered by 17 mineral licences comprised of 137 map-staked claims ("the Amended Option Agreement") (Figure 1). All other terms of the Amended Option Agreement remain the same as original Option Agreement.

Figure 1: Gregory River Property land tenure, showing newly acquired licences and targets.

Overview of Gregory River Property and the New Licences

The Property is strategically centered over an approximate 11-kilometer-long stretch of the Gregory River VMS-belt, a north-northeast trending corridor of very prospective ground with potential to host "Cyprus-type"[1] polymetallic VMS deposits (Figure 1). In addition, the Property hosts a cluster of high-grade, copper ±gold vein structures that occur mainly in the northeast quadrant of the Property (the "Vein Zone"). The licences are well located in terms of infrastructure, just 42 km north-northwest of the city of Corner Brook, and 53 km west of the city of Deer Lake.

[1] Cyprus-type (also known as mafic-type) volcanogenic massive sulphide ("VMS") deposits are commonly polymetallic, copper-rich, stratabound mineral deposits, hosted by submarine mafic-volcanic rocks that form on, or near the seafloor at mid-ocean ridges and back-arc basins in an extensional tectonic regime.

The addition of the two licences removes some crucial gaps in the land position and adds significant mineral exploration potential to the Property, for both VMS- and vein-style copper and gold mineralization. Historically explored VMS prospects, Steep Brook and Lode 9 are both added to the Property, and in the north, five vein-style prospects, including Palmer, Hall, Lode 6, Lode 7, and Lode 2 are also added to the inventory. Some of the significant newly added prospects are briefly described below:

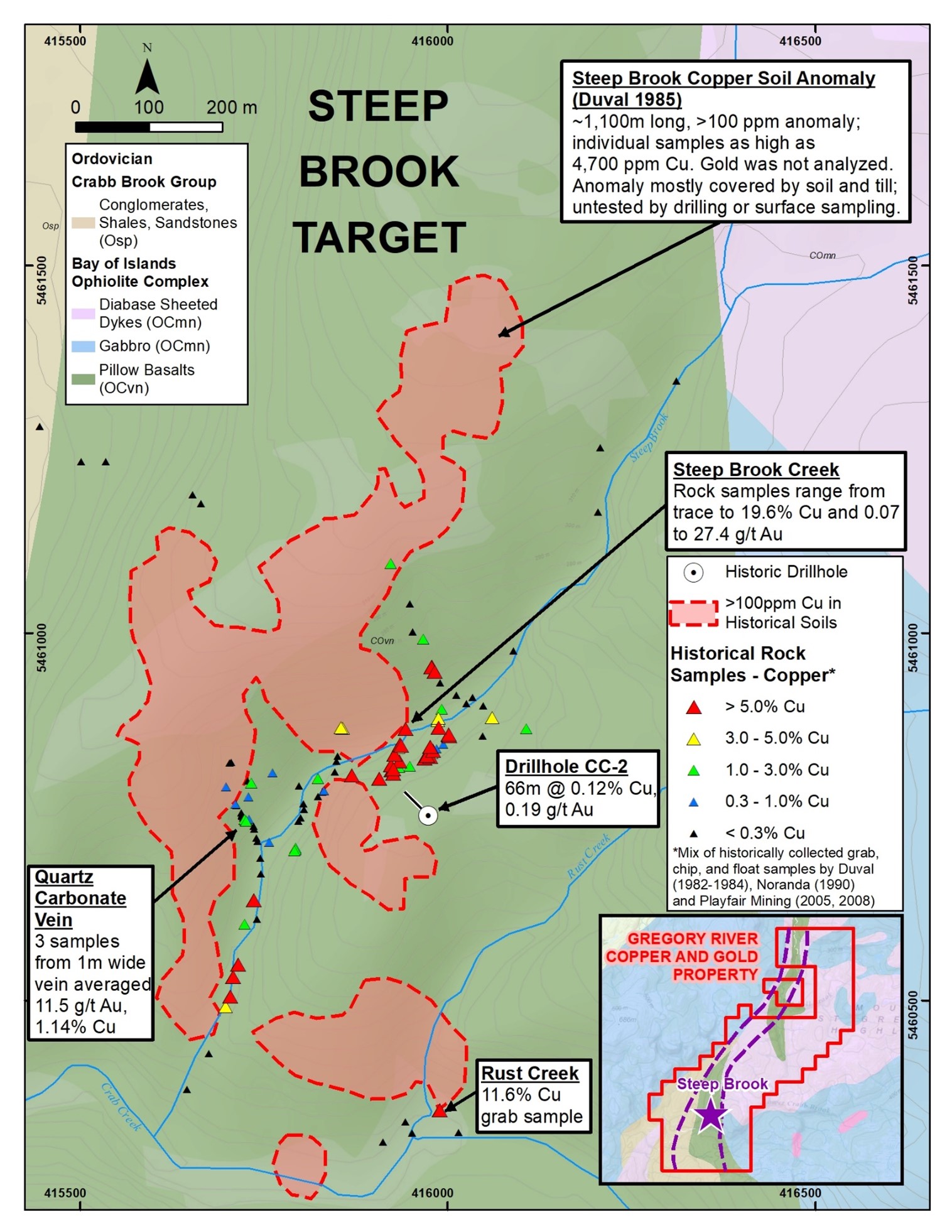

Steep Brook Prospect

Steep Brook is an early-stage prospect strategically located in the southern part of the Property (Figure 2) within the Gregory River VMS-belt and in proximity to the Gregory River Fault. The prospect area is underlain by mafic pillowed basalts of the Bay of Islands Complex and is considered to be in a very favourable environment to host Cyprus-type VMS deposits.

Historical exploration by Duval International (1982-1984), Noranda (1990) and Playfair Mining (2005, 2008), identified numerous outcrops intermittently exposed along a north-northeast trending creek bed over an approximate one-kilometre distance, many displaying widespread alteration (chloritization, silicification, carbonatization) and disseminated to semi-massive chalcopyrite and pyrite mineralization. A total of 122 historical float, grab and chip samples returned highly anomalous assays with 56 samples returning values greater than 1% copper. Sample results are in the following ranges:

- Copper: 0.01% to 19.6% (average 3.15%),

- Zinc: trace to 11.2% (average 0.21%),

- Gold: trace to 27.4 grams per tonne ("g/t") (average 1.0 g/t),

- Silver: trace to 20.9 g/t (average 4.4 g/t).

Duval's sampling included three rock chip samples collected from a one-metre-wide quartz-carbonate vein that returned an average grade of 11.5 g/t Au and 1.14% Cu indicating the potential for structurally controlled lode gold-copper mineralization.

Noranda completed a 1,000-metre by 1,500-metre grid of soil samples, which revealed a north-northeast trending, 1,100 metre-long, >100 parts per million ("ppm") copper soil anomaly, with grades as high as 4,700 ppm copper. Gold was not analysed for this survey. The majority of the soil anomaly occurs west of, and topographically higher than the mineralized outcrops in the creek bed, in an area with few outcrops that remains untested by surface trenching or drilling (Figure 2).

Figure 2: Steep Brook target area

Prior to completing their sampling program, Duval drilled core hole, CC-2 to 137 metres depth, however it was collared too far east to test the depth potential of either the copper soil anomaly or the anomalous surface rock samples. Even so, the hole intersected highly anomalous results including 66 m @ 0.12% copper and 0.19 g/t gold. No follow-up was ever completed over this target area.

Lode 9 Prospect

The Lode 9 Prospect occurs in the northern portion of the Property and similar to Steep Brook, is in a very favourable lithological and structural environment to host VMS-style mineralization. The area was explored by Noranda in 1991, who completed geological mapping, a soil survey, ground geophysics (magnetics, VLF, HLEM) and four wide-spaced diamond drill holes. The soil survey revealed a 1,200 metre long, north trending, >100 ppm copper soil trend with values as high as 1,000 ppm that remains open to the north. The survey was also assayed for zinc, with the resulting >100 ppm anomalies overlapping with many of the copper soil trends and with individual soil samples as high as 4,000 ppm zinc. Most of these soil anomalies remain untested by drilling.

In 1991 Noranda completed four wide spaced drill holes, one hole at Lode 9, two testing an EM anomaly 380 metres northwest of Lode 9 and one hole testing a narrow copper showing approximately 1,200 meters to the north of Lode 9. Significant assay results were returned from the hole at Lode 9, as follows:

- DDH G-91-2: 0.93% copper and 0.27 g/t gold over 20.2 m (from 38.0 to 58.2 m)

Including, 2.12% copper and 0.60 g/t gold over 7.2 m (51.0 to 58.2 m)

This target has never been followed up with additional drilling.

The drill results shown above for the Steep Brook and Lode 9 prospects are historical in nature, having been reported by previous exploration companies. A qualified person has not done sufficient work to verify or validate these analytical data, as the historic core is no longer available for sampling and therefore these results should not be relied upon. Insufficient drilling has been completed at the Steep Brook and Lode 9 prospects to determine the true widths of the intervals.

Palmer/Hall Veins

The Palmer and Hall veins are part of a cluster of at least eleven, high-grade copper ± gold vein prospects within a 3 by 2.3-kilometre, oval shaped target area (the "Vein Zone") in the northeastern part of the Property (Figure 1). Based on historical reports, the Palmer and Hall veins both average in the range 2% - 6% copper over widths averaging around 1.5 metres. These veins are among the initial copper vein discoveries in the district back in the 1920's. Palmer was explored through a 90-metre adit (no longer accessible) and several surface trenches, which reportedly traced the west-trending structure for about 150 meters. In addition, drill logs from 11 shallow underground and surface drill holes at Palmer and Hall from 1957-1958 provide an indication of the potential for additional chalcopyrite-pyrite mineralized vein structures that may occur adjacent to the known veins, however analytical results were not included in most of the historical drill logs available to the Company. Other known veins in the vicinity of Hall and Palmer veins include, Lode 2, Lode 6, and Lode 7, which have only seen limited surface sampling and have never been drill tested.

The QP has not yet visited all of the prospects, which are part of these new licences and thus cannot validate the historical databases, nor the results of the historical work presented, however, the QP will complete a site visit at the earliest opportunity. Historical surface sampling programs at many of the prospects was completed by several companies, including majors RioCanex (Rio Tinto) and Noranda, who both reported copper values in similar high-grade ranges to the earlier sampling programs, along with anomalous values of other metals, including gold. It is believed that these companies would have had sampling methodologies and quality control processes in place that were considered industry-standard for that time and therefore the QP feels that it is reasonable to report these surface and drill results as historical and to use them as a guide for future exploration at these prospects.

In the coming weeks the Company will continue to compile the historical exploration information from prospects located within these two new licences and use this data to develop and fine-tune our Phase 2 exploration program (refer to press release dated November 9, 2022, "Golden Spike Initiates Field Program Over Gregory River Property".)

Camping Lake Property

The Company has reviewed the results of the 2021 exploration program over the Camping Lake Property in the Red Lake Mining Division, Ontario, which comprised a grid of soil samples over the eastern portion of the property. In general, the analytical results for gold and other elements were low and only a few isolated anomalous soil results were returned. Based on this, and the Company's decision to focus future exploration efforts on the Gregory River Property, the Company has advised Northbound Capital Corp., the vendor of Camping Lake that it has terminated the option agreement.

Stock Option Grant

The Company's Board of Directors has approved the granting of an aggregate of 1,850,000 stock options to directors, officers and consultants of the Company exercisable at a price of $0.25 per common share for a period of five years from the date of grant. The grant is subject to the terms and conditions of the Company's existing stock option plan and is subject to the approval of the CSE and all regulatory requirements. All stock options granted are subject to a four-month statutory hold period.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved for disclosure by Mr. Robert Cinits, P.Geo, a director of the Company and a "Qualified Person" within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). To the best of his knowledge, the technical information pertaining to the Property and discussion of it as disclosed in this news release is neither inaccurate nor misleading; however, the technical information presented in this news release comprises paper records maintained by various companies that conducted exploration work on the Property. Details of the sampling methods, security, assaying, and quality control methods used in the generation of this historical technical data are unknown to the Company and the results discussed herein cannot be and have not been verified by Mr. Cinits for the purposes of National Instrument 43-101 and should not be relied upon.

About Golden Spike

Golden Spike Resources Corp. (CSE:GLDS) is a Canadian mineral exploration company focused on identifying, acquiring and unlocking value in mineral opportunities in Canada and other low-risk jurisdictions. The Company currently holds the rights to acquire 100% interest in the 3,425-hectare Gregory River Property in Newfoundland, strategically centered over an approximate 11-kilometer-long stretch of the Gregory River VMS-belt, a north-northeast trending corridor of very prospective ground with potential to host Cyprus-type polymetallic VMS deposits. In addition, the Property hosts a cluster of historically explored, high-grade, copper ±gold vein structures.

ON BEHALF OF THE BOARD OF DIRECTORS

Keith Anderson

Golden Spike Resources Corp.

830 - 1100 Melville St.,

Vancouver, BC, V6E 4A6

+1 (604) 786-7774

[email protected]

www.goldenspikeresources.com

"Neither the Canadian Securities Exchange (the "CSE") nor its Regulation Services Provider (as that term is defined in policies of the CSE) accepts responsibility for the adequacy or accuracy of this release."

Cautionary Note Regarding Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" occur. This information and these statements, referred to herein as "forward-looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding: the intention of the Company to proceed with the exercise of the Option under the Option Agreement on the terms and conditions set out therein, the Company's expectations to make the cash payment, issue the Subsequent Consideration Shares, and incur the expenditures as required by the Option Agreement, the Company's intention to perform the balance of its obligations under the Option Agreement, the anticipated content and timing of commencement of planned exploration programs, any anticipated exploration program results, the ability to complete future financings, the ability to complete the required permitting, the ability to complete the exploration programs and drilling, and the anticipated business plans and timing of future activities of the Company. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, assumptions that the Company will have the resources required to perform the balance of its obligations under the Option Agreement, that the Company's cost and timing expectations are accurate, that capital and financing will be available if and when needed and on reasonable terms, that general business and economic conditions will not change in a material adverse manner and that the Company and its operations will not be adversely impacted by COVID-19, or other potential pandemics, or the ongoing conflict in eastern Europe. Additionally, forward-looking information involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: the volatility of global capital markets, political instability, unanticipated costs, risks relating to the extent and duration of the conflict in Eastern Europe and its impact on global markets, the lack of availability of capital and financing, general economic, market or business conditions, adverse weather conditions, failure to maintain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), risk that future exploration results do not replicate historical results or that the Company is unable to identify new mineralized targets, increase in costs, litigation, failure of counterparties to perform their contractual obligations, and those risks, uncertainties and factors set forth in the Company's disclosure record under the Company's profile on SEDAR at www.sedar.com. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information contained herein. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement or forward-looking information disclosed herein, except in accordance with applicable securities laws.

SOURCE: Golden Spike Resources Corp.