ST. JOHN'S, NL / ACCESSWIRE / December 21, 2022 / Sokoman MineralsCorp. (TSXV:SIC)(OTCQB:SICNF) (the "Company" or "Sokoman") is pleased to provide the final results for all 1,260 C-Horizon tills taken on the Fleur de Lys project on the Baie Verte Peninsula, in north-central Newfoundland. The results confirm the potential of the Fleur de Lys Supergroup to host significant gold mineralization similar to deposits at advanced stages of development in both Northern Ireland and Scotland in the Dalradian Supergroup. The Fleur de Lys and the Dalradian Supergroups are believed to be equivalent sequences of metamorphic rocks spatially associated with major structural breaks.

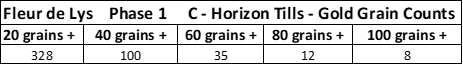

The background level of gold grains in tills for the Fleur de Lys Project (the "Project") has been determined to be 10 grains in a 10- to 12-kilogram sample of screened till. Ottawa-based Overburden Drilling Management (ODM), who is overseeing the Project, considers a sample to be anomalous if it contains two-times background or 20 gold grains. Results indicate that of the 1,260 samples, 328, or just over 25%, have at least 20 gold grains (to a maximum of 230 grains) and are considered anomalous. Fifty-five (55) samples contain at least 60 grains (six-times background) and a number with more than 50% pristine gold grains. Gold grains described as pristine are considered to be from a local bedrock source (less than 200 m transport).

In addition to the anomalous gold grains in tills, prospecting has also located anomalous gold in bedrock and float with 34 samples giving gold values >100 ppb Au (0.1 g/t Au), including 18 >500 ppb Au (0.5 g/t Au), and 10 >1000 ppb Au (>1.0 g/t Au) with a maximum of 4.6 g/t Au. The highest gold value was in outcrop in an area of strong gold-grain counts.

Tim Froude, President and CEO of Sokoman, commented: "We are extremely pleased with the success of the till program in outlining strongly-anomalous gold in tills overlying favourable rocks and structures that have given significant gold values in both float and bedrock. The property is ideally suited to cost-effective exploration with a supportive local population, operating mines, and support businesses. We are prioritizing the anomalies for continued follow-up prospecting, trenching, and or fast-tracking to the diamond drill stage. Planning will include a review of data by ODM with input from our field crews. A preliminary interpretation of the till results by ODM defines a target area of 30-km strike-length, within which better-defined anomalies are found."

The Fleur de Lys Supergroup, which underlies the Project, are equivalent rocks to the Dalradian Supergroup in the UK, where three significant gold deposits, including the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland are found. Dalradian-type gold deposits occur in moderate- to high-grade metamorphic terranes and are typically high grade (the Curraghinalt deposit has >6 million ounces of NI 43-101 compliant gold resources including 6.3 million tonnes at 14.95 grams per tonne (Measured and Indicated) for 3.06 million ounces; and 7.72 million tonnes at 12.24 grams per tonne gold (Inferred) for 3.03 million ounces {2018 Mineral Resource Statement, Curraghinalt Gold Project, Northern Ireland, SRK Consulting (Canada)}.

About the Fleur de Lys Gold Project

The 100%-owned Fleur de Lys Gold Project is located on the west side of the Baie Verte Peninsula in north-central Newfoundland. The Project is highly prospective for Dalradian-style (e.g., Curraghinalt) orogenic vein-hosted gold deposits and as such, represents a readily accessible yet underexplored, district-scale, gold target in the Newfoundland Appalachians. The property has seen little modern exploration, with some areas remaining completely unexplored although historical grab sample values of 3.3 g/t Au to 25.5 g/t Au are reported from several locations (note: historical assays have not been verified by the Company and should not be relied upon).

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Till Sampling QA/QC

The till samples were collected by Sokoman personnel using field collection techniques provided by ODM. All samples were hand dug to the desired depth (C-Horizon Till) with a 10- to 12-kg sieved sample (8 mesh) placed in a clear plastic sample bag and sealed. Samples were shipped in plastic pails by bonded courier to the ODM lab in Ottawa, Ontario. The till samples are processed using procedures designed to progressively concentrate the heavy minerals, expose the gold grains and prepare a split of the heavy mineral concentrate ("HMC") suitable for geochemical analysis if requested. The sample is wet screened at 2 mm with a preliminary concentrate extracted from the -2 mm fraction by tabling. Geological observations on the character of the sample are made during both the screening and tabling operations. The table concentrate is purposely large (typically 300-400 g) and of low grade (10%-25% heavy minerals) in order to achieve a high, 80% to 90% recovery rate for all desired heavy minerals irrespective of their grain size or relative specific gravity. The gold grains, more than 95% of which are normally silt-sized (Averill 2001), are observed at this stage with the aid of micro-panning and are counted, measured and classified as to degree of wear (ie distance of glacial transport), then returned to the table concentrate. The pyrite content of the pan concentrate is estimated and the number of grains of heavier, visually distinctive indicator minerals such as arsenopyrite, galena, scheelite, cinnabar, etc. is recorded.

Quality Control and Quality Assurance Measures

In addition to using field duplicates to monitor the quality of the indicator mineral data obtained from specific projects, ODM performs blind tests to ensure that the recovery rates for all targeted minerals are consistently in the 80% to 90% range. Furthermore, both the quality of the mineral separation and the overall mineralogy of the concentrate are visible at every stage of the concentration process, minimizing the potential for sample mix-ups, indicator mineral carryover between samples, and other potential contamination issues. For example, gold grains, which are the most important indicator mineral on many surveys, are more susceptible to inter-sample carryover than any other indicator mineral due to their very small size, but these grains are physically observed during the first stage of mineral concentration, tabling, and, if anomalous concentrations are present, blank samples are tabled and carefully inspected for gold grains before the next project sample is processed.

Rock Sample Analysis

Rock sample analysis (gold by fire assay) completed at Eastern Analytical Ltd., in Springdale NL. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Eastern routinely inserts industry accepted standards and blanks in all sample runs performed as well as completing random duplicate analysis.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in north-central Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims - 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada's newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby and/or referenced properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Fleur de Lys Project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: [email protected]

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: [email protected]

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: [email protected]

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOURCE: Sokoman Minerals Corp.