- Combined entity would create a mid tier market capitalization company once all assets are in operation

- Acquisition follows strong production growth at MDN and a very robust Feasibility Study at MDC expected by end of May

- Sprott Streaming and Royalty US$10 million Equalization Stream Financing Closed

TORONTO, ON / ACCESSWIRE / March 7, 2023 / Cerrado Gold Inc. [TSXV:CERT] [OTCQX:CRDOF] ("Cerrado" or the "Company") has entered into a definitive agreement (the "Arrangement Agreement") with Voyager Metals Inc. (TSXV: VONE) ("Voyager") pursuant to which Cerrado will acquire all of the issued and outstanding shares of Voyager (each, a "Voyager Share") not already owned by Cerrado by way of a plan of arrangement under Business Corporations Act (Ontario) (the "Arrangement"). Upon completion of the Arrangement, Cerrado will, indirectly through a wholly-owned subsidiary, own a 100% interest in the Mont Sorcier Iron and Vanadium project located near Chibougamou, Quebec ("Mont Sorcier").

Mont Sorcier is a well advanced, large, long-life and economically robust Project in a tier one mining jurisdiction. In September 2022, Voyager completed a Preliminary Economic Assessment (the "PEA") on Mont Sorcier, which outlined a project with an after-tax NPV of US$1.6 Billion and IRR of 43% producing 5.0MM tpa of iron concentrates over a mine life of 21 years with annual free cash flow of US$235 million. The project is currently advancing towards completion of a bankable Feasibility Study expected by the end of 2023.

Under the terms of the Arrangement Agreement, Voyager shareholders would receive one (1) common share of Cerrado ("Cerrado Share") for every six (6) common shares of Voyager (the "Exchange Ratio"). The Exchange Ratio implies consideration of C$0.1523 per Voyager Share (the "Transaction Price"), based on the 20 day volume weighted average price (‘VWAP") of the closing price of Cerrado common shares on the TSX Venture Exchange (the "TSXV") on March 3, 2023, representing a 16.8% premium to 20-day VWAP of Voyager on the TSXV on March 3, 2023. Upon closing, the Arrangement would result in Voyager shareholders owning approximately 18% of the Cerrado Shares outstanding upon closing of the Arrangement.

Holders of Voyager options will receive equivalent securities of Cerrado adjusted in accordance with the Exchange Ratio. Securityholders of Voyager are expected to receive an aggregate of approximately 15,496,022 Cerrado Shares and 1,266,666 Cerrado options. Outstanding Voyager warrants will remain outstanding and in accordance with their terms will be exercisable for up to 2,140,452 Cerrado Shares based on the Exchange Ratio following the closing of the Arrangement.

Transaction Rationale

- The Arrangement is expected to offer a number of significant benefits to Cerrado including:Attractive valuation for Cerrado to gain access to a robust, well defined, long-life project well known to the Cerrado operating team.

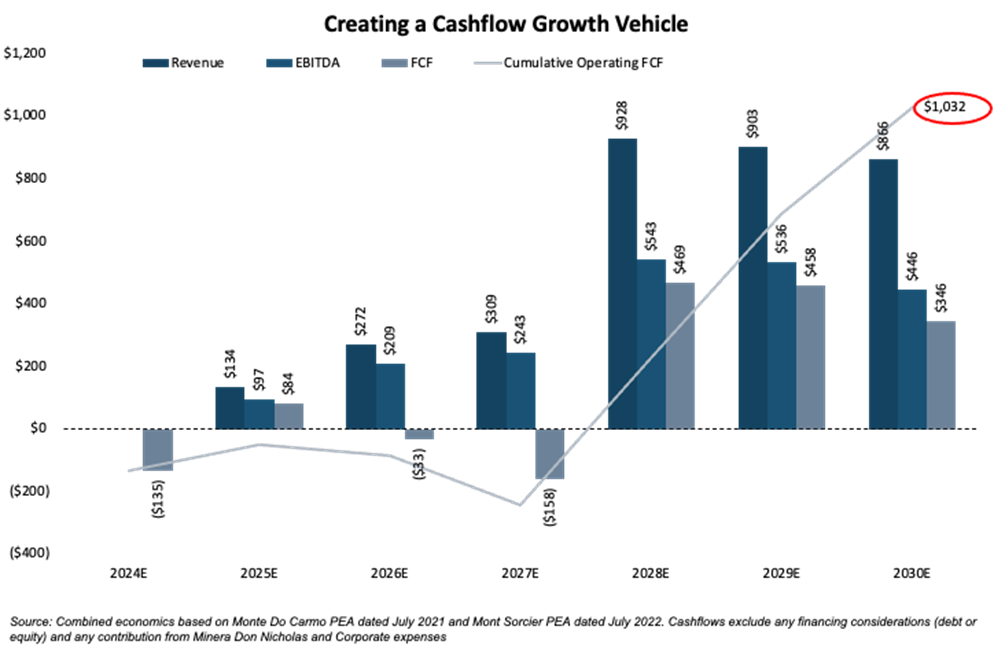

- Financing and cash flow synergies could reduce the dilution for project development and significantly reduce dilution for Cerrado's and Voyager's current respective shareholders. (See Figure 1. Below)

- Addition of a low cost, capital efficient and economically robust project to the portfolio in a low risk jurisdiction

- Mont Sorcier is expectd to generate in excess of US$235m per annum in free cash flow over its 21-year life, which is expected to begin production in 2028 (with the potential for expansion & extension).

- Mont Sorcie's PEA demonstrated anNPV of US$1.6B based on Indicated Resources only, representing 25% of total defined resource leaving room for optimization and expansion potential.

- Combined company would create a mid tier market capitalization once all assets are in operation.

For additional information please see Cerrado's corporate presentation on the company's website at

https://www.cerradogold.com/assets/Cerrado-Voyager.pdf

Figure 1. Pro forma Finacials for Operating Assets

In connection with the Arrangement, Cerrado has entered into a subscription agreement (the "Subscription Agreement") with Voyager pursuant to which Cerrado has agreed to subscribe for and purchase Voyager Shares at a price per Voyager Share equal to the Transaction Price, as part of a larger non-brokered private placement (the "Private Placement") of Voyager for gross proceeds of up to $4.725 million to be completed prior to the closing of the Arrangement. Assuming the Private Placement is fully subscribed, it is anticipated that Cerrado will subscribe for and purchase $3.7 million of Voyager Shares and will own approximately 19.9% of the issued and outstanding Voyager Shares (on a non-diluted basis) prior to the completion of the Arrangement. If the Private Placement is not fully subscribed, Cerrado will subscribe for no more than that numer of Voyager Shares as will result in Cerrado owning 19.9% of the outstanding Voyager Shares upon completion of the Private Placement and prior to completion of the Arrangement.

Mark Brennan, CEO & Co-Chairman of the Company, commented, "We continue to see strong production growth at our MDN operation and we are very confident in delivering a strong Feasibility Study by the end of May for MDC. The addition of the Mont Sorcier project represents a significant opportunity to increase Cerrado's long term cash generation, asset life and relevance to the mineral sector. Mont Sorcier is expected to be a very high margin, high return project similar to our very robust Monte Do Carmo project. In addition, we see tremendous synergies to reduce future equity requirements to develop the Company's assets and this will add significant value to all shareholders of the combined company."

He continued, "It is our belief that there is a clear path to develop a very significant market capitalized entity within a very modest timeframe, while limiting dilution to shareholders."

US$10 million Stream Financing Closed

The Company is also pleased to announced that has closed its previously announced Sprott Private Resources Streaming and Royalty Corp. $10 million Equation Stream Financing in connection with the amended and restated metals purchase and sale agreement announced on March 2, 2023.

Arrangement Summary

The Arrangement will be implemented by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario). At closing, existing Cerrado and Voyager shareholders will own approximately 82% and 18% of the combined company, respectively, on a fully-diluted basis. The combined company will continue trading under the name Cerrado Gold Inc. and the ticker symbol TSX.V:CERT.

All options and warrants of Voyager outstanding as at the effective date of the Arrangement will be exchanged for equivaluent securities of Cerrado, adjusted for the Exchange Ratio and in accordance with the Arrangement Agreement. Closing of the Arrangement, as contemplated by the Arrangement Agreement, is subject to the satisfaction of a number of conditions, including: the approval of the Voyager shareholders for the Arrangement at special meeting of Voyager shareholders (the "Voyager Meeting"), court approval, and the receipt of all applicable regulatory approvals (including the acceptance of the TSXV), and the satisfaction of certain other closing conditions customary in transactions of this nature. The Arrangement Agreement provides for termination rights, including in the event the Arrangement is not completed by July 30, 2023. There can be no assurance that the Arrangement or the Private Placement will be completed as proposed or at all.

Holders representing 28% of the issued and outstanding Voyager Shares and options as of the date of the Arrangement Agreement have entered into voting support agreements, pursuant to which they have agreed to vote their common shares and options held in favor of the Arrangement, subject to certain conditions.

Futher details regarding the terms of the Arrangement are set out in the Arrangement Agreement, a copy of which will be filed under each of Cerrado's and Voyager's SEDAR profiles at www.sedar .com. Additional information in respect of the Arrangement will be provided in the management information circular to be prepare by Voyager in connection with the Voyager Meeting which will be mailed to Voyager securityholders and also available on Voyager's website at www.voyagermetals.com And filed under Voyager's profile on SEDAR at www.sedar.com.

None of the securities to be issued by Cerrado pursuant to the Arrangement have been or will be registered under the United States Securities Act of 1933, as amended, or any state securities laws, and any securities issued pursuant to the Arrangement are anticipated to be issued in reliance upon available exemptions from such registration requirements. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Board Approvals and Recommendations

The entry into of the Arrangement Agreement and Subscription Agreement and the completion of the Arrangement and Private Placement have been unanimously approved by the members of the respective boards of directors of Cerrado and Voyager eligible to vote thereon.

In the case of Voyager, the board of directors approved the Arrangement and Private Placement upon receipt of the unanimous recommendation of a special committee composed exclusively of independent directors of Voyager (the "Special Committee"). In connection with the recommendation, Echelon Capital Markets provided an independent opinion to the Special Committee, stating that, and based upon and subject to the assumptions, limitations, and qualifications set forth therein, the consideration offered pursuant to the Arrangement is fair, from a financial point of view, to the Voyager shareholders.

Cerrado and Voyager are Non-Arm's Parties (as defined in the policies of the TSXV) as certain directors and officers of Cerrado occupy officers and/or director positions with Voyager. Such individuals, as a group, collectively hold 13.0% of the issued and outstanding Voyager Shares and options. Mr. Mark Brennan recused himself from voting in respect of the Arrangement, and the remaining arm's length directors of Cerrado unanimously approved the Arrangement.

About Voyager

Voyager is a mineral exploration company headquartered in Toronto, Canada. The Company is focused on advancing its Mont Sorcier, Vanadium-rich, Magnetite Iron Ore Project, located just outside of Chibougamau, Quebec.

Mont Sorcier currently has Indicated Resources of 679M tonnes grading 27.8% magnetite and 0.20% V2O5, with the potential to produce 195M tonnes of magnetite concentrate grading at least 65% Fe and 0.52% vanadium pentoxide (V2O5) and a further Inferred Resource estimated at 547M tonnes grading 26.1% magnetite and 0.17% V2O5, with the potential to produce 148M tonnes of magnetite concentrate grading at least 65% Fe and 0.52% vanadium pentoxide (V2O5).

The PEA in respect of the Mount Sorcier project dated effective September 8, 2022, entitled "NI 43-101 Technical Report - Preliminary Economic Assessment (PEA) for the Mont Sorcier Project - Quebec, Canada" was prepared by Simon Boudreau, P.Eng., Tim Fletcher, P.Eng., Daniel Gagnon, P.Eng., Mathieu Girard, P.Eng., Marina Iund, p.Geo. and Carl Pelletier, P.Geo., of DRA Americas Inc., InnovExplo Inc. and SOutex Inc. and is filed under Voyager's SEDAR profile at www.sedar.com. The PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and, as such, there is no certainty that the PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability as there is no certainty that all or any part of the resources will be converted into reserves. To the best of Cerrado's knowledge, information and believe, there is no new material scientific or technical information that would make the disclosure of the mineral resources, mineral reserves or results of this preliminary economic assessment inaccurate or misleading.

Qualified Person

The technical information contained in this news release with respect to the Mont Sorcier Project has been reviewed and approved on behalf of Voyager by Clinton Swemmer, who is a Qualified Person as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in NI 43-101.

For further information, please contact

Mark Brennan

CEO and Co Chairman

Tel: +1-647-796-0023

[email protected]

David Ball

Vice President, Corporate Development

Tel: +1-647-796-0068

[email protected]

About Cerrado

Cerrado is a Toronto based gold production, development and exploration company focused on gold projects in the Americas. The Company is the 100% owner of both the producing Minera Don Nicolás mine in Santa Cruz province, Argentina, and the highly prospective development project, Monte Do Carmo located in Tocantins State, Brazil.

At Minera Don Nicolas, Cerrado is maximising asset value through further operation optimization and continued production growth. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package.

At its Monte Do Carmo project ("Monte Do Carmo"), Cerrado is rapidly advancing the Serra Alta deposit through Feasibility and production. A preliminary economic assessment in respect of the Monte Do Carmo project entitled "Independent Technical Report - Update Preliminary Economic Assessment for Serra Alta Deposit, Monte do Carmo Project, Tocantins State, Brazil"dated September 30, 2021 with an effective date of July 21, 2021 was prepared by Porfirio Cabaleiro Rodriguez, FAIG, B. Terrence Hennessey, P. Geo., Fabio Valerio Xavier, MAIG, and Rooniel Hirose, MAIG, of GE21 LTDA (the "Monte Do Carmo PEA") and filed on SEDAR under Cerrado's issuer profile at www.SEDAR.com. The Serra Alta deposit demonstrated Indicated Resources of 541 kozs of contained gold and Inferred Resources of 780 kozs of contained gold. The Monte Do Carmo PEA demonstrates robust economics as well as the potential to be one of the industry's lowest cost producers. Cerrado also holds an extensive and highly prospective 82,542 ha land package at Monte Do Carmo.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Disclaimer

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to the potential market capitalization of the resulting issuer once all assets in operation, the attractive valuation of the acquisition, assumptions and estimates included in Voyager's PEA and potential synergies of Cerrado and Voyager. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.