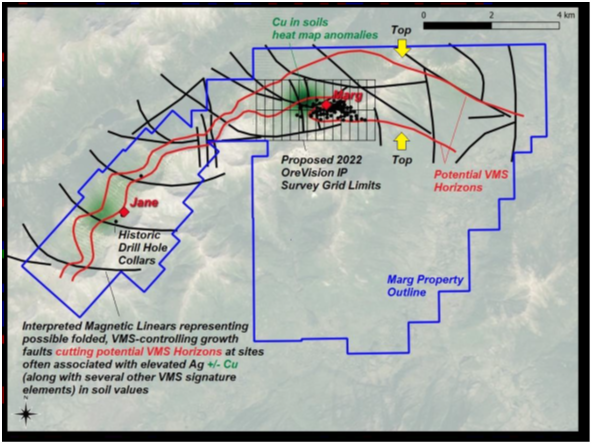

VANCOUVER, BC / ACCESSWIRE / May 23, 2023 / AZARGA METALS CORP. ("Azarga Metals" or the "Company") (TSX-V:AZR) is pleased to have received the final report on its induced polarization ("IP") survey at its high-grade copper-rich Volcanogenic Massive Sulphide ("VMS") Marg project (the "Marg Project"), located in the Keno Hill Silver District, Yukon Territory. The IP survey commenced in late 2022 (see news release dated November 24, 2022) and covered a significant portion of the known Marg VMS horizon, as well as an area immediately north of strong multi-element soil geochemical anomalies lying along an interpreted fold repetition of the Marg VMS horizon (Figure 1).

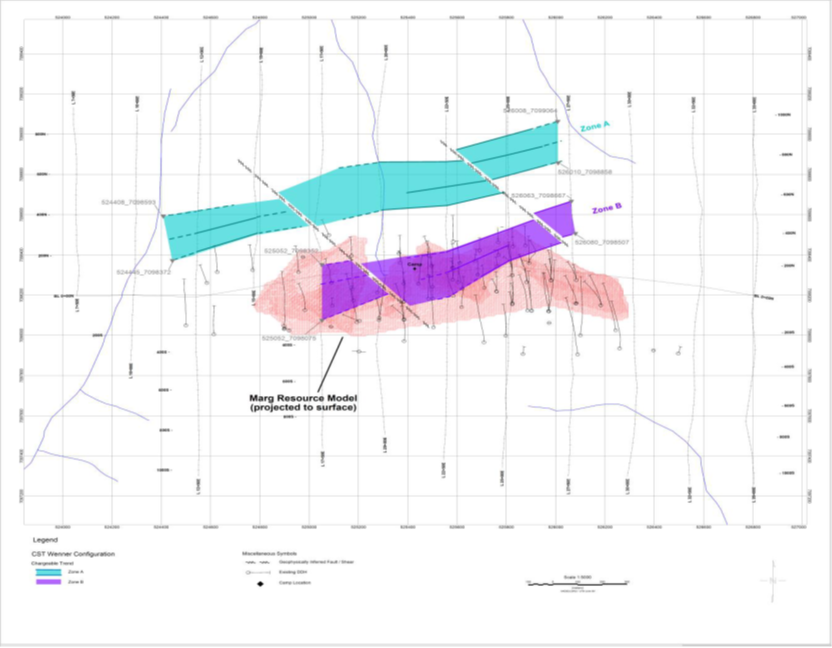

"The results of the IP work completed at Marg by Abitibi continues to suggest that significant exploration potential remains on the property," stated Gordon Tainton, President and CEO of Azarga Metals. "We are excited by the initial interpretation of ‘Zone A', which appears to represent a similar type of structure directly north of the historical resource estimate (Figure 2). Importantly, Zone A has never been drill tested. Our methodical, staged exploration approach of validating every parameter both geophysical and geological will allow us to plan our key drill targets as we continue to move the Marg Project forward."

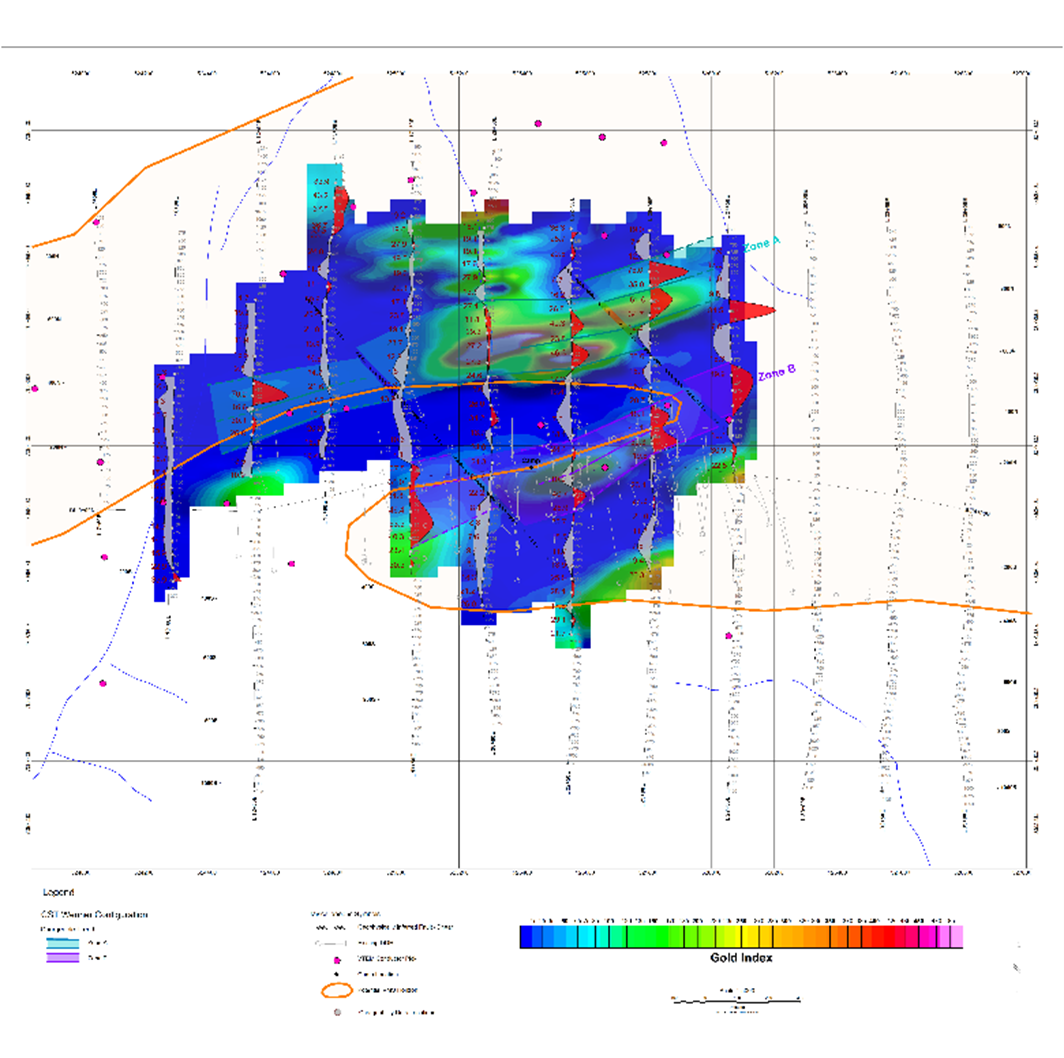

The IP survey was undertaken by Abitibi Geophysics Inc. ("Abitibi"), over, across, and along strike from the Marg deposit, with the goal of assisting to identify drill targets which could extend the known Marg mineralization or discover new zones of interest with similar signatures. The highest priority areas were covered by the IP survey; however, due to winter weather conditions, a minor number of peripheral lines had to be deferred until a later date. The IP survey data was acquired using a "sounding-style" Wenner array to identify resistive and chargeable features. Where chargeable zones with high resistivity coincide, the "Gold Index parameter" amplifies the response. In the IP survey, two such zones, both relatively continuous along strike, were identified, with Zone A lying to the north of Zone B (Figure 3). Zone A is interpreted as the probable "up-dip", near surface mineralized Marg horizon, and Zone B, an apparently sub-parallel horizon, is interpreted as a possible fold repeat of Zone A (and hence of the known Marg horizon), across a tight overturned fold, with both limbs dipping to the south and extending beyond the depth of investigation of the IP survey.

Extension of the IP survey with a deeper penetrating array during the summer months is recommended to test the continuation of chargeable Zones A and B.

ABOUT THE MARG PROJECT

The most recent NI 43-101 Mineral Resource estimate for the Marg Project (see Table 1 below) was completed by Mining Plus Canada Consulting Ltd. in 2016 and incorporated into a Preliminary Economic Assessment ("PEA") for the project (note: the PEA title is "Revere Development Corp, Marg Project Preliminary Economic Assessment, Technical Report, Yukon Canada" and is dated August 31, 2016).

The mineral resource estimate in the 2016 PEA was prepared in accordance with NI 43-101 standards and is considered by Azarga Metals management to have a high degree of reliability, however, the resource has not been verified by Azarga Metals and is considered historical in nature. A qualified person representing Azarga Metals has not done sufficient work to classify the historical estimate as a current mineral resource and Azarga Metals is not treating it as a current mineral resource.

Table 1 - August 31, 2016 Historical Resource estimate for the Marg Project at a 0.5% copper equivalent cut-off (combining high-grade and low-grade zones)1

| Category | Tonnage (mt) | Cu% | Pb% | Zn% | Ag g/t | Au g/t |

| Indicated | 3.7 | 1.5 | 2.0 | 3.8 | 48 | 0.76 |

| Inferred | 6.1 | 1.2 | 1.7 | 3.4 | 44 | 0.74 |

Note: 1. Where CuEq% was calculated = Cu% + 0.28 Pb% + 0.32 Zn% + 0.39 Au g/t + 0.0055 Ag g/t, which was assessed based on the following metal price and recovery assumptions: Cu price of 2.5 US$/lb and recovery of 80% (96.5% payable); Pb price of 0.8 US$/lb and recovery of 70% (95% payable); Zn price of 0.8 US$/lb and recovery of 90% (85% payable); Au price of 1100 US$/oz and recovery of 50% (90% payable); and Ag price of 16 US$/oz and recovery of 50% (90% payable).

Qualified Person

Charles J. Greig, P.Geo., a consultant to Azarga Metals and a Qualified Person as defined by NI 43-101, is relying on the Induced Polarization Survey, CTS Wenner Configuration, logistics and interpretation report prepared for Azarga Metals by Abitibi Geophysics Inc. dated February 2023 for certain disclosure regarding the geophysical interpretation and conclusions contained in this News Release.

About Azarga Metals Corp.

Azarga Metals is a mineral exploration and development company that owns 100% of the high-grade copper-rich VMS Marg project located in the Mayo Mining District in Central Yukon, approximately 40 kilometres east of Keno City and 465 kilometres by road north of Whitehorse.

AZARGA METALS CORP.

"Gordon Tainton"

Gordon Tainton,

President and Chief Executive Officer

For further information please contact Doris Meyer, at +1 604 536-2711 ext. 3, or Gordon Tainton, at + 1-604-248-8380 or visit www.azargametals.com or follow us on Twitter @AzargaMetals. The address of the head office of Azarga Metals is Unit 1 - 15782 Marine Drive, White Rock, BC V4B 1E6, British Columbia, Canada.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement:

This news release contains forward looking statements within the meaning of applicable securities laws. The use of any of the words "ambition", "estimate", "concluded", "offers", "objective", "may", "will", "should", "potential" and similar expressions are intended to identify forward looking statements, but not limited to, the Company's interpretation of the results of the IP survey for the Marg Project and the use of the results of the IP survey to identify drilling targets with high prospectivity with the goal to extend the known Marg mineralization to the north and west of the existing historical deposit and complete an extension of the IP survey with a deeper penetrating array during the summer months, subject to the Company having sufficient funds to complete additional exploration activities. Although the Company believes that the expectations and assumptions on which the forward looking statements are based are reasonable, undue reliance should not be placed on the forward looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with the state of equity financing markets and results of future exploration activities by the Company. Management has provided the above summary of risks and assumptions related to forward looking statements in this news release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward looking statements are made as of the date of this news release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward looking statements, whether as a result of new information, future events or results or otherwise.

SOURCE: Azarga Metals Corp.