Extensions to CD-240's 34.5m @ 5.3% CuEq Mapped via Mise-a-la-Masse Survey

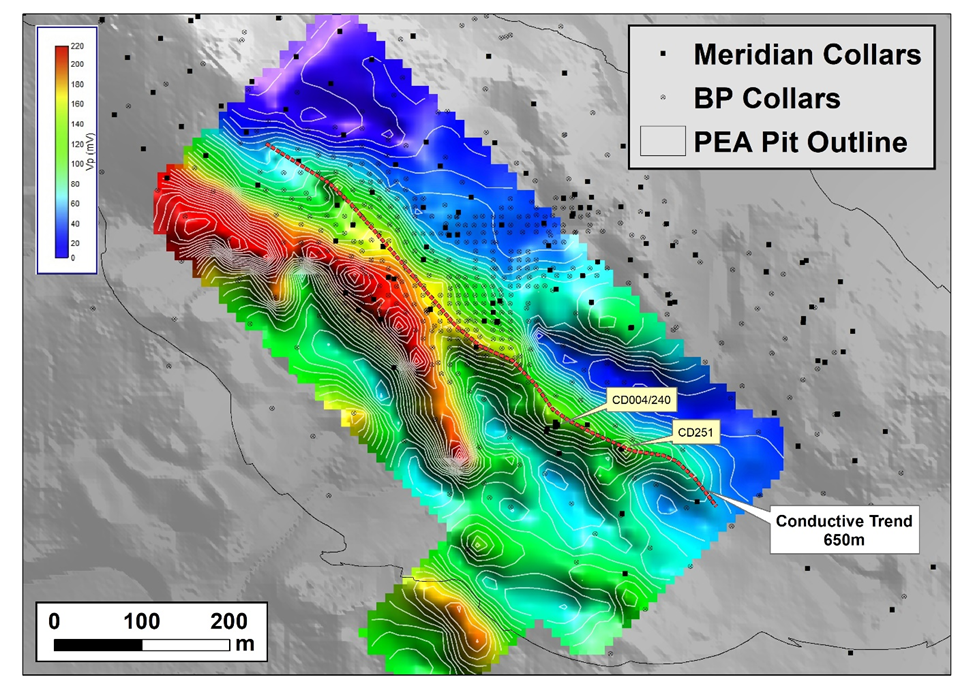

LONDON, UK / ACCESSWIRE / June 14, 2023 / Meridian Mining UK S (TSX:MNO)(OTCQX:MRRDF)(Frankfurt/Tradegate:2MM) ("Meridian" or the "Company") is pleased to provide an update on its geophysical program at Cabaçal, with a Mise-a-la-Masse survey (the "Survey") completed to assist follow-up targeting of the Cabaçal copper feeder zone intersected in CD-2401. The Survey has defined a conductive trend over a 650m strike length, projecting out from the CD-240 position that returned 34.5m @ 5.3% CuEq / 7.9g/t AuEq (4.0% Cu, 1.7g/t Au & 22.4g/t Ag) from 125.35m. CD-240 represents the Company's best copper intersection to date at Cabaçal (Figure 1). This now defined trend will be targeted as part of the Cabaçal infill and extensional drilling program.

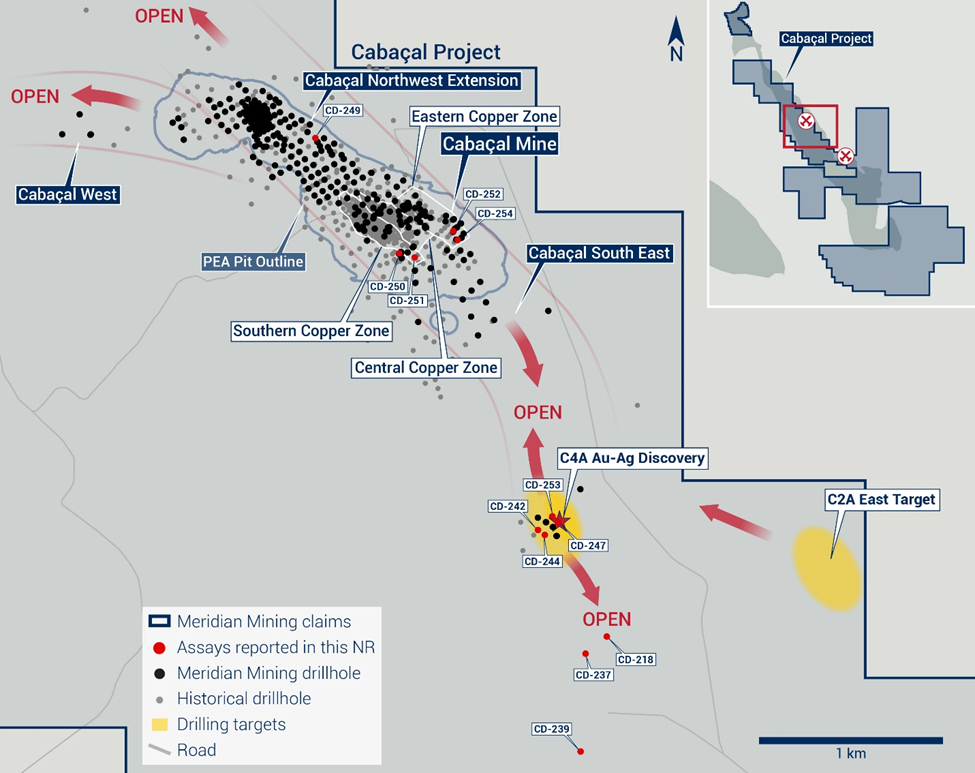

The Company is also reporting that CD-254 has intercepted a strong shallow copper-gold zone in the Eastern Copper Zone ("ECZ") including 4.2m @ 3.5% CuEq / 5.3g/t AuEq (3.0% Cu, 0.8g/t Au, 15.2g/t Ag) from 63.4m. This is part of a previously reported trend of strong copper-gold mineralization along the length of the Cabaçal deposit. The ECZ will now also be surveyed via the Mise-a-la-Masse technique to generate the outline of this extensive and shallow mineralization trend for subsequent testing by the current drill program. Further results are pending.

Highlights Reported Today

- Mise-a-la-Masse survey maps 650m corridor over Cabaçal's copper feeder zone;

- Mise-a-la-Masse survey defines drill targets for northwest/southeast extensions to CD-240;

- Southeastern extension of Cabaçal copper feeder zone sparsely covered by drilling;

- CD-254 returns 17.7m @ 1.6% CuEq / 2.4g/t AuEq (1.3% Cu, 0.4g/t Au & 6.8g/t Ag) from 50.0m, including:

- 5.0m @ 1.9% Cu, 0.6g/t Au & 9.8g/t Ag from 50.5m;

- 4.2m @ 3.0% Cu, 0.8g/t Au & 15.2g/t Ag from 63.4m;

- Additional strong copper-gold mineralization continues to be reported; and

- Third drill rig now on site with fourth rig due in July to accelerate Cabaçal mine and belt program.

Dr. Adrian McArthur, CEO, comments: "The Company is very pleased with the results of the new geophysical techniques applied over the Cabaçal mine area. The Mise-a-la-Masse survey technique was selected for definition of the CD-240 sulphide trend, as it applies a direct current to the sulphide body and assists in projecting the extensions of the more immediately connected sulphide mass. Results have been extremely positive, highlighting a northwest/southeast conductive trend over a 650m strike length, with subsidiary peak responses presenting numerous targets along the trend for further drilling. The strong copper-gold mineralization in CD-254, one of many shallow intercepts along the ECZ, will now be surveyed via Mise-a-la-Masse to map extensions northwest of its position and also its largely open trend to the southeast. We now have three rigs operating on site, with a fourth expected in July. Further assay results will be reported over summer and autumn, as we continue to target the strong upside of the Cabaçal deposit, and the belt-scale upside, commencing at Santa Helena."

[1] See Meridian news release of March 27, 2023.

SCZ Copper Sulphide Feeder System

The CD-240 high-grade feeder intersection of 34.5m @ 5.3% CuEq / 7.9g/t AuEq from 125.35m emphasised the presence of massive to breccia sulphide mineralization in the Cabaçal mineral system that was under-represented in Meridian's previous drill campaigns. The Company has undertaken a Mise-a-la-Masse ("MALM") survey in CD-240 and adjacent drill platforms, to better define the associated sulphide body and its extensions. The survey was designed by Meridian's geophysical consultancy, Core Geophysics, and executed by the Company's dedicated in-house survey team.

The MALM survey method maps surface potentials (or voltages) associated with resistivity contrasts intrinsically linked with geology. Sulphide bodies are particularly amenable to the technique due to their conductivity contrast against more resistive host rocks. The survey was concluded in late May, and results recently processed and interpreted. Three drill hole survey platforms were selected, since the measured response in a conventional survey naturally weakens radially away from the transmitter, assuming no changes in conductivity. A stronger response detected with increasing distance from the transmitter may be due to higher conductivity (potentially reflecting thicker sulphide zones, more massive sulphide, a greater abundance of chalcopyrite - the more conductive sulphide phase - or sulphide present at shallower depths). The MALM survey measured the surface potentials generated from the three down-hole electrodes over an area of 300 x 700m. The technique highlights the zone of more connected sulphides as a voltage "high" (warm colours in gridded image, Figure 1). Note that away from the main zone, polarity is reversed, and satellite conductors are shown as "lows" (blue colours in gridded image), and satellite resistors has "highs".

The results from the first phase of the survey, in CD-240 itself, highlighted the presence of a corridor with a >125mV anomaly associated with the sulphide mineralization, extending over 120m. The anomaly directly over the drill site was 140mV, with the response increasing to the southeast, with three sub-peaks in the contoured data at 155mV. The anomaly persisted along strike to the northwest, dropping to 110mV, before rising again to 140mV on the northern lines, when it was decided to select a separate drill hole as a new survey platform, CD-004.

CD-004 was drilled in the initial stages of the resource program, and intersected 10.2m @ 5.7% CuEq / 8.5g/t AuEq (4.9% Cu, 1.1g/t Au, 20.4g/t Ag) from 152.0m. The hole was directed into the basal contact zone, drilled to the northwest, ~ 60m along strike from CD-240. The survey results showed the continuing northwest projection of the trend, peaking at 170mV, 120-165m along strike from CD-240. CD-098 was drilled near this position but was an angled hole and would not have intersected the position of the anomaly in plan-view. The survey grid was extended some distance to the northwest. The axis of the CD-240 sulphide trend could be continually detected in gridded and contoured data, although further survey platforms will be required to better map anomaly thresholds given the increasing distance.

CD-251 was drilled to provide a survey platform to the southeast. The hole was drilled vertically and lifted to 81 degrees which consequently offset it from the anomaly position. CD-251 intersected 31.5m @ 1.0g/t AuEq (0.5% Cu, 0.3g/t Au & 2.9g/t Ag) from 117.2m, including a basal zone of 5.1m @ 3.4g/t AuEq / 2.3% CuEq (1.8% Cu, 0.7g/t Au, 13.8g/t Ag & 1.6% Zn) from 143.2m. The trend of the sulphide response continues to the southeast, with peaks of 80mV. Although lower in threshold, the change in response may represent a local transition in the sulphide assemblage, with zinc becoming more abundant at this point (almost equalling copper content in the basal sulphide zone).

Together, the combined results of the three surveys are interpreted by the Company's consultancy to indicate a sulphide body or structure with a relatively long strike length (approximately 650m) striking northwest to southeast. Variability of the response may reflect some periodicity in the mineralization (swelling or stepping of the position). The Cabaçal stringer sulphide system up-dip is expressed as a broader zone of conductivity in the northeast sector of the survey corridor. To the southwest, a resistive corridor is present which corresponds to a bedded cherty sediment. This is flanked further to the southwest by more chargeable trends, which will require further investigation as to whether they represent stratigraphic positions, or separate rift- related sulphide targets satellite to the main system. The 1990 Mason and Kerr study hypothesised that more zinc- dominant components of the system might be expected lateral to the copper-dominant core of the Cabaçal system.

The projection of the main 650m conductive trend is consistent with historical reports that additional high-grade copper zones were encountered along strike from the CD-240 intersection, including:

- JUSPD482: 13.4m @ 5.5% Cu, 1.3g/t Au & 24.7g/t Ag; and

- CAIK211: 29.3m @ 6.0% Cu, 3.1g/t Au & 28.8g/t Ag.

Original data for these holes have been lost. Programs will continue to test for these positions. Some areas remain difficult to access beneath multiple room and pillar workings. One of the three rigs will continue to test grade distribution in the vicinity of the underground workings (where one of the PEA starter pits is projected for development), whilst other drilling will continue to infill and extend the broader deposit. Various holes are strategically placed to gather geotechnical data to update the pit design, which previously relied on conservative assumptions for pit-wall angles.

Drilling Results

Further results have been reported from the Company's drilling programs in the Cabaçal mine area, and the C2A target region. Positive results have been returned in the ECZ and its extensions in the CNWE, where drilling in the shallow up-dip sector of the deposit has returned strong Cu-Au-Ag mineralization. Highlights include:

CD-254 (ECZ): 17.7m @ 2.4g/t AuEq / 1.6% CuEq (1.3% Cu, 0.4g/t Au, 6.8g/t Ag) from 50.0m, including:

- 5.0m @ 3.4g/t AuEq / 2.3% CuEq (1.9% Cu, 0.6g/t Au & 9.8g/t Ag) from 50.5m;

- 4.2m @ 5.3g/t AuEq / 3.5% CuEq (3.0% Cu, 0.8g/t Au & 15.2g/t Ag) from 63.4m; and

CD-249 (CNWE): 13.9m @ 1.3% CuEq / 2.0g/t AuEq (1.1% Cu, 0.4g/t Au & 1.9g/t Ag) from 36.2m, including:

- 6.6m @ 3.7 g/t AuEq / 2.5% CuEq (2.1% Cu, 0.7g/t Au & 3.6g/t Ag) from 42.4m.

Results from the ECZ and the up-dip sector of the CNWE represent part of the Company's program to extend drilling into areas where the resource is inferred to unclassified, or the Company feels the grade may be under-represented. Some of the drilling extends mineralization further into the area of the shallow gabbro sill. Following the positive results in conductivity mapping from the SCZ, the Company will extend the MALM into this area to better map the zones of enriched copper. The high grades encountered in CD-254 may indicate that copper is enriched in this structural / intrusive pinch-out position.

CD-251 was drilled to provide an additional geophysical platform in the SCZ. The hole lifted slightly off the trend of the conductor, but still shows increased concentrations of Cu-Zn sulphides compared to surrounding holes.

A number of results have been returned from exploratory holes into the C2A target region in the first quarter. The Au-Ag target area continues to show promise, with highlights including:

- CD-244: 25.4m @ 0.6g/t Au & 1.0g/t Ag from 45.0m; Including:

- 10.8m @ 1.3g/t Au & 1.1g/t Ag from 45.0m; and

- CD-247: 14.2m @ 1.1g/t Au & 1.6g/t Ag from 22.9m; 5.3m @ 0.9g/t Au & 33.5g/t Ag from 49.3m.

Reconnaissance drilling in other satellite IP / geochemical targets all returned early indications of sulphide mineralization (Table 1; Figure 2). The Company is purchasing a Geonics down-hole probe to supplement its geophysical exploration targeting, with some of these targets showing mixed Cu-Zn-Ag assemblages. The Company is also progressing with a regional gravity survey to provide an additional targeting parameter in structural interpretation for the gold overprint event. Regional exploration drilling will recommence with the arrival of a fourth rig to initially target Santa Helena. The Company continues to work with landholders and statutory authorities to formalize access over additional regional targets.

Table 1: Drilling results

About Meridian

Meridian Mining UK S is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- Regional scale exploration of the Cabaçal VMS belt;

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil); and

- Exploring the Espigão polymetallic project in the State of Rondônia, Brazil.

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage sub-vertical gold overprint event has emplaced high-grade gold mineralization cross-cutting the dipping VMS layers.

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade), including a higher-grade near-surface zone supporting a starter pit.

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the first five years, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.1:1, and the low operating cost environment of Brazil (see press release dated March 6, 2023).

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianminig.co and under the Company's profile on SEDAR at www.sedar.com.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO and Director

Meridian Mining UK S

Email: [email protected]

Ph: +1 (778) 715-6410 (PST)

Technical Notes

Samples have been analysed at the accredited ALS laboratory in Lima, Peru, and SGS laboratory in Belo Horizonte. Samples at ALS are dried, crushed with 70% passing <2mm, split off to give a mass of approximately 250g, and pulverized to >85% passing 200#. Routine gold analyses have been conducted by Au-AA23 (fire assay of a 30g charge with AAS finish). High-grade samples (>10g/t Au) are repeated with a gravimetric finish (Au-GRA21). Samples with visible gold identified during logging are analysed by screen fire assay method Au-SCR21. Samples at SGS are dried, crushed with 75% passing <3 mm, split to give a mass of 250-300g, pulverized with 95% passing 150#. Gold analyses are conducted by FAA505 (fire assay of a 50g charge), and base metal analysis by methods ICP40B and ICP40B_S (four acid digest with ICP-OES finish). Visible gold intervals are sampled by metallic screen fire assay method MET150-FAASCR. Samples are held in the Company's secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps are retained for umpire testwork, and ultimately returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by Rocklabs, ITAK and OREAS, supplementing laboratory quality control procedures. In BPM sampling, gold was analysed historically by fire assay and base metals by three acid digest and ICP finish at the Nomos laboratory in Rio de Janeiro. Silver was analysed by aqua regia digest with an atomic absorption finish. True width is considered to be 80-90% of intersection width. Assay figures and intervals are rounded to 1 decimal place. Gold equivalents are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), where:

• Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

• Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

• Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield

The Mise-a-la-Masse survey is being conducted using the Company's in-house team, utilizing its GDD GRx8‐16c receiver and 5000W‐2400‐15A transmitter. Data is processed by the Company's independent consultancy Core Geophysics. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person

Dr. Adrian McArthur, B.Sc. Hons, Ph.D. FAusIMM., CEO and Director of Meridian as well as a Qualified Person as defined by National Instrument 43-101, has reviewed and verified the technical information in this news release.

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

SOURCE: Meridian Mining UK S