VANCOUVER, BC / ACCESSWIRE / June 20, 2023 / Blackwolf Copper and Gold Ltd. ("Blackwolf", or the "Company") (TSXV:BWCG)(OTC:BWCGF) is pleased to announce the appointment of Robert McLeod as Executive Chairman and Morgan Lekstrom as CEO and Director. Concurrently, Blackwolf also announces it has entered a non-binding letter of intent (the "LOI") for a proposed transaction whereby Blackwolf will acquire all the issued and outstanding shares of Optimum Ventures Ltd. ("Optimum") (TSXV: OPV). The LOI contemplates that the shareholders of Optimum will receive 0.65 of a Blackwolf common share for each Optimum common share held, which will result in the Optimum shareholders collectively owning approximately 26% of the resultant company's outstanding common shares (on a non-diluted basis and prior to any issuances of securities by either company prior to closing). Following the successful closing of this transaction, Andrew Bowering will be appointed to the board of Directors of Blackwolf.

Robert McLeod, as Executive Chairman, will be responsible for guiding the board, directing exploration programs, co-developing the strategic direction and working closely with the incoming CEO on transformational growth opportunities. Alongside Rob, Morgan Lekstrom will start immediately as CEO and Director of Blackwolf. Blackwolf's board believes that the skill set combination of Rob and Morgan will create synergies leading to near term significant growth catalysts for the Company and shareholders.

Executive Chairman, Rob McLeod commented, "As Blackwolf enters an accelerated growth period with significant investments from Frank Giustra coupled with the addition of mining executive Andrew Bowering to the board and significant shareholder upon closing, we have significantly expanded our expertise in engineering, marketing and corporate development. I have known Morgan for many years and watched him grow into a mining leader that I believe will be a strong part of fostering significant growth for Blackwolf. We believe Blackwolf is exceptionally well positioned to "Lead the pack" in the Golden Triangle with the right team and strong investor base. With two great projects in Alaska, and Optimum's property in BC on trend from our Cantoo Project and located next to the high-grade Premier Mine that is currently in development, this is an exciting time as we kick off our inaugural drill program at the Cantoo gold-silver Project in the coming month. We are also forward planning for Optimum's Harry Project with drilling envisioned to start later in the 2023 season. Finally, Morgan's strategic thinking and industry experience will help enhance and create long term shareholder value through value added acquisitions like this one. Blackwolf is now well positioned to foster significant growth for years to come."

Andy Bowering with Optimum commented, "Rob McLeod and I first started working together in the Golden Triangle in 1995, when he was a junior geologist with Homestake Mining and I managed Investor Relations for Teuton Resources. I look forward to working with him again, with young, enthusiastic CEO Morgan Lekstrom and mining entrepreneur and major shareholder Frank Giustra in our combined Company."

Morgan Lekstrom, CEO commented, "I am honored to have the opportunity to work alongside Rob McLeod and upon completion of the of proposed transaction, Andy Bowering. Blackwolf is positioned for an accelerated growth period. With major gold-silver discovery potential at Cantoo and drilling starting shortly combined with Niblack's significant resources and expansion potential underpinning our valuation and the proposed acquisition of Optimum and its Harry Project, this will prove to be an exciting year. Blackwolf's multi-company MOU that studies potential production modelling from Niblack is also unique and highly compelling as it integrates a strong engineering approach as well as exploration. I believe Cantoo is the most exciting drill target in the Golden Triangle, an area Rob knows very well. I am looking forward to getting boots on the ground with the team on all sites and collaboratively driving the Company's vision forward."

Morgan Lekstrom, CEO and Director

Mr. Lekstrom has 17 years of mining and industry experience in progressively senior roles from executive management, project management, operations, and engineering management. Most recently he was CEO of Tearlach Resources, a lithium company he helped grow from grassroots into a multi asset company which included, building a world class team, and, within a month having exploration success via the drill bit on their Gabriel project which he negotiated and structured the joint venture in Nevada. Prior to Tearlach he was President & CEO of Silver Hammer Mining Corp. and a co-founder of a publicly traded uranium company. Mr. Lekstrom has an established track record of delivering successes across numerous projects, capital raises and defining of strategic direction for multiple companies. He had senior technical roles at Freeport McMoran's Grasberg site in Indonesia and Rio Tinto's Oyu Tolgoi Project in Mongolia, and he co-led the design, construction and commissioning of a new steel grinding media plant for Arrium (Moly-corp) in Canada and Peru. He played an integral role in the development and revival of Golden Star Resources' Prestea underground mine in Ghana, West Africa. He has also branched out into supply chain infrastructure development, including construction, commissioning, development of asset strategies, and engineering at the Port of Vancouver's largest grain Terminal, G3 Terminal Vancouver. He served as engineering manager at Sabina Gold and Silver Marine Laydown and Back River project, where he was responsible for the first phases of execution at the Back River Marine Laydown Project, leading the project from the office and on the ground.

Terms of the Proposed Optimum Ventures Transaction

Pursuant to the proposed transaction, Blackwolf will acquire all the issued and outstanding securities of Optimum pursuant to a Plan of Arrangement or another structure to be determined following advice from Blackwolf's and Optimum's respective legal and tax advisors. Shareholders of Optimum will receive 0.65 of a Blackwolf common share for each Optimum common share held, each warrant to purchase Optimum common shares will be converted into a warrant to purchase common shares of Blackwolf on the basis of the same exchange ratio and the Optimum stock options will be cancelled. Each of Optimum's directors and officers and certain other significant Optimum shareholders, collectively holding in aggregate at least 30% of the outstanding shares of Optimum, are expected to enter into voting support agreements in favour of the proposed transaction. On completion of the proposed transaction, the composition of the board of directors of the resulting company will consist of six, five of which will be current members of the board of directors of Blackwolf or chosen by Blackwolf and one will be Andrew Bowering, the nominee of Optimum.

The LOI provides for a binding exclusivity period whereby each party agrees to negotiate exclusively with each other, with a view to completing due diligence and negotiating and settling a definitive agreement.

The LOI does not obligate the parties to enter into a definitive agreement or proceed with the proposed transaction. There can be no assurance that the proposed transaction will be completed on the proposed terms or at all. The completion of the proposed transaction is subject to a number of conditions precedent, including: (i) satisfactory due diligence review, (ii) negotiation and execution of a definitive agreement respecting the proposed transaction; (iii) approval by the boards of directors of each of Blackwolf and Optimum, (iv) approval of the shareholders of Optimum at a special meeting of the shareholders of Optimum; (v) court approval of the Plan of Arrangement, and (vi) obtaining necessary third party approvals, including TSX Venture Exchange acceptance.

Optimum is a Canadian based mineral exploration company actively seeking opportunities in the resource sector. Its properties and projects are all located in the "Golden Triangle" area of northern British Columbia into Alaska. Optimum has an option agreement with Teuton Resources Corp. pursuant to which Teuton has agreed to grant to Optimum the option to acquire an up to 80-per-cent interest in the Harry and Outland Silver Bar properties, located near Stewart, B.C.

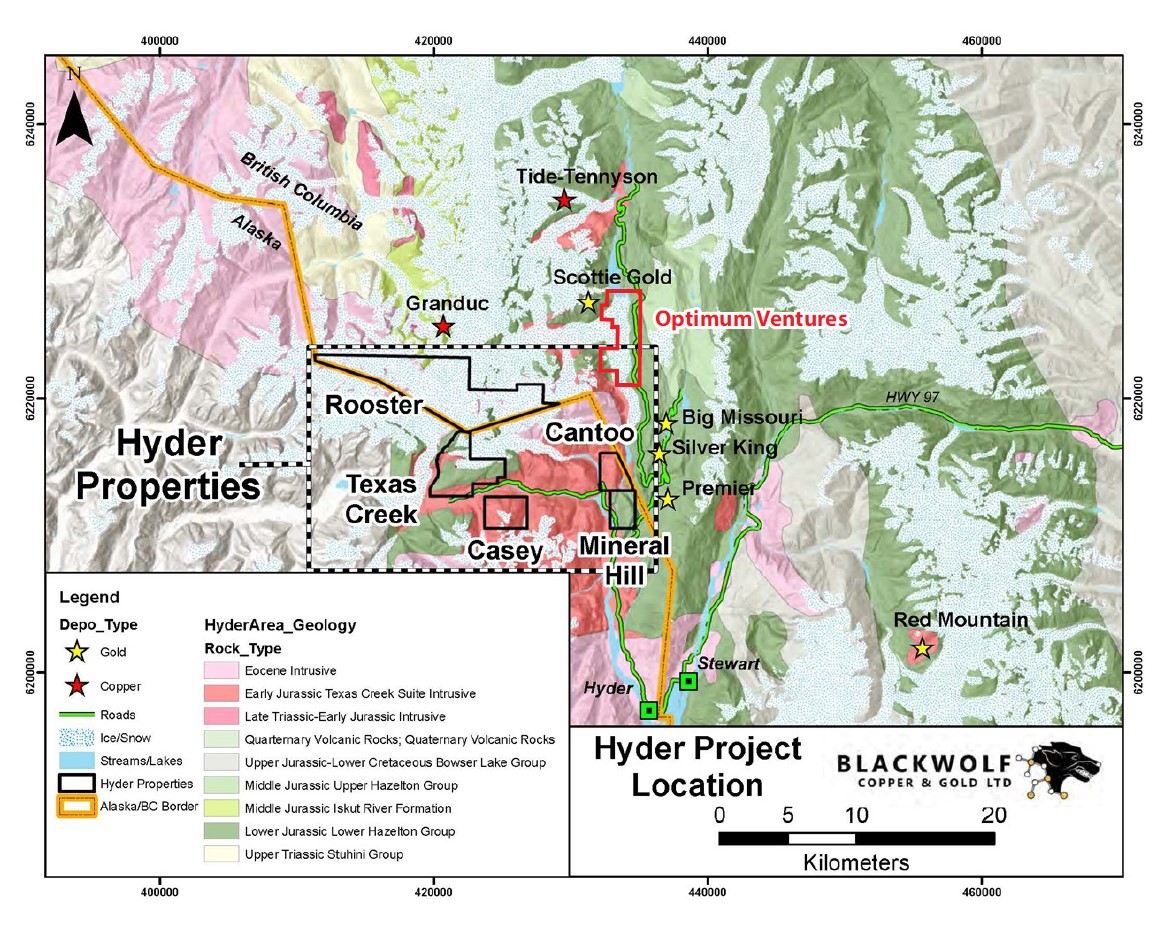

Figure 1: Map of area and proposed transaction

Qualified Persons

Andrew Hamilton, P.Geo, Consultant for the Company, is the Company's Qualified Person, as defined by the National Instrument 43-101, has reviewed and approved the scientific and technical content of this release.

About Blackwolf Copper and Gold

Blackwolf's founding vision is to be an industry leader in transparency, inclusion and innovation. Guided by our Vision and through collaboration with local and Indigenous communities and stakeholders, Blackwolf builds shareholder value through our technical expertise in mineral exploration, engineering and permitting. The Company holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater in southeast Alaska as well as five Hyder Area gold-silver and VMS properties in southeast Alaska and northwest British Columbia in the Golden Triangle, including the high-priority wide gold-silver veins at the Cantoo Property. For more information on Blackwolf, please visit the Company's website at www.blackwolfcopperandgold.com.

On behalf of the Board of Directors

"Robert McLeod"

Robert McLeod

Executive Chairman

"Morgan Lekstrom"

Morgan Lekstrom

CEO and Director

For more information, contact:

Rob McLeod | Morgan Lekstrom |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding the terms upon which the proposed transaction will be completed; that the proposed transaction will be completed on the proposed terms or at all; the negotiation and execution of a definitive agreement; directors and officers and certain other significant Optimum shareholders entering into voting support agreements in favour of the proposed transaction; the composition of the board of directors of the resulting company following completion of the proposed transaction. These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, the failure of the parties completing satisfactory due diligence review during the exclusivity period, or at all; the failure of the parties to negotiate and execute the definitive agreement during the exclusivity period or at all; the proposed transaction not closing when planned or at all or on terms and conditions different than those set forth in the LOI; the failure to obtain the necessary corporate, shareholder, court, regulatory and other third party approvals, including TSX Venture Exchange acceptance; the benefits of the proposed transaction not being realized; market volatility; the state of the financial markets for the Company's securities; and changes in the Company's business plans. In making the forward-looking statements in this news release, the Company has applied several material assumptions that the Company believes are reasonable, including without limitation, the timing and completion of satisfactory due diligence review; the timing and ability to negotiate the definitive agreement; the ability of the parties to receive, in a timely manner, the necessary corporate, shareholder, court, regulatory and other third party approvals, including TSX Venture Exchange acceptance; and the ability of the parties to satisfy, in a timely manner, the other conditions to the closing of the proposed transaction. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. The Company seeks safe harbor.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com

SOURCE: Blackwolf Copper and Gold Ltd