VANCOUVER, BC / ACCESSWIRE / January 24, 2024 / 1Minerals Corp (1Minerals), a dynamic leader in the lithium mining industry, is proud to announce that it has secured North America's largest grassroots lithium portfolio. This significant achievement strengthens 1Minerals leadership in the lithium sector, reinforcing its commitment to advancing the global clean energy transition and securing critical Canadian and North American lithium reserves for the future.

A Transformative Moment in Lithium Exploration

1Minerals extensive lithium portfolio, covering over 820,000 hectares (2 million acres) across more than 100 projects in the lithium-rich James Bay region, Nunavik, and the Northshore of Quebec, represents a transformative moment in lithium exploration. This move highlights the unparalleled value and potential of these projects.

1Minerals Portfolio Highlights

- Over 100 lithium projects at varying stages of exploration and development.

- Over 2,500 untested pegmatites, offering extraordinary potential for multiple significant discoveries.

- Strategic locations near established lithium deposits and critical infrastructure.

- Prime positioning in Quebec, a recognized safe and secure mining jurisdiction with abundant high-grade lithium reserves.

Quebec: The Lithium Hub of North America

Quebec, Canada, has emerged as the epicenter of North America's lithium revolution, boasting some of the highest-grade and purest lithium reserves globally. The province offers a secure and safe mining jurisdiction with a strong commitment to sustainable mining practices.

Unlocking New Lithium Discoveries in Canada

1Minerals has reinforced its leadership in the lithium industry and demonstrated significant potential in exploration. The company's recent partnership with Brunswick Exploration (TSX.V: BRW) on the Mirage Lithium Project, a notable new discovery in North America, exemplifies this. Spanning 427 claims and covering 21,230 hectares, the Mirage Project is strategically located about 40 kilometers south of the Trans-Taiga Highway in Quebec's James Bay region. This significant discovery highlights the vast, yet untapped potential of 1Minerals comprehensive lithium portfolio.

For further details, including the full press release and transaction particulars, please refer to the provided link below.

Read more: https://brwexplo.ca/news- 2023/brunswick-exploration-announces-update-at- mirage-project-quebec/

Valuation Comparison and Market Position

Various factors determine the value of lithium exploration companies in today's market. However, the industry's average price per hectare for lithium assets typically starts at $250 CAD. Using this conservative benchmark of $250 CAD per hectare, the 1Minerals portfolio is estimated to be worth $205 million CAD. This valuation not only highlights the considerable value of our lithium assets but also places us in a competitive position within the market.

Global Comparisons: Brunswick Mirage Lithium Project and Allkem (Arcadium) Mt Cattlin Lithium Mine

The strategic partnership between Brunswick Exploration and the discovery of the Mirage Lithium Project underscores the expansive potential within 1Minerals' portfolio. Drawing geological parallels to the acclaimed Mt Cattlin lithium mine in Australia with abundant spodumene dyke swarms, the Mirage Project stands on the brink of becoming a globally significant lithium discovery. Previously, Mt Cattlin was a pivotal asset under Allkem (ASX:ALK), which has recently united with Livent to form Arcadium Lithium (NYSE: ALTM) (Mkt cap $5.92 billion USD), marking a significant leap in the lithium sector. Brunswick Exploration's market capitalization of approximately $104.8 million CAD further underlines the significant value and potential of lithium mining projects like Mirage. Brunswick Exploration's efforts in lithium discovery are making significant strides, potentially uncovering lithium reserves worth billions, which could rival industry giants.

Brunswick Exploration's valuation appears modest when considering the vast potential of their land holdings and the promising results from the Mirage Project. The company's current market value may not fully reflect the extensive lithium reserves they are poised to tap into, which could be transformative for their financial outlook and industry standing. This juxtaposition of current valuation against resource potential positions Brunswick as a noteworthy player in the market with significant room for growth. For further details, including a recent press release, please refer to the provided link below.

Notable Lithium Exploration Companies in Quebec

- Patriot Battery Metals Inc.: Patriot Battery Metals Inc. (Market Cap $900 million CAD) is a hard-rock lithium exploration company focused on advancing its district scale 100% owned Corvette Property located in the Eeyou Istchee James Bay region of Quebec, Canada. The Corvette Property hosts the CV5 Spodumene Pegmatite with a maiden inferred mineral resource estimate of 109.2 Mt at 1.42% Li 2 O and 160 ppm Ta 2 O 5 (at a cut-off of 0.40% Li 2 O) and ranks as the largest lithium pegmatite resource in the Americas based on contained LCE, and one of the top 10 largest lithium pegmatite resources in the world. The Corvette project signifies Quebec's untapped potential, with vast, underexplored territories suggesting more significant lithium reserves awaiting discovery.

- Sayona Mining Ltd.: Operating the North American Lithium project, with a market capitalization of approximately $430 million AUD, Sayona Mining's projects form the most extensive spodumene resource base on the continent.

- Winsome Resources: Developing the Adina lithium project, Winsome Resources, with a market capitalization of approximately $110.68 million AUD, is actively exploring significant lithium mineralization, contributing to Quebec's dynamic and competitive lithium exploration landscape.

Meeting the Soaring Demand for Lithium

As the world accelerates its transition to clean energy solutions, the demand for lithium has surged. Lithium-ion batteries have become the preferred energy storage solution for various applications, including electric vehicles (EVs), renewable energy storage, and consumer electronics. Major automakers such as Tesla, Ford, General Motors, Honda and Volkswagen are investing billions to electrify their fleets, emphasizing the critical role of lithium in this transition.

Quebec's Lithium Boom: Major Investments by Rio Tinto, Ford, and Tesla Signal Shift in EV Supply Chain

Rio Tinto's Investment in Quebec Lithium Exploration

Rio Tinto (RTEC) has committed to a significant $65 million investment in lithium exploration in Quebec's James Bay region. This venture targets over 1,000 square kilometers across ten properties, positioning Rio Tinto at the forefront of lithium exploration in an area rich with potential. This strategic move allows Rio Tinto to acquire up to a 70% interest over ten years through staged investments, underscoring its commitment to advancing the lithium sector in Quebec and contributing to the global shift towards clean energy solutions.

Ford and SK On's Cathode Manufacturing Plant

Ford, in collaboration with SK On and EcoProBM, is investing $1.2 billion CAD to build a cathode manufacturing facility in Bécancour, Quebec. This facility, Ford's first investment in Quebec, will produce materials for Ford's future electric vehicles and is expected to start production in the first half of 2026. The plant aims to produce 45,000 tons of cathode active materials annually and will create approximately 345 new jobs. This investment is supported by $644 million CAD from the Canadian and provincial governments.

Ford's Lithium Purchase Agreement

Ford has also entered into a purchase agreement with Nemaska Lithium for lithium, which is crucial for its EV batteries. This agreement highlights Ford's commitment to securing essential materials for EV production and underlines the strategic importance of Quebec's lithium resources.

Tesla's Potential Investment in Quebec

Tesla is in discussions with the Quebec government about potentially investing in battery production in the province. Quebec's rich deposits of lithium, nickel, and graphite make it an attractive location for Tesla's battery production needs. These talks are part of Tesla's strategy to secure critical resources for its expanding EV production line. Tesla has previously shown indirect interest in Quebec's lithium resources through its deal with Piedmont Lithium, which sources lithium from Sayona Mining in Quebec's Abitibi region.

Securing National Resources within Canada

1Minerals Corp proudly possesses North America's most extensive lithium portfolio, playing a crucial role in safeguarding the nation's critical mineral supply. This strategic endeavor enhances national security and accelerates the transition to clean energy, aligning with paramount objectives.

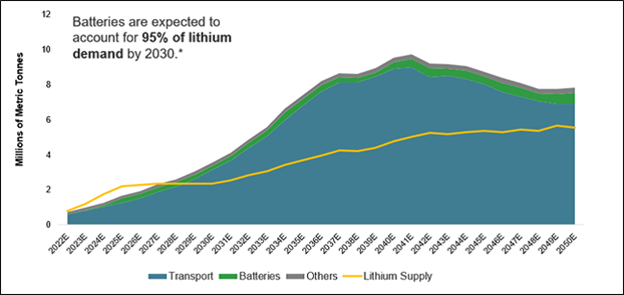

Growth in EV Adoption Expected to Continue and Lithium Supply Unlikely to Keep Up with Demand (2022E-2050E)

According to the Special Report on Electric Vehicles and the Growing Opportunity for Lithium Miners, published by Sprott Asset management on August 23, 2023:

"Growth in EV Adoption Expected to Continue: Electric vehicles (EVs) are poised to play a pivotal role in the coming decades as nations intensify their decarbonization efforts. With 97 countries, responsible for approximately 79% of worldwide emissions, committing to achieve net-zero emissions, the momentum behind EV adoption is gaining strength. By the end of 2022, the global EV fleet had surged to over 26 million units, marking a 60% growth from 2021 and quintupling the figures from 2018. China emerged as the leader in global EV sales, contributing to 59% of the market in 2022, with around 679,000 EVs exported from China the previous year." Source: https://sprott.com/insights/special-report-electric-vehicles-and-the-growing-opportunity-for-lithium-miners/?alttemplate=printblogarticle

Source: BloombergNEF Transition Metals Outlook 2023. Data as of 6/30/2023. Figures are for lithium carbonate equivalent. *McKinsey & Company. Lithium Mining: How New Production Technologies Could Fuel the Global EV Revolution, April 12, 2022. Included for illustrative purposes only. Past performance is no guarantee of future results.

About 1Minerals Corp

1Minerals Corp, a privately held Canadian entity, holds one of the largest grassroots lithium portfolios in the world, particularly in Quebec, Canada. The company is dedicated to driving the global shift towards clean energy solutions and securing critical minerals in North America. 1Minerals Corp not only focuses on lithium but also extends its expertise to Manganese, Graphite, Copper, Rare Earth, and other minerals. 1Minerals has a comprehensive portfolio, encompassing a wealth of mineral properties, primed for acquisition, exploration, and development. We are committed to partnering with companies that share our vision in resource development, underscoring our role as a leading player in the mineral resources sector. For further details and opportunities for collaboration, please feel free to contact us.

A Message from the CEO

"At 1Minerals, our vision extends beyond the immediate horizon of the current lithium market. We recognize the unfolding global energy transition as an unprecedented shift, one that presents opportunities far greater than the challenges. Our focus is not tethered to today's lithium prices or market dynamics. Given the nascent stage of the lithium industry and its critical role in the clean energy transition, prioritizing short-term fluctuations would not only be short-sighted but also overlook the broader, strategic significance of securing essential minerals for Canada and North America. Our investment is in the future - a future powered by sustainable and renewable energy sources. With 1Minerals' lithium portfolio being the largest in North America and among the largest globally, we are uniquely positioned to support and propel this energy transition, meeting the demands of tomorrow with the resources of today."

Yours Sincerely,

Matt Fraser

CEO

ON BEHALF OF THE BOARD

Media Contact:

Matt Fraser, CEO

[email protected]

1minerals.com

For more information, please visit our website 1minerals.com or contact Matt Fraser [email protected]

Cautionary Statement on Forward-Looking Information

This press release contains forward-looking statements and information within the meaning of applicable securities laws (collectively, "forward-looking information"), which reflect the current expectations and projections of 1Minerals Corp ("1Minerals") about its future results, performance, prospects, and opportunities. Forward-looking information includes, but is not limited to, statements regarding 1Minerals' exploration and development plans, the potential of its lithium portfolio, its role in the global clean energy transition, and the anticipated demand and market position of lithium and related products.

Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond 1Minerals' control, that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. These risks and uncertainties include, but are not limited to, the factors described under the heading "Risk Factors" in 1Minerals' most recent regulatory filings, and include the impact of global economic conditions, the volatility of lithium prices, changes in demand for electric vehicles and battery storage solutions, regulatory changes affecting the mining and metals industry, operational challenges, and environmental and climate-related risks.

All forward-looking information in this press release speaks only as of the date of this press release. 1Minerals does not undertake to update any such forward-looking information whether as a result of new information, future events, or otherwise, except as required by law. Readers are cautioned not to put undue reliance on forward-looking information. The forward-looking information contained in this press release is expressly qualified by this cautionary statement.

SOURCE: 1Minerals corp.