VANCOUVER, BC / ACCESSWIRE / July 15, 2024 / Arras Minerals Corp. (TSX-V:ARK) ("Arras" or "the Company") is pleased to announce that it has commenced a 100-hole, 5,000-metre KGK drill program to explore a 6.5 km x 2.1 km buried chargeability anomaly identified by a Soviet era Induced Polarization("IP") survey on Arras's 100% owned Tay exploration License.

Highlights from the KGK drilling program:

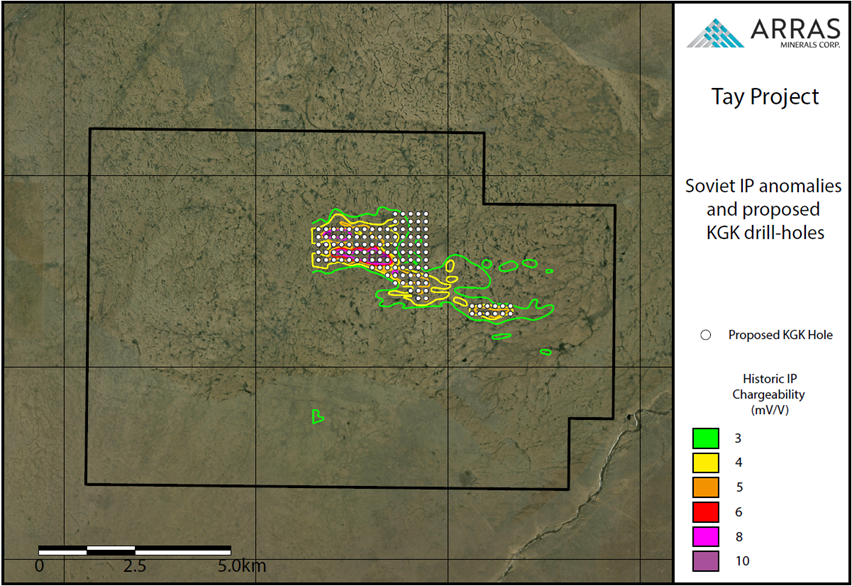

A 100-hole KGK drilling program, totaling approximately 5,000 metres, is planned, targeting the large, buried 6.5 km x 2.1 km East-West trending coherent Soviet-era IP chargeability anomaly comparable to the chargeability high of the Bozshakol open pit copper-gold mine which was completed during the same era.

The purpose of the KGK program is to sample the top of bed rock through the overburden to assess the geology and the cause for the chargeability high on the Tay License. Should the KGK drilling confirm the presence of a buried hydrothermal system or porphyry style alteration, the program will be followed up with a diamond drill program expected later in the year.

The Tay Licence is located 28 km north of Kaz Mineral's Bozshakol mine, a significant copper-gold operation with over one billion tonnes of reserves, producing over 100,000 tonnes of copper annually.

For more details on the Tay chargeability anomaly, please see Arras's news release from February 28, 2024, located at the following link: https://www.arrasminerals.com/february-28-2024

Tim Barry, CEO of Arras Minerals, stated, "We are excited to commence the exploration program at our Tay License. This marks the first modern exploration effort on the site, with no documented drilling to date. Our focus is on the large Soviet-era chargeability anomaly, which is analogous to a Soviet IP anomaly over the Bozshakol deposit, a billion-tonne copper-gold mine located 26 km south. Our team is actively exploring across our tenement package, and this initial program at Tay aims to test the bedrock buried beneath unconsolidated cover. The Tay prospect exemplifies the excellent exploration potential in Kazakhstan, where we have been able to acquire, permit, and now drill in just a few months. This further highlights the outstanding support that mining and exploration companies receive from government agencies in this modern and dynamic country."

Figure 1. Tay exploration license with historical Soviet IP Chargeability Anomaly compared to Bozshakol current and planned pit limits.

Figure 2. The Tay project, showing proposed KGK holes and Soviet IP anomalies.

Figure 3. KGK Drill Rig setting up for the first drill hole at the Tay project

Figure 4. KGK Drill Rig and drill camp

KGK Drilling Program

KGK drilling, also known as "hydraulic-core lift drilling", is a system designed to drill holes for geochemical sampling and geological mapping of basement rocks buried by younger surface cover. Developed in the Soviet Union, this method is similar to "wet" reverse circulation (RC) drilling.

The drilling is carried out by Spetsburmash LLC, based in Kokshetau, Akmola Region, Kazakhstan. They have two URB-2A2-KGK-100 KGK drill rigs on site, and the program is expected to be completed by mid-August.

The Tay Project

The Tay project spans 118 square kilometers in northeastern Kazakhstan within the Bozshakol-Chingiz magmatic arc, an under-explored and emerging porphyry province. It is situated 28 km north of the Bozshakol open-pit copper-gold mine operated by Kaz Minerals. The geology of the area is dominated by volcano-sedimentary and sedimentary rocks, intersected by several major fault zones and intruded by a series of intrusive stocks.

A regional Soviet-era geophysical survey identified a 6.5 km by 2.1 km east-west trending IP chargeability anomaly, comparable in size to the anomaly over the operating Bozshakol copper-gold mine. No historical drilling has been conducted on the property. The Company believes this anomaly could be related to a porphyry intrusion that is covered by 10 to 40 meters of Quaternary cover.

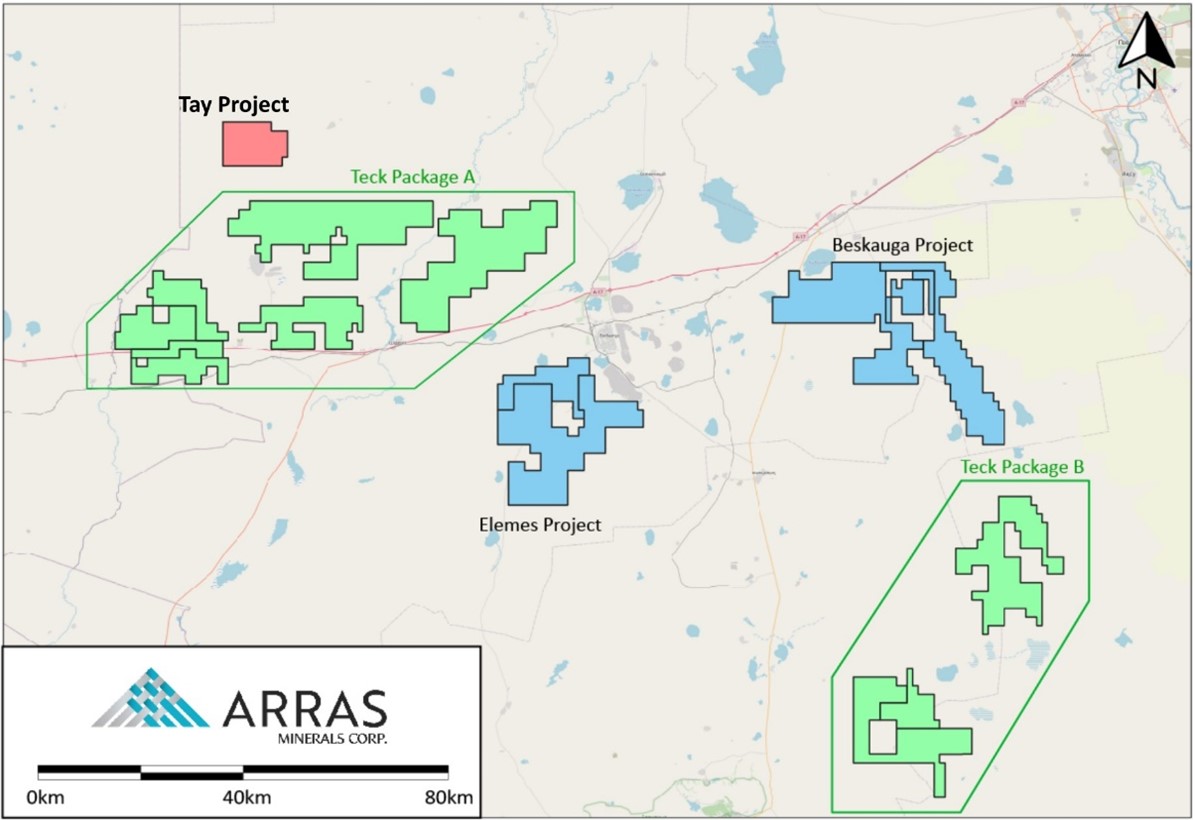

Figure 5. Arras's License Package showing Arras-Teck Strategic Alliance Areas as "Package A" and "Package B" as well as the Elemes Project, Tay Project and Beskauga Project (including adjoining Stepnoe and Ekidos licenses) all of which are 100% owned by Arras.

Qualified Person: The scientific and technical disclosure for this news release has been prepared under supervision of and approved by Matthew Booth, Vice President of Exploration, of Arras Minerals Corp., a Qualified Person for the purposes of NI 43-101. Mr. Booth has over 19 years of mineral exploration experience and is a Qualified Person member of the American Institute of Professional Geologists (CPG 12044).

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, MAusIMM CP(Geo)

Chief Executive Officer and Director

INVESTOR RELATIONS:

+1 604 687 5800

[email protected]

Further information can be found on the Company's website https://www.arrasminerals.com or follow us on LinkedIn: https://www.linkedin.com/company/arrasminerals or on Twitter: https://twitter.com/arrasminerals

About Arras Minerals Corp.

Arras is a Canadian exploration and development company advancing a portfolio of copper and gold assets in northeastern Kazakhstan, including the Option Agreement on the Beskauga copper and gold project. The Company has established the third-largest license package in the country prospective for copper and gold (behind Rio Tinto and Fortescue). In December 2023, the Company entered into a strategic alliance with Teck Resources ("Teck") in which Teck will sole fund a US$5 million generative exploration program over a portion of the Arras license package in 2024-2025 focusing on critical minerals. The Company's shares are listed on the TSX-V under the trading symbol "ARK".

Cautionary Note to U.S. Investors concerning estimates of Measured, Indicated, and Inferred Resources: This press release uses the terms "measured resources", "indicated resources", and "inferred resources" which are defined in, and required to be disclosed by, NI 43-101. The Company advises U.S. investors that these terms are not recognized by the SEC. The estimation of measured, indicated and inferred resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that measured and indicated mineral resources will be converted into reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. U.S. investors are cautioned not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies.

Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations, however the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, the information contained in this press release may not be comparable to similar information made public by U.S. companies that are not subject NI 43-101.

Cautionary note regarding forward-looking statements: This news release contains forward-looking statements regarding future events and Arras' future results that are subject to the safe harbors created under the U.S. Private Securities Litigation Reform Act of 1995, the Securities Act of 1933, as amended, and the Exchange Act, and applicable Canadian securities laws. Forward-looking statements include, among others, statements regarding plans and expectations of the exploration program Arras is in the process of undertaking, including the expansion of the Mineral Resource, and other aspects of the Mineral Resource estimates for the Beskauga project. These statements are based on current expectations, estimates, forecasts, and projections about Arras' exploration projects, the industry in which Arras operates and the beliefs and assumptions of Arras' management. Words such as "expects," "anticipates," "targets," "goals," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "may," variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements. Forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond management's control, including undertaking further exploration activities, the results of such exploration activities and that such results support continued exploration activities, unexpected variations in ore grade, types and metallurgy, volatility and level of commodity prices, the availability of sufficient future financing, and other matters discussed under the caption "Risk Factors" in the Management Discussion and Analysis filed on the Company's profile on SEDAR on February 28, 2024 and in the Company's Annual Report on Form 20-F for the fiscal year ended October 31, 2023 filed with the U.S. Securities and Exchange Commission filed on February 28, 2024 available on www.sec.gov. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Any forward-looking statement made by the Company in this release is based only on information currently available and speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise.

SOURCE: Arras Minerals Corp.