LONDON, UK / ACCESSWIRE / July 15, 2024 / Helping institutional investors engage with digital assets in a secure and regulated environment, digital asset investment management platform Haruko is today announcing a $6m funding round as it expands into Southeast Asia and further consolidate its global presence. This follows heightened interest in the region of its industry-leading portfolio and risk management solutions for digital asset investment professionals.

The series A funding round was co-led by White Star Capital's Digital Asset Fund and MMC Ventures. Haruko has now raised $16m in venture capital funding.

Founded in 2021, Haruko has quickly scaled across North America and Europe with a client base of over 50 investment management institutions and has offices in London and Singapore. Haruko has gained significant traction across all market participants including hedge funds, family offices, market makers, treasury teams and prime brokerages.

It also has notably high adoption among large-scale trading firms owing to its unparalleled depth of functionality, comprehensive exchange (CeFi), on-chain (DeFi) and over-the-counter (OTC) venue coverage and multi-product support.

"Haruko is laser-focused on building institutional-grade solutions for the future of the investment industry and providing a white-glove service to exceed our clients' expectations consistently" said Shamyl Malik, co-founder and CEO of Haruko. "Despite having had several opportunities for growth through acquisition, we instead prioritised our seamless user experience, stayed true to our day one goal and built our market-leading solution entirely in-house. We never deviate from our mission of creating best-in-class technology, simplifying complexity for our clients and supporting their goal of revenue generation, be it through pure alpha creation or franchise building."

"We're looking forward to continuing our global expansion, investing in exceptionally talented team members to support us in our goal of building out an industry-leading, end-to-end solution for digital assets and the future of the finance industry. We will continue to invest singularly in this mission, ensuring the quality of our products and services is at the forefront of all our activity." added Malik.

This round underpins Haruko's impressive growth over the last two years and signals continued confidence in its ability to deliver best-in-class solutions for digital asset investors.

Sep Alavi, General Partner at White Star Capital added: "We invest in game-changing innovators and as the digital asset space continues to mature, Haruko is leading the way in ensuring institutions are equipped to embrace these new opportunities. We're delighted to continue our partnership with Haruko and its experienced founders as they embark on the next phase of their strategic growth journey."

Oliver Richards, General Partner of MMC Ventures commented: "MMC is a research-led fund and we have been actively looking at the blockchain and digital assets space for more than five years. Over that time our conviction that institutional ownership of digital assets will increase, and with it, the need for sophisticated infrastructure has grown. It is clear that the post-trade part of the digital asset landscape which Haruko focuses on has been poorly served to date and we believe that Shamyl and team have the deep domain knowledge required to solve this problem."

Haruko is setting a new standard for fintech solutions in digital assets, earning accolades such as HFM's Most Innovative Technology Firm and HedgeWeek's Best New Solution Provider in 2023, and offering solutions used by the entire digital asset ecosystem. Haruko's client base consists of institutions including hedge funds, market makers, OTC providers, prime brokers, exchanges, DeFi chains and protocols, custodians and other financial service providers.

About Haruko

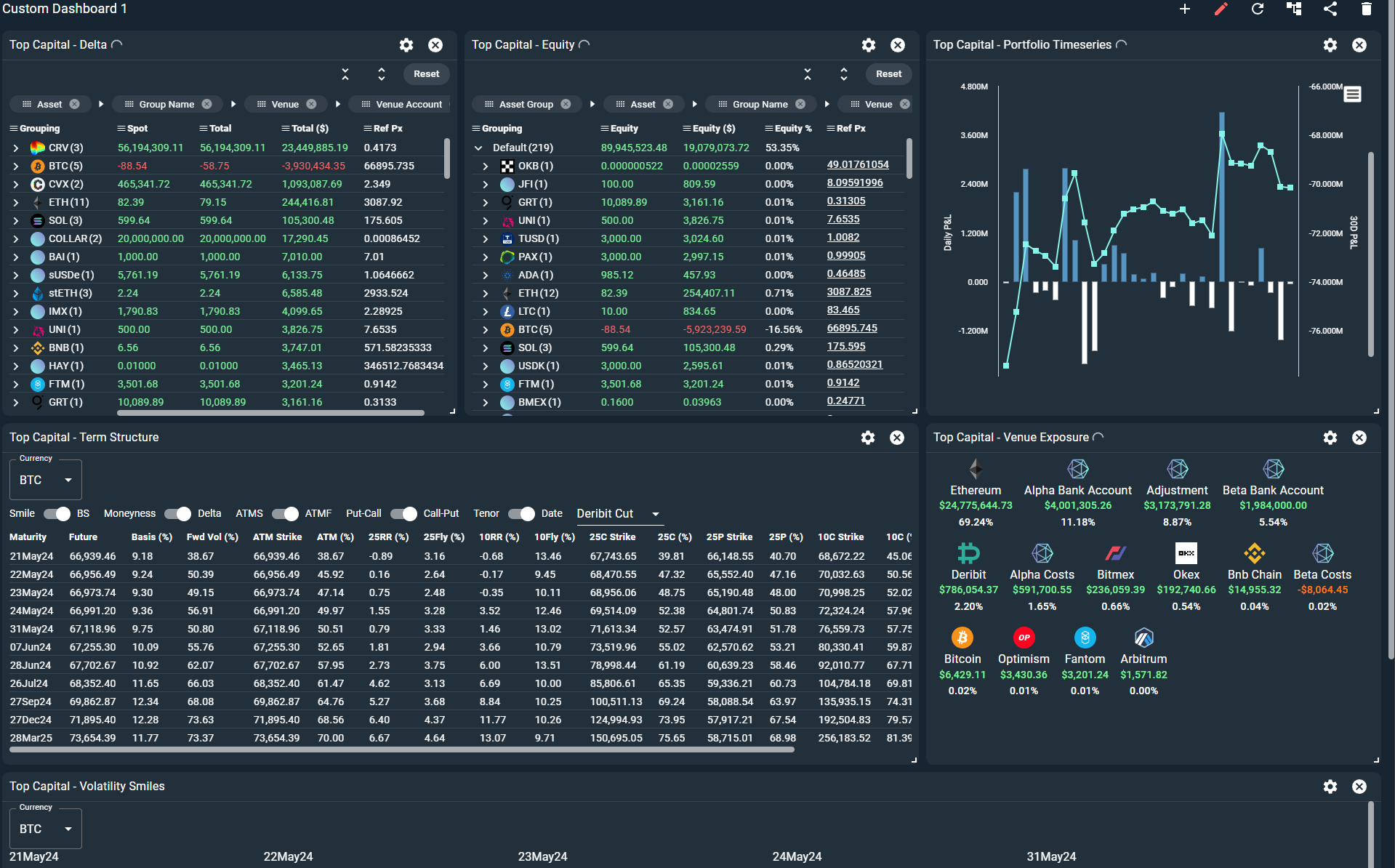

Haruko provides the most comprehensive digital asset technology solution for institutions deploying capital across the digital asset ecosystem. Seamless consolidation of positions across exchanges, on-chain and OTC activity with access to real-time and historical pricing, risk and P&L reporting provides the transparency needed for effective treasury management, compliance, investor reporting and financial controllership functions.

Haruko has an experienced team of TradFi and digital industry veterans located across Europe and Asia supporting more than 50 institutional clients globally using the award-winning Haruko platform to optimise their front-, middle- and back-office workflows and operational controls. For more information on Haruko, please visit https://www.haruko.com/

About White Star Capital

White Star Capital is a global multi-stage technology investment firm that backs exceptional entrepreneurs building ambitious, international businesses. Operating across North America, Europe, the Middle East, and Asia, our global presence, perspective, and people enable us to partner closely with our founders to help them scale internationally.

About MMC Ventures

MMC is a leading European venture capital firm with a focus on early-stage AI and data science companies across sectors including cloud & data infrastructure, enterprise AI, fintech and data-driven health. Examples of fintech companies MMC has backed include Interactive Investor, Copper, YuLife, Safeguard Global and TreasurySpring.

Contact Details

Haruko

Bilal Mahmood

+44 7714 007257

[email protected]

Company Website

SOURCE: Haruko