HONG KONG, CHINA / ACCESSWIRE / August 14, 2024 / SouthGobi Resources Ltd. (Hong Kong Stock Exchange ("HKEX"): 1878, TSX Venture Exchange ("TSX-V"):SGQ) (TSX-V:SGQ)(HK:1878) (the "Company" or "SouthGobi") today announces its financial and operating results for the three and six months ended June 30, 2024. All figures are in U.S. dollars ("USD") unless otherwise stated.

Significant Events and Highlights

The Company's significant events and highlights for the three months ended June 30, 2024 and the subsequent period to August 14, 2024 are as follows:

Operating Results - The Company has been increasing the scale of its mining operations since 2023, as well as implementing various coal processing methods, including screening, wet washing and dry coal processing, which have resulted in improved coal quality and enhanced production volume and growth of coal export volume into China during the quarter.

In response to the market demand for different coal products, the Company focused on expanding the categories of coal products in its portfolio, including mixed coal, wet washed coal and dry processed coal. In addition, the Company has experienced success with processing its inventory of F-grade coal products through cost-effective screening procedures. As a result of the improvement in the quality of the processed F-grade coal, the Company was able to meet the import coal quality standards established by Chinese authorities and has been exporting this product to China for sale since the first quarter of 2024, further enhancing the Company's coal export volume.

The Company recorded sales volume of 1.2 million tonnes for the second quarter of 2024 compared to 0.9 million tonnes for the second quarter of 2023, while the Company recorded an average realised selling price of $77.6 per tonne for the second quarter of 2024 compared to $95.3 per tonne for the second quarter of 2023. The decrease in the average realised selling price was mainly due to changes in the Company's product mix and decreased pricing for premium semi-soft coking coal and processed coal.

Build-Operate-Transfer Agreement - On July 15, 2024, the Company's wholly-owned Mongolian subsidiary, Southgobi Sands LLC ("SGS"), entered into a Build-Operate-Transfer agreement (the "BOT Agreement") with Tangshan Shenzhou Manufacturing Group Co., Ltd ("Tangshan"), pursuant to which Tangshan will be responsible for the construction, operation, and quality management of a new dry coal separation system, including key machinery (collectively, the "Dry Coal Separation System") at the Company's Ovoot Tolgoi Mine in Mongolia, which will be a stand-alone plant separate from the Company's existing dry processing plant. Tangshan will also be responsible for the construction of all related facilities for the Dry Coal Separation System. Under the BOT Agreement, SGS has the right to supervise and manage the overall work of coal quality assurance and operation, including, but not limited to, the supervision and management of operational safety, production planning, and operations management.

The total consideration payable by the Company over the term of the BOT Agreement is approximately $10.9 million, together with certain additional processing volume-based fees. Subject to the terms as set out therein, the BOT Agreement is effective from July 15, 2024 until October 1, 2029.

Financial Results - The Company recorded a $15.0 million profit from operations for the second quarter of 2024 compared to $40.5 million loss from operations for the second quarter of 2023. The turnaround result was mainly due to an additional tax and tax penalty of $75.0 million imposed by the Mongolian Tax Authority ("MTA"), which was recorded in the second quarter of 2023.

Deferral Agreements - On March 19, 2024, the Company and JD Zhixing Fund L.P. ("JDZF") entered into an agreement (the "2024 March Deferral Agreement") pursuant to which JDZF agreed to grant the Company a deferral of (i) the cash and payment-in-kind interest ("PIK Interest"), management fees, and related deferral fees in the aggregate amount of approximately $96.5 million which will be due and payable to JDZF on or before August 31, 2024 pursuant to certain prior deferral agreements dated March 24, 2023 and October 13, 2023; (ii) semi-annual cash interest payment of approximately $7.9 million payable to JDZF on May 19, 2024 under the Company's convertible debenture (the "Convertible Debenture"); (iii) semi-annual cash interest payments of approximately $8.1 million payable to JDZF on November 19, 2024 and the $4.0 million in PIK Interest payable to JDZF on November 19, 2024 under the Convertible Debenture; and (iv) management fees in the aggregate amount of $2.2 million payable to JDZF on November 15, 2024 and February 15, 2025, respectively, under the amended and restated mutual cooperation agreement (the "Amended and Restated Cooperation Agreement") (collectively, the "2024 March Deferred Amounts").

The effectiveness of the 2024 March Deferral Agreement and the respective covenants, agreements and obligations of each party under the 2024 March Deferral Agreement are subject to the Company obtaining the requisite approval of the 2024 March Deferral Agreement from shareholders in accordance with the requirements of applicable Canadian securities laws and Rule 14.33 and Rule 14A.36 of the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (the "Listing Rules"). The Company will be seeking approval of the 2024 March Deferral Agreement from disinterested shareholders through a special meeting of shareholders, which is scheduled to be convened on August 28, 2024.

The principal terms of the 2024 March Deferral Agreement are as follows:

Payment of the 2024 March Deferred Amounts will be deferred until August 31, 2025 (the "2024 March Deferral Agreement Deferral Date").

As consideration for the deferral of the 2024 March Deferred Amounts which relate to the payment obligations arising from the Convertible Debenture, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the outstanding balance of such 2024 March Deferred Amounts, commencing on the date on which each such 2024 March Deferred Amounts would otherwise have been due and payable under the Convertible Debenture.

As consideration for the deferral of the 2024 March Deferred Amounts which relate to payment obligations arising from the Amended and Restated Cooperation Agreement, the Company agreed to pay JDZF a deferral fee equal to 1.5% per annum on the outstanding balance of such 2024 March Deferred Amounts commencing on the date on which each such 2024 March Deferred Amounts would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

The 2024 March Deferral Agreement does not contemplate a fixed repayment schedule for the 2024 March Deferred Amounts or related deferral fees. Instead, the 2024 March Deferral Agreement requires the Company to use its best efforts to pay the 2024 March Deferred Amounts and related deferral fees due and payable under the 2024 March Deferral Agreement to JDZF. During the period beginning as of the effective date of the 2024 March Deferral Agreement and ending as of the 2024 March Deferral Agreement Deferral Date, the Company will provide JDZF with monthly updates of its financial status and business operations, and the Company and JDZF will on a monthly basis discuss and assess in good faith the amount (if any) of the 2024 March Deferred Amounts and related deferral fees that the Company may be able to repay to JDZF, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

If at any time before the 2024 March Deferred Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

On April 30, 2024, the Company and JDZF entered into an agreement (the "2024 April Deferral Agreement") pursuant to which JDZF agreed to grant the Company a deferral of the remaining $1.1 million of PIK interest which was payable on November 19, 2022 under the Convertible Debenture, the payment of which was deferred pursuant to a certain prior deferral agreement dated November 11, 2022 (the "November 2022 Deferral Agreement") until November 19, 2023, as well as related deferral fees under the November 2022 Deferral Agreement (collectively, the "2024 April Deferred Amounts").

The effectiveness of the 2024 April Deferral Agreement and the respective covenants, agreements and obligations of each party under the 2024 April Deferral Agreement are subject to the Company obtaining the requisite approval of the 2024 April Deferral Agreement from shareholders in accordance with the requirements of applicable Canadian securities laws and Rule 14.33 and Rule 14A.36 of the Listing Rules. The Company will be seeking approval of the 2024 April Deferral Agreement from disinterested shareholders through a special meeting of shareholders, which is scheduled to be convened on August 28, 2024.

The principal terms of the 2024 April Deferral Agreement are as follows:

Payment of the 2024 April Deferred Amounts will be deferred until August 31, 2025 (the "2024 April Deferral Agreement Deferral Date").

As consideration for the deferral of the 2024 April Deferred Amounts, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the outstanding balance of such 2024 April Deferred Amounts, commencing on the date on which each such 2024 April Deferred Amounts would otherwise have been due and payable under the Convertible Debenture.

The 2024 April Deferral Agreement does not contemplate a fixed repayment schedule for the 2024 April Deferred Amounts or related deferral fees. Instead, the 2024 April Deferral Agreement requires the Company to use its best efforts to pay the 2024 April Deferred Amounts and related deferral fees due and payable under the 2024 April Deferral Agreement to JDZF. During the period beginning as of the effective date of the 2024 April Deferral Agreement and ending as of the 2024 April Deferral Agreement Deferral Date, the Company will provide JDZF with monthly updates of its financial status and business operations, and the Company and JDZF will on a monthly basis discuss and assess in good faith the amount (if any) of the 2024 April Deferred Amounts and related deferral fees that the Company may be able to repay to JDZF, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

If at any time before the 2024 April Deferred Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

Amendment of Convertible Debenture - On May 13, 2024, the Company and JDZF entered into an amendment agreement (the "Convertible Debenture Amendment") to amend certain terms of the Convertible Debenture.

Pursuant to the Convertible Debenture Amendment, the Company may, by resolution of the Board of Directors (the "Board") of the Company, at any time and from time to time prepay, without penalty, the whole or any part of the principal amount outstanding under the Convertible Debenture, together with accrued cash interest and PIK interest thereon to the date of prepayment, provided that:

the Company has, not later than three (3) business days prior to the proposed prepayment date, delivered to JDZF an irrevocable written notice, signed by an independent director of the Company and setting out the terms of the prepayment;

the amount of such prepayment reduces the then outstanding principal amount under the Convertible Debenture by an amount that is (a) not less than $500,000 and (b) if in excess of $500,000, an integral multiple of $500,000; and

the proposed prepayment date falls on a business day.

The Company is not providing any additional form of consideration to JDZF in connection with the Convertible Debenture Amendment. Aside from the aforementioned amendments, the existing terms of the Convertible Debenture continue in full force and effect and unchanged.

The effectiveness of the Convertible Debenture Amendment is subject to the Company providing notice to, and obtaining acceptance (if required) from the TSX-V and requisite approval from disinterested shareholders of the Company in accordance with the requirements of applicable Canadian securities laws and Listing Rules. The Company must obtain the requisite approval from disinterested shareholders of the Company by August 30, 2024, or otherwise the Convertible Debenture Amendment shall automatically terminate and cease to be of any force and effect. The Company will be seeking approval of the Convertible Debenture Amendment from disinterested shareholders through a special meeting of shareholders, which is scheduled to be convened on August 28, 2024.

Additional Tax and Tax Penalty Imposed by the MTA- On July 18, 2023, SGS received an official notice (the "Notice") issued by the MTA stating that the MTA had completed a periodic tax audit (the "Audit") on the financial information of SGS for the tax assessment years between 2017 and 2020, including transfer pricing, royalty, air-pollution fee and unpaid tax payables. As a result of the Audit, the MTA notified SGS that it is imposing a tax penalty against SGS in the amount of approximately $75.0 million. The penalty mainly relates to the different view on the interpretation of tax law between the Company and the MTA. Under Mongolian law, the Company had a period of 30 days from the date of receipt of the Notice to file an appeal in relation to the Audit. Subsequently the Company engaged an independent tax consultant in Mongolia to provide tax advice and support to the Company and filed an appeal letter in relation to the Audit with the MTA in accordance with Mongolian laws on August 17, 2023.

On February 8, 2024, SGS received notice from the Tax Dispute Resolution Council ("TDRC") which stated that, after the TDRC's review, the TDRC issued a decision in relation to SGS' appeal of the Audit, and ordered that the audit assessments set forth in the Notice of July 18, 2023 be sent back to the MTA for review and re-assessment.

On February 22, 2024, SGS received another notice from the MTA stating that the MTA anticipates commencing the re-assessment process on or about March 7, 2024 and the duration of such process will be approximately 45 working days. Up to the date of this press release, the MTA is still reviewing the supplementary documents and information submitted by the Company and yet to have the re-assessment decision. Any decision of the MTA following the re-assessment process may not be conclusive as the Company retains the right to appeal such decision under Mongolian laws.

On May 15, 2024, SGS received a notice (the "Revised Notice") from the MTA regarding the re-assessment result on the Audit. The re-assessed amount of the tax penalty is approximately $80.0 million (the "Re-assessment Result"). In accordance with applicable Mongolian laws, SGS is entitled to file an appeal to the TDRC regarding the Re-assessment Result within a 30-day period from the date of receiving the Revised Notice.

On June 12, 2024, following consultation with its independent tax consultant in Mongolia, SGS has submitted an appeal letter to the TDRC regarding the Re-assessment Result on the Audit, in accordance with applicable Mongolian laws.

As at June 30, 2024, the Company recorded an additional tax and tax penalty in the amount of $85.1 million, which consists of a tax penalty payable of $75.0 million and a provision of additional late tax penalty of $10.1 million. To date, the Company has paid the MTA an aggregate of $1.7 million in relation to the aforementioned tax penalty. According to Mongolian tax law, the MTA has the legal authority to demand payment from the Company irrespective of any potential appeal process that may change the aforesaid tax penalty. Based on the advice from tax professionals and the best estimate from the management, in the event that the Company's appeal is to be successful in future, it is probable that the Company may recover approximately $46.0 million which represents a portion of the tax penalty payable to the MTA. However, there are inherent uncertainties surrounding the development and outcome of the appeal. The Company cannot determine with any virtual certainty the recoverability or exact recoverable amount of the tax penalty paid in future. If any subsequent event occurs that may impact the amount of the additional tax and tax penalty, an adjustment would be recognised in profit or loss and the carrying amount of the tax liabilities shall be adjusted.

Changes in Directors

Mr. Fan Keung Vic Choi: Mr. Choi was elected as an independent non-executive director at the Company's annual general meeting held on June 27, 2024.

Mr. Mao Sun: Mr. Sun did not stand for the re-election at the annual general meeting and ceased to be an independent non-executive Director on June 27, 2024.

Going Concern - Several adverse conditions and material uncertainties relating to the Company cast significant doubt upon the going concern assumption which includes the deficiencies in assets and working capital.

See section "Liquidity and Capital Resources" of this press release for details.

OVERVIEW OF OPERATIONAL DATA AND FINANCIAL RESULTS

Summary of Operational Data

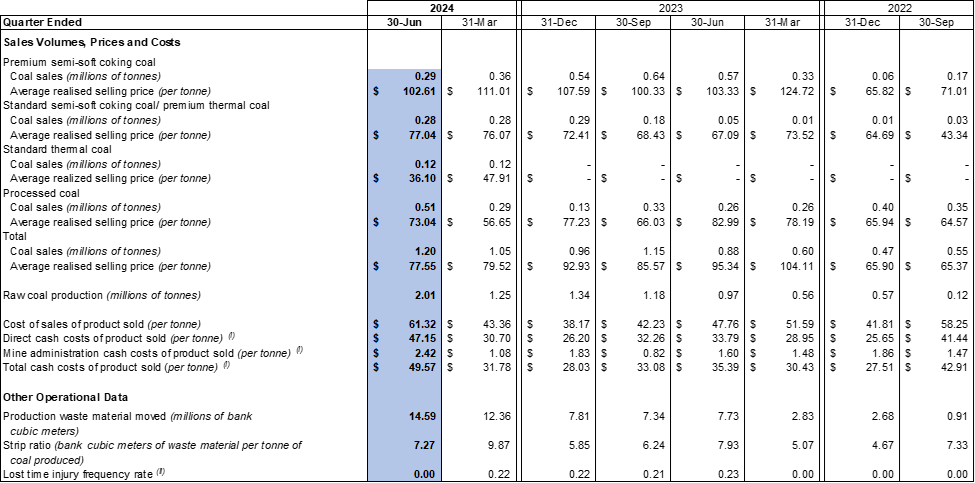

A Non-International Financial Reporting Standards ("non-IFRS") financial measure. Refer to "Non-IFRS Financial Measures" section. Cash costs of product sold exclude idled mine asset cash costs.

Per 200,000 man hours and calculated based on a rolling 12 month average.

Overview of Operational Data

For the three months ended June 30, 2024

The Company recorded an average realised selling price of $77.6 per tonne in the second quarter of 2024 compared to $95.3 per tonne in the second quarter of 2023, the decrease was mainly due to changes in the Company's product mix and decreased pricing for premium semi-soft coking coal and processed coal. The product mix for the second quarter of 2024 consisted of approximately 25% of premium semi-soft coking coal, 23% of standard semi-soft coking coal/premium thermal coal, 10% of standard thermal coal and 42% of processed coal compared to approximately 65% of premium semi-soft coking coal, 5% of standard semi-soft coking coal/premium thermal coal and 30% of processed coal in 2023.

The Company's unit cost of sales of product sold was $61.3 per tonne in the second quarter of 2024 compared to $47.8 per tonne in the second quarter of 2023. The increase was due to the Company expanding into certain categories of processed coal with higher production costs.

For the six months ended June 30, 2024

The Company sold 2.3 million tonnes for the first six months of 2024 as compared to 1.5 million tonnes for the first six months of 2023. The Company recorded an average realised selling price of $78.5 per tonne for the first six months of 2024 compared to $98.9 per tonne for the first six months of 2023, the decrease was mainly due to changes in the Company's product mix and decreased pricing for premium semi-soft coking coal and processed coal.

The Company's unit cost of sales of product sold was $52.9 per tonne for the first six months of 2024 compared to $49.3 per tonne for the first six months of 2023. The increase was due to the Company expanding into certain categories of processed coal with higher production costs.

For the six months ended June 30, 2024, the Company had a lost time injury frequency rate of 0.11.

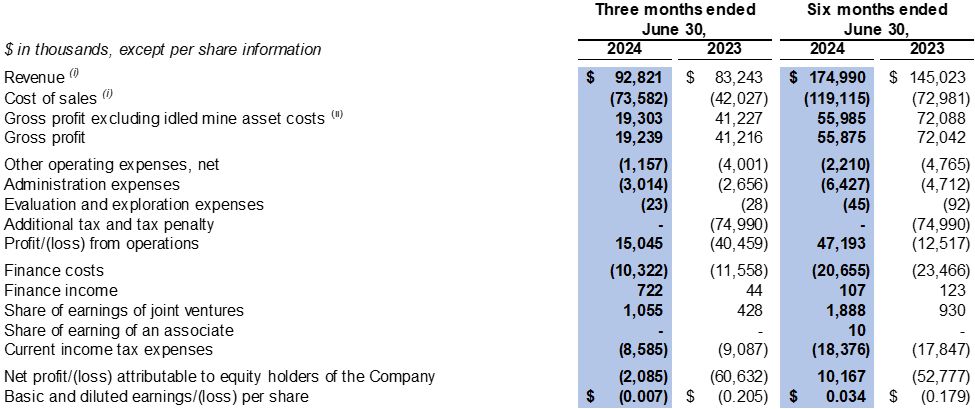

Summary of Financial Results

Revenue and cost of sales related to the Company's Ovoot Tolgoi Mine within the Coal Division operating segment. Refer to note 3 of the condensed consolidated interim financial statements for further analysis regarding the Company's reportable operating segments.

A non-IFRS financial measure, idled mine asset costs represents the depreciation expense relates to the Company's idled plant and equipment.

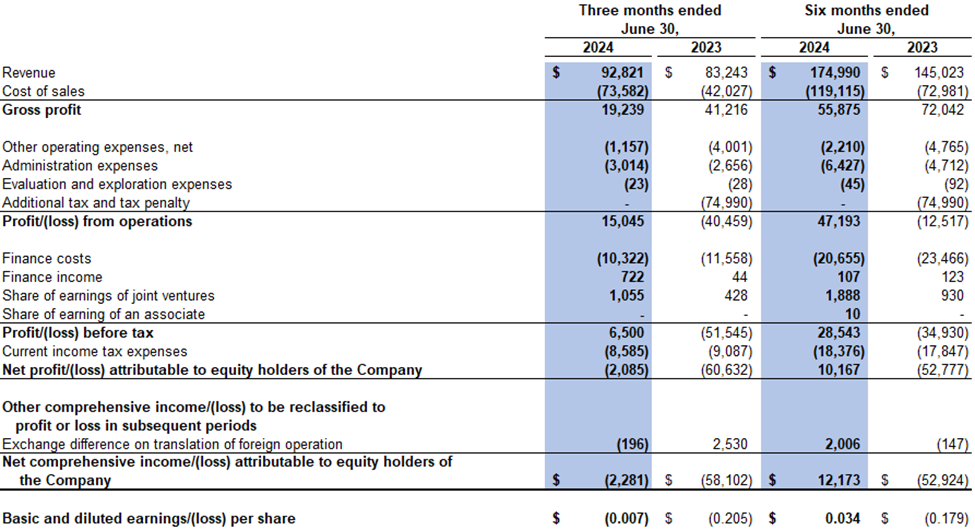

Overview of Financial Results

For the three months ended June 30, 2024

The Company recorded a $15.0 million profit from operations for the second quarter of 2024 compared to $40.5 million loss from operations for the second quarter of 2023. The turnaround result was mainly due to an additional tax and tax penalty of $75.0 million imposed by the MTA, which was recorded in the second quarter of 2023.

Revenue was $92.8 million for the second quarter of 2024 compared to $83.2 million for the second quarter of 2023. The financial results were impacted by increased sales volume, as a result of expansion of its sales network, diversification of its customer base and expansion of the categories of coal products in its portfolio.

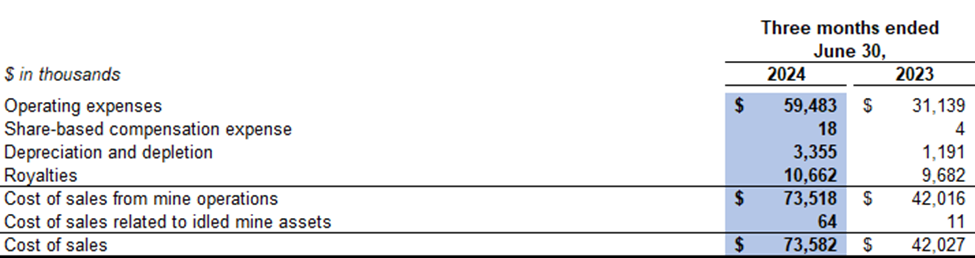

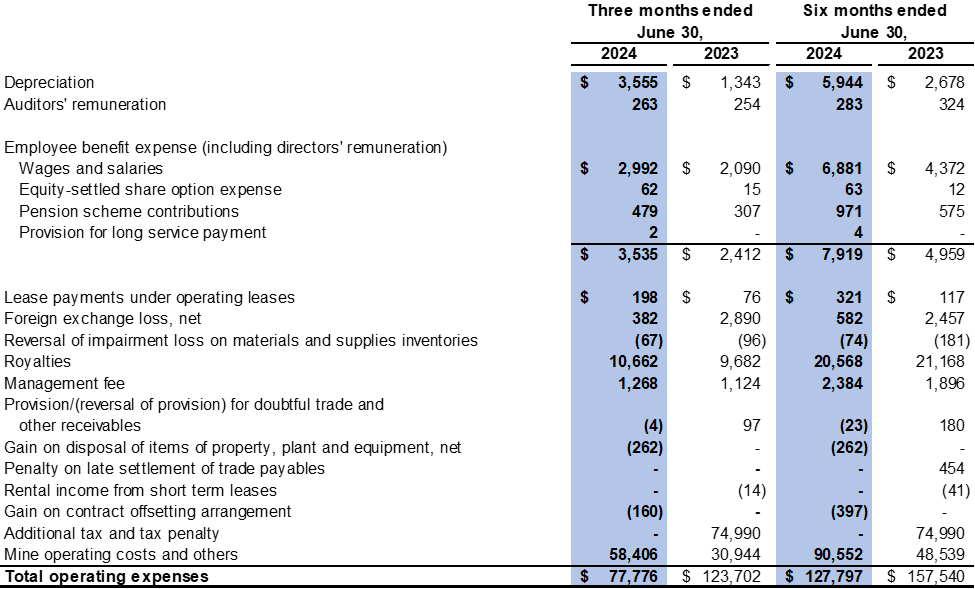

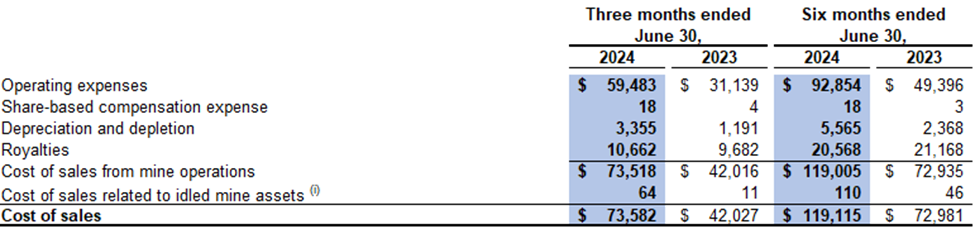

Cost of sales was $73.6 million for the second quarter of 2024 compared to $42.0 million for the second quarter of 2023. The increase in cost of sales was mainly due to increased sales and the Company expanding into certain categories of processed coal with higher production costs.

Cost of sales consists of operating expenses, share-based compensation expense, equipment depreciation, depletion of mineral properties, royalties and idled mine asset costs. Operating expenses in cost of sales reflect the total cash costs of product sold (a Non-IFRS financial measure, refer to "Non-IFRS Financial Measures" section) during the quarter.

Operating expenses in cost of sales were $59.5 million for the second quarter of 2024 compared to $31.1 million for the second quarter of 2023. The overall increase in operating expenses was due to the increased sales and the Company expanding into certain categories of processed coal with higher production costs.

Cost of sales related to idled mine assets for the second quarter of 2024 included $0.1 million related to depreciation expenses for idled equipment (second quarter of 2023: $0.1 million).

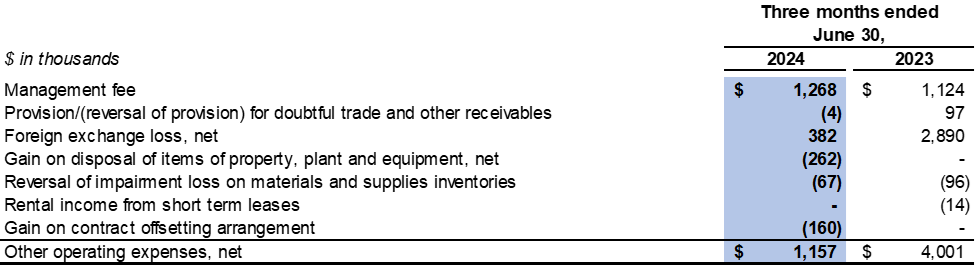

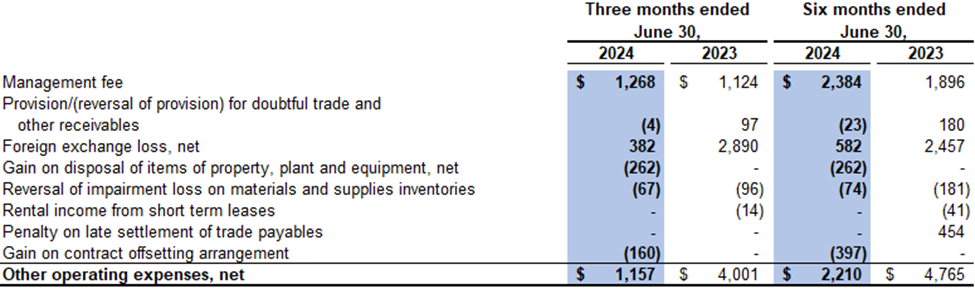

Other operating expenses were $1.2 million for the second quarter of 2024 (second quarter of 2023: $4.0 million). The change was mainly due to decreased net foreign exchange loss.

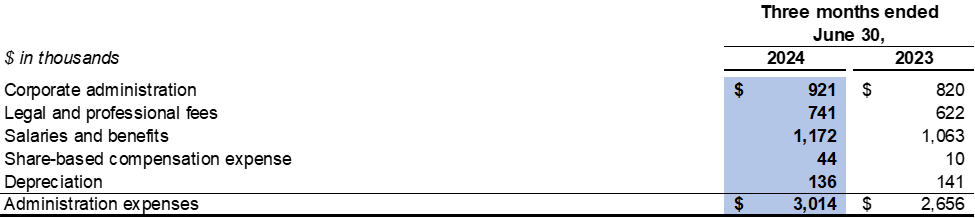

Administration expenses were $3.0 million for the second quarter of 2024 (second quarter of 2023: $2.7 million). The change was mainly due to increase in legal and professional fees and salaries and benefits as a result of expansion of operations.

The Company continued to minimise evaluation and exploration expenditures in the second quarter of 2024 in order to preserve the Company's financial resources. Evaluation and exploration activities and expenditures in the second quarter of 2024 were limited to ensuring that the Company met the Mongolian Minerals Law requirements in respect of its mining licenses.

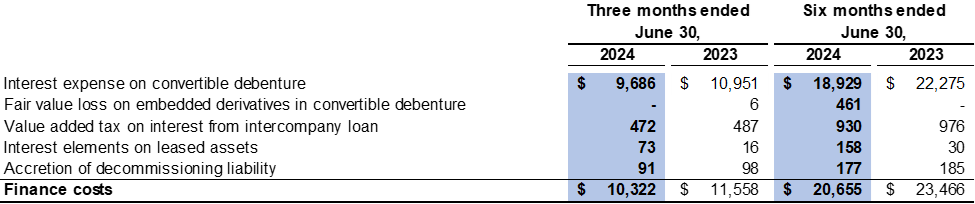

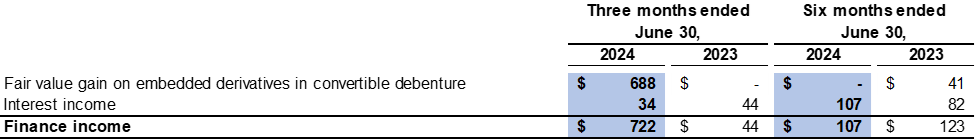

Finance costs were $10.3 million and $11.6 million for the second quarter of 2024 and 2023 respectively, which primarily consisted of interest expense on the $250.0 million Convertible Debenture.

For the six months ended June 30, 2024

The Company recorded a $47.2 million profit from operations in the first six months of 2024 compared to a $12.5 million loss from operations in the first six months of 2023. The turnaround result was mainly due to an additional tax and tax penalty of $75.0 million imposed by MTA was recorded in the second quarter of 2023.

Revenue was $175.0 million in the first six months of 2024 compared to $145.0 million in the first six months of 2023. The financial results were impacted by increased sales volume, as a result of expansion of its sales network, diversification of its customer base and expansion of the categories of coal products in its portfolio.

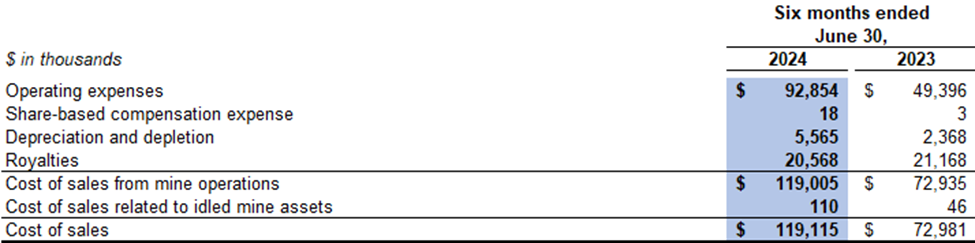

Cost of sales were $119.1 million in the first six months of 2024 compared to $73.0 million in the first six months of 2023, as follows:

Operating expenses in cost of sales were $92.9 million in the first six months of 2024 compared to $49.4 million in the first six months of 2023. The overall increase in operating expenses was due to the increased sales and the Company expanding into certain categories of processed coal with higher production costs.

Cost of sales related to idled mine assets in the first six months of 2024 included $0.1 million related to depreciation expenses for idled equipment (first six months of 2023: $0.1 million).

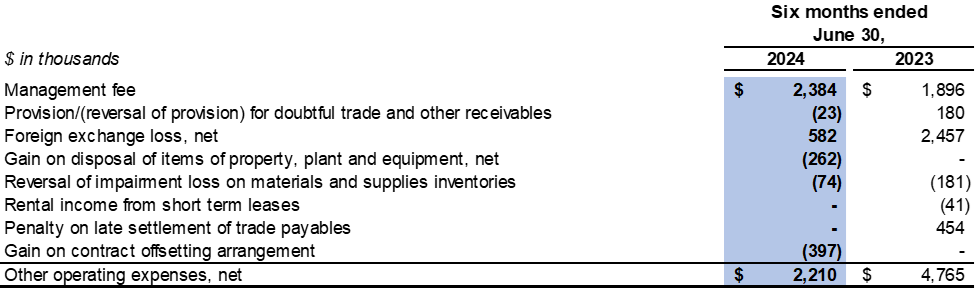

Other operating expenses were $2.2 million in the first six months of 2024 (first six months of 2023: $4.8 million). The change was mainly due to decreased net foreign exchange loss.

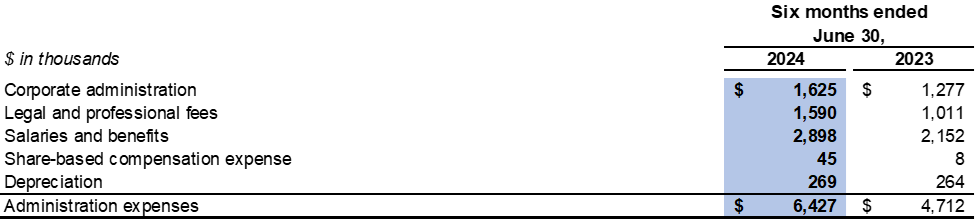

Administration expenses were $6.4 million in the first six months of 2024 (first six months of 2023: $4.7 million). The change was mainly due to increase in legal and professional fees and salaries and benefits as a result of expansion of operations.

The Company continued to minimise evaluation and exploration expenditures in the first six months of 2024 in order to preserve the Company's financial resources. Evaluation and exploration activities and expenditures in the first six months of 2024 were limited to ensuring that the Company met the Mongolian Minerals Law requirements in respect of its mining licenses.

Finance costs were $20.7 million and $23.5 million in the first six months of 2024 and 2023 respectively, which primarily consisted of interest expense on the $250.0 million Convertible Debenture.

Summary of Quarterly Operational Data

A non-IFRS financial measure. Refer to section "Non-IFRS Financial Measures". Cash costs of product sold exclude idled mine asset cash costs.

Per 200,000 man hours and calculated based on a rolling 12 month average.

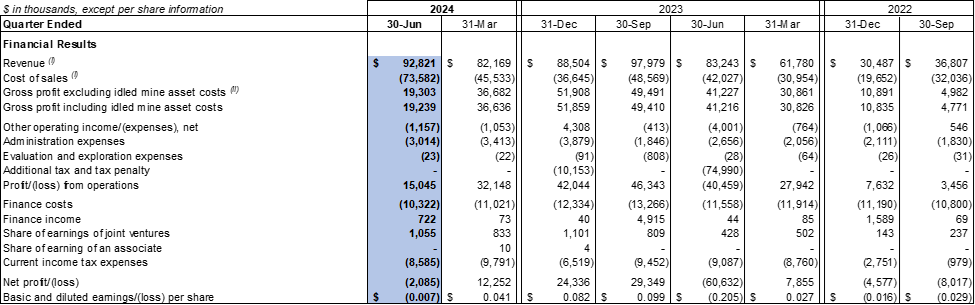

Summary of Quarterly Financial Results

The Company's condensed consolidated interim financial statements are reported under International Accounting Standard ("IAS Standards") 34 - "Interim Financial Reporting" using accounting policies in compliance with the IFRS Accounting Standards issued by the International Accounting Standards Board and Interpretations of the IFRS Interpretations Committee ("IFRS Accounting Standards"). The following table provides highlights, extracted from the Company's annual and interim consolidated financial statements, of quarterly results for the past eight quarters.

Revenue and cost of sales relate to the Company's Ovoot Tolgoi Mine within the Coal Division operating segment. Refer to note 3 of the condensed consolidated interim financial statements for further analysis regarding the Company's reportable operating segments.

A non-IFRS financial measure, idled mine asset costs represents the depreciation expense relates to the Company's idled plant and equipment.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity and Capital Management

The Company has in place a planning, budgeting and forecasting process to help determine the funds required to support the Company's normal operations on an ongoing basis and the Company's expansionary plans.

Costs reimbursable to Turquoise Hill Resources Limited ("Turquoise Hill")

Prior to the completion of a private placement with Novel Sunrise Investments Limited on April 23, 2015, Rio Tinto plc ("Rio Tinto") was the Company's ultimate parent company. In the past, Rio Tinto sought reimbursement from the Company for the salaries and benefits of certain Rio Tinto employees who were assigned by Rio Tinto to work for the Company, as well as certain legal and professional fees incurred by Rio Tinto in relation to the Company's prior internal investigation and Rio Tinto's participation in the tripartite committee. Subsequently Rio Tinto transferred and assigned to Turquoise Hill its right to seek reimbursement for these costs and fees from the Company.

On January 20, 2021, the Company and Turquoise Hill entered into a settlement agreement, whereby Turquoise Hill agreed to a repayment schedule in settlement of certain secondment costs in the amount of $2.8 million (representing a portion of the TRQ Reimbursable Amount) pursuant to which the Company agreed to make monthly payments to Turquoise Hill in the amount of $0.1 million per month from January 2021 to June 2022. The Company is contesting the validity of the remaining balance of the TRQ Reimbursable Amount claimed by Turquoise Hill.

As at June 30, 2024, the amount of reimbursable costs and fees claimed by Turquoise Hill (the "TRQ Reimbursable Amount") amounted to $6.3 million (such amount is included in the trade and other payables).

Additional tax and tax penalty imposed by the MTA

On July 18, 2023, SGS received the Notice issued by the MTA stating that the MTA had completed the Audit on the financial information of SGS for the tax assessment years between 2017 and 2020, including transfer pricing, royalty, air-pollution fee and unpaid tax payables. As a result of the Audit, the MTA notified SGS that it is imposing a tax penalty against SGS in the amount of approximately $75.0 million. The penalty mainly relates to the different view on the interpretation of tax law between the Company and the MTA. Under Mongolian law, the Company had a period of 30 days from the date of receipt of the Notice to file an appeal in relation to the Audit. Subsequently the Company engaged an independent tax consultant in Mongolia to provide tax advice and support to the Company and filed an appeal letter in relation to the Audit with the MTA in accordance with Mongolian laws on August 17, 2023.

On February 8, 2024, SGS received notice from the TDRC which stated that, after the TDRC's review, the TDRC issued a decision in relation to SGS' appeal of the Audit, and ordered that the audit assessments set forth in the Notice of July 18, 2023 be sent back to the MTA for review and re-assessment.

On February 22, 2024, SGS received another notice from the MTA stating that the MTA anticipates commencing the re-assessment process on or about March 7, 2024 and the duration of such process will be approximately 45 working days. Up to the date of this press release, the MTA is still reviewing the supplementary documents and information submitted by the Company and yet to have the re-assessment decision. Any decision of the MTA following the re-assessment process may not be conclusive as the Company retains the right to appeal such decision under Mongolian laws.

On May 15, 2024, SGS received the Revised Notice from the MTA regarding the re-assessment result on the Audit. The re-assessed amount of the tax penalty is approximately $80.0 million. In accordance with applicable Mongolian laws, SGS is entitled to file an appeal to the TDRC regarding the Re-assessment Result within a 30-day period from the date of receiving the Revised Notice.

On June 12, 2024, following consultation with its independent tax consultant in Mongolia, SGS has submitted an appeal letter to the TDRC regarding the Re-assessment Result on the Audit, in accordance with applicable Mongolian laws.

As at June 30, 2024, the Company recorded an additional tax and tax penalty in the amount of $85.1 million, which consists of a tax penalty payable of $75.0 million and a provision of additional late tax penalty of $10.1 million. To date, the Company has paid the MTA an aggregate of $1.7 million in relation to the aforementioned tax penalty. According to Mongolian tax law, the MTA has a legal authority to demand payment from the Company irrespective of any potential appeal process that may change the aforesaid tax penalty. Based on the advice from tax professionals and the best estimate from the management, in the event that the Company's appeal is to be successful in future, it is probable that the Company may recover approximately $46.0 million which represents a portion of the tax penalty payable to the MTA. However, there are inherent uncertainties surrounding the development and outcome of the appeal. The Company cannot determine with any virtual certainty the recoverability or exact recoverable amount of the tax penalty paid in future. If any subsequent event occurs that may impact the amount of the additional tax and tax penalty, an adjustment would be recognised in profit or loss and the carrying amount of the tax liabilities shall be adjusted.

Going concern considerations

The Company's condensed consolidated interim financial statements have been prepared on a going concern basis which assumes that the Company will continue to operate until at least June 30, 2025 and will be able to realise its assets and discharge its liabilities in the normal course of operations as they come due. However, in order to continue as a going concern, the Company must generate sufficient operating cash flows, secure additional capital or otherwise pursue a strategic restructuring, refinancing or other transactions to provide it with sufficient liquidity.

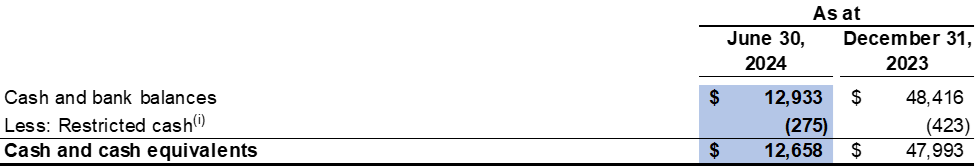

Several adverse conditions and material uncertainties cast significant doubt upon the Company's ability to continue as a going concern and the going concern assumption used in the preparation of the Company's condensed consolidated interim financial statements. The Company had a deficiency in assets of $129.0 million as at June 30, 2024 as compared to a deficiency in assets of $141.3 million as at December 31, 2023 while the working capital deficiency (excess current liabilities over current assets) reached $274.7 million as at June 30, 2024 compared to a working capital deficiency of $218.8 million as at December 31, 2023.

Included in the working capital deficiency as at June 30, 2024 are significant obligations, represented by trade and other payables of $95.0 million and an additional tax and tax penalty of $83.5 million.

The Company may not be able to settle all trade and other payables on a timely basis, and as a result any continuing postponement in settling of certain trade and other payables owed to suppliers and creditors may result in potential lawsuits and/or bankruptcy proceedings being filed against the Company. Furthermore, there is no guarantee that the Company will be successful in its negotiations with the MTA, or any appeal, in relation to the Audit. Except as disclosed elsewhere in this press release, no such lawsuits or proceedings were pending as at August 14, 2024. However, there can be no assurance that no such lawsuits or proceedings will be filed by the Company's creditors in the future and the Company's suppliers and contractors will continue to supply and provide services to the Company uninterrupted.

In the past, the Company has customarily entered into cooperation agreements with the local custom office in Mongolia on an annual basis to facilitate the Company's export of coal into China. The Company's most recently executed cooperation agreement expired on November 23, 2023. While the Company has applied with the local Mongolian custom office to renew its cooperation agreement. In May 2024, the Company has successfully renewed the cooperation agreement.

There are significant uncertainties as to the outcomes of the above events or conditions that may cast significant doubt on the Company's ability to continue as a going concern and, therefore, the Company may be unable to realise its assets and discharge its liabilities in the normal course of business. Should the use of the going concern basis in preparation of the condensed consolidated interim financial statements be determined to be not appropriate, adjustments would have to be made to write down the carrying amounts of the Company's assets to their realisable values, to provide for any further liabilities which might arise and to reclassify non-current assets and non-current liabilities as current assets and current liabilities, respectively. The effects of these adjustments have not been reflected in the condensed consolidated interim financial statements. If the Company is unable to continue as a going concern, it may be forced to seek relief under applicable bankruptcy and insolvency legislation.

For the purpose of assessing the appropriateness of the use of the going concern basis to prepare the financial statements, management of the Company has prepared a cash flow projection covering a period of 12 months from June 30, 2024. The cash flow projection has considered the anticipated cash flows to be generated from the Company's business during the period under projection including cost saving measures. In particular, the Company has taken into account the following measures for improvement of the Company's liquidity and financial position, which include: (a) entering into the 2024 March Deferral Agreement and the 2024 April Deferral Agreement with JDZF on March 19, 2024 and April 30, 2024, respectively for a deferral of the 2024 March Deferred Amounts and 2024 April Deferred Amounts; (b) communicating with vendors in agreeing repayment plans of the outstanding payable; and (c) obtaining an avenue of financial support from an affiliate of the Company's major shareholder for a maximum amount of $127.0 million (equivalent to RMB 900 million) during the period covered in the cash flow projection. Regarding these plans and measures, there is no guarantee that the suppliers would agree the settlement plan as communicated by the Company. Nevertheless, after considering the above, the directors of the Company believe that there will be sufficient financial resources to continue its operations and to meet its financial obligations as and when they fall due in the next 12 months from June 30, 2024 and therefore are satisfied that it is appropriate to prepare the condensed consolidated interim financial statements on a going concern basis.

Significant uncertainties exist regarding the Company's management's ability to achieve its plans as described above. The continued operation of the Company as a going concern depends on a key factor: the utilisation of the financial support from an affiliate of the Company's major shareholder to settle payables, including the additional tax and tax penalty, in a timely manner.

The outcome of this factor will have a significant impact on the Company's ability to continue operating as a going concern. It is crucial to closely monitor and address these uncertainties to ensure the Company's stability and long-term viability.

Factors that impact the Company's liquidity are being closely monitored and include, but are not limited to, restrictions on the Company's ability to import its coal products for sale in China, Chinese economic growth, market prices of coal, production levels, operating cash costs, capital costs, exchange rates of currencies of countries where the Company operates and exploration and discretionary expenditures.

As at June 30, 2024 and December 31, 2023, the Company was not subject to any externally imposed capital requirements.

Convertible Debenture

In November 2009, the Company entered into a financing agreement with China Investment Corporation (together with its wholly-owned subsidiaries and affiliates, "CIC") for $500 million in the form of a secured, convertible debenture bearing interest at 8.0% (6.4% payable semi-annually in cash and 1.6% payable annually in the Company's Common Shares) with a maximum term of 30 years. The Convertible Debenture is secured by a first ranking charge over the Company's assets, including shares of its material subsidiaries. The financing was used primarily to support the accelerated investment program in Mongolia and for working capital, repayment of debts, general and administrative expenses and other general corporate purposes.

On March 29, 2010, the Company exercised its right to call for the conversion of up to $250.0 million of the Convertible Debenture into approximately 21.5 million shares at a conversion price of $11.64 (CA$11.88).

Deferral Agreements

On March 19, 2024, the Company and JDZF entered into the 2024 March Deferral Agreement pursuant to which JDZF agreed to grant the Company a deferral of the 2024 March Deferred Amounts.

The effectiveness of the 2024 March Deferral Agreement and the respective covenants, agreements and obligations of each party under the 2024 March Deferral Agreement are subject to the Company obtaining the requisite approval of the 2024 March Deferral Agreement from shareholders in accordance with the requirements of applicable Canadian securities laws and Rule 14.33 and Rule 14A.36 of the Listing Rules. The Company will be seeking approval of the 2024 March Deferral Agreement from disinterested shareholders through a special meeting of shareholders, which is scheduled to be convened on August 28, 2024.

The principal terms of the 2024 March Deferral Agreement are as follows:

Payment of the 2024 March Deferred Amounts will be deferred until 2024 March Deferral Agreement Deferral Date.

As consideration for the deferral of the 2024 March Deferred Amounts which relate to the payment obligations arising from the Convertible Debenture, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the outstanding balance of such 2024 March Deferred Amounts, commencing on the date on which each such 2024 March Deferred Amounts would otherwise have been due and payable under the Convertible Debenture.

As consideration for the deferral of the 2024 March Deferred Amounts which relate to payment obligations arising from the Amended and Restated Cooperation Agreement, the Company agreed to pay JDZF a deferral fee equal to 1.5% per annum on the outstanding balance of such 2024 March Deferred Amounts commencing on the date on which each such 2024 March Deferred Amounts would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

The 2024 March Deferral Agreement does not contemplate a fixed repayment schedule for the 2024 March Deferred Amounts or related deferral fees. Instead, the 2024 March Deferral Agreement requires the Company to use its best efforts to pay the 2024 March Deferred Amounts and related deferral fees due and payable under the 2024 March Deferral Agreement to JDZF. During the period beginning as of the effective date of the 2024 March Deferral Agreement and ending as of the 2024 March Deferral Agreement Deferral Date, the Company will provide JDZF with monthly updates of its financial status and business operations, and the Company and JDZF will on a monthly basis discuss and assess in good faith the amount (if any) of the 2024 March Deferred Amounts and related deferral fees that the Company may be able to repay to JDZF, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

If at any time before the 2024 March Deferred Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

On April 30, 2024, the Company and JDZF entered into the 2024 April Deferral Agreement pursuant to which JDZF agreed to grant the Company a deferral of the remaining $1.1 million of PIK interest which was payable on November 19, 2022 under the Convertible Debenture, he payment of which was deferred pursuant to the November 2022 Deferral Agreement until November 19, 2023, as well as related deferral fees under the November 2022 Deferral Agreement.

The effectiveness of the 2024 April Deferral Agreement and the respective covenants, agreements and obligations of each party under the 2024 April Deferral Agreement are subject to the Company obtaining the requisite approval of the 2024 April Deferral Agreement from shareholders in accordance with the requirements of applicable Canadian securities laws and Rule 14.33 and Rule 14A.36 of the Listing Rules. The Company will be seeking approval of the 2024 April Deferral Agreement from disinterested shareholders through a special meeting of shareholders, which is scheduled to be convened on August 28, 2024.

The principal terms of the 2024 April Deferral Agreement are as follows:

Payment of the 2024 April Deferred Amounts will be deferred until the 2024 April Deferral Agreement Deferral Date.

As consideration for the deferral of the 2024 April Deferred Amounts, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the outstanding balance of such 2024 April Deferred Amounts, commencing on the date on which each such 2024 April Deferred Amounts would otherwise have been due and payable under the Convertible Debenture.

The 2024 April Deferral Agreement does not contemplate a fixed repayment schedule for the 2024 April Deferred Amounts or related deferral fees. Instead, the 2024 April Deferral Agreement requires the Company to use its best efforts to pay the 2024 April Deferred Amounts and related deferral fees due and payable under the 2024 April Deferral Agreement to JDZF. During the period beginning as of the effective date of the 2024 April Deferral Agreement and ending as of the 2024 April Deferral Agreement Deferral Date, the Company will provide JDZF with monthly updates of its financial status and business operations, and the Company and JDZF will on a monthly basis discuss and assess in good faith the amount (if any) of the 2024 April Deferred Amounts and related deferral fees that the Company may be able to repay to JDZF, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

If at any time before the 2024 April Deferred Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

Amendment of Convertible Debenture

On May 13, 2024, the Company and JDZF entered into the Convertible Debenture Amendment to amend certain terms of the Convertible Debenture.

Pursuant to the Convertible Debenture Amendment, the Company may, by resolution of the Board of the Company, at any time and from time to time prepay, without penalty, the whole or any part of the principal amount outstanding under the Convertible Debenture, together with accrued cash interest and PIK interest thereon to the date of prepayment, provided that:

the Company has, not later than three (3) business days prior to the proposed prepayment date, delivered to JDZF an irrevocable written notice, signed by an independent director of the Company and setting out the terms of the prepayment;

the amount of such prepayment reduces the then outstanding principal amount under the Convertible Debenture by an amount that is (a) not less than $500,000 and (b) if in excess of $500,000, an integral multiple of $500,000; and

the proposed prepayment date falls on a business day.

The Company is not providing any additional form of consideration to JDZF in connection with the Convertible Debenture Amendment. Aside from the aforementioned amendments, the existing terms of the Convertible Debenture continue in full force and effect and unchanged.

The effectiveness of the Convertible Debenture Amendment is subject to the Company providing notice to, and obtaining acceptance (if required) from the TSX-V and requisite approval from disinterested shareholders of the Company in accordance with the requirements of applicable Canadian securities laws and Listing Rules. The Company must obtain the requisite approval from disinterested shareholders of the Company by August 30, 2024, or otherwise the Convertible Debenture Amendment shall automatically terminate and cease to be of any force and effect. The Company will be seeking approval of the Convertible Debenture Amendment from disinterested shareholders through a special meeting of shareholders which is scheduled to be convened on August 28, 2024.

Ovoot Tolgoi Mine Impairment Analysis

The Company determined that an indicator of impairment existed for its Ovoot Tolgoi Mine cash generating unit as at June 30, 2024. The impairment indicator was the potential closure of border crossings in the future. Since the recoverable amount was higher than carrying value of the Ovoot Tolgoi Mine cash generating unit, there was no impairment of non-financial asset recognised during the six months ended June 30, 2024.

REGULATORY ISSUES AND CONTINGENCIES

Lawsuit

In January 2014, Siskinds LLP, a Canadian law firm, filed a class action (the "Class Action") against the Company, certain of its former senior officers and directors, and its former auditors (the "Former Auditors"), in the Ontario Court in relation to the Company's restatement of certain financial statements previously disclosed in the Company's public fillings (the "Restatement").

To commence and proceed with the Class Action, the plaintiff was required to seek leave of the Court under the Ontario Securities Act ("Leave Motion") and certify the action as a class proceeding under the Ontario Class Proceedings Act. The Ontario Court rendered its decision on the Leave Motion on November 5, 2015, dismissing the action against the former senior officers and directors and allowing the action to proceed against the Company in respect of alleged misrepresentation affecting trades in the secondary market for the Company's securities arising from the Restatement. The action against the Former Auditors was settled by the plaintiff on the eve of the Leave Motion.

Both the plaintiff and the Company appealed the Leave Motion decision to the Ontario Court of Appeal. On September 18, 2017, the Ontario Court of Appeal dismissed the Company's appeal of the Leave Motion to permit the plaintiff to commence and proceed with the Class Action. Concurrently, the Ontario Court of Appeal granted leave for the plaintiff to proceed with their action against the former senior officers and directors in relation to the Restatement.

The Company filed an application for leave to appeal to the Supreme Court of Canada in November 2017, but the leave to appeal to the Supreme Court of Canada was dismissed in June 2018.

In December 2018, the parties agreed to a consent Certification Order, whereby the action against the former senior officers and directors was withdrawn and the Class Action would only proceed against the Company.

To date, counsel for the plaintiffs and defendant have completed: (i) all document productionand (ii) defence oral examinations for discovery. Counsel for the plaintiffs have served their expert reports on liability and damages.

Counsel for the plaintiffs and defendant have entered into a good faith procedural agreement (the "Procedural Agreement") telescoping all remaining pre-trial steps into a period that is expected to end on December 31, 2024 including oral examinations for discovery of the plaintiffs by the defendant and, subject to the parties signing and delivering individual commitments that all discovery processes have been completed by December 31, 2024, subsequent delivery of the defendant's expert reports in January 2025. The parties have engaged the services of an experienced neutral former Chief Justice of Ontario (the "Mediator") to act as a mediator to assist the parties in resolving all pre-trial matters as set out in the Procedural Agreement. The parties have agreed to a pre-trial mediation before the Mediator scheduled in April 2025 with an intention to have the entire case ready for trial by April 25, 2025. The Court has not yet scheduled trial dates. The Company continues to urge a trial as early as possible.

The Company firmly believes that it has a strong defense on the merits and will continue to vigorously defend itself against the Class Action through independent Canadian litigation counsel retained by the Company for this purpose. Due to the inherent uncertainties of litigation, it is not possible to predict the final outcome of the Class Action or determine the amount of potential losses, if any. However, the Company has determined that a provision for this matter as at June 30, 2024 was not required.

Toll Wash Plant Agreement with Ejin Jinda

In 2011, the Company entered into an agreement with Ejin Jinda, a subsidiary of China Mongolia Coal Co. Ltd., to toll-wash coal from the Ovoot Tolgoi Mine. The agreement had a duration of five years from the commencement of the contract and provided for an annual washing capacity of approximately 3.5 million tonnes of input coal.

Under the agreement with Ejin Jinda, which required the commercial operation of the wet washing facility to commence on October 1, 2011, the additional fees payable by the Company under the wet washing contract would have been $18.5 million. At each reporting date, the Company assesses the agreement with Ejin Jinda and has determined it is not probable that this $18.5 million will be required to be paid. Accordingly, the Company has determined that a provision for this matter as at June 30, 2024 was not required.

Special Needs Territory in Umnugobi

On February 13, 2015, the Soumber mining licenses (MV-016869, MV-020436 and MV-020451) (the "License Areas") were included into a special protected area (to be further referred as Special Needs Territory, the "SNT") newly set up by the Umnugobi Aimag's Civil Representatives Khural (the "CRKh") to establish a strict regime on the protection of natural environment and prohibit mining activities in the territory of the SNT.

On July 8, 2015, SGS and the chairman of the CRKh, in his capacity as the respondent's representative, reached an agreement (the "Amicable Resolution Agreement") to exclude the License Areas from the territory of the SNT in full, subject to confirmation of the Amicable Resolution Agreement by the session of the CRKh. The parties formally submitted the Amicable Resolution Agreement to the appointed judge of the Administrative Court for her approval and requested a dismissal of the case in accordance with the Law of Mongolia on Administrative Court Procedure. On July 10, 2015, the judge issued her order approving the Amicable Resolution Agreement and dismissing the case, while reaffirming the obligation of CRKh to take necessary actions at its next session to exclude the License Areas from the SNT and register the new map of the SNT with the relevant authorities. Mining activities at the Soumber property cannot proceed unless and until the Company obtains a court order restoring the Soumber mining licenses and until the License Areas are removed from the SNT.

On July 24, 2021, SGS was notified by the Implementing Agency of Mongolian Government that the license area covered by two mining licenses (MV-016869 and MV-020451) are no longer overlapping with the SNT. The Company will continue to work with the Mongolian authorities regarding the license area covered by the mining license (MV-020436).

On December 7, 2023, the Citizen representative Khural of Gurvantes soum held a meeting and passed a resolution (the "Resolution") claiming that the License Areas were part of local special needs protection area. A request letter was sent to Mineral Resources and Petroleum Authority of Mongolia ("MRPAM") on January 4, 2024.

On January 11, 2024, MRPAM issued an official letter to the Citizen representative Khural of Gurvantes soum and concluded that request was not reasonable and the License Areas will not be registered on the Cadastre mapping system.

On June 18, 2024, the Court of First Instance in Umnugobi Province reviewed the above subject matter which SGS acts as the plaintiff and Citizen's Representative Meetings of Gurvantes soum acts as the defendant. The Court of First Instance determined that the claims made by Citizen's Representative Meetings of Gurvantes soum relating to the License Areas as set forth in the Resolution passed on December 7, 2023 were invalid. Citizen's Representative Meetings of Gurvantes soum has applied to the Court of Appeals for an appeal of the Court of First Instance's decision. The date of the Court of Appeals' review decision is yet to be confirmed as of the date here.

TRANSPORTATION INFRASTRUCTURE

On August 2, 2011, the State Property Committee of Mongolia awarded the tender to construct a paved highway from the Ovoot Tolgoi Mine to the Shivee Khuren Border Crossing (the "Paved Highway") to consortium partners NTB LLC and SGS (together referred to as "RDCC LLC") with an exclusive right of ownership of the Paved Highway for 30 years. The Company has an indirect 40% interest in RDCC LLC through its Mongolian subsidiary SGS. The toll rate is MNT 1,800 per tonne.

The Paved Highway has a carrying capacity in excess of 20 million tonnes of coal per year.

For the three and six months ended June 30, 2024, RDCC LLC recognised toll fee revenue of $3.6 million (2023: $1.9 million) and $6.3 million (2023: $3.6 million), respectively.

PLEDGE OF ASSETS

As at June 30, 2024, most of the Company's mobile equipment and other operating equipment with carrying value of $5.5 million (December 31, 2023: $3.2 million) were pledged as security of Convertible Debenture.

PURCHASE, SALE OR REDEMPTION OF LISTED SECURITIES OF THE COMPANY

The Company did not redeem its listed securities, nor did the Company or any of its subsidiaries purchase or sell such securities during the six months ended June 30, 2024.

COMPLIANCE WITH CORPORATE GOVERNANCE

The Company has, throughout the six months ended June 30, 2024, applied the principles and complied with the requirements of its corporate governance practices as defined by the Board and all applicable statutory, regulatory and stock exchange listings standards, which include the code provisions set out in the Corporate Governance Code (the "Corporate Governance Code") contained in Appendix C1 to the Listing Rules, except for the following:

Pursuant to Section C.2 under Part 2 of the Corporate Governance Code, the chairman of the Board (the "Chairman") should be responsible for the overall management of the Board. The Company has not had a Chairman since November 2017. The Board has appointed an Independent Lead Director, who is fulfilling the duties of the Chairman;

Pursuant to code provision C.2.7 of the Corporate Governance Code, the Chairman should at least annually hold meetings with the non-executive directors (including independent non-executive directors) without the executive directors present. During the period of January 1, 2024 to June 30, 2024 there was one meeting between the Independent Lead Director, who is fulfilling the duties of the Chairman, and the non-executive directors without the presence of the executive directors. The opportunity for such communication channel is offered at the end of each Board meeting;

Pursuant to code provision F.2.2 under Part 2 of the Corporate Governance Code, the Chairman of the Board should attend the annual general meeting. Mr. Yingbin Ian He, an independent non-executive director and the Lead Director, attended and acted as Chairman of the Company's annual general meeting held on June 27, 2024 to ensure effective communication with shareholders of the Company.

SECURITIES TRANSACTIONS BY DIRECTORS

The Company has adopted policies regarding directors' securities transactions in its Corporate Disclosure, Confidentiality and Securities Trading Policy that have terms that are no less exacting than those set out in the Model Code for Securities Transactions by Directors of Listed Issuers contained in Appendix C3 to the Listing Rules ("Model Code").

In response to a specific enquiry made by the Company on each of the directors, all directors confirmed that they had complied with the required standards as set out in the Model Code and the Company's Corporate Disclosure, Confidentiality and Securities Trading Policy throughout the six months ended June 30, 2024.

Furthermore, if a Director (a) enters into a transaction involving securities of the Company or, for any other reason, the direct or indirect beneficial ownership of, or control or direction over, securities of the Company changes from that shown or required to be shown in the latest insider report filed by the Director, or (b) enters into a transaction involving a related financial instrument, the Director must, within the prescribed period, file (i) an insider report in the required form on the System for Electronic Disclosure by Insiders website (www.sedi.ca) operated by the Canadian Securities Administrators and (ii) a Disclosure of Interest Form with the HKEX.

A "related financial instrument" is defined as: (a) an instrument, agreement, security or exchange contract, the value, market price or payment obligations of which is/are derived from, referenced to or based on the value, market price or payment obligations of a security, or (b) any other instrument, agreement or understanding that affects, directly or indirectly, a person's economic interest in respect of a security or an exchange contract.

OUTLOOK

The Company had been increasing the scale of its mining operations since 2023, as well as implementing various coal processing methods, including screening, wet washing and dry coal processing, which have resulted in improved coal quality and enhanced production volumes and growth of coal export volume into China during the quarter.

In response to the market demand for different coal products, the Company has focused on expanding the categories of coal products in its portfolio, including mixed coal, wet washed coal and dry processed coal. In addition, the Company has experienced success with processing its inventory of F-grade coal products through cost-effective screening procedures. As a result of the improvement in the quality of the processed F-grade coal, the Company was able to meet the import coal quality standards established by Chinese authorities and have been exporting this product to China for sale since the first quarter of 2024, further enhancing the Company's coal export volume.

Both Chinese and Mongolian governments played a significant role in strengthening their ties on coal trade. The development of new cross-border railways, expansion of road infrastructure, deployment of automated technologies in export operations and streamlined customs clearances underscore the collaborative efforts to facilitate cross-border trade. These strategic initiatives position Mongolian coal favourably in the evolving dynamics of China's coal imports.

With the continuous assistance and support from JDZF, the Company will focus on expanding its market reach and customer base in China to improve the profit margin earned on its coal products.

In 2024, the Company will continue to ramp up its mining operations and production capacity to capitalise on the anticipated increase in sales volume.

The Company remains cautiously optimistic regarding the Chinese coal market, as coal is still considered to be the primary energy source which China will continue to rely on in the foreseeable future. Coal supply and coal import in China are expected to be limited due to increasingly stringent requirements relating to environmental protection and safety production, which may result in volatile coal prices in China. The Company will continue to monitor and react proactively to the dynamic market.

In the medium term, the Company will continue to adopt various strategies to enhance its product mix in order to maximise revenue, expand its customer base and sales network, improve logistics, optimise its operational cost structure and, most importantly, operate in a safe and socially responsible manner.

The Company's objectives for the medium term are as follows:

Enhance product mix - The Company will focus on improving the product mix by: (i) improving mining operations; (ii) utilising the Company's wet coal processing plant; and (iii) trading and blending different types of coal to produce blended coal products that are economical to the Company.

Expand market reach and customer base - The Company will endeavor to increase sales volume and sales price by: (i) expanding its sales network and diversifying its customer base; (ii) increasing its coal logistics capacity to resolve the bottleneck in the distribution channel; and (iii) setting and adjusting the sales price based on a more market-oriented approach in order to maximise profit while maintaining sustainable long-term business relationships with customers.

Increase production and optimise cost structure - The Company will aim to increase coal production volume to take advantage of economies of scale. The Company will also focus to reduce its production costs and optimise its cost structure through engaging sizable third-party contract mining companies to enhance its operation efficiency, strengthening procurement management, ongoing training and productivity enhancement.

Operate in a safe and socially responsible manner - The Company will continue to maintain the highest standards in health, safety and environmental performance and operate in a corporate socially responsible manner.

In the long term, the Company will continue to focus on creating and maximising shareholders value by leveraging its key competitive strengths, including:

Strategic location - The Ovoot Tolgoi Mine is located approximately 40km from China, which represents the Company's main coal market. The Company has an infrastructure advantage, being approximately 50km from a major Chinese coal distribution terminal with rail connections to key coal markets in China.

A large reserves base - The Ovoot Tolgoi Deposit has mineral reserves of more than 90 million tonnes.

Several growth options - The Company has several growth options including the Soumber Deposit and Zag Suuj Deposit, located approximately 20km east and approximately 150km east of the Ovoot Tolgoi Mine, respectively.

Bridge between China and Mongolia - The Company is well-positioned to capture the resulting business opportunities between China and Mongolia. The Company will seek assistance and support from its two largest shareholders, which are both experienced coal mining enterprises in China, and have a strong operational record for the past decade in Mongolia.

NON-IFRS FINANCIAL MEASURES

Cash Costs

The Company uses cash costs to describe its cash production and associated cash costs incurred in bringing the inventories to their present locations and conditions. Cash costs incorporate all production costs, which include direct and indirect costs of production, with the exception of idled mine asset costs and non-cash expenses which are excluded. Non-cash expenses include share-based compensation expense, impairment of coal stockpile inventories, depreciation and depletion of property, plant and equipment and mineral properties. The Company uses this performance measure to monitor its operating cash costs internally and believes this measure provides investors and analysts with useful information about the Company's underlying cash costs of operations. The Company believes that conventional measures of performance prepared in accordance with IFRS Accounting Standards do not fully illustrate the ability of its mining operations to generate cash flows. The Company reports cash costs on a sales basis. This performance measure is commonly utilised in the mining industry.

Summarised Comprehensive Income Information

(Expressed in thousands of USD, except for share and per share amounts)

Summarised Financial Position Information

(Expressed in thousands of USD)

SELECTED INFORMATION FROM THE NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Additional information required by the HKEX and not disclosed elsewhere in this press release is as follows. All amounts are expressed in thousands of USD and shares in thousands, unless otherwise indicated.

1. BASIS OF PREPARATION

1.1 Corporate information and going concern

The Company's condensed consolidated interim financial statements have been prepared on a going concern basis which assumes that the Company will continue to operate until at least June 30, 2025 and will be able to realise its assets and discharge its liabilities in the normal course of operations as they come due. However, in order to continue as a going concern, the Company must generate sufficient operating cash flows, secure additional capital or otherwise pursue a strategic restructuring, refinancing or other transactions to provide it with sufficient liquidity.

Several adverse conditions and material uncertainties cast significant doubt upon the Company's ability to continue as a going concern and the going concern assumption used in the preparation of the Company's condensed consolidated interim financial statements. The Company had a deficiency in assets of $128,998 as at June 30, 2024 as compared to a deficiency in assets of $141,332 as at December 31, 2023 while the working capital deficiency (excess current liabilities over current assets) reached $274,671 as at June 30, 2024 compared to a working capital deficiency of $218,815 as at December 31, 2023.

Included in the working capital deficiency as at June 30, 2024 are significant obligations, represented by trade and other payables of $94,998, and an additional tax and tax penalty of $83,456.

The Company may not be able to settle all trade and other payables on a timely basis, and as a result any continuing postponement in settling of certain trade and other payables owed to suppliers and creditors may result in potential lawsuits and/or bankruptcy proceedings being filed against the Company. Furthermore, there is no guarantee that the Company will be successful in its negotiations with the MTA, or any appeal, in relation to the Audit. Except as disclosed elsewhere in this press release, no such lawsuits or proceedings were pending as at August 14, 2024. However, there can be no assurance that no such lawsuits or proceedings will be filed by the Company's creditors in the future and the Company's suppliers and contractors will continue to supply and provide services to the Company uninterrupted.

In the past, the Company has customarily entered into cooperation agreements with the local custom office in Mongolia on an annual basis to facilitate the Company's export of coal into China. The Company's most recently executed cooperation agreement expired on November 23, 2023. While the Company has applied with the local Mongolian custom office to renew its cooperation agreement. In May 2024, the Company has successfully renewed the cooperation agreement.

There are significant uncertainties as to the outcomes of the above events or conditions that may cast significant doubt on the Company's ability to continue as a going concern and, therefore, the Company may be unable to realise its assets and discharge its liabilities in the normal course of business. Should the use of the going concern basis in preparation of the condensed consolidated interim financial statements be determined to be not appropriate, adjustments would have to be made to write down the carrying amounts of the Company's assets to their realisable values, to provide for any further liabilities which might arise and to reclassify non-current assets and non-current liabilities as current assets and current liabilities, respectively. The effects of these adjustments have not been reflected in the condensed consolidated interim financial statements. If the Company is unable to continue as a going concern, it may be forced to seek relief under applicable bankruptcy and insolvency legislation.

For the purpose of assessing the appropriateness of the use of the going concern basis to prepare the financial statements, management of the Company has prepared a cash flow projection covering a period of 12 months from June 30, 2024. The cash flow projection has considered the anticipated cash flows to be generated from the Company's business during the period under projection including cost saving measures. In particular, the Company has taken into account the following measures for improvement of the Company's liquidity and financial position, which include: (a) entering into the 2024 March Deferral Agreement and the 2024 April Deferral Agreement with JDZF on March 19, 2024 and April 30, 2024, respectively for a deferral of the 2024 March Deferred Amounts and 2024 April Deferred Amounts; (b) communicating with vendors in agreeing repayment plans of the outstanding payable; and (c) obtaining an avenue of financial support from an affiliate of the Company's major shareholder for a maximum amount of $127,000 (equivalent to RMB 900 million) during the period covered in the cash flow projection. Regarding these plans and measures, there is no guarantee that the suppliers would agree the settlement plan as communicated by the Company. Nevertheless, after considering the above, the directors of the Company believe that there will be sufficient financial resources to continue its operations and to meet its financial obligations as and when they fall due in the next 12 months from June 30, 2024 and therefore are satisfied that it is appropriate to prepare the condensed consolidated interim financial statements on a going concern basis.

Significant uncertainties exist regarding the Company's management's ability to achieve its plans as described above. The continued operation of the Company as a going concern depends on a key factor: the utilisation of the financial support from an affiliate of the Company's major shareholder to settle payables, including the additional tax and tax penalty, in a timely manner.

The outcome of this factor will have a significant impact on the Company's ability to continue operating as a going concern. It is crucial to closely monitor and address these uncertainties to ensure the Company's stability and long-term viability.

Factors that impact the Company's liquidity are being closely monitored and include, but are not limited to, restrictions on the Company's ability to import its coal products for sale in China, Chinese economic growth, market prices of coal, production levels, operating cash costs, capital costs, exchange rates of currencies of countries where the Company operates and exploration and discretionary expenditures.

As at June 30, 2024 and December 31, 2023, the Company was not subject to any externally imposed capital requirements.

1.2 Statement of compliance

These condensed consolidated interim financial statements, including comparatives, have been prepared in accordance with International Accounting Standard ("IAS Standards") 34 - "Interim Financial Reporting" using accounting policies in compliance with the IFRS Accounting Standards issued by the International Accounting Standards Board and Interpretations of the IFRS Interpretations Committee.

The condensed consolidated interim financial statements of the Company for the six months ended June 30, 2024 were approved and authorised for issue by the Board on August 14, 2024.

1.3 Basis of presentation

These condensed consolidated interim financial statements have been prepared using accounting policies and methods of computation consistent with those applied in the Company's December 31, 2023 consolidated annual financial statements. These condensed consolidated interim financial statements do not include all the information and note disclosures required by IFRS for annual financial statements and therefore should be read in conjunction with the Company's annual consolidated financial statements for the year ended December 31, 2023.

1.4 Adoption of new and revised standards and interpretations

There have been no other new IFRSs or IFRIC interpretations that are not yet effective that would be expected to have a material impact on the Company, except those disclosed in the Company's annual consolidated financial statements for the year ended December 31, 2023.

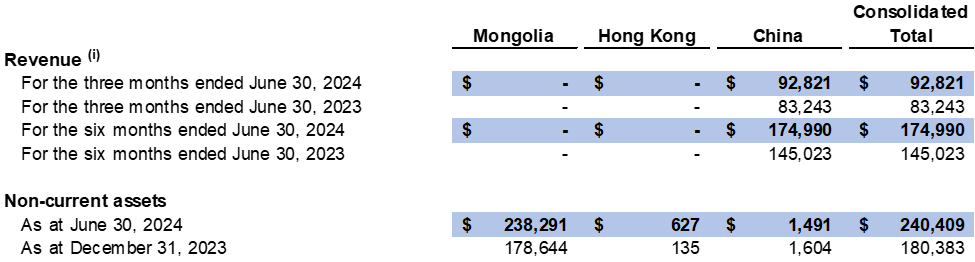

2. SEGMENTED INFORMATION

The Company's Chief Executive Officer (chief operating decision maker) reviews the financial information in order to make decisions about resources to be allocated to the segment and to assess its performance. No operating segment identified by the Board has been aggregated in arriving at the reporting segments of the Company. For management's purpose, the Company has only one reportable operating segment, which is the coal division. The division is principally engaged in coal mining, development and exploration in Mongolia, and logistics and trading of coal in Mongolia and China for the six months ended June 30, 2024 and 2023.

The Company's resources are integrated and as a result, no discrete operating segment financial information is available. Since this is the only reportable and operating segment of the Company, no further analysis thereof is presented. All the revenue of the Company is generated from trading of coal for the six months ended June 30, 2024 and 2023.

2.1 Information about major customers