Black Book's 2025 survey highlights trends and investment priorities in healthcare IT, based on insights from over 1,160 key figures in venture capital, private equity, and healthcare banking.

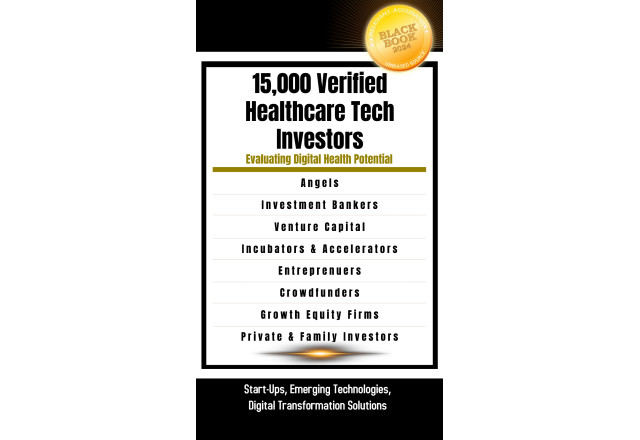

NEW YORK, NY / ACCESSWIRE / September 1, 2024 / In Q3 2024, Black Book conducted a comprehensive survey of 1,160 key figures in healthcare banking, private equity, advisory firms, and venture capital with the goal to assess their investment outlook and priorities for healthcare IT trends heading into 2025. For a decade Black Book has polled VCs, PEs and bankers on healthcare IT start-up viability, creativity, practicality and growth potential with over 15,000 industry professionals participating to date.

WHAT'S NOT

As we move into 2025, 69% of venture capitalists are prioritizing scalable innovations that will guarantee return on investment.

"Healthcare startups must demonstrate that their solutions can seamlessly integrate into existing healthcare systems without disruption," said Doug Brown, President of Black Book. "The current market demands tangible results and practical applications, making it crucial for emerging technologies to prove their real-world value as fewer deals being made at higher values, clearly signals the shift toward greater selectivity among investors."

Investors are increasingly focusing on companies with scalable, proven models. Early-stage investments, particularly in AI and digital health, continue to draw interest, but VCs are now prioritizing sustainable business models and clear ROI pathways as key factors for 2025 investments.

Investor confidence in unproven artificial intelligence solutions is waning rapidly, with 71% of respondents reporting skepticism toward AI technologies that fail to deliver clear clinical outcomes or cost savings. Besides unproved AI solutions, three other areas have seeing investors passing in 2025:

Traditional EHR Systems: Investments in legacy EHR systems that lack innovation, particularly those not focused on interoperability or advanced data analytics, are seeing diminishing returns and VCs have lost interest agree 97% of respondents.

Standalone Health Apps: "Apps that do not integrate well with broader healthcare ecosystems or lack clear pathways to demonstrate ROI are falling out of favor," state 88% of respondents. Many existing apps struggle to generate revenue or scale effectively without integration into broader healthcare systems turning off the investment stream. AI-driven diagnostic tools, particularly those that operate as standalone solutions, are seen as high-risk by 79% of the VCs and PEs participating in the survey due to the need for extensive validation, regulatory approval, and integration challenges within clinical workflows.

Untested Digital Health Solutions: Investors are wary of digital health startups that cannot demonstrate tangible outcomes or scalability. These areas are being overshadowed by more advanced, integrated, and outcome-focused technologies. AI technologies in particular that cannot demonstrate clear clinical outcomes or cost savings are also losing investor confidence, as the market becomes more focused on tangible results. 94% of investors and advisors won't commit to anything untested for at least another calendar year.

Payer Blockchain Technology: While blockchain has potential for enhancing data security, interoperability, and patient privacy, its adoption among healthcare payers has been and will continue to be very low due to concerns over regulatory challenges, and integration with existing systems, confirmed 85% of respondents.

AI for Hospital Clinical Decisions Support: While AI has shown promise in various healthcare applications, 81% of investors remain cautious due to concerns about regulatory hurdles, the need for extensive clinical validation, integration challenges with existing hospital systems, and the potential for liability issues related to GenAI-driven medical decisions, due to hallucinations and jailbreaks.

The following start-ups are expected to be rejected for funding and investment in 2025 by the majority of VC, PE, and bankers include:

Telemedicine for Routine Care: As the initial surge in telemedicine adoption during the pandemic stabilizes, most all (99%) VCs are firmly cautious about investing in telemedicine platforms focused solely on routine care, fearing market saturation and declining demand.

Wearable Health Tech: While consumer interest in wearables remains strong, 90% of investors are hesitant to invest in new wearable health technologies due to concerns about data accuracy, user engagement, and the ability to demonstrate clinical outcomes that lead to reimbursement.

WHAT'S HOT

There is a growing demand for digital health solutions to demonstrate measurable outcomes. 81% of responding Investors state they are increasingly focusing on new technologies that can provide strong evidence of their impact on patient care, which is becoming a critical factor in securing funding. "Investors are becoming more discerning, focusing on companies that can prove their impact on healthcare outcomes and this shift is driven by the increasing demand for evidence-based solutions, where startups must show clear data on how their technology improves patient care or reduces costs, period," said Brown.

68% of respondentVCs claim they are favoring startups that have strong partnerships with established healthcare providers or technology companies. These collaborations are seen as crucial for scaling solutions and achieving market penetration more rapidly. These investments reflect a broader trend towards scalable, innovative solutions that address critical needs in clinical care and healthcare delivery.

For 2025, 514 healthcare venture capitalists indicated they expect to continue their focus on advanced technologies, with significant investments in the following areas:

Artificial Intelligence (AI) and Machine Learning (ML): Not surprisingly, 83% of all investor firm respondents confirmed they will likely prioritize AI and ML applications that drive medical delivery process automation, data analytics, and predictive modeling, especially in the healthcare industry sectors that emphasize finance/revenue cycle management (71%) and cybersecurity (52%).

Cloud Computing and Infrastructure: Investments will focus on scalable cloud solutions that enhance data storage, processing capabilities, and remote work infrastructure according to 21% of respondent VCs.

Cybersecurity: With increasing digital threats, and recent vendor impacts, 19% of VCs will seek investments in innovative technologies that protect data across various providers, payers and ancillaries.

Edge Computing: As medical IoT devices proliferate, edge computing solutions that process data closer to the source will attract interest for their potential to reduce latency and bandwidth use, according to 13% of respondent VCs.

Quantum Computing: Although still in its early stages, VCs are beginning to explore quantum computing for its potential to revolutionize industries like cryptography and complex problem-solving with 8% expressing opportunities for exploration in 2025.

WHAT'S SAFE

Healthcare IT investments that continue to be considered safe in 2025 for venture capital include:

Non-Routine Telehealth and Remote Patient Monitoring: These areas remain strong due to the ongoing demand for virtual care and chronic disease management.

Clinical Decision Support: AI solutions that have proven their effectiveness in improving clinical outcomes and reducing costs are still attracting significant investment.

Interoperability and Data Analytics: Platforms that enhance data sharing and analytics across healthcare systems are crucial for improving efficiency and care quality.

These areas are seen as low-risk by 76% of respondents because they address critical needs in the evolving healthcare landscape and offer clear paths to scalability and ROI.

About Black Book

Black Book conducts crowdsourced polls and surveys with Venture Capitalists, Private Equity Firms, Investment Bankers, advisors, healthcare executives and front-line users about their current technology trends, and services partners and awards top-performing vendors' recognition based on performance using indicators of client experience, loyalty, and customer satisfaction.

Black Book™ does not solicit participation fees, review fees, inclusion or briefing charges, consultant fees, or vendor collaboration during its client polls. For methodology, auditing, resources, comprehensive research, and ranking data, see www.blackbookmarketresearch.com or contact us at [email protected].

Contact Information

Press Office

[email protected]

8008637590

Related Images

SOURCE: Black Book Research

View the original press release on newswire.com.