VANCOUVER, BC / ACCESSWIRE / October 15, 2024 / Axcap Ventures (CSE:AXCP) ("Axcap" or the "Company") and GFG Resources Inc. ("GFG") are pleased to release Mineral Resource Estimate (MRE) for the Rattlesnake Hills Gold Project ("RSH") in Wyoming. Further to the Company's news release on September 25, 2024, the Company, through its wholly-owned subsidiary, PGV Patriot Gold Vault Ltd., entered into a mineral property purchase agreement with GFG to acquire RSH.

Highlights:

Measured and Indicated Resource of 24,857 Kt at 0.77 g/t Au for 612k ounces and Inferred Resource of 19,626 Kt at 0.69 g/t Au for 432k ounces (see Table 1).

Resource Potential: The project hosts a significant gold resource with substantial upside potential through further exploration and drilling.

Established Infrastructure: Rattlesnake Hills benefits from nearby mining infrastructure, reducing the overall capex needed for future development including all weather roads and a substantial network of exploration infrastructure.

Favorable Geology: The deposit is hosted in favorable geology with multiple mineralized zones, suggesting the potential for higher-grade zones and increased resource expansion.

Blake Mclaughlin, VP Exploration of Axcap and CEO of PGV Patriot Gold Vault Ltd. stated, "Rattlesnake Hills represents a cornerstone asset in our portfolio, and the maiden resource demonstrates the significant gold endowment of the project. This is just the beginning. Our focus remains on expanding the resource base while optimizing the project's potential. With drilling set to continue, we expect further upside in the near future."

Table 1: Maiden MRE for Rattlesnake Hills Gold Project

Mineral Resource | Cutoff | Classification | Tonnes | Au | Au |

Pit-Constrained Mineral Resource Estimate | |||||

North Stock | 0.2 | Indicated | 18,338 | 0.80 | 473 |

0.2 | Inferred | 13,284 | 0.58 | 250 | |

Antelope Basin | 0.2 | Indicated | 6,520 | 0.66 | 139 |

0.2 | Inferred | 3,344 | 0.52 | 56 | |

Black Jack | 0.2 | Inferred | 1,788 | 0.72 | 41 |

Total | 0.2 | Indicated | 24,857 | 0.77 | 612 |

0.2 | Inferred | 18,416 | 0.59 | 347 | |

Out-of-Pit Mineral Resource Estimate | |||||

North Stock | 1.5 | Inferred | 1,142 | 2.19 | 81 |

Antelope Basin | 1.5 | Inferred | 68 | 2.33 | 5 |

Total | 1.5 | Inferred | 1,211 | 2.20 | 86 |

Consolidated Mineral Resource Estimate | |||||

Total | 0.2/1.5 | Indicated | 24,857 | 0.77 | 612 |

0.2/1.5 | Inferred | 19,626 | 0.69 | 432 | |

Notes:

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

Mr. Warren Black, M.Sc., P.Geo. of APEX Geoscience Ltd. ("APEX") is a qualified person as defined by NI 43-101 and is responsible for completing the mineral resource estimation, effective September 5, 2024.

All figures are rounded to reflect the relative accuracy of the estimates. Totals may not sum due to rounding. Resources are presented as undiluted and in situ.

Tonnage estimates are based on individually measured and calculated bulk densities for geological units ranging from 2.37 to 2.61 g/cm³.

Economic assumptions used include US$1,950/oz Au, process recoveries of 80% for Au, a US$5/t processing cost, and a G&A cost of US$1.8/t.

The constraining pit optimization parameters were US$2.0 /t mineralized and waste material mining cost and 45° pit slopes. Pit-constrained Mineral Resources are reported at an Au cutoff of 0.2 g/t.

The Out-of-Pit Mineral Resources include blocks outside the constraining pit shell that form continuous and potentially minable shapes. A mining cost of US$60/t and the economic assumptions above result in the Out-of-Pit Au cutoff of 1.5 g/t. Mining shapes encapsulate material within domains with a minimum horizontal width of 1.5 meters, perpendicular to the strike, and target vertical and horizontal dimensions of approximately 15 meters. Blocks narrower than the required mining thickness are only included if their diluted grade exceeds the cutoff when adjusted to the minimum mining width.

Resource Growth Potential

The RSH project covers a complex of alkaline intrusions of which only a small selection has been drill tested for gold potential. There exists substantial potential for expansion of near surface resources by systematically testing know occurrences on the project. Along with the near surface potential, there is also demonstrated potential for high tonnage mineralization at depth which could be amenable to underground extraction in the future.

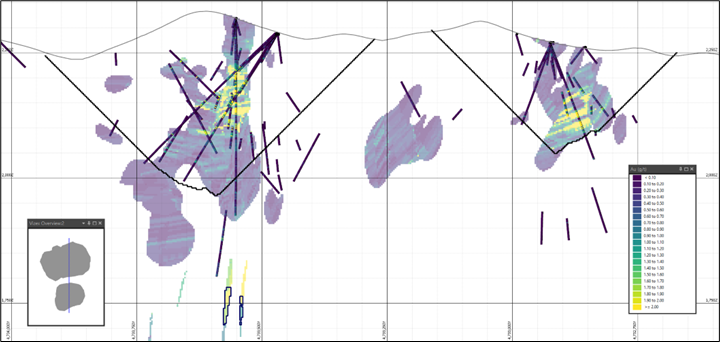

Figure 1: Showing Pit constrained resource at North Stock and Antelope Basin.

This announcement has been reviewed and approved for release by Warren Black, M.Sc., P.Geo of APEX Geoscience Ltd. ("APEX"), who is an independent "qualified person" under NI 43-101 and is responsible for the MRE. Mr. Black has verified the scientific and technical information related to the MRE and consents to the inclusion in this release of said data in the form and context in which it appears.

An NI 43-101 compliant technical report on the Rattlesnake Hills Project, titled "Technical Report on The Rattlesnake Hills Project, Natrona County, Wyoming, USA", will be available on SEDAR+ (www.sedarplus.ca) within 45 days of this release (the "Technical Report"), including all qualifications, assumptions and exclusions that relate to the MRE. The Technical Report is intended to be read as a whole and sections should not be read or relied upon out of context. The independent Qualified Persons for the Technical Report are independent geological consultants with APEX Geoscience and are named as follows:

Warren Black, M.Sc., P. Geol., P.Geo.

Andrew Turner, B.Sc., P.Geol., P.Geo.

Fallon Clarke, B.Sc., P.Geo.

About Axcap Ventures Inc.

Axcap is an investment company, the primary objective of which is to identify promising companies with excellent projects, innovative technologies or both, using management's extensive experience in deal sourcing and capital combination to maximize returns for the company's shareholders. The company will invest its funds with the aim of generating returns from capital appreciation and investment income. It intends to accomplish these goals through the identification of and investment in securities of private and publicly listed entities across a wide range of sectors and industry areas, including, but not limited to, the mineral exploration, technology, software development and biotechnology industries.

Shareholder and Investor Inquiries

For more information, please contact:

Kevin Ma, Chief Financial Officer, or Blake Mclaughlin, VP Exploration

P: 604-687-7130

E: [email protected]

W: www.patriotgoldvault.com

Cautionary Statement Regarding "Forward-Looking" Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur and specifically include statements regarding: the Company's strategies, expectations, planned operations or future actions, including but not limited to exploration programs at the Rattlesnake Hills project and the results thereof; and the Company's acquisition ofGFG. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: general business, economic, competitive, political and social uncertainties; risks related to climate change; operational risks in exploration, delays or changes in plans with respect to exploration projects or capital expenditures; the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; changes in labour costs and other costs and expenses or equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, flooding or unfavourable operating conditions and losses, insurrection or war, delays in obtaining governmental approvals or financing, and commodity prices. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's management's discussion and analysis filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors.

Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: AXCAP VENTURES INC.