Guiding Clients to Life-Changing Outcomes, Clear Start Tax Demonstrates Proven Expertise in IRS Negotiations and Debt Relief

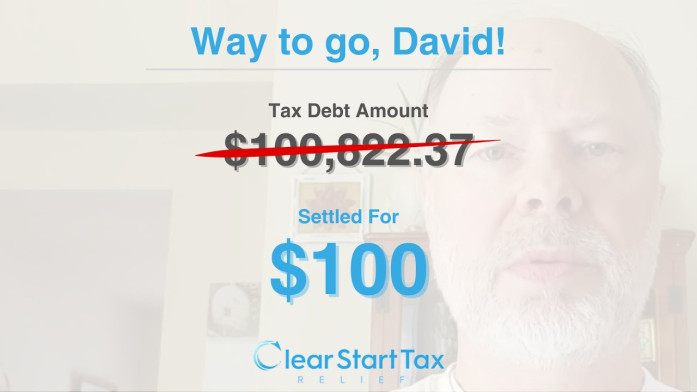

IRVINE, CA / ACCESSWIRE / November 1, 2024 / Clear Start Tax is thrilled to announce a remarkable victory for client David Moody, who managed to settle a $100,822.37 IRS debt for a mere $100. Through strategic guidance and expert negotiation under the IRS Offer in Compromise (OIC) program, Clear Start Tax delivered David the relief he never thought possible. This outcome underscores the firm's unwavering commitment to helping individuals achieve true financial freedom by overcoming overwhelming tax liabilities.

From Financial Overwhelm to a Fresh Start

When David Moody first came to Clear Start Tax, he was facing a seemingly insurmountable debt with the IRS. "I owed so much money I didn't know what I was going to do," he shared, describing how his debt had spiraled to over $100,000. "The biggest pain was getting a hold of the IRS. They're very hard to get a hold of, and it was near impossible."

Clear Start Tax's team took on David's case, dedicating months of in-depth analysis and careful strategizing to determine his eligibility for an Offer in Compromise - a lifeline that could settle his tax debt for less than the full amount owed. With persistence and a client-centered approach, they achieved the life-altering result David needed.

An Astonishing Outcome Through Expert Negotiation

David's case took an incredible turn when Clear Start Tax secured his settlement for just $100.

"What surprised me the most while going through the process was that I owed like a hundred thousand dollars, and my Offer in Compromise was for a hundred dollars-and they took it!"

- David M., Clear Start Tax Client

This drastic reduction gave David a fresh financial start, thanks to the thorough and determined efforts of the Clear Start Tax team.

A Client-Centered Approach to Tax Resolution

Clear Start Tax prides itself on offering more than just tax relief; they deliver hope and peace of mind to clients like David, who have often felt overwhelmed and trapped by their financial burdens. By taking a personalized approach to each case, Clear Start Tax ensures that clients feel supported, understood, and empowered throughout the entire resolution process. The firm's commitment extends beyond immediate debt relief, aiming to restore clients' confidence in their financial futures and provide a clear path toward lasting financial stability.

"I don't know what I would have done without their help. I really don't… I would recommend Clear Start Tax Relief because they did a good job for me."

- David M., Clear Start Tax Client

Clear Start Tax's mission is to provide every client with a personalized and transparent path forward, guiding them step-by-step through complex tax issues while ensuring they fully understand their options. By demystifying the tax resolution process and addressing each client's unique needs, Clear Start Tax helps individuals regain control over their finances with confidence. This approach not only alleviates immediate financial stress but also empowers clients to move forward with a renewed sense of financial security and peace of mind.

"Our approach is rooted in understanding the full financial situation of each client."

"Through programs like the Offer in Compromise, we aim to secure the best possible outcome for each person we work with. David's story is just one example of how impactful this process can be."

- Head Of Client Solutions, Clear Start Tax

Final Outcome

In October 2024, David's Offer in Compromise was officially accepted, allowing him to settle his $100,822.37 IRS debt for only $100. This outcome, representing a debt reduction of over 99.9%, is a testament to Clear Start Tax's expertise and commitment to client success.

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

Testimonials Disclaimer

All estimates and statements regarding program performance are based on historical client outcomes. Results for each individual may vary depending on their specific tax situation, financial status, and the timely and accurate submission of information. Among Clear Start Tax clients who enroll in tax resolution services, approximately 30% qualify for an Offer in Compromise (OIC), 40% qualify for Installment Agreements (IA) or Partial Payment Installment Agreements (PPIA), 15% qualify for Installment Agreements (IA) with Penalty Abatement, and 15% are placed in Currently Not Collectible (CNC) status. We do not guarantee that your tax debt will be reduced by a specific amount or percentage, or that your taxes will be paid off within a certain time frame. Interest and penalties will continue to accrue until your tax liability is resolved in full.

Testimonials provided by Clear Start Tax clients reflect their individual experiences and are based on their specific circumstances. Compensation may have been provided for their honest feedback. These are individual results, which will vary depending on the situation. No testimonial should be considered a promise, guarantee, or prediction of the outcome of your case.

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

949-800-4044

Related Video

https://www.youtube.com/watch?v=44gagCiRtGM

SOURCE: Clear Start Tax