DENVER, CO / ACCESSWIRE / November 14, 2022 / Pure Cycle posted $9.6 million of net income for the year ended August 31, 2022, which marks our fifth consecutive year and fourteenth consecutive quarter with positive net income. Each of our three cohesive business lines, being land development, water resource development, and single-family rentals, contributed to the positive income. We continue developing our master planned community, Sky Ranch, while expanding our water resource development business in terms of adding customers, acquiring water assets, and growing our rental home business. Mark Harding, CEO of Pure Cycle, commented that "as we wrap up 2022 and move into 2023, while cautious about the housing market, we couldn't be more pleased with the progress we made at Sky Ranch, with the continued expansion of our water resource business and the successful launch of our rental business."

Fiscal 2022 Highlights

- Revenues of $23.0 million which drove pre-tax income of $12.7 million

- EBITDA of $14.9 million

- Reconciliation of net income to EBITDA is as follows: net income of $9.6M plus interest expense of $0.1M plus tax expense of $3.1M plus depreciation and depletion of $2.1M equals EBITDA of $14.9 million

- Tap fees of $4.9 million

- All 229 lots delivered, 219 titles transferred to homebuilders in Phase 2A, and 10 lots retained for rentals

- 404.9 million gallons of water delivered; a record year for Pure Cycle's water resource business

- Receipt of $24.1 million from the Sky Ranch CAB, including $23.6 million from the issuance of the CAB's second municipal bond offering

Pure Cycle Corporation (NASDAQ Capital Market: PCYO), for the year ended August 31, 2022, is reporting net income of $9.6 million which was generated from revenues of $23.0 million. Pure Cycle continues construction on Phase 2A at its Sky Ranch Master Planned Community, which is just over 3/4ths complete.

"While interest rates continue to impact demand for housing across all sectors and price points, we believe the strongest segment in the housing market is the entry level market, and we are seeing builders looking to reposition their portfolios to lots that can deliver entry-level homes, which here in Denver are priced in the $400,000's," commented Mr. Harding, "we believe our home building partners achieved incredibly high margins on Phase 1 of Sky Ranch over the past two years which further highlights the current and future attractiveness of the proven Sky Ranch opportunity for Pure Cycle and our builder partners," concluded Mr. Harding.

Financial Summary

Revenue

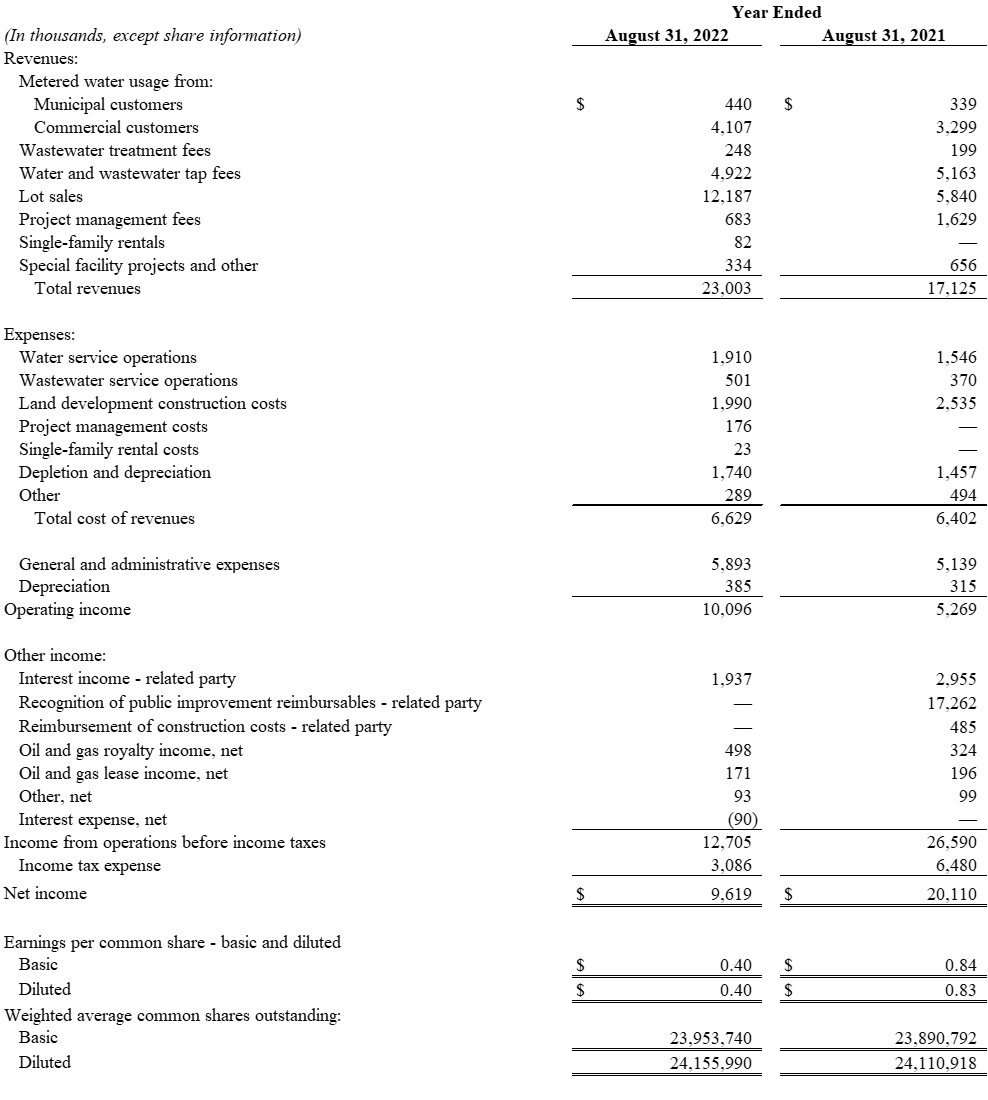

For the years ended August 31, 2022 and 2021, we reported total revenues of $23.0 million and $17.1 million with $10.1 million and $9.7 million being generated in our water and wastewater resource development segment, $12.9 million and $7.5 million generated by our land development segment, and less than $0.1 million and $0 reported in our single-family rental business.

For the years ended August 31, 2022 and 2021, we sold 159 and 167 water and wastewater taps for $4.9 million and $5.2 million. We have sold all taps in Phase 1 of Sky Ranch and have sold 113 of the 219 to be sold in Phase 2A.

For the years ended August 31, 2022 and 2021, we delivered 67 and 174 finished lots to homebuilders, meaning we transferred title on the lots to the builders. Our land development segment primarily recognizes revenue from selling lots based on the progress of construction activities and management of the construction of public improvements, which generated the $12.9 million and $7.5 million of revenue for the years ended noted above.

The single-family rental business has three homes built and rented with eleven additional units under construction.

Profitability

We continue to be profitable with net income of $9.6 million and $20.1 million for the years ended August 31, 2022 and 2021. This equates to $0.40 and $0.83 of earnings per fully diluted share. The 2021 net income was positively impacted by the recognition of amounts reimbursable from the Sky Ranch CAB, which is more fully described in the Form 10-K we filed with the SEC today.

Working Capital

We reported working capital (current assets less current liabilities) of $27.0 million as of August 31, 2022 with $34.9 million of cash and cash equivalents.

"We have spent more than three decades building a long-term sustainable company focused on providing high-quality affordable water and housing in the front range of Colorado, and we firmly believe we are well positioned to continue to grow through difficult market cycles such as this," commented Kevin McNeill, CFO of Pure Cycle. "Fiscal 2022 marked another great year for Pure Cycle. With record water sales, completing the sale of the school site, selling all Phase 2A finished lots, successful placement of the second Sky Ranch CAB bonds, and the successful launch and expansion of our single-family rentals, we are excited to build on these successes in the coming years," concluded Mr. McNeill.

Operational Summary

Water and Wastewater Resource Development

For fiscal 2022, we delivered a record 404.9 million gallons to customers, a 57% increase over the 257.8 million gallons we delivered in fiscal 2021. This substantial increase was due primarily to the sale of water to oil and gas operators for use in their drilling, but we also increased water deliveries to our Sky Ranch customers by 17% (from 43.0 million gallons in fiscal 2021 to 50.5 million gallons in fiscal 2022) due to customer growth as Sky Ranch continues its development progress. As we continue to deliver lots in our land development segment, our monthly recurring water sales continue to strengthen. Water and wastewater tap sales declined in fiscal 2022 compared to fiscal 2021 due to the timing of closings at Sky Ranch. Tap sales are driven by building permit applications and are not contractually established with the builders.

Land Development

Lot sales revenue increased for fiscal 2022 compared to fiscal 2021 due to progress on construction in Phase 2A at Sky Ranch. The price per lot for delivered lots in Phase 2 increased on average 40% over Phase 1, which also added to the increased revenue. Because lot sale revenue is recognized predominately as construction progresses, revenue will fluctuate due to timing of construction activities.

Single Family Rentals

In fiscal 2021, we began construction on three homes that were completed and put into service on November 1, 2021. All three homes were rented effective November 1, 2021, under non-cancellable one-year lease agreements. The revenues presented in the financial statements are for rental fees on all three homes since November 2021, which are recorded monthly throughout the terms of the leases. During fiscal 2022, we contracted for the construction of eleven more rental homes, which all began construction in fiscal 2022. We expect the fourth unit to be completed and ready for rental in Q1-2023 with delivery dates at various times throughout fiscal 2023 for the next ten units.

Other News

On November 2, 2022, our Board of Directors approved a stock repurchase program. The program is open-ended and authorizes repurchases of up to an aggregate of 200,000 shares of common stock in the open market. As of the date of this release, no shares have been repurchased under the repurchase program.

The following table presents our results of operations for the years ended August 31, 2022 and 2021:

The following table presents our consolidated financial position as of August 31, 2022 and 2021:

Year End 2022 EARNINGS CALL

Pure Cycle will host a conference call on Tuesday, November 14, 2022, at 8:30AM Eastern (6:30AM Mountain) to discuss the financial results and answer questions. Call details are presented below. We will post a detailed slide presentation, which provides an overview of Pure Cycle and presents summary financial results on our website which can be accessed at www.purecyclewater.com.

When: 8:30AM Eastern (6:30AM Mountain) on November 15, 2022

Call in number: 888-506-0062 (access code: 931680)

International call-in number: 973-528-0011 (access code: 931680)

Replay number: 877-481-4010 | 919-882-2331 (passcode: 46627)

Replay available until: November 29, 2022 at 8:30AM ET

Event link: https://www.webcaster4.com/Webcast/Page/2247/46627

Company Information

Pure Cycle continues to diversify its operations, grow its balance sheet, and drive recurring revenues. We operate in three distinct business segments, each of which complement the other. At our core, we are an innovative and vertically integrated wholesale water and wastewater service provider. In 2017, we launched our land development segment which develops master planned communities on land we own and to which we provide water and wastewater services. In 2021, we launched our newest line of business, the rental of single-family homes located at Sky Ranch, which provides long-term recurring revenues, furthers our land development operations, and adds more customers to our water resource segment.

Additional information, including our recent press releases and SEC filings, is available at www.purecyclewater.com, or you may contact our President, Mark W. Harding, or our CFO, Kevin B. McNeill, at 303-292-3456 or [email protected]. Be sure to follow Pure Cycle on Twitter @purecyclecorp.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are all statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, such as statements about the following: our positioning to continue to grow through this market cycle, the completion and delivery of our rental units, timing of development at Sky Ranch, tap sales, and home sales by our home builder customers. The words "anticipate," "likely," "may," "should," "could," "will," "believe," "estimate," "expect," "plan," "intend" and similar expressions are intended to identify forward-looking statements. Investors are cautioned that forward-looking statements are inherently uncertain and involve risks and uncertainties that could cause actual results to differ materially. Factors that could cause actual results to differ from projected results include, without limitation: home mortgage interest rates, inflation, and other factors impacting the housing market and home sales; the risk factors discussed in Part I, Item 1A of our most recent Annual Report on Form 10-K for the fiscal year ended August 31, 2022; and those factors discussed from time to time in our press releases, public statement and documents filed or furnished with the U.S. Securities and Exchange Commission. Except as required by law, we disclaim any obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

SOURCE: Pure Cycle Corporation