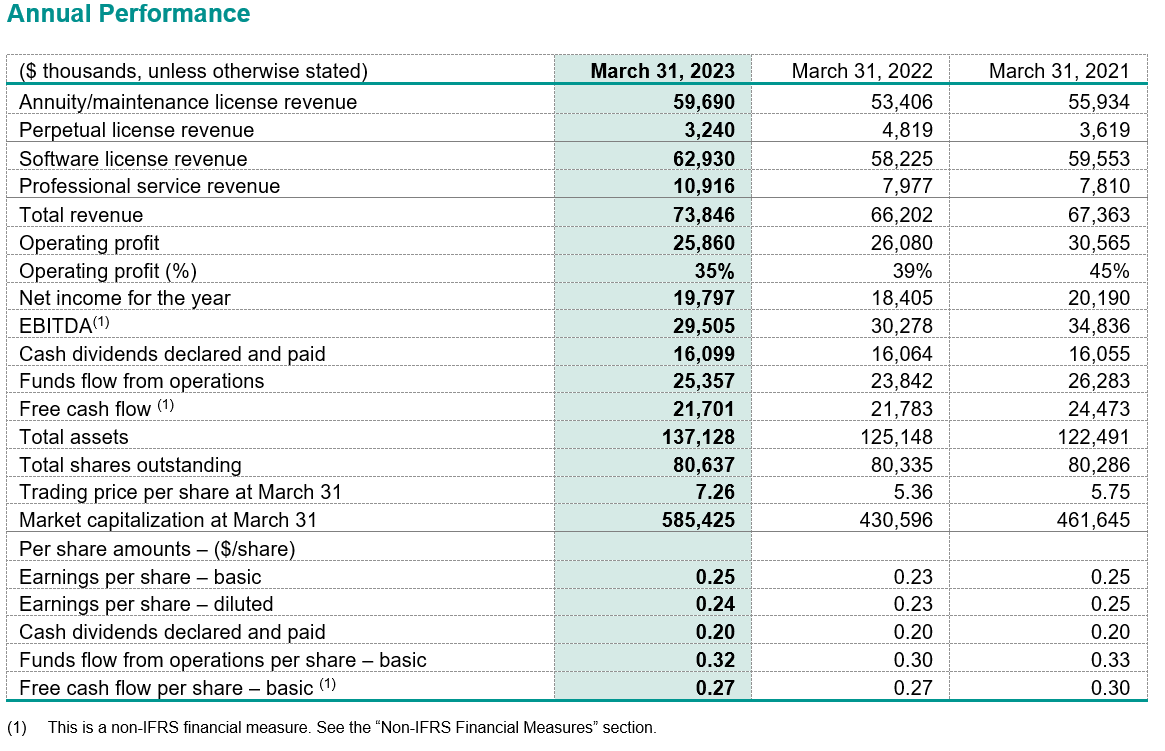

CALGARY, AB / ACCESSWIRE / May 25, 2023 / Computer Modelling Group Ltd. ("CMG" or the "Company") announces its financial results for the year ended March 31, 2023.

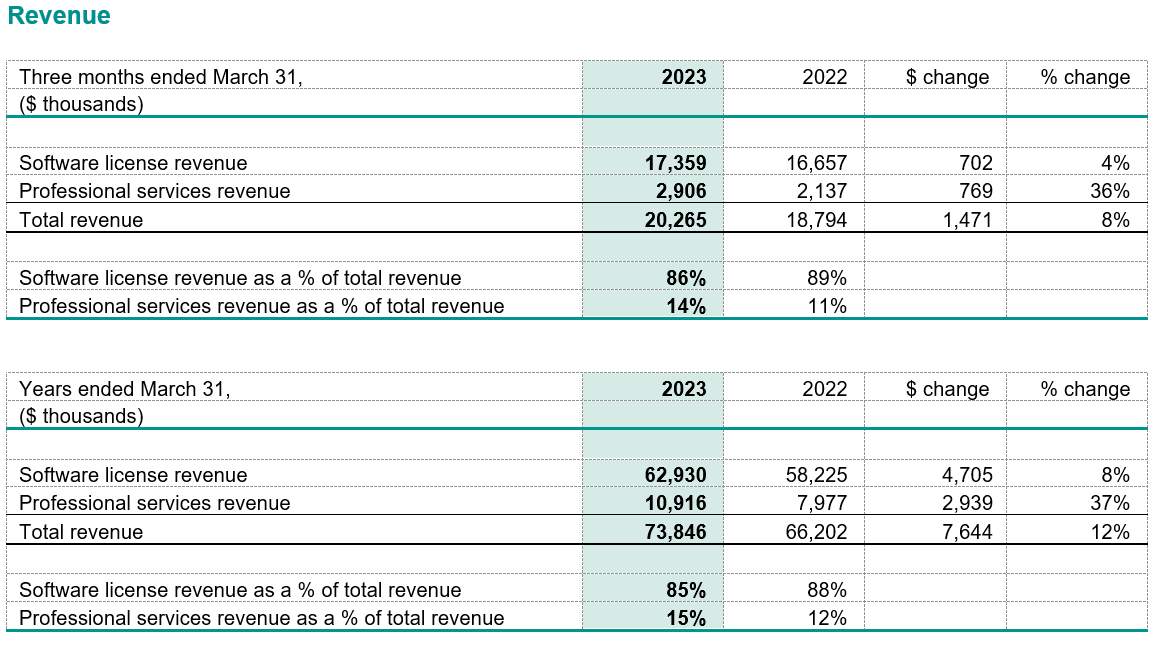

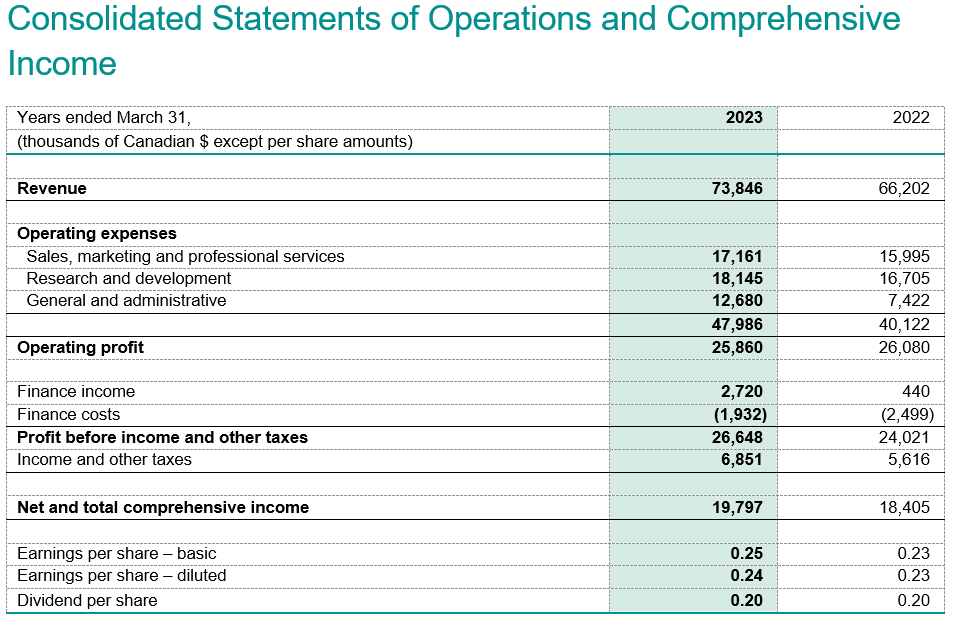

CMG's revenue is comprised of software license sales, which provides the majority of the Company's revenue, and fees for professional services.

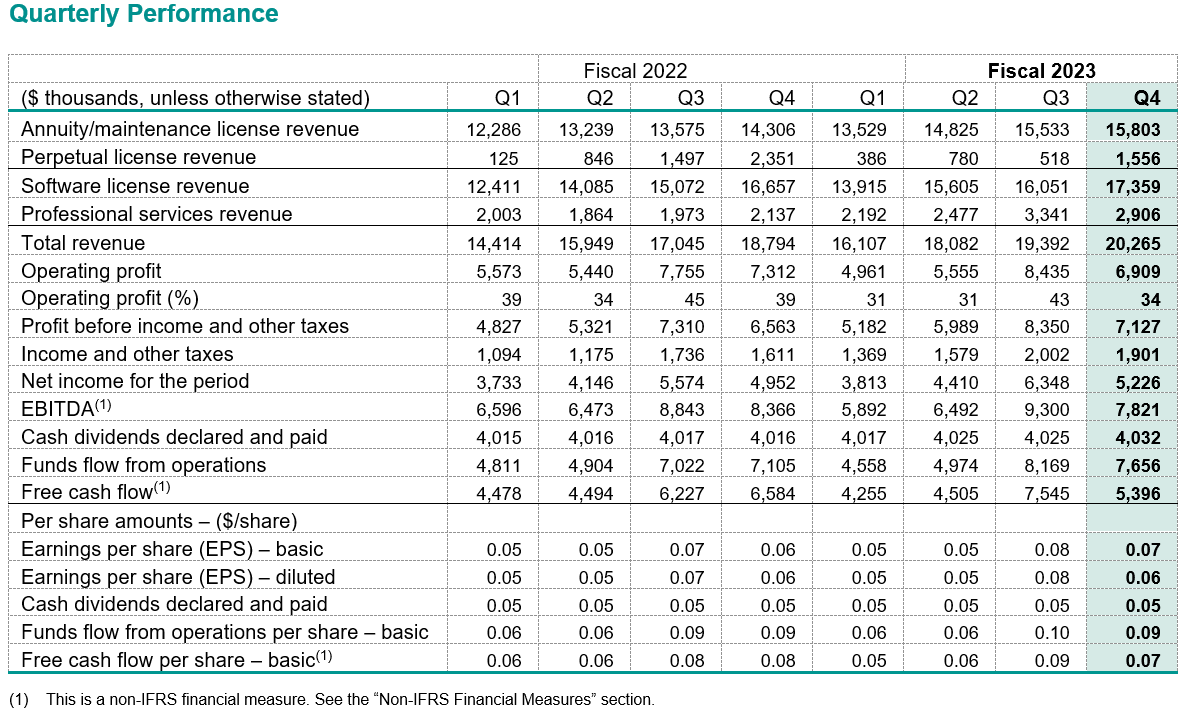

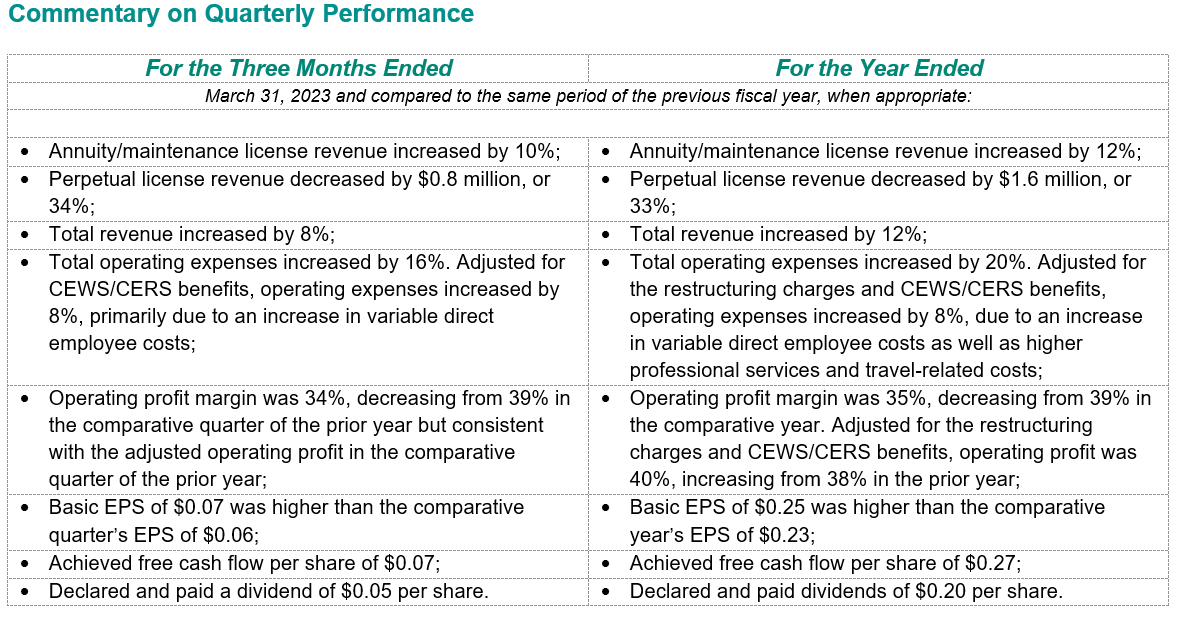

Total revenue for the three months and year ended March 31, 2023 increased by 8% and 12%, respectively, compared to the same periods of the previous fiscal year, due to increases in both software license revenue and professional services revenue.

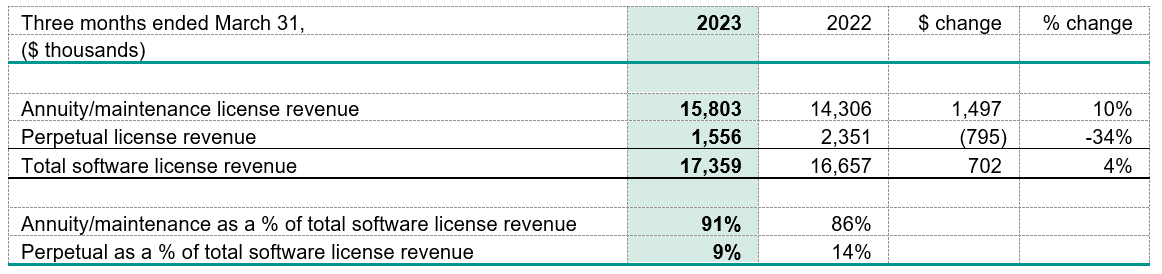

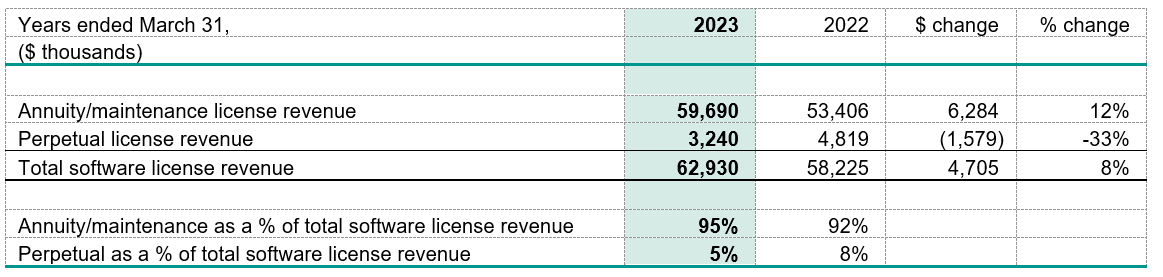

Software License Revenue

Software license revenue is made up of annuity/maintenance license fees charged for the use of the Company's software products, which is generally for a term of one year or less, and perpetual software license sales, whereby the customer purchases the then-current version of the software and has the right to use that version in perpetuity. Annuity/maintenance license fees have historically had a high renewal rate and, accordingly, provide a recurring revenue stream, while perpetual license sales are more variable and unpredictable in nature as the purchase decision and its timing fluctuate with the customers' needs and budgets. The majority of CMG's customers, who have acquired perpetual software licenses, subsequently purchase our maintenance package to ensure ongoing product support and access to current versions of CMG's software.

Total software license revenue for the three months and year ended March 31, 2023 increased by 4% and 8%, respectively, compared to the same periods of the previous fiscal year, due to the increases in annuity/maintenance license revenue, partially offset by the decreases in perpetual license revenue.

Annuity/maintenance license revenue increased by 10% and 12% during the three months and year ended March 31, 2023, respectively, due to increases in all regions except Canada, supported by license fee increases, increased license usage by existing customers and the addition of new customers. We continue to see an increase in revenue from the customers involved in carbon capture and storage projects and estimate that about 18% and 14% of total software revenue for the three months and year ended March 31, 2023, respectively, is attributable to the energy transition solutions.

Perpetual license revenue decreased by 34% and 33% during the three months and year ended March 31, 2023, respectively, compared to the same periods of the previous fiscal year. Sales of perpetual licenses may fluctuate significantly between periods due to the uncertainty associated with the timing and the location where sales are generated. For this reason, even though we expect to achieve a certain level of perpetual sales on an annual basis, we expect to observe fluctuations in the quarterly perpetual revenue amounts throughout the fiscal year. In our experience, the majority of perpetual sales are generated in South America and the Eastern Hemisphere, as North American customers usually prefer annuity licenses to perpetual purchases.

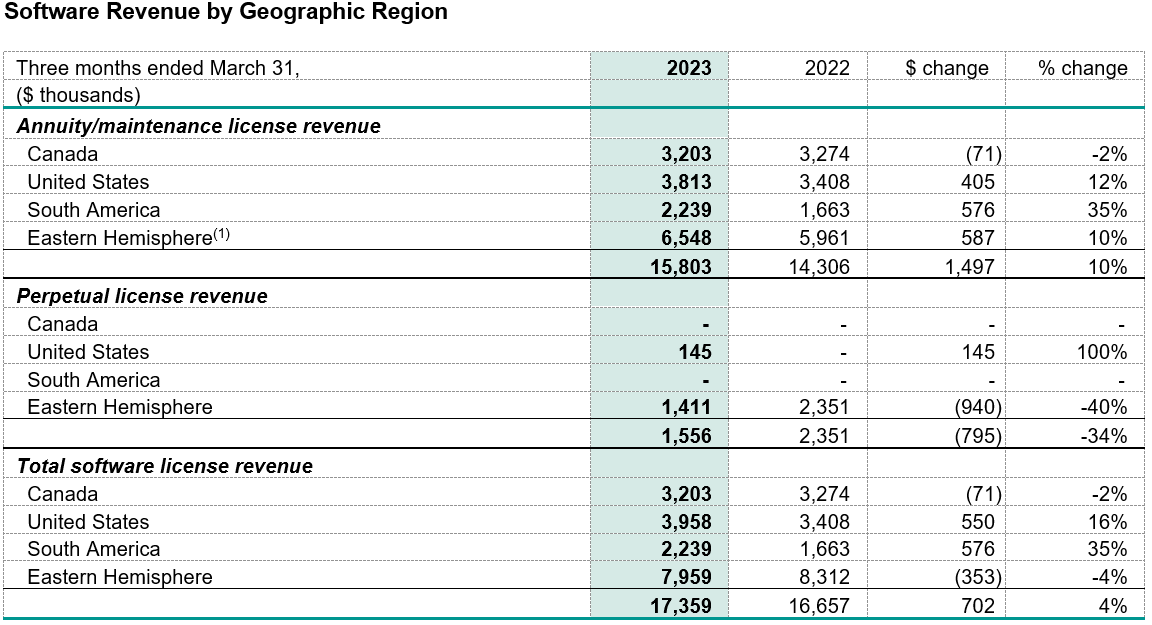

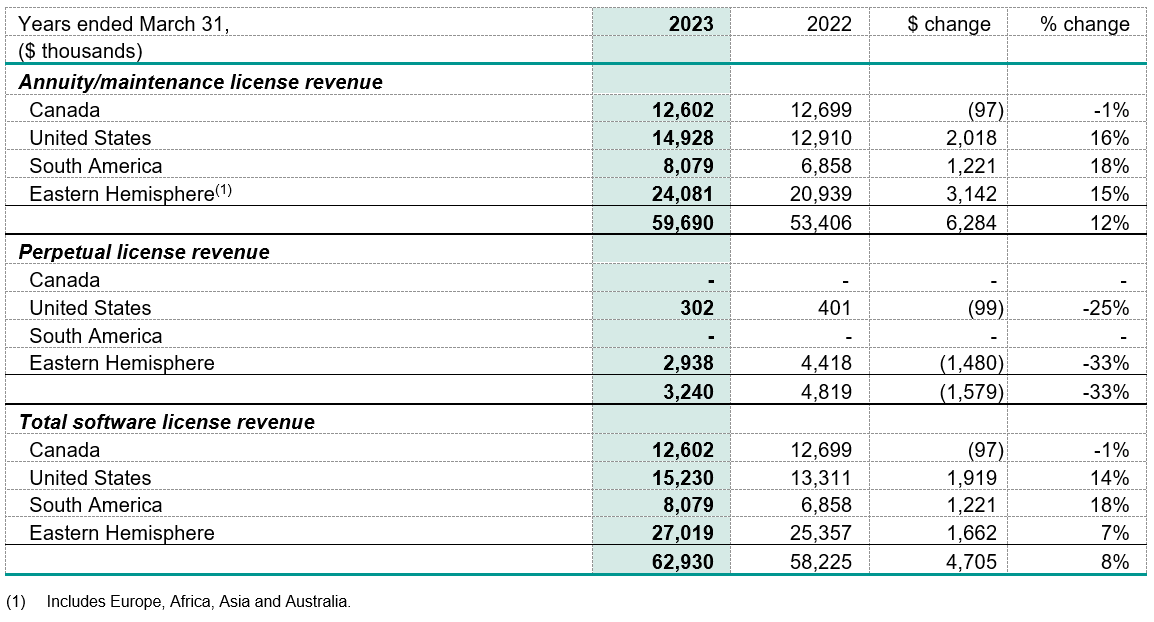

During the three months ended March 31, 2023, compared to the same period of the previous fiscal year, total software license revenue increased in the United States and South America and decreased in the Eastern Hemisphere and Canada. During the year ended March 31, 2023, compared to the previous fiscal year, total software license revenue increased across all of the regions with the exception of Canada which experienced only a slight decrease.

The Canadian region (representing 20% of annual total software license revenue) experienced slight decreases of 2% and 1% in annuity/maintenance license revenue during the three months and year ended March 31, 2023, respectively, compared to the same periods of the previous fiscal year, due to the region continuing to be negatively affected during fiscal 2023 by consolidation activity that started affecting its annuity/maintenance revenue in the first quarter of the current fiscal year.

The United States (representing 24% of annual total software license revenue), experienced increases of 12% and 16% in annuity/maintenance license revenue during the three months and year ended March 31, 2023, respectively, compared to the same periods of the previous fiscal year, due to new customers, including those within the carbon capture and storage industry, and increased licensing by existing customers. Perpetual license revenue increased by 100% during the quarter and decreased by 25% during the year, compared to the same periods of the previous fiscal year.

South America (representing 13% of annual total software license revenue) experienced increases of 35% and 18% in annuity/maintenance license revenue during the three months and year ended March 31, 2023, respectively, due to increased licensing by new and existing customers, which included reactivation of maintenance on perpetual licenses. In addition, year-over-year increase was positively affected by a multi-year lease that commenced in the second quarter of the previous fiscal year. There were no perpetual sales in South America during the current quarter or year.

The Eastern Hemisphere (representing 43% of annual total software license revenue) experienced increases of 10% and 15% in annuity/maintenance license revenue during the three months and year ended March 31, 2023, respectively, due to increased license fees as well as increased licensing by existing customers, and the addition of new customers, including new customers in the carbon capture and storage industry in Europe. Perpetual revenue during the three months and year ended March 31, 2023 decreased by 40% and 33%, respectively, due to not realizing the same level of perpetual sales in the current fiscal year.

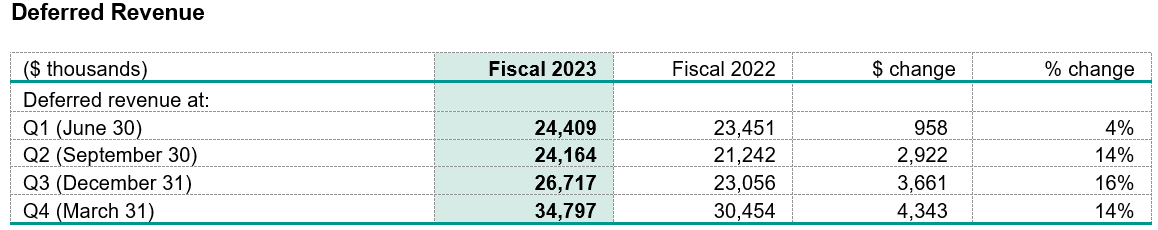

CMG's deferred revenue consists primarily of amounts for prepaid licenses. Our annuity/maintenance revenue is deferred and recognized ratably over the license period, which is generally one year or less. Amounts are deferred for licenses that have been provided and revenue recognition reflects the passage of time.

The above table illustrates the normal trend in the deferred revenue balance from the beginning of the calendar year (which corresponds with Q4 of our fiscal year), when most renewals occur, to the end of the calendar year (which corresponds with Q3 of our fiscal year). Our fourth quarter corresponds with the beginning of the fiscal year for most oil and gas companies, representing a time when they enter a new budget year and sign/renew their contracts.

The deferred revenue balance at the end of Q4 of fiscal 2023 was 14% higher than Q4 of fiscal 2022.

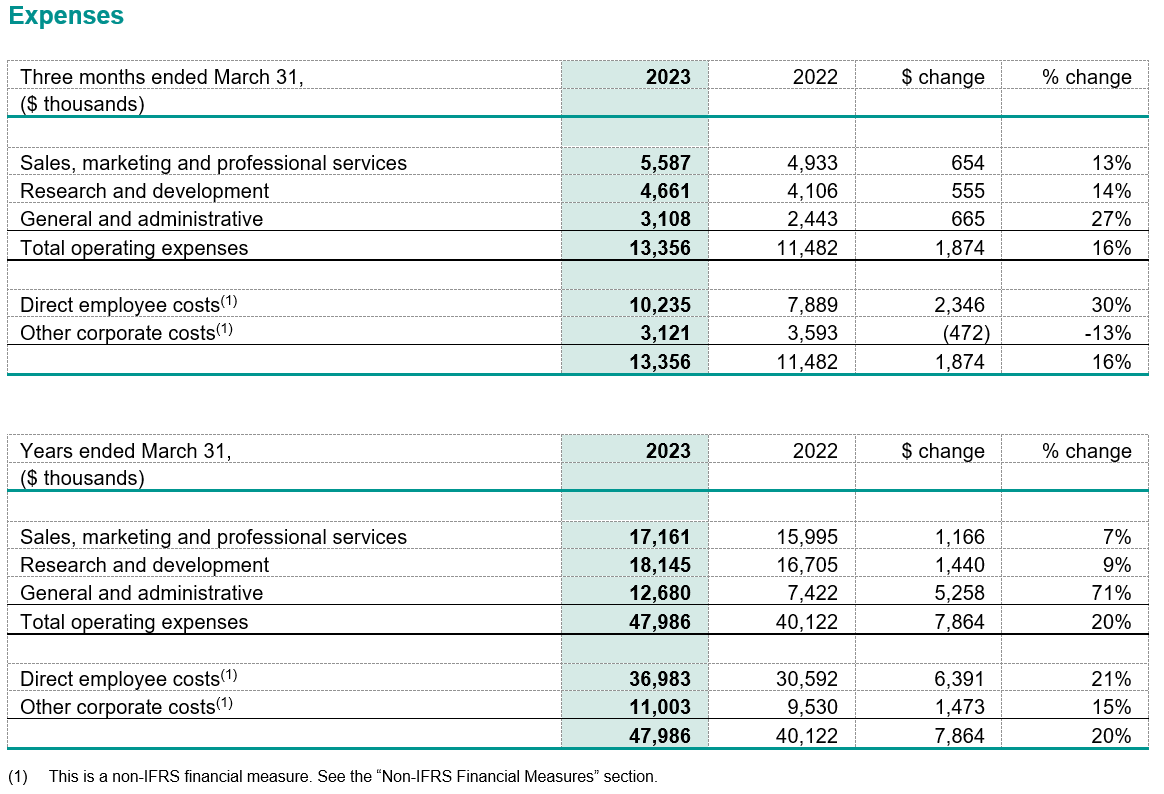

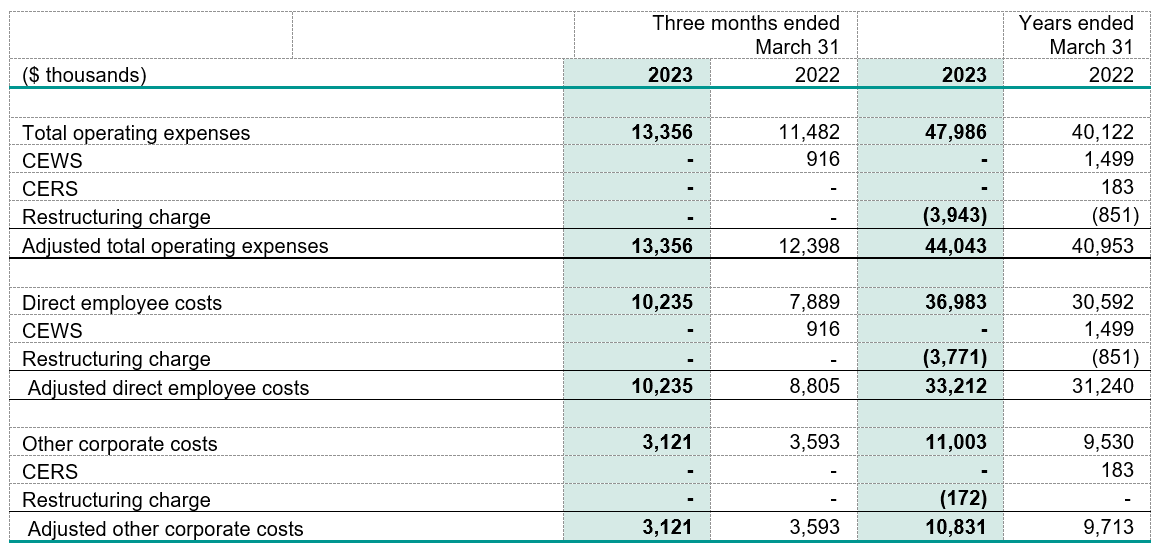

Adjusted total operating expenses, adjusted direct employee costs and adjusted other corporate costs are non-IFRS financial measures. They do not have a standard meaning prescribed by IFRS and, accordingly, may not be comparable to measures used by other companies. They are calculated by excluding CEWS subsidies, CERS subsidies and restructuring charges, as applicable, from the related non-adjusted measures. Management believes that analyzing the Company's expenses exclusive of these items illustrates underlying trends in our costs and provides better comparability between periods.

The following tables provide a reconciliation of total operating expenses to adjusted total operating expenses, direct employee costs to adjusted direct employee costs and other corporate costs to adjusted other corporate costs:

In May 2022, Ryan Schneider stepped down as the Company's President and CEO and Pramod Jain was appointed CEO. This change resulted in restructuring costs of $1.6 million in the first quarter of the current fiscal year. During the second quarter of the current fiscal year, the Company restructured primarily its Calgary office, resulting in additional restructuring costs of $2.3 million in the second quarter and bringing the total restructuring charges for the fiscal year to $3.9 million. The restructuring that occurred in the second quarter was mainly aimed at streamlining operations to align resources with the Company's priorities. This prioritization will allow the Company to strengthen other business operations that are necessary for the Company to be responsive, resilient and able to adapt more quickly to changing business priorities.

The restructuring decreased our headcount and at March 31, 2023, CMG's full-time equivalent staff complement was 165 employees and consultants (March 31, 2022: 175 employees).

Adjusted direct employee costs increased for the three months and year ended March 31, 2023 by $1.4 million (16%) and $2.0 million (6%), compared to the same periods of the previous fiscal year primarily due to increased variable compensation such as stock-based compensation and bonuses.

Adjusted other corporate costs decreased by 13% for the three months ended March 31, 2023 compared to the same period of the previous fiscal year, due to the write-off of receivables from Russian customers included in the comparative period of the previous fiscal year.

Additional IFRS Measure

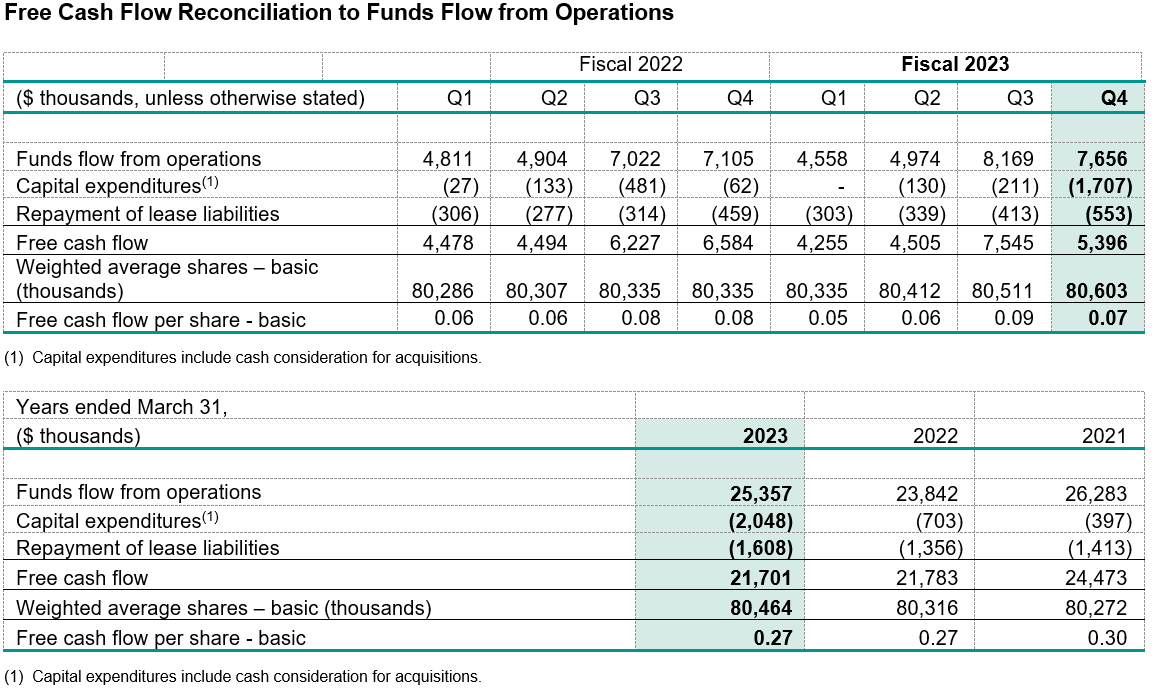

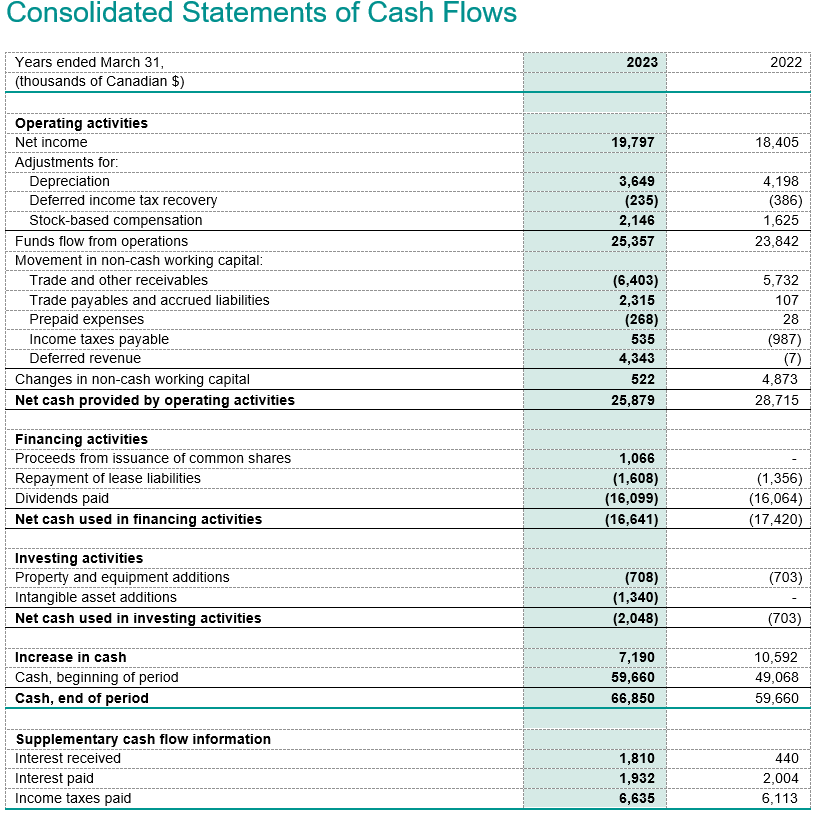

Funds flow from operations is an additional IFRS measure that the Company presents in its consolidated statements of cash flows. Funds flow from operations is calculated as cash flows provided by operating activities adjusted for changes in non-cash working capital. Management believes that this measure provides useful supplemental information about operating performance and liquidity, as it represents cash generated during the period, regardless of the timing of collection of receivables and payment of payables, which may reduce comparability between periods.

Non-IFRS Financial Measures

Certain financial measures in this MD&A - namely, adjusted total operating expenses, direct employee costs, adjusted direct employee costs, other corporate costs, adjusted other corporate costs, adjusted operating profit, adjusted net income, EBITDA, adjusted EBITDA and free cash flow - do not have a standard meaning prescribed by IFRS and, accordingly, may not be comparable to measures used by other companies. Management believes that these indicators nevertheless provide useful measures in evaluating the Company's performance.

Certain additional disclosures for these non-IFRS financial measures have been incorporated by reference and can be found on page 2 in the Company's MD&A for the three months and year ended March 31, 2023, available on SEDAR at www.sedar.com and on the Company's website under the Investors section at www.cmgl.ca/investors.

Reconciliations of the non-IFRS financial measures to the most directly comparable IFRS financial measure are presented below:

Forward-Looking Information

Certain information included in this MD&A is forward-looking. Forward-looking information includes statements that are not statements of historical fact and which address activities, events or developments that the Company expects or anticipates will or may occur in the future, including such things as investment objectives and strategy, the development plans and status of the Company's software development projects, the Company's intentions, results of operations, levels of activity, future capital and other expenditures (including the amount, nature and sources of funding thereof), business prospects and opportunities, research and development timetable, and future growth and performance. When used in this MD&A, statements to the effect that the Company or its management "believes", "expects", "expected", "plans", "may", "will", "projects", "anticipates", "estimates", "would", "could", "should", "endeavours", "seeks", "predicts" or "intends" or similar statements, including "potential", "opportunity", "target" or other variations thereof that are not statements of historical fact should be construed as forward-looking information. These statements reflect management's current beliefs with respect to future events and are based on information currently available to management of the Company. The Company believes that the expectations reflected in such forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking information should not be unduly relied upon.

Corporate Profile

CMG is a global software and consulting company providing advanced reservoir modelling capabilities to the energy industry. CMG provides cutting-edge technologies that support critical field development decisions for upstream planning and energy transition strategies. The Company has a diverse customer base of international oil companies in approximately 60 countries. The Company's professional services consist of highly specialized support, consulting, training, and contract research activities. CMG has sales and technical support services based in Calgary, Houston, London, Dubai, Bogota and Kuala Lumpur. CMG's Common Shares are listed on the Toronto Stock Exchange ("TSX") and trade under the symbol "CMG".

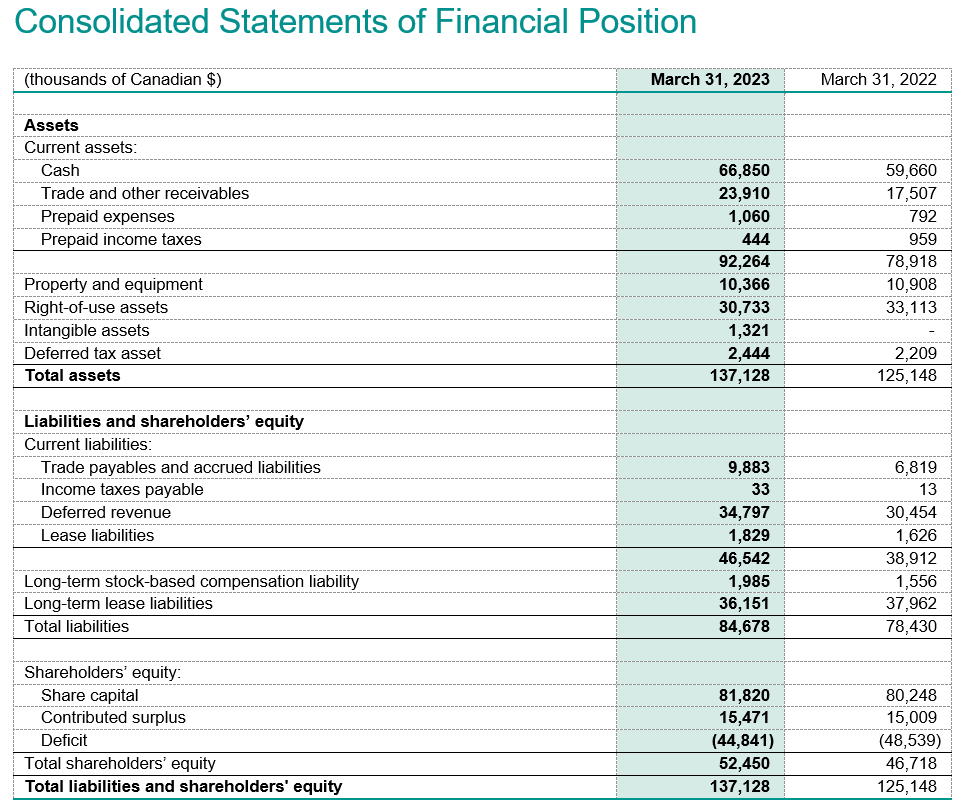

See accompanying notes to consolidated financial statements, which are available on SEDAR at www.sedar.com or on CMG's website at www.cmgl.ca

For further information, please contact:

Pramod Jain

Chief Executive Officer

(403) 531-1300

[email protected]

or

Sandra Balic

Vice President, Finance & CFO

(403) 531-1300

[email protected]

SOURCE: Computer Modelling Group Ltd.