CALGARY, AB / ACCESSWIRE / January 16, 2024 / Southern Energy Corp. ("Southern" or the "Company") (TSXV:SOU)(AIM:SOUC)(OTCQX:SOUTF), an established producer with natural gas and light oil assets in Mississippi, is pleased to announce the preliminary results from its recent Upper Selma Chalk horizontal well completion in the Gwinville Field. In mid-December 2023, Southern successfully completed the first of its four drilled but uncompleted ("DUC") wells from the Company's Q1 2023 drilling program - the GH 14-06 #3 wellbore. Over the first 20 days of production, natural gas rates from the well exceeded 6.5 MMcf/d and averaged 5.3 MMcf/d under restricted flowing conditions as the well cleans up, recovering approximately 33% of load fluid to-date with gas produced flowing directly to Company owned facilities with all volumes sold.

Southern implemented a number of stimulation design changes for this latest Upper Selma Chalk horizontal completion that improved the predictability and efficiency of the fracture operation and, more importantly, reduced the overall completion cost down to US$2.1 million, well below budget estimates. Costs for this completion operation are approximately 40% lower than the two previous 18-10 pad Upper Selma Chalk wells that were completed earlier in 2023.

Southern will continue to monitor the early production performance from the GH 14-06 #3 well over the next couple of months before making a decision on the completion timing of the remaining three DUC wells. The remaining DUC wellbores have been drilled in the Lower Selma Chalk (2) and City Bank formations.

Ian Atkinson, President and Chief Executive Officer of Southern, commented:

"We are extremely excited to deliver the results of this latest Upper Selma Chalk horizontal well, which we expect to fall in-line with our Gen 2 IP30 type curve estimates. The Southern operations team has successfully analyzed and optimized our early well results to execute what may be our best well to-date, for a fraction of the cost of the prior well completions which bodes well for future well activity. Southern is already selling volumes of gas associated with its latest well at gas prices up over 30% from November lows. Improved production rates at lower capital costs will allow Southern to start redeveloping the Gwinville Field on an accelerated timeline as natural gas prices are expected to improve materially into the second half of 2024.

With the success of the completed well, the Company is now looking forward to deploying these successful design changes on our first two Lower Selma Chalk laterals and the next City Bank lateral that remain uncompleted. Our original City Bank horizontal completion at GH 18-10 #1 has shown no decline since being placed on production in July 2023. With these updates we remain eager to highlight the benefits of an optimized completion design performance in this formation delivering value for the business."

Qualified Person's Statement

Gary McMurren, Chief Operating Officer, who has over 23 years of relevant experience in the oil industry, has approved the technical information contained in this announcement. Mr. McMurren is registered as a Professional Engineer with the Association of Professional Engineers and Geoscientists of Alberta and received a Bachelor of Science degree in Chemical Engineering (with distinction) from the University of Alberta.

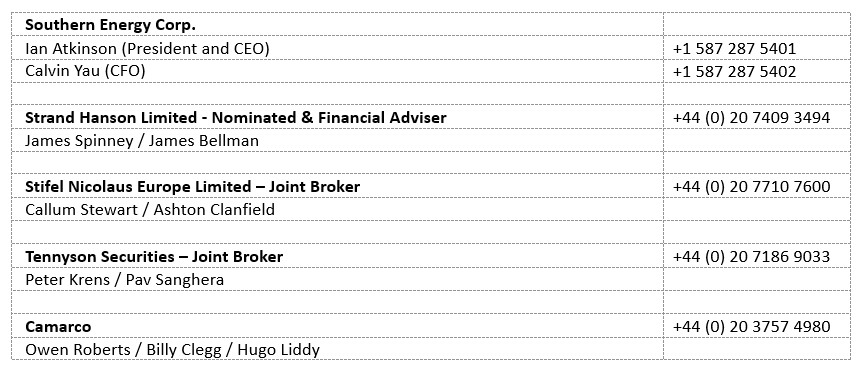

For further information about Southern, please visit our website at www.southernenergycorp.com or contact:

About Southern Energy Corp.

Southern Energy Corp. is a natural gas exploration and production company characterized by a stable, low-decline production base, a significant low-risk drilling inventory and strategic access to premium commodity pricing in North America. Southern has a primary focus on acquiring and developing conventional natural gas and light oil resources in the southeast Gulf States of Mississippi, Louisiana, and East Texas. Our management team has a long and successful history working together and have created significant shareholder value through accretive acquisitions, optimization of existing oil and natural gas fields and the utilization of re-development strategies utilizing horizontal drilling and multi-staged fracture completion techniques.

READER ADVISORY

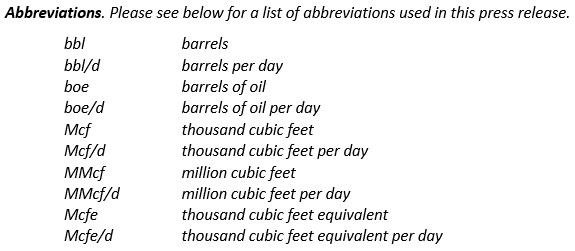

MCFE Disclosure. Natural gas liquids volumes are recorded in barrels of oil (bbl) and are converted to a thousand cubic feet equivalent (Mcfe) using a ratio of six (6) thousand cubic feet to one (1) barrel of oil (bbl). Natural gas volumes recorded in thousand cubic feet (Mcf) are converted to barrels of oil equivalent (boe) using the ratio of six (6) thousand cubic feet to one (1) barrel of oil (bbl). Mcfe and boe may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf:1 bbl or a Mcfe conversion ratio of 1 bbl:6 Mcf is based in an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. In addition, given that the value ratio based on the current price of oil as compared with natural gas is significantly different from the energy equivalent of six to one, utilizing a boe conversion ratio of 6 Mcf:1 bbl or a Mcfe conversion ratio of 1 bbl:6 Mcf may be misleading as an indication of value.

Product Types. Throughout this press release, "crude oil" or "oil" refers to light and medium crude oil product types as defined by National Instrument 51-101 - Standards of Disclosure for Oil and Gas Activities ("NI 51-101"). References to "NGLs" throughout this press release comprise pentane, butane, propane, and ethane, being all NGLs as defined by NI 51-101. References to "natural gas" throughout this press release refers to conventional natural gas as defined by NI 51-101.

Unit Cost Calculation. For the purpose of calculating unit costs, natural gas volumes have been converted to a boe using six thousand cubic feet equal to one barrel unless otherwise stated. A boe conversion ratio of 6:1 is based upon an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. This conversion conforms with NI 51-101. Boe may be misleading, particularly if used in isolation.

Short‐Term Production. References in this press release to peak rates, IP30 and other short-term production rates are useful in confirming the presence of hydrocarbons, however such rates are not determinative of the rates at which such wells will commence production and decline thereafter and are not indicative of long-term performance or of ultimate recovery. While encouraging, readers are cautioned not to place reliance on such rates in calculating the aggregate production of Southern.

Type Curves. Certain type curves disclosure presented herein represent estimates of the production decline and ultimate volumes expected to be recovered from wells over the life of the well. The type curves represent what management thinks an average well will achieve. Individual wells may be higher or lower but over a larger number of wells, management expects the average to come out to the type curve. Over time, type curves can and will change based on achieving more production history on older wells or more recent completion information on newer wells.

Forward-Looking Statements. Certain information included in this press release constitutes forward-looking information under applicable securities legislation. Forward-looking information typically contains statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", "project", "budget", "continue", "evaluate", "forecast", "may", "will", "can", "target" "potential", "result", "could", "should" or similar words suggesting future outcomes or statements regarding an outlook. Forward-looking information in this press release may include, but is not limited to statements concerning the Company's asset base including the development of the Company's assets, oil and natural gas production levels, anticipated operational activities and results including, but not limited to, capital expenditures, drilling and completion plans and casing remediation activities, expectations regarding commodity prices, the performance characteristics of the Company's oil and natural gas properties, the ability of the Company to achieve drilling success consistent with management's expectations, the Company's anticipated results from the GH 14-06 #3 wellbore, the Company's expectations regarding costs and completion of the remaining DUC wellbores and timing thereof, the sources of funding for the Company's activities, the effect of market conditions on the Company's performance, future organic and inorganic growth and acquisition opportunities within the resource market, and cost/debt reducing activities.

The forward-looking statements contained in this press release are based on certain key expectations and assumptions made by Southern, including, but not limited to, the timing of and success of future drilling, development and completion activities, the performance of existing wells, the performance of new wells, the availability and performance of drilling rigs, facilities and pipelines, the geological characteristics of Southern's properties, the characteristics of the Company's assets, the successful integration of recently acquired assets into the Company's operations, the successful application of drilling, completion and seismic technology, the benefits of current commodity pricing hedging arrangements, Southern's ability to enter into future derivative contracts on acceptable terms, Southern's ability to secure financing on acceptable terms, prevailing weather conditions, prevailing legislation, as well as regulatory and licensing requirements, affecting the oil and gas industry, the Company's ability to obtain all requisite permits and licences, prevailing commodity prices, price volatility, price differentials and the actual prices received for the Company's products, royalty regimes and exchange rates, the impact of inflation on costs, the application of regulatory and licensing requirements, the Company's ability to obtain all requisite permits and licences, the availability of capital, labour and services, the creditworthiness of industry partners, the Company's ability to source and complete asset acquisitions, and the Company's ability to execute its plans and strategies.

Although Southern believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Southern can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, regulatory risks, and health, safety and environmental risks), constraint in the availability of labour, supplies, or services, commodity price and exchange rate fluctuations, geo-political risks, political and economic instability abroad, wars and hostilities (including the Russo-Ukrainian War and the Israel-Hamas conflict in Gaza), civil insurrections, inflationary risks including potential increases to operating and capital costs, changes in legislation impacting the oil and gas industry, adverse weather or break-up conditions, and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures. The Russo-Ukrainian War is particularly noteworthy, as this conflict has the potential to disrupt the global supply of oil and gas, and its full impact remains uncertain. These and other risks are set out in more detail in Southern's management's discussion and analysis for the period ended September 30, 2023, and annual information form for the year ended December 31, 2022, which are available on the Company's website at www.southernenergycorp.com and filed under the Company's profile on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained in this press release is made as of the date hereof and Southern undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws. The forward-looking information contained in this press release is expressly qualified by this cautionary statement.

Future Oriented Financial Information. This press release contains future-oriented financial information and financial outlook information (collectively, "FOFI") about Southern's prospective results of operations and cash flows, which are subject to the same assumptions, risk factors, limitations, and qualifications as set forth in the above paragraphs. FOFI contained in this document was approved by management as of the date of this document and was provided for the purpose of providing further information about Southern's future business operations. Southern and its management believe that FOFI has been prepared on a reasonable basis, reflecting management's best estimates and judgments, and represent, to the best of management's knowledge and opinion, the Company's expected course of action. However, because this information is highly subjective, it should not be relied on as necessarily indicative of future results. Southern disclaims any intention or obligation to update or revise any FOFI contained in this document, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. Readers are cautioned that the FOFI contained in this document should not be used for purposes other than for which it is disclosed herein. Changes in forecast commodity prices, differences in the timing of capital expenditures, and variances in average production estimates can have a significant impact on the key performance measures included in Southern's guidance. The Company's actual results may differ materially from these estimates.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of United Kingdom domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended.

SOURCE: Southern Energy Corp.