Potential large-scale operation; multiple optimisation opportunities

EXECUTIVE SUMMARY

Initial Scoping Study completed for Barton's South Australian Tunkillia Gold Project (100%), for potential 5Mtpa bulk open pit mining and processing model targeting capital economies of scale

Initial 6.4 year life-of-mine (LoM) and total ~8 year project life (including construction), with a total of 30.7Mt processed materials grading an avg 0.93 g/t gold (Au) and 2.52 g/t silver (Ag)

Initial LoM estimates include:

total payable metal of ~833koz Au and ~1,993koz Ag

avg annual production of ~130koz Au and ~311koz Ag

avg operating cashflow of ~A$1,626 / oz Au (net of by-product Ag credits), and

avg All-in Sustaining Cost (AISC) ~A$1,917 / oz Au (net of by-product Ag credits), would currently rank Tunkillia #17 of 47 Australian gold operations reporting AISC / oz Au produced.

Higher-grade ‘Starter' pit during first ~18 months of mining and processing:

4.9Mt mill feed averaging 1.26 g/t Au and 3.32 g/t Ag

total production of ~181koz Au and ~420koz Ag, and

avg operating cashflow of ~A$2,265 / oz Au (~A$396m total) (net of Ag credits).

~A$374m initial capital cost (incl. ~A$70m EPC), before owner costs, pre-strip and contingencies

Initial Net Present Value (NPV)7.5% ~A$512m, 40% IRR and 1.9 year payback (unlevered, pre-tax)

ADELAIDE, AUSTRALIA / ACCESSWIRE / July 15, 2024 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to announce the results of an initial scoping study for its Tunkillia Gold Project (Tunkillia) (Scoping Study).

Commenting on the initial Scoping Study results, Barton Managing Director Alex Scanlon said:

"We are pleased to announce these preliminary results which validate our strategy to target economies of scale and outline a project that, were it in operation today, would rank favourably among Australian gold producers.

"Even based upon initial processing cost assumptions that Barton considers to be fairly conservative, and only a 6 year initial mine life, Tunkillia delivers strong returns, competitive AISC performance and a 1.9 year payback.

"This is only a preliminary study and we have already identified multiple areas for potential optimisation in terms of process design, capital costs, operating costs and growth in the life of mine and materials schedule.

"In only 3 years' time we have grown Tunkillia to a 1.5Moz Au JORC Resource and demonstrated a viable, large-scale standalone operation. We believe this is just the start for Tunkillia and its neighbouring assets, and with over A$10m cash we are very well positioned to continue systematically building up their combined potential."

CAUTIONARY STATEMENTS

Preliminary Scoping Study

The Scoping Study referred to in this announcement has been undertaken by Barton as a preliminary assessment of Barton's Tunkillia project for prospective development on a large-scale, 5 million tonne per annum model, and to identify key drivers of value and opportunities for subsequent optimisation.

The Scoping Study is a preliminary technical and economic study of Tunkillia's potential viability. It is based on low level technical and economic assessments insufficient to support the estimation of Ore Reserves. Further exploration and evaluation work and appropriate studies are required before Barton will be in a position to estimate any Ore Reserves or to provide any assurance of an economic development case.

Basis of Study (Key Geological and Cost Estimation Factors)

This announcement has been prepared in compliance with the JORC Code 2012 Edition (JORC) and the ASX Listing Rules. All material assumptions on which the forecast financial information is based have been provided in this announcement and are also outlined in the annexed JORC table disclosures.

The capital cost estimate for the process plant and associated infrastructure has been prepared by GR Engineering Services Limited with a nominal accuracy of ±35%, with mining costs estimated by Mining Associates Pty Ltd at a scoping study level of accuracy from first principles on a bench-by-bench basis.

Production is based on Tunkillia's JORC Mineral Resources Estimate (MRE). The JORC MRE underpinning the production target have been prepared by a competent person in accordance with JORC, with ~66% of materials classified ‘Indicated' and ~34% ‘Inferred'. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised.

~74% of the JORC Mineral Resources scheduled during the first five (5) years of the production target are classified as Indicated. Given a projected 1.9 year payback period (from start of production), Barton considers that Tunkillia's financial viability does not depend upon inclusion of Inferred Resources, and therefore that a reasonable basis exists for disclosing a production target including Inferred Resources.

Funding Requirements

The Scoping Study is based on the material assumptions outlined in this announcement. These include assumptions about the availability of funding. Barton's leadership has a strong track record of raising funding as required on attractive terms, and a significant combined professional track record in the and development of resources projects. However, while Barton considers all of the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the Scoping Study will be achieved.

To achieve the range of outcomes indicated in the Scoping Study, funding in the order of ~A$492 million will likely be required (inclusive of all capital, owner's, and other costs associated with an Engineering, Procurement and Construction (EPC) contract, and all factored contingencies). This funding may take the form of debt and/or equity. Investors should note that there is no certainty that Barton will be able to raise that amount of funding when needed. It is also possible that such funding may only be available on terms that may be dilutive to or otherwise affect the value of Barton's existing shares. It is also possible that Barton could pursue other ‘value realisation' strategies such as a sale, partial sale or joint venture of Tunkillia. If it does, this could materially reduce Barton's proportionate ownership of the project.

Reasonable Basis

Barton considers that it has a reasonable basis for providing the forward-looking statements in this announcement, and to expect that it will be able to complete the development of Tunkillia as outlined in the Scoping Study. However, given the uncertainties involved, investors should not make any investment decisions based solely on the results of the Scoping Study.

Background & Study Approach

Barton acquired Tunkillia in December 2019 with the view that the project had significant growth potential due to limited historical exploration during periods of lower gold prices. During the ~3.5 year period from October 2020 to March 2024, Barton completed multiple rounds of reverse circulation (RC) and diamond (DD) drilling, identified several extensions and new gold zones, and delivered four JORC MRE updates.1

Following Tunkillia's latest JORC MRE upgrade to ~1.5Moz Au (51.3Mt @ 0.91 g/t Au)2 in March 2024, Barton commissioned GR Engineering Services Limited (GRES) and Mining Associates Pty Ltd (Mining Associates) to lead a scoping study for Tunkillia's development on a 5 million tonne per annum (Mtpa) model.3 The Scoping Study is a preliminary technical and economic assessment of Tunkillia's prospective viability for potential development on a large-scale, bulk open pit basis, the primary objectives of which include to:

evaluate indicative capital costs, operating costs and mine design optimisation on a 5Mtpa basis;

validate prospective economies of scale and identify key drivers of cost and value; and

identify key opportunities for subsequent optimisation and growth.

The Scoping Study has evaluated Tunkillia on a ‘standalone' basis, with the process plant and associated process infrastructure delivered via an EPC contract and mining performed by a third-party contractor.

Key Assumptions & Outcomes

Development & Operations Model

The Scoping Study has considered Tunkillia's development as a bulk open pit mining operation sourcing materials from two large-scale pits (Area 223 and Area 51), using a third-party mining contractor model and processing via a newly built adjacent 5Mtpa carbon-in-leach (CIL) processing plant. Project delivery (development and commissioning) has assumed EPC contract basis for the delivery of the processing plant and associate process infrastructure. See ‘Capital Costs' for further detail.

Key Assumptions

The key physical, operating and financial assumptions for the Scoping Study are set out in Table 1 below. Barton notes the conservative assumptions utilised for comminution, specifically bond ball mill and bond rod mill work indices. The 100% percentile (highest) of historical test work results for all mineral domains was selected for the Scoping Study. These are material drivers of operating costs and represent a significant opportunity for optimisation. See ‘Operating Costs' and ‘Key Opportunities' for further detail.

Metric |

| Units |

|

|

|

| ||

Project |

|

|

|

|

|

| ||

Project Life |

| Years |

|

|

| 7.7 |

| |

Development Period |

| Weeks |

|

|

| 104 |

| |

Processing Duration |

| Years |

|

|

| 6.4 |

| |

Mining Optimisation |

|

|

|

|

|

|

| |

Assumed LoM Gold Price |

| A$ /oz |

|

| $ | 3,000 |

| |

Assumed LoM Silver Price |

| A$ /oz |

|

| $ | 37.50 |

| |

Mining Duration |

| Years |

|

|

| 6.4 |

| |

Waste & Low-Grade Mined |

| Mt |

|

|

| 191.5 |

| |

Initial Pre-Strip |

| Mt |

|

|

| 29.0 |

| |

Mineral Resources Mined |

| Mt |

|

|

| 30.7 |

| |

Project Strip Ratio |

| waste:ore |

|

|

| 6.23 |

| |

Operating Strip Ratio |

| waste:ore |

|

|

| 5.29 |

| |

Processing Physicals |

|

|

|

|

|

|

| |

Plant Throughput Capacity |

| Mtpa |

|

|

| 5.0 |

| |

Material Processed |

| Mt |

|

|

| 30.7 |

| |

Bond Ball Mill Work Index |

| kWh/t |

|

|

| 25.5 |

| |

Bond Rod Mill Work Index |

| kWh/t |

|

|

| 26.7 |

| |

Gold Recoveries (Oxide Materials) |

| % |

|

|

| 92.0 | % | |

Gold Recoveries (Fresh Materials) |

| % |

|

|

| 90.0 | % | |

Silver Recoveries (All Materials) |

| % |

|

|

| 80.0 | % | |

Average LoM Gold Grade |

| g/t Au |

|

|

| 0.93 |

| |

Average LoM Silver Grade |

| g/t Ag |

|

|

| 2.52 |

| |

Processing Costs |

|

|

|

|

|

|

| |

Oxide Materials |

| A$ / t |

|

| $ | 23.57 |

| |

Fresh Materials |

| A$ / t |

|

| $ | 25.57 |

| |

Royalties (Public & Private) |

| % |

|

|

| 6.0 | % | |

Selling Costs |

| A$/oz Au |

|

| $ | 37.32 |

| |

General & Administrative |

| A$ / t |

|

| $ | 2.56 |

| |

Financial Assumptions |

|

|

|

|

|

|

|

|

Discount Rate |

| % |

|

|

| 7.5 | % | |

Gold Price |

| A$ / oz |

|

| $ | 3,500 |

| |

Silver Price |

| A$ / oz |

|

| $ | 45.00 |

| |

Table 1 - Key physical, operating and financial assumptions

Key Financial Results

The key estimated LoM production and financial results of the Scoping Study are detailed in Table 2 below.

Tunkillia is estimated to produce a total of ~833,000oz recovered gold and ~1,993,000oz recovered silver during a 6.4 year processing period, for average annual production of ~130koz Au gold and ~311koz silver. Estimated LoM revenue is ~A$3 billion, with an estimated operating pre-tax cash margin of ~A$1.3 billion.

Net of by-product silver, Tunkillia's average estimated operating cash cost is ~A$1,874 / oz Au, with an average estimated operating cash margin of ~A$1,626 / oz Au, and an All-in Sustaining Cost (AISC) of ~A$1,917 / oz Au (see ‘Additional Financial Analysis' for further information). According to Aurum Analytics, this would rank Tunkillia #17 of 47 Australian gold operations reporting AISC per ounce of gold produced.4

The project has an estimated ~A$374m initial capital cost (incl. ~A$70m EPC), before owner costs, pre-strip and contingencies. An additional allowance of ~A$60m is made for capitalised pre-strip, with further allowances totalling ~A$9m for owner's costs and ~A$50m for owner's and design contingencies. Please refer to the ‘Operating Costs', ‘Capital Costs' and ‘Additional Financial Analysis' sections for further detail.

Metric |

| Units |

|

|

|

| ||

Mining Production |

|

|

|

|

|

| ||

Contained Gold |

| oz Au |

|

|

| 919,868 |

| |

Contained Silver |

| oz Ag |

|

|

| 2,491,148 |

| |

Metal Production |

|

|

|

|

|

|

| |

Payable Gold |

| oz Au |

|

|

| 832,852 |

| |

Payable Silver |

| oz Ag |

|

|

| 1,992,919 |

| |

Avg Annual Gold Production (Processing Period) |

| oz Au |

|

|

| 130,133 |

| |

Avg Annual Silver Production (Processing Period) |

| oz Ag |

|

|

| 311,394 |

| |

Operating Financials |

|

|

|

|

|

|

| |

LoM Revenues |

| A$ |

|

| $ | 3.005 billion |

| |

LoM Cash Operating Costs |

| A$ |

|

| $ | 1.710 billion |

| |

LoM Operating Cashflow (EBITDA) |

| A$ |

|

| $ | 1.295 billion |

| |

LoM Operating Margins (excluding initial pre-strip, net of Ag credits) |

|

|

|

|

|

|

|

|

Silver By-Product Credit |

| A$/oz Au |

|

| $ | 108 |

| |

Operating Cash Cost |

| A$/oz Au |

|

| $ | 1,874 |

| |

All-in Sustaining Cost (AISC) |

| A$/oz Au |

|

| $ | 1,917 |

| |

Operating Cashflow |

| A$/oz Au |

|

| $ | 1,626 |

| |

LoM Capital Costs |

|

|

|

|

|

|

|

|

Processing & Infrastructure (incl. ~$70m EPC) |

| A$m |

|

| $ | 374 |

| |

Capitalised pre-strip |

| A$m |

|

| $ | 60 |

| |

Owner's Costs |

| A$m |

|

| $ | 9 |

| |

Owner's Contingency |

| A$m |

|

| $ | 18 |

| |

Design Growth Contingency |

| A$m |

|

| $ | 32 |

| |

Sustaining Capital |

| A$m |

|

| $ | 34 |

| |

Mine Closure & Rehabilitation |

| A$m |

|

| $ | 20 |

| |

Total |

| A$m |

|

| $ | 546 |

| |

Project Returns (Unlevered, Pre-Tax) |

|

|

|

|

|

|

|

|

Project Free Cash Flow (undiscounted) |

| A$m |

|

| $ | 806 |

| |

Project NPV(7.5) |

| A$m |

|

| $ | 512 |

| |

Project IRR |

| % |

|

|

| 40 | % | |

Payback Period (from start of gold production) |

| Years |

|

|

| 1.9 |

| |

Table 2 - LoM production and financial results summary

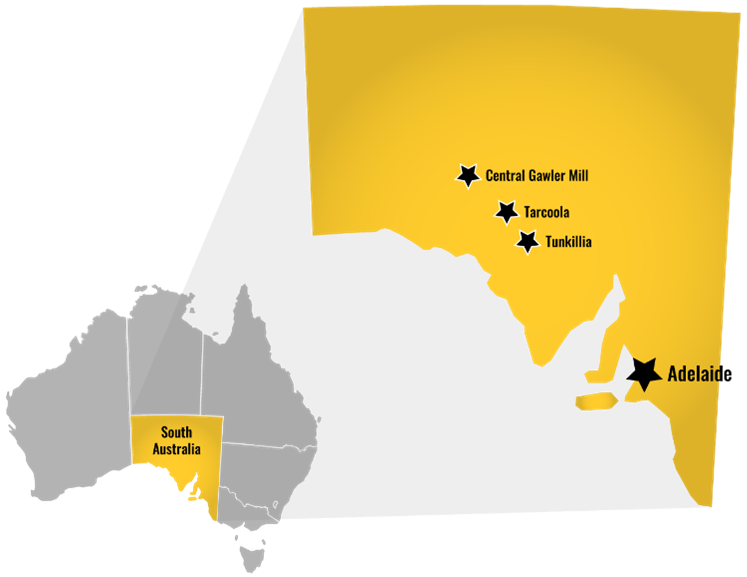

Site Access & Layout

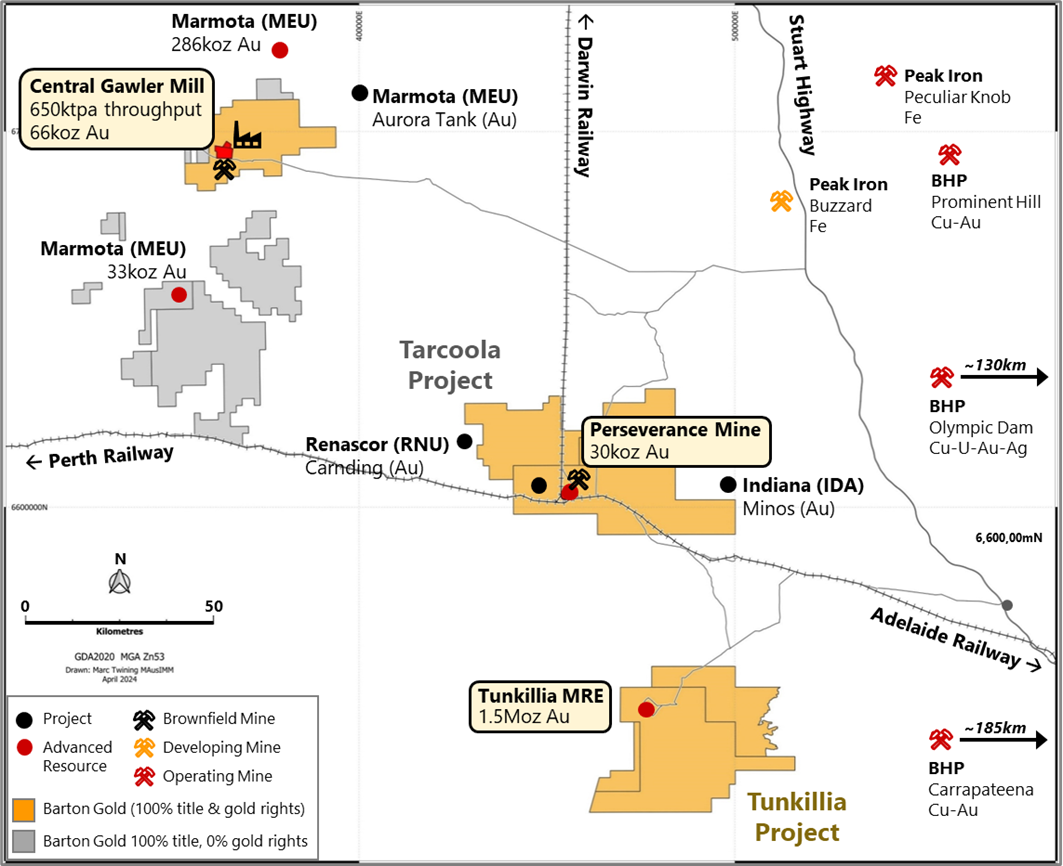

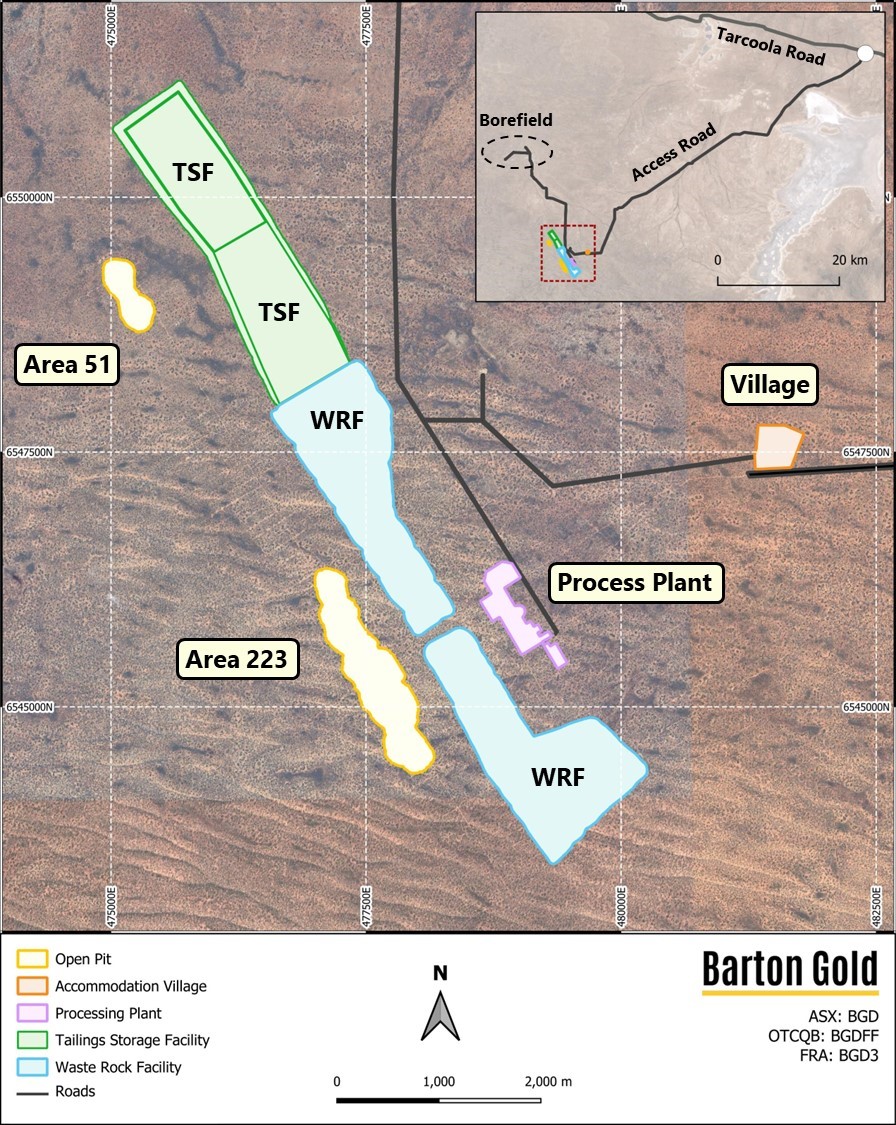

Tunkillia is located ~550km northwest of Adelaide, South Australia and is accessible by existing access tracks on North Well Station connecting Tunkillia to the Tarcoola Road near Kingoonya, South Australia, and from there to the Stuart Highway (which connects Adelaide in the south to Darwin, NT in the north).

65.5km of existing access tracks will be upgraded to an unpaved access road leading to a 300-person accommodation village. Two open pit areas (Area 223 and Area 51), each with a 500m blast exclusion zone, are located ~5km southwest of the village along the western margin of the Yarlbrinda Shear Zone.

Raw water will be sourced from a borefield ~20km north of the project site. A tailings storage facility (TSF) designed to accommodate a total 39.5Mt of tailings (with expansion possible) will be established east of Area 51 open pit with an initial 24 months (10Mt) capacity. A waste rock facility (WRF) will be established east of the Area 223 open pit, between the open pit and a 5Mtpa carbon-in-leach (CIL) process plant.

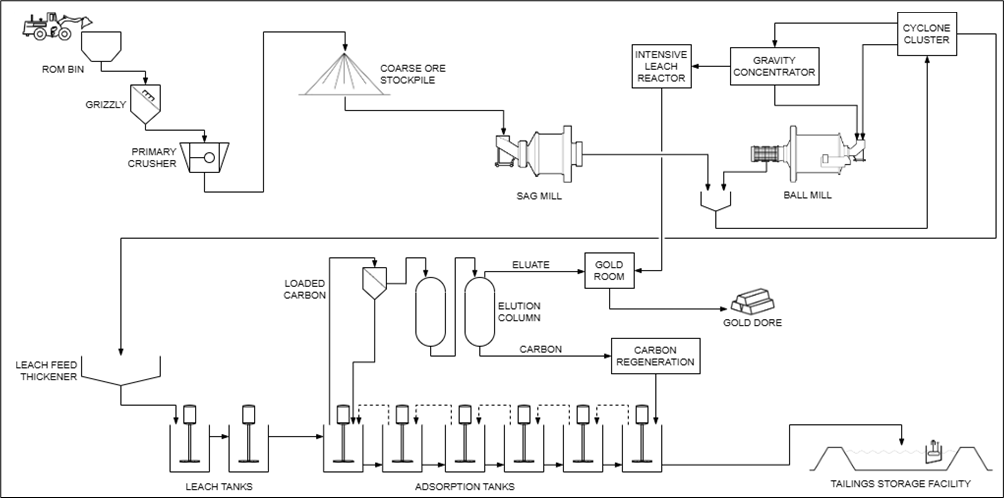

Processing & Recovery Circuit

Comminution is via single stage primary crushing to 80% passing 150mm, followed by two stage grinding in semi-autogenous grinding (SAG) and ball (SABC) mills to 80% passing 75µm. Materials are discharged to a cyclone cluster, with underflow reporting to a gravity circuit feeding concentrates to an intensive leach reactor (ILR). Cyclone overflow reports to a leaching circuit with two leach tanks and six adsorption tanks. Total retention (leaching) time is 24 hours, followed by an elution circuit with an ~18 hour cycle time. ILR and elution circuit outputs are passed through electrowinning cells and then smelted to produce doré. Silver is a material gold production by-product. Tunkillia doré is expected to have ~3 parts silver to 1 part gold (~75% Ag / ~25% Au in doré).

Staged Mine Design

Mining Associates completed a pit optimisation and mine scheduling for Tunkillia utilising processing cost estimates prepared by GRES, and mining costs estimated by Mining Associates from first principles. Further details of these costs are set out in sections entitled ‘Capital Costs' and ‘Operating Costs' below.

A gold price of US$2,000 / oz, a silver price of US$25 / oz, and an AUD / USD exchange rate of 0.6667 were used in the optimisation, equivalent to AUD prices of A$3,000 / oz for gold and A$37.50 / oz for silver.

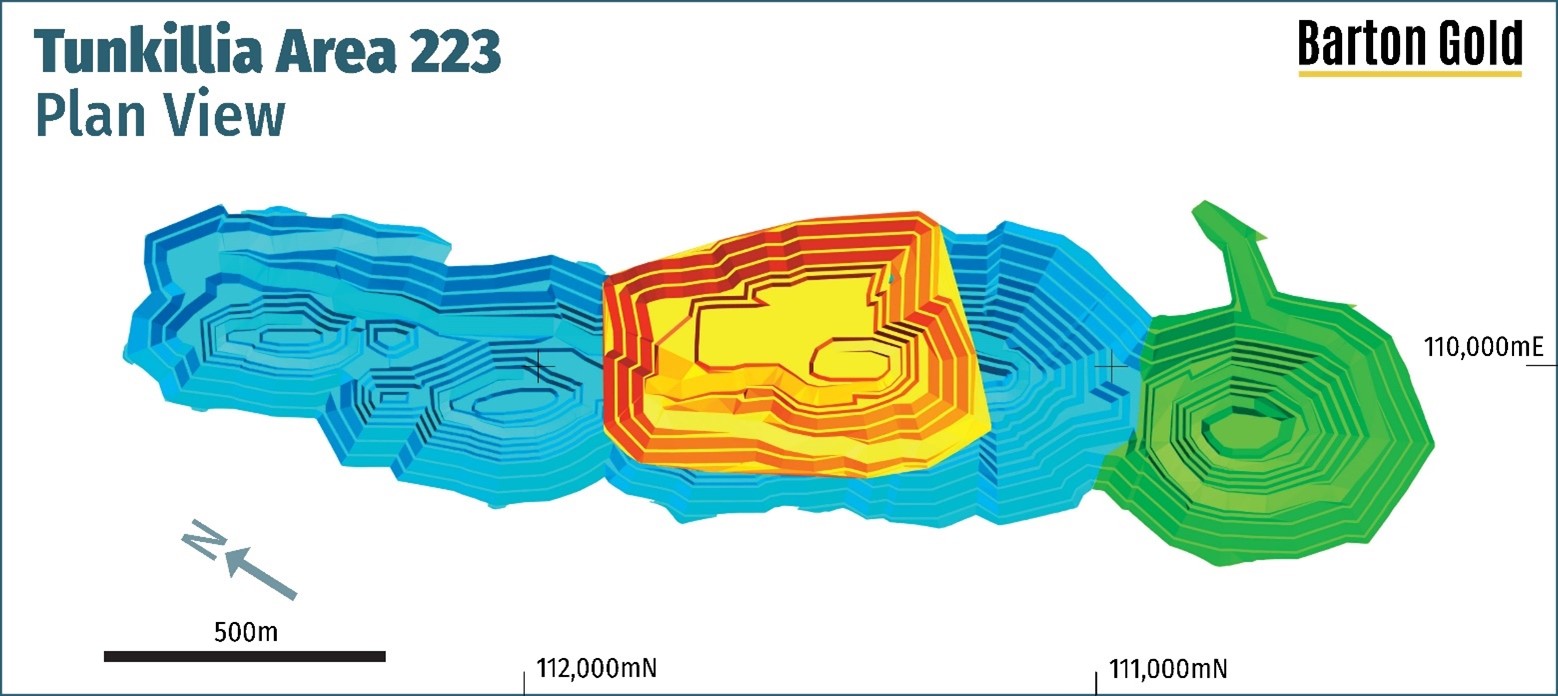

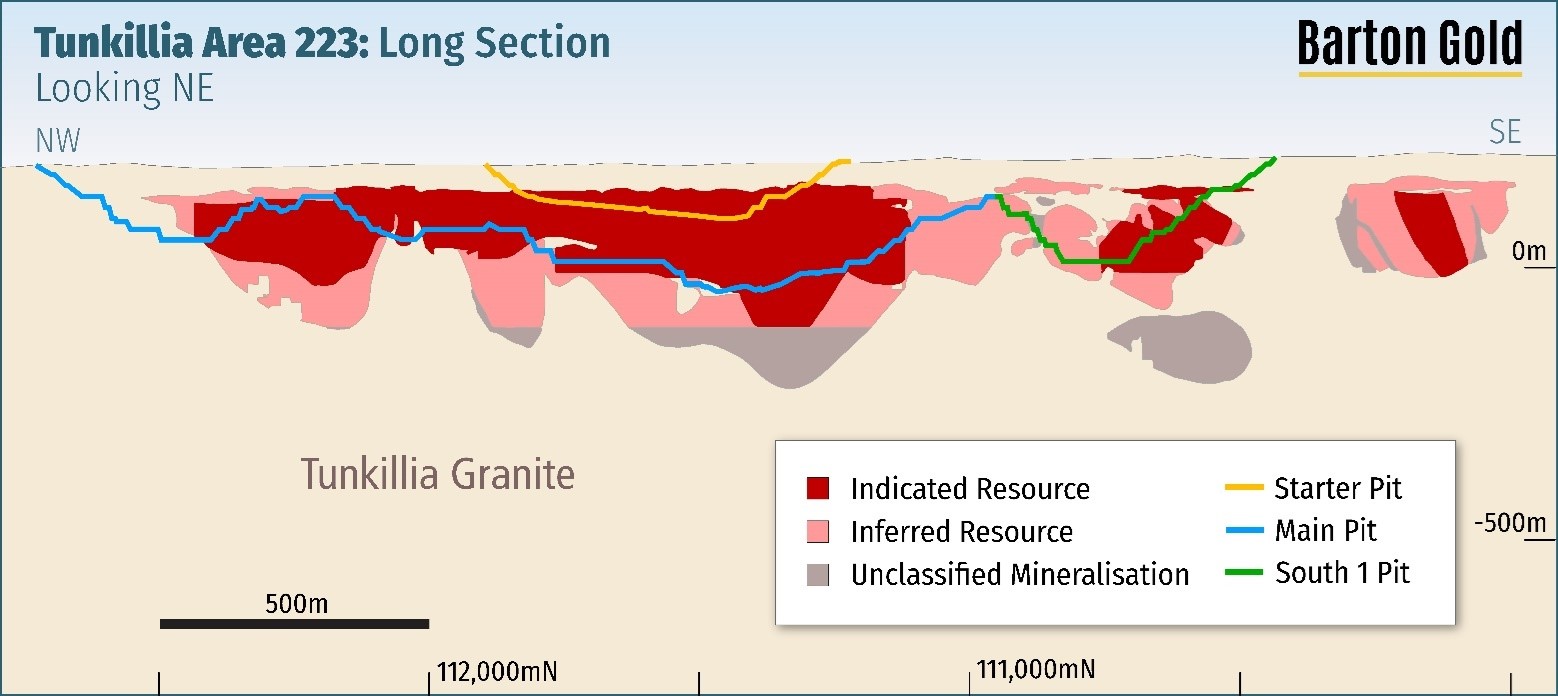

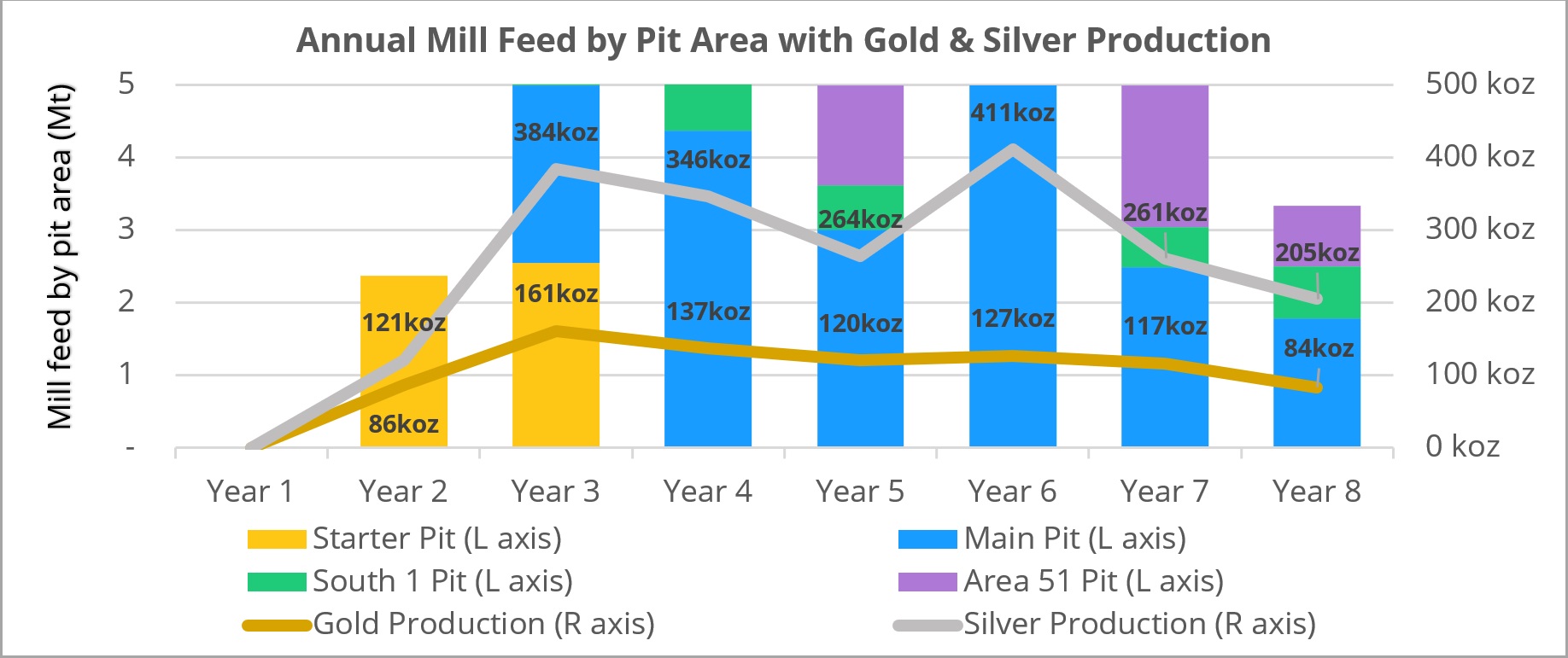

A mine design was then completed using the optimal shells as a basis. Four pit areas (‘Starter', ‘Main', ‘South 1' and ‘Area 51') contain a total of ~30.7Mt materials for processing, with ~191.5Mt of waste and low-grade materials of which ~29Mt are capitalised pre-strip. The project strip ratio (Waste : Resource) is 6.23 and the operating strip ratio is 5.29 excluding capitalised pre-strip.

There is potential for optimisation, including infill drilling, to smooth the profile within and between pits, noting the potential for pit extensions into areas with existing JORC Indicated Resources (see Figure 5).

The maximum vertical mining depth is 256m in the ‘Main' pit shown below.

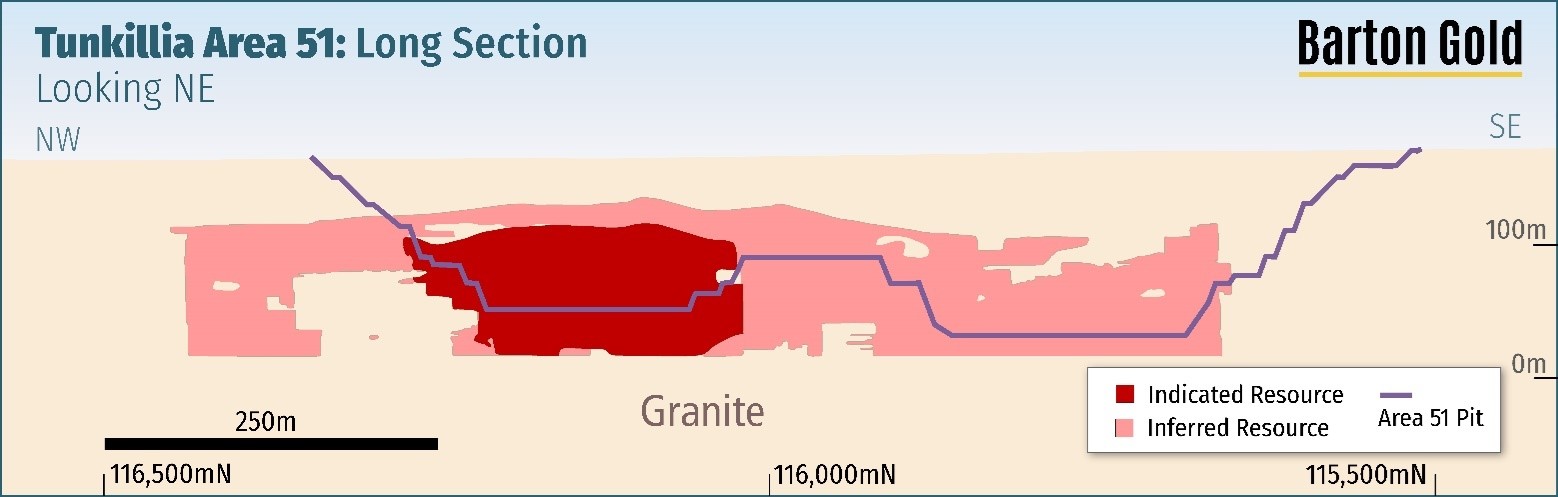

The Area 51 pit is separate to the Area 223 pit(s) and is located ~5km northwest of Area 223. Most of the scheduled materials mined from the Area 51 pit are mined during the 6th and 7th years of mining and processing (see Figure 8), with a lesser proportion mined during the 4th year of mining and processing.

As with the Area 223 pits, there is potential for optimisation to smooth the pit floor profile, and also noting the potential for extensions into areas with existing JORC Indicated Resources (see Figure 7).

Target Production & Materials by Year

An equipment-based schedule was developed by Mining Associates with planned mill feed constrained to 5Mtpa. Mining operations are estimated for 6.4 years (project years 2 - 8), with 5Mtpa mill feed production during years 3 - 7 and less than 5Mtpa during years 2 and 8 (production ramp up and ramp down).

The mining schedule is based on Tunkillia's JORC Mineral Resources Estimate (MRE). 65.6% of materials are classified as ‘Indicated' and 33.7% ‘Inferred' on a LoM basis. Approximately 0.8% of materials are of grade above the MRE's 0.4 g/t Au cut-off grade but are not JORC classified. These are materials ancillary to the JORC MRE which are captured in mine design optimisation and are immaterial to results.

As ~74% of the JORC Mineral Resources scheduled during the first five (5) years of the production target are classified as Indicated, and the project has a projected 1.9 year payback period (from start of production), Barton considers the inclusion of such Inferred and unclassified materials to be reasonable.

Classification | Units | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Total Mt | Total % |

Measured | Mt | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0 | 0% |

Indicated | Mt | 1.7 | 3.1 | 3.9 | 3.4 | 4.4 | 2.2 | 1.3 | 20.1 | 65.6% |

Inferred | Mt | 0.7 | 1.9 | 1.0 | 1.5 | 0.6 | 2.8 | 1.9 | 10.3 | 33.7% |

Unclassified | Mt | 0.0 | 0.0 | 0.1 | 0.1 | 0.0 | 0.0 | 0.0 | 0.2 | 0.8% |

Total |

| 2.4 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 3.3 | 30.7 | 100% |

Table 3 - Annual mill feed mined by JORC category, by total tonnes and proportion of mill feed

Operating Costs

LoM operating costs (excluding capitalised pre-strip mining costs) are estimated, based upon:

a detailed estimate of LoM mining operating costs built by Mining Associates from first principles, averaging A$2.64 /t of material moved or A$19.12 /t material processed (excluding pre-strip costs);

a detailed estimate of process operating costs built by GRES of A$25.57 /t for fresh mill feed materials and A$23.57 /t for oxide mill feed materials; and

an estimate of owner's general and administrative costs of A$11.9 million per annum.

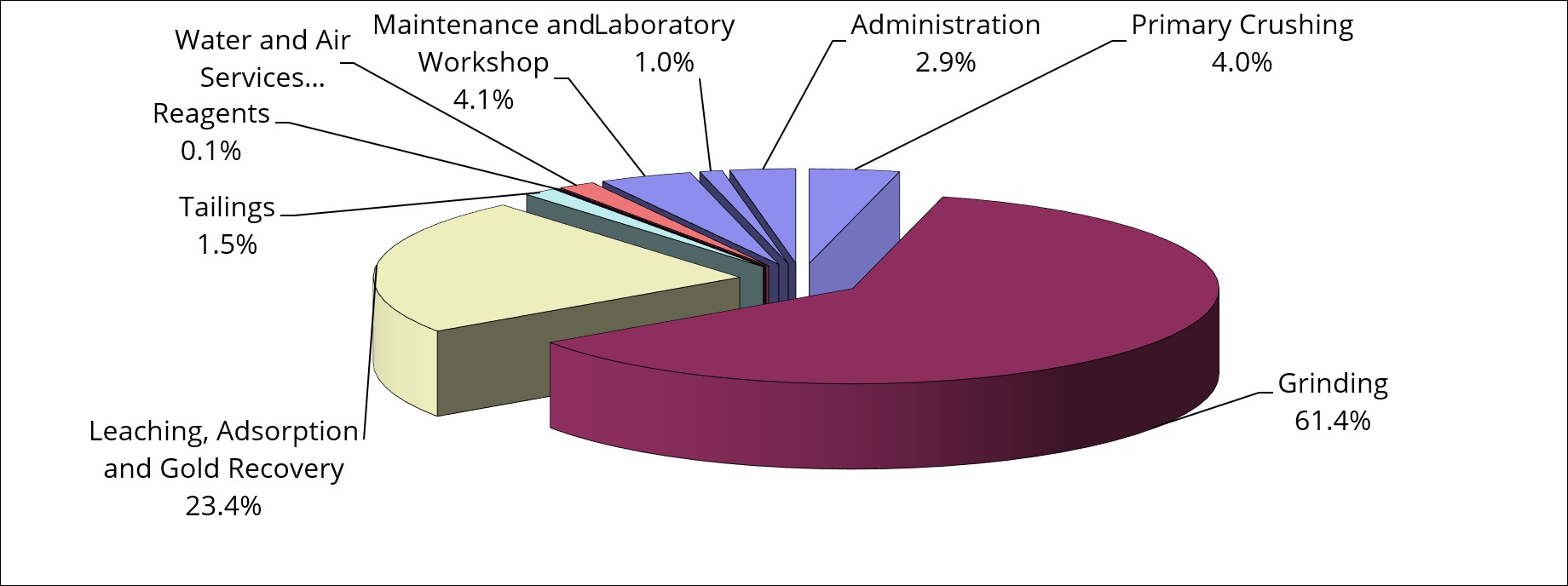

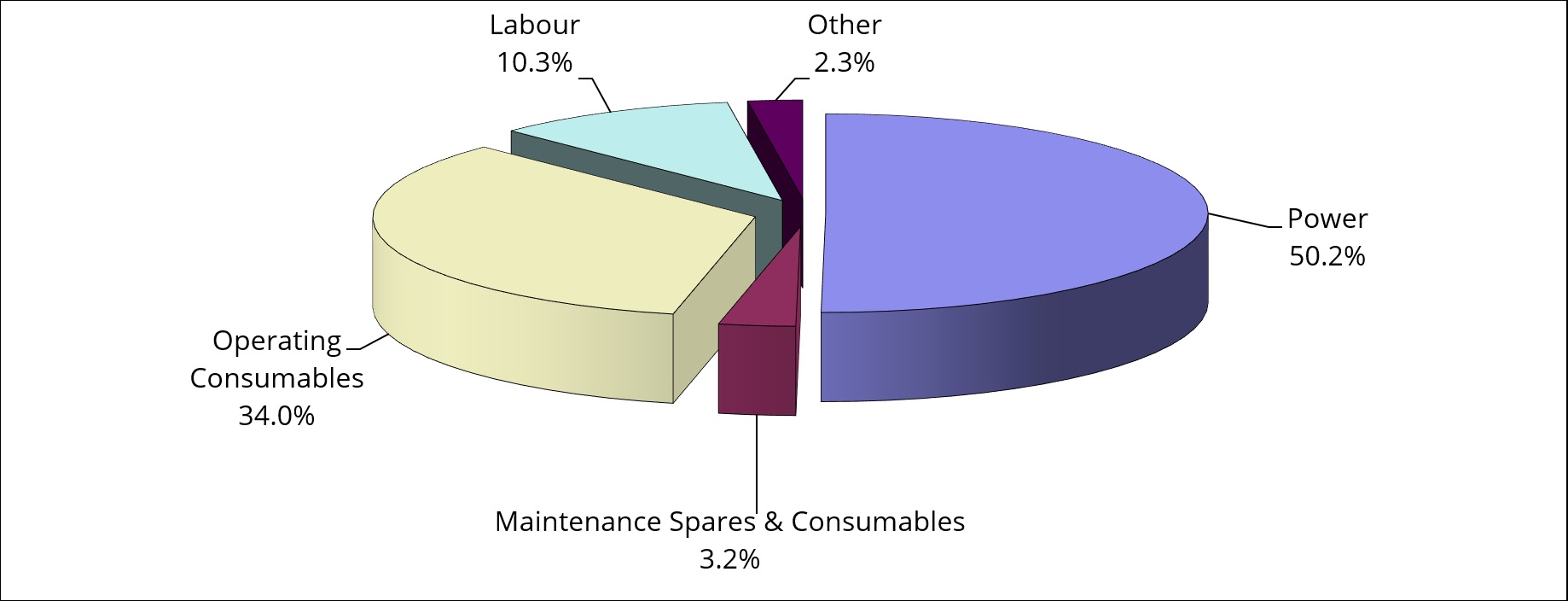

Fresh materials comprise ~75% of mill feed, the estimated processing costs of which are presented by process area input costs in Figures 10 and 11 below. The balance of feed (~25%) comprises oxide material.

Barton notes that the estimate of processing costs for the Scoping Study assumes the 100th percentile (most conservative) of prior test results for bond crushing, bond rod and bond ball work indices. This increases power and consumables consumption for crushing and (in particular) grinding, where estimated grinding costs represent ~61% of total process cost and power represents ~50% of total process costs.

Barton considers these assumptions to be conservative and has identified the crushing and grinding elements of the comminution circuit as key areas for potential future optimisation of operating costs.

Capital Costs

GRES prepared the Tunkillia capital cost estimate with a nominal accuracy of +/- 35% by reference to designs for similar facilities, budget pricing for similar equipment, and rates from recently completed studies and projects. GRES maintains an up-to-date database of such costs which was used for estimation.

A summary of estimated capital cost for the process plant, all associated process infrastructure, and all non-process infrastructure (including design growth contingency and EPC package margins) is as follows:

Project Facility / Area |

| Supply (A$m) |

|

| Install (A$m) |

|

| Freight (A$m) |

|

| Design Growth Contingency (A$m) |

|

| Total (A$m) |

| |||||

Processing infrastructure |

|

| 155.4 |

|

|

| 26.8 |

|

|

| 8.1 |

|

|

| 17.7 |

|

|

| 208.0 |

|

Tailings storage and disposal |

|

| 2.2 |

|

|

| 23.2 |

|

|

| 0.1 |

|

|

| 2.5 |

|

|

| 28.1 |

|

Mine village and construction camp |

|

| 37.5 |

|

|

| 0.0 |

|

|

| 0.0 |

|

|

| 0.0 |

|

|

| 37.5 |

|

Mine infrastructure |

|

| 12.4 |

|

|

| 0.8 |

|

|

| 1.0 |

|

|

| 1.2 |

|

|

| 15.4 |

|

General and supporting infrastructure |

|

| 15.8 |

|

|

| 14.8 |

|

|

| 0.6 |

|

|

| 3.1 |

|

|

| 34.3 |

|

EPC engineering, drafting and management |

|

| 0.4 |

|

|

| 41.7 |

|

|

| 0.0 |

|

|

| 4.2 |

|

|

| 46.3 |

|

Other construction costs |

|

| 27.3 |

|

|

| 5.2 |

|

|

| 0.6 |

|

|

| 3.1 |

|

|

| 36.3 |

|

Total |

|

| 251.0 |

|

|

| 112.6 |

|

|

| 10.5 |

|

|

| 31.8 |

|

|

| 405.8 |

|

Table 4 - Processing and infrastructure capital cost estimate, by project area and cost type

Capital costs were estimated on the basis of a mixed implementation approach. Barton will self-manage early works for site access and supporting infrastructure. An engineering, procurement and construction (EPC) package has been assumed for delivery of the process plant and associated process infrastructure. The estimated total cost for these EPC works is ~A$288m (see Table 5), inclusive of all EPC margin allowance on supply, labour and freight (EPC Margin). Total EPC direct services such as project management, engineering and drafting, site supervision and management, and commission are estimated at a value of ~A$46m (EPC Services).

Cost Type |

| EPC Value (A$m) |

| |

Supply |

| $ | 177.30 |

|

Install |

| $ | 76.40 |

|

Freight |

| $ | 8.50 |

|

Design growth |

| $ | 25.60 |

|

Total |

| $ | 287.80 |

|

Table 5 - EPC package by type

Discipline | Materials | Installation |

General | 10% | 10% |

Earthworks - access road | 15% | 15% |

Mechanical equipment - recent budget quotes1 | 7.50% | 10% |

Buildings - recent budget quotes1 | 7.50% | 10% |

1 Budget quotes received within previous six months |

|

|

Table 6 - Design growth allowances for capital cost estimate

Within the capital cost estimate in Table 4, GRES have also allowed a design growth contingency, based on the scope described in the study and do not include any changes made to the process flow sheet, major equipment selections or process plant layout and design. These are summarised in Table 6.

TSF design and capital costs were completed by Knight Piésold. The TSF is designed to accommodate 39.5Mt of tailings, with initial capacity for 24 months' storage (10Mt). The TSF will subsequently be lifted in biennial raises to suit storage requirements. Further expansion of the TSF is possible if required.

Other Capital Cost Allowances

Mining pre-strip is estimated at ~A$60 million, completed during the ~6 months prior to commissioning.

A provision of 2.5% of the direct and indirect costs (but excluding EPC Services) has been included for Owner's costs, for items such as the Owner's team and consultants, approvals and licenses, operational readiness, training, business systems, pre-production costs, insurances and operating / inventory spares.

A provision of 5% of the direct and indirect costs (but excluding EPC Services) has been included for Owner's contingency, to account for the risks associated with geotechnical conditions, weather delays, industrial actions, incident management, contractual risks, foreign exchange risks and scope changes.

Processing, infrastructure and TSF sustaining capital costs are estimated by project year in Table 7 below.

Year |

|

| Processing & Infrastructure (A$m) |

|

| Tailings Storage Facility (A$m) |

| ||

1 |

|

|

| - |

|

|

| - |

|

2 |

|

| $ | 0.90 |

|

|

| - |

|

3 |

|

| $ | 1.78 |

|

| $ | 9.32 |

|

4 |

|

| $ | 1.78 |

|

|

| - |

|

5 |

|

| $ | 1.78 |

|

| $ | 9.32 |

|

6 |

|

| $ | 1.78 |

|

|

| - |

|

7 |

|

| $ | 1.78 |

|

| $ | 4.66 |

|

8 |

|

| $ | 0.90 |

|

|

| - |

|

Total |

|

| $ | 10.70 |

|

| $ | 23.31 |

|

Table 7 - LoM sustaining capital cost estimate summary

Additionally, TSF closure costs were estimated by Knight Piésold to be ~A$19.6 million.

Additional Financial Analysis

Mining Associates estimated each pit's individual financial performance by reference to mined materials, metal production, and operating cashflows, as shown in Table 8 below. The ‘Starter' pit central to the Main pit generates particularly strong operating cash of ~A$2,265 / oz Au (net of Ag by-product credits). In November 2021 Barton confirmed the central zone of the 223 Deposit as a higher-grade priority development area.5 The Starter pit operates for the first ~18 months of modelled production.

Operating Metric |

| Units |

|

| ALL PITS |

|

| Starter |

|

| Main |

|

| South 1 |

|

| Area 51 |

| |||||

Pit Inventory |

| Mt |

|

|

| 30.7 |

|

|

| 4.9 |

|

|

| 19.1 |

|

|

| 2.5 |

|

|

| 4.2 |

|

Pit Inventory Au Grade |

| g/t |

|

|

| 0.93 |

|

|

| 1.26 |

|

|

| 0.90 |

|

|

| 1.02 |

|

|

| 0.65 |

|

Pit Inventory Ag Grade |

| g/t |

|

|

| 2.52 |

|

|

| 3.32 |

|

|

| 3.03 |

|

|

| 1.29 |

|

|

| 0.00 |

|

Operating Revenue |

| A$ |

|

| $ | 3,004.7 |

|

| $ | 651.2 |

|

| $ | 1,811.5 |

|

| $ | 265.1 |

|

| $ | 276.8 |

|

Operating Cash Cost |

| A$ |

|

| $ | 1,710.0 |

|

| $ | 255.1 |

|

| $ | 1,038.6 |

|

| $ | 185.8 |

|

| $ | 230.6 |

|

Operating Cash Margin |

| A$ |

|

| $ | 1,294.7 |

|

| $ | 396.2 |

|

| $ | 773.0 |

|

| $ | 79.3 |

|

| $ | 46.2 |

|

Au Oz Recovered |

| Oz |

|

|

| 832,852 |

|

|

| 180,670 |

|

|

| 498,434 |

|

|

| 74,671 |

|

|

| 79,078 |

|

Ag Oz Recovered |

| Oz |

|

|

| 1,992,919 |

|

|

| 419,953 |

|

|

| 1,489,577 |

|

|

| 83,388 |

|

|

| 0 |

|

Operating Revenue |

| A$/Oz Au |

|

| $ | 3,500 |

|

| $ | 3,500 |

|

| $ | 3,500 |

|

| $ | 3,500 |

|

| $ | 3,500 |

|

Operating Cash Cost |

| A$/Oz Au |

|

| $ | 1,874 |

|

| $ | 1,235 |

|

| $ | 1,949 |

|

| $ | 2,438 |

|

| $ | 2,916 |

|

Operating Cash Margin |

| A$/Oz Au |

|

| $ | 1,626 |

|

| $ | 2,265 |

|

| $ | 1,551 |

|

| $ | 1,062 |

|

| $ | 584 |

|

Table 8 - Analysis on per-oz-Au basis by pit area (excl. capitalised pre-strip, and net of Ag credits)

Based upon the results of the Scoping Study, Barton has prepared an AISC estimate as follows:

Operating Costs / oz Au Recovered |

| A$ million |

|

| A$ / t milled |

|

| A$ / oz |

| |||

Mining (excluding capitalised pre-strip) |

| $ | 587 |

|

| $ | 19.12 |

|

| $ | 705 |

|

Processing |

| $ | 770 |

|

| $ | 25.07 |

|

| $ | 925 |

|

G&A (inc. transport, refining, insurance, selling and Ag credit) |

| $ | 115 |

|

| $ | 3.73 |

|

| $ | 138 |

|

Silver by-product credit |

| $ | (90 | ) |

| $ | (2.92 | ) |

| $ | (108 | ) |

C1 Cash Cost |

| $ | 1,382 |

|

| $ | 45.00 |

|

| $ | 1,660 |

|

Royalties |

| $ | 180 |

|

| $ | 5.87 |

|

| $ | 216 |

|

Sustaining Capital |

| $ | 34 |

|

| $ | 1.11 |

|

| $ | 41 |

|

All-in Sustaining Cost (AISC) |

| $ | 1,597 |

|

| $ | 51.97 |

|

| $ | 1,917 |

|

Table 9 - AISC calculation for Tunkillia Scoping Study (estimate, subject to rounding)6

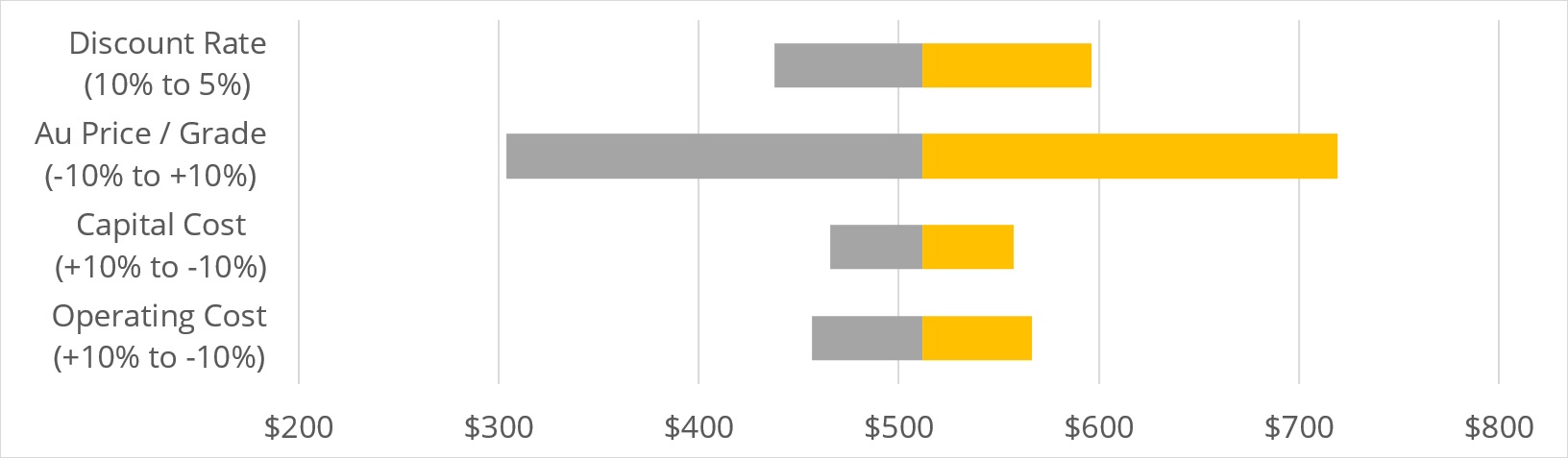

Tunkillia's NPV is most sensitive to variation in gold price / grade and operating costs, but materially less sensitive to variation in capital costs. This is consistent with Barton's expectations for a project targeting capital economies of scale in processing, and will be a key focus for subsequent optimisation reviews.

Key Opportunities

The preliminary Scoping Study has identified multiple areas for potential optimisation of Tunkillia's modelled technical and financial results, in terms of process design, capital costs and operating costs. Several relate to conservative assumptions used to establish key project costs and value drivers, and have a material impact on other technical and financial aspects such as mine optimisation and project life.

Process Design

Crushing: the Scoping Study assumed single stage crushing to 80% passing 150mm before grinding. Three stage crushing could significantly reduce the size of materials entering the milling circuit, with significantly reduced net crushing and grinding requirement, for marginal additional capital cost.

Grind size: the Scoping Study assumes a grind size of 80% passing 75 µm, requiring significantly greater power and consumables costs than coarser grind sizes. There is potential to consider larger grind sizing in combination with further metallurgical analysis to optimise costs versus recoveries.

Capital Costs

Mining infrastructure: the Scoping Study assumes Barton's installation of approximately A$15.4 million worth of Mine Infrastructure, including approximately A$7.6 million for a 2.4 megalitre (ML) fuel farm. There is potential to reduce capital costs via mine contractor provision of these items.

Procurement: the Scoping Study assumes a majority of project supply via indirect procurement (including via EPC) and domestic Australian supply and fabrication of all platework and tankage. There is potential to increase the proportion of direct supply procurement and consider overseas supply and fabrication of platework and tankage, subject to quality control assurances and review.

Operating Costs

Grinding: the Scoping Study assumes the 100th percentile (most conservative) results for bond crushing, bond rod and bond ball work indices. This increases power consumption estimates for crushing and grinding, with power comprising roughly 50% of total process operating costs.

Process consumables: smaller particle sizing and lower work indices could require materially lower grinding media (mill balls) and mill lining costs, currently estimated at ~A$15 million annually.

Energy costs: the Scoping Study assumes a gas fired power supply using an LNG price of A$19.60 / gigajoule (GJ) energy, a price ~60% higher than the A$12 / GJ domestic wholesale price cap set by the Australian Government's Gas Market Code.7 There may be potential to materially reduce energy input costs, process operating costs, and the overall operating cash cost per ounce produced.

Mine Design

Resource / design profile: Barton will review opportunities for selective drilling to improve the Mineral Resources block model and optimise the mine design. Reduced complexity of mine design can materially improve operating costs and mitigate the loss of scheduled materials and mine life.

Cost optimisation: lower key operating costs such as process consumables and power consumption can materially expand mining optimisation, allowing for improved mine design and as a result improved operating efficiencies, operating costs, and total scheduled materials (increased LoM).

Other

Project schedule: several capital cost items include material components inputs such as labour which are effectively time related costs. A faster project delivery schedule can materially reduce total estimated capital costs, with the parallel benefit of bringing forward production and revenues.

Funding

Including all factored contingencies, the Scoping Study estimates a cost of ~A$492 million for Tunkillia's development, including all supply, installation and labour, freight, owner's costs, pre-strip and EPC costs, to cover capital and operating costs from the start of project construction through to gold production.

Barton anticipates that this funding requirement will be met by a typical combination of debt and equity financing, which capital will need to be raised prior to starting the project construction. It is also possible that other forms of financing may be considered in due course, including royalty and streaming options.

Barton considers that there is a reasonable basis to conclude that funding for the project will be available when required, on the following bases (among others):

Conservative assumptions: the preliminary Scoping Study has utilised conservative assumptions to inform a preliminary evaluation of key project cost and value drivers. These in particular relate to crushing circuit design, work indices and grind size, and wholesale energy costs, all of which drive elevated processing cost estimates and restrict optimal pit design and overall project life;

Robust pre-optimisation results: Before any further analysis or optimisation, this preliminary Scoping Study has demonstrated robust estimated technical fundamentals and economic results for Tunkillia which deliver significant operating free cash flows, a reasonably fast payback period, and an attractive return on capital investment at current spot gold and silver prices; and

Professional expertise: Barton's leadership has a strong track record of raising equity funds as required and on attractive terms to advance Tunkillia, and a significant combined professional track record in the evaluation, financing, development and operation of resources projects.

However, and notwithstanding the foregoing, there can be no assurance or certainty that Barton will be able to source this funding as and when required. Where such funding is available, it is possible that it may only be available on terms that may be dilutive to, or otherwise affect, the value of the Company's existing shares.

Conclusion & Recommendations

The preliminary Scoping Study provides a strong initial baseline of estimated technical and financial results for the Tunkillia project, and the justification that it is a commercially viable standalone project. The Scoping Study has also identified multiple areas for additional analysis and potential optimisation.

Accordingly, the Board of Barton is supportive of advancing the project to subsequent analysis in the form of an optimised scoping study and, subject to the results thereof, a preliminary feasibility study (PFS).

Exploration and evaluation activities are ongoing for the Tunkillia project, and Barton is also actively exploring the neighbouring Tarcoola project which may yield complementary development opportunities. Both projects offer potential for additional drilling to increase and / or upgrade JORC Mineral Resources.

The timing of Tunkillia's development has not yet been determined due to the preliminary nature of the recently completed Scoping Study. However, Barton expects to continue its review of optimisation options with an objective to publish an optimised scoping study during the financial year ended 30 June 2025.

Authorised by the Board of Directors of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Shannon Coates |

|

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000oz annually, with ~1.6Moz Au JORC Mineral Resources (52.3Mt @ 0.94 g/t Au), multiple advanced exploration projects and brownfield mines, and 100% ownership of the only regional gold mill in the renowned central Gawler Craton of South Australia.*

Tarcoola Gold Project

Tunkillia Gold Project

Infrastructure

|

|

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

Additional JORC (2012) Disclosures - Reasonable Basis for Forward Looking Assumptions

No JORC (2012) Ore Reserve has been estimated or declared for Tunkillia. This document has been prepared in compliance with the JORC Code (2012) and the ASX Listing Rules. All material assumptions on which the Scoping Study production target and projected financial information are based have been included in this release and disclosed in the table below.

The level of this study does not support the estimation of Ore Reserves or provide any assurance that Tunkillia will proceed to development, or that the production target will be realised. The Scoping Study supports progress to the next level of study in the form of a subsequent optimised Scoping Study and / or a PFS.

JORC Table 1 - Tunkillia Gold Project

Reasonable Basis for Forward Looking Assumptions

Criteria | Commentary |

Mineral Resource estimate for conversion to Ore Reserves Description of the Mineral Resource estimate used as a basis for the conversion to an Ore Reserve. Clear statement as to whether the Mineral Resources are reported additional to, or inclusive of, the Ore Reserves. | The Mineral Resource Estimate (MRE) on which the Scoping Study is based was announced to the ASX on 4 March 2024. No Ore Reserve has been declared as part of the Scoping Study. |

Site Visits Comment on any site visits undertaken by the Competent Person and the outcome of those visits. If no site visits have been undertaken indicate why this is the case. | Marc Twining, the Competent Person for the reporting of exploration results is Barton Gold's General Manager Exploration and conducts regular site visits. Ian Taylor, the Competent Person for the Estimation and Reporting of Mineral Resources at Tunkillia visited the project during November 2022 to inspect the site and review drill core, sampling practices and other field processes related to drilling and data collection contributing to Mineral Resource estimates for the project. |

Study status The type and level of study undertaken to enable Mineral Resources to be converted to Ore Reserves. The Code requires that a study to at least Pre-Feasibility Study level has been undertaken to convert Mineral Resources to Ore Reserves. Such studies will have been carried out and will have determined a mine plan that is technically achievable and economically viable, and that material Modifying Factors have been considered | No Ore Reserve has been declared. The Study is a Scoping Study. |

Cut-off parameters The basis of the cut-off grade(s) or quality parameters applied. | The Mineral Resource for the Area 223 open pit is reported above a 0.4 g/t Au lower cut-off. The Mineral Resource for the Area 51 open pit is reported above a 0.5 g/t Au lower cut-off. Considering likely open pit mining, conventional heap leach or CIL processing and administration costs head grades above these respective cut-off grades are assumed profitable. Key Assumptions for Mineral Resource estimation: • Open pit mining method • 1.25m minimum mining width (sub block width), • 6.9:1 strip ratio • Mining and Processing cost of A$33.24/tonne for mineralised material. • Gold price A$3,000/oz • 95% Metallurgical recovery • 5.0% Dilution • 6.0% Royalty This is in line with assumptions used in previous detailed analyses and Mineral Resource estimates. The metal price used was A$3,000/oz. |

Mining factors or Assumptions The method and assumptions used as reported in the Pre-Feasibility or Feasibility Study to convert the Mineral Resource to an Ore Reserve (i.e. either by application of appropriate factors by optimisation or by preliminary or detailed design). The choice, nature and appropriateness of the selected mining method(s) and other mining parameters including associated design issues such as pre-strip, access, etc. The assumptions made regarding geotechnical parameters (e.g. pit slopes, stope sizes, etc), grade control and pre-production drilling. The major assumptions made and Mineral Resource model used for pit and stope optimisation (if appropriate). The mining dilution factors used. The mining recovery factors used. Any minimum mining widths used. The manner in which Inferred Mineral Resources are utilised in mining studies and the sensitivity of the outcome to their inclusion. The infrastructure requirements of the selected mining methods. | No Ore Reserve has been declared. The deposit is a low-grade gold deposit, under approximately 50m of cover and extending to a depth of ~300m below surface. An open pit mining method was selected for the deposit. Underground mining was not considered due to the low grade and proximity to surface. A pit optimisation was undertaken using a Pseudofllow optimiser to determine the economic pit limits. Geotechnical parameters applied are based on previously commissioned geotechnical studies. Geotechnical assumptions applied in this study are summarised as follows:

Input assumptions used for pit optimisation process are provided in the body of the release. A 0.3 m dilution / ore loss skin was applied to the edge blocks of the mineralised resource in preparation for the pit optimisation. No other dilution or loss factors were applied to the block model prior to the optimisation. No mining recovery factors have been applied as it is a scoping level study. Mineralised blocks to be processed by the processing plant were calculated on a block-by-block basis within the block model. When the recovered gold value within a particular block exceeded the processing cost for that block, then that block was processed through the mill. A minimum mining width of 40m has been applied. Approximately 66% of the material to be processed through the plant is of the Indicated Resource category, with the remaining 34% in the Inferred Resource category. The relative proportion of Inferred Mineral resources to be mined on a year-by-year basis is presented in Figure 9 of the release. The inclusion of these Inferred Mineral resources is suitable for a scoping-level study. Given a projected 1.9 year payback period (from start of production), Tunkillia's financial viability does not depend upon inclusion of Inferred Resources, and therefore that a reasonable basis exists for disclosing a production target including Inferred Resources. Detailed infrastructure requirements relating to the (open cut) mining method have not been included within the scope of the scoping study. |

Metallurgical factors or Assumptions The metallurgical process proposed and the appropriateness of that process to the style of mineralisation. Whether the metallurgical process is well-tested technology or novel in nature. The nature, amount and representativeness of metallurgical test work undertaken, the nature of the metallurgical domaining applied and the corresponding metallurgical recovery factors applied. Any assumptions or allowances made for deleterious elements. The existence of any bulk sample or pilot scale test work and the degree to which such samples are considered representative of the orebody as a whole. For minerals that are defined by a specification, has the ore reserve estimation been based on the appropriate mineralogy to meet the specifications? | The metallurgical process proposed in the study is a conventional Carbon-in-Leach (CIL) process, which is considered appropriate on the basis of existing characterisation testwork. The CIL process is proven process and workflow for this style of orebody. Metallurgical test work has been undertaken across the entire deposit which is sufficient for informing a scoping-level study, with samples representing a broad range of geological & metallurgical domains having been included in characterisation studies. Metallurgical recovery factors have been derived from this testwork. This testwork includes the metallurgical assessment of five gold-bearing samples for Helix Resources N.L. in 1997 conducted by Ammtec Limited; gold recovery from Tunkillia ore in 2006 by Amdel; laboratory test reports for Tunkillia composites Met Sul1, Met Sul 2, Met Ox1, Met Ox2 by Gekko Systems in 2009; the Tunkillia stage 1 metallurgical test work in 2013 by ALS Global; SMC test report by JK Tech in 2012; and Mungana cyanidation test in 2012. No deleterious elements applicable to the proposed metallurgical process have been identified. No pilot-scale test work and limited bulk sampling has been undertaken for this scoping study. |

Environmental The status of studies of potential environmental impacts of the mining and processing operation. Details of waste rock characterisation and the consideration of potential sites, status of design options considered and, where applicable, the status of approvals for process residue storage and waste dumps should be reported. | Baseline environmental surveying has been undertaken during previous project studies and not identified any species or habitats requiring specific consideration. Additional environmental baseline surveying will be required as future studies are progressed. A preliminary waste rock characterisation study has been undertaken and has identified a small proportion of low-capacity potentially acid forming (PAF) material which would be integrated into the Waste Rock Facility (WRF). Consideration of specific approvals is beyond the scope of this study other than there are no issues (relating to process wastes) having been identified that cannot be addressed by accepted industry practices and the necessary approvals related to these practices. |

Infrastructure The existence of appropriate infrastructure: availability of land for plant development, power, water, transportation (particularly for bulk commodities), labour, accommodation; or the ease with which the infrastructure can be provided or accessed. | Tunkillia is a remote project location with the nearest townsite being Kingoonya, approximately 70km to the northeast. The project is serviced by an existing gravel road to within 15km of Kingoonya and the trans-Australian rail having rail siding facilities at Kingoonya. The project is proposed as being self-sufficient for power requirements and water would be derived from an existing defined (saline) borefield with reverse-osmosis generation of fresh water requirements. Existing pastoral station tracks would be upgraded to provide all-weather access to both light vehicles and heavy freight. An on-site accommodation village would house the fly in-fly out workforce. The project is located on an existing pastoral lease and extensive land is available to provide for the requirements of the project. An extensive local network of infrastructure service providers and related capacity are available from both Roxby Downs and more generally in South Australia. Labour for the project is readily available from South Australia. |

Costs The derivation of, or assumptions made, regarding projected capital costs in the study. The methodology used to estimate operating costs. Allowances made for the content of deleterious elements. The source of exchange rates used in the study. Derivation of transportation charges. The basis for forecasting or source of treatment and refining charges, penalties for failure to meet specification, etc. The allowances made for royalties payable, both Government and private. | Capital costs used in the study have been developed by GRES using detailed Mechanical Equipment Lists and recent GRES database pricing for the supply of equipment, labour and installation. Capital costs of the tailings storage facility were provided by Knight Piésold, based upon scoping level design quantities, the mining and processing schedules, and unit costs rates based on historical costs for similar work. Operating costs have been built up from first principals by GRES referencing comparable operations and existing metallurgical test work. MA built up mining operation costs from first principals. No allowance has been made for deleterious elements content on the basis that no deleterious elements have been detected. Previous testwork in particular notes a lower copper content in concentrates and therefore no penalties therefor are anticipated. Exchange rates used in the study are based upon current rates. Transportation charges have been estimated by GRES and based upon database pricing and recent contract history. A conservative estimate has been applied for the forecasting of treatment and refining charges, based upon benchmarked industry pricing. The allowance for royalties payable is based upon state and private royalties applicable to the project and presented in Table 1 of the announcement. |

Revenue factors The derivation of, or assumptions made regarding revenue factors including head grade, metal or commodity price(s) exchange rates, transportation and treatment charges, penalties, net smelter returns, etc. The derivation of assumptions made of metal or commodity price(s), for the principal metals, minerals and co-products. | The derivation of the feed grade comes from the Mineral Resource estimate with the application of the mining schedule. All other relevant revenue factors are assumed in line with current rates and as outlined above. Gold is to be sold in the form of refined gold derived from doré produced at site. Approximate current gold and silver prices have been used in this Scoping Study to estimate revenues. |

Market assessment The demand, supply and stock situation for the particular commodity, consumption trends and factors likely to affect supply and demand into the future. A customer and competitor analysis along with the identification of likely market windows for the product. Price and volume forecasts and the basis for these forecasts. For industrial minerals the customer specification, testing and acceptance requirements prior to a supply contract | Gold is a highly liquid commodity market with low transaction costs. No additional market analysis has been undertaken for this study. |

Economic The inputs to the economic analysis to produce the net present value (NPV) in the study, the source and confidence of these economic inputs including estimated inflation, discount rate, etc. NPV ranges and sensitivity to variations in the significant assumptions and inputs. | The financial model is estimated on a real basis, factoring in both revenue and cost assumptions. All other cost factors have been developed by GRES and MA from first principals, or based upon data base pricing, or recent contract pricing and detailed engineering evaluation. The discount rate of 7.5% is reflective of comparable and contemporary project studies. A sensitivity analysis for influence of key economic parameters has been provided in Figure 12 of the release. |

Social The status of agreements with key stakeholders and matters leading to social licence to operate. | An application for a Mining Lease will be required to authorise the development and operation of this project. Barton Gold maintains proactive relationships with key stakeholders during the exploration and study phase of this project and the company has not identified any specific matters that would impact a future development. Barton Gold has an existing South Australian Native Title Mining Agreement (NTMA) to enable exploration and study-related activities. A new NTMA to authorise the project's development and operation will be required in the future. The project is located on a Pastoral Lease for which there are established processes for obtaining authorisation for a potential future mining operation. |

Other (incl Legal and Governmental) To the extent relevant, the impact of the following on the project and/or on the estimation and classification of the Ore Reserves: Any identified material naturally occurring risks. The status of material legal agreements and marketing arrangements. The status of governmental agreements and approvals critical to the viability of the project, such as mineral tenement status, and government and statutory approvals. There must be reasonable grounds to expect that all necessary Government approvals will be received within the timeframes anticipated in the Pre- Feasibility or Feasibility study. Highlight and discuss the materiality of any unresolved matter that is dependent on a third party on which extraction of the reserve is contingent | No Ore Reserve has been declared. No naturally occurring risks have been identified. The project is 100% owned by Barton Gold and there are no marketing arrangements in place. Statutory approvals are required to enable the development and operation of this project. South Australia has a well-defined statutory process for seeking the required approvals and the company anticipates the project would follow the standard approval process which is yet to mapped out in specific detail. Some Commonwealth approvals will also be required but it is anticipated these would follow similarly established approval processes. There are no currently identified third party unresolved matters that may impact upon future approvals. |

Classification The basis for the classification of the Ore Reserves into varying confidence categories. Whether the result appropriately reflects the Competent Person's view of the deposit. The proportion of Probable Ore Reserves that have been derived from Measured Mineral Resources (if any). | No Ore Reserve has been declared. |

Audits or reviews The results of any audits or reviews of Ore Reserve estimates. | No Ore Reserve has been declared. |

__________________

[1] Refer to Prospectus and ASX announcements dated 9 Sep and 3 / 8 / 15 Nov 2021, 6 Jun and 5 / 7 Sep 2022, 23 Jan, 15 Feb, 19 / 26 April, 30 Oct, 15 / 21 Nov, and 4 / 11 Dec 2023, and 14 Feb and 4 Mar 2024

[2] Including 820koz Au (26.7Mt @ 0.96 g/t Au) in Indicated and 672koz Au (24.6Mt @ 0.85 g/t Au) in Inferred categories

[3] Refer to ASX announcements dated 4 Mar and 18 Apr 2024

[4] Aurum Analytics - Australian & New Zealand Gold Operations (March Quarter 2024)

[5] Refer to ASX announcement dated 15 Nov 2021

[6] Includes C1 cost, royalties, sustaining capital and Ag by-product credits, but excludes corporate, exploration, and non-sustaining capital costs.

[7] Source: Australian Government Department of Climate Change, Energy, the Environment and Water (link)

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 3 July 2024. Total Barton attributable JORC (2012) Mineral Resources include 833koz Au (26.9Mt @ 0.96 g/t Au) in Indicated and 754koz Au (25.4Mt @ 0.92 g/t Au) in Inferred categories.

SEE RELATED ATTACHEMENT: https://www.accesswire.com/media/889077/03bgdtunkillia-gold-project-positive-initial-scoping-study16-july-2024-3451-3713-6430-v1.pdf

SOURCE: Barton Gold Holdings Limited