Ore sorting and beneficiation results highlight simple, small-footprint development potential

HIGHLIGHTS

Detailed metallurgical study and test work program on representative Cyclone and Chinook Deposit mineralization has successfully generated potential commercial grade Direct Shipping Products ("DSPs")

The two-circuit, ore sorting* and Inline Pressure Jig ("IPJ") stream is capable of a range of DSP concentrate grades with excellent yields of copper ("Cu")

The DSP processing test work has delivered:

Cyclone Deposit at 1.2% Cu to 1.5% Cu feed grades

16-22% Cu concentrate, 58-62% copper metal to DSP

Chinook Deposit at 1.2% Cu to 1.5% Cu feed grade

16-22% Cu concentrate, 64-71% of copper metal to DSP

DSP process can be easily optimized to suit increased processing rates and selective concentrate grades

Ongoing test work anticipated to include further upside potential and includes continuing variability, comminution and optimization studies on the Cyclone, Chinook, and Thunder Deposits

The development opportunity has excellent ESG outcomes with a very small environmental footprint and no deleterious elements

Ongoing drilling at Storm is designed to inform an upcoming maiden mineral resource estimate for the Storm Project that is currently being constructed to CIM standards, and to explore the margins of the known deposits as well as new discoveries for additional potential resources.

*"Ore sorting" is an industry-recognized term for the use of advanced sensors to mechanically separate well-mineralized from poorly-mineralized rock. The reader is cautioned that "ore" has specific implications regarding the feasibility and economic viability of a mineral deposit; until these studies are complete, no material from Storm yet satisfies the definition of ore, and "ore sorting" here refers solely to the beneficiation process.

TORONTO, ON / ACCESSWIRE / August 13, 2024 / Aston Bay Holdings Ltd. (TSXV:BAY)(OTCQB:ATBHF) ("Aston Bay" or the "Company") is pleased to confirm that a metallurgical study and test work program on typical Storm mineralization has successfully generated potential commercial grade Direct Shipping Products at the Storm Copper Project ("Storm" or the "Project") on Somerset Island, Nunavut. The studies and exploration program is being conducted by American West Metals Limited ("American West"), who is the operator of the Project. Aston Bay and American West have formed a 20/80 unincorporated joint venture in respect of the Storm Project property, with Aston Bay maintaining a free carried interest until a decision to mine upon completion of a bankable feasibility study.

Thomas Ullrich, Chief Executive Officer of Aston Bay, commented :

"These metallurgical studies have demonstrated that Storm can produce a potential commercial-grade DSP from typical Storm copper mineralization through a simple process. The proposed ore sorting and jig process eliminates the need for conventional flotation plant and its accompanying tailings facility - this would be a small footprint operation with minimized surficial impact. We are very excited to see Storm potentially developing into a compelling development story with excellent ESG qualities."

Figure 1: Storm copper mineralization being processed by a full scale Steinert ore sorter in Perth, Australia.

Process modelling was provided within the studies completed by Nexus Bonum (Perth, Australia). The studies are not scoping studies nor feasibility studies. The primary outcomes from the studies are for desktop or conceptual process modelling which the Company will use for internal purposes to make strategic decisions on the Storm Copper Project.

HIGH-GRADE POTENTIAL OPEN PIT COPPER OPPORTUNITY

Drilling at Storm over the past three seasons has been designed to inform an upcoming maiden mineral resource that is currently being constructed to CIM standards. An additional approximately 20,000 metres ("m") of resource upgrade and expansion drilling is currently underway, with release of the resource anticipated in Q4 2024.

The dominant copper mineral within the Storm deposits is chalcocite. The copper mineralization is hosted within coarse veins and breccias, and there is a direct correlation between the volume and thickness of the mineralized veins with overall copper grade.

Chalcocite is a dark-grey copper sulfide mineral that contains 79.8% copper, with a specific gravity (SG) of 5.5-5.8. The dolomite host rocks to the mineralization are light grey/brown and have an SG of 2.8-2.85. The large difference in physical properties of the copper mineralization and host rocks suggests amenability to upgrading through straightforward beneficiation processing techniques.

Ore sorting was identified as one technique that could have the potential to upgrade the mineralization to be suitable as a Direct Shipping Product (DSP). Ore sorting is a pre-concentration technology that uses advanced sensors and algorithms to separate potentially economically viable mineralized material from waste rock in real time. This processing technique is widely used in the mining and mineral processing industry on a range of commodity types, including other base metals, lithium, iron ore, and nickel.

The use of ore sorting and beneficiation processing technology has the potential to eliminate the necessity for a conventional flotation plant and its accompanying tailings facility. Consequently, it would reduce the operational footprint and provide substantially lower capital requirements. The Nexus study was subsequently broadened to include a range of other beneficiation techniques in addition to ore sorting to assess the DSP potential further.

DSP CONCEPT DESIGN AND RESULTS

ALS Metallurgy in conjunction with Sacre-Davey (North Vancouver, Canada) and Nexus Bonum (Perth, Australia), international consulting firms with highly respected credentials in mineral processing and beneficiation, were engaged to complete detailed studies on the ore sorting and beneficiation performance of typical copper mineralization at Storm using metallurgical samples from the Cyclone and Chinook Deposits.

The test work studied the upgrade performance of a range of sensor-based and gravity technologies using the metallurgical samples provided. The mineralization was tested over a wide range of copper grades and size fractions to determine the DSP potential across the range of mineralized material at Storm.

Of all of the tests completed, ore sorting and wet jigging (a gravity separation technique) using the Inline Pressure Jig (IPJ) produced the most favourable upgrade results, and the combination of the two circuits allowed both the coarse (>11.2 millimetre ("mm")) and fine fractions (<11.2mm) to be processed effectively.

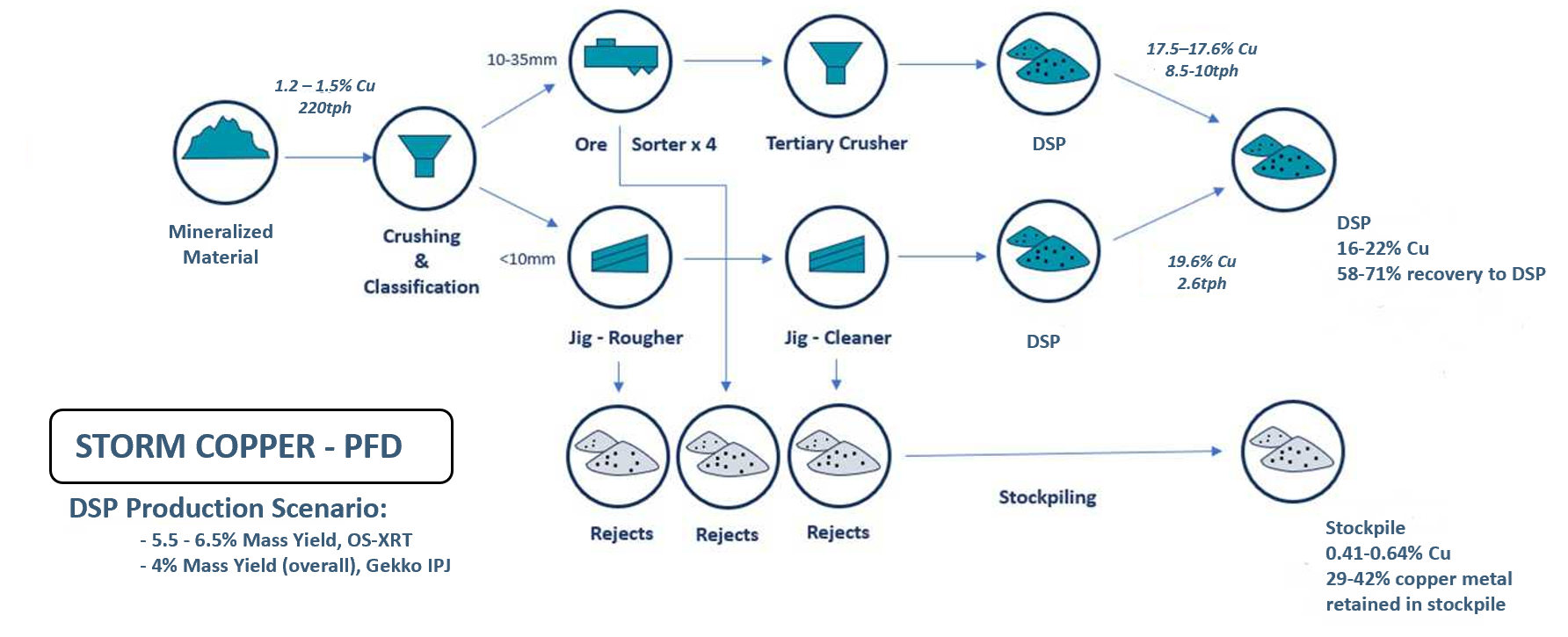

The favourable results were used to generate a design process flow diagram (PFD) incorporating particle ore sorters (XRT) and Inline Pressure Jigs (IPJ) to produce a selected DSP product grade.

DSP processing test work was completed on each of the Cyclone and Chinook Deposits confirming that the Cyclone and Chinook copper mineralization is amenable to upgrading and that high recoveries can be obtained in very low mass yields. For the Cyclone Deposit, feed grades at 1.2% to 1.5% Cu produced a 16-22% Cu concentrate with 58-62% of copper metal reporting to the DSP. For Chinook, feed grades at 1.2% to 1.5% Cu produced a 16-22% Cu concentrate with 64-71% of copper metal reporting to the DSP.

A simplified description of the PFDs for the Cyclone and Chinook Deposits is presented below.

See Appendix A on the Aston Bay website https://astonbayholdings.com/news/dsp-appendix/ for a more detailed description.

Figure 2: Typical mid-range case PFD for the Chinook Deposit using Ore Sorting and Gravity Upgrade based on test work results Note: numbers may not add due to rounding.

Qualified Person

Michael Dufresne, M.Sc., P.Geol., P.Geo., is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical information in this press release.

About the Storm Copper and Seal Zinc-Silver Projects, Nunavut

The Nunavut property consists of 173 contiguous mining claims covering an area of approximately 219,257 hectares on Somerset Island, Nunavut, Canada. The Storm Project comprises both the Storm Copper Project, a high-grade sediment-hosted copper discovery (intersections including 110m* @ 2.5% Cu from surface and 56.3* @ 3.1% Cu from 12.2m as well as the Seal Zinc Deposit (intersections including 14.4m* @ 10.6% Zn, 28.7g/t Ag from 51.8m and 22.3m* @ 23.0% Zn, 5.1g/t Ag from 101.5m). Additionally, there are numerous underexplored and undrilled targets within the 120-kilometre strike length of the mineralized trend, including the Tornado copper prospect where 10 grab samples yielded >1% Cu up to 32% Cu in gossans. The Nunavut property is now the subject of an 80/20 unincorporated joint venture with American West (see "Agreement with American West" below for more details).

Storm Discovery and Historical Work

High-grade copper mineralization was discovered at Storm in the mid-1990s by Cominco geologists conducting regional zinc exploration around their then-producing Polaris lead-zinc mine. A massive chalcocite boulder found in a tributary of the Aston River in 1996 was traced to impressive surface exposures of broken chalcocite mineralization for hundreds of metres of surface strike length at what became named the 2750N, 2200N, and 3500N zones. Subsequent seasons of prospecting, geophysics and over 9,000 m of drilling into the early 2000s confirmed a significant amount of copper mineralization below the surface exposures as well as making the blind discovery of the 4100N Zone, a large area of copper mineralization with no surface exposure.

Following the merger of Cominco with Teck in 2001 and the closure of the Polaris Mine, the Storm claims were allowed to lapse in 2007. Commander Resources staked the property in 2008 and flew a helicopter-borne VTEM survey in 2011 but conducted no additional drilling. Aston Bay subsequently entered into an earn-in agreement with Commander and consolidated 100% ownership in 2015. Commander retained a 0.875% Gross Overriding Royalty in the area of the original Storm claims which was purchased by Taurus Mining Royalty Fund L.P. in January 2024.

In 2016 Aston Bay entered into an earn-in agreement with BHP, who conducted a 2,000-station soil sampling program and drilled 1,951m of core in 12 diamond drill holes, yielding up to 16m* @ 3.1% Cu. BHP exited the agreement in 2017 and retains no residual interest in the project. Aston Bay conducted a property-wide airborne gravity gradiometry survey in 2017 and drilled 2,913m in nine core holes in the Storm area in 2018 yielding a best intercept of 1.5m* @ 4.4% Cu and 20.5m* @ 0.6% Cu.

Agreement with American West

On March 9, 2021, Aston Bay entered into an option agreement with American West Metals Limited (American West), and its wholly owned Canadian subsidiary Tornado Metals Ltd., pursuant to which American West was granted an option to earn an 80% undivided interest in the Project by spending a minimum of CAD$10 million on qualifying exploration expenditures. The parties amended and restated the Option Agreement as of February 27, 2023, to facilitate American West directly earning an interest in the Project alongside its Canadian subsidiary without any change to the overall commercial agreement between the parties. The expenditures were completed during 2023, and American West exercised the option. American West and Aston Bay have formed an 80/20 unincorporated joint venture.

Under the joint venture, Aston Bay shall have a free carried interest until American West has made a decision to mine upon completion of a bankable feasibility study, meaning American West will be solely responsible for funding the joint venture until such decision is made. After such decision is made, Aston Bay will be diluted in the event it does not elect to contribute its proportionate share and its interest in the Project will be converted into a 2% net smelter returns royalty if its interest is diluted to below 10%.

Recent Work

American West completed a fixed loop electromagnetic (FLEM) ground geophysical survey in 2021 that yielded several new subsurface conductive anomalies. A total of 1,534m were drilled in 10 diamond drill holes in the 2022 season, yielding several impressive near-surface intercepts including 41m* @ 4.1% Cu as well as 68m of sulfide mineralization associated with a deeper conductive anomaly.

In April 2022, results of beneficiation studies demonstrated that a mineralized intercept grading 4% Cu from the 4100N area could be upgraded to a 54% Cu direct ship product using standard sorting technology. Further beneficiation and metallurgical studies are ongoing.

In April 2023, American West embarked on a spring delineation drilling program using a helicopter-portable RC drill rig as well as conducting gravity and moving loop electromagnetic (MLEM) ground geophysical programs.

The summer 2023 program conducted further delineation drilling of the near-surface high-grade copper zones to advance them toward maiden resource estimates in 2024. Deep diamond drilling during 2023 discovered high-grade copper sulfides up to 2.7% Cu at approximately 300m vertical depth (ST23-02), suggesting the potential for discovery of large-scale copper targets at depth.

Diamond drilling of new high-priority deep MLEM targets, RC delineation drilling for resource development and additional geophysical surveys are now underway in the 2024 program. Metallurgical studies and environmental baseline studies are ongoing, with bulk sampling for prefeasibility-level processing planned for summer 2024.

*Stated drill hole intersections are all core length, and true width is expected to be 60% to 100% of core length.

About Aston Bay Holdings

Aston Bay is a publicly traded mineral exploration company exploring for high-grade critical and precious metal deposits in Nunavut, Canada and Virginia, USA.

The Company is currently exploring the Storm Copper Property and Cu-Ag-Zn-Co Epworth Property in Nunavut, and the high-grade Buckingham Gold Vein in central Virginia. The company is also in advanced stages of negotiation on other lands with high-grade critical metals potential in North America

The Company and its joint venture partners, American West Metals Limited and its wholly-owned subsidiary, Tornado Metals Ltd. (collectively, " American West ") have formed a 20/80 unincorporated joint venture in respect of the Storm Project property, which hosts the Storm Copper Project and the Seal Zinc Deposit. Under the unincorporated joint venture, Aston Bay shall have a free carried interest until American West has made a decision to mine upon completion of a bankable feasibility study, meaning American West will be solely responsible for funding the joint venture until such decision is made. After such decision is made, Aston Bay will be diluted in the event it does not elect to contribute its proportionate share and its interest in the Storm Project property will be converted into a 2% net smelter returns royalty if its interest is diluted to below 10%.

About American West Metals Limited

AMERICAN WEST METALS LIMITED (ASX: AW1) is an Australian clean energy mining company focused on growth through the discovery and development of major base metal mineral deposits in Tier 1 jurisdictions of North America. The company's strategy is focused on developing mines that have a low-footprint and support the global energy transformation. AW1's portfolio of copper and zinc projects in Utah and Canada include significant existing resource inventories and high-grade mineralization that can generate robust mining proposals. Core to AW1's approach is a commitment to the ethical extraction and processing of minerals and making a meaningful contribution to the communities where its projects are located.

Led by a highly experienced leadership team, AW1's strategic initiatives lay the foundation for a sustainable business which aims to deliver high-multiplier returns on shareholder investment and economic benefits to all stakeholders.

For further information on American West, visit: www.americanwestmetals.com .

FORWARD-LOOKING STATEMENTS

Statements made in this news release, including those regarding entering into the joint venture and each party's interest in the Project pursuant to the agreement in respect of the joint venture, management objectives, forecasts, estimates, expectations, or predictions of the future may constitute "forward-looking statement", which can be identified by the use of conditional or future tenses or by the use of such verbs as "believe", "expect", "may", "will", "should", "estimate", "anticipate", "project", "plan", and words of similar import, including variations thereof and negative forms. This press release contains forward-looking statements that reflect, as of the date of this press release, Aston Bay's expectations, estimates and projections about its operations, the mining industry and the economic environment in which it operates. Statements in this press release that are not supported by historical fact are forward-looking statements, meaning they involve risk, uncertainty and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Although Aston Bay believes that the assumptions inherent in the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which apply only at the time of writing of this press release. Aston Bay disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by securities legislation.

Neither TSX Venture Exchange nor its regulation services provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

For more information contact:

Thomas Ullrich, Chief Executive Officer

[email protected]

(416) 456-3516

SOURCE: Aston Bay Holdings Ltd.